|

市场调查报告书

商品编码

1793328

全球忠诚度管理市场(至 2030 年)按产品细分(解决方案(基于平台、基于 API)、服务)、程式类型、应用程式、经营模式和产业(BFSI、航空、汽车、媒体、零售和消费品)划分Loyalty Management Market by Offering (Solutions (Platform-based, API-based) and Services), Program Type, Application, Business Model, and Vertical (BFSI, Aviation, Automotive, Media, Retail & Consumer Goods) - Global Forecast to 2030 |

||||||

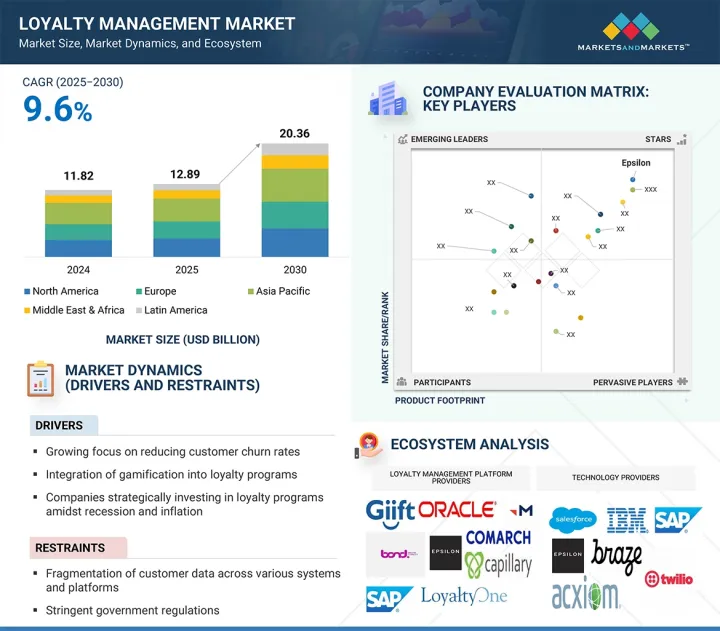

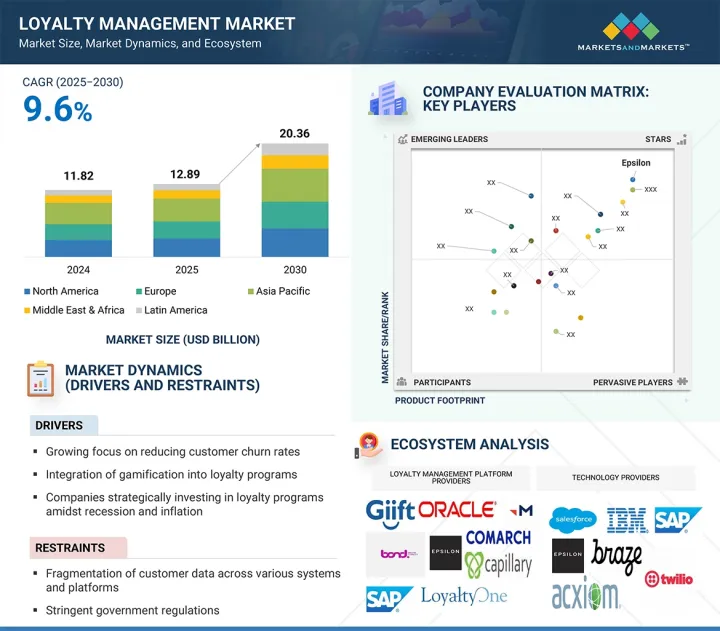

忠诚度管理市场预计将从 2025 年的 128.9 亿美元成长到 2030 年的 203.6 亿美元,复合年增长率为 9.6%。

| 调查范围 | |

|---|---|

| 调查年份 | 2019-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 对价单位 | 美元(USD) |

| 按细分市场 | 依提供类别、项目类型、目的、经营模式、行业和地区 |

| 目标区域 | 北美、欧洲、亚太地区、中东和非洲、拉丁美洲 |

向人工智慧、云端运算和API优先的忠诚度解决方案的转变正在改变企业建立和管理客户关係的方式。这些技术使品牌能够统一各个触点(线上购买、店内访问、行动应用程式和社交媒体)的数据,从而推动即时个人化和更深入的互动。云端基础的忠诚度平台提供扩充性、安全性以及对复杂奖励生态系统的集中管理,而人工智慧和机器学习则推动动态细分、预测奖励和行为分析。这使企业能够了解客户意图、预测客户流失并根据个人偏好客製化忠诚度宣传活动。

“按照经营模式,B2C 领域将在预测期内实现最快的增长。”

在 B2C 忠诚度管理中,策略主要着重于与个人消费者建立情感联繫,以鼓励重复购买。其主要目标是了解并回应个人偏好,改善购物体验并建立品牌亲和力。 B2C经营模式通常包含奖励系统,允许消费兑换奖励,会员等级分明,奖励等级分明,并享有独家销售、活动和个人化内容的存取权限。沟通通常直接且高度个人化,使用电子邮件、简讯、行动应用程式和社交媒体等管道提供优惠和更新。其重点在于推动即时互动,培养品牌拥护者,并透过使购买流程无缝衔接且引人入胜来缩短销售週期。

“按地区划分,预计亚太地区在预测期内的增长率最高。”

不断变化的消费行为和新兴趋势使该地区成为了创新中心。该地区的市场多种多样,从日本等精通技术的市场到印度等对价格敏感的市场,都需要灵活的忠诚度计画。这里的消费者更喜欢即时满足,而像 GrabRewards 这样的计划允许他们即时兑换积分以用于乘车和送餐,适合他们忙碌的生活方式。像阿里巴巴的 88VIP 这样的基于订阅的忠诚度模式通过提供月费专属奖励而越来越受欢迎。此外,与中国微信等社群媒体平台的整合使品牌能够透过小程式与客户建立联繫,将忠诚度与社群互动融为一体。亚太地区年轻、精通数位技术的人口和不断增长的可支配收入正在激发忠诚度管理市场,强调创造力和以消费者为中心的策略。

本报告调查了全球特许权使用费管理市场,并提供了市场概况、影响市场成长的各种因素分析、技术和专利趋势、法律制度、案例研究、市场规模趋势和预测、各个细分市场、地区/主要国家的详细分析、竞争格局和主要企业的概况。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章市场概况及产业趋势

- 市场动态

- 驱动程式

- 抑制因素

- 机会

- 任务

- 忠诚度管理市场:简史

- 供应链分析

- 生态系统

- 案例研究

- 波特五力模型

- 专利分析

- 影响忠诚度管理市场买家/顾客的中断

- 定价分析

- 主要相关利益者和采购标准

- 技术分析

- 监管状况

- 大型会议及活动

- 技术蓝图

- 最佳实践

- 当前和新兴的经营模式经营模式

- 忠诚度管理市场使用的工具、架构与技术

- 投资金筹措场景

- 人工智慧/生成人工智慧对忠诚度管理市场的影响

- 2025年美国关税的影响-特许权使用费管理市场

第六章:忠诚度管理市场(依服务细分)

- 解决方案

- 基于平台

- 基于API

- 服务

- 专业服务

- 託管服务

7. 忠诚度管理市场(依计画类型)

- 积分制

- 联盟(合作型)

- 基于订阅

- 基于价值

- 其他的

第 8 章:忠诚度管理市场(按应用)

- 客户生命週期管理

- 全通路互动

- 通路和合作伙伴参与

- 其他的

9. 忠诚度管理市场(依经营模式)

- B2B

- B2C

第十章 忠诚度管理市场(依垂直产业)

- BFSI

- 航空

- 车

- 媒体与娱乐

- 零售和消费品

- 饭店业

- 通讯

- 卫生保健

- 石油和天然气

- 其他的

第 11 章:忠诚度管理市场(按地区)

- 北美洲

- 北美:市场驱动因素

- 北美:宏观经济展望

- 美国

- 加拿大

- 欧洲

- 欧洲:市场驱动因素

- 欧洲:宏观经济展望

- 英国

- 德国

- 义大利

- 法国

- 西班牙

- 北欧国家

- 其他的

- 亚太地区

- 亚太地区:市场驱动因素

- 亚太地区:宏观经济展望

- 中国

- 日本

- 印度

- 澳洲和纽西兰

- 韩国

- 东南亚

- 其他的

- 中东和非洲

- 中东和非洲:市场驱动因素

- 中东与非洲:宏观经济展望

- 海湾合作委员会国家

- 南非

- 其他的

- 拉丁美洲

- 拉丁美洲:市场驱动因素

- 拉丁美洲:宏观经济展望

- 巴西

- 墨西哥

- 其他的

第十二章竞争格局

- 概述

- 主要参与企业的策略/优势

- 市场占有率分析

- 主要企业收益分析

- 品牌/产品比较

- 估值和财务指标

- 公司评估矩阵:主要企业

- 公司评估矩阵:Start-Ups/中小企业

- 竞争场景

第十三章:公司简介

- 主要企业

- EPSILON

- ORACLE

- COMARCH

- BOND BRAND LOYALTY

- MERKLE

- CAPILLARY

- JAKALA

- KOBIE MARKETING

- GIIFT MANAGEMENT

- MARITZ MOTIVATION

- 其他主要企业

- CHEETAH DIGITAL BY MARIGOLD

- COLLINSON

- AIR MILES REWARD

- SAP SE

- 中小企业/Start-Ups

- ANNEX CLOUD

- APEX LOYALTY

- SUMUP

- KANGAROO

- SMILE.IO

- SESSIONM

- LOYALTYLION

- SAILPLAY

- YOTPO

- ZINRELO

- PUNCHH

- EBBO

- PREFERRED PATRON

- LOOPYLOYALTY

- PAYSTONE

- LOYLOGIC

- ASCENDA

- LOYALTY JUGGERNAUT

- GRATIFII

- PHAEDON

第 14 章:相邻/相关市场

第十五章 附录

MarketsandMarkets: The loyalty management market is estimated at USD 12.89 billion in 2025 and is expected to reach USD 20.36 billion by 2030 at a CAGR of 9.6%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | USD (Billion) |

| Segments | By Offering, Program Type, Application, Business Model, Vertical, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

