|

市场调查报告书

商品编码

1740935

汽车超音波技术市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Ultrasonic Technologies Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

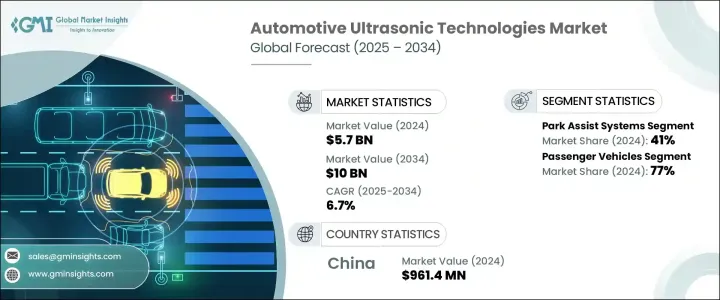

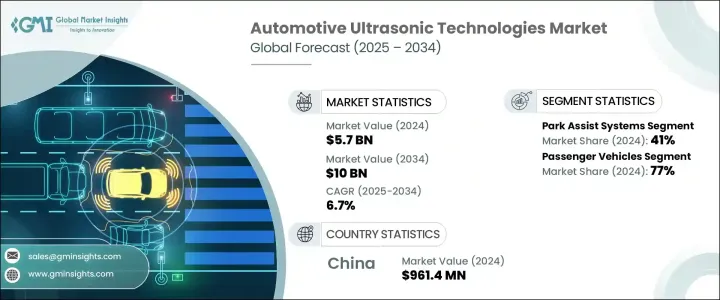

2024年,全球汽车超音波技术市场规模达57亿美元,预计到2034年将以6.7%的复合年增长率成长,达到100亿美元,这得益于对先进汽车安全功能和ADAS等驾驶辅助系统日益增长的需求。随着车辆安全日益成为人们关注的焦点,超音波技术的整合已成为下一代出行的关键推动因素。汽车製造商面临越来越大的压力,需要满足消费者对更安全、更聪明、更连网汽车的期望。这种转变不仅限于高端品牌;中端和经济型汽车市场也在迅速整合超音波感测器系统,以在日益注重安全的消费者主导的市场中保持竞争力。

汽车安全规范的不断演变、技术的进步以及自动驾驶能力的不断提升,正在创造一个超音波技术不再只是可有可无,而是不可或缺的环境。汽车製造商、供应商和技术创新者正在密切合作,致力于将可扩展且经济高效的超音波解决方案推向市场,确保即使是入门级车辆也能配备先进的安全系统。该行业正在加速研发投资,专注于提高感测器的精度、耐用性和价格承受能力,从而扩大其大众市场的普及范围。随着世界各国政府推出严格的汽车安全框架并鼓励智慧出行创新,汽车超音波技术市场将在成熟经济体和新兴经济体中持续成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 57亿美元 |

| 预测值 | 100亿美元 |

| 复合年增长率 | 6.7% |

随着安全标准的日益严格,停车感应器、防撞和盲点侦测等技术正变得越来越流行。各国政府正积极更新车辆安全法规,并引进新的合规框架,强调采用先进的驾驶辅助技术。联合国欧洲经济委员会、美国国家公路交通安全管理局等监管机构以及其他全球组织正在发挥核心作用,强制要求车辆安装障碍物侦测、行人警报系统、自动煞车和增强型停车支援等功能,而这些功能都严重依赖超音波感测功能。随着安全法规从基本合规转向主动事故预防,超音波技术在汽车安全创新中发挥关键作用。汽车製造商现在不仅在高端车型中嵌入超音波感测器,还在中端和入门级车型中嵌入超音波感测器,以满足这些全球安全规范并赢得注重安全的消费者的忠诚度。

在各类应用中,停车辅助系统占最大份额,2024 年占 41%。这些系统让低速操控和停车更加轻鬆安全,尤其适用于小型和中型车辆。与其他先进的安全系统相比,停车辅助系统价格实惠、操作简便,使其成为各类车辆消费者的首选。

