|

市场调查报告书

商品编码

1876544

汽车喷涂机器人系统市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Automotive Paint Robot System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

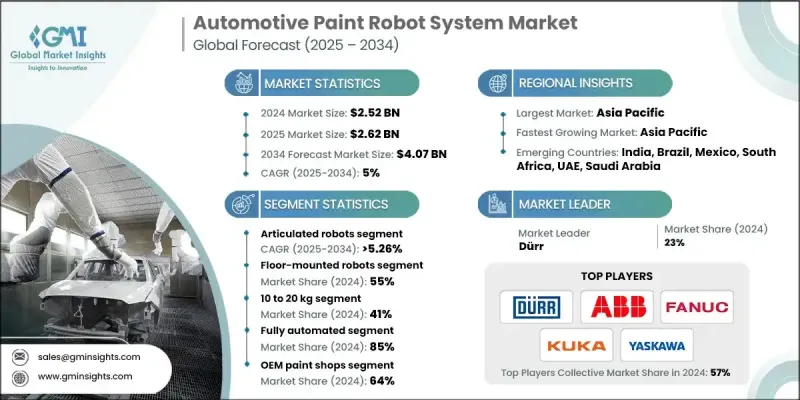

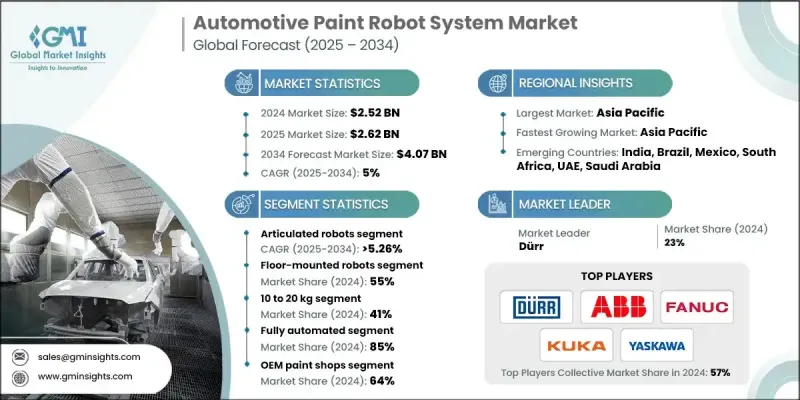

2024 年全球汽车喷漆机器人系统市场价值为 25.2 亿美元,预计到 2034 年将以 5% 的复合年增长率增长至 40.7 亿美元。

汽车生产设施中自动化程度的不断提高正在推动这一市场的发展,因为製造商正在寻求在车辆喷涂作业中实现更高的精度、均匀性和可持续性。旨在实现车身搬运、涂装和精加工自动化的汽车喷涂机器人系统已成为现代汽车生产线不可或缺的一部分。全球汽车产量的成长、电动车的加速转型以及对客製化涂装日益增长的需求,都是推动市场扩张的主要因素。机器人喷涂能够提供一致的涂层厚度、卓越的表面品质和最小的材料浪费,同时确保更快的循环时间和更高的效率。这些系统还能透过减少排放和提高能源效率来支持製造商的永续发展目标。此外,更严格的环境法规、降低营运成本的压力以及数位化和绿色製造的持续发展趋势,都进一步推动了对自动化喷涂车间的投资。由于机器人喷涂技术能够提供可重复的结果并消除人工操作带来的不一致性,汽车製造商正在优先考虑采用先进的喷涂机器人技术,以在每个生产阶段实现更高的生产效率和精度。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 25.2亿美元 |

| 预测值 | 40.7亿美元 |

| 复合年增长率 | 5% |

2024年,关节型机器人市占率达到69%,预计2025年至2034年将以5.26%的复合年增长率成长。其主导地位归功于关节型机器人的多功能性、远距离作业能力以及轻鬆应对复杂车辆几何形状的能力。这些机器人配备多个关节,通常拥有六个或更多轴,能够像人臂一样提供流畅精准的运动,使其成为对精度和适应性要求极高的汽车喷漆应用的理想选择。它们能够处理复杂的喷涂角度和轮廓,从而在保持大规模生产线效率的同时,提升整体喷涂品质。

