|

市场调查报告书

商品编码

1755253

ADAS 软体市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测ADAS Software Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

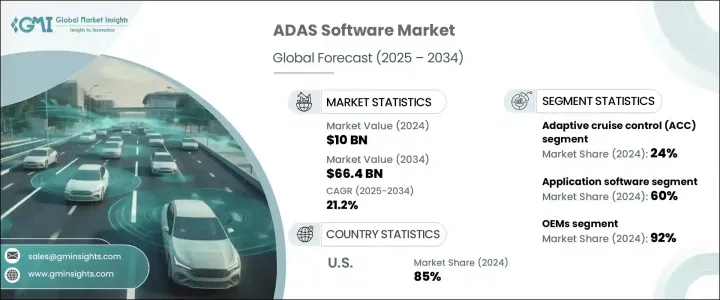

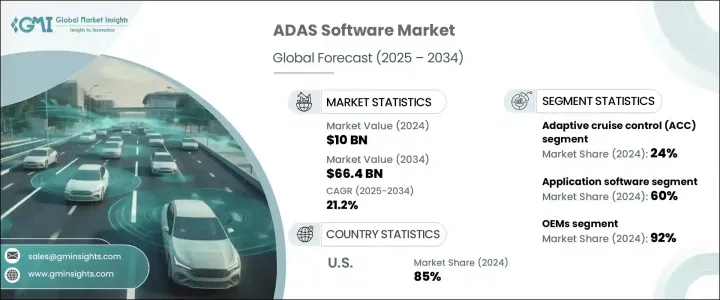

2024年,全球ADAS软体市场规模达100亿美元,预计到2034年将以21.2%的复合年增长率成长,达到664亿美元。这一显着成长主要得益于消费者道路安全意识的提升,以及对配备自动驾驶辅助功能的车辆日益增长的需求。对自动车道维持和煞车辅助等功能的需求日益增长,使ADAS技术成为现代车辆的主流配置。此外,包括卫星、摄影机和雷射雷达技术在内的感测器系统技术创新,使这些系统更加高效、可靠且易于访问,最终提升了整体性能并降低了营运成本。

市场成长的另一个主要驱动力是人工智慧和机器学习与ADAS平台的整合。这些功能使车辆能够处理即时资料并做出预测性决策,从而显着提升态势感知和反应能力。随着全球监管机构强制执行更严格的车辆安全要求,汽车公司面临整合高级辅助系统以满足合规性的压力。消费者也越来越倾向于半自动驾驶体验,促使复杂的驾驶辅助功能迅速普及。因此,对更高水准车辆自动驾驶的追求正促使製造商大力投资于能够支援日益复杂的驾驶功能的软体。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 100亿美元 |

| 预测值 | 664亿美元 |

| 复合年增长率 | 21.2% |

驾驶辅助功能日益复杂,这意味着软体在自动紧急应变、智慧导航和车辆定位等系统中发挥着至关重要的作用。汽车製造商致力于实现 ADAS 软体与更广泛的车辆架构的无缝整合。对智慧、响应式系统的需求不断增长,已使软体成为竞争激烈的汽车产品的差异化因素。即时感测器融合和 AI 驱动的情境决策的持续创新将塑造 ADAS 解决方案的未来。

依组件划分,ADAS 软体市场可细分为软体平台、中介软体、应用软体和作业系统。 2024 年,应用软体占据最大市场份额,贡献了约 60% 的总收入。预计在整个预测期内,该领域的复合年增长率将超过 22%。该领域在市场中占据关键地位,因为它能够与车辆感测器直接互动并实现基于演算法的决策过程。作为实现即时功能的主要元素,应用软体确保高级驾驶辅助功能在所有车型上有效执行。

就係统而言,市场分为车道偏离预警 (LDW)、自适应巡航控制 (ACC)、自动紧急煞车 (AEB)、停车辅助、盲点侦测 (BSD)、夜视系统、交通标誌识别 (TSR) 等。自适应巡航控制在 2024 年占据市场主导地位,占据 24% 的收入份额。这种主导地位归功于其在保持安全车距和提升驾驶舒适度方面发挥的重要作用,尤其是在交通拥堵或高速行驶的路况下。全球对部分自动驾驶汽车的青睐,进一步提升了此类系统在城市和高速公路驾驶场景中的普及率。

依车型分析,ADAS 软体市场分为商用车和乘用车。受整合安全和便利技术需求成长的推动,乘用车在 2024 年占据市场主导地位。这一趋势在中阶和入门级细分市场尤其明显,因为这些市场的买家正在积极寻求安全性能更强的车辆。随着汽车製造商不断扩展产品线以满足消费者的期望,ADAS 功能在私家车中的大规模整合将继续成为关键的成长动力。

根据最终用途,市场分为原始设备製造商 (OEM) 和售后市场参与者。 2024 年,OEM 占据了约 92% 的主导份额。这得益于他们能够在车辆生产过程中整合 ADAS 软体,从而实现更好的最佳化、更高的资料安全性和无缝的使用者体验。汽车製造商意识到购车者对智慧安全技术的需求日益增长,因此积极将这些功能作为标配。

