|

市场调查报告书

商品编码

1876535

精准益生元市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Precision Prebiotics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

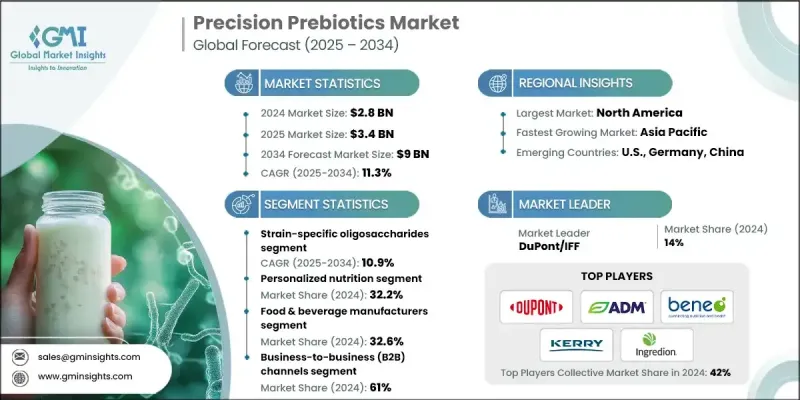

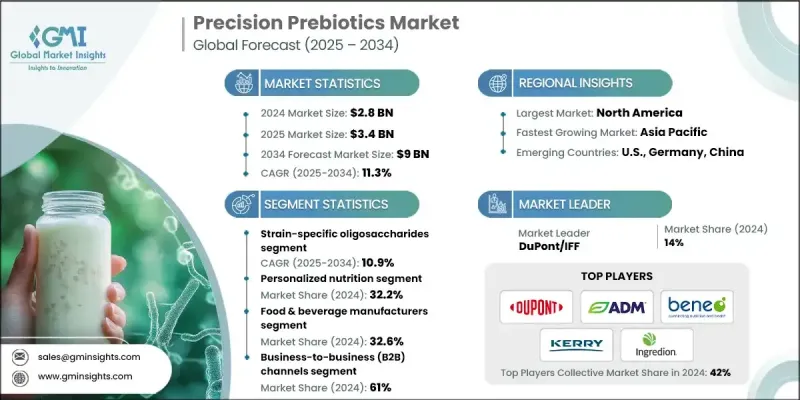

2024 年全球精准益生元市场价值为 28 亿美元,预计到 2034 年将以 11.3% 的复合年增长率成长至 90 亿美元。

益生元干预措施的科学验证不断增多,以及其在多个行业的应用日益广泛,正推动市场成长。各公司正迅速将精准益生元纳入其产品组合,旨在调节肠道菌丛并改善特定健康结果。发酵技术和个人化营养平台的进步,使得开发高标靶性和高效益生元成为可能。与更广泛的功能性成分类别相比,精准益生元因其与健康和保健趋势的直接关联而表现更佳。在个人化营养、临床和治疗应用以及功能性食品和饮料领域的应用,正引领市场成长。这些益生元专注于对结肠健康、免疫力、新陈代谢和消化产生精准的益处,契合了消费者对基于实证医学的个人化健康解决方案的需求。监管政策的明确化进一步加速了商业化进程,尤其是在那些拥有完善支援框架和简化审批流程的地区。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 28亿美元 |

| 预测值 | 90亿美元 |

| 复合年增长率 | 11.3% |

2024年,菌株特异性寡糖市占率达到39.5%,预计到2034年将以10.9%的复合年增长率成长。这些益生元利用结构精确的化合物,选择性地滋养有益肠道细菌,例如双歧桿菌和乳酸桿菌,这些化合物的设计旨在与微生物的酶活性相匹配。大量的临床证据表明,这些标靶干预措施能够调节肠道菌群,从而带来持续且可预测的健康益处。

个人化营养领域在2024年占了32.2%的市场份额,预计在2025年至2034年间将以10.9%的复合年增长率成长。透过结合微生物组分析、基因检测和代谢谱分析,企业能够提供量身订製的健康建议,满足个人化的健康需求。消费者对个人化健康策略的兴趣日益浓厚,促使企业创造整合诊断技术和精准益生元输送的平台。皮肤健康和抗衰老等新兴领域可望透过与外用和口服产品产生协同效应,进一步提升市场机会。

2024年,北美精准益生元市占率达39.5%。该地区受益于完善的监管环境,鼓励创新和快速产品开发。先进的新成分审批流程使企业能够更有信心地投资研发,从而确保高价值益生元产品更快实现商业化。消费者对个人化营养的强烈需求进一步巩固了北美在该领域的领先地位。

