|

市场调查报告书

商品编码

1635517

中东和非洲的太阳能板回收:市场占有率分析、行业趋势和成长预测(2025-2030)Middle East and Africa Solar Panel Recycling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

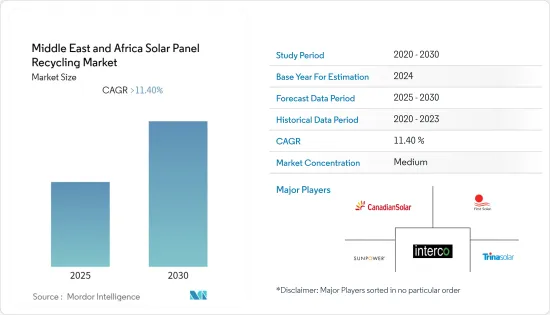

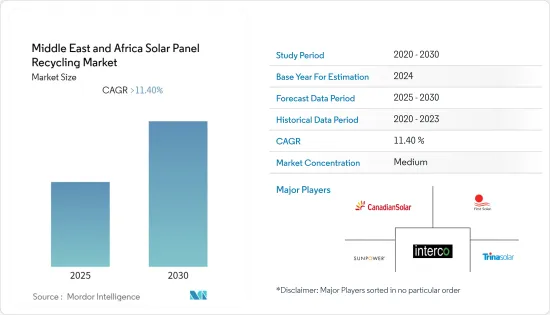

预计中东和非洲的太阳能板回收市场在预测期内复合年增长率将超过 11.4%。

2020 年,市场受到 COVID-19 大流行的负面影响。我们现在处于大流行前的水平。

主要亮点

- 从长远来看,预计全部区域太阳能板废弃物产生量将增加,越来越多的政府和组织透过支持措施、法规和政策关注太阳能板回收,预计将促进中国的市场研究。

- 另一方面,由于回收成本高于回收材料的经济价值,企业不会投资回收活动,预计这将对市场成长产生负面影响。

- 提高效率、减少负面影响并降低迴收成本的新回收方法的开发预计将在未来几年为太阳能电池板回收参与企业提供重大商机。

- 预计在预测期内,南非的中东和非洲太阳能板回收市场将强劲成长。

中东和非洲太阳能板回收市场趋势

硅晶型(c-Si)类型实现显着成长

- 在中东和非洲,硅晶型太阳能板占据市场主导地位,占据大部分市场占有率。但由于效率低下,近年来晶硅产品已经停产,晶硅太阳能板的回收市场大幅扩大。

- c-Si 技术由太阳能级硅薄带(也称为晶圆)组成,组装电池并与电池板电连接。太阳能板由 76% 玻璃、10% 塑胶、8% 铝、5% 硅和 1% 金属製成。回收过程产生约 96% 的材料,可重新用于製造新的太阳能板。

- 在纯机械製程中,以面板品质计算,硅晶型的回收率约为 85%。然而,热、机械和化学过程的结合会导致杂质含量较高和转售价值较低,因此需要结合多种方法,而不仅仅是单一方法。

- 过程的第一步是拆卸铝和玻璃组件,从中回收约 95% 的玻璃和 100% 的金属。其余材料,如塑胶和电池模组,在热处理机中进行 500°C 的热处理,以鬆开电池元件之间的结合。

- 从太阳能电池板回收的玻璃的回收成本相对较低,并且对平板玻璃回收商来说只需要很少的额外投资。此外,到2030年,太阳能板中玻璃的重量预计将增加4%,达到80%左右,从而降低新太阳能板的成本并提高旧太阳能板的回收效率。

- 因此,由于上述因素,预计在预测期内,中东和非洲太阳能板回收市场对硅晶型类型的需求将庞大。

南非预计需求量大

- 南非是该地区最大的太阳能市场之一。该国的装置容量约为5.7GW,使其成为截至2021年运作中的最大太阳能係统市场。然而,该国的太阳能市场近年来经历了停滞,主要原因是可再生能源竞标的延迟。

- 到 2030 年,太阳能板废弃物预计将增加约 8,500 吨,高于 2021 年估计的 450 吨。然而,截至2021年,该国还没有太阳能设备的回收设施。

- 回收太阳能板在非洲国家在经济上不可行,因此大部分太阳能废弃物在 2021 年被倒入该国的垃圾掩埋场。此外,该国政府也专注于投资新的太阳能板回收技术。因此,预计预测期内市场成长率将温和。

- 短期内,该国可回收的太阳能电池板废弃物并不多,但随着该国的能源目标朝着比其他地区更永续的模式发展,未来是光明的。预计该国将在不久的将来成为太阳能废弃物回收的潜在中心。

- 因此,由于上述因素,预计南非的中东和非洲太阳能板回收市场在预测期内将显着成长。

中东和非洲太阳能板回收产业概况

中东和非洲的太阳能板回收市场具有综合性。市场主要企业包括(排名不分先后)First Solar Inc.、Interco Trading Inc.、Trina Solar Ltd.、SunPower Corporation 和 Canadian Solar Inc.。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2027年市场规模及需求预测(单位:百万美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按流程

- 热

- 机器

- 化学

- 其他的

- 按类型

- 硅晶型

- 薄膜

- 按地区

- 南非

- 埃及

- 阿拉伯聯合大公国

- 其他中东/非洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Canadian Solar Inc.

