|

市场调查报告书

商品编码

1773257

钻井废弃物控制与处理市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Containment and Handling Drilling Waste Management Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

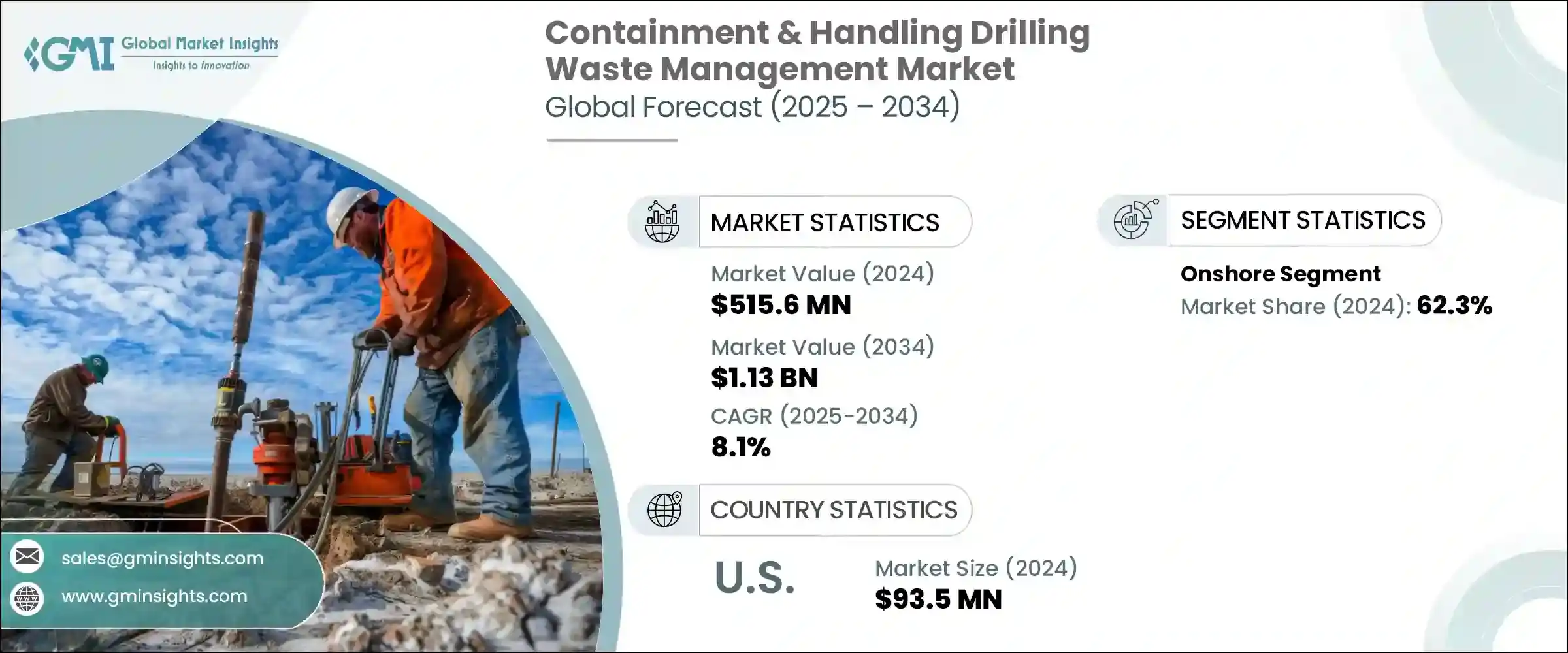

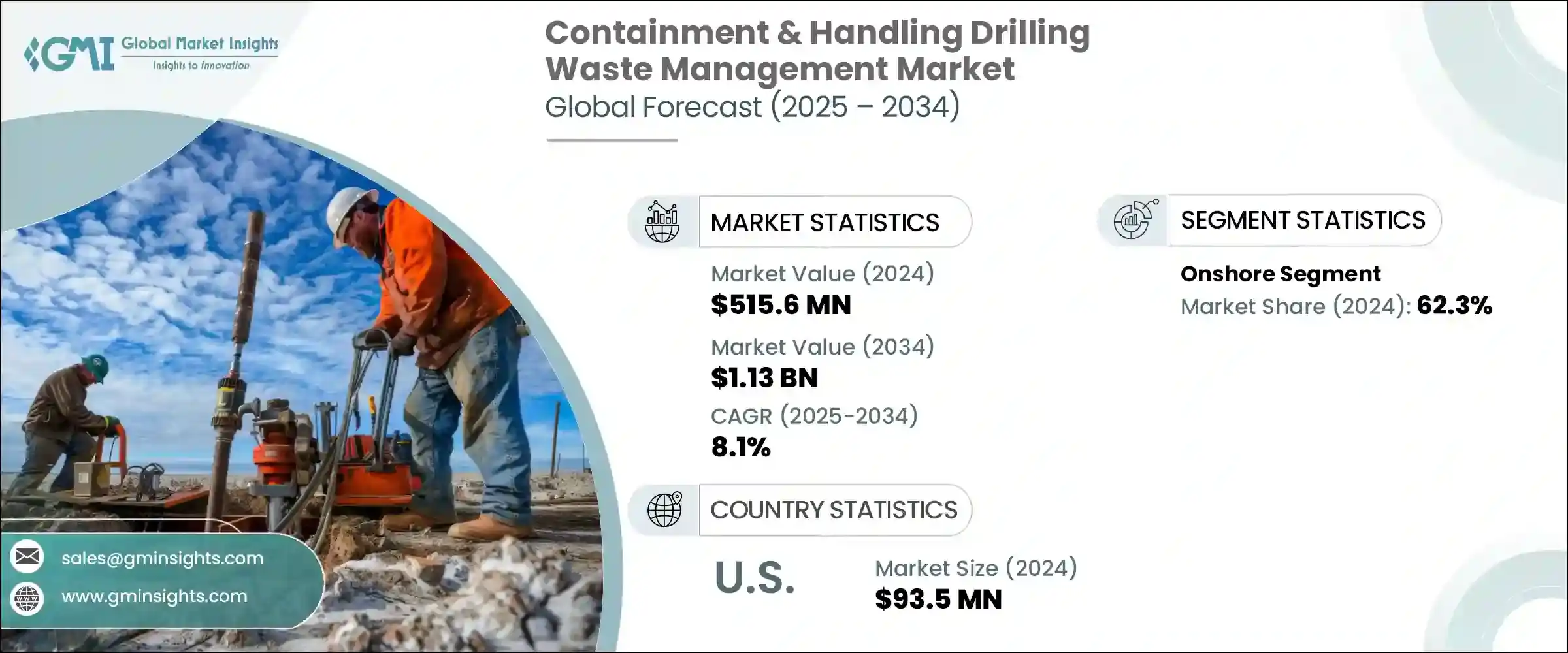

2024年,全球钻井废弃物控制与处理市场规模达5.156亿美元,预计年复合成长率将达8.1%,2034年将达到11.3亿美元。日益严格的钻井废弃物处理环境法规是推动市场成长的主要力量。世界各国政府正在实施更严格的政策,以规范钻井泥浆、岩屑及相关污染物的管理、控制和最终处置,从而最大限度地减少生态损害。日益严格的监管架构迫使企业采用更先进的废弃物处理解决方案。

此外,现场废弃物处理的改进以及向水基钻井液的转变(与传统的油基或合成泥浆相比,水基钻井液产生的危险废弃物更少)正在影响市场动态。然而,一些油基钻井废弃物仍被环保部门列为危险废弃物,导致处理要求更加复杂且成本更高。日益严格的环保审查正在推动创新浪潮,并吸引整个产业的大量投资。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 5.156亿美元 |

| 预测值 | 11.3亿美元 |

| 复合年增长率 | 8.1% |

企业积极开发先进技术和更智慧的解决方案,不仅满足监管要求,甚至超越监管要求。这种动力正推动企业采用人工智慧驱动的分析、即时监控和自动报告系统等尖端工具。投资者认识到永续实践的长期价值,将资金投向那些优先考虑环境合规和营运效率的公司。因此,该行业正在加速研发工作,建立策略合作伙伴关係,并扩展产品组合,旨在应对不断变化的环境挑战,同时支持业务成长。

