|

市场调查报告书

商品编码

1798383

全球资料中心互连 (DCI) 市场类型与应用预测 - 2030 年Data Center Interconnect Market by Type [Products (Packet Switching Network, Optical DCI), Software, Services (Professional, Managed)], Application (Real-time Disaster Recovery & Business Continuity, Workload & Data Mobility) - Global Forecast to 2030 |

||||||

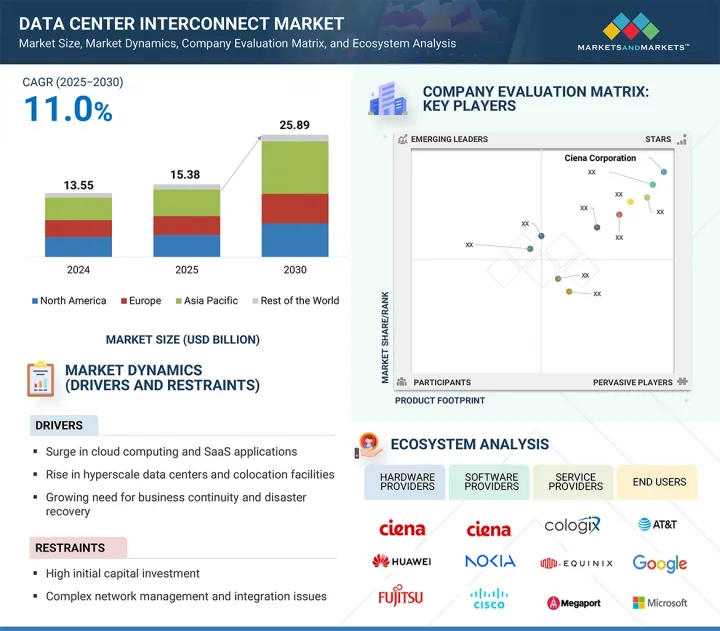

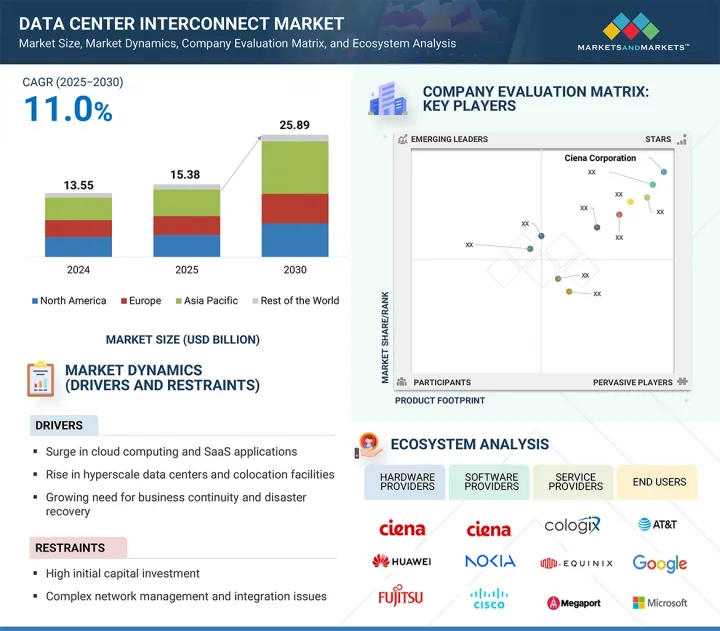

全球资料中心互联 (DCI) 市场预计将从 2025 年的 153.8 亿美元成长到 2030 年的 258.9 亿美元,复合年增长率为 11.0%。

受边缘运算的快速成长以及地理分布资料中心之间对低延迟、高频宽连线的需求不断增长的推动,市场预计将大幅成长。

| 调查范围 | |

|---|---|

| 调查年份 | 2021-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 单元 | 10亿美元 |

| 部分 | 类型、用途、最终用户、地区 |

| 目标区域 | 北美、欧洲、亚太地区及其他地区 |

资料密集型服务的消费不断增长正在加速基础设施的升级,而开放式和分解式网路架构的实施以及云端原生网路功能的日益普及等机会正在支援企业和服务供应商部署扩充性、灵活且经济高效的 DCI。

“预计在预测期内,服务业的复合年增长率最高。”

预计服务部门将在资料中心互连 (DCI) 市场中实现最高的复合年增长率,这得益于互连基础设施日益复杂,以及对部署、整合和维护各个阶段的专业支援需求不断增长。随着企业采用混合云和多重云端环境,他们需要专业服务来管理安全、高效能的 DCI 网络,以促进地理位置分散的资料中心之间的无缝资料交换。对即时监控、流量优化和灾害復原计划的需求也在推动对託管服务和专业服务的需求。此外, IT基础设施营运越来越多地外包给服务供应商,以及网路管理向软体定义和虚拟的转变,正在推动能够实现 DCI 部署的灵活性、扩充性和成本效益的服务产品的重要性。

“预测期内,通讯服务供应商(CSP)将占据第二大市场占有率。”

通讯服务供应商(CSP) 部门预计将占据资料中心互连 (DCI) 市场的第二大市场份额,这得益于其在支援大规模分散式网路市场占有率中的高频宽、低延迟连线方面的关键作用。随着对高速互联网、5G 部署和行动数据使用的需求不断增长,CSP 正在大力投资扩展其网路容量和互连能力。为了保持服务品质和运作,这些供应商正在寻求强大的 DCI 解决方案,以确保核心、边缘和区域资料中心之间的顺畅资料传输。此外,CSP 正在采用网路虚拟、SDN 和 NFV 来提供可扩展和高效的服务,进一步推动了对先进 DCI 技术的需求,以支援不断发展的通讯和企业工作负载。

“到2030年,欧洲将成为最大的DCI市场。”

预计欧洲资料中心互联 (DCI) 市场将以全球第二高的复合年增长率成长,这得益于数位转型的快速推进、云端基础服务的日益普及以及超大规模和主机託管资料中心的扩张。欧盟 (EU) 对资料主权、GDPR 合规性和永续IT基础设施的重视,正在推动对安全节能的 DCI 解决方案的需求。此外,德国、英国、法国和荷兰等国的政府和企业正在大力投资先进的互联基础设施,以支援其人工智慧、物联网和边缘运算计画。

本报告分析了全球资料中心互连 (DCI) 市场,提供了关键驱动因素和限制因素、竞争格局和未来趋势的资讯。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章 主要发现

- 资料中心连结市场为企业带来诱人机会

- 资料中心互连市场按类型和应用划分

- 资料中心互连市场(依最终用户划分)

