|

市场调查报告书

商品编码

1801847

海藻基肥料市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Seaweed-Based Fertilizers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

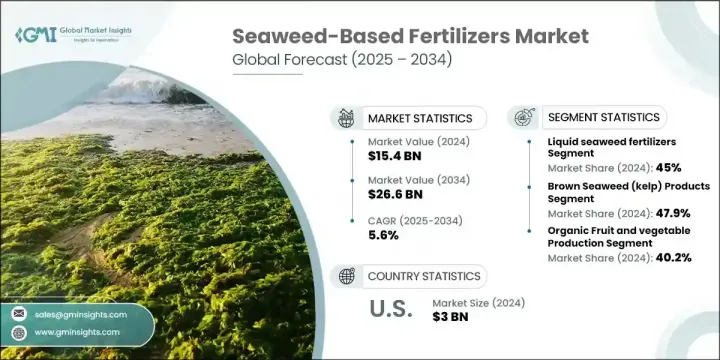

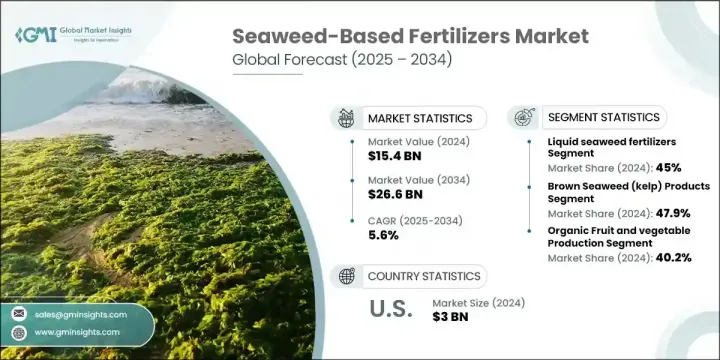

2024年,全球海藻基肥料市场规模达154亿美元,预计2034年将以5.6%的复合年增长率成长,达到266亿美元。海藻基肥料利用各种海藻的天然萃取物来促进作物生长、改善土壤健康并增强环境復原力,在永续农业中发挥日益重要的作用。随着越来越多的农民寻求无化学成分且营养丰富的产品,人们日益转向有机和永续的农业实践,这是市场扩张的主要驱动力。此外,人们对土壤健康和微生物多样性在农业中重要性的认识不断提高,也进一步刺激了需求。

海藻肥料富含生物活性化合物,有助于形成有益的土壤群落,增强养分循环、保湿性和抗病性。此外,这些肥料还能提高土壤碳含量和作物对环境压力的适应能力,最终减少碳足迹,有助于减缓气候变迁。萃取技术的不断进步带来了更有效率、更优质的海藻肥料,为各种农业需求提供了一系列产品。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 154亿美元 |

| 预测值 | 266亿美元 |

| 复合年增长率 | 5.6% |

液态海藻肥料市场在 2024 年占 45% 的份额,预计到 2034 年的复合年增长率将达到 5.7%。液态海藻肥料之所以受欢迎,是因为它们吸收迅速、使用方便,并且可用于叶面和土壤灌注方法,因此特别受到有机农业和精准农业的青睐。

褐藻产品领域在2024年占最大份额,达到47.9%,预计复合年增长率为5.6%。海带产品富含天然植物生长激素、微量营养素和藻酸盐,对提高作物产量、抗旱能力和土壤健康至关重要。

2024年,美国海藻基肥料市场规模达30亿美元,预计2034年复合年增长率为4.7%。美国凭藉其大力推广有机农业实践、先进的作物管理技术以及对永续农业(尤其是在液态海藻基生物刺激素方面)的大量投资,引领了市场发展。美国先进的生产基础设施以及农业科技创新者之间的合作进一步加速了该市场的成长,尤其是在精准农业领域。

全球海藻肥料市场的主要参与者包括 Seasol International Pty Ltd.、Haifa Group、AlgaEnergy SA、Acadian Seaplants Limited、Brandt Consolidated, Inc.、Kelpak (Kelp Products International)、Bioiberica SAU、Biostadt India Limited、COMPO EXPERT GmbH、Grows, Inc.、Maxicy.和 West Coast Marine Bio-Processing Corp. 为巩固市场地位,海藻肥料行业的公司专注于几项关键策略。这些策略包括持续投资研发,以提高产品的效率和品质。公司也在扩大产品组合,以满足从大规模商业化养殖到小型有机养殖的各种农业需求。与农业研究机构和农业社区建立策略伙伴关係和协作有助于促进产品创新并提高市场渗透率。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 对有机和永续农业的需求不断增加

