|

市场调查报告书

商品编码

1750514

商用瓦斯锅炉市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Commercial Gas Fired Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

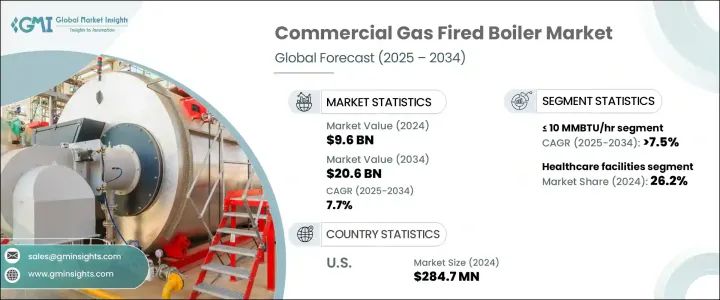

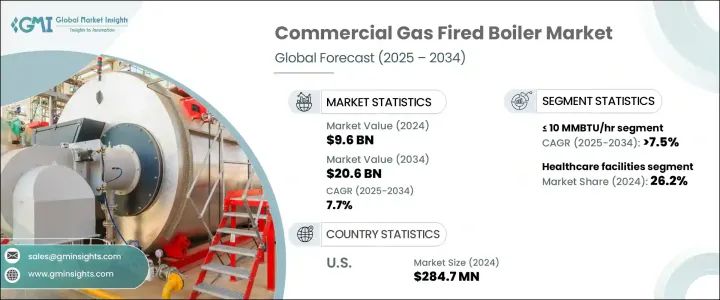

2024年,全球商用瓦斯锅炉市场规模达96亿美元,预计到2034年将以7.7%的复合年增长率成长,达到206亿美元。这得益于各行业不断变化的供暖需求,以及对更智慧、更有效率楼宇系统的持续追求。物联网(IoT)在锅炉系统中的日益普及,实现了远端监控、即时效能最佳化和预测性维护,从而减少了停机时间并降低了营运成本。该行业受益于氢混合技术的创新,领先的製造商正在设计先进的模型来满足不断变化的供暖需求。这些努力旨在支持更清洁的能源转型,同时保持性能可靠性。

模组化暖气系统需求的成长正在改变大型园区、公司办公室和商业设施的能源使用方式。生物技术、製药和资料基础设施等领域的持续扩张,推动了对可靠性和适应性兼具的精准供暖解决方案的需求。为了应对供应链的不确定性和不断变化的贸易法规,锅炉製造商投资于国内生产,以提高供应响应能力并降低地缘政治风险。例如,早期对金属征收的关税显着影响了製造业的经济效益,促使企业实施在地化营运并多元化零件采购策略。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 96亿美元 |

| 预测值 | 206亿美元 |

| 复合年增长率 | 7.7% |

额定功率小于等于 10 MMBTU/小时的系统预计将保持强劲成长势头,到 2034 年将以 7.5% 的复合年增长率成长。这些紧凑高效的解决方案非常适合空间受限的环境,例如教育机构、零售店、医疗机构和酒店建筑。其可扩展性以及较低的前期和维护成本,提供了一种经济高效的方式,可在不影响性能或排放标准的情况下提供持续的供暖。

预计到2034年,商业办公室市场规模将达到35亿美元,这得益于对符合现代永续发展基准的智慧节能暖气系统日益增长的需求。企业正在采用冷凝锅炉和超低氮氧化物技术,不仅是为了满足合规要求,也是为了提高营运效率。与楼宇自动化系统的整合正变得越来越普遍,使设施管理人员能够控製暖气负荷并减少能源浪费。

受全国范围内基础设施现代化建设和更严格的环境法规(旨在减少温室气体排放)的推动,美国商用燃气锅炉市场在2024年实现了2.847亿美元的产值。商业建筑,尤其是那些需要供暖升级的老旧建筑,正在转向支援更高热效率和数位化整合的先进锅炉系统。政府激励措施和鼓励采用清洁能源的区域法规也促进了高性能燃气替代系统取代传统系统的趋势。

BDR Thermea Group、Lochinvar、Viessmann、Ariston Holding、Bosch Industriekessel、Weil-McLain、Bradford White Corporation、AO Smith、Burnham Commercial、大金、Vaillant Group、FERROLI、FONDITAL、Immergas、Remeha、Hoval、Cleaver-Brooks 和 Babcock & Bab.这些策略包括扩展智慧产品线、强化氢能车型研发、改进客户支援系统以及建立区域製造中心,以提高交付速度并降低成本,同时实现永续发展目标。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 策略倡议

