|

市场调查报告书

商品编码

1883933

全球化学浓度监测仪市场按介质、产品、技术、终端用户产业和地区划分-预测至2030年Chemical Concentration Monitor Market by Medium, Product, Technology, End use Industry and Region - Global Forecast to 2030 |

||||||

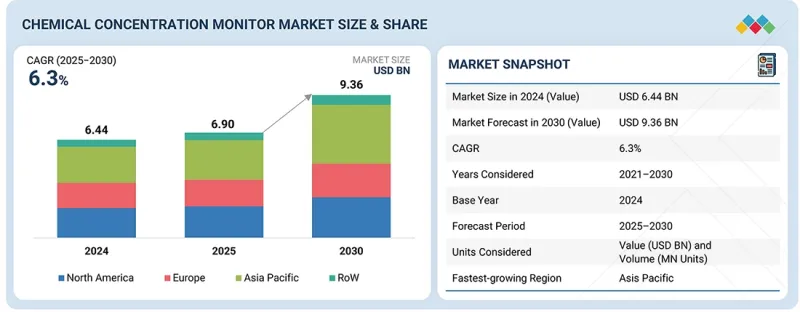

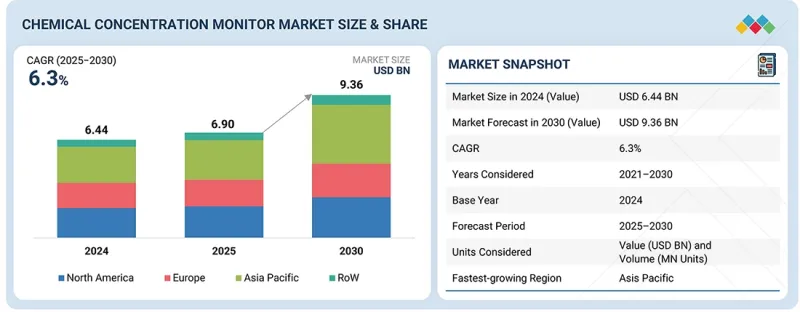

2025 年全球化学浓度监测器市场规模估计为 69 亿美元,预计到 2030 年将达到 93.6 亿美元,预测期内复合年增长率为 6.3%。

由于各种工业製程中对即时、连续和精确浓度测量的需求不断增长,市场正经历强劲增长。製程自动化的广泛应用、日益严格的环境法规以及对品管和安全法规合规性的日益重视,进一步推动了对先进监测系统的需求。光学、超音波和屈光感测技术的进步,以及物联网连接和人工智慧分析功能的集成,正在提高测量的精度、可靠性和处理效率。

| 调查范围 | |

|---|---|

| 调查期 | 2021-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 单元 | 10亿美元 |

| 部分 | 类型、媒介、产品、技术、最终用途产业、地区 |

| 目标区域 | 北美、欧洲、亚太地区及其他地区 |

此外,化学製造、製药、半导体、食品饮料以及污水等行业的快速工业扩张也创造了巨大的成长机会。这些系统在减少人工测试错误、优化资源利用以及确保全球现代化自动化设施的环境和营运永续性方面发挥着至关重要的作用。

“按类型划分,预计固定式显示器在整个预测期内将占据最大的市场份额。”

由于其高精度、高稳定性和连续监测能力,预计固定式监测仪将在预测期内占据化学浓度监测仪市场最大的份额。这些系统被广泛整合到工业生产线、实验室和加工厂中,用于即时分析和品管。与携带式监测仪不同,固定式监测仪能够长时间自动、不间断地进行资料测量,这对于製程优化和法规遵循至关重要。与先进的製程自动化系统、物联网连接和数位控制平台的兼容性进一步提高了运作效率。化工、半导体和製药等行业的日益普及正在推动其市场主导地位。

“按介质划分,预计天然气领域在预测期内将实现最高的复合年增长率。”

预计在预测期内,气体领域将成为化学浓度监测市场中复合年增长率最高的细分市场,这主要得益于半导体、石化、製药和环境监测等行业对精密气体浓度分析需求的不断增长。对空气品质控制、排放和製程安全的日益重视,推动了先进气体浓度监测技术的应用。此外,非接触式光学/红外线分析仪的进步,以及物联网赋能的远端监控和即时资料分析,正在提升这些设备的精度和可靠性。这些创新使得工业气体应用领域能够实现高效的洩漏检测、合规性和更佳的营运管理。

“亚太地区在预测期内将实现最高的复合年增长率。”

由于中国、日本、韩国和印度等国家快速的工业化进程、製造业的显着扩张以及製程自动化技术的广泛应用,预计亚太地区在预测期内将成为化学浓度监测市场复合年增长率最高的地区。该地区蓬勃发展的化学、半导体、製药和水处理行业正在推动对精准、连续浓度监测解决方案的需求。此外,政府为促进环境合规而製定的法规以及对智慧製造和品管系统投资的增加,也推动了该技术的应用。人们对流程效率、安全性和永续性的日益重视,进一步促进了该地区的市场成长。

本报告分析了全球化学浓度监测仪市场,提供了关键驱动因素和限制因素、竞争格局和未来趋势的资讯。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章 主要发现

- 化学浓度监测仪市场的巨大机会

- 化学浓度监测仪市场按类型划分

- 按介质分類的化学浓度监测仪市场

- 按技术分類的化学浓度监测仪市场

- 按最终用途行业分類的化学浓度监测仪市场

- 按地区分類的化学浓度监测仪市场

- 各国化学浓度监测仪市场

第五章 市场概览

- 介绍

- 市场动态

- 司机

- 抑制因素

- 机会

- 任务

- 影响客户业务的趋势/颠覆性因素

- 定价分析

- 主要企业的化学浓度监测仪平均售价(按产品分类)(2024 年)

- 2021-2024年各地区化学浓度监测仪平均售价趋势

- 价值链分析

- 生态系分析

- 技术分析

- 主要技术

- 互补技术

- 邻近技术

- 专利分析

- 贸易分析

- 进口场景(HS编码9027)

- 出口情境(HS编码9027)

- 重大会议和活动(2025-2026)

- 案例研究

- 投资和资金筹措方案

- 关税和监管环境

- 海关分析(HS编码9027)

