|

市场调查报告书

商品编码

1850610

无线物联网连接晶片组市场:2025-2030Wireless IoT Connectivity Chipset Market Report 2025-2030 |

|||||||

本报告对无线物联网连接晶片组市场进行了详区隔析,涵盖市场规模(支出、出货量和平均售价)、厂商占有率以及蜂窝、Wi-Fi、蓝牙和非授权低功耗广域网路(LPWA)等区隔市场的技术趋势。

范例预览

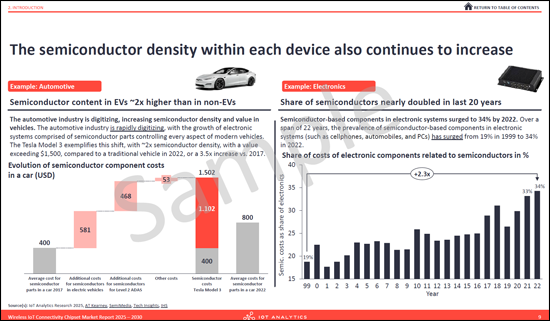

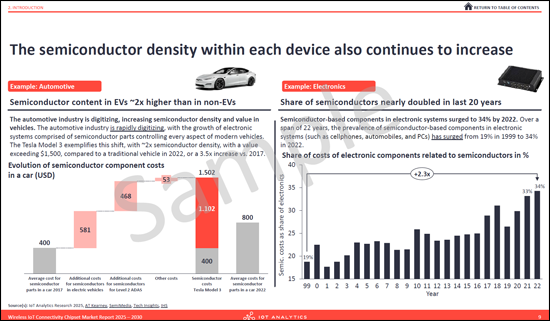

连网物联网设备的数量逐年增加,每个设备所需的半导体价值也不断上升。典型的物联网设备包含多达九种不同的半导体组件,本报告重点在于实现无线通讯的连接晶片组。

本报告系统性地介绍了四个关键技术领域的市场规模和预测、竞争格局和技术趋势:蜂窝物联网、免许可低功耗广域网路 (LPWA)、Wi-Fi 物联网和蓝牙物联网。

该分析基于对晶片组供应商和终端用户公司的访谈,并结合对重大行业事件的观察和广泛的二手研究。

范例预览

报告概述

- 156页报告: 提供五年预测无线物联网连接晶片组市场

- 四大技术详区隔析: 对蜂窝物联网、Wi-Fi 物联网、蓝牙物联网和非授权低功耗广域网路 (LPWA) 进行结构化分析。

- 超过 12 项技术趋势分析: 分析关键发展,包括 5G RedCap、LTE Cat-1 bis、能量收集和 Wi-Fi 7 的应用。

- 厂商占有率分析: 提供蜂窝、Wi-Fi 和蓝牙物联网晶片组市场竞争格局的详区隔析。

主要分析领域

- 物联网半导体市场概述: 定义物联网设备中使用的九种半导体组件,并计算整个物联网半导体市场及其价值链(代工厂、EDA、IP 等)的规模。 本报告还概述了影响该行业的五大总体趋势,包括人工智慧整合、硬体安全、地缘政治动态、国家战略投资和供应链多元化。

- 物联网连接技术概述 详细介绍了 24 种主要的蜂窝和非蜂窝技术标准,包括传统蜂窝、宽频蜂窝和授权 LPWA 蜂窝,以及有线、WPAN、免授权 LPWA、WLAN 和卫星蜂窝。

- 蜂窝物联网深度分析 分析了蜂窝物联网晶片组市场(包括支出、出货量和平均售价),并预测到 2030 年的发展趋势。报告依技术、地区和垂直行业进行了区隔,并详细介绍了五大关键趋势,包括 5G RedCap 的采用和 LTE Cat-1 bis 的成长。

- 免授权 LPWA 深度分析 分析了免授权 LPWA 晶片组市场,涵盖了依技术划分的市场支出、出货量和平均售价。本报告探讨了四大关键趋势,包括用于无电池设备的能量收集以及低功耗广域网路 (LPWAN) 和卫星连接的融合。

