|

市场调查报告书

商品编码

1755313

气调包装设备市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Modified Atmosphere Packaging Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

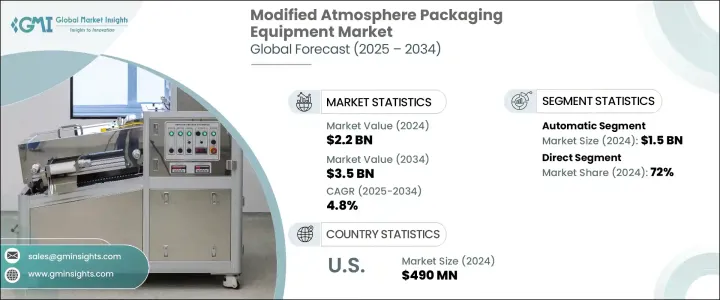

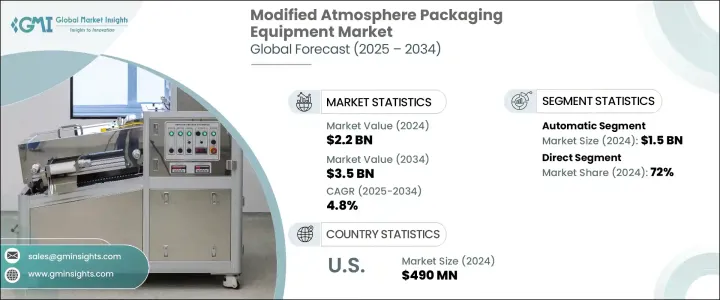

2024年,全球气调包装设备市场规模达22亿美元,预计2034年将以4.8%的复合年增长率成长,达到35亿美元。这一增长主要源于人们对保质期较长的食品日益增长的需求,而保质期在减少食品浪费方面发挥着至关重要的作用。这些设备将包装内的氧气替换为氮气和二氧化碳等惰性气体,减缓食品腐败,延长食品保鲜期。这项技术正在食品包装产业迅速普及,尤其是在易腐产品领域。

随着城市生活方式的改变,消费者习惯也随之改变,对方便食品和即食食品的偏好也日益增长。预包装食品和预切农产品的消费量不断增长,对可持续且能够长时间保鲜的包装解决方案的需求也日益强烈。气调包装设备能够相容于环保材料,并有助于减少传统的一次性塑胶包装,从而满足了这项需求。凭藉延长产品保质期和减少环境影响的双重优势,这类设备正成为全球食品製造商和零售商的首选。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 22亿美元 |

| 预测值 | 35亿美元 |

| 复合年增长率 | 4.8% |

2024年,自动气调包装系统产值达15亿美元。其受欢迎程度源自于其高效能和处理大规模生产的能力,这对于食品加工等高产量产业至关重要。预测性维护和即时系统监控等先进功能可透过减少停机时间并提高生产效率,进一步提升了其吸引力。这些智慧技术可协助製造商满足不断增长的产量需求,同时保持不同批次产品品质的一致性。

直销市场在2024年占据了72%的市场份额,因为它能够提供个人化解决方案,并促进製造商和最终用户之间的一对一合作。气调包装机通常需要高度定制,并针对特定食品进行量身定制,而直销渠道使这一定制流程更加精简高效。此类销售策略也有助于建立长期合作伙伴关係,使设备供应商和买家互惠互利。

2024年,美国气调包装设备市场规模达4.9亿美元,占76%的市占率。繁忙的生活方式推动着速食需求的不断增长,这持续影响着全球消费者的偏好。因此,对能够延长保鲜期并使用可持续材料的包装的需求日益增长。包装设备的技术创新和自动化进一步推动了美国市场的发展,越来越多的企业开始采用智慧系统来提升效能并降低营运成本。

引领全球气调包装设备市场的主要公司包括 ULMA Packaging、Webomatic、Proseal、Ross Industries、Robert Reiser、MULTIVAC Group、Ishida、ORICS Industries、GEA Group、Ilapak、Reepack、Henkelman、PFM Group、G. Mondini 和 Coesia Group。这些关键参与者在创新、规模和客製化方面展开竞争。为了保持市场竞争优势,领先的製造商专注于将先进的自动化和数位监控功能整合到他们的设备中,以提高可靠性并减少营运停机时间。他们透过客製化机械和灵活的定价模式加强与食品加工公司的合作伙伴关係。此外,对永续包装材料的研发投资正在帮助他们遵守环境法规并改变消费者的期望。透过直销策略扩大地理覆盖范围并加强售后支援是提高长期客户保留率和全球影响力的常用方法。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素。

- 利润率分析。

- 中断

- 未来展望

- 製成品

- 经销商

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 供应商格局

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 延长保存期限并减少食物浪费

- 即食食品和方便食品需求不断成长

- 永续性和监管合规压力

- 产业陷阱与挑战

- 高初始资本投资

- 气体混合物校准和监测的复杂性

- 塑胶包装废弃物引发的环境担忧

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 真空气调包装设备

- 托盘密封气调包装设备

- 水平流动包装气调包装

- 垂直流动包装气调包装

- 其他(多车道机器、客製化 MAP 系统等)

第六章:市场估计与预测:按运营,2021-2034

- 主要趋势

- 自动化

- 半自动化

第七章:市场估计与预测:依包装类型,2021-2034

- 主要趋势

- 托盘密封

- 热成型

- 袋/包

- 硬质容器

第 8 章:市场估计与预测:按最终用途应用,2021 年至 2034 年

- 主要趋势

- 肉类、家禽和海鲜

- 烘焙和糖果

- 新鲜农产品(水果和蔬菜)

