|

市场调查报告书

商品编码

1885836

汽车远端资讯处理服务市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Automotive Telematics Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

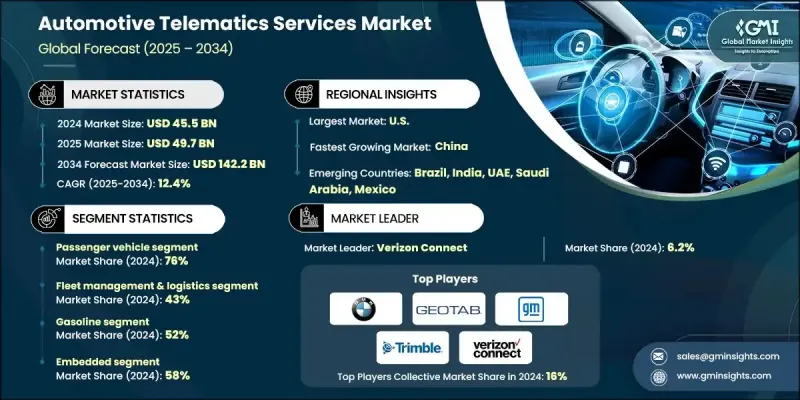

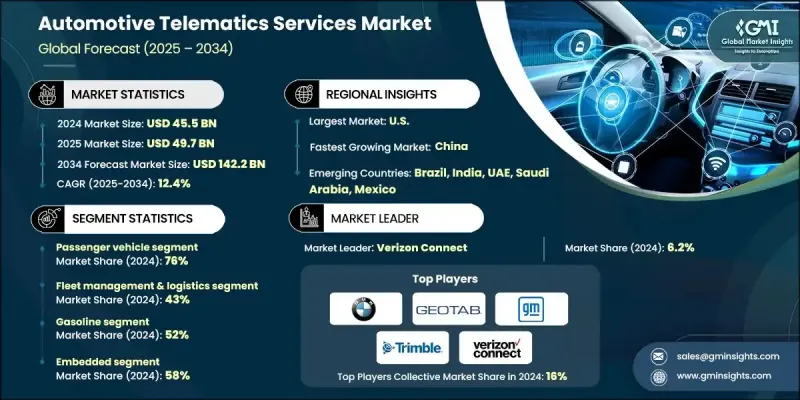

2024 年全球汽车远端资讯处理服务市场价值为 455 亿美元,预计到 2034 年将以 12.4% 的复合年增长率成长至 1,422 亿美元。

随着商业车队、出行运营商和运输服务提供商越来越多地依赖远端资讯处理技术来减少停机时间、优化路线、管理维护和控制燃油支出,远端资讯处理技术的应用正在加速发展。先进的诊断、预测性故障检测、自动服务警报和行为洞察等功能日益广泛地用于提升营运效率和实现强劲的投资回报,从而增强了对定期服务订阅的需求。汽车製造商正在将远端资讯处理功能嵌入到新的车辆平台中,以满足法规、远端监控需求和空中升级带来的安全、合规和互联要求。随着越来越多的车辆在出厂时就配备了远端资讯处理技术,基于订阅的服务正在迅速扩张。保险公司也高度依赖远端资讯处理资料来支援基于使用量的保险模式,对风险模式、里程和驾驶行为的即时洞察,为连网设备和资料平台创造了稳定的需求。随着商业客户和个人投保人转向基于行为的保险,远端资讯处理生态系统持续扩展,并巩固其长期收入基础。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 455亿美元 |

| 预测值 | 1422亿美元 |

| 复合年增长率 | 12.4% |

2024年,乘用车市占率达到76%,预计到2034年将以12.7%的复合年增长率成长。由车载资讯服务支援的嵌入式安全功能,包括碰撞警报、紧急回应通讯、防盗追踪和持续监控,已成为消费者购车的关键驱动因素。汽车製造商正在将互联繫统标准化应用于各种乘用车车型,以满足监管要求并增强用户信心。

2024年,车队管理和物流领域占据43%的市场份额,预计2025年至2034年间将以12%的复合年增长率成长。不断上涨的燃油成本和日益增加的营运费用正促使物流业者采用远端资讯处理工具,以追踪燃油效率、测量怠速时间并优化路线。数据驱动的洞察能够帮助车队降低营运成本、提高利用率并提升生产力,从而使远端资讯处理成为竞争激烈的运输营运中的关键技术。

美国汽车远端资讯处理服务市场占据86%的市场份额,预计到2024年将创造155亿美元的收入。由于安全系统、排放监管、电子日誌记录和车辆诊断等方面的监管要求,该技术的应用正在快速发展。联邦和州政府的合规压力持续推动全国各地的製造商和车队营运商部署先进的互联平台。

