|

市场调查报告书

商品编码

1801929

资料中心互连市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Data Center Interconnect Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

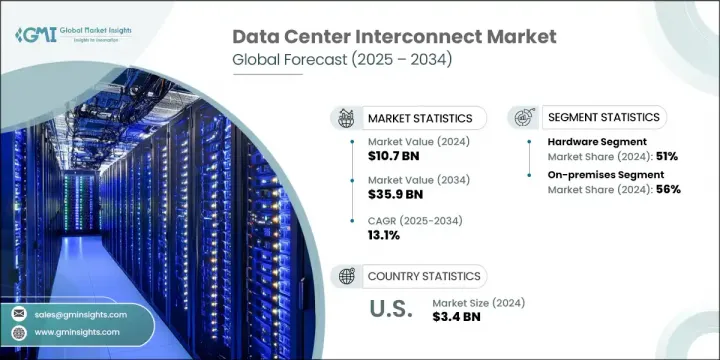

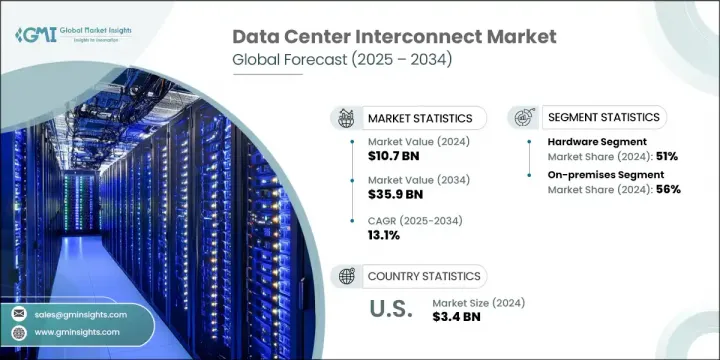

2024年,全球资料中心互连市场规模达107亿美元,预计2034年将以13.1%的复合年增长率成长,达到359亿美元。随着数位转型加速和资料量持续激增,对先进互连解决方案的需求变得至关重要。混合云端策略和人工智慧驱动型应用的兴起,已将焦点转向高速可编程光纤网路。企业正迅速转向400G和800G光纤解决方案,以确保资料中心之间低延迟、可扩展且安全的资料传输。这些技术提供自适应频宽控制、加密功能和延迟最佳化。

如今,竞争差异化需要基于意图的网路、先进的自动化以及针对企业和云端原生客户量身定制的分层服务模式。供应商正在提供智慧资料中心互联 (DCI) 解决方案,这些解决方案具备即时遥测、SLA 追踪和网路可程式性,使基础设施与合规标准和关键工作负载保持一致。北美凭藉着密集的云端基础架构、强大的网路交换中心和大规模超大规模部署,持续引领 DCI 格局。凭藉跨境光纤连接和先进的光纤骨干网,该地区仍然是该市场创新和扩张的焦点。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 107亿美元 |

| 预测值 | 359亿美元 |

| 复合年增长率 | 13.1% |

2024年,硬体部分占据了51%的市场份额,预计到2034年将以12%的复合年增长率成长。实体基础设施仍然是资料中心互联(DCI)实施的支柱,支援设施之间可靠、高速的资料传输。光收发器、路由器、多工器和交换器等核心组件的需求正在成长,尤其是支援400G和800G相干光模组的组件。这些元件对于云端运算、人工智慧和物联网用例至关重要,儘管它们也占据了资料中心投资的很大一部分。

2024年,本地部署领域以56%的市占率领先DCI市场,预计2025-2034年期间的复合年增长率将达到12%。本地部署使超大规模资料中心营运商和企业能够直接控制其网路环境,这对于关键任务、低延迟应用至关重要。这些配置还允许对计算密集型操作(例如AI模型训练、金融演算法和科学计算)进行更深入的客製化和效能最佳化。此外,政府、金融服务和保险等行业继续青睐本地DCI,以满足严格的监管和资料驻留要求。

2024年,美国资料中心互连市场规模达34亿美元,约占北美市场的85%。美国在数位基础设施领域的领先地位得益于其庞大的超大规模供应商、企业资料中心和主机託管设施。医疗保健、电子商务和金融等关键产业对城域网路和区域网路高速互连的需求仍然强劲。美国在升级到400G和800G光纤技术以及采用开放网路标准方面也处于领先地位,这进一步加速了美国全国范围内资料中心互连(DCI)的部署。

