|

市场调查报告书

商品编码

1750529

电子烟市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测E-cigarette Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

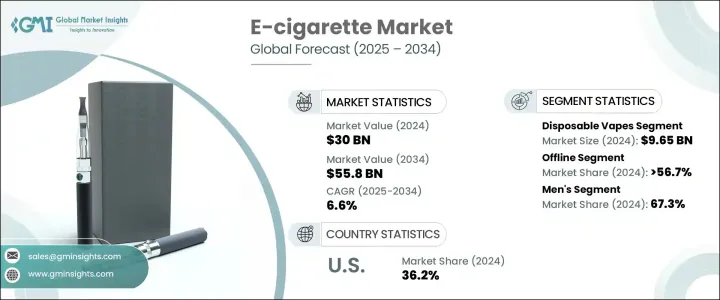

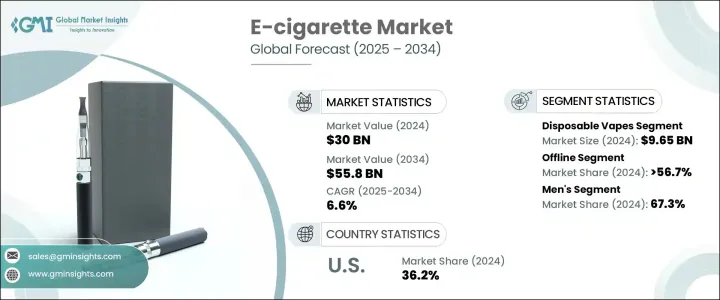

2024年,全球电子烟市场规模达300亿美元,预计到2034年将以6.6%的复合年增长率成长,达到558亿美元。推动这一成长的因素包括:便捷且口味多样的一次性电子烟日益普及。 Instagram、TikTok和YouTube等社群媒体平台的兴起也在推广电子烟方面发挥了重要作用,尤其是在年轻族群中。网红经常展示电子烟产品,强调其易用性和诱人的口味,这有助于电子烟的正常化和美化。此外,技术进步也推动了配备蓝牙和GPS等功能的「智慧」电子烟的发展,以满足追求个人化体验的科技爱好者的需求。

出于环保考虑,一些品牌将永续材料融入其产品中,以满足日益增长的环保需求。这种转变不仅是对消费者偏好的回应,也是更广泛努力的一部分,旨在符合国际永续发展标准,减少製造过程的环境足迹。企业在装饰产品中使用再生材料、负责任采购的木材和可生物降解的替代品。这些环保创新不仅吸引了注重环保的买家,也有助于在竞争激烈的市场中提升品牌的差异化。此外,製造商正在开发更耐用、维护成本更低的材料,从而减少频繁更换的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 300亿美元 |

| 预测值 | 558亿美元 |

| 复合年增长率 | 6.6% |

2024年,一次性电子烟市场规模达96.5亿美元,预计2025年至2034年期间的复合年增长率将达到7%。这类设备因其简洁、便携和口味多样而备受青睐。它们预注油,无需充电,可立即使用,对于新用户或追求轻鬆体验的用户来说,是一个极具吸引力的选择。便利商店、加油站和其他零售场所的一次性电子烟供应充足,进一步提升了其普及度。

线下零售通路在2024年占据了56.7%的市场份额,预计到2034年将继续以5.6%的速度成长。消费者重视店内体验,这使得他们在购买前可以品嚐不同的口味和尼古丁含量。实体店也为品牌提供了透过产品展示、促销优惠和活动与顾客互动的机会,从而培养信任和品牌忠诚度。

2024年美国电子烟市场将占据36.2%的市场份额,这得益于市场对吸烟替代品的旺盛需求,以及透过上市前烟草产品申请(PMTA)程序验证产品的监管措施。主流电子烟品牌的出现以及产品在零售店的广泛供应,进一步巩固了美国电子烟市场的地位。