2024年,陆上作业板块占了62.3%的市场份额,这得益于水力压裂技术在各新兴经济体的不断扩张。这些高产量钻井活动会产生大量的钻屑、返排液和采出水,所有这些都需要在进行任何下游处理或处置之前,采用安全的现场围堵解决方案。随着资源丰富地区的钻井活动日益频繁,对可扩展且合规的废弃物处理系统的需求急剧增长。营运商正在优先投资围堵设备和现场专用基础设施,以符合环境合规性和营运效率标准。

2024年,美国钻井废弃物控制与处理市场规模达9,350万美元。美国和加拿大持续面临来自联邦和地区严格环境法规的日益增长的压力,尤其是在排放、水安全和土地使用方面。加之页岩油气储量丰富的地层钻井活动日益增多,这种监管环境加速了先进控制技术和永续废弃物处理架构的转变。该地区注重在保持产量的同时降低生态风险,这进一步巩固了北美在製定全球钻井废弃物管理实践标准方面的作用。

活跃于市场的公司包括贝克休斯、斯伦贝谢、Clean Harbors、哈里伯顿、GN Solids Control、Newpark Resources、TWMA、Derrick Equipment Company、Secure Energy Services、Imdex、Ridgeline Canada、Soli-Bond、Select Water Solutions、Weatherford、Augean 和 NOV。为了巩固市场地位,领先企业专注于拓展技术能力,包括根据监管要求量身定制的先进现场废弃物处理和控制系统。

他们优先遵守不断发展的环境标准,并开发更安全、更有效率的处理解决方案,以减少对生态的影响。策略伙伴关係和收购是拓展服务范围和地理覆盖范围的常见方式。许多公司投资研发以增强产品创新,尤其是在处理黏性或危险材料等高难度废弃物流方面。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 战略仪表板