- Wi-Fi 物联网深度分析: 本报告分析了 Wi-Fi 物联网晶片组市场,包括支出、出货量和平均售价 (ASP),并依地区进行了区隔。报告中还涵盖了竞争格局和关键趋势,包括低功耗 Wi-Fi 模组和 Wi-Fi 7 的扩展。

- 蓝牙物联网深度分析: 本报告探讨了蓝牙物联网晶片组市场,包括支出、出货量和平均售价 (ASP),并依地区进行了区隔。报告还涵盖了竞争格局以及为优化连接而采用 Wi-Fi 和蓝牙双模模组的趋势。

公司列表

|

|

|

目录

第一章:摘要整理

第二章:引言

第三章:概览:物联网半导体市场

- 章节概要:概览 - 物联网半导体市场

- 概述:物联网半导体市场分为两部分

- 第一部分:物联网半导体元件 - 依类型划分的支出

- 第二部分:扩展的物联网半导体价值链 - 依价值链区隔划分的支出

- 物联网半导体市场的整体竞争格局市场

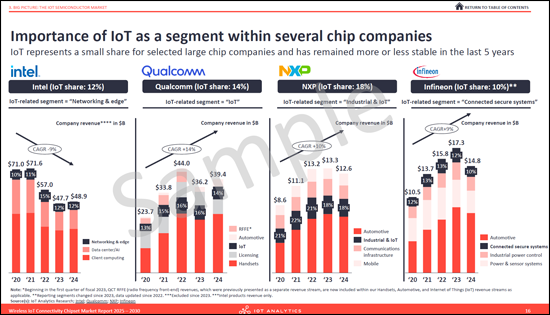

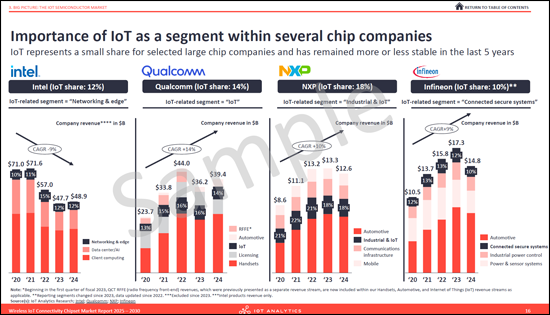

- 物联网产业对半导体公司的重要性

- 影响物联网半导体的五大整体趋势

- 整体趋势

- 近期新半导体晶圆厂建置公告

- 研究方法:物联网相关业务概况-以台积电为例

第四章:物联网连接晶片组:概述

- 章节概要:物联网连结格局

- 物联网连接晶片组:关键标准概述

- 物联网连接晶片组:蜂窝网络

- 物联网连接晶片组:非蜂窝网路 - 有线

- 物联网连接晶片组:非蜂窝网路 - 无线

- 全球半导体元件支出:物联网连接晶片组与其他半导体元件的比较

- 全球物联网连接晶片组市场支出

- 全球物联网连接晶片组市场依技术划分的支出

- 物联网半导体市场整体竞争格局

- 主要公司简介:高通

- 主要公司简介:博通

第五章:物联网连接晶片组:蜂窝物联网

- 章节概述:物联网连接晶片组 - 蜂巢物联网

- 全球蜂窝物联网晶片组支出 - 概述

- 分析师对蜂窝物联网市场的评论

- 全球蜂窝物联网晶片组支出 - 依技术划分

- 全球蜂窝物联网晶片组支出 - 依地区划分

- 全球蜂窝物联网晶片组支出 - 依垂直行业划分

- 全球蜂窝物联网晶片组出货量 - 概述

- 全球蜂窝物联网晶片组出货量 - 依技术划分

- 全球蜂窝物联网晶片组出货量 - 依地区划分

- 全球蜂巢式物联网晶片组出货量 - 依垂直产业划分

- 全球蜂窝物联网晶片组平均售价 - 依地区划分

- 蜂窝物联网晶片组竞争格局:主要供应商市场占有率(基于收入)

- 蜂窝物联网晶片组竞争格局:过去与未来市场表现(基于收入)

- 蜂窝物联网晶片组竞争格局:主要供应商市场占有率(基于出货量)

- 蜂窝物联网晶片组竞争格局:过去与未来市场表现(基于出货量)