- 环境问题及化肥替代品

- 土壤健康和微生物组增强重点

- 减缓气候变迁与碳封存

- 产业陷阱与挑战

- 与传统化学肥料相比成本较高

- 海藻供应和收穫能力有限

- 市场机会

- 新兴市场有机农业成长

- 精准农业与技术整合

- 加值加工和产品开发

- 政府激励措施和永续发展计划

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 依产品类型

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考虑

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 液体海藻肥料

- 浓缩液体萃取物

- 即用型喷雾溶液

- 固体和颗粒产品

- 干海藻粉

- 颗粒肥料

- 特殊和功能性产品

- 生物刺激剂配方

- 混合和增强产品

第六章:市场估计与预测:按海藻类型,2021-2034 年

- 主要趋势

- 褐藻(海带)产品

- 泡叶藻

- 海带和海带种类

- 红藻製品

- 江蓠和紫菜属植物

- 绿色海藻产品

- 石莼和小球藻的应用

- 混合海藻产品

第七章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 有机水果和蔬菜生产

- 有机果园

- 苹果、柑橘和核果

- 浆果和小水果生产

- 热带和外来水果种植

- 有机蔬菜种植

- 绿叶蔬菜和沙拉作物

- 根茎类蔬菜和块茎

- 番茄和茄科作物

- 有机果园

- 农田作物和谷物生产

- 有机谷物和谷类作物

- 小麦、玉米和稻米生产

- 特种谷物和传统谷物

- 豆类和豆科作物

- 牧草和饲料作物

- 草和干草生产

- 牲畜饲料和放牧

- 有机谷物和谷类作物

- 特色高价值作物

- 有机香草和香料生产

- 观赏与景观应用

- 水产养殖与海洋应用

- 鱼类和贝类生产

第八章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Acadian Seaplants Limited

- AlgaEnergy SA

- Bioiberica SAU

- Biostadt India Limited

- Brandt Consolidated, Inc.

- Chase Organics GB Ltd.

- COMPO EXPERT GmbH

- Grow More, Inc.

- Haifa Group

- Kelpak (Kelp Products International)

- Leili Marine Bioindustry Inc.

- Maxicrop USA, Inc.

- Seasol International Pty Ltd.

- West Coast Marine Bio-Processing Corp.

The Global Seaweed-Based Fertilizers Market was valued at USD 15.4 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 26.6 billion by 2034. Seaweed-based fertilizers are playing an increasingly vital role in sustainable agriculture by using natural extracts from various seaweed species to improve crop growth, enhance soil health, and boost environmental resilience. The growing shift toward organic and sustainable farming practices is the primary driver of market expansion, as more farmers seek chemical-free and nutrient-dense products. Additionally, the rising awareness of soil health and the importance of microbial diversity in agriculture further fuels demand.

Seaweed fertilizers, with their bioactive compounds, help create beneficial soil communities, enhance nutrient cycling, moisture retention, and resistance to diseases. Furthermore, these fertilizers contribute to climate change mitigation by improving soil carbon content and crop resilience to environmental stresses, which ultimately lowers carbon footprints. Ongoing advancements in extraction techniques have led to more efficient and high-quality seaweed-based fertilizers, offering a range of products for various farming needs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.4 Billion |

| Forecast Value | $26.6 Billion |

| CAGR | 5.6% |

The liquid seaweed fertilizers segment held a 45% share in 2024, with expectations to grow at a CAGR of 5.7% by 2034. Their popularity stems from their quick absorption, easy application, and versatility in both foliar and soil drenching methods, making them particularly favored for organic and precision agriculture.

The brown seaweed products segment held the largest share of 47.9% in 2024 and is expected to grow at a CAGR of 5.6%. Kelp products are rich in natural plant growth hormones, micronutrients, and alginates, making them crucial for improving crop yield, drought resistance, and soil health.

U.S. Seaweed-Based Fertilizers Market was valued at USD 3 billion in 2024, with an expected CAGR of 4.7% by 2034. The U.S. leads the market due to strong adoption of organic farming practices, cutting-edge crop management techniques, and significant investments in sustainable agriculture, particularly in liquid seaweed-based biostimulants. The country's advanced production infrastructure and collaboration between agri-tech innovators have further accelerated the growth of this market, particularly in precision agriculture.

