|

市场调查报告书

商品编码

1822628

棋盘游戏市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Board Games Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

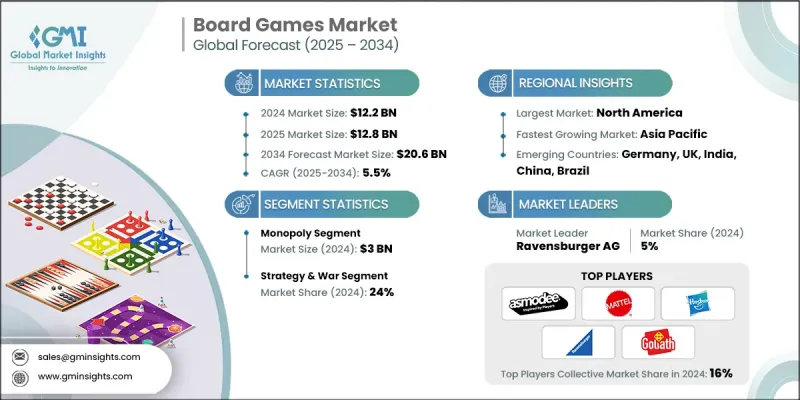

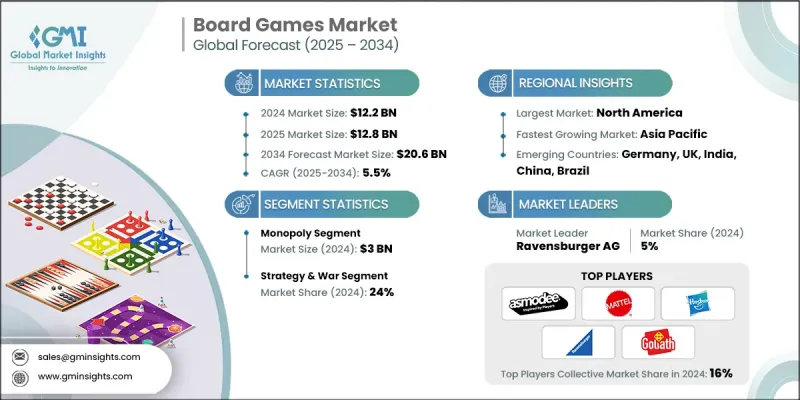

2024 年全球棋盘游戏市场价值为 122 亿美元,预计将以 5.5% 的复合年增长率成长,到 2034 年达到 206 亿美元。

在日益发展的数位世界中,许多个人和家庭都在积极寻求减少萤幕时间、重新进行有意义的面对面互动的方法。桌游为人们提供了一个独特的机会,透过共同的体验来增进彼此的联繫,从而促进沟通、团队合作、竞争和乐趣。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 122亿美元 |

| 预测值 | 206亿美元 |

| 复合年增长率 | 5.5% |

垄断的采用率不断上升

2024年,大富翁游戏细分市场占据了显着份额,这得益于其标誌性地位和跨越几代人的吸引力。大富翁以其简单却引人入胜的经济玩法而闻名,在经典版和授权版中依然表现强劲。各大品牌透过限量版、流行文化搭售和数位整合等方式扩展了该系列的影响力,以保持游戏的新鲜感和相关性。大富翁游戏面向广泛年龄层的玩家,其高辨识度的品牌形象使其不仅仅是一款游戏,更是家庭娱乐的文化载体。在稳定的消费者需求和怀旧价值的支撑下,该细分市场持续占据显着份额。

战略与战争获得牵引力

2024年,策略与战争类游戏占据了相当大的份额,这主要得益于那些追求深度、复杂性和竞技性游戏玩法的资深玩家和成年玩家。这类游戏,例如战争模拟游戏和欧式策略游戏,通常机制丰富、游戏时间更长、重玩价值高。由于游戏社群、游戏大会以及网路红人的兴起,这类游戏实现了强劲成长。随着玩家越来越追求沉浸式和智力刺激的体验,发行商纷纷推出错综复杂的剧情、模组化扩充包和高端组件。这类游戏的需求虽然小众,但玩家忠诚度很高,从而催生了强劲的复购行为和强劲的售后市场。

区域洞察

北美将成为利润丰厚的地区

2024年,北美桌游市场收入可观,这得益于其强大的零售基础设施、家庭和社交游戏文化以及消费者在娱乐方面的高支出。随着年轻一代对超越传统游戏的桌游兴趣日益浓厚,市场也随之发展。创新的游戏设计、透过影响力提升的知名度以及众筹的广泛应用,进一步加速了成长。由于北美消费者既注重怀旧,也注重新奇,市场保持活力,并有望持续扩张。