- 蜂窝物联网晶片组趋势

第六章:物联网连接晶片组:免授权低功耗广域网路 (LPWA)

- 章节概述:物联网连接晶片组 - 免授权低功耗广域网路 (LPWA)

- 全球免授权低功耗广域网路 (LPWA) 晶片组支出概览

- 分析师评论免授权低功耗广域网路 (LPWA) 市场

- 全球免授权 LPWA 晶片组支出 - 依技术划分

- 全球免授权 LPWA 晶片组出货量 - 概述

- 全球免授权 LPWA 晶片组出货量 - 依技术划分

- 全球免授权 LPWA 晶片组平均售价 - 依技术划分

- 免授权 LPWA 晶片组发展趋势

第七章:物联网连接晶片组:Wi-Fi 物联网

- 章节概述:物联网连接晶片组 - Wi-Fi 物联网

- 全球 Wi-Fi 物联网晶片组支出 - 概述

- 全球 Wi-Fi 物联网晶片组出货量 - 概述

- 全球 Wi-Fi 物联网晶片组平均售价 - 概述

- 分析师对 Wi-Fi 物联网市场的评论

- 全球 Wi-Fi 物联网晶片组支出 - 依技术划分区域

- Wi-Fi 物联网晶片组竞争格局:主要供应商的市场占有率(基于收入)

- Wi-Fi 物联网晶片组竞争格局:过去与未来的市场表现(基于收入)

- Wi-Fi 物联网晶片组物联网趋势

第八章:物联网连接晶片组:蓝牙物联网

- 章节概要:物联网连接晶片组 - 蓝牙物联网

- 全球蓝牙物联网晶片组支出概览

- 全球蓝牙物联网晶片组出货量概览

- 全球蓝牙物联网晶片组平均售价概览

- 分析师对蓝牙物联网市场的评论

- 全球蓝牙物联网晶片组支出 - 依地区划分

- 蓝牙物联网晶片组竞争格局:主要供应商的市场占有率(基于收入)

- 蓝牙物联网晶片组竞争格局:过去与未来的市场表现(基于收入)

- 蓝牙物联网晶片组趋势

第九章:研究方法与市场定义

第十章:物联网分析概论

A 156-page report on the wireless IoT chipset market with forecast. Details market sizing (spending, shipments, ASP), vendor shares, and technology trends across cellular, Wi-Fi, Bluetooth, and unlicensed LPWA segments.

Sample preview

The number of connected IoT devices continues to grow, with rising semiconductor value per device. Each IoT device typically contains up to nine semiconductor components. This report focuses on connectivity chipsets, which enable wireless communication across cellular and non-cellular networks.

This report provides an in-depth analysis of the wireless IoT connectivity chipset market, focusing on four core technology segments: Cellular IoT, Unlicensed LPWA, Wi-Fi IoT, and Bluetooth IoT. It offers a structured view of market size and forecast, competitive dynamics, and the key technology developments shaping each segment.

The analysis is grounded in primary research, including interviews with experts from chipset vendors and end-user organizations. These insights are supported by extensive secondary research and observations from major industry trade events.

Sample preview

Report at a glance:

- 156-page report: Detailing the wireless IoT connectivity chipset market with a 5-year forecast.

- 4 technology deep dives: A structured analysis of Cellular IoT, Wi-Fi IoT, Bluetooth IoT, and Unlicensed LPWA.

- 12+ technology trends analyzed: Examination of key developments, including 5G RedCap, LTE Cat-1 bis, energy harvesting, and Wi-Fi 7 adoption.

- Vendor market share analysis: A breakdown of the competitive landscape for cellular, Wi-Fi, and Bluetooth IoT chipset markets.

