|

市场调查报告书

商品编码

1750284

太阳能光电回收市场机会、成长动力、产业趋势分析及2025-2034年预测Solar PV Recycling Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

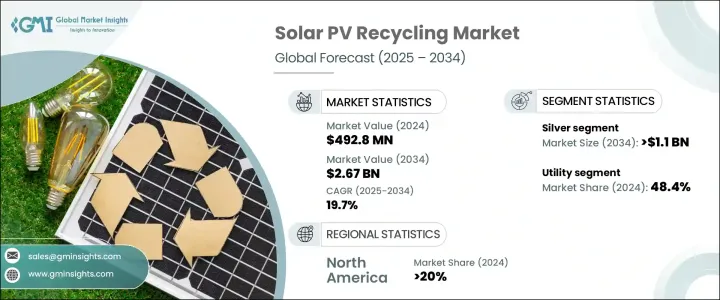

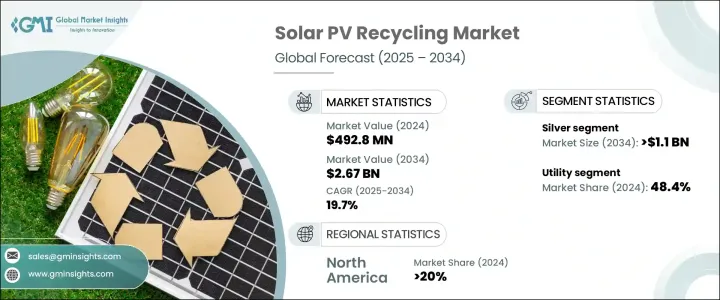

2024年,全球太阳能光电回收市场规模达4.928亿美元,预计到2034年将以19.7%的复合年增长率成长,达到26.7亿美元。这得归功于全球日益增强的环境永续意识,以及管理日益增加的太阳能光电废弃物的迫切需求。随着越来越多二、三十年前安装的光电板达到生命週期的终点,市场对高效率回收流程的需求激增。各国政府、环保机构和私人利益相关者正在推动改善回收基础设施,以防止垃圾掩埋场的堆积,并回收电池板生产过程中使用的关键材料。

太阳能产业对高纯度硅、铟和银等有限资源的依赖,推动了回收创新的进一步发展。地缘政治动盪加剧以及全球供应链中断,加剧了人们对国内材料回收的兴趣,认为这不仅能增强供应安全,还能支持环境目标。企业正在转向先进的回收技术,以优化成本并减少浪费。现代科技正在帮助製造商回收有价值的材料,同时符合循环经济政策,进一步推动市场发展。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 4.928亿美元 |

| 预测值 | 26.7亿美元 |

| 复合年增长率 | 19.7% |

2024年,铜的市占率高达17.3%,这得益于其日益稀缺的材质和持续的高市场回收价值。铜是太阳能电池板和整个再生能源系统的关键组成部分,因此从退役太阳能板中回收铜已成为回收商的首要任务。随着全球减少对采矿业依赖和支持循环经济的压力日益增大,从废弃太阳能板中提取铜既能带来环境效益,又能带来经济效益。

预计到2034年,住宅太阳能市场将创造8.01亿美元的市场价值,这得益于消费者对太阳能废弃物环境影响意识的不断增强。越来越多的房主寻求可持续的解决方案,将太阳能板回收纳入住宅太阳能係统正逐渐成为常态。国家关于电子和危险废物处理的规定,以及税收抵免和回收计划,正在强化这种做法。随着消费者优先考虑环保能源系统,回收商正利用这一转变,提供家庭友善、合规且经济高效的回收服务,以延长太阳能组件的使用寿命。

到2034年,亚太地区太阳能光电回收市场将创造11.2亿美元的产值,这得益于中国、日本和印度等国家广泛建立的太阳能基础设施,以及大量过时或故障的太阳能板。日益严峻的废弃物挑战正促使该地区的政府和私人企业投资建造在地化的回收设施。这些措施不仅有助于实现国家永续发展目标,还能创造新的就业机会,并推动区域製造业生态系统的发展。

全球太阳能光电回收市场的主要参与者包括 Aurubis、SunPower Corporation、SILCONTEL、Solarcycle、Reiling、Veolia、Canadian Solar、天合光能、丸红株式会社、We Recycle Solar、Echo Environmental 和 First Solar。为了在不断发展的太阳能光电回收市场中站稳脚跟,各公司正在实施各种策略,例如建立本地回收设施、建立公私合作伙伴关係以及投资研发下一代回收方法。许多公司正在扩大业务覆盖范围、提升加工能力,并使营运符合环保合规标准,以提高获利能力和品牌信誉。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 策略倡议

