|

市场调查报告书

商品编码

1740915

乳製品混合市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Dairy Blends Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

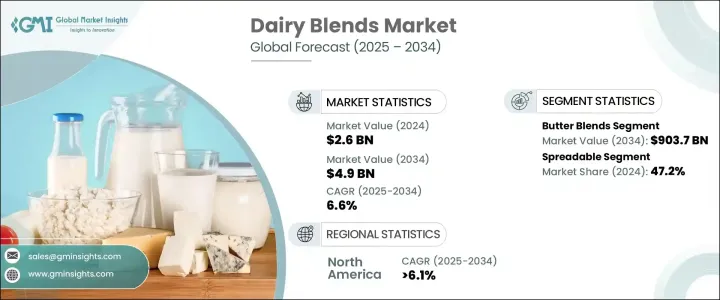

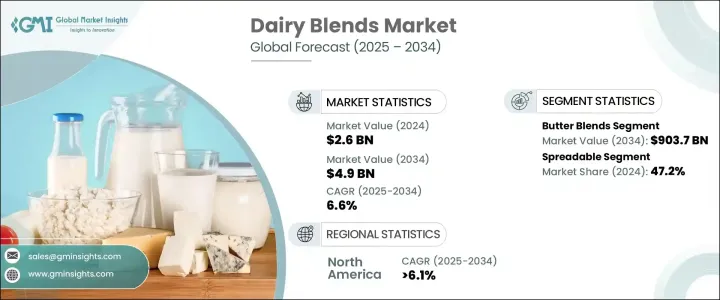

2024年,全球乳製品混合市场规模达26亿美元,预计到2034年将以6.6%的复合年增长率增长,达到49亿美元,这得益于对满足现代消费模式的多功能食品配料日益增长的需求。如今,消费者越来越追求兼顾口味、营养和便利性的食品选择,而乳製品混合市场恰好满足了这一需求。这种转变源自于人们日益增强的健康意识、对即食产品的青睐、以及对可持续且令人愉悦的饮食体验的追求。乳製品混合市场完美地融合了这一平衡点——它们将传统乳製品的丰富感官吸引力与额外的功能性和健康益处相结合。这些产品口感较佳,保存期限较长,热稳定性较高,涂抹性较强。这些特性使乳製品混合市场成为各种食品应用的理想选择,从冷冻食品、烘焙食品到酱料和零食。随着全球食品偏好的演变,消费者越来越倾向于选择易于融入日常膳食且营养成分个人化的乳製品混合市场。

由于科技的重大进步,乳製品配方正在快速发展。均质化、微胶囊化和精准混合技术的突破,使製造商能够生产出满足特定健康目标或饮食需求的配方。无论是降低脂肪含量、添加维生素,或是为儿童、运动员或老年人定製配方,乳製品行业如今都拥有提供精准营养的工具。人们对健康的关注比以往任何时候都更加强烈,这些量身定制的解决方案正在帮助消费者在不牺牲风味和口感的情况下实现个人健康目标。全球供应链多元化是另一个驱动因素。企业如今在采购和生产方面更加灵活,这有助于它们快速适应原材料价格波动、贸易动态以及气候相关挑战。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 26亿美元 |

| 预测值 | 49亿美元 |

| 复合年增长率 | 6.6% |

市场按类型细分为精緻奶油、黄油、起司、优格和其他特殊混合产品。其中,黄油混合产品市场影响力强劲,预计到2034年将达到9.037亿美元,复合年增长率为6.5%。这些混合产品因其稳定的质地、风味以及稳定产品配方(尤其是在烘焙和包装食品中)的能力,在食品加工领域备受推崇。

就形态而言,乳製品混合物可分为粉状、液态和涂抹型产品。涂抹型混合物占据主导地位,市占率达47.2%,预计到2034年将达到12亿美元,复合年增长率为6.9%。涂抹型混合物使用方便,与快节奏的生活方式相得益彰,用途广泛,从直接涂抹到酱料和餐食套装,都深受消费者喜爱。

预计2025年至2034年间,北美混合乳製品市场的复合年增长率将达到6.1%,这得益于该地区向健康、植物性饮食的转变。添加大豆、燕麦或杏仁成分的混合乳製品正受到那些寻求清洁标籤、功能性传统乳製品替代品的消费者的青睐。人们对风味增强、营养丰富且耐储存的食品的需求不断增长,进一步推动了市场成长。

嘉吉、Agropur、菲仕兰坎皮纳、凯里集团、恆天然、Dohler 和 AFP 等领先企业正在加大研发投入,力求提供更干净的标籤和更高的营养价值。透过策略合作和以永续发展为重点的倡议,这些企业正在扩大其全球影响力,同时满足消费者对负责任采购和减少环境影响的期望。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 贸易统计(HS编码)

- 主要出口国

- 主要进口国

註:以上贸易统计仅提供重点国家

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 消费者喜欢脂肪和胆固醇含量较低的乳製品混合物。

- 功能性食品需求不断成长

- 混合乳製品是合适的替代品

- 产业陷阱与挑战

- 严格的标籤和成分法律可能会限制市场扩张。

- 一些买家认为混合乳製品的品质比纯乳製品低。

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 奶油混合物

- 奶油混合物

- 混合优格

- 起司混合物

- 其他混合

第六章:市场估计与预测:依形式,2021 - 2034 年

- 主要趋势

- 可涂抹

- 液体

- 粉末

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 烘焙和糖果

- 乳製品和冷冻甜点

- 饮料

- 营养和功能性食品

- 其他的

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Kerry Group plc

- FrieslandCampina

- Cargill, Incorporated

- Fonterra Co-operative Group Limited

- Dohler GmbH

- Agropur

- AFP advanced food products llc

- Cape Food Ingredients

- Intermix Australia Pty Ltd.