Key areas of analysis:

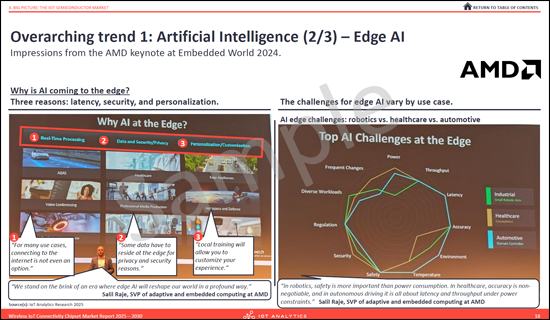

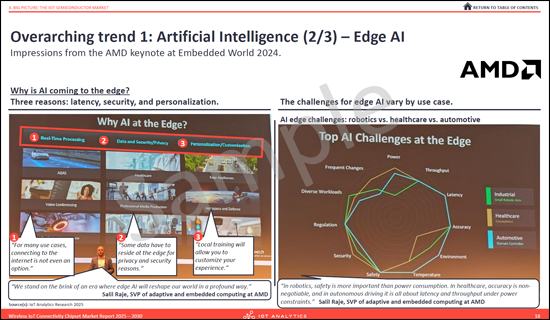

- IoT semiconductor market overview: Defines nine types of IoT semiconductor components and sizes the general IoT semiconductor market and its enhanced value chain (foundries, EDA, IP). It also outlines five overarching trends impacting the industry: AI integration, hardware security, geopolitical dynamics, strategic national investments, and supply chain diversification.

- IoT connectivity technology overview: Details 24 main standards across cellular and non-cellular technologies, including legacy, broadband, and licensed LPWA for cellular, and wired, WPAN, unlicensed LPWA, WLAN, and satellite for non-cellular.

- Cellular IoT deep dive: Analyzes the market for cellular IoT chipsets, including spending, shipments, and average selling price (ASP), with forecasts to 2030. It provides breakdowns by technology, region, and industry vertical and details five key trends, such as the introduction of 5G RedCap and the growth of LTE Cat-1 bis

- Unlicensed LPWA deep dive: Examines the market for unlicensed LPWA chipsets, covering market spending, shipments, and ASP by technology. It discusses four key trends, including energy harvesting for battery-free devices and the convergence of LPWAN and satellite connectivity.

- Wi-Fi IoT deep dive: Details the market for Wi-Fi IoT chipsets, with analysis of spending, shipments, and ASP, alongside a regional breakdown. The competitive landscape is outlined, as are key trends such as low-power Wi-Fi modules and the expansion of Wi-Fi 7.

- Bluetooth IoT deep dive: Presents an analysis of the Bluetooth IoT chipset market, including spending, shipments, and ASP, with a regional breakdown. It covers the competitive landscape and the trend toward dual-mode Wi-Fi & Bluetooth modules for optimized connectivity.

A data-driven foundation for key business functions:

- Strategy & corporate development: Inform long-term strategy with market forecasts, regional growth analysis, and insights into the five overarching trends shaping the semiconductor industry, from geopolitics to supply chain diversification.

- Product management & marketing: Shape product roadmaps with detailed analysis of technology adoption (e.g., 5G RedCap vs. LTE Cat-1 bis), competitive landscapes for each connectivity segment, and emerging use cases driven by new standards.

- R&D & engineering leadership: Direct technical priorities with insights into key trends like low-power chipset design, multi-protocol integration.

- Market intelligence & competitive analysis: Benchmark company performance with granular market share data for cellular IoT, Wi-Fi IoT, and Bluetooth IoT chipsets, alongside profiles of key vendors' product portfolios and R&D focus areas.

Key concepts defined:

- IoT semiconductor: Specialized semiconductor-based components that provide the core functionality and connectivity of IoT devices, including processing, communication, sensing/actuating, power management, and security. The report categorizes these components based on their intended use at the "design stage" of a product's life cycle.

- IoT connectivity chipset: An IoT connectivity chipset is a radio SoC or baseband transceiver embedded in an IoT device, either directly or via a communication module, that enables and manages wired or wireless connectivity. It supports communication over technologies such as cellular (2G-5G, NB-IoT, LTE-M), Wi-Fi, Bluetooth, Zigbee, Thread, LoRa, or Ethernet, allowing the device to connect and exchange data within the IoT ecosystem.

- Cellular IoT chipset: A cellular IoT chipset is a radio SoC or a baseband/transceiver solution embedded in an IoT device, either directly or via a communication module, that enables and manages connectivity over licensed cellular networks. It supports technologies such as 2G, 3G, 4G (LTE, LTE-M, NB-IoT, Cat-1 bis) and 5G (RedCap, eRedCap) to facilitate wide-area IoT communication.

