|

市场调查报告书

商品编码

1913380

烘焙设备市场:市场机会、成长驱动因素、产业趋势分析及预测(2026-2035)Bakery Processing Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

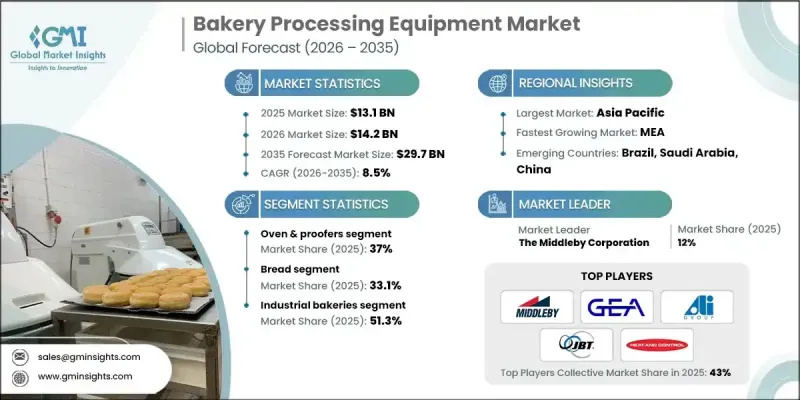

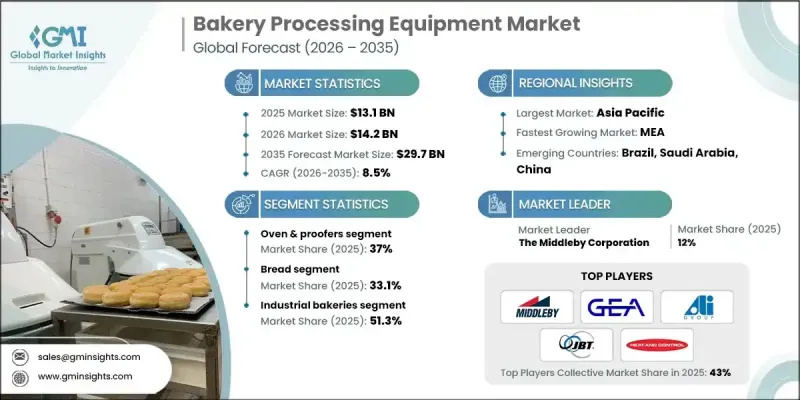

全球烘焙设备市场预计到 2025 年将达到 131 亿美元,到 2035 年将达到 297 亿美元,年复合成长率为 8.5%。

市场成长的驱动力在于整个麵包製作流程中自动化程度的加速提升,越来越多的公司致力于提高效率、减少劳动力依赖并维持统一的产品标准。自动化系统的广泛应用优化了端到端的生产流程,帮助烘焙师在满足不断增长的生产需求的同时,有效控制了营运成本。消费者对差异化、客製化烘焙产品的需求日益增长,也影响着设备的采购决策,促使企业投资于能够适应频繁产品变更而不影响生产效率的灵活型机器。同时,人们对食品安全和卫生标准的日益重视也影响着设备的设计重点。烘焙师更加重视能够支援卫生管理、降低污染风险并符合不断变化的监管要求的机器。设备供应商也积极回应,推出兼顾清洁性、耐用性和合规性的设计,进一步强调了品质保证在现代烘焙环境中的重要性。这些趋势共同作用,使麵包製作设备成为实现扩充性、合规性和满足消费者需求的关键基础。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测期 | 2026-2035 |

| 初始市场规模 | 131亿美元 |

| 市场规模预测 | 297亿美元 |

| 复合年增长率 | 8.5% |

预计到2025年,商用烘焙领域将占据51.3%的市场。该领域高度依赖大型高性能设备,以支援连续生产,同时确保大批量产品的品质稳定。该领域的需求将继续集中在能够提高精度、减少人工劳动并有助于实现成本效益型大规模生产的解决方案上。