The shift toward AI, cloud, and API-first loyalty solutions is transforming how companies build and manage customer relationships. These technologies enable brands to unify data across touchpoints such as online purchases, in-store visits, mobile apps, and social media, fostering real-time personalization and deeper engagement. Cloud-based loyalty platforms provide scalability, security, and centralized management of complex reward ecosystems, while AI and machine learning drive dynamic segmentation, predictive rewards, and behavioral analysis. This empowers businesses to understand customer intent, anticipate churn, and tailor loyalty campaigns to individual preferences.

API-first platforms provide flexibility and enable rapid integration with CRM, POS, eCommerce, and payment systems, facilitating seamless omnichannel loyalty execution. Brands can now launch custom programs more quickly, iterate efficiently, and improve customer experiences without being limited by legacy systems. As customer expectations for personalization and value rise, and as data privacy becomes a global priority, loyalty vendors are adapting with composable platforms, zero-party data strategies, and real-time engagement capabilities. These innovations are making loyalty programs more relevant, agile, and outcome-focused, marking this evolution as the foundation of digital loyalty transformation.

"B2C business model segment will witness the fastest growth during the forecast period."

In B2C loyalty management, strategies are primarily designed to cultivate emotional connections and encourage repeat purchases with individual consumers. The core objective is to understand and cater to personal preferences, enhance the shopping experience, and build brand affinity. B2C business models often involve points systems that convert purchases into redeemable rewards, tiered membership structures offering escalating benefits, and exclusive access to sales, events, or personalized content. Communication is typically direct and highly personalized, utilizing channels such as email, SMS, mobile apps, and social media to deliver tailored offers and updates. The focus is on driving immediate engagement, fostering brand evangelism, and shortening the sales cycle by making the purchasing journey seamless and rewarding.

"Customer lifecycle management application segment is expected to have the largest market size during the forecast period."

Customer lifecycle management involves managing and optimizing the entire customer journey, from acquisition and activation to retention and re-engagement, using loyalty programs as a strategic tool. Its primary role is to maximize customer lifetime value by providing targeted incentives and personalized experiences at every stage of the relationship. This segment recognizes that retaining existing customers is more cost-effective and profitable than acquiring new ones: a 5% increase in retention can boost profits by up to 25%. Brands are investing in advanced analytics, automation, and omnichannel integration to create seamless, context-aware loyalty experiences that foster lasting relationships.

"Asia Pacific is expected to record the highest growth rate during the forecast period."

Asia Pacific's loyalty management market is a hotbed of innovation, driven by evolving consumer behaviors and emerging trends. The region's diverse markets, from tech-savvy Japan to price-sensitive India, require flexible loyalty programs. Consumers here prefer instant gratification, with programs like GrabRewards offering real-time points redemption for rides or food deliveries, which aligns with the fast-paced lifestyle. Subscription-based loyalty models, such as those by Alibaba's 88VIP, are gaining traction by providing exclusive benefits for a monthly fee. The integration of social media platforms, like WeChat in China, enables brands to engage customers through mini programs, blending loyalty with social interaction. Asia Pacific's youthful, digitally engaged population and rising disposable incomes create a dynamic market for loyalty management, emphasizing creativity and consumer-centric strategies.

Breakdown of primaries

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The break-up of the primaries is as follows.

- By Company Type: Tier 1 - 30%, Tier 2 - 45%, and Tier 3 - 25%

- By Designation: C-level -35%, D-level - 30%, and Others - 35%

- By Region: North America - 40%, Europe - 20%, Asia Pacific - 30%, Middle East & Africa - 5%, Latin America - 5%

The major players in the loyalty management market include Epsilon (US), Oracle (US), Comarch (Poland), Bond Brand Loyalty (Canada), Merkle (US), Capillary (Singapore), Jakala (Italy), Kobie (US), Giift Management (Singapore), Maritz Motivation (US), Cheetah Digital (US), Collinson (UK), AIR MILES Loyalty (Canada), Punchh (US), Ebbo (US), Preferred Patron (US), Loopy Loyalty (China), Paystone (UK), LoyLogic (Switzerland), Ascenda (Singapore), Loyalty Juggernaut (US), Gratifii (Australia), SAP SE (Germany), Annex Cloud (US), Apex Loyalty (US), Sumup (UK), Kangaroo (Canada), Smile.io (Canada), SessionM (US), LoyaltyLion (UK), Yotpo (US), SailPlay (US), Phaedon (US), and Zinrelo (US). These players have adopted various growth strategies, such as partnerships, agreements, collaborations, new product launches, enhancements, and acquisitions, to expand their loyalty management market footprint.

Research Coverage

The market study analyzes the loyalty management market size and growth potential across various segments, including offerings, program type, application, business model, vertical, and region. The offerings are divided into solutions and services. The solutions examined within the loyalty management market include platform-based loyalty management and API-based loyalty management. The services considered in the loyalty management market consist of professional services (consulting, implementation, support, and maintenance) and managed services. The program type segment encompasses points-based programs, coalition programs, subscription-based programs, value-based programs, and other program types. The application segment features customer lifecycle management, omnichannel engagement, channel and partner engagement, and additional applications. The business model segment includes business-to-business and business-to-consumer. The vertical segment consists of BFSI, aviation, automotive, media & entertainment, retail & consumer goods, hospitality, telecom, healthcare, oil and gas, and other verticals. The regional analysis of the loyalty management market covers North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

Key Benefits of Buying the Report

The report will assist market leaders and new entrants by providing information on the closest approximations of the global loyalty management market's revenue figures and subsegments. It will also enable stakeholders to understand the competitive landscape, gain insights, and develop suitable go-to-market strategies. Furthermore, the report will offer stakeholders a clearer understanding of the market's pulse and supply them with information on key market drivers, restraints, and challenges opportunities.

The report provides the following insights.

1. Analysis of key drivers (include growing focus on reducing customer churn rates, integration of gamification into loyalty programs, companies strategically investing in loyalty programs amidst recession and inflation, emergence of loyalty management mobile applications, demand for advanced solutions to monitor customer scores and enhance customer engagement, and rising adoption of omnichannel customer loyalty strategy), restraints (fragmentation of customer data across various systems and platforms, stringent government regulations), opportunities (Increasing investments in loyalty system technology, surging investments in customer success startup platforms, and rising applications of big data and machine learning), and challenges (exponential rise in marketing technology, Rapidly changing trends and diverse consumer preferences, low awareness of loyalty program benefits, data security and privacy issues, and unappealing rewards) influencing the growth of the loyalty management market.

2. Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the loyalty management market

3. Market Development: The report provides comprehensive information about lucrative markets, analysing the loyalty management market across various regions.

4. Market Diversification: Comprehensive information about new products and services, untapped geographies, recent developments, and investments in the loyalty management market.

5. Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players Epsilon (US), Oracle (US), Comarch (Poland), Bond Brand Loyalty (Canada), Merkle (US), Capillary (Singapore), Jakala (Italy), Kobie (US), Giift Management (Singapore), Maritz Motivation (US), Cheetah Digital (US), Collinson (UK), AIR MILES Loyalty (Canada), Punchh (US), Ebbo (US), Preferred Patron (US), Loopy Loyalty (China), Paystone (UK), LoyLogic (Switzerland), Ascenda (Singapore), Loyalty Juggernaut (US), Gratifii (Australia), SAP SE (Germany), Annex Cloud (US), Apex Loyalty (US), Sumup (UK), Kangaroo (Canada), Smile.io (Canada), SessionM (US), LoyaltyLion (UK), Yotpo (US), SailPlay (US), Phaedon (US), and Zinrelo (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES OF THE STUDY

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary interview participants

- 2.1.2.2 Breakup of primary profiles

- 2.1.2.3 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.2.3 DEMAND-SIDE ANALYSIS

- 2.3 DATA TRIANGULATION

- 2.4 RISK ASSESSMENT

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 STUDY LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN LOYALTY MANAGEMENT MARKET