市场也依车型细分,到2024年,乘用车将占据77%的市场。随着越来越多的汽车製造商为紧凑型和中型车配备超音波安全功能,需求持续攀升。监管压力要求即使在经济型车型中也必须提高安全性,这进一步加剧了这一趋势。

2024年,中国将占据全球38%的市场份额,这得益于其蓬勃发展的汽车产业以及政府推动汽车安全和智慧的倡议。对电动、混合动力、网路连线和自动驾驶汽车日益增长的需求,进一步加速了超音波技术的普及。

全球汽车超音波技术市场的主要参与者包括现代摩比斯、博世、大陆集团、麦格纳国际、恩智浦半导体、罗克韦尔自动化、三菱电机、意法半导体、泰科电子和德州仪器。这些公司专注于策略合作伙伴关係、持续研发和产品创新,以推动整合、提高性能并满足日益增长的先进汽车安全功能需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 零件製造商

- 模组和系统整合商

- 汽车原厂设备製造商

- 售后市场供应商和安装商

- 利润率分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(销售价格)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 对车辆安全功能和 ADAS 的需求不断增加

- 自动驾驶和半自动驾驶汽车的成长

- 政府法规和安全标准

- 超音波感测器的技术进步

- 消费者对智慧停车解决方案的偏好日益增加

- 产业陷阱与挑战

- 恶劣条件下的性能限制

- 范围和视野有限

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 停车辅助系统

- 盲点侦测

- 避免碰撞

- 自动停车系统

- 其他的

第六章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- 越野车

- 商用车

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车(HCV)

第七章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- 接近检测感测器

- 距离测量感测器

第八章:市场估计与预测:依销售管道,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十章:公司简介

- Autoliv

- Balluff

- Baumer Holding

- Bosch

- Continental

- Elmos Semiconductor

- Garmin

- Honeywell International

- Hyundai Mobis

- Keyence Corporation

- Magna International

- Mitsubishi Electric

- NXP Semiconductors

- Omron Corporation

- Pepperl+Fuchs

- Rockwell Automation

- STMicroelectronics

- TDK Corporation

- TE Connectivity

- Texas Instruments

The Global Automotive Ultrasonic Technologies Market was valued at USD 5.7 billion in 2024 and is estimated to grow at a CAGR of 6.7% to reach USD 10 billion by 2034, driven by rising demand for advanced automotive safety features and driver assistance systems like ADAS. As vehicle safety continues to take center stage, the integration of ultrasonic technologies has emerged as a critical enabler of next-generation mobility. Automakers are under growing pressure to meet consumer expectations for safer, smarter, and more connected vehicles. This shift is not limited to premium brands; mid-range and budget-friendly car segments are also rapidly incorporating ultrasonic sensor systems to stay competitive in a market increasingly shaped by safety-conscious consumers.

The continuous evolution of vehicle safety norms, technological advancements, and a push for autonomous capabilities are creating an environment where ultrasonic technologies are not just optional but essential. Automakers, suppliers, and tech innovators are collaborating intensively to bring scalable, cost-effective ultrasonic solutions to the market, ensuring that even entry-level vehicles are equipped with cutting-edge safety systems. The industry is witnessing accelerated R&D investments focused on enhancing sensor accuracy, durability, and affordability, thus widening the scope for mass-market adoption. As governments worldwide introduce stringent vehicle safety frameworks and encourage smart mobility innovations, the automotive ultrasonic technologies market is set to experience sustained growth across both mature and emerging economies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.7 Billion |

