|

市场调查报告书

商品编码

1892692

电动巴士系统市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Electric Bus System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

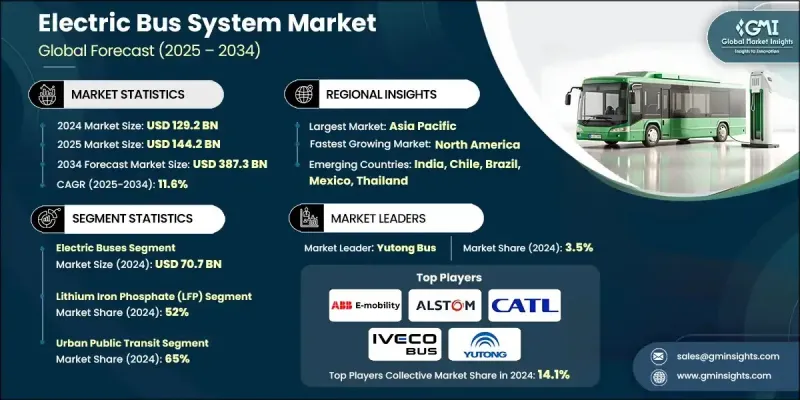

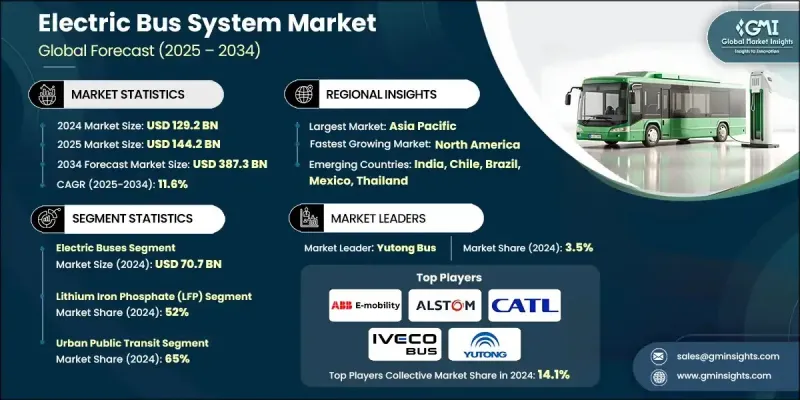

2024 年全球电动巴士系统市场价值为 1,292 亿美元,预计到 2034 年将以 11.6% 的复合年增长率成长至 3,873 亿美元。

全球政府大力推广零排放公共交通的措施推动了市场成长。诸如拨款、税收优惠和补贴等政策鼓励地方政府和公车机构将现有车队升级为电动公车,同时扩大必要的充电基础设施。锂离子电池成本的下降和能量密度的提高降低了车辆运营成本并增加了续航里程,使电动公车能够更有效地与柴油公车竞争。城市化、永续发展目标和空气品质改善措施推动了公车走廊、快速公车系统 (BRT) 和车辆段基础设施的电气化发展。协调一致的部署策略有助于公车部门在实现环境目标的同时最大限度地提高效率,从而进一步促进市场扩张。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1292亿美元 |

| 预测值 | 3873亿美元 |

| 复合年增长率 | 11.6% |

2024年,电动巴士市场规模达到707亿美元,预计2025年至2034年将以9.7%的复合年增长率成长。电池成本下降、续航里程延长以及政府激励措施是推动纯电动巴士广泛普及的主要因素。公车机构正日益重视车队电气化,这需要更大容量的电池以及与智慧电网系统的集成,以实现快速充电。

2024年,磷酸铁锂(LFP)电池市占率达到52%,预计2025年至2034年将以12.7%的复合年增长率成长。 LFP电池因其循环寿命长、热稳定性好和成本效益高等优点而备受青睐。许多製造商,尤其是在亚洲和欧洲,正在为包括标准型和铰接式公车在内的所有类型公车配备LFP电池。诸如电芯到电池包(CTP)结构等创新技术提高了能量密度、安全性和循环寿命,使其成为大规模公共交通运营的理想选择。

