|

市场调查报告书

商品编码

1741047

汽车数据记录器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Data Logger Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

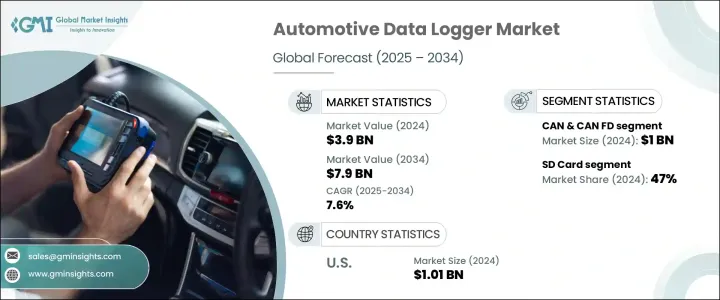

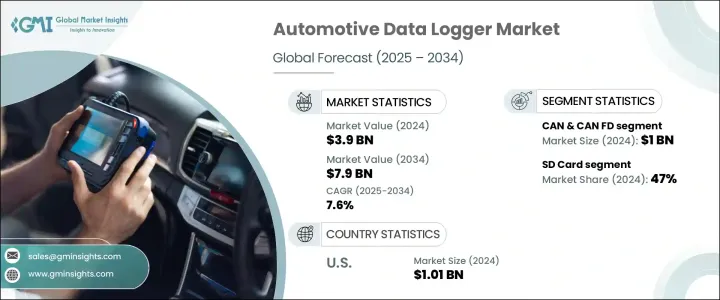

2024年,全球汽车数据记录器市场规模达39亿美元,预计2034年将以7.6%的复合年增长率成长至79亿美元。这一成长主要源自于连网汽车技术的快速发展、安全与排放法规的严格执行,以及对先进车辆诊断和远端资讯处理日益增长的需求。随着全球汽车製造商向电动化和自动驾驶平台转型,资料记录器在收集、储存和分析乘用车和商用车性能资料方面发挥核心作用。这些设备是即时追踪和系统评估的重要工具,能够从电池管理系统、资讯娱乐单元、ADAS和ECU等各种组件中撷取资料。它们的使用增强了预测性维护、软体调试、法规遵循和驾驶员行为洞察,这些对于确保车辆效率和安全都至关重要。随着物联网和云端生态系统在汽车领域的影响力日益增强,现代资料记录器越来越能够支援远端操作和无线更新,从而实现与互联出行和车队管理系统的无缝整合。

就通讯协定而言,市场细分为 CAN 和 CAN FD、LIN、FlexRay 和乙太网路。其中,CAN 和 CAN FD 类别在 2024 年引领市场,创造了约 10 亿美元的收入。这些协议的主导地位源于它们在汽车行业的长期采用。几十年来,CAN 一直是可靠的车载通讯标准,促进了引擎控制和车辆安全等领域的关键系统互动。升级后的 CAN FD 版本允许更高的资料吞吐量并支援更多资料密集型功能,特别是那些涉及现代驾驶辅助系统的功能。其广泛的实用性、成本效益和低延迟功能继续使 CAN 和 CAN FD 成为车载诊断和测试应用中不可或缺的一部分。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 39亿美元 |

| 预测值 | 79亿美元 |

| 复合年增长率 | 7.6% |

从连接类型来看,市场选项包括 USB、蓝牙/Wi-Fi 和 SD 卡。 SD 卡在 2024 年占据 47% 的市场份额,占据领先地位。这种优势源自于 SD 卡的可靠性、易用性和价格实惠。 SD 卡体积小巧,提供高容量储存空间,非常适合在测试和试驾期间记录大量车辆资料。其即插即用的设计简化了设置,并允许在离线环境中提取资料,使其成为在无线基础设施可能受限或易受干扰的预生产阶段非常有价值的工具。

依组件分类,市场分为硬体和软体两大类,其中硬体在2024年将占据主导地位。此细分市场是汽车资料记录系统的核心,包括用于资料撷取的微处理器、用于资料储存的大容量记忆体、用于维护资料完整性的讯号调节器以及用于即时监控的感测器介面。这些组件支援资料记录器和车辆系统使用CAN、FlexRay和乙太网路等协定进行通讯。製造商不断增强这些硬体平台,以满足电动和自动驾驶汽车系统日益增长的复杂性,以及在实际应用中对多通道、高速和多协议功能日益增长的需求。

根据应用,市场分为售前和售后两部分。售前部分在2024年成为主导领域。数据记录器在车辆上市前被广泛使用,用于验证性能、安全性和环保标准合规性。工程师依靠在设计和测试阶段的精确资料采集来优化动力系统、校准ADAS功能并验证电动车型的电池效率。儘管售后部分由于其在诊断和预测性维护中的作用而正在增长,但目前其在整体市场份额中所占比例较小。

