|

市场调查报告书

商品编码

1766258

汽车数据货币化市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Data Monetization Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

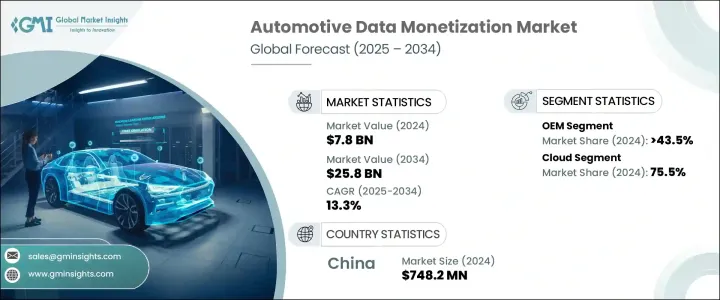

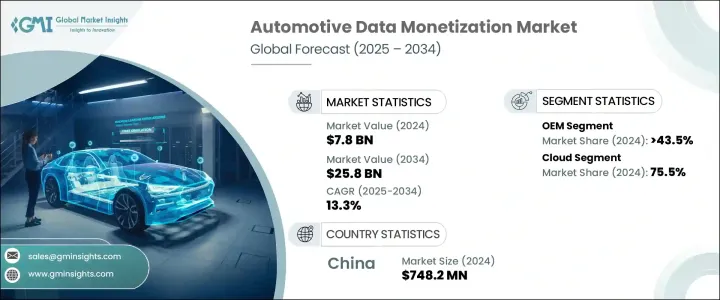

2024年,全球汽车数据货币化市场规模达78亿美元,预计2034年将以13.3%的复合年增长率成长,达到258亿美元。市场成长主要得益于连网汽车的广泛应用。这些汽车透过嵌入式感测器、远端资讯处理和通讯系统产生大量即时资料。连网汽车收集的数据,包括驾驶行为、环境状况、位置信息,甚至驾驶员健康状况,为汽车製造商、保险公司、车队运营商和服务提供商创造了开发新型数据驱动型商业模式的机会。

利用云端平台和进阶分析技术,近乎即时地处理、分析和货币化车辆资料的能力变得越来越重要。政府法规和基础设施的发展也促进了对资料透明度以及车辆与公共系统整合的需求日益增长。此外,预测性维护、基于远端资讯处理的保险和资讯娱乐服务等先进技术,使企业能够从汽车资料中开闢新的收入来源。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 78亿美元 |

| 预测值 | 258亿美元 |

| 复合年增长率 | 13.3% |

2024年,原始设备製造商 ( OEM ) 占据市场主导地位,价值30亿美元,占43.5%。 OEM是收集和管理连网汽车资料的关键参与者,因为它们整合了可直接存取引擎性能、用户偏好和车辆诊断资料的技术。透过控制和管理资料流,OEM拥有独特的优势,可以提供个人化服务,例如基于订阅的功能、即时资讯娱乐和预测性维护解决方案。此外,OEM正在增加对云端平台的投资,以便在内部管理资料或与其他企业合作,从而对资料治理保持严格的控制。

2024年,云端运算领域占了75.5%的份额。云端平台助力汽车资料货币化生态系统,因为它们使原始设备製造商(OEM)和服务供应商能够扩展储存和处理能力,这对于管理连网汽车产生的大量即时资料至关重要。这些平台透过支援即时分析和机器学习模型,支援各种服务,包括预测性维护、基于使用情况的保险 (UBI) 和行动出行管理。云端基础架构也减少了对昂贵的本地IT系统的需求,为资料管理提供了更具成本效益的解决方案,并允许企业按实际使用量付费。这使得云端运算成为寻求高效、可扩展且经济实惠的资料货币化解决方案的企业中越来越受欢迎的选择。

亚太地区汽车数据货币化产业占据35%的市场份额,2024年创造了7.482亿美元的市场规模。中国5G网路的快速普及以及物联网(IoT)生态系统的进步,推动了对车联网服务的需求,包括远端资讯处理和车联网(V2X)通讯。中国本土汽车製造商正在大力投资云端服务、车载人工智慧和数位服务平台,这推动了数据驱动型商业模式的成长。中国消费者对数位汽车产品和服务的接受度更高,使得车联网技术和资料货币化策略的接受度更高。

全球汽车数据货币化行业的主要参与者包括博世、IBM、Caruso GmbH、大陆集团、Airlinq Inc.、考克斯汽车、Geotab、哈曼国际、甲骨文和 Urgent.ly Inc (Otonomo)。为了巩固市场地位,汽车资料货币化领域的公司正致力于扩大与原始设备製造商 (OEM)、保险公司和服务提供者的合作伙伴关係。这种方法增强了他们提供全面数据驱动解决方案的能力。此外,许多公司正在投资建立强大的基于云端的平台,以提供可扩展且经济高效的资料管理服务。这些公司专注于进阶分析和机器学习能力,旨在为客户提供更有价值的洞察和预测功能。此外,公司正在针对特定地区开发客製化解决方案,利用当地的基础设施、法规和客户偏好。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 衝击力

- 成长动力

- 连网汽车的普及

- 预测性维护的成长

- 扩大车队和行动服务

- 政府法规和智慧基础设施

- 产业陷阱与挑战

- 资料隐私和安全问题

- 缺乏标准化

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 用例

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 直接获利

- 间接获利

第六章:市场估计与预测:按部署,2021 - 2034 年

- 主要趋势

- 本地

- 云

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 保险

- 预测性维护

- 车队管理

- 出游即服务 (MaaS)

