|

市场调查报告书

商品编码

1801901

动力运动市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Power Sports Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

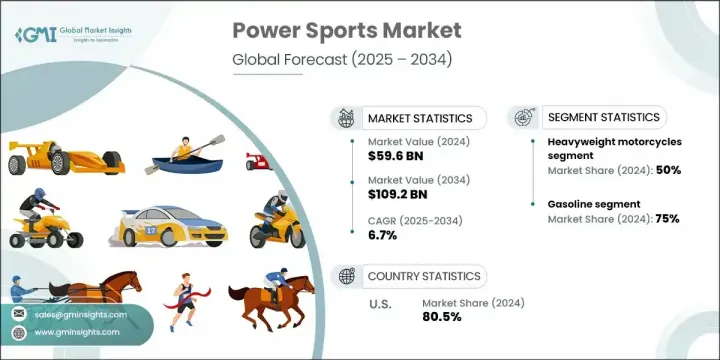

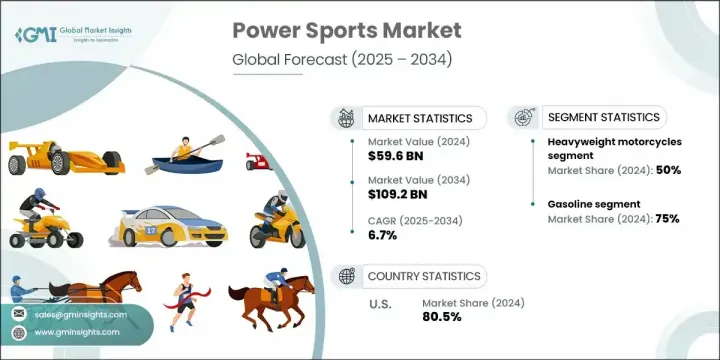

2024年,全球动力运动市场规模达596亿美元,预计2034年将以6.7%的复合年增长率成长,达到1,092亿美元。随着消费者对摩托车、个人水上摩托车、全地形车和雪地摩托车等休閒和高性能车辆的热情持续高涨,该市场正呈现持续成长动能。可支配收入的增加、户外休閒趋势的不断扩大以及人们对冒险活动更广泛的文化兴趣,都在推动这些车辆的普及。在全球减排和永续出行努力的推动下,电动和混合动力运动车型的吸引力不断增强,进一步支撑了市场的成长。

除此之外,捆绑服务和融资方案正成为主要的价值驱动因素。转向全方位服务的拥有体验,包括维护、道路救援和灵活的支付模式等支援功能,正在提升客户参与度和品牌忠诚度。在印度、日本和中国等多个亚洲市场,持续的基础设施投资和贸易自由化正在创造新的需求和製造潜力。此外,跨境物流的加强、供应链本地化和监管激励措施正在新兴市场和成熟市场开闢新的成长管道。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 596亿美元 |

| 预测值 | 1092亿美元 |

| 复合年增长率 | 6.7% |

到2034年,重型摩托车市场的复合年增长率将达到6.9%。它们的吸引力源于其高性能、更长的驾驶舒适度和标誌性的设计,使其成为经验丰富的骑手和旅行爱好者的首选。骑行社群的普及和以品牌为中心的忠诚度将继续增强这一市场。这个类别在北美、欧洲和部分亚太国家/地区尤为突出,而高阶车型中电动版本的采用则进一步推动了这个市场的发展。

2024年,汽油动力汽车市场占据75%的市场份额,预计2034年的复合年增长率将达到6.7%。该市场凭藉其卓越的动力输出、广泛的加油基础设施和可靠的性能,继续保持领先地位。汽油引擎在所有车型中都受到青睐,包括摩托车、并排式皮卡、全地形车和雪地摩托车,尤其是在充电网路仍然有限的地区。汽油引擎加速强劲、续航里程更长、加油速度快,使其特别适合偏远地区、对性能要求苛刻的休閒和专业用途。

2024年,美国动力运动市场产值达208亿美元,占80.5%的市占率。美国悠久的户外和赛车运动文化,加上强大的越野和旅游基础设施,使其成为高价值市场。美国是各种车型製造和消费的中心枢纽。此外,美国在动力运动车辆的客製化、售后市场升级以及在国防、林业和农业等行业的多用途应用方面也处于领先地位。