到2034年,美国电动巴士系统市占率将成长至86%。包括两党基础设施法案和低排放/零排放巴士计划在内的联邦项目正在加速车队转型。随着公车机构投资于车辆段升级、员工培训和新型电动巴士,美国製造商也受惠于「购买美国货」条款,从而加强了电池、充电器和电力电子产品的国内供应链。

目录

第一章:方法论

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 政府车队电气化强制令

- 电池成本下降和能量密度提高

- 城市交通电气化计画的扩展

- 燃料电池公车氢基础设施的发展

- OEM及技术创新

- 产业陷阱与挑战

- 高昂的前期车辆和基础设施成本

- 电网容量和基础设施限制

- 市场机会

- 智慧充电与能源管理的集成

- 电池二次利用和回收计划

- 拓展至城际及长途客车服务

- 公私部门合作与国际融资

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 目前技术

- 新兴技术

- 专利分析

- 定价分析

- 按地区

- 副产品

- 成本細項分析

- 电池供应链脆弱性与矿物来源

- 全球电池供应链结构

- 关键矿物依赖性

- 供应链中断情景

- 供应链缓解策略

- 物流和交货时间

- 总拥有成本 (TCO) 建模和融资机制

- TCO框架及方法论

- 总拥有成本比较:电动巴士与柴油/CNG巴士

- 电池组成本走势

- 充电基础设施经济学

- 融资机制与资本结构

- 充电基础设施部署的经济性和互通性

- 按收费策略分類的基础建设投资需求

- 併网及公用事业费用

- 充电互通性挑战

- 智慧充电与负载管理经济性

- 充电网路商业模式

- 电池衰减、保固管理和生命週期经济学

- 实际效能退化资料及表现

- 电池保固结构及条款

- 电池更换经济学

- 客户采纳障碍与采购模式创新

- 技术采纳障碍

- 经济性采纳障碍

- 组织和营运障碍

- 基础设施和电网障碍

- 采购模式创新以克服障碍

- 风险缓解策略

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 重要新闻和倡议

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估算与预测:依组件划分,2021-2034年

- 电动巴士

- 电池电动巴士(BEB)

- 插电式混合动力电动巴士(PHEV)

- 燃料电池电动巴士(FCEB)

- 无轨电车

- 充电方式

- 充电站充电

- 机会收费

- 受电弓充电

- 能源供应与电网整合

- 车队及营运管理

- 维护与支援系统

第六章:市场估计与预测:依电池化学类型划分,2021-2034年

- 磷酸铁锂(LFP)

- 镍锰钴(NMC)

- 镍钴铝(NCA)

- 钛酸锂(LTO)

- 固态电池

- 其他的

第七章:市场估计与预测:依应用领域划分,2021-2034年

- 城市大众运输

- 城际和区域交通

- 校园及机场接驳车

- 企业及工业接驳车

- 其他的

第八章:市场估算与预测:依地区划分,2021-2034年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧

- 荷兰

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳新银行

- 新加坡

- 泰国

- 越南

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- 全球参与者

- ABB E-Mobility

- Alstom

- BYD Company

- CATL (Contemporary Amperex Technology)

- Daimler Buses (Mercedes-Benz / Thomas Built Buses)

- IVECO Bus

- NFI Group (New Flyer Industries)

- Proterra

- Scania (TRATON)

- Siemens Smart Infrastructure

- Volvo Buses (Volvo)

- Yutong Bus

- 区域玩家

- Blue Bird

- Gillig

- Karsan

- King Long United Automotive Industry

- Lion Electric Company

- Motor Coach Industries (MCI)

- Solaris Bus & Coach

- Tata Motors

- VDL Bus & Coach

- Zhongtong Bus

- 新兴参与者和颠覆者

- Arrival

- CaetanoBus

- Ebusco

- Forsee Power

- GreenPower Motor Company

- Lightning eMotors

- Microvast

- Phoenix Motor

- RIDE

- Vicinity Motor

The Global Electric Bus System Market was valued at USD 129.2 billion in 2024 and is estimated to grow at a CAGR of 11.6% to reach USD 387.3 billion by 2034.

