|

市场调查报告书

商品编码

1773237

沥青乳化剂市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Bitumen Emulsifiers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

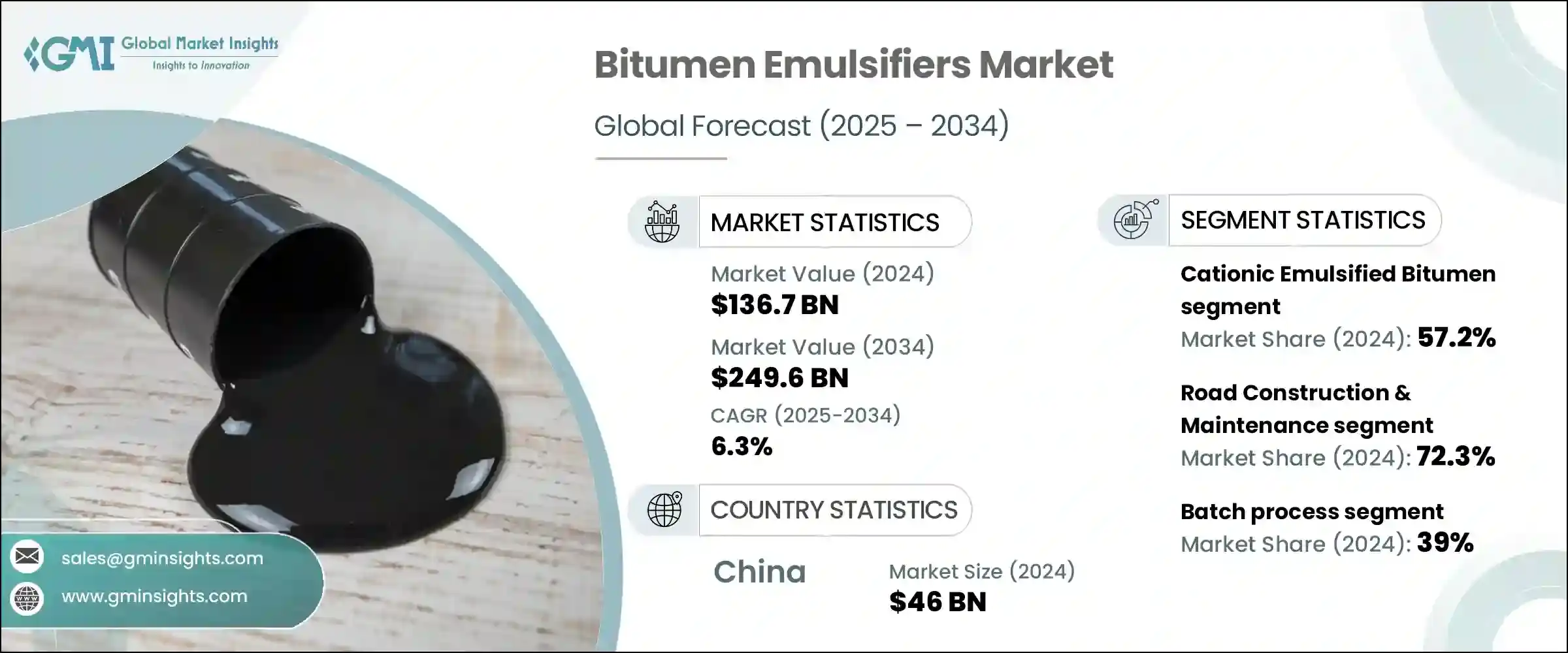

2024年,全球沥青乳化剂市场规模达1,367亿美元,预计到2034年将以6.3%的复合年增长率成长,达到2,496亿美元。这一成长主要源自于基础设施投资的增加,尤其是在具有挑战性地形的大规模政府计画。沥青乳化剂因其耐寒施工和强大的耐恶劣天气性能而成为这些项目的首选,是长期道路建设和维护的理想选择。其水性配方显着减少了碳氢化合物排放,无需加热,符合全球各地日益严格的环境和安全法规。

