|

市场调查报告书

商品编码

1871209

植物性蛋清蛋白分离物市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Plant-Based Egg Protein Isolates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

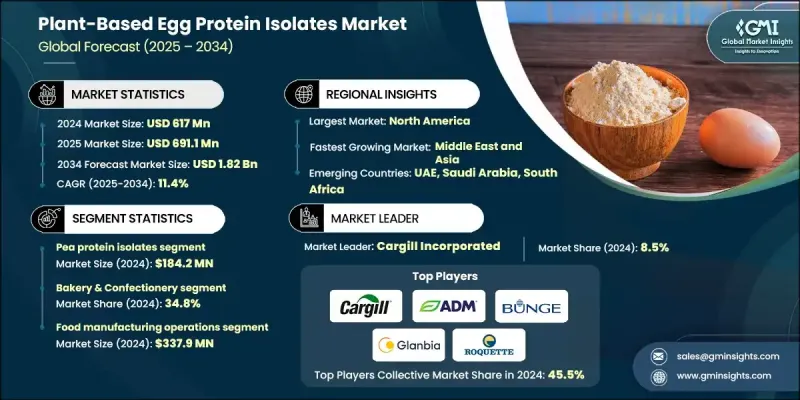

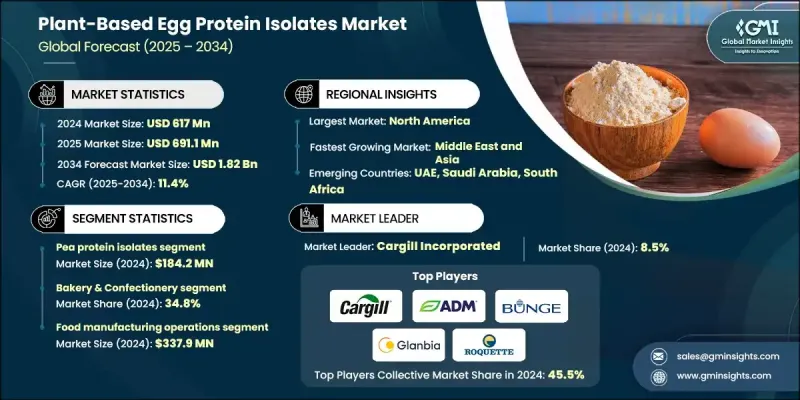

2024 年全球植物性蛋白分离物市场价值为 6.17 亿美元,预计到 2034 年将以 11.4% 的复合年增长率增长至 18.2 亿美元。

随着消费者越来越多地转向纯素、素食和弹性素食饮食,市场正在迅速扩张。以鹰嘴豆、绿豆和藻类等原料製成的植物性蛋蛋白,因其符合伦理、环保且健康,被广泛接受为传统鸡蛋的替代品。这些产品不含胆固醇,且可持续,符合现代消费者註重健康和环境责任的价值。人们对动物福利的日益关注,以及全球对减少食品生产环境足迹的重视,都在推动市场需求。製造商正大力投资先进的加工技术,包括蛋白质工程和人工智慧驱动的最佳化,以复製传统鸡蛋的口感、质地和营养价值。此外,混合蛋白混合物和微胶囊化等创新技术有助于提高产品的稳定性、保质期和风味保持性,使植物性蛋蛋白对全球消费者和食品製造商的吸引力与日俱增。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 6.17亿美元 |

| 预测值 | 18.2亿美元 |

| 复合年增长率 | 11.4% |

2024年,豌豆分离蛋白市场规模预计将达到1.842亿美元。在植物性蛋蛋白中,豌豆分离蛋白和大豆分离蛋白凭藉其成本效益、加工稳定性以及与多种食品体系的兼容性,占据市场主导地位。这些蛋白能够很好地融入干粉和液体配方中,从而顺利地添加到烘焙混合料、酱汁和即食食品中。豌豆蛋白因其不含致敏物质和中性口味而备受青睐,而大豆蛋白则因其强大的乳化和粘合能力而备受推崇,其功能与传统鸡蛋类似。