- 资料中心互连市场(按国家/地区)

第五章市场概述

- 介绍

- 市场动态

- 驱动程式

- 抑制因素

- 机会

- 任务

- 影响客户业务的趋势/中断

- 价值链分析

- 生态系分析

- 波特五力分析

- 专利分析

- 监管格局

- 监管机构、政府机构和其他组织

- 标准

- 规定

- 贸易分析

- 进口情形(HS 编码 851769)

- 出口情形(HS 编码 851769)

- 定价分析

- 主要企业按产品分類的参考定价分析(2024年)

- 各地区平均销售价格趋势(2021-2024)

- 技术分析

- 主要技术

- 互补技术

- 邻近技术

- 案例研究分析

- 思科携手 MEGAPORT 为领先能源公司增强全球 SD-WAN 连接

- EXTREME NETWORKS 协助荷兰布雷达打造面向未来的智慧城市网络

- 华为协助Cyberagent公司建置IDN云端资料中心

- Ciena Corporation 透过扩充性且灵活的 DCI 网路帮助 Interxion 扩展其资料中心业务

- 诺基亚透过模组化资料中心连接解决方案帮助 ESPANIX 扩展其对等平台

- DIGITAL REALTY 助力 Rackspace 以低成本增强互联互通

- INFINERA 利用 DCI 解决方案帮助 JPIX 解决流量激增相关问题

- 大型会议和活动(2025-2026年)

- 主要相关利益者和采购标准

- 人工智慧对资料中心连结市场的影响

- 2025年美国关税的影响—概述

- 主要关税税率

- 对不同地区产生重大影响

- 对终端产业的影响

第六章:资料中心互连市场(按类型)

- 介绍

- 产品

- 软体

- 服务

第 7 章:资料中心互连市场(按应用)

- 介绍

- 即时灾害復原和业务永续营运

- 共用资料、资源/伺服器 HA丛集(丛集)

- 工作负载(虚拟机器)和资料(储存)移动性

第 8 章:资料中心互连市场(依最终使用者)

- 介绍

- 通讯服务供应商(CSPS)

- 营运商中立提供者 (CNP)/网路内容提供者 (ICP)

- 政府

- 公司

9. 资料中心互连市场(按地区)

- 介绍

- 北美洲

- 北美宏观经济展望

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 欧洲宏观经济展望

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 亚太宏观经济展望

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 其他地区

- 其他地区的宏观经济展望

- 中东

- 非洲

- 南美洲

第十章 竞争格局

- 概述

- 主要参与企业的策略/优势(2021-2025)

- 收益分析(2021-2024)

- 市场占有率分析(2024年)

- 公司估值及财务指标

- 品牌/产品比较

- 企业评估矩阵:主要企业(2024年)

- 公司评估矩阵:Start-Ups/中小企业(2024 年)

- 竞争场景

第十一章:公司简介

- 主要企业

- CIENA CORPORATION

- HUAWEI TECHNOLOGIES CO., LTD.

- NOKIA

- CISCO SYSTEMS, INC.

- JUNIPER NETWORKS, INC.

- ADTRAN

- EXTREME NETWORKS

- FUJITSU

- COLT TECHNOLOGY SERVICES GROUP LIMITED

- RIBBON COMMUNICATIONS OPERATING COMPANY, INC.

- 其他公司

- MARVELL

- EPLUS INC.

- ZTE CORPORATION

- COLOGIX

- MEGAPORT

- RANOVUS

- LIGHTMATTER

- CELESTIAL AI

- AYAR LABS

- EDGECORE NETWORKS CORPORATION

- RTBRICK

- DRIVENETS

- ORIOLE NETWORKS

- EFFECT PHOTONICS

- XSCAPE PHOTONICS

第十二章 附录

The DCI market is projected to grow from USD 15.38 billion in 2025 to USD 25.89 billion by 2030, with a CAGR of 11.0%. The data center interconnect (DCI) market is set for substantial growth, fueled by the rapid increase in edge computing and the rising demand for low-latency, high-bandwidth connections between geographically spread data centers.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, Application, End User, and Region |

| Regions covered | North America, Europe, APAC, RoW |

Growing consumption of data-heavy services is speeding up infrastructure upgrades. Moreover, opportunities like implementing open and disaggregated networking architectures and the increasing adoption of cloud-native network functions are supporting more scalable, flexible, and cost-efficient DCI deployments across enterprises and service providers.

"Services are projected to record the highest CAGR during the forecast period"

The services segment is expected to experience the highest CAGR in the data center interconnect (DCI) market due to the increasing complexity of interconnection infrastructures and the rising demand for specialized support throughout deployment, integration, and maintenance phases. As organizations adopt hybrid and multi-cloud environments, they need expert services to manage secure and high-performance DCI networks that facilitate seamless data exchange across geographically dispersed data centers. The demand for real-time monitoring, traffic optimization, and disaster recovery planning is also boosting the need for managed and professional services. Additionally, the growth of outsourcing IT infrastructure operations to service providers and the shift toward software-defined and virtualized network management are reinforcing the importance of service offerings in achieving agility, scalability, and cost-efficiency in DCI deployments.

"Communications service providers (CSPs) will hold the second-largest market share during the forecast period"

The communications service providers (CSPs) segment is expected to hold the second-largest market share in the data center interconnect (DCI) market because of their crucial role in supporting high-bandwidth, low-latency connections across large and dispersed network infrastructures. As demand for high-speed internet, 5G deployment, and mobile data usage increases, CSPs are heavily investing in expanding their network capacity and interconnection capabilities. To maintain service quality and uptime, these providers require robust DCI solutions to ensure smooth data transfer between core, edge, and regional data centers. Furthermore, CSPs are adopting network virtualization, SDN, and NFV to deliver scalable and efficient services, which further drives the need for advanced DCI technologies to accommodate evolving telecom and enterprise workloads.

"Europe to grow at a significant rate in the DCI market by 2030"

Europe is expected to grow at the second-highest CAGR in the data center interconnect (DCI) market due to the region's rapid push toward digital transformation, rising adoption of cloud-based services, and the expansion of hyperscale and colocation data centers. The European Union's strong focus on data sovereignty, GDPR compliance, and sustainable IT infrastructure is fueling demand for secure, energy-efficient DCI solutions. Additionally, governments and businesses in countries such as Germany, the UK, France, and the Netherlands heavily invest in advanced connectivity infrastructure to support AI, IoT, and edge computing initiatives.

Extensive primary interviews were conducted with key industry experts in the DCI market to verify and define the market size for various segments and subsegments identified through secondary research. The list of primary participants involved in the report is shown below.

