|

市场调查报告书

商品编码

1766363

汽车工程服务外包市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Engineering Services Outsourcing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

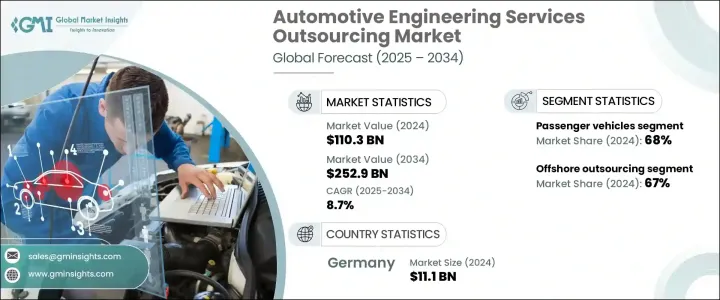

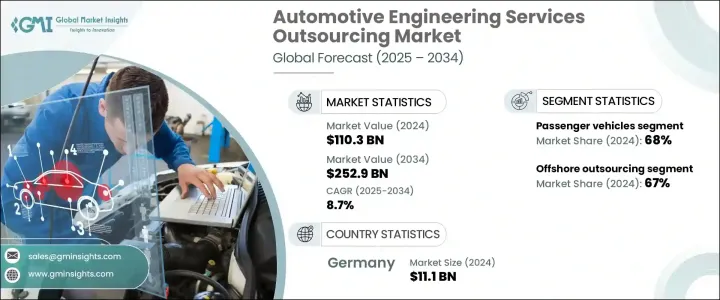

2024 年全球汽车工程服务外包市场规模达 1,103 亿美元,预计到 2034 年将以 8.7% 的复合年增长率成长,达到 2,529 亿美元。这一成长的主要推动因素是电动车需求的不断增长,这引发了汽车架构的根本性转变。电动车的发展需要热调节、电力推进、电池系统和充电基础设施等领域的先进工程技术,而许多原始设备製造商 (OEM) 缺乏这些领域的内部能力,这促使他们与 ESO 公司合作以获得专业支援。同时,连网汽车技术的日益融合已将现代汽车转变为数据丰富的数位平台。随着汽车製造商竞相开发先进的软体功能、远端资讯处理和即时车辆通讯系统,他们越来越多地向 ESO 供应商寻求端到端工程协助、快速部署和可扩展性。对连网、个人化和软体驱动的车内体验的需求继续在全球范围内推动这一趋势。

乘用车领域在2024年占据了68%的市场份额,预计到2034年将以9%的复合年增长率成长。由于产量高,以及对智慧功能、电气化和自动化日益增长的研发需求,该领域仍然是ESO领域中最大的细分市场。汽车製造商正在将乘用车的工程任务外包,以加速产品创新,缩短上市时间,并满足消费者对先进安全性、使用者体验和性能不断变化的需求。专业服务供应商提供可扩展的工程人才和领域专业知识,使原始设备製造商能够以经济高效的方式跨地区交付下一代车型。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1103亿美元 |

| 预测值 | 2529亿美元 |

| 复合年增长率 | 8.7% |

离岸外包市场在2024年占据了67%的份额,预计到2034年将以9.1%的复合年增长率成长。这种模式为汽车製造商提供了显着的成本效益,并使其能够接触到东欧、中国和印度等地区的技术人才。离岸供应商如今已成为CAD/CAE开发、嵌入式系统工程和软体整合领域的重要合作伙伴。他们能够在全球时区错开的情况下提供持续的工程支持,从而加快专案完成速度。随着汽车对软体和电子产品的依赖程度日益加深,这些地区为汽车製造商提供了保持竞争力所需的灵活性和成本效益,同时又能遵守国际标准和品质基准。

2024年,德国汽车工程服务外包市场占29%的市场份额,产值达111亿美元。作为汽车生产和创新的强国,德国持续引领欧洲的ESO格局。德国成熟的原始设备製造商和一级供应商正积极与外部工程伙伴合作,以推动自动驾驶、电动化和数位化行动平台的发展。监管压力和对技术卓越的追求加剧了模拟、车辆合规性和测试流程的外包需求。德国市场凭藉先进的研发文化和政策驱动的创新蓬勃发展,进一步加强了整个开发流程中ESO的整合。