全球精准益生元市场的主要参与者包括养乐多本社株式会社、Seed Health、Kerry Group plc、Viome Life Sciences、ADM(Archer Daniels Midland)、Cosucra Group Warcoing SA、杜邦/IFF、Deerland Enzymes、OptibioA Limited、Roquette Freres、BENEO(Sudz. Genomics。精准益生元市场的企业正透过多种策略巩固其市场地位。他们大力投资研发,以开发菌株特异性且经过临床验证的益生元。与个人化营养平台和诊断公司建立合作关係,有助于整合数据驱动型解决方案,为消费者提供个人化建议。遵守监管规定并积极与政府机构沟通,有助于加速产品审批和市场准入。各公司正在利用先进的发酵和生物加工技术来提高生产效率和稳定性。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 健康意识和养生趋势的提升

- 个人化营养与精准医疗的成长

- 微生物组研究进展及科学证据

- 产业陷阱与挑战

- 高昂的开发成本和资金需求

- 监理复杂性和审批时间

- 市场机会

- 新型应用开发与创新

- 技术融合与平台集成

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 透过技术

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依技术划分,2021-2034年

- 主要趋势

- 菌株特异性寡糖

- 低聚果糖(FOS)

- 低聚半乳糖(GOS)

- 木寡糖(XOS)

- 甘露寡糖(MOS)

- 阿拉伯木寡糖(AXOS)

- 人乳低聚醣(HMO)

- 2'-岩藻糖基乳糖(2'-FL)

- 乳糖-N-新四糖(LNnT)

- 3-岩藻糖基乳糖(3-FL)

- 6'-唾液酸乳糖(6'-SL)

- 复杂的HMO结构

- 精准发酵产品

- 微生物发酵

- 酵素生产

- 合成生物学

- 无细胞生产

- 改良及工程化益生元

- 化学修饰的寡糖

- 酵素修饰结构

- 混合益生元分子

- 功能化递送系统

- 新型益生元技术

- 基于噬菌体

- 后生元-益生元组合

- 微胶囊化益生元

- 标靶释放系统

第六章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 个人化营养

- 临床与治疗

- 功能性食品和饮料

- 动物营养

- 药物应用

- 个人护理及化妆品

- 农业应用

第七章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 食品饮料製造商

- 营养保健品公司

- 製药公司

- 动物饲料业

- 个人护理行业

- 合约製造组织

第八章:市场估算与预测:依配销通路划分,2021-2034年

- 主要趋势

- 企业对企业 (B2B) 管道

- 企业对消费者 (B2C) 管道

- 电子商务与数位平台

- 医疗保健和临床频道

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- DuPont/IFF

- ADM (Archer Daniels Midland)

- BENEO (Sudzucker Group)

- Kerry Group plc

- Ingredion Incorporated

- Cargill Incorporated

- Tate & Lyle PLC

- Cosucra Group Warcoing SA

- Roquette Freres

- Yakult Honsha Co., Ltd.

- Deerland Enzymes

- Optibiotix Limited

- Sun Genomics

- Viome Life Sciences

- Seed Health

The Global Precision Prebiotics Market was valued at USD 2.8 billion in 2024 and is estimated to grow at a CAGR of 11.3% to reach USD 9 billion by 2034.

Growth is being driven by increasing scientific validation of prebiotic interventions and expanding applications across multiple industries. Companies are rapidly incorporating precision prebiotics into their product portfolios, targeting microbiome modulation and specific health outcomes. Advances in fermentation technologies and personalized nutrition platforms are enabling the development of highly targeted and effective prebiotics. Compared to broader functional ingredient categories, precision prebiotics are outperforming due to their direct connection with health and wellness trends. Applications in personalized nutrition, clinical and therapeutic use, and functional foods and beverages are leading to market growth. These prebiotics focus on precise benefits for colonic health, immunity, metabolism, and digestion, aligning with consumer demand for evidence-based, personalized wellness solutions. Regulatory clarity is further accelerating commercialization, particularly in regions with supportive frameworks and streamlined approval processes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $9 Billion |

| CAGR | 11.3% |

The strain-specific oligosaccharides segment held a 39.5% share in 2024 and is expected to grow at a CAGR of 10.9% through 2034. These prebiotics selectively nourish beneficial gut bacteria, such as Bifidobacterium and Lactobacillus, using structurally precise compounds designed to align with microbial enzymatic capabilities. Substantial clinical evidence supports the ability of these targeted interventions to modulate microbiomes, delivering consistent and predictable health benefits.

The personalized nutrition segment held a 32.2% share in 2024 and is projected to grow at a CAGR of 10.9% during 2025-2034. By combining microbiome analysis, genetic testing, and metabolic profiling, companies are providing tailored recommendations that address individual health needs. Consumer interest in customized health strategies is rising, prompting companies to create platforms that integrate diagnostics with precision prebiotic delivery. Emerging areas such as skin health and anti-aging are expected to further enhance market opportunities by creating synergies with topical and ingestible applications.