- 政府和基础设施

- 其他的

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- OEM

- 车队营运商

- 第三方服务提供者

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Airlinq

- Bosch

- Caruso

- Continental

- Cox Automotive

- Geotab

- Harman

- High Mobility

- IBM

- INRIX

- Lear

- Masternaut

- Motorq

- Nexar

- Octo Telematics

- Oracle

- The Floow

- Urgent.ly (Otonomo)

- Vinchain

- Vinli

The Global Automotive Data Monetization Market was valued at USD 7.8 billion in 2024 and is estimated to grow at a CAGR of 13.3% to reach USD 25.8 billion by 2034. The growth in the market is primarily driven by the widespread adoption of connected vehicles. These vehicles generate vast amounts of real-time data through embedded sensors, telematics, and communication systems. Data gathered from connected cars, including driving behavior, environmental conditions, location, and even driver health, creates opportunities for automotive manufacturers, insurance providers, fleet operators, and service providers to develop new data-driven business models.

By leveraging cloud-based platforms and advanced analytics, the ability to process, analyze, and monetize vehicle data in near real-time has become increasingly essential. Government regulations and infrastructure developments are also contributing to the increasing demand for data transparency and the integration of vehicles with public systems. Additionally, advanced technologies, such as predictive maintenance, telematics-based insurance, and infotainment services, are enabling companies to unlock new revenue streams from automotive data.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.8 Billion |

| Forecast Value | $25.8 Billion |

| CAGR | 13.3% |

In 2024, the OEM (Original Equipment Manufacturer) segment held a dominant position in the market, valued at USD 3 billion and accounting for a 43.5% share. OEMs are key players in collecting and managing data from connected vehicles, as they integrate technologies that provide direct access to data on engine performance, user preferences, and vehicle diagnostics. By controlling and managing data flow, OEMs are in a unique position to offer personalized services such as subscription-based features, real-time infotainment, and predictive maintenance solutions. Additionally, OEMs are increasingly investing in their cloud platforms to manage data internally or collaborate with other businesses, maintaining strict control over data governance.

The cloud segment held a 75.5% share in 2024. Cloud platforms help in the automotive data monetization ecosystem, as they enable OEMs and service providers to scale storage and processing capabilities, crucial for managing massive volumes of real-time data generated by connected vehicles. These platforms support various services, including predictive maintenance, usage-based insurance (UBI), and mobility management, by enabling real-time analytics and machine learning models. The cloud infrastructure also reduces the need for expensive on-premises IT systems, offering a more cost-effective solution for data management and allowing companies to pay only for what they use. This has made the cloud an increasingly popular choice among businesses seeking efficient, scalable, and affordable solutions for data monetization.

Asia Pacific Automotive Data Monetization Industry held a 35% share and generated USD 748.2 million in 2024. China's rapid adoption of 5G networks and advancements in the Internet of Things (IoT) ecosystem have helped in driving the demand for connected vehicle services, including telematics and vehicle-to-everything (V2X) communication. Domestic vehicle manufacturers in China are investing heavily in cloud services, in-car artificial intelligence, and digital services platforms, which are fueling the growth of data-driven business models. Chinese consumers are more receptive to digital automotive products and services, enabling greater acceptance of connected car technologies and data monetization strategies.

Key players in the Global Automotive Data Monetization Industry include Bosch, IBM, Caruso GmbH, Continental, Airlinq Inc., Cox Automotive, Geotab, Harman International, Oracle, and Urgent.ly Inc (Otonomo). To strengthen their market position, companies in the automotive data monetization sector are focusing on expanding their partnerships with OEMs, insurance firms, and service providers. This approach enhances their ability to offer comprehensive, data-driven solutions. Additionally, many companies are investing in building robust cloud-based platforms to offer scalable and cost-efficient data management services. Emphasizing advanced analytics and machine learning capabilities, these firms aim to provide more valuable insights and predictive features to their clients. Furthermore, companies are developing tailored solutions for specific regions, leveraging local infrastructure, regulations, and customer preferences.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.5 Forecast model

- 1.6 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Deployment

- 2.2.4 Application

- 2.2.5 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Proliferation of connected vehicles

- 3.2.1.2 Growth in predictive maintenance

- 3.2.1.3 Expansion of fleet and mobility services

- 3.2.1.4 Government regulations and smart infrastructure

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Data privacy and security concerns

- 3.2.2.2 Lack of standardization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.9 Patent analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly initiatives

- 3.10.5 Carbon footprint considerations

- 3.11 Use cases

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Direct monetization

- 5.3 Indirect monetization

Chapter 6 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 On-premises

- 6.3 Cloud

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Insurance

- 7.3 Predictive maintenance

- 7.4 Fleet management

- 7.5 Mobility-as-a-service (MaaS)

- 7.6 Government & infrastructure

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Fleet operators

- 8.4 Third-party service providers

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Airlinq

- 10.2 Bosch

- 10.3 Caruso

- 10.4 Continental

- 10.5 Cox Automotive

- 10.6 Geotab

- 10.7 Harman

- 10.8 High Mobility

- 10.9 IBM

- 10.10 INRIX

- 10.11 Lear

- 10.12 Masternaut

- 10.13 Motorq

- 10.14 Nexar

- 10.15 Octo Telematics

- 10.16 Oracle

- 10.17 The Floow

- 10.18 Urgent.ly (Otonomo)

- 10.19 Vinchain

- 10.20 Vinli