|

市场调查报告书

商品编码

1797767

农林物种及品种市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Agroforestry Species and Varieties Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

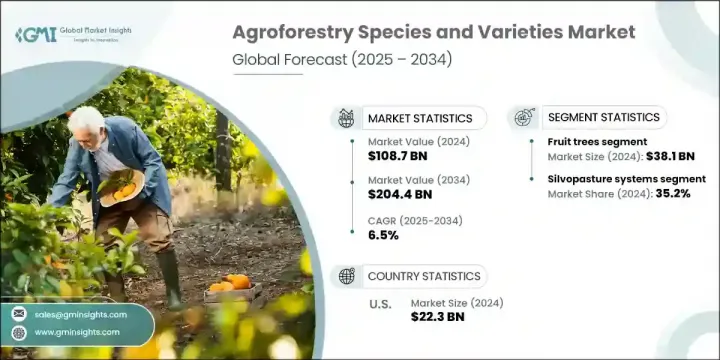

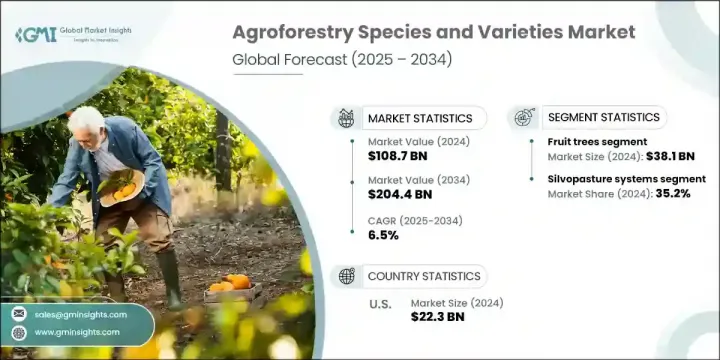

2024年,全球农林物种和品种市场价值为1087亿美元,预计到2034年将以6.5%的复合年增长率增长,达到2044亿美元。这一增长主要源于日益加剧的环境压力,例如生物多样性丧失、土壤退化和极端气候事件。农林系统日益被视为透过增强碳捕获、改善保水性和减少侵蚀来增强抵抗力的重要解决方案。全球气候倡议正在推动私营部门和公共部门青睐基于自然的方法。耐旱果树和固氮灌木等物种的日益普及,凸显了人们正转向生态系统友善解决方案。由于全球致力于生态修復和栖息地改善,对农林物种的需求也激增。

农民和土地所有者正在将树木纳入其农业经营,以降低单一栽培和气候波动带来的风险。这些综合系统透过多种收入来源(从木材到水果和饲料)实现了财务稳定,同时透过自然分解和深层根系结构促进土壤肥力。在小农户基础雄厚的地区,包括拉丁美洲和亚太部分地区,由于该系统的长期生态和经济优势,其应用率正在显着提高。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1087亿美元 |

| 预测值 | 2044亿美元 |

| 复合年增长率 | 6.5% |

2024年,果树市场规模达到381亿美元,这得益于其兼具气候适应力和经济回报的双重优势。果树在创造收入的同时也能固碳,使其成为永续农林系统的重要组成部分。近期,抗病性和嫁接技术的突破也提高了果树的产量和获利能力。然而,由于价格难以预测,且易受病虫害和环境压力因素的影响,果树市场仍面临持续的挑战。

种子领域凭藉其成本效益、储存便利性以及在各种农林复合系统中的适应性,在2024年占据了显着的市场份额。种子技术的进步,包括杂交和改良的遗传性状,进一步巩固了该领域的领先地位,使农民能够以更低的投入成本实现更高的生产力和永续性。

2024年,美国农林物种及品种市场产值达223亿美元,占80%的市占率。美国对再生农业实践的大力投资,使美国在林牧复合种植和林间种植等农林复合技术的应用方面处于领先地位。这些方法增强了生态系统服务,同时也有助于碳补偿策略。此外,优惠的政府项目和政策激励措施也持续支持永续土地利用计画的推广。