- 监管机构、政府机构和其他组织

- 主要规定

- 波特五力分析

- 主要相关利益者和采购标准

- 人工智慧/生成式人工智慧对化学浓度监测市场的影响

- 2025年美国关税对化学浓度监测仪市场的影响

- 介绍

- 主要关税税率

- 价格影响分析

- 对国家的影响

- 对终端用户产业的影响

第六章 化学浓度监测仪市场(按类型划分)

- 介绍

- 携带式的

- 固定类型

第七章 依介质分類的化学浓度监测仪市场

- 介绍

- 液体

- 气体

第八章 化学浓度监测仪市场(依产品划分)

- 介绍

- 在线连续屈光

- 光纤浓度监测器

- 非接触式光学显示器

- 红外线/近红外线分析仪

- 安培离子感测器

- 其他产品

9. 按技术分類的化学浓度监测仪市场

- 介绍

- 超音波

- 光学

- 红外线/近红外光谱

- 紫外-可见光谱

- 拉曼光谱

- 电导率

- 电化学

- 其他技术

第十章 化学浓度监测仪市场(依产品/服务分类)

- 介绍

- 硬体

- 感测器和探头

- 发送器

- 控制器

- 显示介面单元

- 其他硬体

- 软体

- 服务

第十一章 依最终用途产业分類的化学浓度监测仪市场

- 介绍

- 半导体和电子设备製造

- 食品/饮料

- 医疗和药品

- 水和污水处理

- 其他终端用户产业

第十二章 各地区化学浓度监测仪市场

- 介绍

- 北美洲

- 北美宏观经济展望

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 欧洲宏观经济展望

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 波兰

- 比利时

- 荷兰

- 北欧的

- 其他欧洲

- 亚太地区

- 亚太宏观经济展望

- 中国

- 日本

- 澳洲

- 印度

- 韩国

- 东南亚

- 亚太其他地区

- 其他地区

- 其他地区的宏观经济展望

- 中东

- 非洲

- 南美洲

第十三章 竞争格局

- 概述

- 主要参与企业的策略/优势(2021-2025)

- 市占率分析(2024 年)

- 收入分析(2020-2024)

- 公司估值和财务指标

- 品牌/产品对比

- 企业评估矩阵:主要企业(2024)

- 公司评估矩阵:Start-Ups/中小企业(2024 年)

- 竞争场景

第十四章:公司简介

- 介绍

- 主要企业

- THERMO FISHER SCIENTIFIC INC.

- EMERSON ELECTRIC CO.

- ABB

- ENDRESS+HAUSER GROUP SERVICES AG

- VERALTO

- AMETEK.INC.

- METTLER TOLEDO

- YOKOGAWA ELECTRIC CORPORATION

- XYLEM

- HORIBA GROUP

- 其他公司

- AGILENT TECHNOLOGIES, INC.

- TELEDYNE TECHNOLOGIES INCORPORATED

- HONEYWELL INTERNATIONAL INC.

- FUJI ELECTRIC CO., LTD.

- SIEMENS

- ENTEGRIS

- KURABO INDUSTRIES LTD.

- ANTON PAAR GMBH

- CI SEMI

- VAISALA

- SHIMADZU CORPORATION

- SENSOTECH GMBH

- SERVOMEX

- PIMACS

- PERKINELMER

第十五章附录

The global chemical concentration monitor market was valued at USD 6.90 billion in 2025 and is projected to reach USD 9.36 billion by 2030, growing at a CAGR of 6.3% during the forecast period. The market is experiencing strong growth driven by the growing demand for real-time, continuous, and precise concentration measurement across various industrial processes. The rising adoption of process automation, stringent environmental regulations, and the increasing emphasis on quality control and safety compliance are further driving demand for advanced monitoring systems. Technological advancements in optical, ultrasonic, and refractometric sensing, along with the integration of IoT-enabled connectivity and AI-based analytics, are enhancing accuracy, reliability, and process efficiency.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, Medium, Offering, Product, Technology End use Industry and Region |

| Regions covered | North America, Europe, APAC, RoW |

Additionally, rapid industrial expansion in sectors such as chemical manufacturing, pharmaceuticals, semiconductors, food & beverages, and water & wastewater treatment is creating significant growth opportunities. These systems play a vital role in reducing manual testing errors, optimizing resource utilization, and ensuring environmental and operational sustainability across modern automated facilities worldwide.

"Based on type, stationary monitors to account for largest market share throughout forecast period"

Stationary monitors are expected to account for the largest share of the chemical concentration monitor market during the forecast period due to their high precision, stability, and continuous monitoring capabilities. These systems are widely integrated into industrial production lines, laboratories, and process plants for real-time analysis and quality control. Unlike portable units, stationary monitors offer long-term, automated, and uninterrupted data measurement, which is essential for process optimization and regulatory compliance. Their compatibility with advanced process automation systems, IoT connectivity, and digital control platforms further enhances operational efficiency. Growing adoption in sectors such as chemicals, semiconductors, and pharmaceuticals drives their market dominance.

"Based on medium, gas segment projected to register highest CAGR during forecast period"

The gas segment is projected to register the highest CAGR in the chemical concentration monitor market during the forecast period, driven by the increasing demand for precise gas concentration analysis in industries such as semiconductors, petrochemicals, pharmaceuticals, and environmental monitoring. The growing emphasis on air quality control, emission reduction, and process safety is driving the adoption of advanced gas concentration monitoring technologies. Moreover, the development of non-contact optical and infrared analyzers, coupled with IoT-enabled remote monitoring and real-time data analytics, is enhancing the accuracy and reliability of these devices. These innovations are enabling efficient leak detection, regulatory compliance, and improved operational control across industrial gas applications.

" Asia Pacific to register highest CAGR during forecast period"

The Asia Pacific region is projected to register the highest CAGR in the chemical concentration monitor market during the forecast period, driven by rapid industrialization, substantial manufacturing expansion, and increasing adoption of process automation across countries such as China, Japan, South Korea, and India. The region's growing chemicals, semiconductors, pharmaceuticals, and water treatment industries are driving demand for precise and continuous concentration monitoring solutions. Additionally, government regulations promoting environmental compliance, combined with increasing investments in smart manufacturing and quality control systems, are driving the adoption of technology. Increasing awareness of process efficiency, safety, and sustainability further supports market growth in the region.