- 公司市占率

- 战略仪表板

- 公司标竿分析

- 创新与技术格局

第五章:市场规模及预测:按可回收材料,2021 年至 2034 年

- 主要趋势

- 银

- 铝

- 铜

- 玻璃

- 其他的

第六章:市场规模及预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 住宅

- 商业和工业

- 公用事业

第七章:市场规模及预测:依工艺,2021 年至 2034 年

- 主要趋势

- 机械的

- 热的

- 雷射

第八章:市场规模及预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 义大利

- 法国

- 英国

- 亚太地区

- 中国

- 印度

- 日本

- 中东和非洲

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 智利

第九章:公司简介

- Aurubis

- Canadian Solar

- Echo Environmental

- First Solar

- Marubeni Corporation

- Reiling

- SILCONTEL

- Solarcycle

- SunPower Corporation

- Trina Solar

- Veolia

- We Recycle Solar

The Global Solar PV Recycling Market was valued at USD 492.8 million in 2024 and is estimated to grow at a CAGR of 19.7% to reach USD 2.67 billion by 2034, driven by increasing global awareness around environmental sustainability and the urgent need to manage the growing volume of solar photovoltaic waste. As more PV panels installed two to three decades ago reach the end of their lifecycle, the market is witnessing a surge in demand for efficient recycling processes. Governments, environmental agencies, and private stakeholders push for better recycling infrastructure to prevent landfill accumulation and recover critical materials used in panel production.

The solar industry's reliance on finite resources such as high-purity silicon, indium, and silver pushes for greater recycling innovation. Escalating geopolitical instability and disruptions in the global supply chain have heightened interest in domestic material recovery, which enhances supply security while supporting environmental goals. Companies are turning toward advanced recovery technologies to optimize costs and reduce waste. Modern techniques are helping manufacturers reclaim valuable materials while aligning with circular economy policies, further propelling market momentum.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $492.8 Million |

| Forecast Value | $2.67 Billion |

| CAGR | 19.7% |

In 2024, copper secured a notable 17.3% share, attributed to its increasing material scarcity and consistently high market recovery value. With copper being a critical component in solar panels and overall renewable energy systems, its recovery from decommissioned panels has become a major priority for recyclers. As pressure mounts globally to reduce dependency on mining and support a circular economy, copper extraction from used solar modules offers both environmental and financial benefits.

The residential segment is expected to generate USD 801 million by 2034, backed by heightened consumer awareness about the environmental impact of solar waste. Homeowners are increasingly seeking sustainable solutions, and the integration of panel recycling into residential solar energy systems is steadily becoming the norm. National regulations surrounding electronic and hazardous waste disposal, along with tax credits and take-back programs, are reinforcing this behavior. As consumers prioritize eco-friendly energy systems, recyclers are capitalizing on this shift by offering household-friendly, compliant, and cost-effective recycling services that extend the lifecycle of solar components.

Asia Pacific Solar PV Recycling Market generated USD 1,120 million by 2034, driven by the widespread solar infrastructure established across nations like China, Japan, and India, and the volume of outdated or failing solar panels. This mounting waste challenge is pushing governments and private enterprises in the region to invest in localized recycling facilities. These efforts are not only meeting national sustainability targets but also generating new employment opportunities and advancing regional manufacturing ecosystems.

Key players in the Global Solar PV Recycling Market include Aurubis, SunPower Corporation, SILCONTEL, Solarcycle, Reiling, Veolia, Canadian Solar, Trina Solar, Marubeni Corporation, We Recycle Solar, Echo Environmental, and First Solar. To secure their foothold in the evolving solar PV recycling market, companies are implementing strategies such as establishing local recycling facilities, forming public-private partnerships, and investing in R&D for next-generation recovery methods. Many are expanding their geographic reach, upgrading processing capacities, and aligning operations with environmental compliance standards to improve profitability and brand credibility.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic initiatives

- 4.3 Company market share

- 4.4 Strategic dashboard

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Recyclable Material, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Silver

- 5.3 Aluminum

- 5.4 Copper

- 5.5 Glass

- 5.6 Others

Chapter 6 Market Size and Forecast, By End Use, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Residential

- 6.3 Commercial & industrial

- 6.4 Utility

Chapter 7 Market Size and Forecast, By Process, 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 Mechanical

- 7.3 Thermal

- 7.4 Laser

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 Italy

- 8.3.3 France

- 8.3.4 UK

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.5 Middle East & Africa

- 8.5.1 UAE

- 8.5.2 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Chile

Chapter 9 Company Profiles

- 9.1 Aurubis

- 9.2 Canadian Solar

- 9.3 Echo Environmental

- 9.4 First Solar

- 9.5 Marubeni Corporation

- 9.6 Reiling

- 9.7 SILCONTEL

- 9.8 Solarcycle

- 9.9 SunPower Corporation

- 9.10 Trina Solar

- 9.11 Veolia

- 9.12 We Recycle Solar