全球汽车远端资讯处理服务市场的主要公司包括宝马、通用汽车、博世、大陆集团、Geotab、Verizon Connect、Ituran、采埃孚、Trimble 和 Samsara。这些公司正透过扩展云端平台、改进人工智慧驱动的分析以及为车队和消费者建立统一的仪表板来巩固其竞争地位。他们还与汽车製造商、保险公司和旅游服务提供者建立策略合作伙伴关係,将资料丰富的远端资讯处理功能整合到更广泛的生态系统中。网路安全、预测性维护能力和即时监控工具的投资,为终端用户提供了更强大的价值主张。各公司正在扩展订阅模式、增强空中下载更新系统,并开发适用于不同车型细分市场的模组化远端资讯处理单元。这些策略有助于公司增加经常性收入、提高客户留存率,并在互联汽车领域保持长期竞争力。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基准估算和计算

- 基准年计算

- 市场估算的关键趋势

- 初步研究和验证

- 原始资料

- 预测模型

- 研究假设和局限性

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 互联汽车和软体定义汽车的普及率不断提高

- 扩展基于使用量的保险(UBI)和数据驱动的风险模型

- 商业车队和物流数位化快速成长

- 4G/5G 连线和云端平台的进步

- 产业陷阱与挑战

- 资料隐私、网路安全风险和监管合规性

- 标准碎片化和互通性问题

- 新兴市场安装和订阅成本高昂

- 农村和偏远地区的网路可用性不稳定

- 市场机会

- 电动车和智慧充电生态系统的发展

- 视讯远端资讯处理和人工智慧驱动的安全分析的扩展

- 出行即服务(MaaS)平台的兴起

- 售后远端资讯处理、改装和定制

- 成长驱动因素

- 成长潜力分析

- 主要市场趋势和颠覆性因素

- 未来市场趋势

- 监管环境

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 目前技术

- 具有整合连接功能的高阶远端资讯处理控制单元 (TCU)

- 即时车辆追踪与GPS/GNSS定位系统

- 基于云端的车队管理平台

- 支援嵌入式 SIM/eSIM 的车载连接

- 新兴技术

- 利用人工智慧进行驾驶员行为和车辆健康预测分析

- 用于低延迟远端资料处理的边缘运算

- 支援5G的V2X(车联网)通讯架构

- 用于车队优化和远端诊断的数位孪生模型

- 目前技术

- 专利分析

- 生产统计

- 生产中心

- 消费中心

- 进出口

- 价格趋势

- 按地区

- 透过推进

- 成本細項分析

- 软体和平台开发成本

- 硬体、整合和处理成本

- 品质控制、测试和合规成本

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 宏观与微观经济分析

- 宏观经济分析

- 影响车载资讯系统普及的全球经济因素

- 产业特定经济驱动因素

- 区域经济分析

- 贸易政策和关税的影响

- 微观经济分析

- 组件级成本结构

- 软体及平台成本分析

- 连接和订阅成本结构

- 安装和整合成本

- 定价模型和收入结构

- 总拥有成本分析

- 宏观经济分析

- 产品生命週期分析

- 技术生命週期阶段

- 平均产品生命週期

- 技术更新与升级週期

- 生命末期管理

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估算与预测:依服务类型划分,2021-2034年

- 主要趋势

- 车队管理与物流

- 按使用量计费的保险

- 车辆追踪与监控

- 远端诊断和维护

- 安全与应急

- 资讯娱乐和导航

- 其他的

第六章:市场估算与预测:以推进方式划分,2021-2034年

- 汽油

- 柴油引擎

- 纯电动车

- 插电式混合动力汽车

- 戊型肝炎病毒

第七章:市场估计与预测:依技术划分,2021-2034年

- 主要趋势

- 车辆互联繫统

- 车载诊断

- 车载电子记录仪

- 合作资讯科技服务

- 基于智慧型手机的远端资讯处理

- 其他的

第八章:市场估算与预测:以连结方式划分,2021-2034年

- 主要趋势

- 嵌入式

- 融合的

- 繫绳

第九章:市场估价与预测:依车辆类型划分,2021-2034年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- SUV

- 商用车辆

- 轻型

- 中型

- 重负

第十章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 新加坡

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十一章:公司简介

- 全球参与者

- CalAmp

- Geotab

- Masternaut

- Microlise

- Omnitracs

- Spireon

- Teletrac Navman

- Trimble

- Verizon Connect

- Webfleet Solutions

- BMW

- Bosch

- Continental

- GM

- Ituran

- ZF

- 区域玩家

- Azuga

- Cartrack

- Ctrack

- MiX Telematics

- Octo Telematics

- Platform Science

- Quartix Technologies

- Trakm8

- 新兴参与者

- Bouncie

- Fleetio

- Lytx

- Mojio

- Motive

- Nauto

- Netradyne

- Samsara

- SmartDrive Systems

- Zubie

The Global Automotive Telematics Services Market was valued at USD 45.5 billion in 2024 and is estimated to grow at a CAGR of 12.4% to reach USD 142.2 billion by 2034.

