|

市场调查报告书

商品编码

1871319

益生元市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Prebiotics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

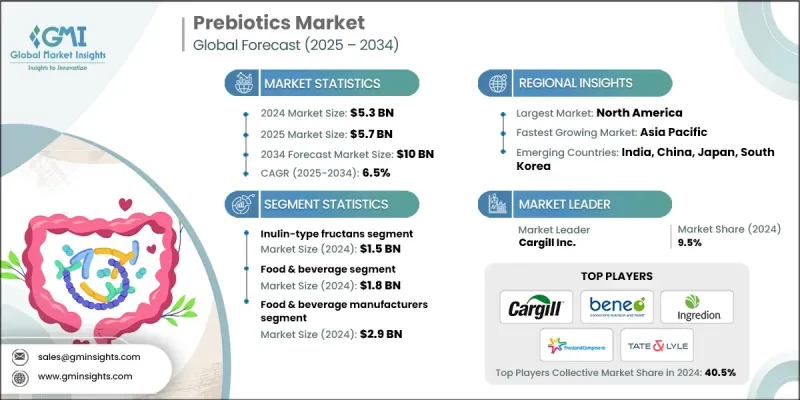

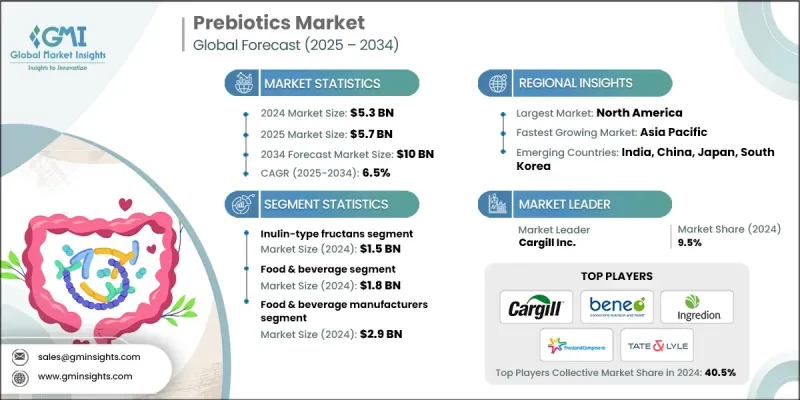

2024 年全球益生元市场价值为 53 亿美元,预计到 2034 年将以 6.5% 的复合年增长率增长至 100 亿美元。

益生元是不可消化的成分,有助于刺激肠道有益菌的生长,从而支持消化健康和整体健康。它们天然存在于多种植物来源中,并越来越多地被添加到功能性食品、饮料和膳食补充剂中。消费者对肠道健康、免疫力和预防保健日益增长的关注,使益生元成为更广泛的健康和营养产业的重要组成部分。萃取和配方技术的进步提高了益生元的稳定性和效力,使其应用范围更加广泛。酵素法加工和微胶囊化等创新技术正在提高益生元成分的效率,并增强其与各种产品配方的兼容性。消费者对天然、植物基和清洁标籤产品的偏好不断增长,进一步推动了市场需求。向预防保健和以生活方式为导向的健康理念的转变,促使食品和膳食补充剂生产商推出添加益生元的产品,以改善消化平衡和增强免疫力。此外,人们对肠脑轴及其在身心健康中的作用的认识不断提高,也持续扩大着全球市场,尤其是在城市化和已开发经济体中。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 53亿美元 |

| 预测值 | 100亿美元 |

| 复合年增长率 | 6.5% |

2024年,菊糖型果聚醣市场规模达15亿美元。这些益生元化合物与低聚果糖一起,在维持肠道菌丛平衡和促进消化健康方面发挥着至关重要的作用。抗性淀粉和甘露寡糖(MOS)也因其促进代谢和增强免疫力的功效而需求不断增长。 MOS在人类和动物营养领域日益受到关注,为功能性食品和饲料应用创造了机会。这些化合物共同代表着功能性和强化营养领域一个充满前景的成长方向。

2024年,食品饮料产业创造了18亿美元的收入。随着消费者关注点转向增强免疫力和消化功能的产品,食品饮料产业仍是益生元的主要应用领域。在个人化和预防性营养趋势的推动下,膳食补充剂市场正经历快速成长,消费者越来越多地将益生元融入日常健康生活中。婴幼儿配方奶粉和营养品中也持续添加益生元,以促进婴幼儿肠道菌丛健康,增强免疫力,从而推动了全球市场的持续需求。

美国益生元市场占82.2%的市场份额,预计2024年市场规模将达到13.6亿美元。北美地区仍然是益生元市场成长的强劲中心,这主要得益于消费者对肠道健康和免疫力的日益关注。在美国,消费者对功能性产品和清洁标章产品的偏好正在推动产品创新,并加速食品、饮料和膳食补充剂等类别的普及。製造商不断改进配方,并丰富产品组合,以满足该地区日益增长的健康意识消费者的需求。

