|

市场调查报告书

商品编码

1644944

欧洲太阳能板回收 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Europe Solar Panel Recycling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

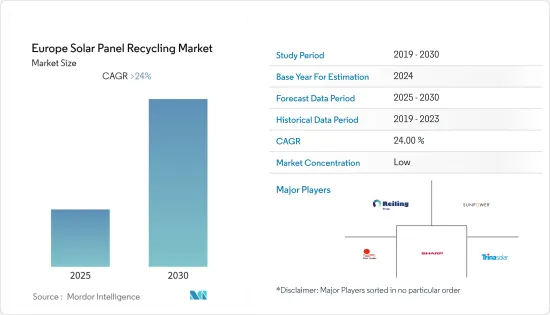

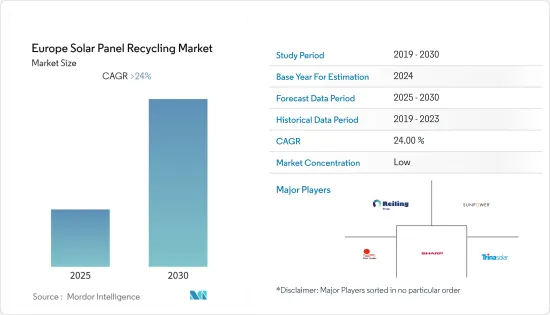

预测期内,欧洲太阳能板回收市场预计将以超过 24% 的复合年增长率成长。

市场受到了 COVID-19 的不利影响。目前市场已恢復至疫情前的水准。

关键亮点

- 从长远来看,预计预测期内对太阳能的不断增长的需求以及太阳能电池对更绿色环境的贡献将推动市场的发展。此外,降低太阳能板的成本是市场成长的重要因素。

- 然而,公众认知度和兴趣较低是市场发展的一大限制。重复使用光伏板有时在经济上可能是一种困难的选择,从而阻碍市场成长。

- 近年来回收过程效率的提高预计将为市场提供充足的机会。目前处于研究阶段的回收方法的一个例子是由 Loser Chemie 开发的方法。

- 预计未来几年德国将透过规划的各种太阳能板安装计划占据市场主导地位。

欧洲太阳能板回收市场的趋势

硅晶型占据市场主导地位

- 硅晶型太阳能板的製造使用铝框架、玻璃、铜线、聚合物层、背板、硅太阳能电池和塑胶接线盒。聚合物层可以保护面板免受自然因素的影响,但也使其难以回收或拆卸,因为通常需要高温才能去除黏合剂。

- 另外,实验室硅晶型太阳能电池能量转换效率达25%以上,实验室多晶太阳能电池能量转换效率达20%以上。使用硅晶型的优点包括可靠性(硅晶型电池的模组寿命超过25年,且长期性能几乎不会劣化),以及硅的易得性,硅是地壳中第二丰富的元素。

- 到 2030 年,全球可从废弃面板中回收材料的价值将达到约 4.5 亿美元,相当于製造约 6,000 万块新面板所需材料的价值。将太阳能电池板从垃圾掩埋场转移到回收利用可以节省垃圾掩埋场空间,同时实现原料的价值。

- 根据WEEE指令,欧洲国家必须制定光伏废弃物管理政策,并要求生产商负责其销售的太阳能板的收集和回收。该法规有两个主要目标。首先,它将鼓励市场创造使用更少原料、更容易回收的产品。其次,它鼓励生产商将产品收集和报废护理的成本纳入消费者为其商品支付的价格中。

- 2021年,欧洲太阳能光电装置容量达18.35万千瓦。预测期内光伏容量预计会增加。太阳能板使用量的突然增加,加上政府对太阳能板回收的倡议,产生了对负责任的工业规模回收和废物处理的需求,从而推动了太阳能电池板回收市场的发展。

- 因此,由于硅晶型部分比其他部分享有更大的利用优势,预计预测期内将占据市场主导地位。

德国占据市场主导地位

- 德国占欧洲太阳能发电能力的大部分,因此预计将主导太阳能板回收市场。此外,政府也设定了2030年将太阳能发电能力提高到200GW的目标,为实现这一目标,政府计划将太阳能发电竞标提高到20GW。

- 此外,德国的发电能力将增加约八倍,从2020年的50吉瓦多一点增加到本世纪中叶的4.15吉瓦左右。为实现2030年能源消耗中65%可再生能源的目标,太阳能和风电装置容量每年的新增规模必须达到至少5GW。因此,太阳能发电能力的增加将导致太阳能板安装数量的增加,这将为预测期内的太阳能板回收市场带来机会。

- 为了回收废弃旧光伏(PV)模组,德国威立雅公司正在计划监督下开发一种高效而独特的技术。与活跃于光伏组件回收供应链的公共和私营部门合作伙伴一起。欧盟透过 EIT RawMaterials 项目为该倡议提供了总计 480 万欧元的资金。

- 2021年,德国太阳能发电装置容量达58,500千瓦。预测期内,太阳能发电能力预计会增加,这将增加太阳能板的装置容量,从而推动未来太阳能板回收市场的发展。

- 鑑于上述情况,由于光伏回收技术和计划的新兴市场发展,预计德国将在预测期内占据市场主导地位。

欧洲太阳能板回收产业概况

欧洲太阳能板回收市场适度整合。市场的主要企业(不分先后顺序)包括天合光能有限公司、夏普株式会社、First Solar Inc、SunPower Corporation 和 Reiling Group GmbH &Co.KG。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 2027 年市场规模及需求预测(十亿美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 按工艺

- 热

- 机器

- 雷射

- 按类型

- 硅晶型

- 薄膜

- 按地区

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 欧洲其他地区

第六章 竞争格局

- 供应商市场占有率

- 合併和收购

- 公司简介

- Sunpower Corporation

- Reiling Group GmbH & Co. KG

- Rosi Solar

- JA Solar Co.