影响全球动力运动市场的关键参与者包括雅马哈、本田、宝马摩托车、铃木汽车、春风摩托车、川崎、KTM、哈雷戴维森、北极星和 BRP。动力运动产业的领先公司正在透过汽车电气化创新、扩大全球分销和多样化产品线来增强竞争优势。为了保持相关性,各大品牌正在加速进军电动车款和连网功能,以适应不断变化的环境和消费者偏好。此外,许多製造商正在推出订阅服务和捆绑套餐,涵盖保险、维护和路边支持,以提高客户保留率。透过在地化生产和经销商网路扩展到新兴市场也是重中之重。对研发的策略性投资,以及透过赛车运动赞助和车手社群进行的品牌推广,正在进一步巩固他们的市场立足点。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 加值映射

- 製造增值与品牌溢价

- 技术整合与创新价值

- 服务和售后市场价值创造

- 价值链影响因素

- 技术颠覆和电气化影响

- 供应链弹性和地理多样化

- 法规遵从性和环境标准

- 生态系统破坏

- 基于平台的商业模式和数位转型

- 垂直整合趋势与供应链重组

- 新进入者的威胁与市场演变

- 产业衝击力

- 成长动力

- 人口结构转型与世代交替

- 户外休閒参与人数激增

- 电气化与技术创新

- 经济和基础设施发展

- 战略挑战和行业限制

- 经济压力和市场波动

- 监理合规负担

- 贸易和关税压力

- 市场结构和分销挑战

- 市场机会评估

- 电动车市场扩张

- 军事和政府部门扩张

- 国际市场渗透

- 技术整合和互联服务

- 成长动力

- 成长潜力分析

- 产品细分成长比较

- 市场成熟度评估与生命週期定位

- 成长阶段部分

- 成熟阶段

- 竞争强度对成长潜力的影响

- 主要生产国(2023-2024)

- UTV和ATV

- 雪地摩托车

- 个人水上摩托车(PWC)

- 重型摩托车(>500cc)

- 主要消费国家(2023-2024)

- UTV和ATV

- 雪地摩托车

- 个人水上摩托车(PWC)

- 重型摩托车(>500cc)

- 贸易流量分析

- UTV 和 ATV 贸易流

- 雪地摩托车贸易流

- 普华永道贸易流量

- 重量级摩托车(>500cc)贸易流

- 特定于段的表

- 生命週期评估(LCA)和比较影响

- ICE 与电动运动

- 製造阶段

- 竞争基准测试

- 投资报酬率和商业案例

- 节省成本

- 降低监理风险

- 障碍与机会

- 障碍

- 机会

- 政策、投资者和市场驱动因素

- 政策

- 投资者压力

- 市场

- 最佳实践和案例研究

- 生命週期评估表(内燃机与电动)

- 建议

- 最佳实践和案例研究

- 北极星(UTV/ATV、雪地摩托车)

- 雅马哈(所有细分市场)

- BRP(Can-Am、Sea-Doo、Ski-Doo)

- 哈雷戴维森(重量级 MC)

- 投资报酬率和商业案例

- 电气化

- 减少废物和循环利用

- 监理与合规

- 市场和投资者价值

- 主要障碍和战略建议

- UTV

- ATV(全地形车)

- 雪地摩托车

- 个人水上摩托车(PWC)

- 重型摩托车(>500cc)

- 监理合规性

- 特定领域的成就与差距

- 碳减排策略

- 切实可行的建议

- 北美洲

- 环保署(EPA)排放标准

- 消费者产品安全委员会(CPSC)安全标准

- 美国国家公路交通安全管理局(NHTSA)摩托车标准

- 美国海岸防卫队个人水上摩托车法规

- 欧洲

- 根据 (EU) 168/2013 号法规制定的型式核准制度

- 欧5排放标准

- 安全要求和先进系统

- 噪音法规

- 休閒船舶指令

- 亚太地区

- 区域协调努力

- 市场准入和合规要求

- 拉丁美洲

- 监理框架的演变

- 中东和非洲

- 监管发展趋势

- 合规成本分析与策略影响

- 定量合规成本评估

- 策略市场准入的影响

- 区域价格动态

- 区域套利机会

- 地域价格差异

- 市场开发定价

- 价格弹性和敏感度分析

- 跨区隔市场的需求弹性

- 所得弹性和经济因素

- 竞争价格动态

- 定价权分配

- 製造商定价控制

- 经销商定价弹性

- 供应链定价压力

- 情境规划和趋势推断

- 基准情境:电气化和市场稳定成长(2025-2034 年)

- 加速转型情境:快速电气化和数位整合(2025-2030年)

- 保守演进情境:渐进式变革与市场整合(2025-2034年)