Extensive primary interviews were conducted with key industry experts in the chemical concentration monitor market to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below.

The study draws insights from a range of industry experts, including component suppliers, tier 1 companies, and OEMs. The break-up of the primaries is as follows:

- By Company Type - Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation - Directors - 50%, Managers - 30%, and Others - 20%

- By Region - North America - 45%, Europe - 30%, Asia Pasific - 20%, and RoW - 5%

The chemical concentration monitor market is dominated by a few globally established players, such as Thermo Fisher Scientific Inc. (US), Emerson Electric Co. (US), ABB Ltd. (Switzerland), Endress+Hauser Group Services AG (Switzerland), Veralto (US), Mettler-Toledo International Inc. (US), AMETEK, Inc. (US), Yokogawa Electric Corporation (Japan), Xylem (US), and HORIBA Group (Japan).

The study includes an in-depth competitive analysis of these key players in the chemical concentration monitor market, with their company profiles, recent developments, and key market strategies.

Study Coverage:

The report segments the chemical concentration monitor market and forecasts its size, by type (portable monitors, stationary monitors), medium (liquid, gas), product (inline refractometer, fiber-optic concentration monitor, non-contact optical monitor, NIR/IR analyzer, amperometric ion sensor, other products), technology (ultrasonic, optical, conductivity, electrochemical, other technologies), end-use industry (semiconductor & electronics, food & beverages, healthcare & pharmaceuticals, water & wastewater treatment, other applications), offering (hardware, software, services). It also discusses the market's drivers, restraints, opportunities, and challenges. It gives a detailed view of the market across four main regions (North America, Europe, Asia Pacific, and RoW). The report includes a value chain analysis of the key players and their competitive analysis in the chemical concentration monitor ecosystem.

Key Benefits of Buying the Report:

- Analysis of key drivers (Growing demand for real-time chemical analysis in industries such as healthcare & pharmaceuticals, stringent food & beverage safety standards), restraints (high upfront cost of chemical concentration monitors), opportunities (expansion into emerging markets and decentralized treatment systems, rising adoption by high-precision industries such as batteries, semiconductors, and electronics), challenges (integration challenges with legacy infrastructure, standardization and interoperability issues).

- Product development/innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the chemical concentration monitor market

- Market development: Comprehensive information about lucrative markets - the report analyzes the chemical concentration monitor market across varied regions

- Market diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the chemical concentration monitor market

- Competitive assessment: In-depth assessment of market shares and growth strategies of leading players, such as Thermo Fisher Scientific Inc. (US), Emerson Electric Co. (US), ABB Ltd. (Switzerland), Endress+Hauser Group Services AG (Switzerland), Veralto (US), Mettler-Toledo International Inc. (US), AMETEK, Inc. (US), Yokogawa Electric Corporation (Japan), Xylem (US), and HORIBA Group (Japan).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 FACTOR ANALYSIS

- 2.3.1 DEMAND-SIDE ANALYSIS

- 2.3.2 SUPPLY-SIDE ANALYSIS

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CHEMICAL CONCENTRATION MONITOR MARKET

- 4.2 CHEMICAL CONCENTRATION MONITOR MARKET, BY TYPE

- 4.3 CHEMICAL CONCENTRATION MONITOR MARKET, BY MEDIUM

- 4.4 CHEMICAL CONCENTRATION MONITOR MARKET, BY TECHNOLOGY

- 4.5 CHEMICAL CONCENTRATION MONITOR MARKET, BY END-USE INDUSTRY

- 4.6 CHEMICAL CONCENTRATION MONITOR MARKET, BY REGION

- 4.7 CHEMICAL CONCENTRATION MONITOR MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing need for real-time chemical analysis in industries

- 5.2.1.2 Rising implementation of stringent food and beverage safety standards

- 5.2.2 RESTRAINTS

- 5.2.2.1 High upfront and maintenance costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rapid urbanization and water scarcity concerns

- 5.2.3.2 Emphasis on accurate chemical control in semiconductors, batteries, and electronics

- 5.2.4 CHALLENGES

- 5.2.4.1 Issues related to integration with legacy infrastructure

- 5.2.4.2 Standardization and interoperability challenges

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE OF CHEMICAL CONCENTRATION MONITORS OFFERED BY KEY PLAYERS, BY PRODUCT, 2024

- 5.4.2 AVERAGE SELLING PRICE TREND OF CHEMICAL CONCENTRATION MONITORS, BY REGION, 2021-2024

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Ultrasonic

- 5.7.1.2 Near-infrared (NIR) spectroscopy

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Internet of Things (IoT)

- 5.7.2.2 Edge computing

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Conductivity measurement systems

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO (HS CODE 9027)

- 5.9.2 EXPORT SCENARIO (HS CODE 9027)

- 5.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.11 CASE STUDIES

- 5.11.1 SEMICONDUCTOR MANUFACTURER UNITES WITH PROCESS AUTOMATION VENDOR TO PRECISELY CONTROL CHEMICAL CONCENTRATIONS

- 5.11.2 NESTLE IMPLEMENTS INLINE MONITORING SYSTEM TO MAINTAIN CHEMICAL CONCENTRATION LEVELS

- 5.11.3 SWISS PHARMACEUTICAL PRODUCER PARTNERS WITH INSTRUMENTATION VENDOR TO IMPLEMENT CHEMICAL CONCENTRATION MONITORING SYSTEM

- 5.11.4 JAPANESE PROCESS AUTOMATION COMPANIES USE CCM TO MAINTAIN CHEMICAL CONCENTRATION LEVELS IN CRITICAL MANUFACTURING PROCESSES

- 5.12 INVESTMENT AND FUNDING SCENARIO

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF ANALYSIS (HS CODE 9027)

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.3 KEY REGULATIONS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREATS OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDER IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI/GEN AI ON CHEMICAL CONCENTRATION MONITOR MARKET

- 5.17 IMPACT OF 2025 US TARIFF ON CHEMICAL CONCENTRATION MONITOR MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia pacific