- 公司市占率分析

- 竞争基准测试

- 创新与永续发展格局

第五章:市场规模及预测:依产能,2021 - 2034 年

- 主要趋势

- ≤ 10 百万英热单位/小时

- > 10 - 50 百万英热单位/小时

- > 50 - 100 百万英热单位/小时

- > 100 - 250 百万英热单位/小时

- > 250 百万英热单位/小时

第六章:市场规模及预测:依技术分类,2021 - 2034 年

- 主要趋势

- 冷凝

- 无凝结

第七章:市场规模及预测:依应用,2021 - 2034

- 主要趋势

- 办公室

- 医疗保健设施

- 教育机构

- 住宿

- 零售店

- 其他的

第八章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 法国

- 英国

- 波兰

- 义大利

- 西班牙

- 奥地利

- 德国

- 瑞典

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 菲律宾

- 日本

- 韩国

- 澳洲

- 印尼

- 中东和非洲

- 沙乌地阿拉伯

- 伊朗

- 阿联酋

- 奈及利亚

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

第九章:公司简介

- AO Smith

- Ariston Holding

- Babcock & Wilcox Enterprises

- BDR Thermea Group

- Bosch Industriekessel

- Bradford White Corporation

- BURNHAM COMMERCIAL BOILERS

- Cleaver-Brooks

- Daikin

- FERROLI

- FONDITAL

- Hoval

- Immergas

- Lochinvar

- Remeha

- Vaillant Group

- VIESSMANN

- Weil-McLain

The Global Commercial Gas Fired Boiler Market was valued at USD 9.6 billion in 2024 and is estimated to grow at a CAGR of 7.7% to reach USD 20.6 billion by 2034, driven by evolving heating needs across sectors and the continued push for smarter, more efficient building systems. The increasing use of Internet of Things (IoT) in boiler systems enables remote monitoring, real-time performance optimization, and predictive maintenance, reducing downtime and cutting operational costs. The sector benefits from hydrogen blending innovations, with leading manufacturers designing advanced models to accommodate dynamic heating demands. These efforts aim to support cleaner energy transitions while maintaining performance reliability.

A rise in demand for modular heating systems is transforming how large campuses, corporate offices, and commercial facilities approach energy use. The continued expansion of sectors like biotechnology, pharmaceuticals, and data infrastructure has pushed for precision heating solutions that offer reliability and adaptability. In response to supply chain uncertainties and shifting trade regulations, boiler manufacturers invest in domestic production to enhance supply responsiveness and reduce geopolitical risks. For instance, earlier tariff implementations on metals significantly impacted manufacturing economics, motivating companies to localize operations and diversify component sourcing strategies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.6 Billion |

| Forecast Value | $20.6 Billion |

| CAGR | 7.7% |

Systems rated at <= 10 MMBTU/hr are expected to maintain a strong growth trajectory, expanding at a CAGR of 7.5% through 2034. These compact, high-efficiency solutions are well-suited for space-constrained environments such as educational institutions, retail outlets, healthcare facilities, and hospitality buildings. Their scalability and lower upfront and maintenance costs offer a cost-effective way to deliver consistent heating without compromising performance or emissions standards.

The commercial office segment is projected to reach USD 3.5 billion by 2034, fueled by increased demand for intelligent, energy-efficient heating systems in line with modern sustainability benchmarks. Organizations are adopting condensing boilers and ultra-low NOx technology not only to meet compliance requirements but also to enhance operational efficiency. Integration with building automation systems is becoming more common, allowing facility managers to control heating loads and reduce energy waste.

United States Commercial Gas Fired Boiler Market generated USD 284.7 million in 2024, driven by the nationwide infrastructure modernization efforts and stricter environmental mandates reducing greenhouse gas emissions. Commercial buildings-especially aging structures in need of heating upgrades-are switching to advanced boiler systems that support higher thermal efficiency and digital integration. Government incentives and regional regulations encouraging clean energy adoption have also contributed to the increased replacement of conventional systems with high-performance gas-fired alternatives.

Leading manufacturers such as BDR Thermea Group, Lochinvar, Viessmann, Ariston Holding, Bosch Industriekessel, Weil-McLain, Bradford White Corporation, A.O. Smith, Burnham Commercial, Daikin, Vaillant Group, FERROLI, FONDITAL, Immergas, Remeha, Hoval, Cleaver-Brooks, and Babcock & Wilcox are adopting key strategies to stay competitive. These include expanding smart product lines, boosting R&D in hydrogen-ready models, improving customer support systems, and building regional manufacturing hubs to increase delivery speed and reduce costs while meeting sustainability targets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Strategic initiatives

- 4.4 Company market share analysis, 2024

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 ≤ 10 MMBTU/hr

- 5.3 > 10 - 50 MMBTU/hr

- 5.4 > 50 - 100 MMBTU/hr

- 5.5 > 100 - 250 MMBTU/hr

- 5.6 > 250 MMBTU/hr

Chapter 6 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Condensing

- 6.3 Non-condensing

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Offices

- 7.3 Healthcare facilities

- 7.4 Educational institutions

- 7.5 Lodgings

- 7.6 Retail stores

- 7.7 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 France

- 8.3.2 UK

- 8.3.3 Poland

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Austria

- 8.3.7 Germany

- 8.3.8 Sweden

- 8.3.9 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Philippines

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.4.6 Australia

- 8.4.7 Indonesia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 Iran

- 8.5.3 UAE

- 8.5.4 Nigeria

- 8.5.5 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

- 8.6.3 Chile

Chapter 9 Company Profiles

- 9.1 A.O. Smith

- 9.2 Ariston Holding

- 9.3 Babcock & Wilcox Enterprises

- 9.4 BDR Thermea Group

- 9.5 Bosch Industriekessel

- 9.6 Bradford White Corporation

- 9.7 BURNHAM COMMERCIAL BOILERS

- 9.8 Cleaver-Brooks

- 9.9 Daikin

- 9.10 FERROLI

- 9.11 FONDITAL

- 9.12 Hoval

- 9.13 Immergas

- 9.14 Lochinvar

- 9.15 Remeha

- 9.16 Vaillant Group

- 9.17 VIESSMANN

- 9.18 Weil-McLain