2024年,落地式机器人市占率达到55%,预计到2034年将以5.63%的复合年增长率成长。由于其稳定性、易于整合以及与现有生产布局的兼容性,落地式机器人仍然是製造工厂中最常用的配置。这些机器人直接固定在基座或车间地面上,为机械手臂和涂漆器提供稳固的支撑,从而在高速喷涂循环中实现精确控制和稳定运行。其坚固的结构和适应性使其成为大型汽车装配线不可或缺的一部分。

亚太地区汽车喷涂机器人系统市场占50%的市场份额,预计2024年市场规模将达到12.5亿美元。该地区强劲的市场地位得益于快速的工业化进程、大规模的汽车製造以及对自动化技术日益增长的投资。中国、日本、韩国和印度等国家正透过战略倡议引领这一成长,这些倡议旨在推动智慧製造、机器人技术和工业4.0的普及应用。这些政府支持的项目以及高水准的技术创新,使该地区成为先进製造和自动化发展的重要中心。

全球汽车喷涂机器人系统市场的主要参与者包括库卡(KUKA)、发那科(FANUC)、ABB、杜尔(Durr)、科茂(Comau)、川崎重工、史陶比尔机器人(Staubli Robotics)、安川电机和欧姆龙。这些领先企业正透过创新、合作和拓展技术能力来巩固其竞争地位。他们专注于研发,致力于推出更高精度、更高能源效率和更数位化整合的智慧机器人喷涂解决方案。与汽车製造商的合作,使得他们能够开发出满足特定生产需求的客製化自动化系统。此外,各公司也持续扩大产能和服务网络,以满足新兴市场日益增长的需求。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基准估算和计算