The study contains insights from various industry experts, from equipment suppliers to Tier 1 companies and service providers. The break-up of the primaries is as follows:

- By Company Type: Tier 1-40%, Tier 2-40%, and Tier 3-20%

- By Designation: C-level Executives-20%, Directors-30%, and Others-50%

- By Region: Asia Pacific-40%, Europe-30%, North America-20%, and RoW-10%

The DCI market is led by a few global players, including Ciena Corporation (US), Huawei Technologies Co., Ltd. (China), Cisco Systems, Inc. (US), Nokia (Finland), Juniper Networks, Inc. (US), Fujitsu (Japan), ADTRAN (US), Ribbon Communications Operating Company, Inc. (US), Extreme Networks (US), Colt Technology Services Group Limited (UK), Marvell (US), ePlus Inc. (US), ZTE Corporation (China), Cologix (US), Megaport (Australia), Ranovus (Canada), Lightmatter (US), Celestial AI (US), Ayar Labs (US), Edgecore Networks Corporation (Taiwan), RtBrick (India), DriveNets (Israel), Oriole Networks (UK), EFFECT Photonics (Netherlands), and Xscape Photonics (US).

The study includes an in-depth competitive analysis of these key players in the DCI market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the DCI market based on type (product, software, services), applications (real-time disaster recovery and business continuity, shared data and resources/server high-availability clusters (geo clustering), workload (VM), and data (storage) mobility), and end users (communication service providers (CSPs), carrier-neutral providers (CNPs)/internet content providers (ICPs), government, and enterprises). It also discusses the market's drivers, restraints, opportunities, and challenges. Additionally, it provides a detailed view of the market across four main regions (North America, Europe, Asia Pacific, and RoW). The report includes an ecosystem analysis of key players.

Key Benefits of Buying the Report:

- Analysis of key drivers (surge in cloud computing and SaaS applications, rise in hyperscale data centers and colocation facilities, growing need for business continuity and disaster recovery), restraints (high initial capital investment, complex network management and integration issues), opportunities (adoption of AI and machine learning workloads, transition to 400G and 800G optical transceivers, integration of software-defined networking (SDN) and network function virtualization (NFV)), challenges (security and compliance risks, interoperability among vendors, latency and network congestion)

- Service Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the DCI market

- Market Development: Comprehensive information about lucrative markets through the analysis of the DCI market across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the DCI market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players, such as Ciena Corporation (US), Huawei Technologies Co., Ltd. (China), Cisco Systems, Inc. (US), Nokia (Finland), Juniper Networks, Inc. (US), Fujitsu (Japan), ADTRAN (US), Ribbon Communications Operating Company, Inc. (US), Extreme Networks (US), Colt Technology Services Group Limited (UK), Marvell (US), ePlus inc. (US), ZTE Corporation (China), Cologix (US), Megaport (Australia), among others

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- 2.6 LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DATA CENTER INTERCONNECT MARKET

- 4.2 DATA CENTER INTERCONNECT MARKET, BY TYPE AND APPLICATION

- 4.3 DATA CENTER INTERCONNECT MARKET, BY END USER

- 4.4 DATA CENTER INTERCONNECT MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surge in cloud computing and SaaS applications

- 5.2.1.2 Rise in hyperscale data centers and colocation facilities

- 5.2.1.3 Growing need for business continuity and disaster recovery

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial capital investment

- 5.2.2.2 Complex network management and integration issues

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Adoption of AI and machine learning workloads

- 5.2.3.2 Transition to 400G and 800G optical transceivers

- 5.2.3.3 Integration of software-defined networking (SDN) and network function virtualization (NFV)

- 5.2.4 CHALLENGES

- 5.2.4.1 Security and compliance risks

- 5.2.4.2 Interoperability among vendors

- 5.2.4.3 Latency and network congestion

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- 5.7 PATENT ANALYSIS

- 5.8 REGULATORY LANDSCAPE

- 5.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8.2 STANDARDS

- 5.8.3 REGULATIONS

- 5.8.3.1 North America

- 5.8.3.1.1 US

- 5.8.3.1.2 Canada

- 5.8.3.2 Europe

- 5.8.3.2.1 Germany

- 5.8.3.2.2 France

- 5.8.3.3 Asia Pacific

- 5.8.3.3.1 Japan

- 5.8.3.3.2 China

- 5.8.3.4 RoW

- 5.8.3.4.1 Brazil

- 5.8.3.4.2 South Africa

- 5.8.3.1 North America

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO (HS CODE 851769)

- 5.9.2 EXPORT SCENARIO (HS CODE 851769)

- 5.10 PRICING ANALYSIS

- 5.10.1 INDICATIVE PRICING ANALYSIS OF KEY PLAYERS, BY PRODUCT, 2024

- 5.10.1.1 Indicative pricing analysis of data center interconnect for optical DCI, by key players (2024)

- 5.10.1.2 Indicative pricing analysis of data center interconnect for packet switching network, by key players (2024)

- 5.10.2 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024

- 5.10.1 INDICATIVE PRICING ANALYSIS OF KEY PLAYERS, BY PRODUCT, 2024

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 KEY TECHNOLOGIES

- 5.11.1.1 Wavelength division multiplexing (WDM)

- 5.11.1.2 Packet-optical transport systems (P-OTS)

- 5.11.1.3 Coherent optical transmission

- 5.11.2 COMPLEMENTARY TECHNOLOGIES

- 5.11.2.1 Photonic integrated circuits (PICs)

- 5.11.2.2 MEMS-based optical switches

- 5.11.3 ADJACENT TECHNOLOGIES

- 5.11.3.1 Software-defined networking (SDN)

- 5.11.3.2 Network function virtualization (NFV)

- 5.11.3.3 Network slicing (for 5G/MEC)

- 5.11.1 KEY TECHNOLOGIES

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 CISCO AND MEGAPORT ENHANCED GLOBAL SD-WAN CONNECTIVITY FOR LEADING ENERGY COMPANY

- 5.12.2 EXTREME NETWORKS HELPS BUILD SMART, FUTURE-READY CITY NETWORK FOR BREDA, NETHERLANDS

- 5.12.3 HUAWEI TECHNOLOGIES HELPS CYBERAGENT INC. TO BUILD IDN CLOUD DC

- 5.12.4 CIENA CORPORATION HELPED INTERXION TO GROW ITS DATA CENTER OPERATIONS WITH SCALABLE, AGILE DCI NETWORKS

- 5.12.5 NOKIA CORPORATION HELPED ESPANIX TO SCALE ITS PEERING PLATFORM WITH ITS MODULAR DATA CENTER INTERCONNECT SOLUTION

