|

市场调查报告书

商品编码

1773239

海上钻井废弃物管理市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Offshore Drilling Waste Management Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

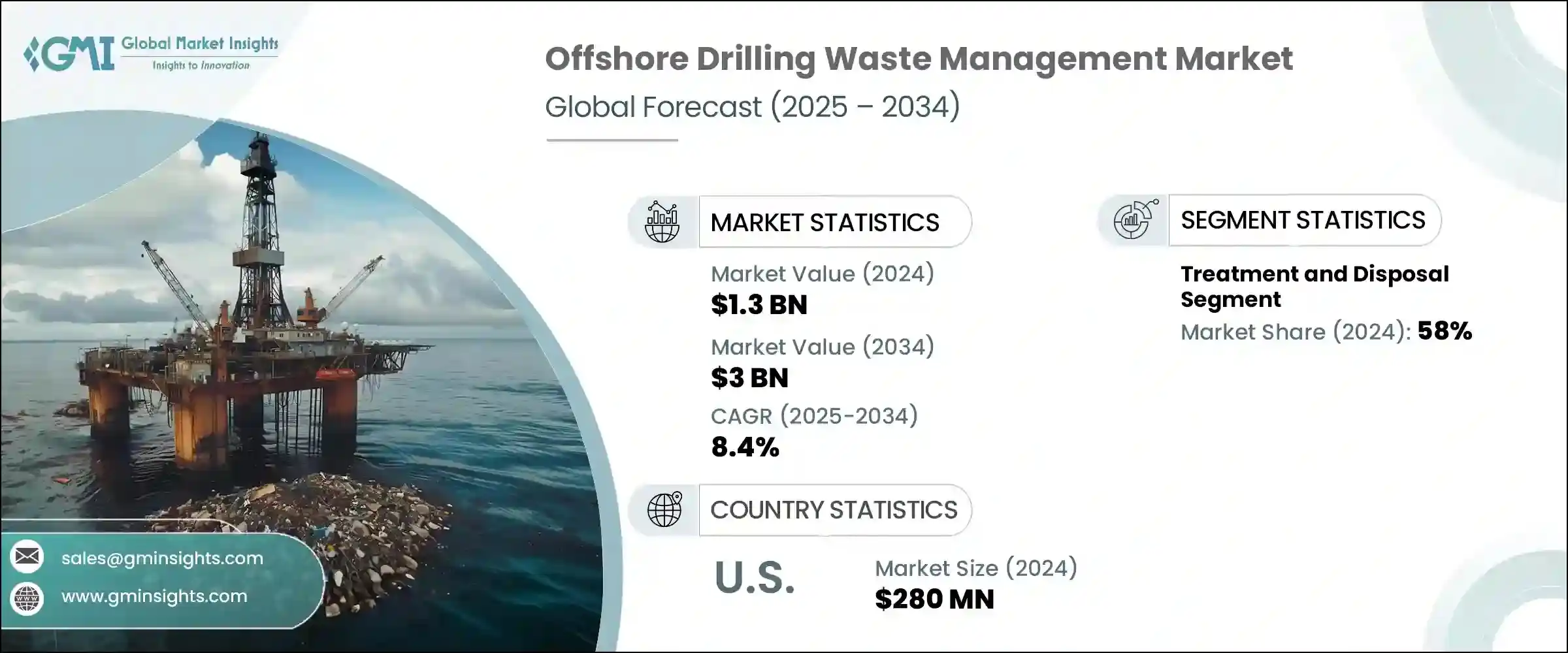

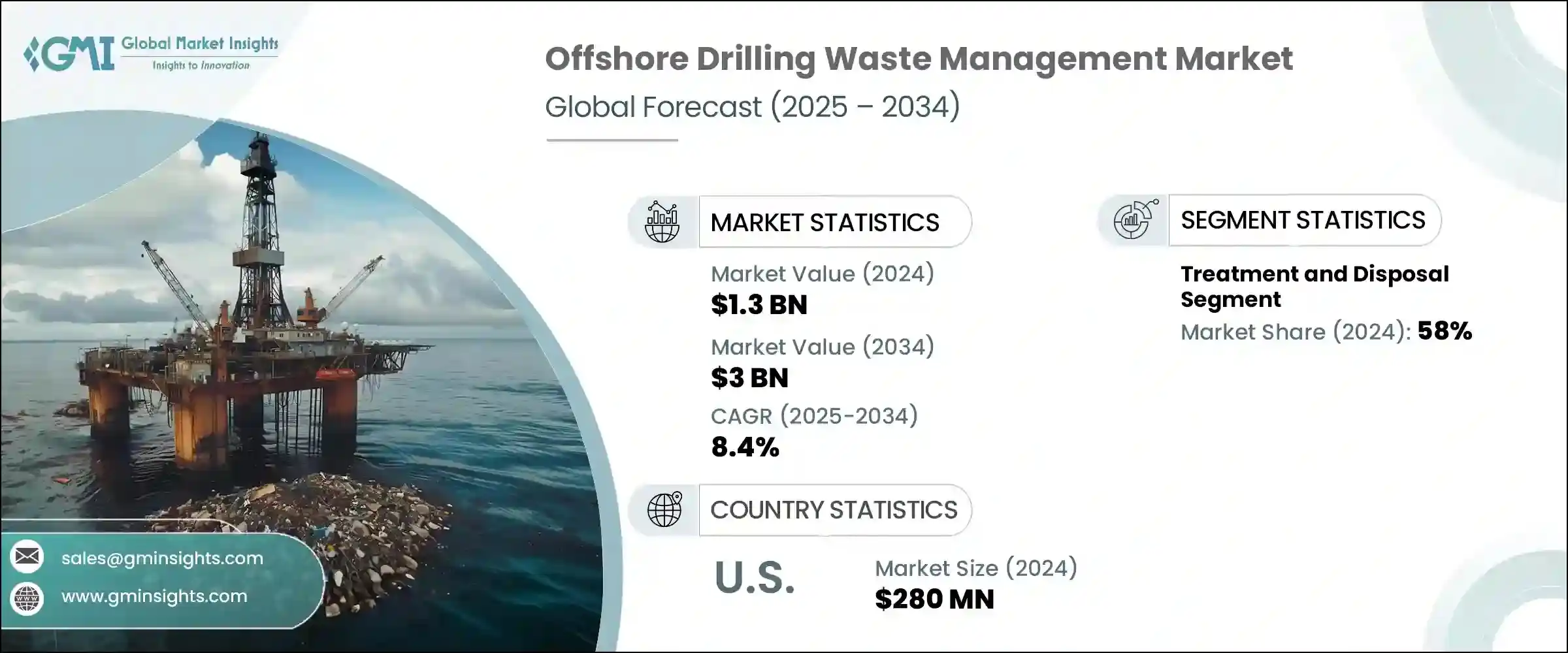

2024年,全球海上钻井废弃物管理市场规模达13亿美元,预计2034年将以8.4%的复合年增长率成长,达到30亿美元。该市场的扩张主要得益于日益严格的环境法规的实施,尤其是在环境影响备受关注的海上钻井区域。随着勘探活动持续向深水和超深水区域转移,钻井废弃物的数量和复杂性也不断增加,对更先进、更合规的废弃物管理解决方案的需求也日益增加。石油和天然气行业日益重视永续性,营运商面临着在保持生产效率的同时减少环境足迹的压力,这进一步推动了这一成长。

海上钻井会产生各种废弃物流,包括钻井液、钻屑和采出水,所有这些废弃物都需要适当的控制、处理和处置,以防止环境污染。为此,各公司正大力投资专门用于在海上环境中处理这些物质的技术。这包括支援闭环系统和零排放作业的解决方案,尤其是在生态敏感的海上区域。多个地区的监管机构正在加强合规措施,迫使钻井公司采用先进的废弃物处理方法并维持更高的环境标准。因此,对海上废弃物管理服务的需求激增,反映出产业正在更广泛地转向负责任和永续的营运。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 13亿美元 |

| 预测值 | 30亿美元 |

| 复合年增长率 | 8.4% |

市场技术也取得了显着进步,创新重点在于提高效率、减少排放和最大限度地减少海洋污染。营运商越来越多地部署综合废弃物管理系统,该系统提供即时资料追踪和自动化功能,以确保最佳性能和合规性。这些数位化解决方案能够深入了解废弃物成分和处理结果,从而加快决策速度并改善成本控制。这些技术的整合正在透过简化营运流程和减少对人工监督的依赖,彻底改变废弃物管理实务。