| Forecast Value | $10 Billion |

| CAGR | 6.7% |

Technologies such as parking sensors, collision avoidance, and blind-spot detection are becoming increasingly popular as safety standards tighten. Governments across various regions are actively updating vehicle safety regulations and introducing new compliance frameworks that emphasize the adoption of advanced driver assistance technologies. Regulatory bodies like UNECE, NHTSA, and other global organizations are playing a central role by mandating features such as obstacle detection, pedestrian alert systems, automated braking, and enhanced parking support, all of which rely heavily on ultrasonic sensing capabilities. As safety regulations shift from basic compliance to proactive accident prevention, ultrasonic technologies are securing a pivotal role in automotive safety innovation. Automakers are now embedding ultrasonic sensors not only in premium models but also across mid-range and entry-level vehicles to meet these global safety norms and capture the loyalty of safety-focused consumers.

Among different applications, parking assist systems hold the largest share, accounting for 41% in 2024. These systems make low-speed maneuvering and parking much easier and safer, especially for compact and mid-range vehicles. Their affordability and simplicity compared to other advanced safety systems have made them a go-to choice for consumers across various vehicle categories.

The market is also segmented by vehicle type, with passenger vehicles dominating a 77% share in 2024. Demand continues to climb as more automakers equip compact and mid-sized cars with ultrasonic-enabled safety features. Regulatory pressures requiring enhanced safety even in economy-class models further fuel this trend.

China held a dominant 38% share of the global market in 2024, driven by its robust automotive industry and government initiatives promoting vehicle safety and smart mobility. Growing demand for electric, hybrid, connected, and autonomous vehicles is further accelerating ultrasonic adoption.

Key players in the Global Automotive Ultrasonic Technologies Market include Hyundai Mobis, Bosch, Continental, Magna International, NXP Semiconductors, Rockwell Automation, Mitsubishi Electric, STMicroelectronics, TE Connectivity, and Texas Instruments. These companies are focusing on strategic partnerships, continuous R&D, and product innovation to drive integration, improve performance, and cater to the rising demand for advanced automotive safety features.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturers

- 3.2.3 Module and system integrators

- 3.2.4 Automotive original equipment manufacturers

- 3.2.5 Aftermarket suppliers and installers

- 3.3 Profit margin analysis

- 3.4 Trump Administration Tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on the industry

- 3.4.2.1 Supply-side impact (Raw Materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply Chain Restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.2 Demand-side impact (Selling Price)

- 3.4.2.2.1 Price transmission to end markets

- 3.4.2.2.2 Market share dynamics

- 3.4.2.2.3 Consumer response patterns

- 3.4.2.1 Supply-side impact (Raw Materials)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.4.3 Policy engagement

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing demand for vehicle safety features and ADAS

- 3.9.1.2 Growth of autonomous and semi-autonomous vehicles

- 3.9.1.3 Government regulations and safety standards

- 3.9.1.4 Technological advancements in ultrasonic sensors

- 3.9.1.5 Increasing consumer preference for smart parking solutions

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Performance limitations in adverse conditions

- 3.9.2.2 Limited range and field of view

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Park assist system

- 5.3 Blind spot detection

- 5.4 Collision avoidance

- 5.5 Self-parking system

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Passenger vehicles

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light Commercial Vehicles (LCV)

- 6.3.2 Medium Commercial Vehicles (MCV)

- 6.3.3 Heavy Commercial Vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Proximity detection sensors

- 7.3 Range measurement sensors

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Autoliv

- 10.2 Balluff

- 10.3 Baumer Holding

- 10.4 Bosch

- 10.5 Continental

- 10.6 Elmos Semiconductor

- 10.7 Garmin

- 10.8 Honeywell International

- 10.9 Hyundai Mobis

- 10.10 Keyence Corporation

- 10.11 Magna International

- 10.12 Mitsubishi Electric

- 10.13 NXP Semiconductors

- 10.14 Omron Corporation

- 10.15 Pepperl+Fuchs

- 10.16 Rockwell Automation

- 10.17 STMicroelectronics

- 10.18 TDK Corporation

- 10.19 TE Connectivity

- 10.20 Texas Instruments