全球资料中心互连市场的领导者包括 Arista Networks、华为、思科、富士通、诺基亚、Extreme Networks 和瞻博网路。资料中心互连市场的顶尖公司正专注于创新、可扩展性和网路智能,以巩固其市场地位。主要供应商正在投资支援 400G/800G 技术的高容量光传输系统,以满足不断增长的资料需求。与超大规模云端供应商的策略合作伙伴关係正在扩展解决方案的覆盖范围并提高互通性。企业正在整合人工智慧和遥测工具,以提供即时分析、SLA 合规性和自动网路调整。模组化硬体和软体定义的解决方案正在开发中,以确保灵活性和快速部署。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 人工智慧和机器学习工作量的增加

- 云端运算的快速采用和边缘运算的扩展

- 全球资料流量和储存需求激增

- 增加超大规模资料中心部署

- 产业陷阱与挑战

- DCI 基础设施的初始资本支出高。

- 复杂的网路管理和整合问题。

- 市场机会

- 开发AI优化的DCI平台

- 5G和边缘资料中心部署的成长

- 新兴市场数位基础设施的扩张

- 对节能环保 DCI 解决方案的需求不断增长

- 成长动力

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 科技与创新格局

- 当前的技术趋势

- 新兴技术

- 专利分析

- 定价趋势与经济分析

- 历史定价分析与市场演变(2019-2024)

- 目前 DCI 定价格局(2024-2025 年)

- 总拥有成本 (TCO) 和经济分析

- 未来价格预测与市场趋势(2025-2034)

- DCI网路架构与拓朴设计

- 网路拓朴模型与设计原则

- 点对点DCI架构

- 中心辐射型资料中心互联模型

- 网状和任意连接

- 混合和多拓扑设计

- 基于距离的DCI解决方案架构

- 城域DCI(0-100km)解决方案

- 区域DCI(100-1000公里)解决方案

- 长途DCI(1000公里以上)解决方案

- 特定应用的DCI架构

- 云端提供商 DCI 架构

- 企业DCI架构

- 金融服务DCI架构

- 网路拓朴模型与设计原则

- DCI容量管理和效能优化

- 网路容量规划与管理

- 效能监控和分析

- 服务品质和流量管理

- 用例

- 能源效率和永续性

- DCI网路能耗分析

- 绿色网路和永续发展计划

- 能源效率技术与创新

- 永续性投资报酬率和商业效益

- 最佳情况

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 硬体

- 光收发器

- 交换器和路由器

- 电缆和连接器

- 光放大器

- 其他的

- 软体

- 软体定义网路(SDN)

- 网路管理软体

- 分析及优化软体

- 其他的

- 服务

- 专业的

- 託管

第六章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- 同步光纤网路(SONET)

- 密集波分复用(DWDM)

- 乙太网路

- 光传输网路 (OTN)

- 其他的

第七章:市场估计与预测:依部署模式,2021 - 2034 年

- 主要趋势

- 基于云端

- 本地

- 杂交种

第八章:市场估计与预测:按频宽,2021 - 2034 年

- 主要趋势

- 低频宽(高达 1 Gbps)

- 中等频宽(1-10 Gbps)

- 高频宽(10-100 Gbps)

- 超高频宽(100 Gbps 以上)

第九章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 灾难復原

- 内容传递

- 资料复製

- 负载平衡

- 云端连线

第十章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 通讯服务提供者 (CSP)

- 网路内容供应商和营运商中立供应商 (ICP/CNP)

- 政府

- 企业

- 金融服务业

- 卫生保健

- 媒体与娱乐

- 其他的

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 北欧人

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 菲律宾

- 印尼

- 新加坡

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十二章:公司简介

- 全球参与者

- ADVA Optical Networking

- Arista Networks

- Broadcom

- Ciena

- Cisco

- Fujitsu

- Huawei

- IBM

- Infinera

- Juniper

- Nokia

- ZTE

- 区域参与者

- Brocade Communication Systems

- Colt Technology Services

- CoreSite Realty

- Digital Realty Trust

- Evoque Data Center Solutions

- Fiber Mountain

- Flexential

- Megaport

- Zayo Group

- 新兴玩家

- Cologix

- Cyxtera Technologies

- Dolphin Interconnect Solutions

- Ekinops

- Eoptolink

- Innolight

- Macom Technology Solutions

- Pluribus Networks

- XKL

The Global Data Center Interconnect Market was valued at USD 10.7 billion in 2024 and is estimated to grow at a CAGR of 13.1% to reach USD 35.9 billion by 2034. As digital transformation accelerates and data volumes continue to surge, the need for advanced interconnect solutions becomes critical. The rise of hybrid cloud strategies and AI-driven applications has shifted focus toward high-speed, programmable optical networks. Enterprises are rapidly moving to 400G and 800G optical solutions to ensure low-latency, scalable, and secure data transfers between data centers. These technologies offer adaptive bandwidth control, encryption capabilities, and latency optimization.