全球益生元市场的主要活跃企业包括帝斯曼营养产品公司 (DSM Nutritional Products)、罗盖特兄弟公司 (Roquette Freres)、贝内欧公司 (Beneo GmbH)、ADM(阿彻丹尼尔斯米德兰公司)、嘉吉公司 (Cargill Inc.)、菲仕兰坎皮纳公司 (Friestland)、嘉吉公司 (Cargill Inc.)、菲仕兰坎皮纳公司 (Friestland), Nred吉公司 (Falient), &a图片公司、英莱食品公司 (FriesS) (Ingredion Inc.)、第一製糖公司 (CJ CheilJedang)、凯瑞集团 (Kerry Group plc)、杰罗配方公司 (Jarrow Formulas)、克拉萨多生物科学公司 (Clasado Biosciences)、OptiBiotix Health、Tereos Group、三养控股公司 (Samyang Holdings)、Sensus(高科技公司) Chemicals)、宝灵宝生物公司 (BAOLINGBAO Biology)、Prenexus Health、明治控股公司 (Meiji Holdings)、Cosucra、养乐多本社株式会社 (Yakult Honsha Co., Ltd.) 和 Jennewein Biotechnologie。益生元市场的企业正透过策略併购、合作和产能扩张来扩大其全球影响力,以满足不断增长的消费者需求。领导企业正在加大研发投入,以开发新型益生元配方,从而提高其在各种食品和膳食补充剂应用中的消化效率、稳定性和功能整合性。目前,企业重点在于生产符合永续发展和健康趋势的清洁标籤植物基益生元。许多公司正在加强供应链建设,以确保产品品质稳定和采购透明度。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 消费者越来越重视健康和保健

- 功能性食品和饮料产业的扩张

- 萃取和配方方面的技术进步

- 成长驱动因素

- 产业陷阱与挑战

- 高昂的生产和加工成本

- 监管和标籤方面的挑战

- 市场机会

- 素食和植物性食品市场不断成长

- 与益生菌产品整合

- 用于婴儿配方奶粉和老年人营养

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2021-2034年

- 主要趋势

- 菊糖型果聚醣

- 低聚果糖(FOS)

- 低聚半乳糖(GOS)

- 人乳低聚醣(HMO)

- 抗性淀粉

- 甘露寡糖(MOS)

- 其他的

第六章:市场估算与预测:依应用领域划分,2021-2034年

- 食品饮料业

- 膳食补充剂

- 婴儿配方奶粉和婴儿食品

- 动物饲料与营养

- 化妆品及个人护理

- 医药应用

第七章:市场估算与预测:依最终用途产业划分,2021-2034年

- 主要趋势

- 食品饮料製造商

- 製药公司

- 动物饲料生产商

- 化妆品和个人护理公司

第八章:市场估算与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- ADM (Archer Daniels Midland)

- BAOLINGBAO Biology

- Beneo GmbH

- Cargill Inc.

- CJ CheilJedang

- Clasado Biosciences

- Cosucra

- DSM Nutritional Products

- FrieslandCampina Ingredients

- Ingredion Inc.

- Jarrow Formulas

- Jennewein Biotechnologie

- Kerry Group plc

- Meiji Holdings

- Nexira

- OptiBiotix Health

- Prenexus Health

- Quantum Hi-Tech

- Roquette Freres

- Samyang Holdings

- Sensus (Royal Cosun)

- Tate & Lyle PLC

- Tereos Group

- Tata Chemicals

- Yakult Honsha Co., Ltd.

The Global Prebiotics Market was valued at USD 5.3 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 10 billion by 2034.

Prebiotics are non-digestible ingredients that help stimulate the growth of beneficial gut bacteria, supporting digestive wellness and overall health. They are naturally present in several plant-based sources and are increasingly being incorporated into functional foods, beverages, and supplements. Rising consumer interest in gut health, immunity, and preventive wellness has positioned prebiotics as a crucial component in the broader health and nutrition industry. Advances in extraction and formulation technologies have improved the stability and potency of prebiotics, enabling their use in a wider range of applications. Innovations such as enzymatic processing and microencapsulation are enhancing the efficiency of prebiotic ingredients and boosting their compatibility with various product formulations. Growing preferences for natural, plant-based, and clean-label products are further fueling market demand. The shift toward preventive healthcare and lifestyle-driven wellness has encouraged food and supplement manufacturers to introduce prebiotic-enhanced offerings that address digestive balance and immunity. Additionally, increasing awareness of the gut-brain connection and its role in mental and physical health continues to expand the global market, particularly across urbanized and developed economies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.3 Billion |

| Forecast Value | $10 Billion |

| CAGR | 6.5% |

In 2024, the inulin-type fructans segment generated USD 1.5 billion. Along with fructooligosaccharides, these prebiotic compounds play a crucial role in maintaining gut microbiota balance and promoting digestive well-being. Resistant starch and mannan-oligosaccharides (MOS) are also witnessing rising demand due to their metabolic and immune-boosting benefits. MOS is gaining traction in both human and animal nutrition, creating opportunities across functional foods and feed applications. Together, these compounds represent a promising growth avenue in the evolving field of functional and fortified nutrition.