- 5.17.5 IMPACT ON END-USE INDUSTRIES

6 CHEMICAL CONCENTRATION MONITOR MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 PORTABLE 93 6.2.1 FLEXIBILITY AND ABILITY TO PROVIDE RAPID AND ACCURATE CHEMICAL ANALYSIS TO FUEL SEGMENTAL GROWTH

- 6.3 STATIONARY

- 6.3.1 USE TO DELIVER CONTINUOUS, UNATTENDED OPERATION WITH MINIMAL MANUAL INTERVENTION TO BOOST SEGMENTAL GROWTH

7 CHEMICAL CONCENTRATION MONITOR MARKET, BY MEDIUM

- 7.1 INTRODUCTION

- 7.2 LIQUID

- 7.2.1 HIGH EMPHASIS ON PROCESS AUTOMATION, PRODUCT QUALITY, AND ENVIRONMENTAL COMPLIANCE TO SPUR DEMAND

- 7.3 GAS

- 7.3.1 RISING IMPLEMENTATION OF STRINGENT ENVIRONMENTAL REGULATIONS TO ACCELERATE SEGMENTAL GROWTH

8 CHEMICAL CONCENTRATION MONITOR MARKET, BY PRODUCT

- 8.1 INTRODUCTION

- 8.2 INLINE REFRACTOMETERS

- 8.2.1 USE TO ACHIEVE CONTINUOUS, HIGH ACCURACY MONITORING OF LIQUID CONCENTRATION AND COMPOSITION TO SPUR DEMAND

- 8.3 FIBER-OPTIC CONCENTRATION MONITORS

- 8.3.1 IMMUNITY TO ELECTROMAGNETIC INTERFERENCE AND SUITABILITY FOR REMOTE AND HAZARDOUS ENVIRONMENTS TO FUEL SEGMENTAL GROWTH

- 8.4 NON-CONTACT OPTICAL MONITOR

- 8.4.1 ABILITY TO PERFORM PRECISE MEASUREMENT WITHOUT DIRECT PHYSICAL CONTACT TO BOLSTER SEGMENTAL GROWTH

- 8.5 IR/NIR ANALYZERS

- 8.5.1 RELIANCE ON DATA-DRIVEN MANUFACTURING AND CONTINUOUS PROCESS VERIFICATION TO CONTRIBUTE TO SEGMENTAL GROWTH

- 8.6 AMPEROMETRIC ION SENSORS

- 8.6.1 INCORPORATION OF AI-BASED DATA ANALYTICS AND DIGITAL TWINS IN ION SENSING PLATFORMS TO AUGMENT SEGMENTAL GROWTH

- 8.7 OTHER PRODUCTS

9 CHEMICAL CONCENTRATION MONITOR MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- 9.2 ULTRASONIC

- 9.2.1 NON-CONTACT MEASUREMENT CAPABILITY AND HIGH RELIABILITY TO BOLSTER SEGMENTAL GROWTH

- 9.3 OPTICAL

- 9.3.1 IR & NIR SPECTROSCOPY

- 9.3.1.1 Ability to deliver precise, rapid, and non-destructive measurement of chemical compositions to fuel segmental growth

- 9.3.2 UV-VISIBLE SPECTROSCOPY

- 9.3.2.1 Use to ensure regulatory compliance to accelerate segmental growth

- 9.3.3 RAMAN SPECTROSCOPY

- 9.3.3.1 Ability to analyze complex multi-component mixtures and detect low-level contaminants to drive market

- 9.3.1 IR & NIR SPECTROSCOPY

- 9.4 CONDUCTIVITY

- 9.4.1 SIMPLICITY, RELIABILITY, AND COST-EFFECTIVENESS IN MEASURING ION CONCENTRATION TO CONTRIBUTE TO SEGMENTAL GROWTH

- 9.5 ELECTROCHEMICAL

- 9.5.1 SUITABILITY FOR DETECTING SPECIFIC IONS OR COMPOUNDS IN LIQUID AND GASEOUS MEDIA TO BOOST SEGMENTAL GROWTH

- 9.6 OTHER TECHNOLOGIES

10 CHEMICAL CONCENTRATION MONITOR MARKET, BY OFFERING

- 10.1 INTRODUCTION

- 10.2 HARDWARE

- 10.2.1 SENSORS & PROBES

- 10.2.1.1 Ability to withstand harsh industrial environments to contribute to segmental growth

- 10.2.2 TRANSMITTERS

- 10.2.2.1 Focus on smart process control and digitalization in industries to drive market

- 10.2.3 CONTROLLERS

- 10.2.3.1 Adoption of Industry 4.0 and smart factory initiatives to accelerate segmental growth

- 10.2.4 DISPLAY & INTERFACE UNITS

- 10.2.4.1 Prioritization of digital transformation and workforce efficiency to bolster segmental growth

- 10.2.5 OTHER HARDWARE

- 10.2.1 SENSORS & PROBES

- 10.3 SOFTWARE

- 10.3.1 SHIFT TOWARD INDUSTRY 4.0 AND DIGITAL TRANSFORMATION TO ACCELERATE SEGMENTAL GROWTH

- 10.4 SERVICES

- 10.4.1 ADOPTION OF COMPLEX, AUTOMATED, AND NETWORKED MONITORING INFRASTRUCTURE TO FOSTER SEGMENTAL GROWTH

11 CHEMICAL CONCENTRATION MONITOR MARKET, BY END-USE INDUSTRY

- 11.1 INTRODUCTION

- 11.2 SEMICONDUCTOR & ELECTRONICS MANUFACTURING

- 11.2.1 DEMAND FOR ADVANCED, CONTAMINATION-FREE MONITORING TO CONTRIBUTE TO SEGMENTAL GROWTH

- 11.3 FOOD & BEVERAGES

- 11.3.1 FOCUS ON ENSURING CONSISTENT PRODUCT QUALITY, PROCESS EFFICIENCY, AND REGULATORY COMPLIANCE TO DRIVE MARKET

- 11.4 HEALTHCARE & PHARMACEUTICALS

- 11.4.1 EMPHASIS ON REGULATORY COMPLIANCE, DRUG QUALITY, AND PROCESS ACCURACY TO BOOST SEGMENTAL GROWTH

- 11.5 WATER & WASTEWATER TREATMENT

- 11.5.1 GLOBAL CONCERNS AROUND WATER SCARCITY AND ENVIRONMENTAL PROTECTION TO BOLSTER SEGMENTAL GROWTH

- 11.6 OTHER END-USE INDUSTRIES

12 CHEMICAL CONCENTRATION MONITOR MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 12.2.2 US

- 12.2.2.1 Mounting demand for advanced process control and monitoring solutions to drive market

