|

市场调查报告书

商品编码

1801930

冷冻熟食市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Frozen Cooked Ready Meals Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

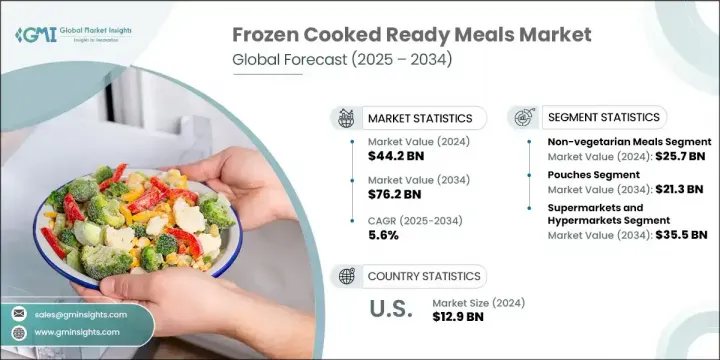

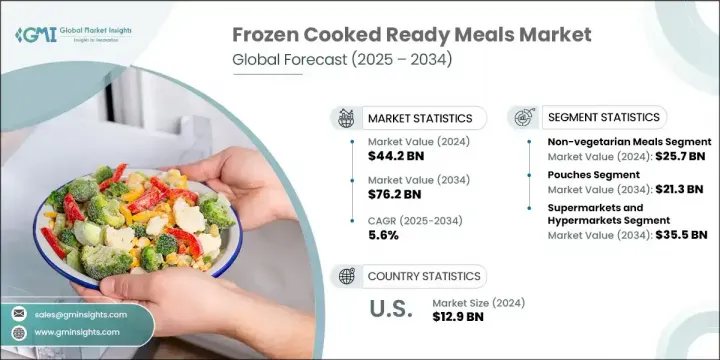

2024年,全球冷冻熟食即食食品市场规模达442亿美元,预计到2034年将以5.6%的复合年增长率成长,达到762亿美元。消费者对便利快速餐饮解决方案的日益偏好,并持续推动市场发展动能。城镇化、双收入家庭的增加以及日常生活节奏的加快,都在推动人们对符合日益提升的健康标准的速食食品的需求。改良的包装形式和先进的保鲜方法,使品牌能够提供口味更新鲜、营养更丰富的冷冻食品。同时,电子商务正在重塑消费者的购物方式,使这些食品更容易取得。

预计到2034年,全球市场规模将成长近一倍,这得益于饮食偏好的转变、产品供应的扩大以及消费者越来越愿意在更健康、更省时的食品上花费更多。植物性饮食习惯正在进一步推动成长,越来越多的消费者寻求可持续的无肉选择。各大品牌正在将肉类食品转变为植物蛋白替代品,并加入扁豆、大豆和豌豆等成分,吸引註重道德和健康的消费者。随着对清洁标籤、即食和多样化全球美食的需求不断增长,冷冻熟食即食食品类别正成为现代膳食计划和食品消费模式的重要组成部分。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 442亿美元 |

| 预测值 | 762亿美元 |

| 复合年增长率 | 5.6% |

2024年,非素食冷冻食品市场规模达257亿美元,占58.1%。由于市场对富含蛋白质且风味浓郁的膳食选择的需求普遍存在,该市场仍占据主导地位。儘管素食选择日益受到青睐,这主要得益于人们对植物性饮食和健康意识的提升,但非素食仍然受益于其稳定的消费者群体以及对便捷性与多样性兼顾的日益增长的需求。消费者青睐既能满足饮食需求又能节省时间的膳食,尤其是在註重便利性的城市环境中。健康意识的提升正推动各大品牌推出更干净、更均衡的非素食食品,从而进一步促进其成长。

2034年,包装创新领域将达到213亿美元。包装袋易于使用、方便携带,并能提高储存效率。这些轻巧的包装选择不仅迎合了快节奏的生活方式,也顺应了市场向永续发展的转变。新型包装袋具有更佳的隔热性、可回收性和智慧包装功能,正在影响产品的展示和保存方式。