North America Precision Prebiotics Market held a 39.5% share in 2024. The region benefits from an established regulatory environment, encouraging innovation and rapid product development. Advanced approval processes for novel ingredients allow companies to confidently invest in research and development, ensuring faster commercialization of high-value prebiotic products. Strong consumer preference for personalized nutrition further reinforces North America's leadership in this sector.

Key players in the Global Precision Prebiotics Market include Yakult Honsha Co., Ltd., Seed Health, Kerry Group plc, Viome Life Sciences, ADM (Archer Daniels Midland), Cosucra Group Warcoing SA, DuPont/IFF, Deerland Enzymes, Optibiotix Limited, Roquette Freres, BENEO (Sudzucker Group), Tate & Lyle PLC, Ingredion Incorporated, Cargill Incorporated, and Sun Genomics. Companies in the Precision Prebiotics Market are strengthening their foothold through a combination of strategies. They are investing heavily in research and development to create strain-specific and clinically validated prebiotics. Partnerships with personalized nutrition platforms and diagnostic firms allow integration of data-driven solutions for individualized consumer recommendations. Regulatory compliance and proactive engagement with government agencies accelerate product approvals and market entry. Firms are leveraging advanced fermentation and bioprocessing technologies to enhance production efficiency and consistency.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Application

- 2.2.4 End use

- 2.2.5 Distribution channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising health consciousness & wellness trends

- 3.2.1.2 Personalized nutrition & precision medicine growth

- 3.2.1.3 Microbiome research advances & scientific evidence

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development costs & capital requirements

- 3.2.2.2 Regulatory complexity & approval timelines

- 3.2.3 Market opportunities

- 3.2.3.1 Novel application development & innovation

- 3.2.3.2 Technology convergence & platform integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By technology

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Technology, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Strain-specific Oligosaccharides

- 5.2.1 Fructooligosaccharides (FOS)

- 5.2.2 Galactooligosaccharides (GOS)

- 5.2.3 Xylooligosaccharides (XOS)

- 5.2.4 Mannanoligosaccharides (MOS)

- 5.2.5 Arabinoxylanoligosaccharides (AXOS)

- 5.3 Human milk Oligosaccharides (HMOs)

- 5.3.1 2'-Fucosyllactose (2'-FL)

- 5.3.2 Lacto-N-neotetraose (LNnT)

- 5.3.3 3-Fucosyllactose (3-FL)

- 5.3.4 6'-Sialyllactose (6'-SL)

- 5.3.5 Complex HMO Structures

- 5.4 Precision fermentation products

- 5.4.1 Microbial fermentation

- 5.4.2 Enzymatic production

- 5.4.3 Synthetic biology

- 5.4.4 Cell-free production

- 5.5 Modified & engineered prebiotics

- 5.5.1 Chemically modified oligosaccharides

- 5.5.2 Enzymatically modified structures

- 5.5.3 Hybrid prebiotic molecules

- 5.5.4 Functionalized delivery systems

- 5.6 Novel prebiotic technologies

- 5.6.1 Bacteriophage-based

- 5.6.2 Postbiotic-prebiotic combinations

- 5.6.3 Microencapsulated prebiotics

- 5.6.4 Targeted release systems

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Personalized nutrition

- 6.3 Clinical & therapeutic

- 6.4 Functional foods & beverages

- 6.5 Animal nutrition

- 6.6 Pharmaceutical applications

- 6.7 Personal care & cosmetics

- 6.8 Agricultural applications

Chapter 7 Market Estimates and Forecast, By End use, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food & beverage manufacturers

- 7.3 Nutraceutical companies

- 7.4 Pharmaceutical companies

- 7.5 Animal feed industry

- 7.6 Personal care industry

- 7.7 Contract manufacturing organizations

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Business-to-business (B2B) channels

- 8.3 Business-to-consumer (B2C) channels

- 8.4 E-commerce & digital platforms

- 8.5 Healthcare & clinical channels

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 DuPont/IFF

- 10.2 ADM (Archer Daniels Midland)

- 10.3 BENEO (Sudzucker Group)

- 10.4 Kerry Group plc

- 10.5 Ingredion Incorporated

- 10.6 Cargill Incorporated

- 10.7 Tate & Lyle PLC

- 10.8 Cosucra Group Warcoing SA

- 10.9 Roquette Freres

- 10.10 Yakult Honsha Co., Ltd.

- 10.11 Deerland Enzymes

- 10.12 Optibiotix Limited

- 10.13 Sun Genomics

- 10.14 Viome Life Sciences

- 10.15 Seed Health