- 12.2.3 CANADA

- 12.2.3.1 Strong focus on process optimization and quality management to expedite market growth

- 12.2.4 MEXICO

- 12.2.4.1 Rising enforcement of standards for effluent and potable water quality maintenance to boost market growth

- 12.3 EUROPE

- 12.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 12.3.2 UK

- 12.3.2.1 High emphasis on water quality compliance and industrial digitalization to bolster market growth

- 12.3.3 GERMANY

- 12.3.3.1 Implementation of strict effluent compliance norms to accelerate market growth

- 12.3.4 FRANCE

- 12.3.4.1 Enforcement of strict national and EU water quality regulations to boost market growth

- 12.3.5 ITALY

- 12.3.5.1 Strong focus on drought resilience and wastewater reuse to contribute to market growth

- 12.3.6 SPAIN

- 12.3.6.1 Rapid modernization of industrial infrastructure to fuel market growth

- 12.3.7 POLAND

- 12.3.7.1 Focus on strengthening environmental compliance and modernization of industrial infrastructure to drive market

- 12.3.8 BELGIUM

- 12.3.8.1 Emphasis on wastewater reuse and decentralized treatment systems to expedite market growth

- 12.3.9 NETHERLANDS

- 12.3.9.1 Implementation of circular water management policies to accelerate market growth

- 12.3.10 NORDICS

- 12.3.10.1 Focus on conforming to stringent environmental protection policies to augment market growth

- 12.3.11 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 12.4.2 CHINA

- 12.4.2.1 Rapid industrial expansion and tightening environmental regulations to fuel market growth

- 12.4.3 JAPAN

- 12.4.3.1 Strong commitment to industrial automation and environmental protection to accelerate market growth

- 12.4.4 AUSTRALIA

- 12.4.4.1 Expansion of water infrastructure, mining operations, and sustainability initiatives to drive market

- 12.4.5 INDIA

- 12.4.5.1 Increasing investment in water and wastewater treatment and industrial automation to support market growth

- 12.4.6 SOUTH KOREA

- 12.4.6.1 Strong regulatory framework for water quality and technological innovation to contribute to market growth

- 12.4.7 SOUTHEAST ASIA

- 12.4.7.1 Rapid industrialization and expanding water and wastewater infrastructure to bolster market growth

- 12.4.8 REST OF ASIA PACIFIC

- 12.5 ROW

- 12.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 12.5.2 MIDDLE EAST

- 12.5.2.1 Bahrain

- 12.5.2.1.1 Growing emphasis on environmental protection and industrial modernization to accelerate market growth

- 12.5.2.2 Kuwait

- 12.5.2.2.1 Strong focus on sustainable water management to contribute to market growth

- 12.5.2.3 Oman

- 12.5.2.3.1 Mounting demand for precise and automated concentration monitoring systems to fuel market growth

- 12.5.2.4 Qatar

- 12.5.2.4.1 Heavy reliance on desalination for freshwater supply to drive market

- 12.5.2.5 Saudi Arabia

- 12.5.2.5.1 Growing emphasis on environmental sustainability to augment market growth

- 12.5.2.6 UAE

- 12.5.2.6.1 Strong focus on meeting net-zero strategy to expedite market growth

- 12.5.2.7 Rest of Middle East

- 12.5.2.1 Bahrain

- 12.5.3 AFRICA

- 12.5.3.1 South Africa

- 12.5.3.1.1 Increasing investment in water and wastewater treatment to bolster market growth

- 12.5.3.2 Rest of Africa

- 12.5.3.1 South Africa

- 12.5.4 SOUTH AMERICA

- 12.5.4.1 Brazil

- 12.5.4.1.1 Expanding industrial base and strict environmental regulations to expedite market growth

- 12.5.4.2 Argentina

- 12.5.4.2.1 Aging infrastructure and recurring water quality challenges to support market growth

- 12.5.4.3 Rest of South America

- 12.5.4.1 Brazil

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 13.3 MARKET SHARE ANALYSIS, 2024

- 13.4 REVENUE ANALYSIS, 2020-2024

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Type footprint

- 13.7.5.4 Medium footprint

- 13.7.5.5 Product footprint

- 13.7.5.6 Technology footprint

- 13.7.5.7 End-use industry footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of startups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

14 COMPANY PROFILES

- 14.1 INTRODUCTION

- 14.2 KEY PLAYERS

- 14.2.1 THERMO FISHER SCIENTIFIC INC.

- 14.2.1.1 Business overview

- 14.2.1.2 Products/Solutions/Services offered

- 14.2.1.3 MnM view

- 14.2.1.3.1 Key strengths/Right to win

- 14.2.1.3.2 Strategic choices

- 14.2.1.3.3 Weaknesses/Competitive threats

- 14.2.2 EMERSON ELECTRIC CO.

- 14.2.2.1 Business overview

- 14.2.2.2 Products/Solutions/Services offered

- 14.2.2.3 MnM view

- 14.2.2.3.1 Key strengths/Right to win

- 14.2.2.3.2 Strategic choices

- 14.2.2.3.3 Weaknesses/Competitive threats

- 14.2.3 ABB

- 14.2.3.1 Business overview

- 14.2.3.2 Products/Solutions/Services offered

- 14.2.3.3 Recent developments

- 14.2.3.3.1 Product launches

- 14.2.3.3.2 Deals

- 14.2.3.4 MnM view

- 14.2.3.4.1 Key strengths/Right to win

- 14.2.3.4.2 Strategic choices

- 14.2.3.4.3 Weaknesses/Competitive threats

- 14.2.4 ENDRESS+HAUSER GROUP SERVICES AG

- 14.2.4.1 Business overview

- 14.2.4.2 Products/Solutions/Services offered

- 14.2.4.3 Recent developments

- 14.2.4.3.1 Product launches

- 14.2.4.3.2 Deals

- 14.2.4.4 MnM view

- 14.2.4.4.1 Key strengths/Right to win

- 14.2.4.4.2 Strategic choices

- 14.2.4.4.3 Weaknesses/Competitive threats

- 14.2.5 VERALTO

- 14.2.5.1 Business overview

- 14.2.5.2 Products/Solutions/Services offered

- 14.2.5.3 MnM view

- 14.2.5.3.1 Key strengths/Right to win

- 14.2.5.3.2 Strategic choices

- 14.2.5.3.3 Weaknesses/Competitive threats

- 14.2.6 AMETEK.INC.