The market growth is driven by global government initiatives promoting zero-emission public transit. Policies such as grants, tax incentives, and subsidies are encouraging local governments and transit agencies to upgrade their existing fleets to electric buses while expanding the necessary charging infrastructure. Falling lithium-ion battery costs and improved energy density are reducing vehicle expenses and increasing operational range, allowing electric buses to compete more effectively with diesel alternatives. The growing trend toward electrified bus corridors, bus rapid transit (BRT) systems, and depot infrastructure is fueled by urbanization, sustainability goals, and air quality initiatives. Coordinated deployment strategies help transit authorities maximize efficiency while meeting environmental targets, further supporting market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $129.2 Billion |

| Forecast Value | $387.3 Billion |

| CAGR | 11.6% |

The electric buses segment generated USD 70.7 billion in 2024 and is expected to grow at a CAGR of 9.7% from 2025 to 2034. The widespread adoption of battery-electric buses is being driven by declining battery costs, extended driving ranges, and government incentives. Transit agencies are increasingly focusing on fleet electrification, which necessitates higher-capacity batteries and integration with smart grid systems for rapid charging.

The lithium iron phosphate (LFP) batteries segment held a 52% share in 2024 and is projected to grow at a CAGR of 12.7% from 2025 to 2034. LFP batteries are favored for their long lifecycle, thermal stability, and cost efficiency. Many manufacturers, especially in Asia and Europe, are equipping all bus types, including standard and articulated models, with LFP batteries. Innovations such as cell-to-pack (CTP) structures enhance energy density, safety, and lifecycle performance, making them ideal for large-scale transit operations.

U.S. Electric Bus System Market will grow at an 86% share by 2034. Federal programs, including the Bipartisan Infrastructure Law and Low-No Emission Bus Program, are accelerating fleet transitions. As transit agencies invest in depot upgrades, workforce training, and new electric buses, U.S. manufacturers benefit from the "Buy America" provisions, strengthening domestic supply chains for batteries, chargers, and power electronics.

Key players in the Global Electric Bus System Market include ABB E-Mobility, Alstom, CATL, Forsee Power, IVECO Bus, NFI, RIDE, Siemens Smart Infrastructure, Solaris Bus & Coach, and Yutong Bus. Companies in the Global Electric Bus System Market are employing several strategies to reinforce their market position. They are investing heavily in R&D to enhance battery efficiency, increase vehicle range, and integrate smart charging solutions. Strategic partnerships with local transit authorities and global suppliers enable faster deployment of electric fleets and infrastructure. Manufacturers are focusing on modular and scalable designs to accommodate various city sizes and route requirements. Expansion into emerging markets and establishing regional production facilities reduces costs and improves delivery timelines. Companies are also leveraging government incentives and aligning with sustainability goals to strengthen brand credibility, while advanced maintenance and service programs ensure long-term operational efficiency and customer retention.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Component

- 2.2.2 Battery Chemistry

- 2.2.3 Application

- 2.2.4 Region

- 2.3 TAM Analysis, 2026-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Government fleet electrification mandates

- 3.2.1.2 Falling battery costs & improved energy density

- 3.2.1.3 Expansion of urban transit electrification programs

- 3.2.1.4 Growth of hydrogen infrastructure for fuel cell buses

- 3.2.1.5 OEM & technology innovations

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High upfront vehicle & infrastructure costs

- 3.2.2.2 Grid capacity & infrastructure limitations

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of smart charging & energy management

- 3.2.3.2 Battery second-life & recycling programs

- 3.2.3.3 Expansion into intercity & coach services

- 3.2.3.4 Public-private partnerships & international funding

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle east and Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technology