全球农林物种和品种市场中的知名行业参与者包括 Advanced Nursery Growers、Bailey Nurseries、Territorial Seed Company、Proven Winners、Costa Farms、Greenleaf Nursery Company、Dave Wilson Nursery、Agroforestry Solutions、California Tropical Fruit Tree Nursery、Forestage, Nurs. Company、Kuffel Creek Apple Nursery、Dummen Orange、Strictly Medicinal Seeds、Ball Horticultural Company、J. Frank Schmidt & Son Co.、Monrovia Nursery Company 和 Spring Meadow Nursery。农林物种和品种市场中的公司正在透过投资研发引进耐气候高产品种来提升其市场占有率。与当地种植者和学术机构的策略合作有助于支持基因改良计划,同时扩大针对不同地理和气候带的产品组合。许多参与者正在建立特定区域的苗圃和种子库,以确保供应链的稳定性和更好的客户扩展。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 衝击力

- 成长动力

- 减缓气候变迁与碳封存需求

- 政府政策和财政激励

- 永续农业和再生农业趋势

- 陷阱/挑战

- 建立週期长,初期投资成本高

- 有限的技术知识与推广服务

- 市场准入与价值链发展挑战

- 机会

- 碳信用市场和生态系统服务付费

- 生物技术和先进育种计划

- 精准农业与数位科技融合

- 成长动力

- 成长潜力分析

- 监管格局

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 按物种类型

- 未来市场趋势

- 技术和创新格局

- 专利态势

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东非洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依物种类型,2021-2034

- 主要趋势

- 固氮树

- 金合欢属

- 大叶金合欢

- 马占相思树

- 塞内加尔金合欢

- 塞亚尔相思树

- 大叶木犀

- 合欢属

- 合欢

- 合欢

- 银合欢

- 其他豆科树种

- 金合欢属

- 果树

- 温带果树

- 苹果品种(安娜、多塞特金、热带甜)

- 核果(桃子、李子、樱桃)