- 14.2.6.1 Business overview

- 14.2.6.2 Products/Solutions/Services offered

- 14.2.6.3 Recent developments

- 14.2.6.3.1 Product launches

- 14.2.6.3.2 Deals

- 14.2.7 METTLER TOLEDO

- 14.2.7.1 Business overview

- 14.2.7.2 Products/Solutions/Services offered

- 14.2.8 YOKOGAWA ELECTRIC CORPORATION

- 14.2.8.1 Business overview

- 14.2.8.2 Products/Solutions/Services offered

- 14.2.8.3 Recent developments

- 14.2.8.3.1 Product launches

- 14.2.9 XYLEM

- 14.2.9.1 Business overview

- 14.2.9.2 Products/Solutions/Services offered

- 14.2.9.3 Recent developments

- 14.2.9.3.1 Product launches

- 14.2.9.3.2 Deals

- 14.2.10 HORIBA GROUP

- 14.2.10.1 Business overview

- 14.2.10.2 Products/Solutions/Services offered

- 14.2.10.3 Recent developments

- 14.2.10.3.1 Product launches

- 14.2.10.3.2 Deals

- 14.2.1 THERMO FISHER SCIENTIFIC INC.

- 14.3 OTHER PLAYERS

- 14.3.1 AGILENT TECHNOLOGIES, INC.

- 14.3.2 TELEDYNE TECHNOLOGIES INCORPORATED

- 14.3.3 HONEYWELL INTERNATIONAL INC.

- 14.3.4 FUJI ELECTRIC CO., LTD.

- 14.3.5 SIEMENS

- 14.3.6 ENTEGRIS

- 14.3.7 KURABO INDUSTRIES LTD.

- 14.3.8 ANTON PAAR GMBH

- 14.3.9 CI SEMI

- 14.3.10 VAISALA

- 14.3.11 SHIMADZU CORPORATION

- 14.3.12 SENSOTECH GMBH

- 14.3.13 SERVOMEX

- 14.3.14 PIMACS

- 14.3.15 PERKINELMER

15 APPENDIX

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

List of Tables

- TABLE 1 CHEMICAL CONCENTRATION MONITOR MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 MAJOR SECONDARY SOURCES

- TABLE 3 PRIMARY INTERVIEW PARTICIPANTS

- TABLE 4 DATA CAPTURED FROM PRIMARY SOURCES

- TABLE 5 CHEMICAL CONCENTRATION MONITOR MARKET: RISK ANALYSIS

- TABLE 6 AVERAGE SELLING PRICE OF INLINE REFRACTOMETERS PROVIDED BY KEY PLAYERS, 2024 (USD)

- TABLE 7 AVERAGE SELLING PRICE OF AMPEROMETRIC ION SENSORS PROVIDED BY KEY PLAYERS, 2024 (USD)

- TABLE 8 AVERAGE SELLING PRICE TREND OF INLINE REFRACTOMETERS, BY REGION, 2021-2024 (USD)

- TABLE 9 AVERAGE SELLING PRICE TREND OF AMPEROMETRIC ION SENSORS, BY REGION, 2021-2024 (USD)

- TABLE 10 ROLE OF COMPANIES IN CHEMICAL CONCENTRATION MONITOR ECOSYSTEM

- TABLE 11 LIST OF MAJOR PATENTS, 2023-2024

- TABLE 12 IMPORT DATA FOR HS CODE 9027-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 13 EXPORT DATA FOR HS CODE 9027-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 14 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 15 MFN IMPORT TARIFFS FOR HS CODE 9027-COMPLIANT PRODUCTS, BY COUNTRY, 2024

- TABLE 16 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 IMPACT OF PORTER'S FIVE FORCES

- TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES (%)

- TABLE 22 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 23 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 24 EXPECTED CHANGE IN PRICES AND IMPACT ON END-USE MARKETS DUE TO TARIFF

- TABLE 25 CHEMICAL CONCENTRATION MONITOR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 26 CHEMICAL CONCENTRATION MONITOR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 27 CHEMICAL CONCENTRATION MONITOR MARKET, BY MEDIUM, 2021-2024 (USD MILLION)

- TABLE 28 CHEMICAL CONCENTRATION MONITOR MARKET, BY MEDIUM, 2025-2030 (USD MILLION)

- TABLE 29 CHEMICAL CONCENTRATION MONITOR MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 30 CHEMICAL CONCENTRATION MONITOR MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 31 CHEMICAL CONCENTRATION MONITOR MARKET, BY PRODUCT, 2021-2024 (MILLION UNITS)

- TABLE 32 CHEMICAL CONCENTRATION MONITOR MARKET, BY PRODUCT, 2025-2030 (MILLION UNITS)

- TABLE 33 INLINE REFRACTOMETERS: CHEMICAL CONCENTRATION MONITOR MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 34 INLINE REFRACTOMETERS: CHEMICAL CONCENTRATION MONITOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 35 FIBER-OPTIC CONCENTRATION MONITORS: CHEMICAL CONCENTRATION MONITOR MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 36 FIBER-OPTIC CONCENTRATION MONITORS: CHEMICAL CONCENTRATION MONITOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 37 NON-CONTACT OPTICAL MONITORS: CHEMICAL CONCENTRATION MONITOR MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 38 NON-CONTACT OPTICAL MONITORS: CHEMICAL CONCENTRATION MONITOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 39 IR/NIR ANALYZERS: CHEMICAL CONCENTRATION MONITOR MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 40 IR/NIR ANALYZERS: CHEMICAL CONCENTRATION MONITOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 41 AMPEROMETRIC ION SENSORS: CHEMICAL CONCENTRATION MONITOR MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 42 AMPEROMETRIC ION SENSORS: CHEMICAL CONCENTRATION MONITOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 43 OTHER PRODUCTS: CHEMICAL CONCENTRATION MONITOR MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 44 OTHER PRODUCTS: CHEMICAL CONCENTRATION MONITOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 45 CHEMICAL CONCENTRATION MONITOR MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 46 CHEMICAL CONCENTRATION MONITOR MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 47 ULTRASONIC: CHEMICAL CONCENTRATION MONITOR MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 48 ULTRASONIC: CHEMICAL CONCENTRATION MONITOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 49 ULTRASONIC: CHEMICAL CONCENTRATION MONITOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 50 ULTRASONIC: CHEMICAL CONCENTRATION MONITOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 ULTRASONIC: CHEMICAL CONCENTRATION MONITOR MARKET FOR SEMICONDUCTOR & ELECTRONICS MANUFACTURING, BY REGION, 2021-2024 (USD MILLION)