这些环保优势显着加速了沥青乳化剂在永续建筑实践中的应用,尤其是在优先考虑碳中和和职业安全的地区。由于乳化剂无需在施工过程中进行高温加热,因此可大幅降低燃料消耗和相关的温室气体排放。这种能源消耗的减少与全球向绿色基础设施和净零排放目标的转变相契合。此外,其冷施工特性可最大限度地降低火灾隐患和工人接触有害烟雾的风险,从而提高施工现场的安全性。北美、欧洲和亚太地区的政府和监管机构越来越多地要求在公共基础设施项目中使用低挥发性有机化合物 (VOC) 和环保材料,这进一步增强了对沥青乳化剂的需求,使其成为比传统沥青更安全、更清洁、更高效的替代品。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1367亿美元 |

| 预测值 | 2496亿美元 |

| 复合年增长率 | 6.3% |

阳离子沥青乳化剂领域在2024年占据主导地位,市占率达57.2%,这主要归功于其与带负电荷的骨材表面的出色黏结能力。这种卓越的附着力确保了路面在交通繁忙和天气变化条件下具有更好的耐久性和弹性。阳离子配方还具有多功能性,使其非常适合从山区地形到沿海气候的各种施工环境。它们在不同温度和湿度条件下的稳定性能持续推动其需求,尤其是在大规模城市发展和主要道路基础设施项目。

2024年,道路建设和维护领域占了72.3%的市场。沥青乳化剂在现代铺路施工中至关重要,因为它们广泛用于黏结层、修补料、碎石封层和路面敷料。其冷施工特性降低了操作风险,即使在低温条件下也能施工,从而减少了能源消耗和专案延误。这些优势使其成为新建和日常维护的理想选择,尤其适用于交通繁忙的道路和快速修復工程。其速凝特性还能最大限度地减少交通中断,这在城市地区至关重要。

2024年,中国沥青乳化剂市场规模达460亿美元。中国持续投资交通基础设施,包括国道、乡村公路和智慧城市走廊,推动了高性能沥青乳化剂的广泛应用。政府致力于永续、低排放施工实务的措施与冷敷乳化沥青的环境效益相契合,冷敷乳化沥青的挥发性有机化合物(VOC)排放量更低,能耗更低。随着长期战略性基础设施项目的实施,对环保耐用道路材料的需求将持续增长,这将巩固中国在市场成长领域的领先地位。

影响沥青乳化剂产业的关键参与者包括英杰维蒂公司、阿科玛集团、赢创工业股份公司、诺力昂和巴斯夫欧洲公司。这些公司透过持续的产品开发和市场扩张来塑造竞争环境。为了巩固自身地位,沥青乳化剂领域的公司正在优先研发能够满足不同气候和环境需求的先进配方。他们正在扩大区域分销网络,并与道路建设公司和公共基础设施机构建立策略合作伙伴关係。永续性是核心关注点——各公司正在加大对环保、低VOC乳化剂的投资,并推广符合绿色建筑要求的解决方案。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 基础建设不断推进

- 环境效益与法规

- 成本效益

- 技术进步

- 产业陷阱与挑战

- 应用温度范围有限

- 储存稳定性问题

- 与热拌沥青相比强度较低

- 原油价格波动

- 市场机会

- 新兴经济体的需求不断成长

- 更重视永续建筑

- 生物基乳化剂的开发

- 冷回收技术的应用日益广泛

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 按产品

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利态势

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 阳离子沥青乳化剂

- 快速凝固(CRS)

- 中等设定(CMS)

- 慢速设定(CSS)

- 阴离子沥青乳化剂

- 快速设定(RS)

- 中等设定(MS)

- 慢凝(SS)

- 非离子沥青乳化剂

- 改质沥青乳化剂

- 聚合物改性

- SBS改性

- SBR改性

- 其他的

- 乳胶改性

- 其他的

- 聚合物改性

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 道路建设与维护

- 表面修整

- 黏层

- 底漆

- 稀浆封层

- 微表处

- 冷拌沥青

- 雾封

- 碎石封层

- 防水

- 建筑施工

- 基础设施

- 路面回收

- 全深度填海(FDR)

- 就地冷再生(CIR)

- 冷中央工厂回收(CCPR)