- 柑橘类

- 热带和亚热带水果

- 酪梨品种

- 芒果品种

- 特色热带水果

- 浆果作物

- 接骨木

- 枸杞

- 沙棘/沙棘

- 温带果树

- 坚果树

- 栗子

- 美国栗子杂交种

- 栗

- 欧洲栗子

- 榛子

- 杂交榛子

- 传统品种

- 核桃

- 黑胡桃

- 英国核桃

- 灰胡桃及其杂交品种

- 其他坚果种类

- 栗子

- 木材和多用途树木

- 快速生长的物种

- 杨树杂交种

- 尤加利树种

- 柳树品种

- 硬木树种

- 橡木品种

- 枫树种类

- 白蜡木和其他硬木

- 针叶树种

- 松树杂交种

- 云杉品种

- 冷杉树种

- 特种树种和药用树种

- 药用树种

- 芳香树和精油树

- 饲料树和灌木

- 观赏农林物种

- 快速生长的物种

第六章:市场估计与预测:按农林业系统,2021-2034 年

- 主要趋势

- 林牧系统

- 牛放牧系统

- 绵羊和山羊系统

- 家禽整合系统

- 混合畜牧系统

- 林间种植系统

- 一年生作物整合

- 多年生作物系统

- 蔬菜生产系统

- 特色作物整合

- 林业种植系统

- 林下作物生产

- 蘑菇栽培

- 药用植物生产

- 特种林产品

- 河岸缓衝系统

- 流保护缓衝区

- 湿地边缘系统

- 农业径流控制

- 野生动物栖息地走廊

- 防风林系统

- 田间防风林

- 牲畜防风林

- 农庄保护

- 雪管理系统

第七章:市场估计与预测:依种植材料类型,2021-2034

- 主要趋势

- 种子

- 树种子

- 经过认证的种子来源

- 优良品种种子

- 野生采集种子

- 农林作物种子

- 特种和稀有种子

- 树种子

- 幼苗和移植苗

- 裸根苗

- 容器栽培植物

- 高级苗木

- 组织培养植物

- 嫁接植物

- 果树嫁接

- 坚果树嫁接

- 特种嫁接品种

- 营养繁殖体

- 插枝和木桩

- 根分裂

- 分层材料

- 生物技术产品

- 微繁植物

- 体细胞胚

- 基因改良品种

第 8 章:市场估计与预测:按最终用途应用,2021 年至 2034 年

- 主要趋势

- 商业性农业

- 大规模农业经营

- 特色作物生产

- 牲畜整合系统

- 有机农业经营

- 小农和自给农业

- 加强粮食安全

- 收入多样化

- 居家营养改善

- 传统农林业系统

- 保护与修復

- 退化土地恢復

- 流域保护项目

- 生物多样性保育倡议

- 碳封存项目

- 城市和郊区农业

- 城市食物森林

- 社区花园

- 教育和示范点

- 绿色基础设施项目

- 研究与开发

- 大学研究项目

- 政府研究倡议

- 私部门研发

- 国际发展项目

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- Forestag (Forest Agriculture Enterprises)

- Agroforestry Solutions

- Green Barn Nursery

- Territorial Seed Company

- Strictly Medicinal Seeds

- Seedman.com

- Dave Wilson Nursery

- California Tropical Fruit Tree Nursery

- Kuffel Creek Apple Nursery

- Advanced Nursery Growers

- Dummen Orange

- Ball Horticultural Company

- Costa Farms

- Monrovia Nursery Company

- J. Frank Schmidt & Son Co.

- Bailey Nurseries

- Proven Winners

- Spring Meadow Nursery

- Greenleaf Nursery Company

- Weyerhaeuser Company

The Global Agroforestry Species and Varieties Market was valued at USD 108.7 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 204.4 billion by 2034. This expansion is largely fueled by growing environmental pressures such as biodiversity loss, degraded soils, and extreme climate events. Agroforestry systems are increasingly seen as a vital solution for building resilience through enhanced carbon capture, improved water retention, and reduced erosion. Global climate initiatives are pushing both private and public sectors to favor nature-based approaches. The rising popularity of species like drought-tolerant fruit trees and nitrogen-fixing shrubs highlights the shift toward ecosystem-friendly solutions. Demand is also surging due to global commitments to ecological restoration and habitat enhancement.

Farmers and landowners are incorporating trees into their agricultural operations to lower risks associated with monoculture and climate volatility. These integrated systems offer financial stability through multiple revenue streams-ranging from timber to fruits and forage-while supporting soil enrichment through natural decomposition and deep root structures. Regions with a strong base of smallholder farmers, including parts of Latin America and Asia-Pacific, are showing significant adoption due to the system's long-term ecological and economic advantages.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $108.7 Billion |

| Forecast Value | $204.4 Billion |

| CAGR | 6.5% |

In 2024, the fruit tree segment reached USD 38.1 billion, owing to its dual benefits of climate resilience and economic return. Their ability to sequester carbon while generating income makes them a key component of sustainable agroforestry systems. Recent breakthroughs in disease resistance and grafting techniques are also enhancing yields and profitability. However, the segment faces ongoing hurdles due to unpredictable pricing and vulnerability to pests and environmental stressors.

The seeds segment held a significant share in 2024 owing to their cost efficiency, storage convenience, and adaptability across diverse agroforestry systems. The segment's leadership is further reinforced by advancements in seed technology, including hybrids and improved genetic traits, which allow farmers to achieve higher productivity and sustainability with lower input costs.

United States Agroforestry Species and Varieties Market generated USD 22.3 billion and held an 80% share in 2024. Strong investment in regenerative agriculture practices has made the U.S. a leader in deploying agroforestry techniques such as silvopasture and alley cropping. These methods enhance ecosystem services while contributing to carbon offset strategies. Additionally, favorable government programs and policy incentives continue to support the expansion of sustainable land-use initiatives.