- 5.12.6 DIGITAL REALTY HELPED RACKSPACE TO ENHANCE INTERCONNECTIVITY AT LOWER COSTS

- 5.12.7 INFINERA CORPORATION HELPED JPIX TO ADDRESS ISSUES RELATED TO TRAFFIC SURGES WITH ITS DCI SOLUTION

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 IMPACT OF AI ON DATA CENTER INTERCONNECT MARKET

- 5.16 2025 US TARIFF IMPACT - OVERVIEW

- 5.16.1 KEY TARIFF RATES

- 5.16.2 KEY IMPACTS ON VARIOUS REGIONS

- 5.16.2.1 US

- 5.16.2.2 Europe

- 5.16.2.3 Asia Pacific

- 5.16.3 IMPACT ON END-USE INDUSTRIES

6 DATA CENTER INTERCONNECT MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 PRODUCTS

- 6.2.1 SURGING BANDWIDTH DEMANDS AND CLOUD WORKLOADS PROPELING ADOPTION OF HIGH-SPEED DCI PRODUCTS

- 6.2.2 PACKET SWITCHING NETWORK

- 6.2.2.1 Proliferation of SDN-enabled Ethernet switches to drive packet switching network in DCI deployments

- 6.2.3 OPTICAL DCI

- 6.2.3.1 Adoption of 400G/800G coherent optics to drive high-bandwidth, low-latency optical DCI expansion

- 6.2.3.2 Compact DCI

- 6.2.3.3 Traditional WDM for DCI

- 6.3 SOFTWARE

- 6.3.1 RISING DEMAND FOR INTELLIGENT AND AUTOMATED DCI MANAGEMENT TO DRIVE GROWTH

- 6.4 SERVICES

- 6.4.1 DEMAND FOR SCALABLE, COST-EFFICIENT NETWORK MANAGEMENT TO FUEL SEGMENTAL GROWTH

- 6.4.2 PROFESSIONAL SERVICES

- 6.4.2.1 Rising DCI complexity and hybrid cloud adoption to drive demand for consulting and integration services

- 6.4.2.2 Consulting and integration

- 6.4.2.2.1 Increasing transition to high-speed optics and multivendor environments to drive integration services uptake

- 6.4.2.3 Training, support, and maintenance

- 6.4.2.3.1 Rising complexity of multi-site DCI networks boosting demand for support and technical training services

- 6.4.3 MANAGED SERVICES

- 6.4.3.1 Rising need for network reliability and SLA compliance to accelerate adoption of managed DCI services

7 DATA CENTER INTERCONNECT MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 REAL-TIME DISASTER RECOVERY AND BUSINESS CONTINUITY

- 7.2.1 INCREASED DATA AGGREGATION AND CRITICAL WORKLOAD MIGRATION DRIVING INVESTMENT IN DCI FOR DISASTER RECOVERY READINESS

- 7.3 SHARED DATA AND RESOURCES/SERVER HIGH-AVAILABILITY CLUSTERS (GEOCLUSTERING)

- 7.3.1 RISING DEMAND FOR ZERO-DOWNTIME OPERATIONS AND DISTRIBUTED DATA AVAILABILITY ACCELERATING DCI ADOPTION

- 7.4 WORKLOAD (VM) AND DATA (STORAGE) MOBILITY

- 7.4.1 RISING DEMAND FOR SEAMLESS VM AND DATA MIGRATION ACROSS HYBRID CLOUD AND MULTI-DATA CENTER ENVIRONMENTS DRIVING ADOPTION

8 DATA CENTER INTERCONNECT MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 COMMUNICATION SERVICE PROVIDERS (CSPS)

- 8.2.1 RISING NETWORK TRAFFIC AND DEMAND FOR HIGH-CAPACITY SERVICE DELIVERY DRIVING INVESTMENT IN SCALABLE DCI INFRASTRUCTURE

- 8.3 CARRIER-NEUTRAL PROVIDERS (CNPS)/INTERNET CONTENT PROVIDERS (ICPS)

- 8.3.1 SURGE IN CROSS-PLATFORM CONNECTIVITY AND PEERING SERVICES PROMOTING GROWTH OF DCI FOR COLOCATION AND INTERCONNECTION HUBS

- 8.4 GOVERNMENT

- 8.4.1 CYBERSECURITY MANDATES AND DISASTER RECOVERY REQUIREMENTS PROPELLING INVESTMENT IN RESILIENT DCI SOLUTIONS

- 8.5 ENTERPRISES

- 8.5.1 INCREASED DATA MOBILITY AND CLOUD WORKLOADS FUELING EXPANSION OF OPTICAL DCI IN ENTERPRISE NETWORKS

- 8.5.2 BANKING & FINANCE

- 8.5.2.1 Rising fintech collaborations and multi-cloud deployments accelerating demand in financial services

- 8.5.3 HEALTHCARE

- 8.5.3.1 Increasing need to connect and exchange data between disparate IT systems in healthcare institutions to drive market growth

- 8.5.4 UTILITY & POWER

- 8.5.4.1 Rising adoption of smart grids and real-time grid management driving demand for scalable DCI solutions

- 8.5.5 MEDIA & ENTERTAINMENT

- 8.5.5.1 Adoption of cloud-based production and hybrid workflows driving real-time DCI integration across studios and broadcast hubs

- 8.5.6 RETAIL & E-COMMERCE

- 8.5.6.1 Omnichannel expansion and real-time personalization fueling strong demand for high-speed DCI solutions

- 8.5.7 OTHERS

9 DATA CENTER INTERCONNECT MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Major data center investments by technology providers increasing demand for high-performance DCI

- 9.2.3 CANADA

- 9.2.3.1 Data localization mandates and regional cloud expansion propelling growth of DCI ecosystem

- 9.2.4 REST OF NORTH AMERICA

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Expansion of high-bandwidth applications to strengthen demand for advanced DCI solutions

- 9.3.3 UK

- 9.3.3.1 Growing colocation footprint and domestic interconnection requirements to accelerate DCI investments

- 9.3.4 FRANCE

- 9.3.4.1 Rising hybrid cloud deployments and sustainable interconnect demands accelerating market growth

- 9.3.5 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 Data localization and cybersecurity regulations propelling secure, high-capacity DCI networks

- 9.4.3 JAPAN

- 9.4.3.1 Increased focus on secure and high-speed interconnection to support Japan's digital transformation

- 9.4.4 INDIA

- 9.4.4.1 Unprecedented increase in data consumption fueling need for DCI solutions

- 9.4.5 SOUTH KOREA

- 9.4.5.1 High-power data center projects and regional cloud growth catalyzing market growth

- 9.4.6 REST OF ASIA PACIFIC

- 9.5 REST OF THE WORLD

- 9.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 9.5.2 MIDDLE EAST

- 9.5.2.1 Rising inter-data center traffic to drive market during forecast period

- 9.5.3 AFRICA

- 9.5.3.1 Surge in urban data center development fueling demand for interconnected DCI networks

- 9.5.4 SOUTH AMERICA

- 9.5.4.1 Advanced optical transport innovations to strengthen long-haul and metro DCI capabilities across South America

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 10.3 REVENUE ANALYSIS, 2021-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 BRAND/PRODUCT COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 Type footprint

- 10.7.5.4 Application footprint

- 10.7.5.5 End user footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 CIENA CORPORATION

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Services/Solutions offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product Launches

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Other developments

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 HUAWEI TECHNOLOGIES CO., LTD.