2024年,烘焙和糖果产业创造了2.145亿美元的收入,占34.8%的市场。随着植物蛋白能够提供烘焙所需的关键特性,例如蓬鬆度、结构性和保水性,该行业的需求正在加速增长,这些特性对于生产高品质的纯素和无过敏原烘焙食品至关重要。同样,蛋黄酱和乳化产品生产商也越来越多地使用植物蛋白,利用其乳化和稳定特性,帮助品牌满足日益增长的「清洁标籤」趋势,同时保持理想的质地和货架稳定性。

2024年,美国植物基蛋蛋白分离物市场规模预估为2.219亿美元。北美地区持续引领全球市场成长,消费者越来越重视永续性、无过敏原营养和以植物为主的饮食。在美国,零售和餐饮服务的创新共同推动了市场需求,餐厅和速食连锁店纷纷将植物性蛋蛋白融入菜单。健康食品替代品的流行趋势以及富含蛋白质的饮料和烘焙食品的日益普及,正进一步推动该地区市场的成长。

全球植物性蛋白分离物市场的主要参与者包括 Roquette Freres、Axiom Foods Inc.、Beneo GmbH、Aminola BV、Motif FoodWorks、Glanbia PLC、PURIS Holdings LLC、Archer Daniels Midland Company (ADM)、Cargill Incorporated、AGT Food and Ingreds Inc.、Bunge、Coates Inc. SA、烟台双塔食品有限公司、FUJI Plant Protein Labs、VW Ingredients、Verdient Foods、Laybio Natural Ingredients、ETprotein Co. Ltd.、Organicway Inc.、Burcon NutraScience Corporation 和 Vestkorn Milling AS。领先企业正透过持续创新、合作和以永续发展为中心的策略来巩固其市场地位。主要生产商正投资先进的研发,以提升植物性蛋白的感官品质和营养成分,使其更接近传统鸡蛋。与食品生产商和科技公司的合作正在帮助拓展产品在烘焙、饮料和方便食品等领域的应用。各公司也正在扩大永续采购实践,并实现原材料来源多元化,以确保成本效益和供应稳定性。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 消费者对植物基替代品的需求不断增长

- 食品科技的进步

- 消费者越来越重视健康和保健

- 成长驱动因素

- 产业陷阱与挑战

- 高昂的生产成本限制了市场扩张。

- 关键植物原料供应不稳定会扰乱生产。

- 市场机会

- 对可持续蛋白质来源的需求日益增长

- 技术进步促进产品改进

- 消费者越来越倾向于弹性素食饮食

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 植物来源

- 未来市场趋势

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依植物来源划分,2021-2034年

- 主要趋势

- 豌豆蛋白分离物

- 大豆分离蛋白

- 绿豆分离蛋白

- 鹰嘴豆/豆类蛋白质分离物

- 混合植物性蛋白质分离物

第六章:市场估算与预测:依应用领域划分,2021-2034年

- 烘焙食品和糖果

- 蛋黄酱和乳液产品

- 饮料和营养应用

- 植物肉和植物乳製品替代品

- 餐饮服务与工业应用

第七章:市场估算与预测:依最终用途产业划分,2021-2034年

- 主要趋势

- 食品製造

- 餐饮服务经营

- 零售及消费品

- 营养补充品

第八章:市场估算与预测:依加工技术划分,2021-2034年

- 主要趋势

- 传统萃取分离物

- 酵素修饰分离物

- 发酵衍生分离物

- 天然/冷加工分离物

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- AGT Food and Ingredients Inc.

- Aminola BV

- Archer Daniels Midland Company (ADM)

- Axiom Foods Inc.