电子烟产业的主要参与者包括 Blu、Elf Bar、GeekVape、Innokin、Lost Mary、Lost Vape、MC、MOK、PAX、Pulze、SMOK、Suorin、Vaporesso 和 Vuse。为了加强市场影响力,电子烟产业的公司正在采取多种策略。这些策略包括扩大产品组合以满足不同的消费者偏好、投资研发以创新和提高产品质量,以及加强线上和线下行销力度以覆盖更广泛的受众。此外,公司也专注于遵守监管标准,以确保产品安全并赢得消费者信任。他们还与零售商和有影响力的人士合作,以提高品牌知名度和消费者参与度。此外,一些公司正在探索产品设计和包装方面的永续实践,以吸引具有环保意识的消费者。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 衝击力

- 有多种口味可供选择

- 消费者意识不断提高

- 社群媒体影响力的提升

- 产业陷阱与挑战

- 监管不确定性和限制

- 青少年电子烟氾滥与大众的强烈反对

- 成长潜力分析

- 消费者行为分析

- 人口趋势

- 影响购买决策的因素

- 消费者产品采用

- 首选配销通路

- 首选价格范围

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按产品,2021 - 2034 年(十亿美元)

- 主要趋势

- Cigalikes

- 电子烟

- 免洗电子烟

- Pod 电子烟

- 盒子改装

第六章:市场估计与预测:按类别,2021 - 2034 年(十亿美元)

- 主要趋势

- 打开

- 关闭

第七章:市场估计与预测:按口味,2021 - 2034 年(十亿美元)

- 主要趋势

- 烟草

- 植物

- 水果

- 甜的

- 饮料

- 其他的

第八章:市场估计与预测:按价格,2021-2034 年(十亿美元)

- 主要趋势

- 低的

- 中等的

- 高的

第九章:市场估计与预测:按使用者划分,2021 - 2034 年(十亿美元)

- 主要趋势

- 男士

- 女性

第十章:市场估计与预测:按营运模式,2021 - 2034 年(十亿美元)

- 主要趋势

- 手动的

- 自动的

第 11 章:市场估计与预测:按配销通路,2021 年至 2034 年(十亿美元)

- 主要趋势

- 在线的

- 电子商务

- 公司网站

- 离线

- 超市/大卖场

- 电子烟专卖店

- 便利商店和加油站

- 其他的

第 12 章:市场估计与预测:按地区,2021 年至 2034 年(十亿美元)

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十三章:公司简介

- Blu

- Elf Bar

- GeekVape

- Innokin

- Lost Mary

- Lost Vape

- MC

- MOK

- PAX

- Pulze

- SMOK

- Suorin

- Vaporesso

- Vuse

The Global E-cigarette Market was valued at USD 30 billion in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 55.8 billion by 2034, driven by several factors, including the increasing popularity of disposable vapes, which offer convenience and a variety of flavors. The rise of social media platforms like Instagram, TikTok, and YouTube has also played a significant role in promoting e-cigarettes, particularly among younger audiences. Influencers often showcase e-cigarette products, highlighting their ease of use and appealing flavors, which have contributed to the normalization and glamorization of vaping. Additionally, technological advancements have led to the development of "smart" e-cigarettes equipped with features like Bluetooth and GPS, catering to tech-savvy users seeking a personalized experience.

Environmental concerns have prompted some brands to incorporate sustainable materials into their products, addressing the growing demand for eco-friendly options. This shift is not only a response to consumer preferences but also part of broader efforts to align with international sustainability standards and reduce the environmental footprint of manufacturing processes. Companies use recycled content, responsibly sourced wood, and biodegradable alternatives in decking products. These eco-conscious innovations not only appeal to green-minded buyers but also contribute to brand differentiation in a competitive market. In addition, manufacturers are developing materials that offer extended durability and require less maintenance, reducing the need for frequent replacements.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $30 Billion |

| Forecast Value | $55.8 Billion |

| CAGR | 6.6% |

In 2024, the disposable vapes segment generated USD 9.65 billion and is expected to grow at a CAGR of 7% during 2025=2034. These devices are favored for their simplicity, portability, and variety of flavors. They are prefilled, require no charging, and are ready to use, making them an attractive option for new users or those seeking a hassle-free experience. The availability of disposable vapes in convenience stores, gas stations, and other retail locations has further increased their accessibility.

The offline retail channels segment accounted for 56.7% share in 2024 and is expected to continue growing at a rate of 5.6% until 2034. Consumers appreciate the in-store experience, which allows them to sample flavors and nicotine levels before purchasing. Physical stores also provide opportunities for brands to engage with customers through product demonstrations, promotional offers, and events, fostering trust and brand loyalty.