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Services/Solutions offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product Launches

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 NOKIA

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Services/Solutions offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Deals

- 11.1.3.3.2 Other developments

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 CISCO SYSTEMS, INC.

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Services/Solutions offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product Launches

- 11.1.4.3.2 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 JUNIPER NETWORKS, INC.

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Services/Solutions offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product Launches

- 11.1.5.3.2 Deals

- 11.1.5.3.3 Other developments

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 ADTRAN

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Services/Solutions offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product Launches

- 11.1.6.3.2 Deals

- 11.1.7 EXTREME NETWORKS

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Services/Solutions offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product Launches

- 11.1.7.3.2 Deals

- 11.1.8 FUJITSU

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Services/Solutions offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product Launches

- 11.1.8.3.2 Deals

- 11.1.9 COLT TECHNOLOGY SERVICES GROUP LIMITED

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Services/Solutions offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Deals

- 11.1.10 RIBBON COMMUNICATIONS OPERATING COMPANY, INC.

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Services/Solutions offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product Launches

- 11.1.10.3.2 Deals

- 11.1.1 CIENA CORPORATION

- 11.2 OTHER PLAYERS

- 11.2.1 MARVELL

- 11.2.2 EPLUS INC.

- 11.2.3 ZTE CORPORATION

- 11.2.4 COLOGIX

- 11.2.5 MEGAPORT

- 11.2.6 RANOVUS

- 11.2.7 LIGHTMATTER

- 11.2.8 CELESTIAL AI

- 11.2.9 AYAR LABS

- 11.2.10 EDGECORE NETWORKS CORPORATION

- 11.2.11 RTBRICK

- 11.2.12 DRIVENETS

- 11.2.13 ORIOLE NETWORKS

- 11.2.14 EFFECT PHOTONICS

- 11.2.15 XSCAPE PHOTONICS

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

List of Tables

- TABLE 1 DATA CENTER INTERCONNECT MARKET: RISK ANALYSIS

- TABLE 2 DATA CENTER INTERCONNECT MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 3 DATA CENTER INTERCONNECT MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 LIST OF APPLIED/GRANTED PATENTS RELATED TO DATA CENTER INTERCONNECT, FEBRUARY 2023-JULY 2025

- TABLE 5 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 STANDARDS

- TABLE 10 IMPORT DATA FOR HS CODE 851769-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 11 EXPORT DATA FOR HS CODE 851769-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 12 INDICATIVE PRICING ANALYSIS OF DATA CENTER INTERCONNECT FOR OPTICAL DCI OFFERED, BY KEY PLAYERS, 2024 (USD/UNIT)

- TABLE 13 INDICATIVE PRICING ANALYSIS OF DATA CENTER INTERCONNECT FOR PACKET SWITCHING NETWORK OFFERED BY KEY PLAYERS, 2024 (USD/UNIT)

- TABLE 14 AVERAGE SELLING PRICE TREND OF OPTICAL DCI, BY REGION, 2021-2024 (USD/UNIT)

- TABLE 15 AVERAGE SELLING PRICE TREND OF PACKET SWITCHING NETWORK, BY REGION, 2021-2024 (USD/UNIT)

- TABLE 16 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END USERS (%)

- TABLE 18 KEY BUYING CRITERIA FOR TOP 3 END USERS

- TABLE 19 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 20 DATA CENTER INTERCONNECT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 21 DATA CENTER INTERCONNECT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 22 DATA CENTER INTERCONNECT MARKET, BY PRODUCTS, 2021-2024 (USD MILLION)

- TABLE 23 DATA CENTER INTERCONNECT MARKET, BY PRODUCTS, 2025-2030 (USD MILLION)

- TABLE 24 PRODUCTS: DATA CENTER INTERCONNECT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 25 PRODUCTS: DATA CENTER INTERCONNECT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 26 PACKET-SWITCHING NETWORK: DATA CENTER INTERCONNECT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 27 PACKET-SWITCHING NETWORK: DATA CENTER INTERCONNECT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 28 OPTICAL DCI: DATA CENTER INTERCONNECT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 29 OPTICAL DCI: DATA CENTER INTERCONNECT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 SOFTWARE: DATA CENTER INTERCONNECT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 31 SOFTWARE: DATA CENTER INTERCONNECT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 DATA CENTER INTERCONNECT MARKET, BY SERVICES, 2021-2024 (USD MILLION)

- TABLE 33 DATA CENTER INTERCONNECT MARKET, BY SERVICES, 2025-2030 (USD MILLION)

- TABLE 34 SERVICES: DATA CENTER INTERCONNECT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 35 SERVICES: DATA CENTER INTERCONNECT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 DATA CENTER INTERCONNECT MARKET, BY PROFESSIONAL SERVICES, 2021-2024 (USD MILLION)

- TABLE 37 DATA CENTER INTERCONNECT MARKET, BY PROFESSIONAL SERVICES, 2025-2030 (USD MILLION)