- 基准年计算

- 市场估算的关键趋势

- 初步研究和验证

- 原始资料

- 预报

- 研究假设和局限性

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 汽车客製化需求不断成长

- 大批量车辆生产要求

- 劳动成本削减压力

- 环境法规

- 机器人技术的进步

- 製造商的永续发展倡议

- 产业陷阱与挑战

- 高昂的初始投资成本

- 复杂的维护要求

- 市场机会

- 新兴市场的扩张

- 电动车产量成长

- 协作机器人开发

- 人工智慧与物联网的融合

- 成长驱动因素

- 成长潜力分析

- 专利分析

- 波特的分析

- PESTEL 分析

- 成本細項分析

- 技术格局

- 当前技术趋势

- 新兴技术

- 监管环境

- 价格趋势

- 按地区

- 由机器人

- 生产统计

- 生产中心

- 消费中心

- 进出口

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 投资和供应链分析

- 投资和融资趋势分析

- 供应链动态和原料影响

- 卓越营运、永续性和劳动力管理

- 品质标准和绩效基准

- 环境影响与永续发展倡议

- 劳动力影响和技能需求分析

- 培训和发展计划评估

- 供应商和风险管理

- 供应商评估标准与选择框架

- 风险评估和缓解策略

- 自动化对取得高规格合约的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新安装项目启动

- 扩张计划和资金

第五章:市场估算与预测:依机器人划分,2021-2034年

- 主要趋势

- 关节机器人

- 笛卡儿机器人

- Scara机器人

- 协作机器人

第六章:市场估算与预测:以年计算,2021-2034年

- 主要趋势

- 落地式机器人

- 壁挂式机器人

- 轨道式机器人

第七章:市场估计与预测:依有效载荷划分,2021-2034年

- 主要趋势

- 最多 5 公斤

- 5至10公斤

- 10至20公斤

- 体重超过20公斤

第八章:市场估算与预测:依自动化程度划分,2021-2034年

- 主要趋势

- 全自动

- 半自动

第九章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- OEM喷漆车间

- 一级供应商设施

- 售后市场和碰撞维修中心

- 特种车辆製造

第十章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 印尼

- 菲律宾

- 泰国

- 韩国

- 新加坡

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十一章:公司简介

- 全球参与者

- ABB

- Comau

- Denso

- Durr

- Epson Robots

- FANUC

- Kawasaki Heavy Industries

- KUKA

- Mitsubishi Electric

- Nachi-Fujikoshi

- Omron

- Panasonic

- Staubli Robotics

- Yaskawa Electric

- 区域玩家

11.2.1. 3M公司

- 斗山机器人

- 精英机器人

- 现代机器人

- 里斯机器人

- 优傲机器人

- 新兴参与者/颠覆者

- 弗兰卡·埃米卡

- 精确自动化

- 重新思考机器人技术

- 标准机器人

- 泰克曼机器人

The Global Automotive Paint Robot System Market was valued at USD 2.52 billion in 2024 and is estimated to grow at a CAGR of 5% to reach USD 4.07 billion by 2034.

The growing adoption of automation across automotive production facilities is driving this market, as manufacturers seek enhanced precision, uniformity, and sustainability in vehicle painting operations. Automotive paint robot systems, designed to automate body handling, coating, and finishing, have become essential to modern vehicle manufacturing lines. Rising global vehicle output, the accelerating transition toward electric vehicles, and increasing demand for customized finishes are major factors contributing to market expansion. Robotic painting offers consistent coating thickness, superior finish quality, and minimal material waste while ensuring faster cycle times and higher efficiency. These systems also support manufacturers' sustainability goals by reducing emissions and improving energy efficiency. Moreover, stricter environmental regulations, pressure to reduce operational costs, and the ongoing trend toward digital and green manufacturing are further fueling investments in automated paint shops. With robotic painting technology delivering repeatable results and eliminating inconsistencies associated with manual operations, automakers are prioritizing advanced paint robotics to achieve higher productivity and precision in every production stage.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.52 billion |

| Forecast Value | $4.07 billion |

| CAGR | 5% |

The articulated robots segment held 69% share in 2024 and is projected to grow at a CAGR of 5.26% from 2025 to 2034. This dominance is attributed to their versatility, extended reach, and ability to handle complex vehicle geometries with ease. These robots, equipped with multiple joints and typically six or more axes, provide smooth and precise motion like that of a human arm, making them ideal for automotive paint applications that demand accuracy and adaptability. Their capability to manage intricate painting angles and contours enhances the overall finish quality while maintaining efficiency on large-scale production lines.

The floor-mounted robots segment held a 55% share in 2024 and is expected to grow at a CAGR of 5.63% through 2034. Floor-mounted configurations remain the most adopted setup in manufacturing facilities due to their stability, ease of integration, and compatibility with existing production layouts. These robots are fixed directly onto pedestals or plant floors, providing a solid base for the robotic arm and paint applicator, which allows for precise control and steady operation during high-speed painting cycles. Their robust structure and adaptability make them an essential part of large automotive assembly lines.

Asia Pacific Automotive Paint Robot System Market held a 50% share and generated USD 1.25 billion in 2024. The region's strong position is supported by rapid industrialization, large-scale automotive manufacturing, and rising investment in automation technologies. Countries including China, Japan, South Korea, and India are leading this growth through strategic initiatives that promote smart manufacturing, robotics, and Industry 4.0 adoption. These government-backed programs and high levels of technological innovation have positioned the region as a major hub for advanced manufacturing and automation development.

Key players operating in the Global Automotive Paint Robot System Market include KUKA, FANUC, ABB, Durr, Comau, Kawasaki Heavy Industries, Staubli Robotics, Yaskawa Electric, and Omron. Leading companies in the Automotive Paint Robot System Market are strengthening their competitive position through innovation, collaboration, and expansion of technological capabilities. They are focusing on research and development to introduce intelligent robotic painting solutions with higher accuracy, energy efficiency, and digital integration. Partnerships with automotive manufacturers are enabling tailored automation systems designed to meet specific production requirements. Companies are also expanding their manufacturing capacity and service networks to cater to rising demand in emerging markets.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Robot

- 2.2.3 Mounting

- 2.2.4 Pay load

- 2.2.5 Automation level

- 2.2.6 End use

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future-outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factors affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for automotive customization