美国冷冻熟食市场占80.1%的市场份额,2024年市场规模达129亿美元。得益于成熟的零售基础设施和消费者对产品种类创新的持续需求,该地区呈现强劲成长动能。双收入家庭的成长和时间紧迫的消费者等生活方式的改变,创造了一种追求便利的文化,并持续推动市场扩张。儘管线上食品配送平台显着提升了冷冻食品的曝光度和可及性,但传统杂货店和大型零售商仍然是重要的销售管道。随着消费者饮食越来越注重健康,美国品牌正在稳步增加植物性产品,以补充其核心的肉类产品线。

影响全球冷冻熟食即食食品市场的关键参与者包括 Dr. Oetker、通用磨坊、Frosta、嘉里集团和康尼格拉品牌。为了在冷冻熟食即食食品市场中占据竞争优势,领先品牌正致力于持续的产品创新,以满足多样化的消费者需求。各公司正在扩大其植物基和清洁标籤产品组合,以吸引註重健康的消费者和弹性素食消费者。投资研发有助于改善口味并延长保存期限,无需添加人工防腐剂。与本地供应商建立策略合作伙伴关係可以加快产品上市速度并更好地控製成分。增强型包装解决方案(包括可回收包装袋和微波炉安全容器)也是优先事项。各品牌正透过全通路零售策略进一步加强其市场影响力,强调线上杂货平台和直接面向消费者的通路。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 消费者对快速、方便、省时的餐饮解决方案的需求日益增长

- 都市化进程加快,双收入家庭烹调时间减少

- 冷冻技术的进步保留了风味、质地和营养

- 有组织的零售和电子商务杂货平台的渗透率不断提高

- 产业陷阱与挑战

- 消费者认为冷冻食品不如新鲜食品健康

- 新鲜餐点和餐厅外送服务的激烈竞争

- 市场机会

- 对植物性和清洁标籤冷冻食品的需求不断增长

- 向中产阶级人口不断增长的新兴市场扩张

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 科技与创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 素食

- 非素食餐

第六章:市场估计与预测:依包装类型,2021 - 2034 年

- 主要趋势

- 袋装

- 托盘

- 包包

- 盒子

第七章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 超市/大卖场

- 便利商店

- 网路零售

- 专卖店

- 餐饮服务/餐厅

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

8.3.1 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 埃及

- MEA 其余地区

第九章:公司简介

- Ajinomoto Co., Inc.

- Bellisio Foods

- Conagra Brands

- Dr. Oetker

- Frosta AG

- General Mills

- Iceland Foods

- Kerry Group

- Kraft Heinz

- McCain Foods

- MTR Foods

- Nestle

- Nomad Foods

- Seara Foods (JBS)

- Tyson Foods

The Global Frozen Cooked Ready Meals Market was valued at USD 44.2 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 76.2 billion by 2034. Rising consumer preference for convenient and fast meal solutions continues to drive market momentum. Urbanization, increasing dual-income households, and the growing pace of everyday life are fueling the demand for quick-prep meals that also meet evolving health standards. Enhanced packaging formats and advanced preservation methods are enabling brands to deliver fresher-tasting, nutrient-retaining frozen meals. Simultaneously, e-commerce is reshaping how consumers shop, making these meals more accessible.

Across global regions, market volumes are expected to nearly double by 2034, supported by changing dietary preferences, expanded product offerings, and growing consumer willingness to spend more on healthier, time-saving food options. Plant-based eating habits are further propelling growth, with more consumers seeking sustainable, meat-free choices. Brands are evolving meat-based meals into plant protein alternatives, incorporating ingredients like lentils, soy, and peas to appeal to ethical and health-conscious shoppers. With demand rising for clean-label, ready-to-serve, and varied global cuisines, the frozen cooked ready meals category is becoming a central part of modern meal planning and food consumption patterns.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $44.2 Billion |

| Forecast Value | $76.2 Billion |

| CAGR | 5.6% |

The non-vegetarian frozen meals segment accounted for USD 25.7 billion in 2024, capturing 58.1% share. This segment remains dominant due to the widespread demand for protein-rich and flavorful meal options. While vegetarian options are gaining traction, largely because of increased awareness around plant-based diets and health, non-vegetarian meals continue to benefit from an established consumer base and growing appetite for convenience without compromising variety. Consumers are drawn to meals that meet dietary needs while saving time, and this is especially true in urban environments where convenience is a priority. The rise in health consciousness is pushing brands to offer cleaner, better-balanced non-veg meals, further boosting growth.