棋盘游戏市场的主要参与者有 IELLO、Indie Boards and Cards、Kosmos Verlags-GmbH & Co. KG、North Star Games、HABA - Habermaass GmbH、Fantasy Flight Games、Schmidt Spiele GmbH、Hasbro Inc.、CMON Limited、Z-Mann Games、Asmodt Spiele GmbH、Hasbro Inc.、CMON Limited、Z-Man Games Games、Asmod、 LLC、Matt J. Corp.、Czech Games Edition、University Games Corp.、Ravensburger AG 和 PlayMonster LLC。

为了巩固市场地位,桌游产业的公司正专注于多项策略性措施。这些倡议包括透过与电影、电视节目和游戏特许经营商的授权合作来拓展智慧财产权,以挖掘现有的粉丝群。公司也积极拥抱数位转型,提供应用程式辅助游戏和线上教程,以提升用户体验。群众募资正被用于验证概念并建立早期消费者参与度,尤其是对于独立游戏而言。此外,与桌游咖啡馆、游戏商店和电商平台的合作有助于实现分销管道的多元化。许多公司也正在投资全球在地化策略,以进入新市场,同时根据地区偏好客製化内容。

目录

第一章:方法论与范围

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 数位化整合

- 扩大棋盘游戏咖啡馆和社区活动

- 增加众筹和独立游戏开发

- 产业陷阱与挑战

- 数位干扰和萤幕为主的娱乐

- 製造和物流成本高

- 机会

- 混合实体数字游戏

- 教育和治疗应用

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 贸易统计(HS 代码 - 9504)

- 主要进口国

- 主要出口国

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL分析

- 消费者行为分析

- 购买模式

- 偏好分析

- 消费者行为的区域差异

- 电子商务对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034

- 主要趋势

- 垄断

- 拼字游戏

- 棋

- 谜题

- 卡牌和骰子

- 收藏卡

- 微型

- 其他的

第六章:市场估计与预测:依游戏主题,2021 - 2034 年

- 主要趋势

- 战略与战争

- 科幻游戏

- 奇幻游戏

- 运动的

- 冒险与探索

- 恐怖与神秘

- 教育与琐事

- 其他(历史文明等)

第七章:市场估计与预测:按类型,2021 - 2034

- 主要趋势

- 身体的

- 数位棋盘游戏/行动应用程式改编

- AR/VR 融合棋盘游戏

- 列印并玩游戏

第八章:市场估计与预测:依年龄段,2021 - 2034

- 主要趋势

- 2 - 5年

- 5 - 12岁

- 12 - 25岁

- 25岁以上

第九章:市场估计与预测:按配销通路,2021 - 2034

- 主要趋势

- 在线的

- 电子商务

- 公司网站

- 离线

- 玩具和百货公司

- 专卖店

- 超市和大卖场

- 其他(桌游咖啡厅、酒吧等)

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Asmodee Group

- CMON Limited

- Czech Games Edition

- Days of Wonder

- Fantasy Flight Games

- Goliath Games LLC

- HABA - Habermaass GmbH

- Hasbro Inc.

- IELLO

- Indie Boards and Cards

- Kosmos Verlags-GmbH & Co. KG

- Mattel Inc.

- North Star Games

- PlayMonster LLC

- Ravensburger AG

- Schmidt Spiele GmbH

- Spin Master Corp.

- University Games Corp.

- USAopoly Inc.

- Z-Man Games LLC

The Global Board Games Market was valued at USD 12.2 billion in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 20.6 billion by 2034.

In the growing digital world, many individuals and families are actively seeking ways to reduce screen time and re-engage in meaningful, face-to-face interactions. Board games offer a unique opportunity for people to connect in person through shared experiences that foster communication, teamwork, competition, and fun.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.2 Billion |

| Forecast Value | $20.6 Billion |

| CAGR | 5.5% |

Rising Adoption of Monopoly

The monopoly segment held a notable share in 2024, driven by its iconic status and multigenerational appeal. Known for its simple yet engaging economic gameplay, Monopoly continues to perform strongly in the classic and licensed versions. Brands have extended the franchise through limited editions, pop culture tie-ins, and digital integrations to keep the game fresh and relevant. Its accessibility to a broad age group and its recognizable branding makes Monopoly not just a game but a cultural fixture in family entertainment. The segment consistently contributes a significant share, backed by steady consumer demand and nostalgic value.

Strategy & War to Gain Traction

The strategy and war segment witnessed a significant share in 2024, backed by serious hobbyists and adult players seeking depth, complexity, and competitive gameplay. Games in this category, such as war simulations and Euro-style strategy titles, often feature rich mechanics, longer play times, and high replay value. This segment has seen strong growth due to the rise of gaming communities, conventions, and online influencers who spotlight these titles. As players increasingly look for immersive and intellectually stimulating experiences, publishers are responding with intricate storylines, modular expansions, and premium components. The demand in this segment is niche but highly loyal, creating strong repeat purchase behavior and a robust aftermarket.