就最终用户而言,市场包括原始设备OEM商 (OEM)、服务站、监管机构等。 OEM 细分市场在 2024 年占据最大份额,因为製造商在整个车辆开发生命週期中仍然高度依赖资料记录器。从原型设计到最终验证,资料记录器用于确保始终满足品质标准。随着车辆采用的技术日益复杂,OEM 正在投资先进的资料记录解决方案,以管理从 ECU 验证到下一代系统整合的所有环节。

从地区来看,美国引领北美市场,2024 年营收达 10.1 亿美元,预测期内复合年增长率预计为 6.4%。美国强大的市场地位源于其快速的技术应用、强大的研究基础设施以及对电动和互联出行的持续推动。美国各地的研究实验室、测试机构和製造商持续部署尖端资料记录设备,以支援创新、合规性和系统验证。

在整个产业中,企业正透过合併、策略合作以及对感测器技术和即时分析的投资不断进步。越来越多的企业转向智慧、物联网和无线连接的资料记录器,以简化诊断和效能追踪。这些创新正在帮助整个汽车价值链上的企业提高可靠性,满足更严格的监管要求,并支援更永续、更智慧的车辆设计。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 硬体提供者

- 软体供应商

- 技术提供者

- 最终用途

- 利润率分析

- 供应商格局

- 川普政府关税的影响

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 对贸易的影响

- 技术与创新格局

- 专利分析

- 监管格局

- 用例

- 重要新闻和倡议

- 衝击力

- 成长动力

- 增加电动车产量和自动驾驶汽车测试

- 现代车辆对 ADAS 功能的需求不断增长

- 对即时车辆资料的需求不断增加

- 大幅提高排放标准以减少对环境的影响

- 车队管理解决方案需求不断成长

- 产业陷阱与挑战

- 缺乏训练有素的劳动力来开发先进的资料记录器

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 硬体

- 软体

第六章:市场估计与预测:按通路,2021 - 2034 年

- 主要趋势

- CAN 和 CAN FD

- 林

- FlexRay

- 乙太网路

第七章:市场估计与预测:按连接,2021 - 2034 年

- 主要趋势

- SD卡

- 蓝牙/Wi-Fi

- USB

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 预售

- 售后

- ADAS 和安全

- 汽车保险

- 车队管理

- 车载诊断系统 (OBD)

第九章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- OEM

- 服务站

- 监管机构

- 其他的

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 比荷卢经济联盟

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚

- 澳新银行

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- Aptiv

- Continental

- Danlaw

- Delphi

- Dewesoft

- dSPACE

- Elektrobit

- HEM Data

- Influx Technology

- Intrepid

- IPETRONIK

- Kistler

- MathWorks

- National Instruments

- NSM Solutions

- Racelogic

- Robert Bosch

- TT Tech

- Vector Informatik

- Xilinx

The Global Automotive Data Logger Market was valued at USD 3.9 billion in 2024 and is estimated to grow at a CAGR of 7.6% to reach USD 7.9 billion by 2034. This growth is being shaped by the fast-paced development of connected car technologies, heightened safety and emissions regulations, and the rising demand for advanced vehicle diagnostics and telematics. As automakers worldwide transition toward electric and autonomous platforms, data loggers are playing a central role in gathering, storing, and analyzing performance data across both passenger and commercial vehicle categories. These devices are essential tools for real-time tracking and system evaluations, capturing data from various components like battery management systems, infotainment units, ADAS, and ECUs. Their use enhances predictive maintenance, software debugging, regulatory compliance, and driver behavior insights, which are all crucial for ensuring vehicle efficiency and safety. With the rising influence of IoT and cloud-based ecosystems in the automotive landscape, modern data loggers are increasingly capable of supporting remote operations and over-the-air updates, offering seamless integration into connected mobility and fleet management systems.

In terms of communication protocols, the market is segmented into CAN & CAN FD, LIN, FlexRay, and Ethernet. Among these, the CAN & CAN FD category led the market in 2024, generating approximately USD 1 billion in revenue. The dominance of these protocols stems from their longstanding adoption across the automotive industry. CAN has been a reliable in-vehicle communication standard for decades, facilitating critical system interactions in areas like engine control and vehicle safety. The upgraded CAN FD version allows higher data throughput and supports more data-intensive functions, especially those involving modern driving assistance systems. Their widespread utility, cost-efficiency, and low-latency capabilities continue to make CAN & CAN FD indispensable for in-vehicle diagnostics and testing applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.9 Billion |

| Forecast Value | $7.9 Billion |

| CAGR | 7.6% |

Looking at the market by connection type, options include USB, Bluetooth/Wi-Fi, and SD card. The SD card segment took the lead with a 47% market share in 2024. This preference is due to the SD card's reliability, ease of use, and affordability. Offering high-capacity storage in a compact format, SD cards are well-suited for logging vast volumes of vehicle data during tests and trials. Their plug-and-play design simplifies setup and allows data extraction in offline environments, making them valuable tools in pre-production phases where wireless infrastructure might be limited or vulnerable to interference.