- 4.2 LOYALTY MANAGEMENT MARKET SHARE, BY OFFERING, 2025

- 4.3 LOYALTY MANAGEMENT MARKET SHARE, BY SOLUTION, 2025

- 4.4 LOYALTY MANAGEMENT MARKET SHARE, BY PROGRAM TYPE, 2025

- 4.5 LOYALTY MANAGEMENT MARKET SHARE, BY APPLICATION, 2025

- 4.6 LOYALTY MANAGEMENT MARKET SHARE, BY BUSINESS MODEL, 2025

- 4.7 LOYALTY MANAGEMENT MARKET SHARE, BY VERTICAL, 2025

- 4.8 NORTH AMERICA: LOYALTY MANAGEMENT MARKET, BY OFFERING AND COUNTRY (2025)

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing focus on reducing customer churn rates

- 5.2.1.2 Integration of gamification into loyalty programs

- 5.2.1.3 Economic volatility drives loyalty investments

- 5.2.1.4 Emergence of loyalty management mobile applications

- 5.2.1.5 Demand for advanced solutions to monitor customer scores and enhance customer engagement

- 5.2.1.6 Rising adoption of omnichannel customer loyalty strategy

- 5.2.2 RESTRAINTS

- 5.2.2.1 Fragmentation of customer data across various systems and platforms

- 5.2.2.2 Stringent government regulations

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing investments in loyalty system technology

- 5.2.3.2 Surging investments in customer success startup platforms

- 5.2.3.3 Rising applications of big data and machine learning

- 5.2.4 CHALLENGES

- 5.2.4.1 Exponential rise in marketing technology

- 5.2.4.2 Rapidly changing trends and diverse consumer preferences

- 5.2.4.3 Low awareness of loyalty program benefits

- 5.2.4.4 Data security and privacy issues

- 5.2.4.5 Unappealing rewards

- 5.2.1 DRIVERS

- 5.3 LOYALTY MANAGEMENT MARKET: BRIEF HISTORY

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 ECOSYSTEM

- 5.6 CASE STUDIES

- 5.6.1 DUNKIN' ENGAGES 24M CUSTOMERS THROUGH EPSILON

- 5.6.2 RUE21 TRANSFORMS CUSTOMER ENGAGEMENT WITH ORACLE CROWDTWIST

- 5.6.3 DEFENAGE ACHIEVES 65% GROWTH WITH ZINRELO'S LOYALTY PROGRAM

- 5.6.4 BOND BRAND LOYALTY COLLABORATES WITH CIBC TO IMPLEMENT HUMAN-CENTRIC ENGAGEMENT STRATEGY

- 5.6.5 HEATHROW AIRPORT'S LOYALTY TRANSFORMATION WITH COMARCH

- 5.7 PORTER'S FIVE FORCES MODEL

- 5.7.1 THREAT OF NEW ENTRANTS

- 5.7.2 THREAT OF SUBSTITUTES

- 5.7.3 BARGAINING POWER OF BUYERS

- 5.7.4 BARGAINING POWER OF SUPPLIERS

- 5.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.8 PATENT ANALYSIS

- 5.8.1 METHODOLOGY

- 5.9 DISRUPTIONS IMPACTING BUYERS/CLIENTS IN LOYALTY MANAGEMENT MARKET

- 5.10 PRICING ANALYSIS

- 5.10.1 INDICATIVE PRICING ANALYSIS OF KEY PLAYERS, BY PROGRAM TYPE, 2024

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 TECHNOLOGY ANALYSIS

- 5.12.1 KEY TECHNOLOGIES

- 5.12.1.1 Artificial intelligence and machine learning

- 5.12.1.2 Blockchain technology

- 5.12.1.3 Mobile wallets & apps

- 5.12.1.4 Customer data platforms

- 5.12.2 COMPLEMENTARY TECHNOLOGIES

- 5.12.2.1 Marketing automation

- 5.12.2.2 Customer relationship management

- 5.12.3 ADJACENT TECHNOLOGIES

- 5.12.3.1 Sustainability IoT

- 5.12.3.2 Augmented reality & virtual reality

- 5.12.3.3 Biometrics

- 5.12.1 KEY TECHNOLOGIES

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 KEY REGULATIONS

- 5.13.2.1 North America

- 5.13.2.1.1 US

- 5.13.2.1.2 Canada

- 5.13.2.2 Europe

- 5.13.2.3 Asia Pacific

- 5.13.2.3.1 South Korea

- 5.13.2.3.2 China

- 5.13.2.3.3 India

- 5.13.2.4 Middle East & Africa

- 5.13.2.5 UAE

- 5.13.2.6 Saudi Arabia

- 5.13.2.7 Latin America

- 5.13.2.7.1 Brazil

- 5.13.2.7.2 Mexico

- 5.13.2.1 North America

- 5.14 KEY CONFERENCES & EVENTS

- 5.15 TECHNOLOGY ROADMAP FOR LOYALTY MANAGEMENT MARKET

- 5.15.1 SHORT-TERM ROADMAP (2025-2026)

- 5.15.2 MID-TERM ROADMAP (2027-2028)

- 5.15.3 LONG-TERM ROADMAP (2029-2030)

- 5.16 BEST PRACTICES IN LOYALTY MANAGEMENT MARKET

- 5.16.1 MEETING CUSTOMER NEEDS

- 5.16.2 OFFERING CHOICES

- 5.16.3 DEFINING CLEAR GOALS

- 5.16.4 UTILIZING CUSTOMER DATA

- 5.17 CURRENT AND EMERGING BUSINESS MODELS

- 5.18 TOOLS, FRAMEWORKS, AND TECHNIQUES USED IN LOYALTY MANAGEMENT MARKET

- 5.19 INVESTMENT AND FUNDING SCENARIO

- 5.20 IMPACT OF AI/GENERATIVE AI ON LOYALTY MANAGEMENT MARKET

- 5.20.1 USE CASES OF GENERATIVE AI IN LOYALTY MANAGEMENT

- 5.21 IMPACT OF 2025 US TARIFF - LOYALTY MANAGEMENT MARKET

- 5.21.1 INTRODUCTION

- 5.21.2 KEY TARIFF RATES

- 5.21.3 PRICE IMPACT ANALYSIS

- 5.21.4 IMPACT ON COUNTRY/REGION

- 5.21.4.1 US

- 5.21.4.2 Europe

- 5.21.4.3 Asia Pacific

- 5.21.5 IMPACT ON LOYALTY MANAGEMENT MARKET SEGMENTS

6 LOYALTY MANAGEMENT MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: LOYALTY MANAGEMENT MARKET DRIVERS

- 6.2 SOLUTIONS

- 6.2.1 GROWING DEMAND FOR CUSTOMIZED AND SCALABLE LOYALTY PROGRAMS TO DRIVE MARKET GROWTH

- 6.2.2 PLATFORM-BASED

- 6.2.2.1 Growing need for integrated, ready-to-deploy solutions to boost market growth

- 6.2.3 API-BASED

- 6.2.3.1 Rising preference for customizable and headless loyalty architectures

- 6.3 SERVICES

- 6.3.1 PROFESSIONAL SERVICES

- 6.3.1.1 Consulting

- 6.3.1.1.1 Need to enhance strategic outlook and performance of organizations to boost market

- 6.3.1.2 Implementation

- 6.3.1.2.1 Seamless integration of loyalty management solutions and systems to propel market

- 6.3.1.3 Support & maintenance

- 6.3.1.3.1 Ability to improve operations and gain control over existing systems to drive market

- 6.3.1.1 Consulting

- 6.3.2 MANAGED SERVICES

- 6.3.2.1 Efficient management of organization's loyalty program lifecycle to bolster market growth

- 6.3.1 PROFESSIONAL SERVICES

7 LOYALTY MANAGEMENT MARKET, BY PROGRAM TYPE

- 7.1 INTRODUCTION

- 7.1.1 PROGRAM TYPE: LOYALTY MANAGEMENT MARKET DRIVERS

- 7.2 POINTS-BASED

- 7.2.1 HIGH ADOPTION OF SIMPLE, SCALABLE LOYALTY MODELS ACROSS INDUSTRIES

- 7.3 COALITION

- 7.3.1 GROWING COLLABORATION AMONG BRANDS TO EXPAND LOYALTY ECOSYSTEM REACH

- 7.4 SUBSCRIPTION-BASED

- 7.4.1 SURGE IN CONSUMER WILLINGNESS TO PAY FOR EXCLUSIVE LOYALTY BENEFITS

- 7.5 VALUE-BASED

- 7.5.1 RISING CONSUMER PREFERENCE FOR PURPOSE-DRIVEN BRAND ENGAGEMENT

- 7.6 OTHER PROGRAM TYPES

8 LOYALTY MANAGEMENT MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.1.1 APPLICATION: LOYALTY MANAGEMENT MARKET DRIVERS