- 3.2.1.2 High-volume vehicle production requirements

- 3.2.1.3 Labor cost reduction pressures

- 3.2.1.4 Environmental regulations

- 3.2.1.5 Technological advancements in robotics

- 3.2.1.6 Sustainability initiatives by manufacturers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Complex maintenance requirements

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in emerging markets

- 3.2.3.2 Electric vehicle production growth

- 3.2.3.3 Collaborative robotics development

- 3.2.3.4 Integration of AI and IoT

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Patent analysis

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Cost breakdown analysis

- 3.8 Technology landscape

- 3.8.1 Current technological trends

- 3.8.2 Emerging technologies

- 3.9 Regulatory landscape

- 3.9.1 North America

- 3.9.2 Europe

- 3.9.3 Asia Pacific

- 3.9.4 Latin America

- 3.9.5 Middle East and Africa

- 3.10 Price trends

- 3.10.1 By region

- 3.10.2 By robot

- 3.11 Production statistics

- 3.11.1 Production hubs

- 3.11.2 Consumption hubs

- 3.11.3 Export and import

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

- 3.14 Investment and supply chain analysis

- 3.14.1 Investment and funding trends analysis

- 3.14.2 Supply chain dynamics and raw material impact

- 3.15 Operational excellence, sustainability, and workforce management

- 3.15.1 Quality standards and performance benchmarking

- 3.15.2 Environmental impact and sustainability initiatives

- 3.15.3 Workforce impact and skills requirements analysis

- 3.15.4 Training and development programs assessment

- 3.16 Vendor and risk management

- 3.16.1 Vendor evaluation criteria and selection framework

- 3.16.2 Risk assessment and mitigation strategies

- 3.17 Impact of Automation on Securing High-Specification Contracts

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New mounting launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Robot, 2021 - 2034 (USD Bn, Units)

- 5.1 Key trends

- 5.2 Articulated robots

- 5.3 Cartesian robots

- 5.4 Scara robots

- 5.5 Collaborative robots

Chapter 6 Market Estimates & Forecast, By Mounting, 2021 - 2034 (USD Bn, Units)

- 6.1 Key trends

- 6.2 Floor-mounted robots

- 6.3 Wall-mounted robots

- 6.4 Rail-mounted robots

Chapter 7 Market Estimates & Forecast, By Pay Load, 2021 - 2034 (USD Bn, Units)

- 7.1 Key trends

- 7.2 Up to 5 kg

- 7.3 5 to 10 kg

- 7.4 10 to 20 kg

- 7.5 Above 20 kg

Chapter 8 Market Estimates & Forecast, By Automation Level, 2021 - 2034 (USD Bn, Units)

- 8.1 Key trends

- 8.2 Fully automated

- 8.3 Semi-automated

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Bn, Units)

- 9.1 Key trends

- 9.2 OEM paint shops

- 9.3 Tier-1 supplier facilities

- 9.4 Aftermarket and collision repair centers

- 9.5 Specialty vehicle manufacturing

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 Indonesia

- 10.4.6 Philippines

- 10.4.7 Thailand

- 10.4.8 South Korea

- 10.4.9 Singapore

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 ABB

- 11.1.2 Comau

- 11.1.3 Denso

- 11.1.4 Durr

- 11.1.5 Epson Robots

- 11.1.6 FANUC

- 11.1.7 Kawasaki Heavy Industries

- 11.1.8 KUKA

- 11.1.9 Mitsubishi Electric

- 11.1.10 Nachi-Fujikoshi

- 11.1.11 Omron

- 11.1.12 Panasonic

- 11.1.13 Staubli Robotics

- 11.1.14 Yaskawa Electric

- 11.2 Regional Players

11.2.1. 3 M Company

- 11.2.2 Doosan Robotics

- 11.2.3 Elite Robots

- 11.2.4 Hyundai Robotics

- 11.2.5 Reis Robotics

- 11.2.6 Universal Robots

- 11.3 Emerging Players / Disruptors

- 11.3.1 Franka Emika

- 11.3.2 Precise Automation

- 11.3.3 Rethink Robotics

- 11.3.4 Standard Bots

- 11.3.5 Techman Robot