从地区来看,美国在2024年引领了ADAS软体市场,市场规模约30亿美元,约占北美市场份额的85%。该地区的成长与政府安全措施以及对强制车辆辅助功能的监管支援密切相关。此外,对国内创新和国家安全的关注也促使对本土ADAS技术的投资增加。

随着许多汽车公司和一级供应商致力于开发专有软体生态系统,市场也正在经历向垂直整合的转变。这种方法可以提高相容性、安全性和系统控制能力,同时减少对第三方开发者的依赖。另一个重要趋势是与人工智慧公司、半导体生产商和云端服务供应商建立策略合作,以加强研发并加速创新。这些合作伙伴关係实现了可扩展性,并使企业能够调整ADAS解决方案,以满足全球市场不同的监管和道路要求。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 自动驾驶和半自动驾驶汽车的需求不断增长

- 人工智慧和机器学习的融合度提高

- 感测器和连接技术的进步

- 快速城市化和智慧移动计划

- 消费者对车内安全性和便利性的需求

- 产业陷阱与挑战

- 开发和整合成本高

- 感测器融合和即时处理的复杂性

- 市场机会

- 与电动车(EV)集成

- 云端原生平台的兴起

- OEM软体供应商合作伙伴关係

- 人工智慧和机器学习集成

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 软体平台

- 中介软体

- 应用软体

- 作业系统

第六章:市场估计与预测:按系统,2021 - 2034 年

- 主要趋势

- 自适应巡航控制 (ACC)

- 车道偏离警示 (LDW)

- 自动紧急煞车(AEB)

- 盲点侦测(BSD)

- 停车辅助

- 交通标誌识别(TSR)

- 夜视系统

- 其他的

第七章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- SUV(运动型多用途车)

- MPV(多用途汽车)

- 商用车

- 轻型商用车(LCV)

- 中型商用车(HCV)

- 重型商用车(HCV)

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- OEM (原始设备製造商)

- 售后市场

第九章:市场估计与预测:依自主级别,2021 - 2034 年

- 主要趋势

- 1级(驾驶辅助)

- 2级(部分自动化)

- 3级(有条件自动化)

- 4级(高度自动化)

- 5级(全自动)

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 新加坡

- 马来西亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- Ambarella

- Aptiv

- Baidu Apollo

- Bosch

- Continental

- Innoviz Technologies

- Luminar Technologies

- Magna International

- Mobileye (Intel)

- Nvidia

- NXP Semiconductors

- Qualcomm

- Renesas Electronics

- Sony

- Tesla

- Valeo

- Velodyne Lidar (Ouster)

- Waymo (Alphabet)

- XPeng

- ZF Friedrichshafen

The Global ADAS Software Market was valued at USD 10 billion in 2024 and is estimated to grow at a CAGR of 21.2% to reach USD 66.4 billion by 2034. This significant expansion is largely fueled by rising consumer awareness regarding road safety and a growing appetite for vehicles equipped with automated support features. Increasing demand for functionalities such as automated lane keeping and braking assistance has made ADAS technologies a mainstream requirement in modern vehicles. In addition, technological innovations in sensor systems, including satellite, camera, and Lidar technologies, have made these systems more efficient, reliable, and accessible, ultimately enhancing overall performance while reducing operational costs.

Another major driver of market growth is the integration of artificial intelligence and machine learning into ADAS platforms. These capabilities allow vehicles to process real-time data and make predictive decisions, significantly improving situational awareness and responsiveness. With global regulatory bodies enforcing more stringent vehicle safety requirements, automotive companies are under pressure to incorporate advanced assistance systems to meet compliance. Consumers are also leaning toward semi-autonomous driving experiences, prompting a rapid adoption of sophisticated driver-assist features. As a result, the push toward higher levels of vehicle autonomy is encouraging manufacturers to invest heavily in software that can support increasingly complex driving functions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10 Billion |

| Forecast Value | $66.4 Billion |

| CAGR | 21.2% |

The growing complexity of driver-assistance features means software plays a critical role in enabling systems like automated emergency response, smart navigation, and vehicle positioning. Automakers are focused on achieving seamless integration of ADAS software within the broader vehicle architecture. The rise in demand for intelligent, responsive systems has turned software into a differentiator in competitive vehicle offerings. Continued innovation in real-time sensor fusion and AI-driven contextual decision-making will shape the future of ADAS solutions.

By component, the ADAS software market is segmented into software platform, middleware, application software, and operating system. In 2024, the application software segment accounted for the largest market share, contributing approximately 60% of total revenue. It is also anticipated to grow at a CAGR exceeding 22% throughout the forecast period. This segment holds a critical position in the market as it enables direct interaction with vehicle sensors and algorithm-based decision-making processes. As the primary element responsible for real-time functionality, application software ensures the effective execution of advanced driver-assistance features across all vehicle types.