- 技术轨迹的影响

- 电气化技术演进

- 自动驾驶和网联汽车技术

- 先进材料和製造技术

- 市场结构转型

- 商业模式演变

- 竞争格局重塑

- 地理市场开发

- 消费者行为与人口结构演变

- 世代转变的影响

- 体验式消费

- 永续性和环境融合

- 碳中和路径

- 循环经济一体化

- 战略意义与未来定位

- 技术投资重点

- 市场定位策略

- 目前的技术范式

- 新兴科技颠覆

- 创新週期分析

- 研发投资模式和强度

- 技术采用的障碍与加速器

- 创新生态系发展

- 技术轨迹的影响

- 电气化技术演进

- 连结性和数位服务演进

- 战略创新意义

- 技术投资重点

- 竞争技术定位

- 创新热点与智慧财产权集中度

- 专利悬崖分析及影响

- 研发投资模式与专利相关性

- 技术领域专利分析

- 战略专利情报影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 并排车辆

- 全地形车

- 重量级摩托车

- 个人水上摩托车

- 雪地摩托车

第六章:市场估计与预测:以推进方式,2021 - 2034 年

- 主要趋势

- 汽油

- 柴油引擎

- 电的

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 休閒娱乐

- 并排车辆

- 全地形车

- 重量级摩托车

- 个人水上摩托车

- 雪地摩托车

- 公用事业

- 并排车辆

- 全地形车

- 重量级摩托车

- 个人水上摩托车

- 雪地摩托车

- 商业的

- 并排车辆

- 全地形车

- 重量级摩托车

- 个人水上摩托车

- 雪地摩托车

- 运动的

- 并排车辆

- 全地形车

- 重量级摩托车

- 个人水上摩托车

- 雪地摩托车

- 并排车辆

- 全地形车

- 重量级摩托车

- 个人水上摩托车

- 雪地摩托车

- 建造

- 并排车辆

- 全地形车

- 重量级摩托车

- 个人水上摩托车

- 雪地摩托车

- 防御

- 并排车辆

- 全地形车

- 重量级摩托车

- 个人水上摩托车

- 雪地摩托车

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- 全球参与者

- Honda Motor Company

- Yamaha Motor Company

- Polaris Industries

- BRP (Bombardier Recreational Products)

- Harley-Davidson

- Kawasaki Heavy Industries

- Suzuki Motor Corporation

- BMW Motorrad

- KTM AG

- 区域参与者

- Arctic Cat

- CFMOTO

- Ducati Motor Holding

- Hisun Motors

- John Deere

- Kubota Corporation

- KYMCO

- Mahindra & Mahindra

- Piaggio Group

- Toro Company

- Triumph Motorcycles

The Global Power Sports Market was valued at USD 59.6 billion in 2024 and is estimated to grow at a CAGR of 6.7% to reach USD 109.2 billion by 2034. This market is witnessing sustained momentum as consumer enthusiasm for recreational and performance-oriented vehicles like motorcycles, personal watercraft, ATVs, and snowmobiles continues to grow. Rising disposable income, expanding outdoor recreational trends, and a broader cultural interest in adventure-based activities are encouraging the adoption of these vehicles. Increasing traction of electric and hybrid power sports models is further supporting growth, driven by global efforts to cut emissions and implement sustainable mobility.

On top of that, bundled service offerings and financing options are becoming a major value driver. The shift toward delivering full-service ownership experiences with support features like maintenance, roadside assistance, and flexible payment models is adding to customer engagement and brand loyalty. In several Asian markets such as India, Japan, and China, continued investment in infrastructure and trade liberalization is creating fresh demand and manufacturing potential. Additionally, enhanced cross-border logistics, supply chain localization, and regulatory incentives are opening new growth channels across emerging and established markets alike.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $59.6 Billion |

| Forecast Value | $109.2 Billion |

| CAGR | 6.7% |

The heavyweight motorcycles segment will grow at a CAGR of 6.9% through 2034. Their appeal stems from their high-performance capabilities, extended ride comfort, and iconic design, making them a preferred option for experienced riders and touring enthusiasts. The popularity of riding communities and brand-centric loyalty continues to strengthen this segment. This category is particularly dominant across North America, Europe, and selected Asia-Pacific countries, further propelled by the adoption of electric variants among premium models.