Regional Insights

North America to Emerge as a Lucrative Region

North America board games market generated significant revenues in 2024, driven by a strong retail infrastructure, a culture that embraces family and social gaming, and high consumer spending on entertainment. The market evolves as younger demographics show growing interest in tabletop games beyond traditional titles. Innovative game design, increased visibility through influences, and widespread adoption of crowdfunding have further accelerated growth. With North American consumers valuing both nostalgia and novelty, the market remains dynamic and primed for continued expansion.

Major players in the board games market are IELLO, Indie Boards and Cards, Kosmos Verlags-GmbH & Co. KG, North Star Games, HABA - Habermaass GmbH, Fantasy Flight Games, Schmidt Spiele GmbH, Hasbro Inc., CMON Limited, Z-Man Games LLC, Asmodee Group, Mattel Inc., Days of Wonder, Goliath Games LLC, USAopoly Inc., Spin Master Corp., Czech Games Edition, University Games Corp., Ravensburger AG, and PlayMonster LLC.

To strengthen their market foothold, companies in the board games industry are focusing on several strategic initiatives. These include expanding intellectual property through licensed collaborations with movies, TV shows, and gaming franchises to tap into established fan bases. Firms are also embracing digital transformation, offering app-assisted games and online tutorials to enhance user experience. Crowdfunding is being leveraged to validate concepts and build early consumer engagement, especially for indie titles. In addition, partnerships with board game cafes, hobby stores, and e-commerce platforms help diversify distribution. Many companies are also investing in global localization strategies to enter new markets while tailoring content to regional preferences.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021-2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Game theme

- 2.2.4 Type

- 2.2.5 Age group

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Digital integration

- 3.2.1.2 Expansion of board game cafes and community events

- 3.2.1.3 Increasing crowdfunding and indie game development

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Digital distraction and screen-based entertainment

- 3.2.2.2 High manufacturing and logistics costs

- 3.2.3 Opportunities

- 3.2.3.1 Hybrid physical-digital games

- 3.2.3.2 Educational and therapeutic applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Trade statistics (HS code- 9504)

- 3.7.1 Major importing countries

- 3.7.2 Major exporting countries

- 3.8 Regulatory landscape

- 3.8.1 Standards and compliance requirements

- 3.8.2 Regional regulatory frameworks

- 3.8.3 Certification standards

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behaviour analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behaviour

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.7 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Monopoly

- 5.3 Scrabble

- 5.4 Chess

- 5.5 Puzzles

- 5.6 Card & dice

- 5.7 Collectible card

- 5.8 Miniature

- 5.9 Others

Chapter 6 Market Estimates & Forecast, By Game Theme, 2021 - 2034, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Strategy & war

- 6.3 Sci-fi games

- 6.4 Fantasy games

- 6.5 Sports

- 6.6 Adventure & exploration

- 6.7 Horror & mystery

- 6.8 Educational & trivia

- 6.9 Others (history and civilization, etc.)

Chapter 7 Market Estimates & Forecast, By Type, 2021 - 2034, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Physical

- 7.3 Digital board games / mobile app adaptations

- 7.4 AR/VR integrated board games

- 7.5 Print and play games

Chapter 8 Market Estimates & Forecast, By Age Group, 2021 - 2034, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 2 - 5 years

- 8.3 5 - 12 years

- 8.4 12 - 25 years

- 8.5 Above 25 years

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 E-commerce

- 9.2.2 Company websites

- 9.3 Offline

- 9.3.1 Toy and department stores

- 9.3.2 Specialty stores

- 9.3.3 Supermarkets and hypermarkets

- 9.3.4 Others (board game cafes & bars, etc.)

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Asmodee Group

- 11.2 CMON Limited

- 11.3 Czech Games Edition

- 11.4 Days of Wonder

- 11.5 Fantasy Flight Games

- 11.6 Goliath Games LLC

- 11.7 HABA - Habermaass GmbH

- 11.8 Hasbro Inc.

- 11.9 IELLO

- 11.10 Indie Boards and Cards

- 11.11 Kosmos Verlags-GmbH & Co. KG

- 11.12 Mattel Inc.

- 11.13 North Star Games

- 11.14 PlayMonster LLC

- 11.15 Ravensburger AG

- 11.16 Schmidt Spiele GmbH

- 11.17 Spin Master Corp.

- 11.18 University Games Corp.

- 11.19 USAopoly Inc.

- 11.20 Z-Man Games LLC