- First Solar Inc.

- Rinovasol GMBH

- Sharp Corporation

- SunPower Corporation

- Trina Solar Ltd

- Interco Trading Inc.

第七章 市场机会及未来趋势

The Middle East and Africa Solar Panel Recycling Market is expected to register a CAGR of greater than 11.4% during the forecast period.

The market was negatively impacted by the COVID-19 pandemic in 2020. Presently, it has reached pre-pandemic levels.

Key Highlights

- Over the long term, factors such as increasing solar panel waste generation across the region, coupled with increasing focus of the respective governments and organizations on solar panel recycling through supportive initiatives, policies, and regulations, are expected to drive the market studied during the forecast period.

- On the flip side, with recycling costing more than the economic value of the recovered materials, companies are not expected to invest in recycling activities, thereby negatively impacting the market's growth.

- The development of new recycling methods to increase efficiency, reduce downsides, and reduce recycling costs is expected to present huge opportunities for solar panel recycling players in the coming years.

- South Africa is expected to witness significant growth in the Middle East and African solar panel recycling market during the forecast period.

MEA Solar Panel Recycling Market Trends

Crystalline Silicon (c-Si) Type to Witness Significant Growth

- Crystalline silicon solar panels dominate the market and hold a majority of the market share in the Middle East and African regions. But due to low-efficiency ratios, the c-Si products have been discontinued in recent years, which has significantly increased the c-Si solar panel recycling market.

- The c-Si technology consists of thin slices of solar-grade silicon, also known as wafers, made into cells, assembled into panels, and connected electrically. The solar panels are made of 76% glass, 10% plastic, 8% aluminum, 5% silicon, and 1% metals. The recycling process yields about 96% of the materials to be reused for producing new solar panels.

- Through the purely mechanical process, the recovery from crystalline silicon is around 85% by panel mass. However, without a combination of the thermal, mechanical, and chemical process, the level of impurities is high enough to reduce the resale value, thereby making it necessary to use a combination of methods instead of just a single method.

- The first step of the process is disassembling the aluminum and glass parts, from which around 95% of the glass and 100% of the metals can be reused. The remaining materials, like plastics and cell modules, are treated thermally at 500 °C in a thermal processing unit to ease the binding between the cell elements.

- The recycling of glass recovered from a solar panel is relatively low cost and involves minimal additional investments for flat-glass recycling companies. Also, by 2030, the weight of glass in a solar panel is expected to rise by 4%, making it around 80%, reducing the cost of new solar panels and increasing the recovery efficiency of old solar panels.

- Therefore, based on the above factors, the crystalline silicon type is expected to witness significant demand in the Middle East and African solar panel recycling market during the forecast period.

South Africa to Witness Significant Demand

- South Africa is one of the largest solar PV markets in the region. With an installed PV capacity of around 5.7 GW, the country, as of 2021, is the largest market in terms of operational solar systems. However, the country's solar market experienced stagnation in the past years, primarily due to the postponement of its renewable energy auctions.

- By 2030, the country is expected to add around 8,500 tons of solar panel waste, up from an estimated 450 metric tons in 2021. However, as of 2021, the country has no recycling facilities for solar equipment.

- In 2021, most of the solar waste was emptied into a landfill in the country as recycling solar panels is not economically viable in African countries. Moreover, the country's government is focusing on investing in new solar panel recycling technology. Therefore, the market is expected to witness a moderate growth rate during the forecast period.

- Although, in the short term, the country has not realized significant solar panel waste that can be viably recycled domestically, the future remains bright as the country's energy goals are steered toward more sustainable models than its regional counterparts. The country is expected to emerge as a potential hub for solar waste recycling in the near future.

- Therefore, based on the above factors, South Africa is expected to witness significant growth in the Middle East and African solar panel recycling market during the forecast period.

MEA Solar Panel Recycling Industry Overview

The Middle East and African solar panel recycling market is consolidated in nature. Some of the major players in the market (in no particular order) include First Solar Inc., Interco Trading Inc., Trina Solar Ltd, SunPower Corporation, and Canadian Solar Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD Million, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Process

- 5.1.1 Thermal

- 5.1.2 Mechanical

- 5.1.3 Chemical

- 5.1.4 Other Processes

- 5.2 By Type

- 5.2.1 Crystalline Silicon

- 5.2.2 Thin Film

- 5.3 By Geography

- 5.3.1 South Africa

- 5.3.2 Egypt

- 5.3.3 United Arab Emirates

- 5.3.4 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Canadian Solar Inc.

- 6.3.2 First Solar Inc.

- 6.3.3 Rinovasol GMBH

- 6.3.4 Sharp Corporation

- 6.3.5 SunPower Corporation

- 6.3.6 Trina Solar Ltd

- 6.3.7 Interco Trading Inc.