In 2024, the gasoline-powered vehicles segment held 75% share and is projected to grow at a CAGR of 6.7% during 2034. The segment continues to lead due to its superior power delivery, widespread fueling infrastructure, and performance reliability. Riders opt for gasoline engines across all vehicle categories-including motorcycles, side-by-sides, ATVs, and snowmobiles-especially in regions where access to charging networks remains limited. Their strong acceleration, greater range, and quick refueling advantage make them especially viable for remote, performance-demanding recreational and professional applications.

United States Power Sports Market generated USD 20.8 billion and held 80.5% share in 2024. The country's long-standing culture of outdoor and motorsport activity, coupled with a robust infrastructure for off-road riding and touring, makes it a high-value market. It serves as a central hub for both manufacturing and consumption across a variety of vehicle types. The U.S. also leads in customization, aftermarket enhancements, and usage of power sports vehicles for utility purposes in industries such as defense, forestry, and agriculture.

Key players influencing the Global Power Sports Market include Yamaha, Honda, BMW Motorrad, Suzuki Motor, CFMOTO, Kawasaki, KTM, Harley-Davidson, Polaris, and BRP. Leading companies in the power sports industry are enhancing their competitive edge through innovation in vehicle electrification, expanded global distribution, and diversified product lines. To maintain relevance, brands are accelerating their push into electric models and connected features to align with shifting environmental and consumer preferences. Additionally, many manufacturers are introducing subscription services and bundled packages covering insurance, maintenance, and roadside support to boost customer retention. Expansion into emerging markets through localized production and dealer networks is also a top priority. Strategic investments in R&D, along with branding through motorsports sponsorships and rider communities, are further solidifying their market foothold.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Propulsion

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Value addition mapping

- 3.1.3.1 Manufacturing value addition and brand premium

- 3.1.3.2 Technology integration and innovation value

- 3.1.3.3 Service and aftermarket value creation

- 3.1.4 Value chain impact factors

- 3.1.4.1 Technology disruption and electrification impact

- 3.1.4.2 Supply chain resilience and geographic diversification

- 3.1.4.3 Regulatory compliance and environmental standards

- 3.1.5 Ecosystem disruptions

- 3.1.5.1 Platform-based business models and digital transformation

- 3.1.5.2 Vertical integration trends and supply chain reconfiguration

- 3.1.5.3 New entrant threats and market evolution

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Demographic transformation and generational shift

- 3.2.1.2 Outdoor recreation participation surge

- 3.2.1.3 Electrification and technology innovation

- 3.2.1.4 Economic and infrastructure development

- 3.2.2 Strategic challenges & industry restraints

- 3.2.2.1 Economic pressures and market volatility

- 3.2.2.2 Regulatory compliance burden

- 3.2.2.3 Trade and tariff pressures

- 3.2.2.4 Market structure and distribution challenges

- 3.2.3 Market opportunity assessment

- 3.2.3.1 Electric vehicle market expansion

- 3.2.3.2 Military and government sector expansion

- 3.2.3.3 International market penetration

- 3.2.3.4 Technology integration and connected services

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.3.1 Application growth potential ranking

- 3.3.1.1 Top-ranked growth applications

- 3.3.2 Product segment growth comparison

- 3.3.3 Market maturity assessment and lifecycle positioning

- 3.3.3.1 Growth stage segments

- 3.3.3.2 Mature stage segments

- 3.3.4 Competitive intensity impact on growth potential

- 3.3.1 Application growth potential ranking

- 3.4 Trade Flow Analysis

- 3.4.1 Top production countries (2023-2024)

- 3.4.1.1 UTVs & ATVs

- 3.4.1.2 Snowmobiles

- 3.4.1.3 Personal Watercraft (PWC)

- 3.4.1.4 Heavyweight motorcycles (>500cc)

- 3.4.2 Top consumption countries (2023-2024)

- 3.4.2.1 UTVs & ATVs

- 3.4.2.2 Snowmobiles

- 3.4.2.3 Personal Watercraft (PWC)

- 3.4.2.4 Heavyweight motorcycles (>500cc)

- 3.4.3 Trade flow analysis

- 3.4.3.1 UTV & ATV trade flows

- 3.4.3.2 Snowmobile trade flows

- 3.4.3.3 PWC trade flows

- 3.4.3.4 Heavyweight motorcycle (>500cc) trade flows

- 3.4.4 Segment-specific tables

- 3.4.1 Top production countries (2023-2024)