- 3.7.2 Emerging technology

- 3.8 Patent analysis

- 3.9 Pricing analysis

- 3.9.1 By region

- 3.9.2 By product

- 3.10 Cost breakdown analysis

- 3.11 Battery supply chain vulnerabilities & mineral sourcing

- 3.11.1 Global battery cell supply chain structure

- 3.11.2 Critical mineral dependencies

- 3.11.3 Supply chain disruption scenarios

- 3.11.4 Supply chain mitigation strategies

- 3.11.5 Logistics & lead times

- 3.12 Total cost of ownership (tco) modeling & financing mechanisms

- 3.12.1 Tco framework & methodology

- 3.12.2 Tco comparison: electric vs diesel/cng buses

- 3.12.3 Battery pack cost trajectory

- 3.12.4 Charging infrastructure economics

- 3.12.5 Financing mechanisms & capital structures

- 3.13 Charging infrastructure deployment economics & interoperability

- 3.13.1 Infrastructure investment requirements by charging strategy

- 3.13.2 Grid connection & utility costs

- 3.13.3 Charging interoperability challenges

- 3.13.4 Smart charging & load management economics

- 3.13.5 Charging network business models

- 3.14 Battery degradation, warranty management & lifecycle economics

- 3.14.1 Real-world degradation data & performance

- 3.14.2 Battery warranty structures & terms

- 3.14.3 Battery replacement economics

- 3.15 Customer adoption barriers & procurement model innovation

- 3.15.1 Technical adoption barriers

- 3.15.2 Economic adoption barriers

- 3.15.3 Organizational & operational barriers

- 3.15.4 Infrastructure & grid barriers

- 3.15.5 Procurement model innovations to overcome barriers

- 3.15.6 Risk mitigation strategies

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key news and initiatives

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Electric Buses

- 5.2.1 Battery Electric Buses (BEBs)

- 5.2.2 Plug-in Hybrid Electric Buses (PHEVs)

- 5.2.3 Fuel Cell Electric Buses (FCEBs)

- 5.2.4 Trolleybuses

- 5.3 Charging Method

- 5.3.1 Depot Charging

- 5.3.2 Opportunity Charging

- 5.3.3 Pantograph Charging

- 5.4 Energy Supply & Grid Integration

- 5.5 Fleet & Operations Management

- 5.6 Maintenance & Support System

Chapter 6 Market Estimates & Forecast, By Battery Chemistry, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Lithium Iron Phosphate (LFP)

- 6.3 Nickel Manganese Cobalt (NMC)

- 6.4 Nickel Cobalt Aluminum (NCA)

- 6.5 Lithium Titanate (LTO)

- 6.6 Solid-State Batteries

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Urban Public Transit

- 7.3 Intercity & Regional Transport

- 7.4 Campus & Airport Shuttles

- 7.5 Corporate & Industrial Shuttles

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 US

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Nordics

- 8.3.7 Netherlands

- 8.3.8 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 ANZ

- 8.4.5 Singapore

- 8.4.6 Thailand

- 8.4.7 Vietnam

- 8.4.8 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Global Players

- 9.1.1 ABB E-Mobility

- 9.1.2 Alstom

- 9.1.3 BYD Company

- 9.1.4 CATL (Contemporary Amperex Technology)

- 9.1.5 Daimler Buses (Mercedes-Benz / Thomas Built Buses)

- 9.1.6 IVECO Bus

- 9.1.7 NFI Group (New Flyer Industries)

- 9.1.8 Proterra

- 9.1.9 Scania (TRATON)

- 9.1.10 Siemens Smart Infrastructure

- 9.1.11 Volvo Buses (Volvo)

- 9.1.12 Yutong Bus

- 9.2 Regional Players

- 9.2.1 Blue Bird

- 9.2.2 Gillig

- 9.2.3 Karsan

- 9.2.4 King Long United Automotive Industry

- 9.2.5 Lion Electric Company

- 9.2.6 Motor Coach Industries (MCI)

- 9.2.7 Solaris Bus & Coach

- 9.2.8 Tata Motors

- 9.2.9 VDL Bus & Coach

- 9.2.10 Zhongtong Bus

- 9.3 Emerging players and disruptors

- 9.3.1 Arrival

- 9.3.2 CaetanoBus

- 9.3.3 Ebusco

- 9.3.4 Forsee Power

- 9.3.5 GreenPower Motor Company

- 9.3.6 Lightning eMotors

- 9.3.7 Microvast

- 9.3.8 Phoenix Motor

- 9.3.9 RIDE

- 9.3.10 Vicinity Motor