Competitive differentiation now requires intent-based networking, advanced automation, and tiered service models tailored to enterprise and cloud-native clients. Providers are offering intelligent DCI solutions with real-time telemetry, SLA tracking, and network programmability, aligning infrastructure with compliance standards and critical workloads. North America continues to lead the DCI landscape, supported by dense cloud infrastructure, robust internet exchanges, and large-scale hyperscale deployments. With cross-border fiber connectivity and sophisticated optical backbones, the region remains a focal point for innovation and expansion in this market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.7 Billion |

| Forecast Value | $35.9 Billion |

| CAGR | 13.1% |

In 2024, the hardware segment accounted for 51% share and is expected to grow at a CAGR of 12% through 2034. Physical infrastructure remains the backbone of DCI implementations, enabling reliable and high-speed data movement between facilities. Core components like optical transceivers, routers, multiplexers, and switches are seeing increased demand-especially those supporting 400G and 800G coherent optics. These elements are vital for powering cloud computing, artificial intelligence, and IoT use cases, although they also command a significant portion of data center investment.

The on-premises segment led the DCI market in 2024 with 56% share and is anticipated to grow at a CAGR of 12% during 2025-2034. On-premise deployments offer hyperscalers and enterprises direct control over their networking environment, which is essential for mission-critical, low-latency applications. These configurations also allow deeper customization and performance optimization for compute-intensive operations such as AI model training, financial algorithms, and scientific computing. Moreover, industries like government, BFSI, and healthcare continue to prefer on-premise DCI to meet strict regulatory and data residency requirements.

United States Data Center Interconnect Market generated USD 3.4 billion in 2024, capturing around 85% of the North American market. The country's leadership in digital infrastructure is driven by its large presence of hyperscale providers, enterprise data centers, and colocation facilities. Demand for high-speed interconnection across metro and regional networks remains strong across key industries such as healthcare, e-commerce, and finance. The US is also at the forefront of upgrading to 400G and 800G optical technologies and adopting open networking standards, further accelerating DCI deployment across the nation.

The leading players in the Global Data Center Interconnect Market include Arista Networks, Huawei, Cisco, Fujitsu, Nokia, Extreme Networks, and Juniper. Top companies in the data center interconnect market are focusing on innovation, scalability, and network intelligence to solidify their market position. Major vendors are investing in high-capacity optical transport systems that support 400G/800G technology to meet growing data demands. Strategic partnerships with hyperscale cloud providers are expanding solution reach and improving interoperability. Firms are integrating AI and telemetry tools to deliver real-time analytics, SLA compliance, and automated network adjustments. Modular hardware and software-defined solutions are being developed to ensure flexibility and quick deployment.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Technology

- 2.2.4 Application

- 2.2.5 Bandwidth

- 2.2.6 Deployment mode

- 2.2.7 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in AI and machine learning workloads

- 3.2.1.2 Rapid cloud adoption and edge computing expansion

- 3.2.1.3 Surge in global data traffic and storage demands

- 3.2.1.4 Increasing hyperscale data center deployments

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial capital expenditure for DCI infrastructure.

- 3.2.2.2 Complex network management and integration issues.

- 3.2.3 Market opportunities

- 3.2.3.1 Development of AI-optimized DCI platforms

- 3.2.3.2 Growth in 5G and edge data center deployments

- 3.2.3.3 Expansion of digital infrastructure in emerging markets

- 3.2.3.4 Rising demand for energy-efficient and green DCI solutions

- 3.2.1 Growth drivers

- 3.3 Regulatory landscape

- 3.3.1 North America

- 3.3.2 Europe

- 3.3.3 Asia Pacific

- 3.3.4 Latin America

- 3.3.5 Middle East & Africa

- 3.4 Porter’s analysis

- 3.5 PESTEL analysis

- 3.6 Technology and Innovation landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Patent analysis

- 3.8 Pricing trends and economic analysis

- 3.8.1 Historical pricing analysis and market evolution (2019-2024)