- 其他的

- 土壤稳定

- 黏合剂

- 工业应用

第七章:市场估计与预测:按最终用途产业,2021 - 2034 年

- 主要趋势

- 道路和高速公路建设

- 机场建设

- 建筑施工

- 住宅

- 商业的

- 工业的

- 其他的

- 铁路

- 海洋

- 农业

第八章:市场估计与预测:按製造工艺,2021 - 2034 年

- 主要趋势

- 批次处理

- 连续製程

- 半连续工艺

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- Alternative Environmental Technologies (AET)

- Arkema Group

- BASF SE

- Bharat Petroleum Corporation Limited (BPCL)

- BTBA

- Dow Chemical Company

- Evonik Industries AG

- GlobeCore

- Hindustan Colas Limited (HINCOL)

- Hindustan Petroleum Corporation Limited (HPCL)

- Ingevity Corporation

- Jey Oil Refining Company

- Kao Corporation

- Marathon Petroleum Asphalt & Emulsions

- Nouryon

- Nynas AB

- Petro Naft

- Pro-Road Global

- Royal Dutch Shell plc

- Tiki Tar Industries

- Total Energies SE

- Winstrol Petrochemicals Pvt. Ltd.

The Global Bitumen Emulsifiers Market was valued at USD 136.7 billion in 2024 and is estimated to grow at a CAGR of 6.3% to reach USD 249.6 billion by 2034. This growth is primarily driven by increased investment in infrastructure, particularly large-scale government initiatives across challenging terrains. Bitumen emulsifiers are preferred for these projects due to their cold application and strong resistance to adverse weather, making them ideal for long-lasting road construction and maintenance. Their water-based formulation significantly reduces hydrocarbon emissions and eliminates the need for heating, aligning well with stricter environmental and safety regulations across global regions.

These eco-friendly benefits have significantly accelerated the adoption of bitumen emulsifiers in sustainable construction practices, particularly in regions prioritizing carbon neutrality and occupational safety. Since emulsifiers eliminate the need for high-temperature heating during application, they drastically lower fuel consumption and associated greenhouse gas emissions. This reduction in energy usage aligns with the global shift toward green infrastructure and net-zero targets. Additionally, their cold-application nature minimizes risks of fire hazards and worker exposure to harmful fumes, enhancing safety on construction sites. Governments and regulatory bodies across North America, Europe, and Asia-Pacific are increasingly mandating the use of low-VOC and environmentally responsible materials in public infrastructure projects, which has further reinforced the demand for bitumen emulsifiers as a safer, cleaner, and more efficient alternative to conventional asphalt.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $136.7 Billion |

| Forecast Value | $249.6 Billion |

| CAGR | 6.3% |

The cationic bitumen emulsifiers segment held the dominant position with a 57.2% market share in 2024, largely attributed to its excellent bonding ability with negatively charged aggregate surfaces. This superior adhesion ensures better durability and resilience of road surfaces under heavy traffic and shifting weather conditions. Cationic formulations also offer versatility, making them highly suitable for a range of construction environments-from mountainous terrains to coastal climates. Their consistent performance under various temperature and moisture levels continues to drive their demand, particularly in large-scale urban development and major roadway infrastructure projects.

The road construction and maintenance segment held a 72.3% share in 2024. Bitumen emulsifiers are critical in modern paving operations as they are widely used in tack coats, patching compounds, chip seals, and surface dressings. Their cold-application properties reduce operational hazards and allow construction even in low-temperature conditions, cutting down on energy usage and project delays. These advantages make them ideal for both new construction and routine maintenance, especially for high-traffic roads and rapid rehabilitation efforts. Their quick-setting nature also minimizes traffic disruptions, which is essential in urban areas.

China Bitumen Emulsifiers Market generated USD 46 billion in 2024. The country's ongoing investments in transportation infrastructure-including national highways, rural roads, and smart city corridors-have fueled the widespread adoption of high-performance bitumen emulsifiers. Government initiatives focused on sustainable, low-emission construction practices further align with the environmental benefits of cold-applied emulsified bitumen, which releases fewer VOCs and requires less energy. With long-term strategic infrastructure projects in place, the demand for eco-friendly, durable road materials is set to increase, reinforcing China's position at the forefront of market growth.