- Wi-Fi IoT chipset: A Wi-Fi IoT chipset is a radio SoC or a transceiver embedded in an IoT device, either directly or via a module, that enables wireless local-area connectivity using Wi-Fi standards such as Wi-Fi 4, 5, 6, 6E, 7, or 802.11ah (HaLow).

- Bluetooth IoT chipset: A Bluetooth IoT chipset is a radio SoC or a transceiver solution embedded in an IoT device, either directly or through a module, that provides short-range wireless communication based on Bluetooth Classic, Bluetooth Low Energy (BLE), or Bluetooth Mesh standards for applications such as lighting and building controls. It excludes chipsets primarily used for consumer audio applications.

- Unlicensed LPWA chipset: An unlicensed LPWA (Low-Power Wide-Area) chipset is a radio SoC or a transceiver solution embedded in an IoT device, either directly or via a module, that enables long-range, low-power connectivity over unlicensed spectrum technologies such as LoRa, LoRaWAN, or mioty. It supports both public and private network deployments and is designed for IoT applications requiring low data throughput, extended battery life, and wide coverage.

Questions answered:

- What are wireless IoT connectivity chipsets, and how are they classified? (i.e., definition and types of IoT connectivity chipsets)

- What does the competitive landscape for wireless IoT connectivity chipsets look like?

- What are the market shares of leading vendors across cellular IoT, Wi-Fi IoT, and Bluetooth IoT segments?

- What is the current and forecasted market size for the cellular IoT, Wi-Fi IoT, Bluetooth IoT, and unlicensed LPWA market?

- What regional dynamics shape the wireless IoT connectivity market?

- What are the emerging trends in the wireless IoT connectivity market?

Companies mentioned:

A selection of companies mentioned in the report.

|

|

|

Table of Contents

1. Executive summary

2. Introduction

- 1. Chapter overview: Introduction

- 2. Starting point: The number of IoT connected devices continues to grow

- 3. The semiconductor density within each device also continues to increase

- 4. There are 9 different types of IoT semiconductor components, only Connectivity chipsets are in scope of this report

- 5. Definitions (1/6): Semiconductors & IoT semiconductors

- 6. Definitions (2/6): Processors

- 7. Definitions (3/6): Connectivity chipsets

- 8. Definitions (4/6): AI chipsets

- 9. Definitions (5/6): Security chipsets

- 10. Definitions (6/6): Other key components

3. Big picture: The IoT semiconductor market

- 1. Chapter overview: Big picture - The IoT semiconductor market

- 2. Overview: The general IoT semiconductor market is split into 2 parts

- 3. Part 1: IoT semiconductor components - Spending by type

- 4. Part 2: Enhanced IoT semiconductor value chain - Spending by value chain segment

- 5. Overall IoT semiconductor competitive landscape

- 6. Importance of IoT as a segment within several chip companies

- 7. 5 overarching trends impacting IoT semiconductors

- 8. Overarching trend 1 (3 parts)

- 9. Overarching trend 2

- 10. Overarching trend 3 (2 parts)

- 11. Overarching trend 4 (4 parts)

- 12. Overarching trend 5 (2 parts)

- 13. Recent announcements for new semiconductor plants

- 14. Methodology: Mapping IoT-related business - TSMC

4. IoT connectivity chipsets: Overview

- 1. Chapter overview: IoT connectivity: Overview

- 2. IoT connectivity chipsets: Overview of the main standards

- 3. IoT connectivity chipsets: Cellular (6 parts)

- 4. IoT connectivity chipsets: Non-cellular - Wired (2 parts)

- 5. IoT connectivity chipsets: Non-cellular - Wireless (6 parts)

- 6. Global semiconductor component spending: IoT connectivity chipsets vs other semiconductor components (2020-2030)

- 7. Global IoT connectivity chipset market spending

- 8. Global IoT connectivity chipset market spending by technology

- 9. Overall IoT semiconductor competitive landscape

- 10. Key company profile: Qualcomm (6 parts)

- 11. Key company profile: Broadcom (3 parts)