- Beneo GmbH

- Bunge Limited

- Burcon NutraScience Corporation

- Cargill, Incorporated

- Cosucra Groupe Warcoing SA

- Eat Just, Inc.

- Equinom Ltd.

- ETprotein Co., Ltd.

- FUJI Plant Protein Labs

- Glanbia PLC

- Laybio Natural Ingredients

- Motif FoodWorks

- Organicway Inc.

- PURIS Holdings LLC

- Roquette Freres

- Tate & Lyle

- Verdient Foods

- Vestkorn Milling AS

- VW Ingredients

- Yantai Shuangta Food Co., Ltd

The Global Plant-Based Egg Protein Isolates Market was valued at USD 617 million in 2024 and is estimated to grow at a CAGR of 11.4% to reach USD 1.82 Billion by 2034.

The market is expanding rapidly as consumers increasingly shift toward vegan, vegetarian, and flexitarian diets. Plant-based egg proteins, produced from ingredients such as chickpeas, mung beans, and algae, are widely adopted as ethical, eco-friendly, and health-conscious alternatives to conventional eggs. These products provide a cholesterol-free and sustainable option that aligns with modern consumer values focused on wellness and environmental responsibility. Rising awareness of animal welfare, coupled with the global emphasis on reducing the environmental footprint of food production, is fueling demand. Manufacturers are investing heavily in advanced processing technologies, including protein engineering and AI-driven optimization, to replicate the taste, texture, and nutritional quality of traditional eggs. Additionally, innovations like hybrid protein blends and microencapsulation are helping improve product stability, shelf life, and flavor retention, making plant-based egg proteins increasingly appealing to both consumers and food manufacturers worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $617 Million |

| Forecast Value | $1.82 Billion |

| CAGR | 11.4% |

The pea protein isolates segment generated USD 184.2 million in 2024. Among plant-based egg proteins, pea and soy isolates lead the market due to their cost-effectiveness, processing stability, and compatibility with diverse food systems. These proteins blend well into both dry and liquid formulations, allowing smooth incorporation into bakery mixes, sauces, and ready-to-eat meals. Pea protein remains preferred for its allergen-free nature and neutral taste, while soy protein is valued for its strong emulsifying and binding capabilities, offering functionality similar to that of conventional eggs.

The bakery and confectionery segment generated USD 214.5 million in 2024 and held a 34.8% share. Demand from this segment is accelerating as plant-based egg proteins provide essential baking characteristics such as aeration, structure, and moisture retention, essential for producing high-quality vegan and allergen-free baked goods. Similarly, mayonnaise and emulsion product manufacturers are increasingly incorporating plant-based proteins for their emulsifying and stabilizing properties, helping brands meet the growing clean-label trend while maintaining desirable texture and shelf stability.

U.S. Plant-Based Egg Protein Isolates Market was valued at USD 221.9 million in 2024. North America continues to lead global adoption as consumers prioritize sustainability, allergen-free nutrition, and plant-forward diets. In the U.S., demand is being driven by both retail and foodservice innovation, with restaurants and quick-service chains integrating plant-based eggs into menus. The trend toward health-driven food alternatives and the growing presence of protein-enriched beverages and baked goods are propelling further growth across the region.

Key players active in the Global Plant-Based Egg Protein Isolates Market include Roquette Freres, Axiom Foods Inc., Beneo GmbH, Aminola BV, Motif FoodWorks, Glanbia PLC, PURIS Holdings LLC, Archer Daniels Midland Company (ADM), Cargill Incorporated, AGT Food and Ingredients Inc., Bunge Limited, Tate & Lyle, Equinom Ltd., Cosucra Groupe Warcoing SA, Yantai Shuangta Food Co. Ltd., FUJI Plant Protein Labs, VW Ingredients, Verdient Foods, Laybio Natural Ingredients, ETprotein Co. Ltd., Organicway Inc., Burcon NutraScience Corporation, and Vestkorn Milling AS. Leading companies are strengthening their presence through continuous innovation, partnerships, and sustainability-focused strategies. Major manufacturers are investing in advanced R&D to enhance the sensory qualities and nutritional profiles of plant-based egg proteins, ensuring closer parity with conventional eggs. Collaborations with food producers and technology firms are helping expand product applications across bakery, beverages, and convenience foods. Firms are also scaling up sustainable sourcing practices and diversifying raw material bases to ensure cost efficiency and supply stability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Plant Source