Packaging innovation segment will reach USD 21.3 billion by 2034, pouches offer ease of use, portability, and better storage efficiency. These lightweight options cater to fast-paced lifestyles and align with the market's shift toward sustainability. New pouch formats with improved insulation, recyclability, and smart-packaging features are influencing how products are presented and preserved.

U.S. Frozen Cooked Ready Meals Market held 80.1% share and generated USD 12.9 billion in 2024. The region shows strong growth thanks to mature retail infrastructure and consistent consumer demand for innovation in product variety. Lifestyle changes such as the growth of dual-income homes and time-constrained consumers have created a culture of convenience that continues to expand the market. Traditional grocery stores and large-format retailers remain essential channels, though online grocery delivery platforms have significantly boosted visibility and accessibility of frozen meals. As consumer diets shift toward health and wellness, brands in the U.S. are steadily adding plant-based options to complement their core meat-based lines.

The key players shaping the Global Frozen Cooked Ready Meals Market include Dr. Oetker, General Mills, Frosta, Kerry Group, and Conagra Brands. To secure a competitive position in the frozen cooked ready meals market, leading brands are focusing on continuous product innovation, targeting diverse consumer needs. Companies are expanding their plant-based and clean-label portfolios to appeal to health-conscious and flexitarian consumers. Investing in R&D helps improve taste profiles and extend shelf life without artificial preservatives. Strategic partnerships with local suppliers allow faster product launches and better control over ingredients. Enhanced packaging solutions, including recyclable pouches and microwave-safe containers, are also a priority. Brands are further strengthening their market footprint through omnichannel retail strategies, emphasizing online grocery platforms and direct-to-consumer channels.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Product type

- 2.2.2 Packaging type

- 2.2.3 Distribution channel

- 2.2.4 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing consumer demand for quick, convenient, and time-saving meal solutions

- 3.2.1.2 Rising urbanization and dual-income households with less cooking time

- 3.2.1.3 Advancements in freezing technology preserving taste, texture, and nutrition

- 3.2.1.4 Increasing penetration of organized retail and e-commerce grocery platforms

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Consumer perception of frozen meals as less healthy than fresh alternatives

- 3.2.2.2 Intense competition from fresh meal kits and restaurant delivery services

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand for plant-based and clean-label frozen meal options

- 3.2.3.2 Expansion into emerging markets with growing middle-class population

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product type

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly Initiatives

- 3.12 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Bn, Tons)

- 5.1 Key trends

- 5.2 Vegetarian meals

- 5.3 Non-vegetarian meals

Chapter 6 Market Estimates & Forecast, By Packaging Type, 2021 - 2034 (USD Bn, Tons)

- 6.1 Key trends

- 6.2 Pouches

- 6.3 Trays

- 6.4 Bags

- 6.5 Boxes

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 (USD Bn, Tons)

- 7.1 Key trends

- 7.2 Supermarkets/hypermarkets

- 7.3 Convenience stores

- 7.4 Online retail

- 7.5 Specialty stores

- 7.6 Foodservice/restaurants

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Mn, Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest Of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

- 8.6.4 Egypt

- 8.6.5 Rest of MEA

Chapter 9 Company Profiles

- 9.1 Ajinomoto Co., Inc.

- 9.2 Bellisio Foods

- 9.3 Conagra Brands

- 9.4 Dr. Oetker

- 9.5 Frosta AG

- 9.6 General Mills

- 9.7 Iceland Foods

- 9.8 Kerry Group

- 9.9 Kraft Heinz

- 9.10 McCain Foods

- 9.11 MTR Foods

- 9.12 Nestle

- 9.13 Nomad Foods

- 9.14 Seara Foods (JBS)

- 9.15 Tyson Foods