塑造全球汽车工程服务外包市场的关键参与者包括里卡多 (Ricardo)、塔塔科技 (Tata Technologies)、AVL、凯捷 (Capgemini)、Bertrandt、Tech Mahindra、HCL Technologies、IAV、Wipro 和 L&T Technology Services。为了巩固市场地位,ESO 市场的领先公司正在电动汽车系统、ADAS 和车辆互联等关键领域扩展特定领域的服务组合。

他们正在投资提升人才库技能,建立离岸交付中心,并与原始设备製造商 (OEM) 和一级供应商建立策略合作伙伴关係。一些参与者正在将人工智慧 (AI)、机器学习 (ML) 和数位孪生技术融入其工程工作流程,以提供更快、更智慧的开发週期。各公司也专注于合规准备,并使其能力与各地区不断变化的监管标准保持一致。透过联合创新模式和敏捷协作,ESO 公司正在缩短客户的上市时间,同时提高成本效率。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 汽车工程日益复杂

- 电动车普及率不断上升

- 汽车软体的快速发展

- 连网汽车技术的整合

- 产业陷阱与挑战

- 资料安全和智慧财产权问题

- 整合与沟通差距

- 市场机会

- 电动车(EV)发展激增

- 对数位工程服务的需求不断增加

- 售后工程及改造服务

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 案例研究

- 用例

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:依服务分类,2021 - 2034 年

- 主要趋势

- 设计和工程

- 原型设计

- 测试和验证

- 製造工程

- 其他的

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 车身和外观

- 动力传动系统

- 资讯娱乐和远端资讯处理

- ADAS和安全系统

- 其他的

第七章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- 越野车

- 商用车

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车(HCV)

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 在岸外包

- 离岸外包

第九章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 原始设备製造商

- 一级供应商

- 二级和三级供应商

- 售后市场公司

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

- MEA 其余地区

第 11 章:公司简介

- AKKA Technologies

- Altran

- ASAP Holding

- AVL

- Bertrandt

- Capgemini

- Contrio

- ESG Mobility

- FEV Group

- HCL Technologies

- IAV

- Infosys

- KPIT Technologies

- L&T Technology Services

- Luxoft

- Ricardo

- Semcon

- Tata Technologies

- Tech Mahindra

- Wipro

The Global Automotive Engineering Services Outsourcing Market was valued at USD 110.3 billion in 2024 and is estimated to grow at a CAGR of 8.7% to reach USD 252.9 billion by 2034. A major contributor to this growth is the rising demand for electric vehicles, which has sparked a fundamental shift in vehicle architecture. EV development calls for advanced engineering in areas like thermal regulation, electric propulsion, battery systems, and charging infrastructure-disciplines where many OEMs lack internal capacity, prompting collaboration with ESO firms for specialized support. In parallel, the growing integration of connected car technologies has transformed modern vehicles into data-rich digital platforms. As automakers race to develop advanced software features, telematics, and real-time vehicle communication systems, they increasingly turn to ESO providers for end-to-end engineering assistance, rapid deployment, and scalability. The demand for connected, personalized, and software-driven experiences inside vehicles continues to drive this trend on a global scale.

Passenger vehicles segment accounted for 68% share in 2024 and is projected to grow at a 9% CAGR through 2034. This segment remains the largest within the ESO space due to high production volumes and mounting R&D demands for smart features, electrification, and automation. Automakers are outsourcing engineering tasks for passenger vehicles to accelerate product innovation, reduce time to market, and meet evolving consumer demands for advanced safety, user experience, and performance. Specialized service providers offer scalable engineering talent and access to domain expertise, making it cost-efficient for OEMs to deliver next-generation vehicle models across regions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $110.3 Billion |

| Forecast Value | $252.9 Billion |

| CAGR | 8.7% |

Offshore outsourcing segment held 67% share in 2024 and is estimated to grow at a CAGR of 9.1% through 2034. This model offers OEMs significant cost benefits and access to skilled talent pools in regions such as Eastern Europe, China, and India. Offshore vendors are now essential partners for CAD/CAE development, embedded systems engineering, and software integration. Their ability to provide continuous engineering support through staggered global time zones allows for quicker project completion. As cars become more dependent on software and electronics, these regions provide OEMs with the flexibility and cost-efficiency required to stay competitive while adhering to international standards and quality benchmarks.