- 8.2 CUSTOMER LIFECYCLE MANAGEMENT

- 8.2.1 GROWING FOCUS ON MAXIMIZING CUSTOMER LIFETIME VALUE

- 8.3 OMNICHANNEL ENGAGEMENT

- 8.3.1 RISING NEED FOR SEAMLESS, CROSS-CHANNEL CUSTOMER EXPERIENCES

- 8.4 CHANNEL & PARTNER ENGAGEMENT

- 8.4.1 ACCELERATED PUSH TOWARD B2B LOYALTY ECOSYSTEM EXPANSION

- 8.5 OTHER APPLICATIONS

9 LOYALTY MANAGEMENT MARKET, BY BUSINESS MODEL

- 9.1 INTRODUCTION

- 9.1.1 BUSINESS MODEL: LOYALTY MANAGEMENT MARKET DRIVERS

- 9.2 BUSINESS-TO-BUSINESS

- 9.2.1 SURGING DEMAND TO PRIORITIZE SATISFACTION AND LOYALTY OF EXISTING CLIENTS TO DRIVE MARKET

- 9.3 BUSINESS-TO-CUSTOMER

- 9.3.1 PERSONALIZED, INTERACTIVE, AND REVENUE-GENERATING DIGITAL EXPERIENCES TO PROPEL MARKET GROWTH

10 LOYALTY MANAGEMENT MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- 10.2 BFSI

- 10.2.1 GROWING DEMAND FOR TAILORED INTERACTIONS AND PERSONALIZED EXPERIENCES TO DRIVE GROWTH

- 10.2.2 BFSI: LOYALTY MANAGEMENT USE CASES

- 10.2.2.1 Credit card rewards programs

- 10.2.2.2 Premium banking services

- 10.2.2.3 Insurance loyalty programs

- 10.2.2.4 Personalized financial planning

- 10.3 AVIATION

- 10.3.1 NEED TO ENHANCE TRAVEL EXPERIENCES AND CREATE BRAND LOYALTY TO FAVOR MARKET

- 10.3.2 AVIATION: LOYALTY MANAGEMENT USE CASES

- 10.3.2.1 Frequent flyer programs

- 10.3.2.2 Airport lounge access

- 10.3.2.3 Co-branded credit cards

- 10.4 AUTOMOTIVE

- 10.4.1 INCREASED FOCUS ON PERSONALIZED LOYALTY PROGRAMS TO BOOST MARKET

- 10.4.2 AUTOMOTIVE: LOYALTY MANAGEMENT USE CASES

- 10.4.2.1 Service maintenance rewards

- 10.4.2.2 Vehicle purchase incentives

- 10.4.2.3 Referral programs

- 10.4.2.4 Exclusive events and experiences

- 10.5 MEDIA & ENTERTAINMENT

- 10.5.1 ENHANCED CUSTOMER ENGAGEMENT AND LOYALTY THROUGH TARGETED CONTENT TO FUEL GROWTH

- 10.5.2 MEDIA & ENTERTAINMENT: LOYALTY MANAGEMENT USE CASES

- 10.5.2.1 Subscription loyalty programs

- 10.5.2.2 Content personalization

- 10.5.2.3 Partnership programs

- 10.5.2.4 Event-based rewards

- 10.6 RETAIL & CONSUMER GOODS

- 10.6.1 NEED TO DIFFERENTIATE FROM COMPETITORS THROUGH TARGETED PROMOTIONS AND PERSONALIZED OFFERS TO PROPEL GROWTH

- 10.6.2 RETAIL & CONSUMER GOODS: LOYALTY MANAGEMENT USE CASES

- 10.6.2.1 Personalized offers

- 10.6.2.2 Omni-channel integration

- 10.6.2.3 Customer feedback and engagement

- 10.6.2.4 Social responsibility initiatives

- 10.7 HOSPITALITY

- 10.7.1 NEED TO INCREASE REPEAT PATRONAGE TO BOOST MARKET

- 10.7.2 HOSPITALITY: LOYALTY MANAGEMENT USE CASES

- 10.7.2.1 Restaurant loyalty programs

- 10.7.2.2 Tourism and travel loyalty programs

- 10.7.2.3 Entertainment loyalty programs

- 10.7.2.4 Corporate loyalty programs

- 10.8 TELECOM

- 10.8.1 CUSTOMER SATISFACTION, ENGAGEMENT, AND LONG-TERM LOYALTY TO DRIVE MARKET

- 10.8.2 TELECOM: LOYALTY MANAGEMENT USE CASES

- 10.8.2.1 Rewards for usage

- 10.8.2.2 Referral programs

- 10.8.2.3 Tiered loyalty programs

- 10.8.2.4 Gamification

- 10.9 HEALTHCARE

- 10.9.1 BENEFITS, INCENTIVES, AND REWARDS FOR USE OF HEALTHCARE SERVICES TO ACCELERATE MARKET GROWTH

- 10.9.2 HEALTHCARE: LOYALTY MANAGEMENT USE CASES

- 10.9.2.1 Patient retention programs

- 10.9.2.2 Medication adherence initiatives

- 10.9.2.3 Wellness programs

- 10.9.2.4 Referral programs

- 10.10 OIL & GAS

- 10.10.1 INNOVATIONS IN FUEL RETAIL LOYALTY PROGRAMS AND MOBILE APP INTEGRATION TO BOOST MARKET

- 10.10.2 OIL & GAS: LOYALTY MANAGEMENT USE CASES

- 10.10.2.1 Fleet loyalty programs

- 10.10.2.2 Sustainable fuel adoption rewards

- 10.10.2.3 Premium service membership

- 10.10.2.4 Mobile app integration

- 10.11 OTHER VERTICALS

11 LOYALTY MANAGEMENT MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: MARKET DRIVERS

- 11.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 11.2.3 US

- 11.2.3.1 Increased adoption of advanced technologies to develop rich customer experience

- 11.2.4 CANADA

- 11.2.4.1 Growing awareness of benefits of loyalty management programs to boost market

- 11.3 EUROPE

- 11.3.1 EUROPE: MARKET DRIVERS

- 11.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 11.3.3 UK

- 11.3.3.1 Customer loyalty schemes and government initiatives to propel market

- 11.3.4 GERMANY

- 11.3.4.1 Increasing investments in digital customer experience to propel market growth

- 11.3.5 ITALY

- 11.3.5.1 Increased value on customer relationships with brands to propel market

- 11.3.6 FRANCE

- 11.3.6.1 Incorporation of digital loyalty management to augment market

- 11.3.7 SPAIN

- 11.3.7.1 Programs aimed at fostering customer retention and engagement to accelerate market growth

- 11.3.8 NORDIC COUNTRIES

- 11.3.8.1 Increasing adoption of 5G and digital banking to drive market

- 11.3.9 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: MARKET DRIVERS

- 11.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 11.4.3 CHINA

- 11.4.3.1 Spike in purchasing power of consumers and greater focus on customer experience to foster growth

- 11.4.4 JAPAN

- 11.4.4.1 Growing demand for loyalty management solutions to boost market

- 11.4.5 INDIA

- 11.4.5.1 Increasing demand for loyalty programs to propel market

- 11.4.6 AUSTRALIA & NEW ZEALAND

- 11.4.6.1 Surging customer retention strategies with special features and data-driven logic to fuel market growth

- 11.4.7 SOUTH KOREA

- 11.4.7.1 Digital transformation and government initiatives to drive market

- 11.4.8 SOUTHEAST ASIA

- 11.4.8.1 Adoption of digital loyalty programs to bolster market growth

- 11.4.9 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: MARKET DRIVERS

- 11.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 11.5.3 GCC COUNTRIES

- 11.5.3.1 Saudi Arabia

- 11.5.3.1.1 Increasing adoption of digital technologies to foster market growth

- 11.5.3.2 UAE

- 11.5.3.2.1 Increased customer loyalty for brands and products to propel market growth

- 11.5.3.3 OTHER GCC COUNTRIES

- 11.5.3.1 Saudi Arabia

- 11.5.4 SOUTH AFRICA

- 11.5.4.1 Increased need for consumer engagement and retention to boost market

- 11.5.5 REST OF MIDDLE EAST & AFRICA

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: MARKET DRIVERS

- 11.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 11.6.3 BRAZIL

- 11.6.3.1 Fast-growing eCommerce market and high brand engagement on social media to propel market growth

- 11.6.4 MEXICO

- 11.6.4.1 Increased adoption of cloud technology to boost market

- 11.6.5 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 12.3 MARKET SHARE ANALYSIS, 2024

- 12.3.1 MARKET RANKING ANALYSIS

- 12.4 REVENUE ANALYSIS OF LEADING PLAYERS, 2021-2024

- 12.5 BRAND/PRODUCT COMPARISON

- 12.6 COMPANY VALUATION AND FINANCIAL METRICS

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS

- 12.7.5.1 Region footprint

- 12.7.5.2 Business model footprint

- 12.7.5.3 Vertical footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Company footprint: Startups/SMEs

- 12.8.5.3 Business model footprint: Startups/SMEs

- 12.8.5.4 Vertical footprint: Startups/SMEs

- 12.8.5.5 Region footprint: Startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 MAJOR PLAYERS