2023年,醒发箱市占率比37%。此细分市场在控制烘焙和醒发条件方面发挥核心作用,这些条件直接影响产品的均匀性、结构和整体品质。此类设备因其能够维持稳定的加工环境,从而确保可靠的生产效果而备受青睐。

预计到2025年,欧洲烘焙设备市场规模将达到39亿美元,这主要得益于强大的创新能力、严格的品质标准以及对永续发展的永续性重视。该地区的製造商在继续优先考虑先进工程技术、能源效率和环保生产实践的同时,也始终遵守法规结构并满足不断变化的消费者期望。

目录

第一章:分析方法和范围

第二章执行摘要

第三章业界考察

- 产业生态系分析

- 供应商情况

- 利润率

- 每个阶段的附加价值

- 影响价值链的因素

- 中断

- 产业影响因素

- 司机

- 提高自动化程度以弥补烘焙行业的人手不足

- 冷冻和包装烘焙产品成长

- 注重食品安全和产品一致性

- 产业潜在风险与挑战

- 小规模麵包店初始资本投资成本高

- 现有设施的空间和公用设施限制

- 市场机会

- 零售连锁店和店内烘焙坊的扩张

- 洁净标示、无麸质和特色产品趋势

- 司机

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特五力分析

- PESTEL 分析

- 价格趋势

- 按地区

- 依产品类型

- 未来市场趋势

- 科技与创新趋势

- 当前技术趋势

- 新兴技术

- 专利状态

- 贸易统计(HS编码)

(註:贸易统计数据仅涵盖主要国家。)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续努力

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 考虑到碳足迹

第四章 竞争情势

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 企业矩阵分析

- 主要企业的竞争分析

- 竞争定位矩阵

- 主要趋势

- 企业合併(M&A)

- 商业伙伴关係与合作

- 新产品发布

- 业务拓展计划

第五章 依产品类型分類的市场估算与预测(2022-2035 年)

- 烤箱醒发箱

- 混合器

- 体重低于250公斤

- 250~500 kg

- 500~1,000 kg

- 1,000~1,500 kg

- 1500公斤或以上

- 切片机

- 体重低于100公斤

- 100-150 kg

- 150~250 kg

- 250~350 kg

- 350公斤或以上

- 片状成型机/模具成型机

- 500~1,000 kg

- 1,000~1,500 kg

- 1500公斤或以上

- 其他的

第六章 按应用领域分類的市场估算与预测(2022-2035 年)

- 麵包

- 糕点

- 披萨

- 可颂麵包

- 扁麵包

- 派饼/乳酪馅饼

- 饼干

- 玉米饼

7. 依最终用途分類的市场估计与预测(2022-2035 年)

- 商用麵包店

- 手工麵包店

- 零售麵包店

- 其他的

第八章 各地区市场估算与预测(2022-2035 年)

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 其他欧洲

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿拉伯聯合大公国

- 其他中东和非洲地区

第九章:公司简介

- The Middleby Corporation

- GEA Group

- ALI Group SRL A Socio Unico

- John Bean Technologies Corporation

- Markel Ventures Inc.

- Heat and Control, Inc.

- Rheon Automatic Machinery Co., Ltd.

- Fritsch Group

- Baker Perkins Ltd.

- Gemini Bakery Equipment Company

The Global Bakery Processing Equipment Market was valued at USD 13.1 billion in 2025 and is estimated to grow at a CAGR of 8.5% to reach USD 29.7 billion by 2035.

Market momentum is driven by the accelerating shift toward automation across bakery operations, as businesses focus on improving efficiency, lowering workforce dependency, and maintaining uniform product standards. Automated systems are increasingly being adopted to optimize end-to-end production workflows, helping bakeries meet rising output requirements while controlling operational expenses. Growing consumer demand for differentiated and made-to-order bakery offerings is also influencing equipment purchasing decisions, encouraging investment in adaptable machinery capable of handling frequent product changes without affecting throughput. In parallel, heightened attention to food safety and hygiene standards is shaping equipment design priorities. Bakeries place greater emphasis on machinery that supports sanitation, reduces contamination risk, and aligns with evolving regulatory expectations. Equipment suppliers are responding by introducing designs that support cleanliness, durability, and compliance, reinforcing the importance of quality assurance in modern bakery environments. These combined trends continue to position bakery processing equipment as a critical enabler of scalable, compliant, and consumer-responsive production.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $13.1 Billion |