在关键服务领域中,处理和处置在2024年占据了最大的市场份额,约占总收入的58%。该领域涵盖了各种处理方法,例如热处理、化学中和、固化和生物处理。人们对环保和低排放处理解决方案的日益青睐正在重塑服务产品,企业逐渐摆脱传统做法,转而专注于减少长期环境责任。海上运营商尤其倾向于现场处理方案,这种方案允许在现场处理废物,从而减少对大量运输的需求,并最大限度地降低环境风险。

美国市场发展势头强劲,海上钻井废弃物管理产业的估值预计在2022年达到2.3亿美元,2023年达到2.5亿美元,2024年达到2.8亿美元。这一增长得益于多种因素,包括严格的环境政策实施、海上钻井项目的扩张以及全行业对永续性的日益重视。钻井强度增加导致废弃物产生量增加,这导致对先进废弃物处理和控制解决方案的需求增加。随着监管机构加强监管并完善技术标准,营运商被迫升级现有系统,并采用更安全、更有效的废弃物处理方法。

海上钻井废弃物管理市场的竞争格局由跨国公司和区域参与者共同塑造。 2024年,排名前五的公司——贝克休斯、哈里伯顿、威德福、SLB和TWMA——合计占据了全球超过30%的市场份额。这些公司凭藉全面的服务组合、全球营运能力和技术创新巩固了其市场地位。他们能够提供端到端的废弃物管理解决方案——从废弃物收容到处理、运输和最终处置——这使其在服务复杂的海上项目方面拥有独特的优势。除了主要参与者之外,由成熟的区域性公司和利基本地服务提供者组成的网路也加剧了竞争,并鼓励技术和营运最佳实践的持续改进。

从策略上讲,领先的公司正优先考虑服务整合和数位转型,以提高效率和合规性。透过在单一服务框架下提供完整的废弃物管理生态系统,他们简化了离岸客户的供应商协调,同时优化了绩效并降低了营运成本。这些公司还采用即时监控系统和资料分析,以提高废弃物处理流程的可追溯性,并推动整个专案生命週期的更好决策。随着市场的发展,此类创新很可能成为保持竞争力和满足日益增长的监管和永续发展期望的关键。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 策略倡议

- 竞争基准测试

- 策略仪表板

- 创新与技术格局

第五章:市场规模及预测:依服务,2021 - 2034 年

- 主要趋势

- 固体控制

- 遏制和处理

- 处理和处置

- 其他的

第六章:市场规模及预测:依地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 法国

- 英国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 拉丁美洲

- 巴西

- 阿根廷

第七章:公司简介

- Augean

- Baker Hughes Company

- CLEAN HARBORS, Inc.

- Derrick Corporation

- Geminor

- GN Solids Control

- Halliburton

- Imdex Limited

- Newpark Drilling Fluids LLC

- NOV

- Ridgeline Canada Inc.

- Secure Energy Services

- SELECT WATER SOLUTIONS

- SLB

- Soli-Bond, Inc.

- TWMA

- Weatherford

The Global Offshore Drilling Waste Management Market was valued at USD 1.3 billion in 2024 and is estimated to grow at a CAGR of 8.4% to reach USD 3 billion by 2034. The expansion of this market is largely driven by the growing implementation of stringent environmental regulations, particularly in offshore drilling zones where environmental impact is a significant concern. As exploration activities continue to shift toward deepwater and ultra-deepwater locations, the volume and complexity of drilling waste are also rising, demanding more advanced and compliant waste management solutions. This growth is further supported by the increasing emphasis on sustainability within the oil and gas industry, with operators under pressure to reduce their environmental footprint while maintaining production efficiency.

Offshore drilling generates a variety of waste streams, including drilling fluids, drill cuttings, and produced water, all of which require proper containment, treatment, and disposal to prevent environmental contamination. In response, companies are investing heavily in technologies specifically designed to handle these materials in offshore environments. This includes solutions that support closed-loop systems and zero-discharge operations, especially in ecologically sensitive offshore areas. Regulatory agencies across multiple regions are reinforcing compliance measures, compelling drilling companies to adopt advanced waste handling practices and maintain higher environmental standards. As a result, the demand for offshore waste management services has surged, reflecting a broader industry shift toward responsible and sustainable operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $3 Billion |

| CAGR | 8.4% |

The market has also seen notable advancements in technology, with innovations focused on improving efficiency, reducing emissions, and minimizing marine pollution. Operators are increasingly implementing integrated waste management systems that offer real-time data tracking and automation to ensure optimal performance and compliance. These digital solutions provide insights into waste composition and treatment outcomes, enabling quicker decision-making and improved cost control. The integration of these technologies is transforming waste management practices by streamlining operations and reducing reliance on manual oversight.