- 13.1.1 EPSILON

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 ORACLE

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 COMARCH

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 BOND BRAND LOYALTY

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 MERKLE

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches

- 13.1.5.3.2 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 CAPILLARY

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches

- 13.1.6.3.2 Deals

- 13.1.7 JAKALA

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.8 KOBIE MARKETING

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.9 GIIFT MANAGEMENT

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Product launches

- 13.1.9.3.2 Deals

- 13.1.10 MARITZ MOTIVATION

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.1 EPSILON

- 13.2 OTHER KEY PLAYERS

- 13.2.1 CHEETAH DIGITAL BY MARIGOLD

- 13.2.2 COLLINSON

- 13.2.3 AIR MILES REWARD

- 13.2.4 SAP SE

- 13.3 SMES/STARTUPS

- 13.3.1 ANNEX CLOUD

- 13.3.2 APEX LOYALTY

- 13.3.3 SUMUP

- 13.3.4 KANGAROO

- 13.3.5 SMILE.IO

- 13.3.6 SESSIONM

- 13.3.7 LOYALTYLION

- 13.3.8 SAILPLAY

- 13.3.9 YOTPO

- 13.3.10 ZINRELO

- 13.3.11 PUNCHH

- 13.3.12 EBBO

- 13.3.13 PREFERRED PATRON

- 13.3.14 LOOPYLOYALTY

- 13.3.15 PAYSTONE

- 13.3.16 LOYLOGIC

- 13.3.17 ASCENDA

- 13.3.18 LOYALTY JUGGERNAUT

- 13.3.19 GRATIFII

- 13.3.20 PHAEDON

14 ADJACENT/RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 CUSTOMER EXPERIENCE MANAGEMENT MARKET

- 14.2.1 MARKET DEFINITION

- 14.2.2 MARKET OVERVIEW

- 14.2.3 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY OFFERING

- 14.2.4 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE

- 14.2.5 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY ORGANIZATION SIZE

- 14.2.6 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY VERTICAL

- 14.2.7 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION

- 14.3 SOCIAL MEDIA ANALYTICS MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- 14.3.3 SOCIAL MEDIA ANALYTICS MARKET, BY OFFERING

- 14.3.4 SOCIAL MEDIA ANALYTICS MARKET, BY ANALYTICS TYPE

- 14.3.5 SOCIAL MEDIA ANALYTICS MARKET, BY BUSINESS FUNCTION

- 14.3.6 SOCIAL MEDIA ANALYTICS MARKET, BY VERTICAL

- 14.3.7 SOCIAL MEDIA ANALYTICS MARKET, BY REGION

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2022-2024

- TABLE 2 KEY PRIMARY INTERVIEW PARTICIPANTS

- TABLE 3 RISK ASSESSMENT

- TABLE 4 RESEARCH ASSUMPTIONS

- TABLE 5 LOYALTY MANAGEMENT MARKET: ECOSYSTEM

- TABLE 6 IMPACT OF PORTER'S FORCES ON LOYALTY MANAGEMENT MARKET

- TABLE 7 LIST OF PATENTS IN LOYALTY MANAGEMENT MARKET, 2021-2025

- TABLE 8 AVERAGE SELLING PRICE OF KEY PLAYERS, 2024

- TABLE 9 INDICATIVE PRICING ANALYSIS OF KEY LOYALTY MANAGEMENT, BY PROGRAM TYPE, 2024

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY VERTICALS (%)

- TABLE 11 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 LOYALTY MANAGEMENT MARKET: KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 17 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 18 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USE MARKETS DUE TO TARIFF IMPACT

- TABLE 19 LOYALTY MANAGEMENT MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 20 LOYALTY MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 21 LOYALTY MANAGEMENT MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 22 LOYALTY MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 23 SOLUTIONS: LOYALTY MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 24 SOLUTIONS: LOYALTY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 25 PLATFORM-BASED LOYALTY MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 26 PLATFORM-BASED LOYALTY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 27 API-BASED LOYALTY MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 28 API-BASED LOYALTY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 SERVICES: LOYALTY MANAGEMENT MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 30 SERVICES: LOYALTY MANAGEMENT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 31 SERVICES: LOYALTY MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 32 SERVICES: LOYALTY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 PROFESSIONAL SERVICES: LOYALTY MANAGEMENT MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 34 PROFESSIONAL SERVICES: LOYALTY MANAGEMENT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 35 PROFESSIONAL SERVICES: LOYALTY MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 36 PROFESSIONAL SERVICES: LOYALTY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 CONSULTING: LOYALTY MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 38 CONSULTING: LOYALTY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 IMPLEMENTATION: LOYALTY MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 40 IMPLEMENTATION: LOYALTY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 SUPPORT & MAINTENANCE: LOYALTY MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 42 SUPPORT & MAINTENANCE: LOYALTY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 MANAGED SERVICES: LOYALTY MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 44 MANAGED SERVICES: LOYALTY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 LOYALTY MANAGEMENT MARKET, BY PROGRAM TYPE, 2019-2024 (USD MILLION)

- TABLE 46 LOYALTY MANAGEMENT MARKET, BY PROGRAM TYPE, 2025-2030 (USD MILLION)

- TABLE 47 POINT-BASED: LOYALTY MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 48 POINT-BASED: LOYALTY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 COALITION: LOYALTY MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 50 COALITION: LOYALTY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 SUBSCRIPTION-BASED: LOYALTY MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 52 SUBSCRIPTION-BASED: LOYALTY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 VALUE-BASED: LOYALTY MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 54 VALUE-BASED: LOYALTY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 OTHER PROGRAM TYPES: LOYALTY MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 56 OTHER PROGRAM TYPES: LOYALTY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 LOYALTY MANAGEMENT MARKET, BY APPLICATION, 2019-2024 (USD MILLION)

- TABLE 58 LOYALTY MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 59 CUSTOMER LIFECYCLE MANAGEMENT: LOYALTY MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 60 CUSTOMER LIFECYCLE MANAGEMENT: LOYALTY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 OMNICHANNEL ENGAGEMENT: LOYALTY MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 62 OMNICHANNEL ENGAGEMENT: LOYALTY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 CHANNEL & PARTNER ENGAGEMENT: LOYALTY MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 64 CHANNEL & PARTNER ENGAGEMENT: LOYALTY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 OTHER APPLICATIONS: LOYALTY MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 66 OTHER APPLICATIONS: LOYALTY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 LOYALTY MANAGEMENT MARKET, BY BUSINESS MODEL, 2019-2024 (USD MILLION)

- TABLE 68 LOYALTY MANAGEMENT MARKET, BY BUSINESS MODEL, 2025-2030 (USD MILLION)

- TABLE 69 BUSINESS-TO-BUSINESS: LOYALTY MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 70 BUSINESS-TO-BUSINESS: LOYALTY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 BUSINESS-TO-CUSTOMER: LOYALTY MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 72 BUSINESS-TO-CUSTOMER: LOYALTY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 LOYALTY MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 74 LOYALTY MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 75 BFSI: LOYALTY MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 76 BFSI: LOYALTY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 AVIATION: LOYALTY MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 78 AVIATION: LOYALTY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 AUTOMOTIVE: LOYALTY MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 80 AUTOMOTIVE: LOYALTY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 MEDIA & ENTERTAINMENT: LOYALTY MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 82 MEDIA & ENTERTAINMENT: LOYALTY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 83 RETAIL & CONSUMER GOODS: LOYALTY MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 84 RETAIL & CONSUMER GOODS: LOYALTY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 HOSPITALITY: LOYALTY MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 86 HOSPITALITY: LOYALTY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 87 TELECOM: LOYALTY MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 88 TELECOM: LOYALTY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 HEALTHCARE: LOYALTY MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 90 HEALTHCARE: LOYALTY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 OIL & GAS: LOYALTY MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 92 OIL & GAS: LOYALTY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 OTHER VERTICALS: LOYALTY MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 94 OTHER VERTICALS: LOYALTY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 95 LOYALTY MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 96 LOYALTY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 NORTH AMERICA: LOYALTY MANAGEMENT MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 98 NORTH AMERICA: LOYALTY MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 99 NORTH AMERICA: LOYALTY MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 100 NORTH AMERICA: LOYALTY MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 101 NORTH AMERICA: LOYALTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 102 NORTH AMERICA: LOYALTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 103 NORTH AMERICA: LOYALTY MANAGEMENT MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 104 NORTH AMERICA: LOYALTY MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 105 NORTH AMERICA: LOYALTY MANAGEMENT MARKET, BY PROGRAM TYPE, 2019-2024 (USD MILLION)

- TABLE 106 NORTH AMERICA: LOYALTY MANAGEMENT MARKET, BY PROGRAM TYPE, 2025-2030 (USD MILLION)

- TABLE 107 NORTH AMERICA: LOYALTY MANAGEMENT MARKET, BY APPLICATION, 2019-2024 (USD MILLION)

- TABLE 108 NORTH AMERICA: LOYALTY MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 109 NORTH AMERICA: LOYALTY MANAGEMENT MARKET, BY BUSINESS MODEL, 2019-2024 (USD MILLION)

- TABLE 110 NORTH AMERICA: LOYALTY MANAGEMENT MARKET, BY BUSINESS MODEL, 2025-2030 (USD MILLION)

- TABLE 111 NORTH AMERICA: LOYALTY MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 112 NORTH AMERICA: LOYALTY MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 113 NORTH AMERICA: LOYALTY MANAGEMENT MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 114 NORTH AMERICA: LOYALTY MANAGEMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 115 US: LOYALTY MANAGEMENT MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 116 US: LOYALTY MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 117 US: LOYALTY MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 118 US: LOYALTY MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 119 US: LOYALTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 120 US: LOYALTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 121 US: LOYALTY MANAGEMENT MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 122 US: LOYALTY MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 123 US: LOYALTY MANAGEMENT MARKET, BY PROGRAM TYPE, 2019-2024 (USD MILLION)