- Spectrum Organics Products, LLC

The Global Dairy Blends Market was valued at USD 2.6 billion in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 4.9 billion by 2034, fueled by the rising demand for multi-functional food ingredients that meet modern consumption patterns. Consumers today are increasingly looking for food options that offer a balance between taste, nutrition, and convenience, and dairy blends deliver on all fronts. This shift is being driven by a growing awareness of health, a busy lifestyle that favors ready-to-use products, and a desire for sustainable yet indulgent eating experiences. Dairy blends strike that perfect middle ground-they combine the rich sensory appeal of traditional dairy with added functionality and health benefits. These products provide improved mouthfeel, longer shelf life, thermal stability, and enhanced spreadability. These attributes make dairy blends ideal for a wide range of food applications, from frozen and baked goods to sauces and snacks. As global food preferences evolve, consumers are turning to blends that are easy to incorporate into their daily meals while offering tailored nutritional profiles.

Dairy blends are evolving quickly, thanks to major advancements in technology. Breakthroughs in homogenization, microencapsulation, and precision blending are allowing manufacturers to create blends that target specific health goals or dietary requirements. Whether it's lowering fat content, enriching with vitamins, or customizing blends for children, athletes, or the elderly, the industry now has the tools to deliver precision nutrition. The focus on wellness is stronger than ever, and these tailored solutions are helping consumers meet personal health targets without giving up flavor or texture. Global supply chain diversification is another driving factor. Companies are now more agile in their sourcing and production, helping them adapt quickly to fluctuations in raw material prices, trade dynamics, and climate-related challenges.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.6 Billion |

| Forecast Value | $4.9 Billion |

| CAGR | 6.6% |

The market is segmented by type into refined creams, butter, cheese, yogurt, and other specialty blends. Among these, butter blends are making a strong impact and are expected to reach USD 903.7 million by 2034, growing at a CAGR of 6.5%. These blends are highly valued in the food processing sector for their consistent texture, flavor, and ability to stabilize product formulations, particularly in baked and packaged foods.

In terms of form, dairy blends are categorized as powders, liquids, and spreadable products. Spreadable blends dominate with a 47.2% market share and are projected to hit USD 1.2 billion by 2034, growing at a CAGR of 6.9%. Their ease of use, compatibility with fast-paced lifestyles, and versatility in everything from direct spreads to sauces and meal kits make them a consumer favorite.

North America's dairy blends market is forecasted to grow at a CAGR of 6.1% between 2025 and 2034, supported by the region's shift toward health-conscious, plant-forward diets. Blends incorporating soy, oat, or almond elements are gaining traction among those seeking clean-label, functional alternatives to traditional dairy. The rising demand for flavor-enhancing, nutrient-rich, and shelf-stable foods further boosts market growth.

Leading companies such as Cargill, Agropur, Friesland Campina, Kerry Group, Fonterra, Dohler, and AFP are pushing the envelope with R&D investments aimed at delivering cleaner labels and higher nutritional value. Through strategic collaborations and sustainability-focused initiatives, these players are expanding their global footprint while meeting consumer expectations for responsible sourcing and reduced environmental impact.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.6 Strategic industry responses

- 3.2.6.1 Supply chain reconfiguration

- 3.2.6.2 Pricing and product strategies

- 3.2.6.3 Policy engagement

- 3.2.7 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS code)

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

Note: The above trade statistics will be provided for key countries only

- 3.4 Supplier landscape

- 3.5 Profit margin analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Consumers prefer dairy blends for lower fat and cholesterol content.

- 3.8.1.2 Growing demand for functional foods

- 3.8.1.3 Dairy blends offer a suitable alternative

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Strict labeling and composition laws can limit market expansion.

- 3.8.2.2 Some buyers see blends as lower quality than pure dairy.

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Dairy cream blends

- 5.3 Butter blends

- 5.4 Yogurt blends

- 5.5 Cheese blends

- 5.6 Other blends

Chapter 6 Market Estimates & Forecast, By Form, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Spreadable

- 6.3 Liquid

- 6.4 Powder

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Bakery & confectionery

- 7.3 Dairy & frozen desserts

- 7.4 Beverages

- 7.5 Nutritional & functional foods

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Kerry Group plc

- 9.2 FrieslandCampina

- 9.3 Cargill, Incorporated

- 9.4 Fonterra Co-operative Group Limited

- 9.5 Dohler GmbH

- 9.6 Agropur

- 9.7 AFP advanced food products llc

- 9.8 Cape Food Ingredients

- 9.9 Intermix Australia Pty Ltd.

- 9.10 Spectrum Organics Products, LLC