Prominent industry players in the Global Agroforestry Species and Varieties Market include Advanced Nursery Growers, Bailey Nurseries, Territorial Seed Company, Proven Winners, Costa Farms, Greenleaf Nursery Company, Dave Wilson Nursery, Agroforestry Solutions, California Tropical Fruit Tree Nursery, Forestag (Forest Agriculture Enterprises), Seedman.com, Green Barn Nursery, Weyerhaeuser Company, Kuffel Creek Apple Nursery, Dummen Orange, Strictly Medicinal Seeds, Ball Horticultural Company, J. Frank Schmidt & Son Co., Monrovia Nursery Company, and Spring Meadow Nursery. Companies in the Agroforestry Species and Varieties Market are enhancing their market presence by investing in research and development to introduce climate-resilient and high-yielding species. Strategic collaborations with local growers and academic institutions help support genetic improvement programs, while expanding product portfolios tailored for different geographies and climate zones. Many players are establishing region-specific nurseries and seed banks to ensure supply chain stability and better customer outreach.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Impact forces

- 3.2.1.1 Growth driver

- 3.2.1.1.1 Climate change mitigation and carbon sequestration demand

- 3.2.1.1.2 Government policies and financial incentives

- 3.2.1.1.3 Sustainable agriculture and regenerative farming trends

- 3.2.1.2 Pitfalls/challenge

- 3.2.1.2.1 Long establishment periods and initial investment costs

- 3.2.1.2.2 Limited technical knowledge and extension services

- 3.2.1.2.3 Market access and value chain development challenges

- 3.2.1.3 Opportunities

- 3.2.1.3.1 Carbon credit markets and payment for ecosystem services

- 3.2.1.3.2 Biotechnology and advanced breeding programs

- 3.2.1.3.3 Precision agriculture and digital technology integration

- 3.2.1.1 Growth driver

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By species type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Species Type, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Nitrogen-fixing trees

- 5.2.1 Acacia species

- 5.2.1.1 Acacia auriculiformis

- 5.2.1.2 Acacia mangium

- 5.2.1.3 Acacia senegal

- 5.2.1.4 Acacia seyal

- 5.2.2 Gliricidia sepium

- 5.2.3 Albizia species

- 5.2.3.1 Albizia lebbeck

- 5.2.3.2 Albizia julibrissin

- 5.2.4 Leucaena leucocephala

- 5.2.5 Other leguminous trees

- 5.2.1 Acacia species

- 5.3 Fruit trees

- 5.3.1 Temperate fruit trees

- 5.3.1.1 Apple varieties (anna, dorsett golden, tropic sweet)

- 5.3.1.2 Stone fruits (peaches, plums, cherries)

- 5.3.1.3 Citrus species

- 5.3.2 Tropical and subtropical fruits

- 5.3.2.1 Avocado varieties

- 5.3.2.2 Mango cultivars

- 5.3.2.3 Specialty tropical fruits

- 5.3.3 Berry crops

- 5.3.3.1 Elderberry

- 5.3.3.2 Goji berry

- 5.3.3.3 Seaberry/sea buckthorn

- 5.3.1 Temperate fruit trees

- 5.4 Nut trees

- 5.4.1 Chestnuts

- 5.4.1.1 American chestnut hybrids

- 5.4.1.2 Chinese chestnuts

- 5.4.1.3 European chestnuts

- 5.4.2 Hazelnuts

- 5.4.2.1 Hybrid hazelnuts

- 5.4.2.2 Traditional varieties

- 5.4.3 Walnuts

- 5.4.3.1 Black walnuts

- 5.4.3.2 English walnuts

- 5.4.3.3 Butternuts and hybrids

- 5.4.4 Other nut species

- 5.4.1 Chestnuts

- 5.5 Timber and multipurpose trees

- 5.5.1 Fast-growing species

- 5.5.1.1 Poplar hybrids

- 5.5.1.2 Eucalyptus species

- 5.5.1.3 Willow varieties

- 5.5.2 Hardwood species

- 5.5.2.1 Oak varieties

- 5.5.2.2 Maple species

- 5.5.2.3 Ash and other hardwoods

- 5.5.3 Coniferous species

- 5.5.3.1 Pine hybrids

- 5.5.3.2 Spruce varieties

- 5.5.3.3 Fir species

- 5.5.4 Specialty and medicinal trees

- 5.5.4.1 Medicinal tree species

- 5.5.4.2 Aromatic and essential oil trees

- 5.5.4.3 Fodder trees and shrubs

- 5.5.4.4 Ornamental agroforestry species

- 5.5.1 Fast-growing species

Chapter 6 Market Estimates & Forecast, By Agroforestry System, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Silvopasture systems