- TABLE 52 ULTRASONIC: CHEMICAL CONCENTRATION MONITOR MARKET FOR SEMICONDUCTOR & ELECTRONICS MANUFACTURING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 ULTRASONIC: CHEMICAL CONCENTRATION MONITOR MARKET FOR FOOD & BEVERAGES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 ULTRASONIC: CHEMICAL CONCENTRATION MONITOR MARKET FOR FOOD & BEVERAGES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 ULTRASONIC: CHEMICAL CONCENTRATION MONITOR MARKET FOR HEALTHCARE & PHARMACEUTICALS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 ULTRASONIC: CHEMICAL CONCENTRATION MONITOR MARKET FOR HEALTHCARE & PHARMACEUTICALS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 ULTRASONIC: CHEMICAL CONCENTRATION MONITOR MARKET FOR WATER & WASTEWATER TREATMENT, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 ULTRASONIC: CHEMICAL CONCENTRATION MONITOR MARKET FOR WATER & WASTEWATER TREATMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 ULTRASONIC: CHEMICAL CONCENTRATION MONITOR MARKET FOR OTHER END-USE INDUSTRIES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 60 ULTRASONIC: CHEMICAL CONCENTRATION MONITOR MARKET FOR OTHER END-USE INDUSTRIES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 OPTICAL: CHEMICAL CONCENTRATION MONITOR MARKET, BY TECHNOLOGY TYPE, 2021-2024 (USD MILLION)

- TABLE 62 OPTICAL: CHEMICAL CONCENTRATION MONITOR MARKET, BY TECHNOLOGY TYPE, 2025-2030 (USD MILLION)

- TABLE 63 OPTICAL: CHEMICAL CONCENTRATION MONITOR MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 64 OPTICAL: CHEMICAL CONCENTRATION MONITOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 65 OPTICAL: CHEMICAL CONCENTRATION MONITOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 OPTICAL: CHEMICAL CONCENTRATION MONITOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 OPTICAL: CHEMICAL CONCENTRATION MONITOR MARKET FOR SEMICONDUCTOR & ELECTRONICS MANUFACTURING, BY REGION, 2021-2024 (USD MILLION)

- TABLE 68 OPTICAL: CHEMICAL CONCENTRATION MONITOR MARKET FOR SEMICONDUCTOR & ELECTRONICS MANUFACTURING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 OPTICAL: CHEMICAL CONCENTRATION MONITOR MARKET FOR FOOD & BEVERAGES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 70 OPTICAL: CHEMICAL CONCENTRATION MONITOR MARKET FOR FOOD & BEVERAGES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 OPTICAL: CHEMICAL CONCENTRATION MONITOR MARKET FOR HEALTHCARE & PHARMACEUTICALS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 72 OPTICAL: CHEMICAL CONCENTRATION MONITOR MARKET FOR HEALTHCARE & PHARMACEUTICALS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 OPTICAL: CHEMICAL CONCENTRATION MONITOR MARKET FOR WATER & WASTEWATER TREATMENT, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 OPTICAL: CHEMICAL CONCENTRATION MONITOR MARKET FOR WATER & WASTEWATER TREATMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 OPTICAL: CHEMICAL CONCENTRATION MONITOR MARKET FOR OTHER END-USE INDUSTRIES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 OPTICAL: CHEMICAL CONCENTRATION MONITOR MARKET FOR OTHER END-USE INDUSTRIES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 CONDUCTIVITY: CHEMICAL CONCENTRATION MONITOR MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 78 CONDUCTIVITY: CHEMICAL CONCENTRATION MONITOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 79 CONDUCTIVITY: CHEMICAL CONCENTRATION MONITOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 80 CONDUCTIVITY: CHEMICAL CONCENTRATION MONITOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 CONDUCTIVITY: CHEMICAL CONCENTRATION MONITOR MARKET FOR SEMICONDUCTOR & ELECTRONICS MANUFACTURING, BY REGION, 2021-2024 (USD MILLION)

- TABLE 82 CONDUCTIVITY: CHEMICAL CONCENTRATION MONITOR MARKET FOR SEMICONDUCTOR & ELECTRONICS MANUFACTURING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 83 CONDUCTIVITY: CHEMICAL CONCENTRATION MONITOR MARKET FOR FOOD & BEVERAGES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 84 CONDUCTIVITY: CHEMICAL CONCENTRATION MONITOR MARKET FOR FOOD & BEVERAGES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 CONDUCTIVITY: CHEMICAL CONCENTRATION MONITOR MARKET FOR HEALTHCARE & PHARMACEUTICALS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 86 CONDUCTIVITY: CHEMICAL CONCENTRATION MONITOR MARKET FOR HEALTHCARE & PHARMACEUTICALS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 87 CONDUCTIVITY: CHEMICAL CONCENTRATION MONITOR MARKET FOR WATER & WASTEWATER TREATMENT, BY REGION, 2021-2024 (USD MILLION)