- TABLE 38 PROFESSIONAL SERVICES: DATA CENTER INTERCONNECT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 39 PROFESSIONAL SERVICES: DATA CENTER INTERCONNECT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 CONSULTING AND INTEGRATION: DATA CENTER INTERCONNECT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 41 CONSULTING AND INTEGRATION: DATA CENTER INTERCONNECT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 TRAINING, SUPPORT, AND MAINTENANCE: DATA CENTER INTERCONNECT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 43 TRAINING, SUPPORT, AND MAINTENANCE: DATA CENTER INTERCONNECT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 MANAGED SERVICES: DATA CENTER INTERCONNECT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 45 MANAGED SERVICES: DATA CENTER INTERCONNECT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 DATA CENTER INTERCONNECT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 47 DATA CENTER INTERCONNECT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 48 REAL-TIME DISASTER RECOVERY AND BUSINESS CONTINUITY: DATA CENTER INTERCONNECT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 49 REAL-TIME DISASTER RECOVERY AND BUSINESS CONTINUITY: DATA CENTER INTERCONNECT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 SHARED DATA AND RESOURCES/SERVER HIGH-AVAILABILITY CLUSTERS (GEOCLUSTERING): DATA CENTER INTERCONNECT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 51 SHARED DATA AND RESOURCES/SERVER HIGH-AVAILABILITY CLUSTERS (GEOCLUSTERING): DATA CENTER INTERCONNECT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 WORKLOAD (VM) AND DATA (STORAGE) MOBILITY: DATA CENTER INTERCONNECT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 53 WORKLOAD (VM) AND DATA (STORAGE) MOBILITY: DATA CENTER INTERCONNECT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 DATA CENTER INTERCONNECT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 55 DATA CENTER INTERCONNECT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 56 COMMUNICATION SERVICE PROVIDERS (CSPS): DATA CENTER INTERCONNECT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 57 COMMUNICATION SERVICE PROVIDERS (CSPS): DATA CENTER INTERCONNECT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 CARRIER-NEUTRAL PROVIDERS (CNPS)/INTERNET CONTENT PROVIDERS (ICPS): DATA CENTER INTERCONNECT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 59 CARRIER-NEUTRAL PROVIDERS (CNPS)/INTERNET CONTENT PROVIDERS (ICPS): DATA CENTER INTERCONNECT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 GOVERNMENT: DATA CENTER INTERCONNECT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 61 GOVERNMENT: DATA CENTER INTERCONNECT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 DATA CENTER INTERCONNECT MARKET, BY ENTERPRISES, 2021-2024 (USD MILLION)

- TABLE 63 DATA CENTER INTERCONNECT MARKET, BY ENTERPRISES, 2025-2030 (USD MILLION)

- TABLE 64 ENTERPRISES: DATA CENTER INTERCONNECT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 65 ENTERPRISES: DATA CENTER INTERCONNECT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 BANKING & FINANCE: DATA CENTER INTERCONNECT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 67 BANKING & FINANCE: DATA CENTER INTERCONNECT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 HEALTHCARE: DATA CENTER INTERCONNECT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 69 HEALTHCARE: DATA CENTER INTERCONNECT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 UTILITY & POWER: DATA CENTER INTERCONNECT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 71 UTILITY & POWER: DATA CENTER INTERCONNECT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 MEDIA & ENTERTAINMENT: DATA CENTER INTERCONNECT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 73 MEDIA & ENTERTAINMENT: DATA CENTER INTERCONNECT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 RETAIL & E-COMMERCE: DATA CENTER INTERCONNECT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 75 RETAIL & E-COMMERCE: DATA CENTER INTERCONNECT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 76 OTHERS: DATA CENTER INTERCONNECT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 77 OTHERS: DATA CENTER INTERCONNECT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 DATA CENTER INTERCONNECT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 79 DATA CENTER INTERCONNECT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 80 NORTH AMERICA: DATA CENTER INTERCONNECT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 81 NORTH AMERICA: DATA CENTER INTERCONNECT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 82 NORTH AMERICA: DATA CENTER INTERCONNECT MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 83 NORTH AMERICA: DATA CENTER INTERCONNECT MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 84 NORTH AMERICA: DATA CENTER INTERCONNECT MARKET, BY SERVICES, 2021-2024 (USD MILLION)

- TABLE 85 NORTH AMERICA: DATA CENTER INTERCONNECT MARKET, BY SERVICES, 2025-2030 (USD MILLION)

- TABLE 86 NORTH AMERICA: DATA CENTER INTERCONNECT MARKET, BY PROFESSIONAL SERVICES, 2021-2024 (USD MILLION)

- TABLE 87 NORTH AMERICA: DATA CENTER INTERCONNECT MARKET, BY PROFESSIONAL SERVICES, 2025-2030 (USD MILLION)

- TABLE 88 NORTH AMERICA: DATA CENTER INTERCONNECT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 89 NORTH AMERICA: DATA CENTER INTERCONNECT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 90 NORTH AMERICA: DATA CENTER INTERCONNECT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 91 NORTH AMERICA: DATA CENTER INTERCONNECT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 92 NORTH AMERICA: DATA CENTER INTERCONNECT MARKET, BY ENTERPRISES, 2021-2024 (USD MILLION)

- TABLE 93 NORTH AMERICA: DATA CENTER INTERCONNECT MARKET, BY ENTERPRISES, 2025-2030 (USD MILLION)

- TABLE 94 NORTH AMERICA: DATA CENTER INTERCONNECT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 95 NORTH AMERICA: DATA CENTER INTERCONNECT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 96 EUROPE: DATA CENTER INTERCONNECT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 97 EUROPE: DATA CENTER INTERCONNECT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 98 EUROPE: DATA CENTER INTERCONNECT MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 99 EUROPE: DATA CENTER INTERCONNECT MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 100 EUROPE: DATA CENTER INTERCONNECT MARKET, BY SERVICES, 2021-2024 (USD MILLION)

- TABLE 101 EUROPE: DATA CENTER INTERCONNECT MARKET, BY SERVICES, 2025-2030 (USD MILLION)

- TABLE 102 EUROPE: DATA CENTER INTERCONNECT MARKET, BY PROFESSIONAL SERVICES, 2021-2024 (USD MILLION)

- TABLE 103 EUROPE: DATA CENTER INTERCONNECT MARKET, BY PROFESSIONAL SERVICES, 2025-2030 (USD MILLION)

- TABLE 104 EUROPE: DATA CENTER INTERCONNECT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 105 EUROPE: DATA CENTER INTERCONNECT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 106 EUROPE: DATA CENTER INTERCONNECT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 107 EUROPE: DATA CENTER INTERCONNECT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 108 EUROPE: DATA CENTER INTERCONNECT MARKET, BY ENTERPRISES, 2021-2024 (USD MILLION)

- TABLE 109 EUROPE: DATA CENTER INTERCONNECT MARKET, BY ENTERPRISES, 2025-2030 (USD MILLION)

- TABLE 110 EUROPE: DATA CENTER INTERCONNECT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 111 EUROPE: DATA CENTER INTERCONNECT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 112 ASIA PACIFIC: DATA CENTER INTERCONNECT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 113 ASIA PACIFIC: DATA CENTER INTERCONNECT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 114 ASIA PACIFIC: DATA CENTER INTERCONNECT MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 115 ASIA PACIFIC: DATA CENTER INTERCONNECT MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 116 ASIA PACIFIC: DATA CENTER INTERCONNECT MARKET, BY SERVICES, 2021-2024 (USD MILLION)