The food & beverage segment generated USD 1.8 billion in 2024. It remains the primary application area for prebiotics, as consumer focus shifts toward products that enhance immunity and digestive function. Dietary supplements are experiencing rapid expansion driven by the rising trend of personalized and preventive nutrition, with consumers increasingly integrating prebiotics into their daily wellness routines. Infant formula and baby nutrition products continue to incorporate prebiotics to promote healthy gut flora and strengthen immune development in infants, fueling consistent demand across global markets.

U.S. Prebiotics Market held 82.2% and generated USD 1.36 billion in 2024. North America remains a strong hub for prebiotics growth, driven by heightened awareness of gut health and immunity among consumers. In the U.S., the preference for functional and clean-label products is shaping product innovation and accelerating adoption across food, beverage, and dietary supplement categories. Manufacturers are continuously improving formulations and diversifying product portfolios to meet the rising expectations of health-conscious consumers throughout the region.

Key companies active in the Global Prebiotics Market include DSM Nutritional Products, Roquette Freres, Beneo GmbH, ADM (Archer Daniels Midland), Cargill Inc., FrieslandCampina Ingredients, Tate & Lyle PLC, Nexira, Ingredion Inc., CJ CheilJedang, Kerry Group plc, Jarrow Formulas, Clasado Biosciences, OptiBiotix Health, Tereos Group, Samyang Holdings, Sensus (Royal Cosun), Quantum Hi-Tech, Tata Chemicals, BAOLINGBAO Biology, Prenexus Health, Meiji Holdings, Cosucra, Yakult Honsha Co., Ltd., and Jennewein Biotechnologie. Companies in the Prebiotics Market are enhancing their global footprint through strategic mergers, collaborations, and capacity expansions to meet growing consumer demand. Leading firms are investing in R&D to develop novel prebiotic formulations that improve digestive efficiency, stability, and functional integration across diverse food and supplement applications. Emphasis is placed on producing clean-label and plant-based prebiotics that align with sustainability and health trends. Many companies are strengthening their supply chains to ensure consistent product quality and sourcing transparency.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product type

- 2.2.2 Application

- 2.2.3 End use industry

- 2.2.4 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing consumer focus on health and wellness

- 3.2.1.2 Expansion of functional food & beverage sector

- 3.2.1.3 Technological advancements in extraction & formulation

- 3.2.1 Growth drivers

- 3.3 Industry pitfalls and challenges

- 3.3.1 High production and processing costs

- 3.3.2 Regulatory and labeling challenges

- 3.4 Market opportunities

- 3.4.1 Growing vegan and plant-based market

- 3.4.2 Integration with synbiotic products

- 3.4.3 Use in infant formula and elderly nutrition

- 3.5 Growth potential analysis

- 3.6 Regulatory landscape

- 3.6.1 North America

- 3.6.2 Europe

- 3.6.3 Asia Pacific

- 3.6.4 Latin America

- 3.6.5 Middle East & Africa

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Price trends

- 3.10.1 By region

- 3.10.2 By product type

- 3.11 Future market trends

- 3.12 Technology and innovation landscape

- 3.12.1 Current technological trends

- 3.12.2 Emerging technologies

- 3.13 Patent landscape

- 3.14 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.14.1 Major importing countries

- 3.14.2 Major exporting countries

- 3.15 Sustainability and environmental aspects

- 3.15.1 Sustainable practices

- 3.15.2 Waste reduction strategies

- 3.15.3 Energy efficiency in production

- 3.15.4 Eco-friendly initiatives

- 3.16 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Inulin-Type Fructans

- 5.3 Fructooligosaccharides (FOS)

- 5.4 Galactooligosaccharides (GOS)

- 5.5 Human Milk Oligosaccharides (HMOs)

- 5.6 Resistant starch

- 5.7 Mannan-oligosaccharides (MOS)

- 5.8 Others

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Food & beverage industry

- 6.2 Dietary supplements

- 6.3 Infant formula & baby food

- 6.4 Animal feed & nutrition

- 6.5 Cosmetics & personal care

- 6.6 Pharmaceutical & medical applications

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food & beverage manufacturers

- 7.3 Pharmaceutical companies

- 7.4 Animal feed manufacturers

- 7.5 Cosmetics & personal care companies

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 ADM (Archer Daniels Midland)

- 9.2 BAOLINGBAO Biology

- 9.3 Beneo GmbH

- 9.4 Cargill Inc.

- 9.5 CJ CheilJedang

- 9.6 Clasado Biosciences

- 9.7 Cosucra

- 9.8 DSM Nutritional Products

- 9.9 FrieslandCampina Ingredients

- 9.10 Ingredion Inc.

- 9.11 Jarrow Formulas

- 9.12 Jennewein Biotechnologie

- 9.13 Kerry Group plc

- 9.14 Meiji Holdings

- 9.15 Nexira

- 9.16 OptiBiotix Health

- 9.17 Prenexus Health

- 9.18 Quantum Hi-Tech

- 9.19 Roquette Freres

- 9.20 Samyang Holdings

- 9.21 Sensus (Royal Cosun)

- 9.22 Tate & Lyle PLC

- 9.23 Tereos Group

- 9.24 Tata Chemicals

- 9.25 Yakult Honsha Co., Ltd.