- 3.5 Sustainability integration

- 3.5.1 Lifecycle Assessment (LCA) and comparative impacts

- 3.5.1.1 ICE vs. electric power sports

- 3.5.1.2 Manufacturing phase

- 3.5.2 Competitive benchmarking

- 3.5.3 ROI and business case

- 3.5.3.1 Cost savings

- 3.5.3.2 Regulatory risk reduction

- 3.5.4 Barriers and opportunities

- 3.5.4.1 Barriers

- 3.5.4.2 Opportunities

- 3.5.5 Policy, investor, and market drivers

- 3.5.5.1 Policy

- 3.5.5.2 Investor pressure

- 3.5.5.3 Market

- 3.5.6 Best practices and case studies

- 3.5.7 Lifecycle assessment table (ICE vs. Electric)

- 3.5.8 Recommendations

- 3.5.1 Lifecycle Assessment (LCA) and comparative impacts

- 3.6 Best practices, case studies, and ROI

- 3.6.1 Best practices & case studies

- 3.6.1.1 Polaris (UTV/ATV, Snowmobile)

- 3.6.1.2 Yamaha (All segments)

- 3.6.1.3 BRP (Can-Am, Sea-Doo, Ski-Doo)

- 3.6.1.4 Harley-Davidson (Heavyweight MC)

- 3.6.2 ROI & business case

- 3.6.2.1 Electrification

- 3.6.2.2 Waste reduction & circularity

- 3.6.2.3 Regulatory & compliance

- 3.6.2.4 Market & investor value

- 3.6.3 Key barriers & strategic recommendations

- 3.6.1 Best practices & case studies

- 3.7 Cost breakdown analysis

- 3.7.1 UTV

- 3.7.2 ATV (All-Terrain Vehicle)

- 3.7.3 Snowmobile

- 3.7.4 Personal Watercraft (PWC)

- 3.7.5 Heavyweight Motorcycle (>500cc)

- 3.8 Carbon impact assessment (2023-2024)

- 3.8.1 Regulatory compliance

- 3.8.2 Segment-specific achievements & gaps

- 3.8.3 Carbon reduction strategies

- 3.8.4 Actionable recommendations

- 3.9 Regulatory landscape

- 3.9.1 North America

- 3.9.1.1 Environmental protection agency (EPA) emissions standards

- 3.9.1.2 Consumer product safety commission (CPSC) safety standards

- 3.9.1.3 National highway traffic safety administration (NHTSA) motorcycle standards

- 3.9.1.4 U.S. coast guard personal watercraft regulations

- 3.9.2 Europe

- 3.9.2.1 Type approval system under regulation (EU) no 168/2013

- 3.9.2.2 Euro 5 emissions standards

- 3.9.2.3 Safety requirements and advanced systems

- 3.9.2.4 Noise regulations

- 3.9.2.5 Recreational craft directive

- 3.9.3 Asia Pacific

- 3.9.3.1 Regional harmonization efforts

- 3.9.3.2 Market access and compliance requirements

- 3.9.4 Latin America

- 3.9.4.1 Regulatory framework evolution

- 3.9.5 Middle East & Africa

- 3.9.5.1 Regulatory development trends

- 3.9.6 Compliance cost analysis and strategic implications

- 3.9.6.1 Quantitative compliance cost assessment

- 3.9.6.2 Strategic market access implications

- 3.9.1 North America

- 3.10 Price trend analysis

- 3.10.1 Regional price dynamics

- 3.10.2 Regional arbitrage opportunities

- 3.10.2.1 Geographic price variations

- 3.10.2.2 Market development pricing

- 3.10.3 Price elasticity and sensitivity analysis

- 3.10.3.1 Demand elasticity across segments

- 3.10.3.2 Income elasticity and economic factors

- 3.10.3.3 Competitive price dynamics

- 3.10.4 Pricing power distribution

- 3.10.4.1 Manufacturer pricing control

- 3.10.4.2 Dealer pricing flexibility

- 3.10.4.3 Supply chain pricing pressures

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

- 3.13 Future market evolution

- 3.13.1 Scenario planning and trend extrapolation

- 3.13.1.1 Base case scenario: Steady electrification and market growth (2025-2034)

- 3.13.1.2 Accelerated transformation scenario: Rapid electrification and digital integration (2025-2030)

- 3.13.1.3 Conservative evolution scenario: Gradual change and market consolidation (2025-2034)