- TABLE 117 ASIA PACIFIC: DATA CENTER INTERCONNECT MARKET, BY SERVICES, 2025-2030 (USD MILLION)

- TABLE 118 ASIA PACIFIC: DATA CENTER INTERCONNECT MARKET, BY PROFESSIONAL SERVICES, 2021-2024 (USD MILLION)

- TABLE 119 ASIA PACIFIC: DATA CENTER INTERCONNECT MARKET, BY PROFESSIONAL SERVICES, 2025-2030 (USD MILLION)

- TABLE 120 ASIA PACIFIC: DATA CENTER INTERCONNECT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 121 ASIA PACIFIC: DATA CENTER INTERCONNECT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 122 ASIA PACIFIC: DATA CENTER INTERCONNECT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 123 ASIA PACIFIC: DATA CENTER INTERCONNECT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 124 ASIA PACIFIC: DATA CENTER INTERCONNECT MARKET, BY ENTERPRISES, 2021-2024 (USD MILLION)

- TABLE 125 ASIA PACIFIC: DATA CENTER INTERCONNECT MARKET, BY ENTERPRISES, 2025-2030 (USD MILLION)

- TABLE 126 ASIA PACIFIC: DATA CENTER INTERCONNECT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 127 ASIA PACIFIC: DATA CENTER INTERCONNECT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 128 ROW: DATA CENTER INTERCONNECT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 129 ROW: DATA CENTER INTERCONNECT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 130 ROW: DATA CENTER INTERCONNECT MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 131 ROW: DATA CENTER INTERCONNECT MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 132 ROW: DATA CENTER INTERCONNECT MARKET, BY SERVICES, 2021-2024 (USD MILLION)

- TABLE 133 ROW: DATA CENTER INTERCONNECT MARKET, BY SERVICES, 2025-2030 (USD MILLION)

- TABLE 134 ROW: DATA CENTER INTERCONNECT MARKET, BY PROFESSIONAL SERVICES, 2021-2024 (USD MILLION)

- TABLE 135 ROW: DATA CENTER INTERCONNECT MARKET, BY PROFESSIONAL SERVICES, 2025-2030 (USD MILLION)

- TABLE 136 ROW: DATA CENTER INTERCONNECT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 137 ROW: DATA CENTER INTERCONNECT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 138 ROW: DATA CENTER INTERCONNECT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 139 ROW: DATA CENTER INTERCONNECT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 140 ROW: DATA CENTER INTERCONNECT MARKET, BY ENTERPRISES, 2021-2024 (USD MILLION)

- TABLE 141 ROW: DATA CENTER INTERCONNECT MARKET, BY ENTERPRISES, 2025-2030 (USD MILLION)

- TABLE 142 ROW: DATA CENTER INTERCONNECT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 143 ROW: DATA CENTER INTERCONNECT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 144 OVERVIEW OF STRATEGIES ADOPTED BY DATA CENTER INTERCONNECT MANUFACTURERS AND PROVIDERS

- TABLE 145 DATA CENTER INTERCONNECT MARKET SHARE ANALYSIS, 2024

- TABLE 146 DATA CENTER INTERCONNECT MARKET: REGIONAL FOOTPRINT, 2024

- TABLE 147 DATA CENTER INTERCONNECT MARKET: TYPE FOOTPRINT, 2024

- TABLE 148 DATA CENTER INTERCONNECT MARKET: APPLICATION FOOTPRINT, 2024

- TABLE 149 DATA CENTER INTERCONNECT MARKET: END USER FOOTPRINT, 2024

- TABLE 150 DATA CENTER INTERCONNECT MARKET: LIST OF KEY STARTUPS/SMES, 2024

- TABLE 151 DATA CENTER INTERCONNECT MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- TABLE 152 DATA CENTER INTERCONNECT MARKET: PRODUCT LAUNCHES, JANUARY 2021-JULY 2025

- TABLE 153 DATA CENTER INERCONNECT MARKET: DEALS, JANUARY 2021-JULY 2025

- TABLE 154 CIENA CORPORATION: COMPANY OVERVIEW

- TABLE 155 CIENA CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 156 CIENA CORPORATION: PRODUCT LAUNCHES

- TABLE 157 CIENA CORPORATION: DEALS

- TABLE 158 CIENA CORPORATION: OTHER DEVELOPMENTS

- TABLE 159 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- TABLE 160 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 161 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCT LAUNCHES

- TABLE 162 NOKIA: COMPANY OVERVIEW

- TABLE 163 NOKIA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 164 NOKIA: DEALS

- TABLE 165 NOKIA: OTHER DEVELOPMENTS

- TABLE 166 CISCO SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 167 CISCO SYSTEMS, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 168 CISCO SYSTEMS, INC.: PRODUCT LAUNCHES

- TABLE 169 CISCO SYSTEMS, INC.: DEALS

- TABLE 170 JUNIPER NETWORKS, INC.: COMPANY OVERVIEW

- TABLE 171 JUNIPER NETWORKS, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 172 JUNIPER NETWORKS, INC.: PRODUCT LAUNCHES

- TABLE 173 JUNIPER NETWORKS, INC.: DEALS

- TABLE 174 JUNIPER NETWORKS, INC.: OTHER DEVELOPMENTS

- TABLE 175 ADTRAN: COMPANY OVERVIEW

- TABLE 176 ADTRAN: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 177 ADTRAN: PRODUCT LAUNCHES

- TABLE 178 ADTRAN: DEALS

- TABLE 179 EXTREME NETWORKS: COMPANY OVERVIEW

- TABLE 180 EXTREME NETWORKS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 181 EXTREME NETWORKS: PRODUCT LAUNCHES

- TABLE 182 EXTREME NETWORKS: DEALS

- TABLE 183 FUJITSU: COMPANY OVERVIEW

- TABLE 184 FUJITSU: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 185 FUJITSU: PRODUCT LAUNCHES

- TABLE 186 FUJITSU: DEALS

- TABLE 187 COLT TECHNOLOGY SERVICES GROUP LIMITED: COMPANY OVERVIEW

- TABLE 188 COLT TECHNOLOGY SERVICES GROUP LIMITED: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 189 COLT TECHNOLOGY SERVICES GROUP LIMITED: DEALS