- Univergy International

- Renesola

- Trina Solar Co.

- First Solar Inc.

第七章 市场机会与未来趋势

简介目录

Product Code: 93272

The Europe Solar Panel Recycling Market is expected to register a CAGR of greater than 24% during the forecast period.

The market was negatively impacted by COVID-19. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the long term, the growing demand for solar energy and solar contribution to a greener environment is expected to drive the market in the forecast period. In addition, the reduction in solar panel costs is an essential factor for market growth.

- On the other hand, lack of general awareness and interest is the major restrain for the market. Sometimes, reusing PV panels becomes a challenging economic option, thus, hampering the growth of the market.

- Improvement in the efficiency of recycling processes in recent years is expected to create ample opportunities for the market. One example of a recycling method under the research phase is the method developed by Loser Chemie.

- Germany is expected to dominate the market with various upcoming solar panel installation projects.

Europe Solar Panel Recycling Market Trends

Crystalline Silicon to Dominate the Market

- An aluminum frame, glass, copper wire, polymer layers, a back sheet, silicon solar cells, and a plastic junction box are used to build crystalline-silicon solar panels. Although the polymer layers protect the panel from the elements, they also make recycling and disassembling the panel challenging because high temperatures are frequently needed to remove the glue.

- Moreover, laboratory energy conversion efficiency for single-crystal and multi-crystalline silicon photovoltaic cells is over 25% and over 20%, respectively. The benefits of using crystalline silicon include reliability as crystalline silicon cells reach module lifetimes of 25+ years and exhibit little long-term degradation and easy availability of silicon as it is the second most abundant element in earth's crust.

- By 2030, around USD 450 million will be the total global worth of recoverable raw materials from end-of-life panels, which is equal to the price of raw materials required to make around 60 million new panels. By diverting solar panels from landfills to recycling, space is saved in landfills, and the value of the raw materials is also realized.

- According to the WEEE Directive, European nations must have PV waste management policies that hold Producers accountable for collecting and recycling the panels they sell. These regulations have two main objectives. First, it pushes the market to create goods that require less raw material and are easier to recycle. Second, it encourages producers to include the cost of product collection and end-of-life care in the price customers pay for their goods.

- In 2021, Europe's total solar photovoltaic capacity accounted for 183.5 thousand MW. The PV capacity is expected to rise during the forecast period. This rapid increase in panel use and government policies for recycling panels necessitates responsible, industrial-scale recycling and disposal processes driving the solar panel recycling market.

- Therefore, the crystalline silicon segment is expected to dominate the market because its usage benefits more than the other segments during the forecast period.

Germany to Dominate the Market

- Germany is expected to dominate the solar panel recycling market as the country has the majority of solar PV capacity in Europe. Moreover, the country's government has set a target of raising its solar power capacity to 200GW by 2030, for which the government is planning to increase solar tenders to 20GW.

- Moreover, Germany's capacity will increase roughly eight times, from slightly over 50 GW in 2020 to about 415 GW by the middle of the century. The yearly capacity expansion for both solar and wind power must reach at least 5 GW to meet the 2030 target of a 65 % renewable share in energy consumption. Thus, the increase in solar capacity will lead to more solar panel installation creating an opportunity for the solar panel recycling market in the forecast period.

- For the recycling of photovoltaic (PV) modules that have reached the end of their useful lives, a highly effective and unique technology is being developed under the project supervision of Veolia Germany. Along with collaborating businesses from the public and private sectors that are active in the PV module recycling supply chain. Through EIT RawMaterials, the European Union is funding the initiative with a total of EUR 4.8 million.

- In 2021, the total solar photovoltaic capacity of Germany accounted for 58.5 thousand MW. The PV capacity is expected to rise in the forecast period, this, in turn, will increase solar panel installation capacity thus driving the solar panel recycling market in the future.

- Therefore, owing to the above points, with the development in technology and project in PV recycling, Germany is expected to dominate the market during the forecast period.

Europe Solar Panel Recycling Industry Overview

The Europe solar panel recycling market is moderately consolidated. The key players in the market ( not in particular order ) include Trina Solar Co., Sharp Corporation, First Solar Inc, SunPower Corporation, and Reiling Group GmbH & Co. KG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD Billion Till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Process

- 5.1.1 Thermal

- 5.1.2 Mechanical

- 5.1.3 Laser

- 5.2 By Type

- 5.2.1 Crystalline silicon

- 5.2.2 Thin film

- 5.3 By Geography

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 France

- 5.3.4 Russia

- 5.3.5 Spain

- 5.3.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Mergers & Acquisitions

- 6.3 Company Profiles

- 6.3.1 Sunpower Corporation

- 6.3.2 Reiling Group GmbH & Co. KG

- 6.3.3 Rosi Solar

- 6.3.4 JA Solar Co.

- 6.3.5 Univergy International

- 6.3.6 Renesola

- 6.3.7 Trina Solar Co.

- 6.3.8 First Solar Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219