- 策略倡议

- 竞争基准测试

- 创新和技术格局

第五章:市场规模及预测:依应用,2021 - 2034

- 主要趋势

- 陆上

- 海上

第六章:市场规模及预测:依地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 拉丁美洲

- 巴西

- 阿根廷

第七章:公司简介

- Augean

- Baker Hughes

- Clean Harbors

- Derrick Equipment Company

- Geminor

- GN Solids Control

- Halliburton

- Imdex

- Newpark Resources

- NOV

- Ridgeline Canada

- Schlumberger

- Secure Energy Services

- Select Water Solutions

- Soli-Bond

- TWMA

- Weatherford

The Global Containment and Handling Drilling Waste Management Market was valued at USD 515.6 million in 2024 and is estimated to grow at a CAGR of 8.1% to reach USD 1.13 billion by 2034. Increasingly stringent environmental regulations around the disposal of drilling waste are a primary force shaping market growth. Governments worldwide are enforcing tougher policies on the management, containment, and final disposal of drilling muds, cuttings, and related pollutants to minimize ecological harm. This tightening regulatory framework is compelling companies to adopt more advanced waste-handling solutions.

Additionally, improvements in on-site waste treatment and a shift toward water-based drilling fluids, which produce less hazardous waste compared to traditional oil-based or synthetic muds, are influencing market dynamics. However, some oil-based drilling waste remains classified as hazardous by environmental authorities, leading to more complex and costly disposal requirements. This increasing environmental scrutiny is fueling a surge in innovation and attracting significant investment across industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $515.6 Million |

| Forecast Value | $1.13 Billion |

| CAGR | 8.1% |

Companies are motivated to develop advanced technologies and smarter solutions that not only meet but exceed regulatory demands. This push is encouraging the adoption of cutting-edge tools such as AI-driven analytics, real-time monitoring, and automated reporting systems. Investors recognize the long-term value in sustainable practices, directing capital toward firms that prioritize environmental compliance and operational efficiency. As a result, the industry is witnessing accelerated research and development efforts, strategic partnerships, and expanded product portfolios designed to address evolving environmental challenges while supporting business growth.

In 2024, the onshore operations segment captured a 62.3% share, driven by the expanding footprint of hydraulic fracturing across various emerging economies. These high-volume drilling activities result in significant amounts of drill cuttings, flowback fluids, and produced water-all of which require secure on-site containment solutions before any downstream processing or disposal. As drilling intensifies in resource-rich territories, the demand for scalable and compliant waste-handling systems is rising sharply. Operators are prioritizing investments in containment equipment and site-specific infrastructure to align with both environmental compliance and operational efficiency standards.

United States Containment and Handling Drilling Waste Management Market was valued at USD 93.5 million in 2024. The U.S. and Canada continue to face mounting pressure from rigorous federal and regional environmental regulations, particularly around emissions, water safety, and land use. Combined with heightened drilling activity in shale-rich formations, this regulatory environment has accelerated the shift toward advanced containment technologies and sustainable waste-handling frameworks. The region's focus on reducing ecological risks while maintaining production output further solidifies North America's role in shaping global standards for drilling waste management practices.

Companies actively operating in this market include Baker Hughes, Schlumberger, Clean Harbors, Halliburton, GN Solids Control, Newpark Resources, TWMA, Derrick Equipment Company, Secure Energy Services, Imdex, Ridgeline Canada, Soli-Bond, Select Water Solutions, Weatherford, Augean, and NOV. To solidify their market position, leading players focus on expanding technological capabilities, including advanced on-site waste treatment and containment systems tailored to regulatory demands.

They prioritize compliance with evolving environmental standards by developing safer, more efficient handling solutions that reduce ecological impact. Strategic partnerships and acquisitions are common to broaden service offerings and geographic reach. Many companies invest in RandD to enhance product innovation, particularly around handling challenging waste streams like viscous or hazardous materials.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Market estimates and forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls and challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation and technology landscape

Chapter 5 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Onshore

- 5.3 Offshore

Chapter 6 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.2.3 Mexico

- 6.3 Europe

- 6.3.1 Germany

- 6.3.2 France

- 6.3.3 UK

- 6.3.4 Spain

- 6.3.5 Italy

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.4.4 Australia

- 6.4.5 South Korea

- 6.5 Middle East and Africa

- 6.5.1 Saudi Arabia

- 6.5.2 South Africa

- 6.5.3 UAE

- 6.6 Latin America

- 6.6.1 Brazil

- 6.6.2 Argentina

Chapter 7 Company Profiles

- 7.1 Augean

- 7.2 Baker Hughes

- 7.3 Clean Harbors

- 7.4 Derrick Equipment Company

- 7.5 Geminor

- 7.6 GN Solids Control

- 7.7 Halliburton

- 7.8 Imdex

- 7.9 Newpark Resources

- 7.10 NOV

- 7.11 Ridgeline Canada

- 7.12 Schlumberger

- 7.13 Secure Energy Services

- 7.14 Select Water Solutions

- 7.15 Soli-Bond

- 7.16 TWMA

- 7.17 Weatherford