U.S. E-cigarette Market in 2024, accounting for a 36.2% share attributed to the high demand for smoking alternatives and regulatory actions that have validated products through the Premarket Tobacco Product Application (PMTA) process. The presence of major e-cigarette brands and the widespread availability of products in retail outlets have further strengthened the market position in the U.S.

Key players in the e-cigarette industry include Blu, Elf Bar, GeekVape, Innokin, Lost Mary, Lost Vape, MC, MOK, PAX, Pulze, SMOK, Suorin, Vaporesso, and Vuse. To strengthen their market presence, companies in the e-cigarette industry are adopting several strategies. These include expanding their product portfolios to cater to diverse consumer preferences, investing in research and development to innovate and improve product quality, and enhancing their online and offline marketing efforts to reach a broader audience. Additionally, companies are focusing on compliance with regulatory standards to ensure product safety and gain consumer trust. Collaborations and partnerships with retailers and influencers are also being pursued to increase brand visibility and consumer engagement. Furthermore, some companies are exploring sustainable practices in product design and packaging to appeal to environmentally conscious consumers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.2 Price volatility in key materials

- 3.2.2.3 Supply chain restructuring

- 3.2.2.4 Production cost implications

- 3.2.2.5 Demand-side impact (selling price)

- 3.2.2.6 Price transmission to end markets

- 3.2.2.7 Market share dynamics

- 3.2.2.8 Consumer response patterns

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Impact forces

- 3.3.1 Availability of a variety of flavors

- 3.3.2 Rising consumer awareness

- 3.3.3 Increase in social media influences

- 3.4 Industry pitfalls & challenges

- 3.4.1 Regulatory uncertainty & restrictions

- 3.4.2 Youth vaping epidemic & public backlash

- 3.5 Growth potential analysis

- 3.6 Consumer behavior analysis

- 3.6.1 Demographic trends

- 3.6.2 Factors affecting buying decisions

- 3.6.3 Consumer product adoption

- 3.6.4 Preferred distribution channel

- 3.6.5 Preferred price range

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn) (Thousand Units)

- 5.1 Key trends

- 5.2 Cigalikes

- 5.3 Vape Pens

- 5.4 Disposable vapes

- 5.5 Pod vapes

- 5.6 Box mods

Chapter 6 Market Estimates & Forecast, By Category, 2021 - 2034 ($Bn) (Thousand Units)

- 6.1 Key trends

- 6.2 Open

- 6.3 Close

Chapter 7 Market Estimates & Forecast, By Flavor, 2021 - 2034 ($Bn) (Thousand Units)

- 7.1 Key trends

- 7.2 Tobacco

- 7.3 Botanical

- 7.4 Fruit

- 7.5 Sweet

- 7.6 Beverage

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Price, 2021 - 2034 ($Bn) (Thousand Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Estimates & Forecast, By User, 2021 - 2034 ($Bn) (Thousand Units)

- 9.1 Key trends

- 9.2 Men

- 9.3 Women

Chapter 10 Market Estimates & Forecast, By Mode of Operation, 2021 - 2034 ($Bn) (Thousand Units)

- 10.1 Key trends

- 10.2 Manual

- 10.3 Automatic

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn) (Thousand Units)

- 11.1 Key trends

- 11.2 Online

- 11.2.1 E-commerce

- 11.2.2 Company website

- 11.3 Offline

- 11.3.1 Supermarkets/hypermarket

- 11.3.2 Specialty vape shops

- 11.3.3 Convenience stores and gas stations

- 11.3.4 Others

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn) (Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 UK

- 12.3.2 Germany

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.6 MEA

- 12.6.1 UAE

- 12.6.2 South Africa

- 12.6.3 Saudi Arabia

Chapter 13 Company Profiles

- 13.1 Blu

- 13.2 Elf Bar

- 13.3 GeekVape

- 13.4 Innokin

- 13.5 Lost Mary

- 13.6 Lost Vape

- 13.7 MC

- 13.8 MOK

- 13.9 PAX

- 13.10 Pulze

- 13.11 SMOK

- 13.12 Suorin

- 13.13 Vaporesso

- 13.14 Vuse