Key players influencing the Bitumen Emulsifiers Industry include Ingevity Corporation, Arkema Group, Evonik Industries AG, Nouryon, and BASF SE. These companies shape the competitive environment through ongoing product development and market expansion. To strengthen their position, companies in the bitumen emulsifiers space are prioritizing R&D for advanced formulations that address varying climatic and environmental demands. They are expanding their regional distribution networks and engaging in strategic partnerships with road construction firms and public infrastructure agencies. Sustainability is a core focus-firms are increasing investment in eco-friendly, low-VOC emulsifiers and promoting solutions that meet green construction mandates.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Application

- 2.2.4 End use industry

- 2.2.5 Manufacturing process

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising infrastructure development

- 3.2.1.2 Environmental benefits & regulations

- 3.2.1.3 Cost-effectiveness

- 3.2.1.4 Technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited temperature range for application

- 3.2.2.2 Storage stability concerns

- 3.2.2.3 Lower strength compared to hot mix asphalt

- 3.2.2.4 Fluctuating crude oil prices

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand in emerging economies

- 3.2.3.2 Increasing focus on sustainable construction

- 3.2.3.3 Development of bio-based emulsifiers

- 3.2.3.4 Rising adoption in cold recycling technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation Landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Cationic bitumen emulsifiers

- 5.2.1 Rapid setting (CRS)

- 5.2.2 Medium setting (CMS)

- 5.2.3 Slow setting (CSS)

- 5.3 Anionic bitumen emulsifiers

- 5.3.1 Rapid setting (RS)

- 5.3.2 Medium setting (MS)

- 5.3.3 Slow setting (SS)

- 5.4 Non-ionic bitumen emulsifiers

- 5.5 Modified bitumen emulsifiers

- 5.5.1 Polymer modified

- 5.5.1.1 SBS modified

- 5.5.1.2 SBR modified

- 5.5.1.3 Others

- 5.5.2 Latex modified

- 5.5.3 Others

- 5.5.1 Polymer modified

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Road construction & maintenance

- 6.2.1 Surface dressing

- 6.2.2 Tack coat

- 6.2.3 Prime coat

- 6.2.4 Slurry seal

- 6.2.5 Micro surfacing

- 6.2.6 Cold mix asphalt

- 6.2.7 Fog seal

- 6.2.8 Chip seal

- 6.3 Waterproofing

- 6.3.1 Building construction

- 6.3.2 Infrastructure

- 6.4 Pavement recycling

- 6.4.1 Full depth reclamation (FDR)

- 6.4.2 Cold in-place recycling (CIR)

- 6.4.3 Cold central plant recycling (CCPR)

- 6.5 Others

- 6.5.1 Soil stabilization

- 6.5.2 Adhesives

- 6.5.3 Industrial applications

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Road & highway construction

- 7.3 Airport construction

- 7.4 Building construction

- 7.4.1 Residential

- 7.4.2 Commercial

- 7.4.3 Industrial

- 7.5 Others

- 7.5.1 Railways

- 7.5.2 Marine

- 7.5.3 Agriculture

Chapter 8 Market Estimates and Forecast, By Manufacturing Process, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Batch process

- 8.3 Continuous process

- 8.4 Semi-continuous process

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Alternative Environmental Technologies (AET)

- 10.2 Arkema Group

- 10.3 BASF SE

- 10.4 Bharat Petroleum Corporation Limited (BPCL)

- 10.5 BTBA

- 10.6 Dow Chemical Company

- 10.7 Evonik Industries AG

- 10.8 GlobeCore

- 10.9 Hindustan Colas Limited (HINCOL)

- 10.10 Hindustan Petroleum Corporation Limited (HPCL)

- 10.11 Ingevity Corporation

- 10.12 Jey Oil Refining Company

- 10.13 Kao Corporation

- 10.14 Marathon Petroleum Asphalt & Emulsions

- 10.15 Nouryon

- 10.16 Nynas AB

- 10.17 Petro Naft

- 10.18 Pro-Road Global

- 10.19 Royal Dutch Shell plc

- 10.20 Tiki Tar Industries

- 10.21 Total Energies SE

- 10.22 Winstrol Petrochemicals Pvt. Ltd.

![中国沥青市场评估:依类型[铺路沥青、氧化沥青、聚合物改质沥青、其他]、应用[道路建设、防水、黏合剂、其他]、地区、机会及预测(2018-2032)](/sample/img/cover/42/default_cover_mx.png)