In terms of systems, the market is categorized into lane departure warning (LDW), adaptive cruise control (ACC), automatic emergency braking (AEB), parking assistance, blind spot detection (BSD), night vision systems, traffic sign recognition (TSR), and others. Adaptive cruise control led the market in 2024, holding a 24% revenue share. This dominance is attributed to its essential role in maintaining safe vehicle spacing and enhancing driver comfort, especially in traffic-heavy or high-speed conditions. The global preference for vehicles that offer partial automation has amplified the popularity of such systems in both urban and highway driving scenarios.

When analyzed by vehicle type, the ADAS software market is divided into commercial vehicles and passenger cars. Passenger cars dominated the market in 2024, driven by heightened demand for integrated safety and convenience technologies. This trend is especially strong in the mid-range and entry-level segments, where buyers are actively seeking vehicles with enhanced safety features. The mass integration of ADAS functionality in personal vehicles continues to be a key growth driver as automakers expand offerings to meet consumer expectations.

Based on end use, the market is split between original equipment manufacturers (OEMs) and aftermarket players. OEMs held a commanding share of around 92% in 2024. This is due to their capability to integrate ADAS software during vehicle production, which results in better optimization, increased data security, and a seamless user experience. Automakers are proactively embedding these features as standard, recognizing the growing demand for intelligent safety technologies among car buyers.

Regionally, the United States led the ADAS software market in 2024, generating approximately USD 3 billion and representing about 85% of the North American share. The growth in this region is closely tied to government safety initiatives and regulatory support for mandatory vehicle assistance features. Additionally, the focus on domestic innovation and national security has led to increased investment in homegrown ADAS technologies.

The market is also witnessing a shift toward vertical integration, as many automotive companies and Tier 1 suppliers aim to develop proprietary software ecosystems. This approach improves compatibility, security, and system control while reducing reliance on third-party developers. Another significant trend involves strategic collaborations with AI firms, semiconductor producers, and cloud service providers to strengthen R&D and accelerate innovation. These partnerships enable scalability and allow companies to adapt ADAS solutions to meet varying regulatory and road requirements across global markets.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 System

- 2.2.4 Vehicle

- 2.2.5 End use

- 2.2.6 Level of autonomy

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for autonomous and semi-autonomous vehicles

- 3.2.1.2 Increased integration of AI and machine learning

- 3.2.1.3 Technological advancements in sensors and connectivity

- 3.2.1.4 Rapid urbanization and smart mobility initiatives

- 3.2.1.5 Consumer demand for in-vehicle safety and convenience

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development and integration costs

- 3.2.2.2 Complexity in sensor fusion and real-time processing

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with electric vehicles (EVs)

- 3.2.3.2 The rise of cloud-native platforms

- 3.2.3.3 OEM-software supplier partnerships

- 3.2.3.4 AI and machine learning integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Sustainability and environmental aspects

- 3.9.1 Sustainable practices

- 3.9.2 Waste reduction strategies

- 3.9.3 Energy efficiency in production

- 3.9.4 Eco-friendly initiatives

- 3.9.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Software platform

- 5.3 Middleware

- 5.4 Application software

- 5.5 Operating system

Chapter 6 Market Estimates & Forecast, By System, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Adaptive cruise control (ACC)

- 6.3 Lane departure warning (LDW)

- 6.4 Automatic emergency braking (AEB)

- 6.5 Blind spot detection (BSD)

- 6.6 Parking assistance

- 6.7 Traffic sign recognition (TSR)

- 6.8 Night vision system

- 6.9 Others

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Passenger cars

- 7.2.1 Hatchbacks

- 7.2.2 Sedans

- 7.2.3 SUVs (Sport utility vehicles)

- 7.2.4 MPVs (Multi-purpose vehicles)

- 7.3 Commercial vehicles

- 7.3.1 Light commercial vehicles (LCVs)

- 7.3.2 Medium commercial vehicles (HCVs)

- 7.3.3 Heavy commercial vehicles (HCVs)

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 OEM (Original equipment manufacturers)

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Level of autonomy, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 Level 1 (Driver assistance)

- 9.3 Level 2 (Partial automation)

- 9.4 Level 3 (Conditional automation)

- 9.5 Level 4 (High automation)

- 9.6 Level 5 (Full automation)

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Singapore

- 10.4.7 Malaysia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Ambarella

- 11.2 Aptiv

- 11.3 Baidu Apollo

- 11.4 Bosch

- 11.5 Continental

- 11.6 Innoviz Technologies

- 11.7 Luminar Technologies

- 11.8 Magna International

- 11.9 Mobileye (Intel)

- 11.10 Nvidia

- 11.11 NXP Semiconductors

- 11.12 Qualcomm

- 11.13 Renesas Electronics

- 11.14 Sony

- 11.15 Tesla

- 11.16 Valeo

- 11.17 Velodyne Lidar (Ouster)

- 11.18 Waymo (Alphabet)

- 11.19 XPeng

- 11.20 ZF Friedrichshafen