Adoption continues to accelerate as commercial fleets, mobility operators, and transportation providers rely on telematics to reduce downtime, optimize routes, manage maintenance, and control fuel spending. Advanced diagnostics, predictive fault detection, automated service alerts, and behavioral insights are increasingly used to boost operational efficiency and unlock strong returns on investment, which strengthens demand for recurring service subscriptions. Automakers are embedding telematics capabilities into new vehicle platforms to meet safety, compliance, and connectivity requirements driven by regulations, remote monitoring needs, and over-the-air updates. With more vehicles equipped at the factory, subscription-based services are expanding rapidly. Insurers are also relying heavily on telematics data to support usage-based insurance models, with real-time insights on risk patterns, mileage, and driving behavior creating steady demand for connected devices and data platforms. As both commercial clients and individual policyholders shift to behavior-driven coverage, the telematics ecosystem continues to expand and reinforce its long-term revenue base.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $45.5 Billion |

| Forecast Value | $142.2 Billion |

| CAGR | 12.4% |

The passenger vehicle segment held a 76% share in 2024 and is forecast to grow at a CAGR of 12.7% through 2034. Embedded safety features supported by telematics, including crash alerts, emergency response communication, theft tracking, and continuous monitoring, have become key purchase incentives for consumers. Automakers are standardizing connected systems across a wide range of passenger models as part of broader efforts to meet regulatory expectations and enhance user confidence.

The fleet management and logistics segment held a 43% share in 2024 and is projected to grow at a CAGR of 12% between 2025 and 2034. Rising fuel expenses and higher operational overheads are pushing logistics operators to adopt telematics tools that track fuel efficiency, measure idle durations, and optimize routing. Data-driven insights enable fleets to lower operating costs, streamline utilization, and improve productivity, establishing telematics as a critical technology within competitive transportation operations.

US Automotive Telematics Services Market held an 86% share and generated USD 15.5 billion in 2024. Adoption is advancing quickly due to regulatory requirements related to safety systems, emissions oversight, electronic logging, and vehicle diagnostics. Federal and state compliance pressures continue to accelerate the rollout of advanced connected platforms among manufacturers and fleet operators across the country.

Major companies in the Global Automotive Telematics Services Market include BMW, GM, Bosch, Continental, Geotab, Verizon Connect, Ituran, ZF, Trimble, and Samsara. Companies in the Automotive Telematics Services Market are strengthening their competitive positions by expanding cloud-based platforms, improving AI-driven analytics, and building unified dashboards for fleets and consumers. They are also forming strategic partnerships with automakers, insurers, and mobility service providers to integrate data-rich telematics functions into broader ecosystems. Investments in cybersecurity, predictive maintenance capabilities, and real-time monitoring tools support stronger value propositions for end users. Firms are scaling subscription models, enhancing over-the-air update systems, and developing modular telematics units that fit diverse vehicle segments. These strategies help companies boost recurring revenue streams, improve customer retention, and maintain long-term relevance in the connected vehicle landscape.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Service

- 2.2.3 Propulsion

- 2.2.4 Technology

- 2.2.5 Connectivity

- 2.2.6 Vehicle

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook

- 2.6 Strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of connected and software-defined vehicles

- 3.2.1.2 Expansion of usage-based insurance (UBI) and data-driven risk models

- 3.2.1.3 Rapid growth of commercial fleets and logistics digitization

- 3.2.1.4 Advancements in 4G/5G connectivity and cloud platforms

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Data privacy, cybersecurity risks & regulatory compliance

- 3.2.2.2 Fragmented standards & interoperability issues

- 3.2.2.3 High installation and subscription costs in emerging markets

- 3.2.2.4 Inconsistent network availability in rural and remote areas

- 3.2.3 Market opportunities

- 3.2.3.1 Growth of electric vehicles and smart charging ecosystems

- 3.2.3.2 Expansion of video telematics and AI-driven safety analytics

- 3.2.3.3 Emergence of mobility-as-a-service (MaaS) platforms

- 3.2.3.4 Aftermarket telematics, retrofits & customization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Major market trends and disruptions

- 3.5 Future market trends

- 3.6 Regulatory landscape

- 3.6.1 North America

- 3.6.2 Europe

- 3.6.3 Asia Pacific

- 3.6.4 Latin America

- 3.6.5 MEA

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Technology and innovation landscape