- TABLE 124 US: LOYALTY MANAGEMENT MARKET, BY PROGRAM TYPE, 2025-2030 (USD MILLION)

- TABLE 125 US: LOYALTY MANAGEMENT MARKET, BY APPLICATION, 2019-2024 (USD MILLION)

- TABLE 126 US: LOYALTY MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 127 US: LOYALTY MANAGEMENT MARKET, BY BUSINESS MODEL, 2019-2024 (USD MILLION)

- TABLE 128 US: LOYALTY MANAGEMENT MARKET, BY BUSINESS MODEL, 2025-2030 (USD MILLION)

- TABLE 129 US: LOYALTY MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 130 US: LOYALTY MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 131 CANADA: LOYALTY MANAGEMENT MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 132 CANADA: LOYALTY MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 133 CANADA: LOYALTY MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 134 CANADA: LOYALTY MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 135 CANADA: LOYALTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 136 CANADA: LOYALTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 137 CANADA: LOYALTY MANAGEMENT MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 138 CANADA: LOYALTY MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 139 CANADA: LOYALTY MANAGEMENT MARKET, BY PROGRAM TYPE, 2019-2024 (USD MILLION)

- TABLE 140 CANADA: LOYALTY MANAGEMENT MARKET, BY PROGRAM TYPE, 2025-2030 (USD MILLION)

- TABLE 141 CANADA: LOYALTY MANAGEMENT MARKET, BY APPLICATION, 2019-2024 (USD MILLION)

- TABLE 142 CANADA: LOYALTY MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 143 CANADA: LOYALTY MANAGEMENT MARKET, BY BUSINESS MODEL, 2019-2024 (USD MILLION)

- TABLE 144 CANADA: LOYALTY MANAGEMENT MARKET, BY BUSINESS MODEL, 2025-2030 (USD MILLION)

- TABLE 145 CANADA: LOYALTY MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 146 CANADA: LOYALTY MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 147 EUROPE: LOYALTY MANAGEMENT MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 148 EUROPE: LOYALTY MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 149 EUROPE: LOYALTY MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 150 EUROPE: LOYALTY MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 151 EUROPE: LOYALTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 152 EUROPE: LOYALTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 153 EUROPE: LOYALTY MANAGEMENT MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 154 EUROPE: LOYALTY MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 155 EUROPE: LOYALTY MANAGEMENT MARKET, BY PROGRAM TYPE, 2019-2024 (USD MILLION)

- TABLE 156 EUROPE: LOYALTY MANAGEMENT MARKET, BY PROGRAM TYPE, 2025-2030 (USD MILLION)

- TABLE 157 EUROPE: LOYALTY MANAGEMENT MARKET, BY APPLICATION, 2019-2024 (USD MILLION)

- TABLE 158 EUROPE: LOYALTY MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 159 EUROPE: LOYALTY MANAGEMENT MARKET, BY BUSINESS MODEL, 2019-2024 (USD MILLION)

- TABLE 160 EUROPE: LOYALTY MANAGEMENT MARKET, BY BUSINESS MODEL, 2025-2030 (USD MILLION)

- TABLE 161 EUROPE: LOYALTY MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 162 EUROPE: LOYALTY MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 163 EUROPE: LOYALTY MANAGEMENT MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 164 EUROPE: LOYALTY MANAGEMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 165 UK: LOYALTY MANAGEMENT MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 166 UK: LOYALTY MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 167 UK: LOYALTY MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 168 UK: LOYALTY MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 169 UK: LOYALTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 170 UK: LOYALTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 171 UK: LOYALTY MANAGEMENT MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 172 UK: LOYALTY MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 173 UK: LOYALTY MANAGEMENT MARKET, BY PROGRAM TYPE, 2019-2024 (USD MILLION)

- TABLE 174 UK: LOYALTY MANAGEMENT MARKET, BY PROGRAM TYPE, 2025-2030 (USD MILLION)

- TABLE 175 UK: LOYALTY MANAGEMENT MARKET, BY APPLICATION, 2019-2024 (USD MILLION)

- TABLE 176 UK: LOYALTY MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 177 UK: LOYALTY MANAGEMENT MARKET, BY BUSINESS MODEL, 2019-2024 (USD MILLION)

- TABLE 178 UK: LOYALTY MANAGEMENT MARKET, BY BUSINESS MODEL, 2025-2030 (USD MILLION)

- TABLE 179 UK: LOYALTY MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 180 UK: LOYALTY MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 181 GERMANY: LOYALTY MANAGEMENT MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 182 GERMANY: LOYALTY MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 183 GERMANY: LOYALTY MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 184 GERMANY: LOYALTY MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 185 GERMANY: LOYALTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 186 GERMANY: LOYALTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 187 GERMANY: LOYALTY MANAGEMENT MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 188 GERMANY: LOYALTY MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 189 GERMANY: LOYALTY MANAGEMENT MARKET, BY PROGRAM TYPE, 2019-2024 (USD MILLION)

- TABLE 190 GERMANY: LOYALTY MANAGEMENT MARKET, BY PROGRAM TYPE, 2025-2030 (USD MILLION)

- TABLE 191 GERMANY: LOYALTY MANAGEMENT MARKET, BY APPLICATION, 2019-2024 (USD MILLION)

- TABLE 192 GERMANY: LOYALTY MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 193 GERMANY: LOYALTY MANAGEMENT MARKET, BY BUSINESS MODEL, 2019-2024 (USD MILLION)

- TABLE 194 GERMANY: LOYALTY MANAGEMENT MARKET, BY BUSINESS MODEL, 2025-2030 (USD MILLION)

- TABLE 195 GERMANY: LOYALTY MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 196 GERMANY: LOYALTY MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 197 ASIA PACIFIC: LOYALTY MANAGEMENT MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 198 ASIA PACIFIC: LOYALTY MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 199 ASIA PACIFIC: LOYALTY MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 200 ASIA PACIFIC: LOYALTY MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 201 ASIA PACIFIC: LOYALTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 202 ASIA PACIFIC: LOYALTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 203 ASIA PACIFIC: LOYALTY MANAGEMENT MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 204 ASIA PACIFIC: LOYALTY MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 205 ASIA PACIFIC: LOYALTY MANAGEMENT MARKET, BY PROGRAM TYPE, 2019-2024 (USD MILLION)

- TABLE 206 ASIA PACIFIC: LOYALTY MANAGEMENT MARKET, BY PROGRAM TYPE, 2025-2030 (USD MILLION)

- TABLE 207 ASIA PACIFIC: LOYALTY MANAGEMENT MARKET, BY APPLICATION, 2019-2024 (USD MILLION)

- TABLE 208 ASIA PACIFIC: LOYALTY MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 209 ASIA PACIFIC: LOYALTY MANAGEMENT MARKET, BY BUSINESS MODEL, 2019-2024 (USD MILLION)

- TABLE 210 ASIA PACIFIC: LOYALTY MANAGEMENT MARKET, BY BUSINESS MODEL, 2025-2030 (USD MILLION)

- TABLE 211 ASIA PACIFIC: LOYALTY MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 212 ASIA PACIFIC: LOYALTY MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 213 ASIA PACIFIC: LOYALTY MANAGEMENT MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 214 ASIA PACIFIC: LOYALTY MANAGEMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 215 CHINA: LOYALTY MANAGEMENT MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 216 CHINA: LOYALTY MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 217 CHINA: LOYALTY MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 218 CHINA: LOYALTY MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 219 CHINA: LOYALTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 220 CHINA: LOYALTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 221 CHINA: LOYALTY MANAGEMENT MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 222 CHINA: LOYALTY MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 223 CHINA: LOYALTY MANAGEMENT MARKET, BY PROGRAM TYPE, 2019-2024 (USD MILLION)

- TABLE 224 CHINA: LOYALTY MANAGEMENT MARKET, BY PROGRAM TYPE, 2025-2030 (USD MILLION)

- TABLE 225 CHINA: LOYALTY MANAGEMENT MARKET, BY APPLICATION, 2019-2024 (USD MILLION)

- TABLE 226 CHINA: LOYALTY MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 227 CHINA: LOYALTY MANAGEMENT MARKET, BY BUSINESS MODEL, 2019-2024 (USD MILLION)

- TABLE 228 CHINA: LOYALTY MANAGEMENT MARKET, BY BUSINESS MODEL, 2025-2030 (USD MILLION)

- TABLE 229 CHINA: LOYALTY MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 230 CHINA: LOYALTY MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 231 JAPAN: LOYALTY MANAGEMENT MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 232 JAPAN: LOYALTY MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 233 JAPAN: LOYALTY MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 234 JAPAN: LOYALTY MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 235 JAPAN: LOYALTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 236 JAPAN: LOYALTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 237 JAPAN: LOYALTY MANAGEMENT MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 238 JAPAN: LOYALTY MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 239 JAPAN: LOYALTY MANAGEMENT MARKET, BY PROGRAM TYPE, 2019-2024 (USD MILLION)

- TABLE 240 JAPAN: LOYALTY MANAGEMENT MARKET, BY PROGRAM TYPE, 2025-2030 (USD MILLION)