When categorized by component, the market is divided into hardware and software, with hardware taking the dominant share in 2024. This segment represents the core of automotive data logging systems, consisting of microprocessors for data acquisition, high-capacity memory for data storage, signal conditioners to maintain data integrity, and sensor interfaces for real-time monitoring. These components enable communication between data loggers and vehicle systems using protocols like CAN, FlexRay, and Ethernet. Manufacturers continue to enhance these hardware platforms to meet the rising complexity of electric and autonomous vehicle systems, increasing demand for multi-channel, high-speed, and multi-protocol capabilities in real-world conditions.

Based on application, the market is split into pre-sale and post-sale uses. The pre-sale segment emerged as the dominant area in 2024. Data loggers are widely used before a vehicle reaches the market to validate performance, safety, and compliance with environmental standards. Engineers depend on accurate data capture during the design and testing stages to optimize powertrains, calibrate ADAS features, and verify battery efficiency in electric models. Though the post-sale segment is growing due to its role in diagnostics and predictive maintenance, it currently accounts for a smaller portion of the overall market share.

In terms of end users, the market includes OEMs, service stations, regulatory authorities, and others. The OEM segment held the largest share in 2024, as manufacturers continue to rely heavily on data loggers throughout the vehicle development lifecycle. From prototyping to final validation, data loggers are used to ensure quality standards are consistently met. As vehicles incorporate increasingly complex technologies, OEMs are investing in sophisticated data logging solutions to manage everything from ECU validation to next-gen system integration.

Regionally, the United States led the North American market, recording USD 1.01 billion in revenue in 2024, with a projected CAGR of 6.4% during the forecast period. The country's strong position stems from rapid technological adoption, robust research infrastructure, and an increasing push toward electric and connected mobility. Research labs, test facilities, and manufacturers across the U.S. continue to deploy cutting-edge data logging equipment to support innovation, compliance, and system validation.

Across the industry, companies are advancing through mergers, strategic collaborations, and investments in sensor technologies and real-time analytics. There's a growing shift toward smart, IoT-enabled, and wirelessly connected data loggers that streamline diagnostics and performance tracking. These innovations are helping organizations across the automotive value chain improve reliability, meet stricter regulatory demands, and support more sustainable and intelligent vehicle designs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Hardware providers

- 3.1.1.2 Software providers

- 3.1.1.3 Technology providers

- 3.1.1.4 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Impact of Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Strategic industry responses

- 3.2.3.1 Supply chain reconfiguration

- 3.2.3.2 Pricing and product strategies

- 3.2.1 Impact on trade

- 3.3 Technology & innovation landscape

- 3.4 Patent analysis

- 3.5 Regulatory landscape

- 3.6 Use cases

- 3.7 Key news & initiatives

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Increasing electric vehicle production and autonomous vehicle testing

- 3.8.1.2 Rising demand for ADAS features in modern vehicles

- 3.8.1.3 Increasing demand for real-time vehicle data

- 3.8.1.4 Surge in emission norms to reduce environmental impact

- 3.8.1.5 Rising demand for fleet management solutions

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Lack of a trained workforce for the development of advanced data loggers

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

Chapter 6 Market Estimates & Forecast, By Channel, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 CAN & CAN FD

- 6.3 LIN

- 6.4 FlexRay

- 6.5 Ethernet

Chapter 7 Market Estimates & Forecast, By Connection, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 SD Card

- 7.3 Bluetooth/Wi-Fi

- 7.4 USB

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Pre-sale

- 8.3 Post-sale

- 8.3.1 ADAS and safety

- 8.3.2 Automotive insurance

- 8.3.3 Fleet management

- 8.3.4 OBD

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Service station

- 9.4 Regulatory bodies

- 9.5 others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Benelux

- 10.3.7 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Southeast Asia

- 10.4.6 ANZ

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Aptiv

- 11.2 Continental

- 11.3 Danlaw

- 11.4 Delphi

- 11.5 Dewesoft

- 11.6 dSPACE

- 11.7 Elektrobit

- 11.8 HEM Data

- 11.9 Influx Technology

- 11.10 Intrepid

- 11.11 IPETRONIK

- 11.12 Kistler

- 11.13 MathWorks

- 11.14 National Instruments

- 11.15 NSM Solutions

- 11.16 Racelogic

- 11.17 Robert Bosch

- 11.18 TT Tech

- 11.19 Vector Informatik

- 11.20 Xilinx