- 3.9.1 Current Technologies

- 3.9.1.1 Advanced telematics control units (TCUs) with integrated connectivity

- 3.9.1.2 Real-time vehicle tracking & GPS/GNSS positioning systems

- 3.9.1.3 Cloud-based fleet management platforms

- 3.9.1.4 Embedded SIM/eSIM-enabled in-vehicle connectivity

- 3.9.2 Emerging Technologies

- 3.9.2.1 AI-powered predictive analytics for driver behavior & vehicle health

- 3.9.2.2 Edge computing for low-latency telematics data processing

- 3.9.2.3 5G-enabled V2X (Vehicle-to-Everything) communication architectures

- 3.9.2.4 Digital twin models for fleet optimization & remote diagnostics

- 3.9.1 Current Technologies

- 3.10 Patent analysis

- 3.11 Production statistics

- 3.11.1 Production hubs

- 3.11.2 Consumption hubs

- 3.11.3 Export and import

- 3.12 Price trends

- 3.12.1 By region

- 3.12.2 By propulsion

- 3.13 Cost breakdown analysis

- 3.13.1 Software & platform development costs

- 3.13.2 Hardware, integration & processing costs

- 3.13.3 Quality control, testing & compliance costs

- 3.14 Sustainability and environmental aspects

- 3.14.1 Sustainable practices

- 3.14.2 Waste reduction strategies

- 3.14.3 Energy efficiency in production

- 3.14.4 Eco-friendly initiatives

- 3.14.5 Carbon footprint considerations

- 3.15 Macro & micro economic analysis

- 3.15.1 Macro-economic analysis

- 3.15.1.1 Global economic factors impacting telematics adoption

- 3.15.1.2 Industry-specific economic drivers

- 3.15.1.3 Regional economic analysis

- 3.15.1.4 Trade policy & tariff impact

- 3.15.2 Micro-economic analysis

- 3.15.2.1 Component-level cost structure

- 3.15.2.2 Software & platform cost analysis

- 3.15.2.3 Connectivity & subscription cost structure

- 3.15.2.4 Installation & integration costs

- 3.15.2.5 Pricing models & revenue structures

- 3.15.2.6 Total cost of ownership analysis

- 3.15.1 Macro-economic analysis

- 3.16 Product lifecycle analysis

- 3.16.1 Technology lifecycle stages

- 3.16.2 Average product lifecycle duration

- 3.16.3 Technology refresh & upgrade cycles

- 3.16.4 End-of-life management

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Service, 2021 - 2034 ($Bn, Fleet Size)

- 5.1 Key trends

- 5.2 Fleet management & logistics

- 5.3 Usage-based insurance

- 5.4 Vehicle tracking & monitoring

- 5.5 Remote diagnostics & maintenance

- 5.6 Safety & emergency

- 5.7 Infotainment & navigation

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Fleet Size)

- 6.1 Gasoline

- 6.2 Diesel

- 6.3 BEV

- 6.4 PHEV

- 6.5 HEV

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Fleet Size)

- 7.1 Key trends

- 7.2 Vehicle connectivity systems

- 7.3 On-board diagnostics

- 7.4 Electronic onboard recorders

- 7.5 Cooperative ITS

- 7.6 Smartphone-based telematics

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Connectivity, 2021 - 2034 ($Bn, Fleet Size)

- 8.1 Key trends

- 8.2 Embedded

- 8.3 Integrated

- 8.4 Tethered

Chapter 9 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Fleet Size)

- 9.1 Key trends

- 9.2 Passenger cars

- 9.2.1 Hatchback

- 9.2.2 Sedan

- 9.2.3 SUV

- 9.3 Commercial vehicles

- 9.3.1 Light duty

- 9.3.2 Medium duty

- 9.3.3 Heavy duty

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 ($Bn, Fleet Size)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Singapore

- 10.4.7 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global players

- 11.1.1 CalAmp

- 11.1.2 Geotab

- 11.1.3 Masternaut

- 11.1.4 Microlise

- 11.1.5 Omnitracs

- 11.1.6 Spireon

- 11.1.7 Teletrac Navman

- 11.1.8 Trimble

- 11.1.9 Verizon Connect

- 11.1.10 Webfleet Solutions

- 11.1.11 BMW

- 11.1.12 Bosch

- 11.1.13 Continental

- 11.1.14 GM

- 11.1.15 Ituran

- 11.1.16 ZF

- 11.2 Regional players

- 11.2.1 Azuga

- 11.2.2 Cartrack

- 11.2.3 Ctrack

- 11.2.4 MiX Telematics

- 11.2.5 Octo Telematics

- 11.2.6 Platform Science

- 11.2.7 Quartix Technologies

- 11.2.8 Trakm8

- 11.3 Emerging Players

- 11.3.1 Bouncie

- 11.3.2 Fleetio

- 11.3.3 Lytx

- 11.3.4 Mojio

- 11.3.5 Motive

- 11.3.6 Nauto

- 11.3.7 Netradyne

- 11.3.8 Samsara

- 11.3.9 SmartDrive Systems

- 11.3.10 Zubie