| Forecast Value | $29.7 Billion |

| CAGR | 8.5% |

The industrial bakeries segment accounted for 51.3% share in 2025. This segment relies heavily on large-scale, high-performance equipment to support continuous production while ensuring consistent quality across large volumes. Demand from this segment remains focused on solutions that improve precision, reduce manual intervention, and support cost-efficient mass production.

The ovens and proofers category represented 37% share in 2023. This segment plays a central role in controlling baking and fermentation conditions, which directly influences product consistency, structure, and overall quality. Equipment in this category is valued for its ability to maintain stable processing environments that support reliable production outcomes.

Europe Bakery Processing Equipment Market reached USD 3.9 billion in 2025, supported by strong innovation capabilities, rigorous quality benchmarks, and a growing focus on sustainability. Regional manufacturers continue to prioritize advanced engineering, energy efficiency, and environmentally responsible production practices, aligning with regulatory frameworks and evolving consumer expectations.

Key companies active in the Global Bakery Processing Equipment Market include GEA Group, Baker Perkins Ltd., The Middleby Corporation, Rheon Automatic Machinery Co., Ltd., Gemini Bakery Equipment Company, ALI Group S.R.L. A Socio Unico, Heat and Control, Inc., John Bean Technologies Corporation, Fritsch Group, and Markel Ventures Inc. Companies operating in the Global Bakery Processing Equipment Market are strengthening their competitive position through technology-driven innovation and customer-focused solutions. Many manufacturers are investing in automation and digital integration to enhance equipment performance and operational reliability. Customization capabilities are being expanded to help bakeries respond to changing consumer preferences without sacrificing efficiency. Strategic partnerships with bakery operators are supporting long-term equipment adoption and service-based revenue models.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Type

- 2.2.3 Application

- 2.2.4 End Use

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising automation to offset bakery labor shortages

- 3.2.1.2 Growth in frozen and packaged bakery products

- 3.2.1.3 Focus on food safety and product consistency

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High upfront capital cost for small bakeries

- 3.2.2.2 Space and utility constraints in existing facilities

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of retail chains and in-store bakeries

- 3.2.3.2 Clean-label, gluten-free and specialty product trends

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)

( Note: The trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Oven & proofers

- 5.3 Mixers

- 5.3.1 Below 250 kg

- 5.3.2 250-500 kg

- 5.3.3 500-1,000 kg

- 5.3.4 1,000-1,500 kg

- 5.3.5 Above 1,500 kg

- 5.4 Slicer

- 5.4.1 Below 100 kg

- 5.4.2 100-150 kg

- 5.4.3 150-250 kg

- 5.4.4 250-350 kg

- 5.4.5 Above 350 kg

- 5.5 Sheeters & molders

- 5.5.1 500-1,000 kg

- 5.5.2 1,000-1,500 kg

- 5.5.3 Above 1,500 kg

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Bread

- 6.3 Pastry

- 6.4 Pizza

- 6.5 Croissant

- 6.6 Flatbread

- 6.7 Pie/Quiche

- 6.8 Biscuits

- 6.9 Tortilla

Chapter 7 Market Estimates and Forecast, By End Use 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Industrial bakeries

- 7.3 Artisanal bakeries

- 7.4 Retail bakeries

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 The Middleby Corporation

- 9.2 GEA Group

- 9.3 ALI Group S.R.L. A Socio Unico

- 9.4 John Bean Technologies Corporation

- 9.5 Markel Ventures Inc.

- 9.6 Heat and Control, Inc.

- 9.7 Rheon Automatic Machinery Co., Ltd.

- 9.8 Fritsch Group

- 9.9 Baker Perkins Ltd.

- 9.10 Gemini Bakery Equipment Company