- TABLE 241 JAPAN: LOYALTY MANAGEMENT MARKET, BY APPLICATION, 2019-2024 (USD MILLION)

- TABLE 242 JAPAN: LOYALTY MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 243 JAPAN: LOYALTY MANAGEMENT MARKET, BY BUSINESS MODEL, 2019-2024 (USD MILLION)

- TABLE 244 JAPAN: LOYALTY MANAGEMENT MARKET, BY BUSINESS MODEL, 2025-2030 (USD MILLION)

- TABLE 245 JAPAN: LOYALTY MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 246 JAPAN: LOYALTY MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 247 MIDDLE EAST & AFRICA: LOYALTY MANAGEMENT MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 248 MIDDLE EAST & AFRICA: LOYALTY MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 249 MIDDLE EAST & AFRICA: LOYALTY MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 250 MIDDLE EAST & AFRICA: LOYALTY MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 251 MIDDLE EAST & AFRICA: LOYALTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 252 MIDDLE EAST & AFRICA: LOYALTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 253 MIDDLE EAST & AFRICA: LOYALTY MANAGEMENT MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 254 MIDDLE EAST & AFRICA: LOYALTY MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 255 MIDDLE EAST & AFRICA: LOYALTY MANAGEMENT MARKET, BY PROGRAM TYPE, 2019-2024 (USD MILLION)

- TABLE 256 MIDDLE EAST & AFRICA: LOYALTY MANAGEMENT MARKET, BY PROGRAM TYPE, 2025-2030 (USD MILLION)

- TABLE 257 MIDDLE EAST & AFRICA: LOYALTY MANAGEMENT MARKET, BY APPLICATION, 2019-2024 (USD MILLION)

- TABLE 258 MIDDLE EAST & AFRICA: LOYALTY MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 259 MIDDLE EAST & AFRICA: LOYALTY MANAGEMENT MARKET, BY BUSINESS MODEL, 2019-2024 (USD MILLION)

- TABLE 260 MIDDLE EAST & AFRICA: LOYALTY MANAGEMENT MARKET, BY BUSINESS MODEL, 2025-2030 (USD MILLION)

- TABLE 261 MIDDLE EAST & AFRICA: LOYALTY MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 262 MIDDLE EAST & AFRICA: LOYALTY MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 263 MIDDLE EAST & AFRICA: LOYALTY MANAGEMENT MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 264 MIDDLE EAST & AFRICA: LOYALTY MANAGEMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 265 GCC COUNTRIES: LOYALTY MANAGEMENT MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 266 GCC COUNTRIES: LOYALTY MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 267 GCC COUNTRIES: LOYALTY MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 268 GCC COUNTRIES: LOYALTY MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 269 GCC COUNTRIES: LOYALTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 270 GCC COUNTRIES: LOYALTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 271 GCC COUNTRIES: LOYALTY MANAGEMENT MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 272 GCC COUNTRIES: LOYALTY MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 273 GCC COUNTRIES: LOYALTY MANAGEMENT MARKET, BY PROGRAM TYPE, 2019-2024 (USD MILLION)

- TABLE 274 GCC COUNTRIES: LOYALTY MANAGEMENT MARKET, BY PROGRAM TYPE, 2025-2030 (USD MILLION)

- TABLE 275 GCC COUNTRIES: LOYALTY MANAGEMENT MARKET, BY APPLICATION, 2019-2024 (USD MILLION)

- TABLE 276 GCC COUNTRIES: LOYALTY MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 277 GCC COUNTRIES: LOYALTY MANAGEMENT MARKET, BY BUSINESS MODEL, 2019-2024 (USD MILLION)

- TABLE 278 GCC COUNTRIES: LOYALTY MANAGEMENT MARKET, BY BUSINESS MODEL, 2025-2030 (USD MILLION)

- TABLE 279 GCC COUNTRIES: LOYALTY MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 280 GCC COUNTRIES: LOYALTY MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 281 MIDDLE EAST & AFRICA: LOYALTY MANAGEMENT MARKET, BY GCC COUNTRY, 2019-2024 (USD MILLION)

- TABLE 282 MIDDLE EAST & AFRICA: LOYALTY MANAGEMENT MARKET, BY GCC COUNTRY, 2025-2030 (USD MILLION)

- TABLE 283 SAUDI ARABIA: LOYALTY MANAGEMENT MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 284 SAUDI ARABIA: LOYALTY MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 285 SAUDI ARABIA: LOYALTY MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 286 SAUDI ARABIA: LOYALTY MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 287 SAUDI ARABIA: LOYALTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 288 SAUDI ARABIA: LOYALTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 289 SAUDI ARABIA: LOYALTY MANAGEMENT MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 290 SAUDI ARABIA: LOYALTY MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 291 SAUDI ARABIA: LOYALTY MANAGEMENT MARKET, BY PROGRAM TYPE, 2019-2024 (USD MILLION)

- TABLE 292 SAUDI ARABIA: LOYALTY MANAGEMENT MARKET, BY PROGRAM TYPE, 2025-2030 (USD MILLION)

- TABLE 293 SAUDI ARABIA: LOYALTY MANAGEMENT MARKET, BY APPLICATION, 2019-2024 (USD MILLION)

- TABLE 294 SAUDI ARABIA: LOYALTY MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 295 SAUDI ARABIA: LOYALTY MANAGEMENT MARKET, BY BUSINESS MODEL, 2019-2024 (USD MILLION)

- TABLE 296 SAUDI ARABIA: LOYALTY MANAGEMENT MARKET, BY BUSINESS MODEL, 2025-2030 (USD MILLION)

- TABLE 297 SAUDI ARABIA: LOYALTY MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 298 SAUDI ARABIA: LOYALTY MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 299 LATIN AMERICA: LOYALTY MANAGEMENT MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 300 LATIN AMERICA: LOYALTY MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 301 LATIN AMERICA: LOYALTY MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 302 LATIN AMERICA: LOYALTY MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 303 LATIN AMERICA: LOYALTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 304 LATIN AMERICA: LOYALTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 305 LATIN AMERICA: LOYALTY MANAGEMENT MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 306 LATIN AMERICA: LOYALTY MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 307 LATIN AMERICA: LOYALTY MANAGEMENT MARKET, BY PROGRAM TYPE, 2019-2024 (USD MILLION)

- TABLE 308 LATIN AMERICA: LOYALTY MANAGEMENT MARKET, BY PROGRAM TYPE, 2025-2030 (USD MILLION)

- TABLE 309 LATIN AMERICA: LOYALTY MANAGEMENT MARKET, BY APPLICATION, 2019-2024 (USD MILLION)

- TABLE 310 LATIN AMERICA: LOYALTY MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 311 LATIN AMERICA: LOYALTY MANAGEMENT MARKET, BY BUSINESS MODEL, 2019-2024 (USD MILLION)

- TABLE 312 LATIN AMERICA: LOYALTY MANAGEMENT MARKET, BY BUSINESS MODEL, 2025-2030 (USD MILLION)

- TABLE 313 LATIN AMERICA: LOYALTY MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 314 LATIN AMERICA: LOYALTY MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 315 LATIN AMERICA: LOYALTY MANAGEMENT MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 316 LATIN AMERICA: LOYALTY MANAGEMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 317 BRAZIL: LOYALTY MANAGEMENT MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 318 BRAZIL: LOYALTY MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 319 BRAZIL: LOYALTY MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 320 BRAZIL: LOYALTY MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 321 BRAZIL: LOYALTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 322 BRAZIL: LOYALTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 323 BRAZIL: LOYALTY MANAGEMENT MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 324 BRAZIL: LOYALTY MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 325 BRAZIL: LOYALTY MANAGEMENT MARKET, BY PROGRAM TYPE, 2019-2024 (USD MILLION)

- TABLE 326 BRAZIL: LOYALTY MANAGEMENT MARKET, BY PROGRAM TYPE, 2025-2030 (USD MILLION)

- TABLE 327 BRAZIL: LOYALTY MANAGEMENT MARKET, BY APPLICATION, 2019-2024 (USD MILLION)

- TABLE 328 BRAZIL: LOYALTY MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 329 BRAZIL: LOYALTY MANAGEMENT MARKET, BY BUSINESS MODEL, 2019-2024 (USD MILLION)

- TABLE 330 BRAZIL: LOYALTY MANAGEMENT MARKET, BY BUSINESS MODEL, 2025-2030 (USD MILLION)

- TABLE 331 BRAZIL: LOYALTY MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 332 BRAZIL: LOYALTY MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 333 MEXICO: LOYALTY MANAGEMENT MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 334 MEXICO: LOYALTY MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 335 MEXICO: LOYALTY MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 336 MEXICO: LOYALTY MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 337 MEXICO: LOYALTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 338 MEXICO: LOYALTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 339 MEXICO: LOYALTY MANAGEMENT MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 340 MEXICO: LOYALTY MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 341 MEXICO: LOYALTY MANAGEMENT MARKET, BY PROGRAM TYPE, 2019-2024 (USD MILLION)

- TABLE 342 MEXICO: LOYALTY MANAGEMENT MARKET, BY PROGRAM TYPE, 2025-2030 (USD MILLION)

- TABLE 343 MEXICO: LOYALTY MANAGEMENT MARKET, BY APPLICATION, 2019-2024 (USD MILLION)