- 3.8.2 Current DCI pricing landscape (2024-2025)

- 3.8.3 Total cost of ownership (TCO) and economic analysis

- 3.8.4 Future pricing projections and market trends (2025-2034)

- 3.9 DCI network architecture and topology design

- 3.9.1 Network topology models and design principles

- 3.9.1.1 Point-to-point DCI architecture

- 3.9.1.2 Hub-and-spoke dci models

- 3.9.1.3 Mesh and any-to-any connectivity

- 3.9.1.4 Hybrid and multi-topology designs

- 3.9.2 Distance-based DCI solution architecture

- 3.9.2.1 Metro DCI (0-100km) solutions

- 3.9.2.2 Regional DCI (100-1000km) solutions

- 3.9.2.3 Long-haul DCI (1000km+) solutions

- 3.9.3 Application-specific dci architecture

- 3.9.3.1 Cloud provider DCI architecture

- 3.9.3.2 Enterprise DCI architecture

- 3.9.3.3 Financial services dci architecture

- 3.9.1 Network topology models and design principles

- 3.10 DCI capacity management and performance optimization

- 3.10.1 Network capacity planning and management

- 3.10.2 Performance monitoring and analytics

- 3.10.3 Quality of service and traffic management

- 3.11 Use cases

- 3.12 Energy efficiency and sustainability

- 3.12.1 Energy consumption analysis in DCI networks

- 3.12.2 Green networking and sustainability initiatives

- 3.12.3 Energy efficiency technologies and innovations

- 3.12.4 Sustainability ROI and business benefits

- 3.13 Best-case scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Optical transceivers

- 5.2.2 Switches & routers

- 5.2.3 Cables & connectors

- 5.2.4 Optical amplifiers

- 5.2.5 Others

- 5.3 Software

- 5.3.1 Software-Defined Networking (SDN)

- 5.3.2 Network management software

- 5.3.3 Analytics & optimization software

- 5.3.4 Others

- 5.4 Service

- 5.4.1 Professional

- 5.4.2 Managed

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Synchronous optical network (SONET)

- 6.3 Dense wavelength division multiplexing (DWDM)

- 6.4 Ethernet

- 6.5 Optical transport network (OTN)

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Cloud-based

- 7.3 On-premises

- 7.4 Hybrid

Chapter 8 Market Estimates & Forecast, By Bandwidth, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Low bandwidth (Up to 1 Gbps)

- 8.3 Medium bandwidth (1-10 Gbps)

- 8.4 High bandwidth (10-100 Gbps)

- 8.5 Ultra-high bandwidth (Above 100 Gbps)

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Disaster recovery

- 9.3 Content delivery

- 9.4 Data replication

- 9.5 Load balancing

- 9.6 Cloud connectivity

Chapter 10 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 Communications service providers (CSPs)

- 10.3 Internet content providers and carrier-neutral providers (ICPs/CNPs)

- 10.4 Government

- 10.5 Enterprises

- 10.5.1 BFSI

- 10.5.2 Healthcare

- 10.5.3 Media & Entertainment

- 10.5.4 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Netherlands

- 11.3.7 Nordics

- 11.3.8 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Philippines

- 11.4.7 Indonesia

- 11.4.8 Singapore

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global Players

- 12.1.1 ADVA Optical Networking

- 12.1.2 Arista Networks

- 12.1.3 Broadcom

- 12.1.4 Ciena

- 12.1.5 Cisco

- 12.1.6 Fujitsu

- 12.1.7 Huawei

- 12.1.8 IBM

- 12.1.9 Infinera

- 12.1.10 Juniper

- 12.1.11 Nokia

- 12.1.12 ZTE

- 12.2 Regional Players

- 12.2.1 Brocade Communication Systems

- 12.2.2 Colt Technology Services

- 12.2.3 CoreSite Realty

- 12.2.4 Digital Realty Trust

- 12.2.5 Evoque Data Center Solutions

- 12.2.6 Fiber Mountain

- 12.2.7 Flexential

- 12.2.8 Megaport

- 12.2.9 Zayo Group

- 12.3 Emerging Players

- 12.3.1 Cologix

- 12.3.2 Cyxtera Technologies

- 12.3.3 Dolphin Interconnect Solutions

- 12.3.4 Ekinops

- 12.3.5 Eoptolink

- 12.3.6 Innolight

- 12.3.7 Macom Technology Solutions

- 12.3.8 Pluribus Networks

- 12.3.9 XKL