Germany Automotive Engineering Services Outsourcing Market held a 29% share in 2024 and generated USD 11.1 billion. As a powerhouse of automotive production and innovation, Germany continues to lead the ESO landscape in Europe. The country's established OEMs and Tier 1 suppliers are actively collaborating with external engineering partners to advance autonomous, electric, and digital mobility platforms. Regulatory pressures and the push for technological excellence have intensified outsourcing needs in simulation, vehicle compliance, and testing processes. The German market thrives on advanced R&D culture and policy-driven innovation, which further strengthens ESO integration across the development pipeline.

Key players shaping the Global Automotive Engineering Services Outsourcing Market include Ricardo, Tata Technologies, AVL, Capgemini, Bertrandt, Tech Mahindra, HCL Technologies, IAV, Wipro, and L&T Technology Services. To strengthen their foothold, leading companies in the ESO market are expanding domain-specific service portfolios in key areas such as EV systems, ADAS, and vehicle connectivity.

They are investing in upskilling talent pools, establishing offshore delivery centers, and forming strategic partnerships with OEMs and Tier 1 suppliers. Several players are integrating AI, ML, and digital twin technologies into their engineering workflows to offer faster, smarter development cycles. Companies are also focusing on compliance readiness and aligning their capabilities with evolving regulatory standards across regions. Through co-innovation models and agile collaboration, ESO firms are shortening time-to-market for clients while improving cost efficiency.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Services

- 2.2.3 Application

- 2.2.4 Vehicle

- 2.2.5 Location

- 2.2.6 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factors affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing complexity in automotive engineering

- 3.2.1.2 Rising adoption of electric vehicles

- 3.2.1.3 Rapid advancement in automotive software

- 3.2.1.4 Integration of connected car technologies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Data security and IP concerns

- 3.2.2.2 Integration and communication gaps

- 3.2.3 Market opportunities

- 3.2.3.1 Surge in electric vehicle (EV) development

- 3.2.3.2 Increasing demand for digital engineering services

- 3.2.3.3 Aftermarket engineering and retrofit services

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Case studies

- 3.9 Use cases

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Services, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Design and engineering

- 5.3 Prototyping

- 5.4 Testing and validation

- 5.5 Manufacturing engineering

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Body and exterior

- 6.3 Powertrain and drivetrain

- 6.4 Infotainment and telematics

- 6.5 ADAS and safety system

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 Light Commercial Vehicles (LCV)

- 7.3.2 Medium Commercial Vehicles (MCV)

- 7.3.3 Heavy Commercial Vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By Location, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Onshore outsourcing

- 8.3 Offshore outsourcing

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 OEMs

- 9.3 Tier 1 suppliers

- 9.4 Tier 2 and tier 3 suppliers

- 9.5 Aftermarket companies

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.3.8 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.4.7 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

- 10.6.4 Rest of MEA

Chapter 11 Company Profiles

- 11.1 AKKA Technologies

- 11.2 Altran

- 11.3 ASAP Holding

- 11.4 AVL

- 11.5 Bertrandt

- 11.6 Capgemini

- 11.7 Contrio

- 11.8 ESG Mobility

- 11.9 FEV Group

- 11.10 HCL Technologies

- 11.11 IAV

- 11.12 Infosys

- 11.13 KPIT Technologies

- 11.14 L&T Technology Services

- 11.15 Luxoft

- 11.16 Ricardo

- 11.17 Semcon

- 11.18 Tata Technologies

- 11.19 Tech Mahindra

- 11.20 Wipro