- TABLE 344 MEXICO: LOYALTY MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 345 MEXICO: LOYALTY MANAGEMENT MARKET, BY BUSINESS MODEL, 2019-2024 (USD MILLION)

- TABLE 346 MEXICO: LOYALTY MANAGEMENT MARKET, BY BUSINESS MODEL, 2025-2030 (USD MILLION)

- TABLE 347 MEXICO: LOYALTY MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 348 MEXICO: LOYALTY MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 349 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN LOYALTY MANAGEMENT VENDORS, 2022-2025

- TABLE 350 LOYALTY MANAGEMENT MARKET: DEGREE OF COMPETITION

- TABLE 351 LOYALTY MANAGEMENT MARKET: REGION FOOTPRINT

- TABLE 352 LOYALTY MANAGEMENT MARKET: BUSINESS MODEL FOOTPRINT

- TABLE 353 LOYALTY MANAGEMENT MARKET: VERTICAL FOOTPRINT

- TABLE 354 LIST OF KEY STARTUPS/SMES

- TABLE 355 LOYALTY MANAGEMENT MARKET: COMPANY FOOTPRINT

- TABLE 356 LOYALTY MANAGEMENT MARKET: BUSINESS MODEL FOOTPRINT

- TABLE 357 LOYALTY MANAGEMENT MARKET: VERTICAL FOOTPRINT

- TABLE 358 LOYALTY MANAGEMENT MARKET: REGION FOOTPRINT

- TABLE 359 LOYALTY MANAGEMENT MARKET: PRODUCT LAUNCHES, 2020-2025

- TABLE 360 LOYALTY MANAGEMENT MARKET: DEALS, 2020-2025

- TABLE 361 EPSILON: BUSINESS OVERVIEW

- TABLE 362 EPSILON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 363 EPSILON: PRODUCT LAUNCHES

- TABLE 364 EPSILON: DEALS

- TABLE 365 ORACLE: BUSINESS OVERVIEW

- TABLE 366 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 367 ORACLE: PRODUCT LAUNCHES

- TABLE 368 ORACLE: DEALS

- TABLE 369 COMARCH: BUSINESS OVERVIEW

- TABLE 370 COMARCH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 371 COMARCH: PRODUCT LAUNCHES

- TABLE 372 COMARCH: DEALS

- TABLE 373 BOND BRAND LOYALTY: BUSINESS OVERVIEW

- TABLE 374 BOND BRAND LOYALTY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 375 BOND BRAND LOYALTY: PRODUCT LAUNCHES

- TABLE 376 BOND BRAND LOYALTY: DEALS

- TABLE 377 MERKLE: BUSINESS OVERVIEW

- TABLE 378 MERKLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 379 MERKLE: PRODUCT LAUNCHES

- TABLE 380 MERKLE: DEALS

- TABLE 381 CAPILLARY: BUSINESS OVERVIEW

- TABLE 382 CAPILLARY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 383 CAPILLARY: PRODUCT LAUNCHES

- TABLE 384 CAPILLARY: DEALS

- TABLE 385 JAKALA: BUSINESS OVERVIEW

- TABLE 386 JAKALA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 387 JAKALA: DEALS

- TABLE 388 KOBIE: BUSINESS OVERVIEW

- TABLE 389 KOBIE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 390 KOBIE: DEALS

- TABLE 391 GIIFT MANAGEMENT: BUSINESS OVERVIEW

- TABLE 392 GIIFT MANAGEMENT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 393 GIIFT MANAGEMENT: PRODUCT LAUNCHES

- TABLE 394 GIIFT MANAGEMENT: DEALS

- TABLE 395 MARITZ MOTIVATION: BUSINESS OVERVIEW

- TABLE 396 MARITZ MOTIVATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 397 MARITZ MOTIVATION: DEALS

- TABLE 398 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 399 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 400 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2017-2022 (USD MILLION)

- TABLE 401 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 402 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 403 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 404 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 405 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 406 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 407 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 408 SOCIAL MEDIA ANALYTICS MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 409 SOCIAL MEDIA ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 410 SOCIAL MEDIA ANALYTICS MARKET, BY ANALYTICS TYPE, 2019-2022 (USD MILLION)

- TABLE 411 SOCIAL MEDIA ANALYTICS MARKET, BY ANALYTICS TYPE, 2023-2028 (USD MILLION)

- TABLE 412 SOCIAL MEDIA ANALYTICS MARKET, BY BUSINESS FUNCTION, 2019-2022 (USD MILLION)

- TABLE 413 SOCIAL MEDIA ANALYTICS MARKET, BY BUSINESS FUNCTION, 2023-2028 (USD MILLION)

- TABLE 414 SOCIAL MEDIA ANALYTICS MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 415 SOCIAL MEDIA ANALYTICS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 416 SOCIAL MEDIA ANALYTICS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 417 SOCIAL MEDIA ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

List of Figures

- FIGURE 1 LOYALTY MANAGEMENT MARKET SEGMENTATION

- FIGURE 2 LOYALTY MANAGEMENT MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKUP OF PRIMARY PROFILES, BY COMPANY, DESIGNATION, AND REGION

- FIGURE 4 KEY INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 5 LOYALTY MANAGEMENT MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH (SUPPLY-SIDE ANALYSIS) (1/2)

- FIGURE 6 LOYALTY MANAGEMENT MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH (SUPPLY-SIDE ANALYSIS) (2/2)

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 STUDY LIMITATIONS

- FIGURE 10 LOYALTY MANAGEMENT MARKET, 2023-2030 (USD MILLION)

- FIGURE 11 LOYALTY MANAGEMENT MARKET: REGIONAL SNAPSHOT

- FIGURE 12 GROWING FOCUS ON REDUCING CUSTOMER CHURN RATES TO DRIVE MARKET

- FIGURE 13 SOLUTIONS SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 14 PLATFORM-BASED LOYALTY MANAGEMENT SOLUTIONS TO DOMINATE MARKET IN 2025

- FIGURE 15 POINT-BASED PROGRAM TYPE SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 16 CUSTOMER LIFECYCLE MANAGEMENT SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 17 B2C SEGMENT TO HOLD LARGER MARKET SHARE IN 2025

- FIGURE 18 BFSI SEGMENT TO COMMAND MARKET SHARE IN 2025

- FIGURE 19 SOLUTIONS SEGMENT TO HOLD MAJOR SHARE OF NORTH AMERICAN MARKET IN 2025

- FIGURE 20 LOYALTY MANAGEMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 BRIEF HISTORY OF LOYALTY MANAGEMENT MARKET

- FIGURE 22 LOYALTY MANAGEMENT MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 23 KEY PLAYERS IN LOYALTY MANAGEMENT MARKET ECOSYSTEM

- FIGURE 24 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 25 MAJOR PATENTS FOR LOYALTY MANAGEMENT MARKET

- FIGURE 26 LOYALTY MANAGEMENT MARKET: DISRUPTIONS IMPACTING BUYERS/CLIENTS

- FIGURE 27 AVERAGE SELLING PRICE TREND OF KEY PLAYERS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY VERTICALS

- FIGURE 29 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 30 TOOLS, FRAMEWORKS, AND TECHNIQUES USED IN LOYALTY MANAGEMENT MARKET

- FIGURE 31 INVESTMENT AND FUNDING SCENARIO

- FIGURE 32 USE CASES OF GENERATIVE AI IN LOYALTY MANAGEMENT

- FIGURE 33 SOLUTIONS SEGMENT TO DOMINATE LOYALTY MANAGEMENT MARKET

- FIGURE 34 API-BASED SOLUTIONS SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 35 MANAGED SERVICES SEGMENT TO REGISTER HIGHER GROWTH RATE DURING FORECAST PERIOD

- FIGURE 36 SUPPORT & MAINTENANCE SERVICES SEGMENT TO GROW FASTEST DURING FORECAST PERIOD

- FIGURE 37 SUBSCRIPTION-BASED PROGRAMS SEGMENT TO HAVE HIGHEST GROWTH RATE IN FORECAST PERIOD

- FIGURE 38 CUSTOMER LIFECYCLE MANAGEMENT TO DOMINATE MARKET IN 2025 AND 2030

- FIGURE 39 B2C SEGMENT TO LEAD LOYALTY MANAGEMENT MARKET

- FIGURE 40 AVIATION SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 41 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 42 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 43 SHARES OF LEADING COMPANIES IN LOYALTY MANAGEMENT MARKET, 2024

- FIGURE 44 LOYALTY MANAGEMENT MARKET: RANKING ANALYSIS OF TOP FIVE PLAYERS

- FIGURE 45 REVENUE ANALYSIS OF TOP PLAYERS, 2021-2024

- FIGURE 46 LOYALTY MANAGEMENT MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 47 COMPANY VALUATION: 2025

- FIGURE 48 FINANCIAL METRICS OF KEY LOYALTY MANAGEMENT VENDORS

- FIGURE 49 LOYALTY MANAGEMENT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 50 LOYALTY MANAGEMENT MARKET: COMPANY FOOTPRINT

- FIGURE 51 LOYALTY MANAGEMENT MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 52 ORACLE: COMPANY SNAPSHOT