- 6.2.1 Cattle grazing systems

- 6.2.2 Sheep and goat systems

- 6.2.3 Poultry integration systems

- 6.2.4 Mixed livestock systems

- 6.3 Alley cropping systems

- 6.3.1 Annual crop integration

- 6.3.2 Perennial crop systems

- 6.3.3 Vegetable production systems

- 6.3.4 Specialty crop integration

- 6.4 Forest farming systems

- 6.4.1 Understory crop production

- 6.4.2 Mushroom cultivation

- 6.4.3 Medicinal plant production

- 6.4.4 Specialty forest products

- 6.5 Riparian buffer systems

- 6.5.1 Stream protection buffers

- 6.5.2 Wetland edge systems

- 6.5.3 Agricultural runoff control

- 6.5.4 Wildlife habitat corridors

- 6.6 Windbreak and shelterbelt systems

- 6.6.1 Field windbreaks

- 6.6.2 Livestock windbreaks

- 6.6.3 Farmstead protection

- 6.6.4 Snow management systems

Chapter 7 Market Estimates & Forecast, By Planting Material Type, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Seeds

- 7.2.1 Tree seeds

- 7.2.1.1 Certified seed sources

- 7.2.1.2 Improved variety seeds

- 7.2.1.3 Wild collection seeds

- 7.2.1.4 Crop seeds for agroforestry

- 7.2.1.5 Specialty and rare seeds

- 7.2.1 Tree seeds

- 7.3 Seedlings and transplants

- 7.3.1 Bare root seedlings

- 7.3.2 Container-grown plants

- 7.3.3 Advanced nursery stock

- 7.3.4 Tissue culture plants

- 7.4 Grafted plants

- 7.4.1 Fruit tree grafts

- 7.4.2 Nut tree grafts

- 7.4.3 Specialty grafted varieties

- 7.5 Vegetative propagules

- 7.5.1 Cuttings and stakes

- 7.5.2 Root divisions

- 7.5.3 Layering materials

- 7.6 Biotechnology products

- 7.6.1 Micropropagated plants

- 7.6.2 Somatic embryos

- 7.7 Genetically improved varieties

Chapter 8 Market Estimates & Forecast, By End Use Application, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Commercial agriculture

- 8.2.1 Large-scale farming operations

- 8.2.2 Specialty crop production

- 8.2.3 Livestock integration systems

- 8.2.4 Organic farming operations

- 8.3 Smallholder and subsistence farming

- 8.3.1 Food security enhancement

- 8.3.2 Income diversification

- 8.3.3 Household nutrition improvement

- 8.3.4 Traditional agroforestry systems

- 8.4 Conservation and restoration

- 8.4.1 Degraded land rehabilitation

- 8.4.2 Watershed protection projects

- 8.4.3 Biodiversity conservation initiatives

- 8.4.4 Carbon sequestration projects

- 8.4.5 Urban and peri-urban agriculture

- 8.5 Urban food forests

- 8.5.1 Community gardens

- 8.5.2 Educational and demonstration sites

- 8.5.3 Green infrastructure projects

- 8.6 Research and development

- 8.6.1 University research programs

- 8.6.2 Government research initiatives

- 8.6.3 Private sector R&D

- 8.6.4 International development projects

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Forestag (Forest Agriculture Enterprises)

- 10.2 Agroforestry Solutions

- 10.3 Green Barn Nursery

- 10.4 Territorial Seed Company

- 10.5 Strictly Medicinal Seeds

- 10.6 Seedman.com

- 10.7 Dave Wilson Nursery

- 10.8 California Tropical Fruit Tree Nursery

- 10.9 Kuffel Creek Apple Nursery

- 10.10 Advanced Nursery Growers

- 10.11 Dummen Orange

- 10.12 Ball Horticultural Company

- 10.13 Costa Farms

- 10.14 Monrovia Nursery Company

- 10.15 J. Frank Schmidt & Son Co.

- 10.16 Bailey Nurseries

- 10.17 Proven Winners

- 10.18 Spring Meadow Nursery

- 10.19 Greenleaf Nursery Company

- 10.20 Weyerhaeuser Company