5. IoT connectivity chipsets: Cellular IoT

- 1. Chapter overview: IoT connectivity chipsets: Cellular IoT

- 2. Global cellular IoT chipset spending 2020-2030-Overview

- 3. Analyst commentary on the cellular IoT market

- 4. Global cellular IoT chipset spending 2020-2030-By technology

- 5. Global cellular IoT chipset spending 2020-2030-By region

- 6. Global cellular IoT chipset spending 2020-2030-By industry vertical

- 7. Global cellular IoT chipset shipments 2020-2030-Overview

- 8. Global cellular IoT chipset shipments 2020-2030-By technology

- 9. Global cellular IoT chipset shipments 2020-2030-By region

- 10. Global cellular IoT chipset shipments 2020-2030-By industry vertical

- 11. Global cellular IoT chipset ASP 2020-2030-By region

- 12. Cellular IoT chipsets competitive landscape (1/4): Market share of key vendors (based on revenue)

- 13. Cellular IoT chipsets competitive landscape (2/4): Historical and expected market performance (based on revenue)

- 14. Cellular IoT chipsets competitive landscape (3/4): Market share of key vendors (based on shipments)

- 15. Cellular IoT chipsets competitive landscape (4/4): Historical and expected market performance (based on shipments)

- 16. Cellular IoT chipset trend 1

- 17. Cellular IoT chipset trend 2

- 18. Cellular IoT chipset trend 3

- 19. Cellular IoT chipset trend 4

- 20. Cellular IoT chipset trend 5 (2 parts)

6. IoT connectivity chipsets: Unlicensed LPWA

- 1. Chapter overview: IoT connectivity chipsets: Unlicensed LPWA

- 2. Global unlicensed LPWA chipset spending 2020-2030-Overview

- 3. Analyst commentary on the unlicensed LPWA market

- 4. Global unlicensed LPWA chipset spending 2020-2030-By technology

- 5. Global unlicensed LPWA chipset shipments 2020-2030-Overview

- 6. Global unlicensed LPWA chipset shipments 2020-2030-By technology

- 7. Global unlicensed LPWA chipset ASP 2020-2030-By technology

- 8. Unlicensed LPWA chipset trend 1

- 9. Unlicensed LPWA chipset trend 2

- 10. Unlicensed LPWA chipset trend 3

- 11. Unlicensed LPWA chipset trend 4

7. IoT connectivity chipsets: Wi-Fi IoT

- 1. Chapter overview: IoT connectivity chipsets: Wi-Fi IoT

- 2. Global Wi-Fi IoT chipset spending 2020-2030-Overview

- 3. Global Wi-Fi IoT chipset shipments 2020-2030-Overview

- 4. Global Wi-Fi IoT chipset ASP 2020-2030-Overview

- 5. Analyst commentary on the Wi-Fi IoT market

- 6. Global Wi-Fi IoT chipset spending 2020-2030-By region

- 7. Wi-Fi IoT chipsets competitive landscape (1/2): Market share of key vendors (based on revenues)

- 8. Wi-Fi IoT chipsets competitive landscape (2/2): Historical and expected market performance (based on revenues)

- 9. Wi-Fi IoT chipset trend 1

- 10. Wi-Fi IoT chipset trend 2

8. IoT connectivity chipsets: Bluetooth IoT

- 1. Chapter overview: IoT connectivity chipsets: Bluetooth IoT

- 2. Global Bluetooth IoT chipset spending 2020-2030-Overview

- 3. Global Bluetooth IoT chipset shipments 2020-2030-Overview

- 4. Global Bluetooth IoT chipset ASP 2020-2030-Overview

- 5. Analyst commentary on the Bluetooth IoT market

- 6. Global Bluetooth IoT chipset spending 2020-2030-By region

- 7. Bluetooth IoT chipsets competitive landscape (1/2): Market share of key vendors (based on revenues)

- 8. Bluetooth IoT chipsets competitive landscape (2/2): Historical and expected market performance (based on revenues)

- 9. Bluetooth IoT chipset trend 1

9. Methodology & market definitions

- 1. Market category definitions (2 parts)

- 2. Other definitions (2 parts)

- 3. Country mappings to regions (3 parts)

- 4. Research Methodology

- 5. Methodology: How individual companies were analyzed

10. About IoT Analytics

- 1. About IoT Analytics

- 2. Other publications by IoT Analytics

- 3. Information and contact