Key players in the Global Seaweed-Based Fertilizers Market include Seasol International Pty Ltd., Haifa Group, AlgaEnergy S.A., Acadian Seaplants Limited, Brandt Consolidated, Inc., Kelpak (Kelp Products International), Bioiberica S.A.U., Biostadt India Limited, COMPO EXPERT GmbH, Grow More, Inc., Maxicrop USA, Inc., Leili Marine Bioindustry Inc., Chase Organics GB Ltd., and West Coast Marine Bio-Processing Corp. To strengthen their position in the market, companies in the seaweed-based fertilizers industry focus on several key strategies. These include continued investment in research and development to enhance the efficiency and quality of their products. Companies are also expanding their product portfolios to meet diverse agricultural needs, from large-scale commercial farming to smaller, organic operations. Strategic partnerships and collaborations with agricultural research institutions and farming communities help foster product innovation and increase market penetration.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Seaweed type

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for organic and sustainable agriculture

- 3.2.1.2 Environmental concerns and chemical fertilizer alternatives

- 3.2.1.3 Soil health and microbiome enhancement focus

- 3.2.1.4 Climate change mitigation and carbon sequestration

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Higher cost vs traditional chemical fertilizers

- 3.2.2.2 Limited seaweed supply and harvesting capacity

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging market organic agriculture growth

- 3.2.3.2 Precision agriculture and technology integration

- 3.2.3.3 Value-added processing and product development

- 3.2.3.4 Government incentives and sustainability programs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Liquid seaweed fertilizers

- 5.2.1 Concentrated liquid extracts

- 5.2.2 Ready-to-use spray solutions

- 5.3 Solid and granular products

- 5.3.1 Dried seaweed meal

- 5.3.2 Granulated and pelletized fertilizers

- 5.4 Specialty and functional products

- 5.4.1 Biostimulant formulations

- 5.4.2 Blended and enhanced product

Chapter 6 Market Estimates and Forecast, By Seaweed Type, 2021-2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Brown seaweed (kelp) products

- 6.2.1 Ascophyllum nodosum

- 6.2.2 Laminaria and kelp species

- 6.3 Red seaweed products

- 6.3.1 Gracilaria and porphyra species

- 6.4 Green seaweed products

- 6.4.1 Ulva and chlorella applications

- 6.5 Mixed and blended seaweed products

Chapter 7 Market Estimates and Forecast, By Application, 2021-2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 Organic fruit and vegetable production

- 7.2.1 Organic fruit orchards

- 7.2.1.1 Apple, citrus, and stone fruit

- 7.2.1.2 Berry and small fruit production

- 7.2.1.3 Tropical and exotic fruit cultivation

- 7.2.2 Organic vegetable farming

- 7.2.2.1 Leafy greens and salad crops

- 7.2.2.2 Root vegetables and tubers

- 7.2.2.3 Tomatoes and nightshade crops

- 7.2.1 Organic fruit orchards

- 7.3 Field crop and grain production

- 7.3.1 Organic grain and cereal crops

- 7.3.1.1 Wheat, corn, and rice production

- 7.3.1.2 Specialty and ancient grains

- 7.3.1.3 Legume and pulse crops

- 7.3.2 Pasture and forage crops

- 7.3.2.1 Grass and hay production

- 7.3.2.2 Livestock feed and grazing

- 7.3.1 Organic grain and cereal crops

- 7.4 Specialty and high-value crops

- 7.4.1 Organic herb and spice production

- 7.4.2 Ornamental and landscape applications

- 7.5 Aquaculture and marine applications

- 7.5.1 Fish and shellfish production

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Acadian Seaplants Limited

- 9.2 AlgaEnergy S.A.

- 9.3 Bioiberica S.A.U.

- 9.4 Biostadt India Limited

- 9.5 Brandt Consolidated, Inc.

- 9.6 Chase Organics GB Ltd.

- 9.7 COMPO EXPERT GmbH

- 9.8 Grow More, Inc.

- 9.9 Haifa Group

- 9.10 Kelpak (Kelp Products International)

- 9.11 Leili Marine Bioindustry Inc.

- 9.12 Maxicrop USA, Inc.

- 9.13 Seasol International Pty Ltd.

- 9.14 West Coast Marine Bio-Processing Corp.