- 2.2.2 Application

- 2.2.3 End use industry

- 2.2.4 Processing technology

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising consumer demand for plant-based alternatives

- 3.2.1.2 Advancements in food technology

- 3.2.1.3 Increasing consumer focus on health and wellness

- 3.2.1 Growth drivers

- 3.3 Industry pitfalls and challenges

- 3.3.1 High production costs limit market expansion

- 3.3.2 Inconsistent supply of key plant ingredients disrupts manufacturing

- 3.4 Market opportunities

- 3.4.1 Growing demand for sustainable protein sources

- 3.4.2 Technological advancements enabling product improvement

- 3.4.3 Rising consumer shift towards flexitarian diets

- 3.5 Growth potential analysis

- 3.6 Regulatory landscape

- 3.6.1 North America

- 3.6.2 Europe

- 3.6.3 Asia Pacific

- 3.6.4 Latin America

- 3.6.5 Middle East & Africa

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Price trends

- 3.10.1 By region

- 3.10.2 By plant source

- 3.11 Future market trends

- 3.12 Patent landscape

- 3.13 Trade statistics (HS code)( Note: the trade statistics will be provided for key countries only)

- 3.13.1 Major importing countries

- 3.13.2 Major exporting countries

- 3.14 Sustainability and environmental aspects

- 3.14.1 Sustainable practices

- 3.14.2 Waste reduction strategies

- 3.14.3 Energy efficiency in production

- 3.14.4 Eco-friendly initiatives

- 3.15 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Plant Source, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Pea protein isolates

- 5.3 Soy protein isolates

- 5.4 Mung bean protein isolates

- 5.5 Chickpea/legume protein isolates

- 5.6 Blended plant protein isolates

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Bakery & confectionery

- 6.2 Mayonnaise & emulsion products

- 6.3 Beverage & nutrition applications

- 6.4 Plant-based meat & dairy alternatives

- 6.5 Foodservice & industrial applications

Chapter 7 Market Estimates and Forecast, By End use Industry, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food manufacturing

- 7.3 Foodservice operations

- 7.4 Retail & consumer products

- 7.5 Nutritional supplements

Chapter 8 Market Estimates and Forecast, By Processing Technology, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Conventional extraction isolates

- 8.3 Enzymatically modified isolates

- 8.4 Fermentation-derived isolates

- 8.5 Native/cold-processed isolates

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 AGT Food and Ingredients Inc.

- 10.2 Aminola BV

- 10.3 Archer Daniels Midland Company (ADM)

- 10.4 Axiom Foods Inc.

- 10.5 Beneo GmbH

- 10.6 Bunge Limited

- 10.7 Burcon NutraScience Corporation

- 10.8 Cargill, Incorporated

- 10.9 Cosucra Groupe Warcoing SA

- 10.10 Eat Just, Inc.

- 10.11 Equinom Ltd.

- 10.12 ETprotein Co., Ltd.

- 10.13 FUJI Plant Protein Labs

- 10.14 Glanbia PLC

- 10.15 Laybio Natural Ingredients

- 10.16 Motif FoodWorks

- 10.17 Organicway Inc.

- 10.18 PURIS Holdings LLC

- 10.19 Roquette Freres

- 10.20 Tate & Lyle

- 10.21 Verdient Foods

- 10.22 Vestkorn Milling AS

- 10.23 VW Ingredients

- 10.24 Yantai Shuangta Food Co., Ltd