Among the key service segments, treatment and disposal accounted for the largest share of the market in 2024, commanding approximately 58% of the overall revenue. This segment includes a wide array of treatment methods such as thermal processing, chemical neutralization, solidification, and biological treatment. The growing preference for eco-friendly and low-emission treatment solutions is reshaping service offerings, with companies moving away from conventional practices and focusing on reducing long-term environmental liabilities. Offshore operators are particularly inclined toward in-situ treatment options that allow waste to be processed on-site, cutting down the need for extensive transport and minimizing environmental risk.

The market in the United States has shown significant momentum, with the offshore drilling waste management sector valued at USD 230 million in 2022, USD 250 million in 2023, and USD 280 million in 2024. This growth is fueled by a combination of factors, including the enforcement of rigorous environmental policies, expansion in offshore drilling projects, and a growing industry-wide focus on sustainability. The rise in waste generation due to increased drilling intensity has led to greater demand for advanced waste processing and containment solutions. With regulatory authorities stepping up oversight and refining technical standards, operators are being pushed to upgrade existing systems and adopt safer, more effective methods for waste handling.

The competitive landscape of the offshore drilling waste management market is shaped by a mix of multinational corporations and regional players. In 2024, the top five companies- Baker Hughes, Halliburton, Weatherford, SLB, and TWMA-together held over 30% of the global market share. These companies have cemented their positions through a combination of comprehensive service portfolios, global operational capabilities, and technological innovation. Their ability to deliver end-to-end waste management solutions-from waste containment to treatment, transportation, and final disposal-gives them a distinct edge in servicing complex offshore projects. Alongside the major players, a network of established regional firms and niche local service providers adds to the competitive intensity, encouraging continuous advancements in technology and operational best practices.

Strategically, leading companies are prioritizing service integration and digital transformation to enhance efficiency and compliance. By offering complete waste management ecosystems under a single service umbrella, they are simplifying vendor coordination for offshore clients while optimizing performance and reducing operational costs. These players are also adopting real-time monitoring systems and data analytics to improve the traceability of waste handling processes and drive better decision-making across project lifecycles. As the market evolves, such innovations are likely to become essential for maintaining competitiveness and meeting rising regulatory and sustainability expectations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic initiative

- 4.4 Competitive benchmarking

- 4.5 Strategy dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Service, 2021 - 2034, (USD Billion)

- 5.1 Key trends

- 5.2 Solid control

- 5.3 Containment & handling

- 5.4 Treatment & disposal

- 5.5 Others

Chapter 6 Market Size and Forecast, By Region, 2021 - 2034, (USD Billion)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.3 Europe

- 6.3.1 Germany

- 6.3.2 France

- 6.3.3 UK

- 6.3.4 Spain

- 6.3.5 Italy

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.4.4 Australia

- 6.4.5 South Korea

- 6.5 Middle East & Africa

- 6.5.1 Saudi Arabia

- 6.5.2 South Africa

- 6.5.3 UAE

- 6.6 Latin America

- 6.6.1 Brazil

- 6.6.2 Argentina

Chapter 7 Company Profiles

- 7.1 Augean

- 7.2 Baker Hughes Company

- 7.3 CLEAN HARBORS, Inc.

- 7.4 Derrick Corporation

- 7.5 Geminor

- 7.6 GN Solids Control

- 7.7 Halliburton

- 7.8 Imdex Limited

- 7.9 Newpark Drilling Fluids LLC

- 7.10 NOV

- 7.11 Ridgeline Canada Inc.

- 7.12 Secure Energy Services

- 7.13 SELECT WATER SOLUTIONS

- 7.14 SLB

- 7.15 Soli-Bond, Inc.

- 7.16 TWMA

- 7.17 Weatherford