- 乳製品

- 即食食品

- 其他的

第九章:市场估计与预测:按配销通路,2021-2034

- 主要趋势

- 直接的

- 间接

第十章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- Coesia Group

- G. Mondini

- GEA Group

- Henkelman

- Ilapak

- Ishida

- MULTIVAC Group

- ORICS Industries

- PFM Group

- Proseal

- Reepack

- Robert Reiser

- Ross Industries

- ULMA Packaging

- Webomatic

The Global Modified Atmosphere Packaging Equipment Market was valued at USD 2.2 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 3.5 billion by 2034. The growth is driven by the increasing demand for food products with extended shelf life, which plays a crucial role in minimizing food waste. These machines replace oxygen inside the packaging with inert gases like nitrogen and carbon dioxide, which slows down spoilage and keeps food fresh longer. This technology is rapidly being adopted in the food packaging industry, particularly in perishable product categories.

As consumer habits evolve with urban lifestyles, there is a rising preference for convenience foods and ready-to-eat meals. The growing consumption of pre-packed meals and precut produce is creating a strong demand for packaging solutions that are both sustainable and capable of maintaining freshness for extended durations. Modified atmosphere packaging equipment supports this need by offering compatibility with eco-friendly materials and helping reduce conventional single-use plastic packaging. With the dual benefit of extending product shelf life and reducing environmental impact, this equipment is becoming a preferred choice for food manufacturers and retailers worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $3.5 Billion |

| CAGR | 4.8% |

In 2024, automatic modified atmosphere packaging systems generated USD 1.5 billion. Their popularity stems from their efficiency and ability to handle large-scale production essential for high-volume sectors like food processing. Advanced features such as predictive maintenance and real-time system monitoring have increased their appeal by reducing downtime and enhancing productivity. These smart technologies help manufacturers meet growing output demands while maintaining consistent product quality across batches.

Direct sales segment accounted for a 72% share in 2024 due to its ability to provide personalized solutions and facilitate one-on-one collaborations between manufacturers and end-users. Modified atmosphere packaging machines often require high degrees of customization, tailored for specific food products, and direct sales channels make this customization process more streamlined and effective. Such sales strategies also help forge long-term partnerships that benefit equipment providers and buyers.

United States Modified Atmosphere Packaging Equipment Market was valued at USD 490 million in 2024, holding a 76% share. The rising demand for quick meals, driven by busy lifestyles, continues to shape consumer preferences globally. As a result, the need for packaging that extends freshness while using sustainable materials is becoming more important. Technological innovations and automation in packaging equipment have further advanced the market in the U.S., where companies are increasingly adopting smart systems to improve performance and reduce operational costs.

Major companies leading the Global Modified Atmosphere Packaging Equipment Market include ULMA Packaging, Webomatic, Proseal, Ross Industries, Robert Reiser, MULTIVAC Group, Ishida, ORICS Industries, GEA Group, Ilapak, Reepack, Henkelman, PFM Group, G. Mondini, and Coesia Group. These key players compete on innovation, scale, and customization. To maintain a competitive edge in the market, leading manufacturers focus on integrating advanced automation and digital monitoring features into their equipment to improve reliability and reduce operational downtimes. They strengthen partnerships with food processing companies through customized machinery and flexible pricing models. Additionally, R&D investment in sustainable packaging materials is helping them align with environmental regulations and shifting consumer expectations. Expanding their geographic footprint through direct sales strategies and enhancing after-sales support is a common approach to boost long-term client retention and global presence.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Shelf-Life Extension & Food Waste Reduction

- 3.6.1.2 Rising Demand for Ready-to-Eat & Convenience Foods

- 3.6.1.3 Sustainability & Regulatory Compliance Pressures

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High Initial Capital Investment

- 3.6.2.2 Complexity in Gas Mixture Calibration & Monitoring

- 3.6.2.3 Environmental Concerns Over Plastic Packaging Waste

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Vacuum-Based MAP Equipment

- 5.3 Tray Sealing MAP Equipment

- 5.4 Horizontal flow pack MAP

- 5.5 Vertical flow pack MAP

- 5.6 Others (multi-lane machines, custom MAP systems, etc.)

Chapter 6 Market Estimates & Forecast, By Operation, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Automated

- 6.3 Semi-automated

Chapter 7 Market Estimates & Forecast, By Packaging Type, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Tray sealing

- 7.3 Thermoforming

- 7.4 Pouch/Bag

- 7.5 Rigid container

Chapter 8 Market Estimates & Forecast, By End Use Application, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Meat, poultry, and seafood

- 8.3 Bakery & confectionery

- 8.4 Fresh produce (fruits and vegetables)

- 8.5 Dairy products

- 8.6 Ready-to-Eat (RTE) meals

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Coesia Group

- 11.2 G. Mondini

- 11.3 GEA Group

- 11.4 Henkelman

- 11.5 Ilapak

- 11.6 Ishida

- 11.7 MULTIVAC Group

- 11.8 ORICS Industries

- 11.9 PFM Group

- 11.10 Proseal

- 11.11 Reepack

- 11.12 Robert Reiser

- 11.13 Ross Industries

- 11.14 ULMA Packaging

- 11.15 Webomatic