- TABLE 190 RIBBON COMMUNICATIONS OPERATING COMPANY, INC.: COMPANY OVERVIEW

- TABLE 191 RIBBON COMMUNICATIONS OPERATING COMPANY, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 192 RIBBON COMMUNICATIONS OPERATING COMPANY, INC.: PRODUCT LAUNCHES

- TABLE 193 RIBBON COMMUNICATIONS OPERATING COMPANY, INC.: DEALS

List of Figures

- FIGURE 1 DATA CENTER INTERCONNECT MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 DATA CENTER INTERCONNECT MARKET: RESEARCH DESIGN

- FIGURE 3 DATA CENTER INTERCONNECT MARKET: RESEARCH FLOW OF MARKET SIZE ESTIMATION

- FIGURE 4 DATA CENTER INTERCONNECT MARKET: SUPPLY SIDE ANALYSIS

- FIGURE 5 DATA CENTER INTERCONNECT MARKET: BOTTOM-UP APPROACH

- FIGURE 6 DATA CENTER INTERCONNECT MARKET: TOP-DOWN APPROACH

- FIGURE 7 DATA CENTER INTERCONNECT MARKET: DATA TRIANGULATION

- FIGURE 8 PRODUCTS SEGMENT TO DOMINATE DATA CENTER INTERCONNECT MARKET IN 2030

- FIGURE 9 SHARED DATA AND RESOURCES/SERVER HIGH-AVAILABILITY CLUSTERS (GEO CLUSTERING) APPLICATION TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 CARRIER-NEUTRAL PROVIDERS (CNPS) AND INTERNET CONTENT PROVIDERS (ICPS) SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE

- FIGURE 11 ASIA PACIFIC TO LEAD GLOBAL DATA CENTER INTERCONNECT MARKET IN 2030

- FIGURE 12 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 RISE IN HYPERSCALE DATA CENTERS AND COLOCATION FACILITIES DRIVING DATA CENTER INTERCONNECT MARKET

- FIGURE 14 REAL-TIME DISASTER RECOVERY AND BUSINESS CONTINUITY SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 15 CARRIER-NEUTRAL PROVIDERS (CNPS)/INTERNET CONTENT PROVIDERS (ICPS) TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 16 SOUTH KOREA TO WITNESS HIGHEST CAGR IN GLOBAL DATA CENTER INTERCONNECT MARKET DURING FORECAST PERIOD

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN DATA CENTER INTERCONNECT MARKET

- FIGURE 18 IMPACT ANALYSIS: DRIVERS

- FIGURE 19 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 20 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 21 IMPACT ANALYSIS: CHALLENGES

- FIGURE 22 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 23 DATA CENTER INTERCONNECT MARKET: VALUE CHAIN ANALYSIS

- FIGURE 24 DATA CENTER INTERCONNECT MARKET: ECOSYSTEM ANALYSIS

- FIGURE 25 DATA CENTER INTERCONNECT MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 26 DATA CENTER INTERCONNECT MARKET: PATENT ANALYSIS, 2014-2024

- FIGURE 27 IMPORT SCENARIO FOR HS CODE 851769-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 28 EXPORT SCENARIO FOR HS CODE 851769-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 29 AVERAGE SELLING PRICE TREND OF OPTICAL DCI, BY REGION, 2021-2024 (USD/UNIT)

- FIGURE 30 AVERAGE SELLING PRICE TREND OF PACKET SWITCHING NETWORK, BY REGION, 2021-2024 (USD/UNIT)

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END USERS

- FIGURE 32 KEY BUYING CRITERIA FOR TOP 3 END USERS

- FIGURE 33 IMPACT OF AI ON DATA CENTER INTERCONNECT MARKET

- FIGURE 34 PRODUCTS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 35 SHARED DATA AND RESOURCES/SERVER HIGH-AVAILABILITY CLUSTERS APPLICATION TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 CARRIER-NEUTRAL PROVIDERS/INTERNET CONTENT PROVIDERS SEGMENT TO LEAD DATA CENTER INTERCONNECT MARKET DURING FORECAST PERIOD

- FIGURE 37 ASIA PACIFIC TO LEAD DATA CENTER INTERCONNECT MARKET DURING FORECAST PERIOD

- FIGURE 38 NORTH AMERICA: DATA CENTER INTERCONNECT MARKET SNAPSHOT

- FIGURE 39 US TO ACCOUNT FOR LARGEST SHARE OF DATA CENTER INTERCONNECT MARKET DURING FORECAST PERIOD

- FIGURE 40 EUROPE: DATA CENTER INTERCONNECT MARKET SNAPSHOT

- FIGURE 41 FRANCE TO LEAD DATA CENTER INTERCONNECT MARKET IN EUROPE IN 2030

- FIGURE 42 ASIA PACIFIC: DATA CENTER INTERCONNECT MARKET SNAPSHOT

- FIGURE 43 CHINA TO BE LARGEST DATA CENTER INTERCONNECT MARKET IN ASIA PACIFIC DURING FORECAST PERIOD

- FIGURE 44 ROW: DATA CENTER INTERCONNECT MARKET SNAPSHOT

- FIGURE 45 SOUTH AMERICA TO REGISTER HIGHEST CAGR IN DATA CENTER INTERCONNECT MARKET IN ROW

- FIGURE 46 REVENUE ANALYSIS OF FIVE KEY PLAYERS IN DATA CENTER INTERCONNECT MARKET, 2021-2024 (USD MILLION)

- FIGURE 47 DATA CENTER INTERCONNECT MARKET SHARE ANALYSIS OF KEY PLAYERS

- FIGURE 48 COMPANY VALUATION, 2025 (USD BILLION)

- FIGURE 49 FINANCIAL METRICS (EV/EBITDA), 2025

- FIGURE 50 BRAND/PRODUCT COMPARISON

- FIGURE 51 DATA CENTER INTERCONNECT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 52 DATA CENTER INTERCONNECT MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 53 DATA CENTER INTERCONNECT MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 54 CIENA CORPORATION: COMPANY SNAPSHOT

- FIGURE 55 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY SNAPSHOT

- FIGURE 56 NOKIA: COMPANY SNAPSHOT

- FIGURE 57 CISCO SYSTEMS, INC.: COMPANY SNAPSHOT

- FIGURE 58 JUNIPER NETWORKS, INC.: COMPANY SNAPSHOT

- FIGURE 59 ADTRAN: COMPANY SNAPSHOT

- FIGURE 60 EXTREME NETWORKS: COMPANY SNAPSHOT

- FIGURE 61 FUJITSU: COMPANY SNAPSHOT

- FIGURE 62 RIBBON COMMUNICATIONS OPERATING COMPANY, INC.: COMPANY SNAPSHOT