- 3.13.2 Technology trajectory implications

- 3.13.2.1 Electrification technology evolution

- 3.13.2.2 Autonomous and connected vehicle technologies

- 3.13.2.3 Advanced materials and manufacturing technologies

- 3.13.3 Market structure transformation

- 3.13.3.1 Business model evolution

- 3.13.3.2 Competitive landscape restructuring

- 3.13.3.3 Geographic market development

- 3.13.4 Consumer behavior and demographic evolution

- 3.13.4.1 Generational transition impact

- 3.13.4.2 Experience-oriented consumption

- 3.13.5 Sustainability and environmental integration

- 3.13.5.1 Carbon neutrality pathways

- 3.13.5.2 Circular economy integration

- 3.13.6 Strategic implications and future positioning

- 3.13.6.1 Technology investment priorities

- 3.13.6.2 Market positioning strategies

- 3.13.1 Scenario planning and trend extrapolation

- 3.14 Technology & innovation landscape

- 3.14.1 Current technology paradigms

- 3.14.2 Emerging technology disruptions

- 3.14.3 Innovation cycle analysis

- 3.14.3.1 R&D investment patterns and intensity

- 3.14.3.2 Technology adoption barriers and accelerators

- 3.14.3.3 Innovation ecosystem development

- 3.14.4 Technology trajectory implications

- 3.14.4.1 Electrification technology evolution

- 3.14.4.2 Connectivity and digital service evolution

- 3.14.5 Strategic innovation implications

- 3.14.5.1 Technology investment priorities

- 3.14.5.2 Competitive technology positioning

- 3.15 Patent analysis

- 3.15.1 Innovation hotspots and IP concentration

- 3.15.2 Patent cliff analysis and implications

- 3.15.3 R&D investment patterns and patent correlation

- 3.15.4 Technology area patent analysis

- 3.15.5 Strategic patent intelligence implications

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Side By Side Vehicle

- 5.3 All-Terrain Vehicle

- 5.4 Heavyweight Motorcycle

- 5.5 Personal Watercrafts

- 5.6 Snowmobile

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Gasoline

- 6.3 Diesel

- 6.4 Electric

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Recreational

- 7.2.1 Side By Side Vehicle

- 7.2.2 All-Terrain Vehicle

- 7.2.3 Heavyweight Motorcycle

- 7.2.4 Personal Watercrafts

- 7.2.5 Snowmobile

- 7.3 Utility

- 7.3.1 Side By Side Vehicle

- 7.3.2 All-Terrain Vehicle

- 7.3.3 Heavyweight Motorcycle

- 7.3.4 Personal Watercrafts

- 7.3.5 Snowmobile

- 7.4 Commercial

- 7.4.1 Side By Side Vehicle

- 7.4.2 All-Terrain Vehicle

- 7.4.3 Heavyweight Motorcycle

- 7.4.4 Personal Watercrafts

- 7.4.5 Snowmobile

- 7.5 Sports

- 7.5.1 Side By Side Vehicle

- 7.5.2 All-Terrain Vehicle

- 7.5.3 Heavyweight Motorcycle

- 7.5.4 Personal Watercrafts

- 7.6 Snowmobile

- 7.6.1 Side By Side Vehicle

- 7.6.2 All-Terrain Vehicle

- 7.6.3 Heavyweight Motorcycle

- 7.6.4 Personal Watercrafts

- 7.6.5 Snowmobile

- 7.7 Construction

- 7.7.1 Side By Side Vehicle

- 7.7.2 All-Terrain Vehicle

- 7.7.3 Heavyweight Motorcycle

- 7.7.4 Personal Watercrafts

- 7.7.5 Snowmobile

- 7.8 Defense

- 7.8.1 Side By Side Vehicle

- 7.8.2 All-Terrain Vehicle

- 7.8.3 Heavyweight Motorcycle

- 7.8.4 Personal Watercrafts

- 7.8.5 Snowmobile

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Global Players

- 9.1.1 Honda Motor Company

- 9.1.2 Yamaha Motor Company

- 9.1.3 Polaris Industries

- 9.1.4 BRP (Bombardier Recreational Products)

- 9.1.5 Harley-Davidson

- 9.1.6 Kawasaki Heavy Industries

- 9.1.7 Suzuki Motor Corporation

- 9.1.8 BMW Motorrad

- 9.1.9 KTM AG

- 9.2 Regional Players

- 9.2.1 Arctic Cat

- 9.2.2 CFMOTO

- 9.2.3 Ducati Motor Holding

- 9.2.4 Hisun Motors

- 9.2.5 John Deere

- 9.2.6 Kubota Corporation

- 9.2.7 KYMCO

- 9.2.8 Mahindra & Mahindra

- 9.2.9 Piaggio Group

- 9.2.10 Toro Company

- 9.2.11 Triumph Motorcycles