- TABLE 88 CONDUCTIVITY: CHEMICAL CONCENTRATION MONITOR MARKET FOR WATER & WASTEWATER TREATMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 CONDUCTIVITY: CHEMICAL CONCENTRATION MONITOR MARKET FOR OTHER END-USE INDUSTRIES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 90 CONDUCTIVITY: CHEMICAL CONCENTRATION MONITOR MARKET FOR OTHER END-USE INDUSTRIES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 ELECTROCHEMICAL: CHEMICAL CONCENTRATION MONITOR MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 92 ELECTROCHEMICAL: CHEMICAL CONCENTRATION MONITOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 93 ELECTROCHEMICAL: CHEMICAL CONCENTRATION MONITOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 94 ELECTROCHEMICAL: CHEMICAL CONCENTRATION MONITOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 95 ELECTROCHEMICAL: CHEMICAL CONCENTRATION MONITOR MARKET FOR SEMICONDUCTOR & ELECTRONICS MANUFACTURING, BY REGION, 2021-2024 (USD MILLION)

- TABLE 96 ELECTROCHEMICAL: CHEMICAL CONCENTRATION MONITOR MARKET FOR SEMICONDUCTOR & ELECTRONICS MANUFACTURING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 ELECTROCHEMICAL: CHEMICAL CONCENTRATION MONITOR MARKET FOR FOOD & BEVERAGES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 98 ELECTROCHEMICAL: CHEMICAL CONCENTRATION MONITOR MARKET FOR FOOD & BEVERAGES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 99 ELECTROCHEMICAL: CHEMICAL CONCENTRATION MONITOR MARKET FOR HEALTHCARE & PHARMACEUTICALS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 100 ELECTROCHEMICAL: CHEMICAL CONCENTRATION MONITOR MARKET FOR HEALTHCARE & PHARMACEUTICALS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 101 ELECTROCHEMICAL: CHEMICAL CONCENTRATION MONITOR MARKET FOR WATER & WASTEWATER TREATMENT, BY REGION, 2021-2024 (USD MILLION)

- TABLE 102 ELECTROCHEMICAL: CHEMICAL CONCENTRATION MONITOR MARKET FOR WATER & WASTEWATER TREATMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 103 ELECTROCHEMICAL: CHEMICAL CONCENTRATION MONITOR MARKET FOR OTHER END-USE INDUSTRIES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 104 ELECTROCHEMICAL: CHEMICAL CONCENTRATION MONITOR MARKET FOR OTHER END-USE INDUSTRIES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 105 OTHER TECHNOLOGIES: CHEMICAL CONCENTRATION MONITOR MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 106 OTHER TECHNOLOGIES: CHEMICAL CONCENTRATION MONITOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 107 OTHER TECHNOLOGIES: CHEMICAL CONCENTRATION MONITOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 108 OTHER TECHNOLOGIES: CHEMICAL CONCENTRATION MONITOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 109 OTHER TECHNOLOGIES: CHEMICAL CONCENTRATION MONITOR MARKET FOR SEMICONDUCTOR & ELECTRONICS MANUFACTURING, BY REGION, 2021-2024 (USD MILLION)

- TABLE 110 OTHER TECHNOLOGIES: CHEMICAL CONCENTRATION MONITOR MARKET FOR SEMICONDUCTOR & ELECTRONICS MANUFACTURING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 111 OTHER TECHNOLOGIES: CHEMICAL CONCENTRATION MONITOR MARKET FOR FOOD & BEVERAGES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 112 OTHER TECHNOLOGIES: CHEMICAL CONCENTRATION MONITOR MARKET FOR FOOD & BEVERAGES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 113 OTHER TECHNOLOGIES: CHEMICAL CONCENTRATION MONITOR MARKET FOR HEALTHCARE & PHARMACEUTICALS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 114 OTHER TECHNOLOGIES: CHEMICAL CONCENTRATION MONITOR MARKET FOR HEALTHCARE & PHARMACEUTICALS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 115 OTHER TECHNOLOGIES: CHEMICAL CONCENTRATION MONITOR MARKET FOR WATER & WASTEWATER TREATMENT, BY REGION, 2021-2024 (USD MILLION)

- TABLE 116 OTHER TECHNOLOGIES: CHEMICAL CONCENTRATION MONITOR MARKET FOR WATER & WASTEWATER TREATMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 117 OTHER TECHNOLOGIES: CHEMICAL CONCENTRATION MONITOR MARKET FOR OTHER END-USE INDUSTRIES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 118 OTHER TECHNOLOGIES: CHEMICAL CONCENTRATION MONITOR MARKET FOR OTHER END-USE INDUSTRIES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 119 CHEMICAL CONCENTRATION MONITOR MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 120 CHEMICAL CONCENTRATION MONITOR MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 121 HARDWARE: CHEMICAL CONCENTRATION MONITOR MARKET, BY HARDWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 122 HARDWARE: CHEMICAL CONCENTRATION MONITOR MARKET, BY HARDWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 123 CHEMICAL CONCENTRATION MONITOR MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 124 CHEMICAL CONCENTRATION MONITOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 125 SEMICONDUCTOR & ELECTRONICS MANUFACTURING: CHEMICAL CONCENTRATION MONITOR MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 126 SEMICONDUCTOR & ELECTRONICS MANUFACTURING: CHEMICAL CONCENTRATION MONITOR MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 127 SEMICONDUCTOR & ELECTRONICS MANUFACTURING: CHEMICAL CONCENTRATION MONITOR MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 128 SEMICONDUCTOR & ELECTRONICS MANUFACTURING: CHEMICAL CONCENTRATION MONITOR MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 129 FOOD & BEVERAGES: CHEMICAL CONCENTRATION MONITOR MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 130 FOOD & BEVERAGES: CHEMICAL CONCENTRATION MONITOR MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 131 FOOD & BEVERAGES: CHEMICAL CONCENTRATION MONITOR MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 132 FOOD & BEVERAGES: CHEMICAL CONCENTRATION MONITOR MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 133 HEALTHCARE & PHARMACEUTICALS: CHEMICAL CONCENTRATION MONITOR MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 134 HEALTHCARE & PHARMACEUTICALS: CHEMICAL CONCENTRATION MONITOR MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 135 HEALTHCARE & PHARMACEUTICALS: CHEMICAL CONCENTRATION MONITOR MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 136 HEALTHCARE & PHARMACEUTICALS: CHEMICAL CONCENTRATION MONITOR MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 137 WATER & WASTEWATER TREATMENT: CHEMICAL CONCENTRATION MONITOR MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 138 WATER & WASTEWATER TREATMENT: CHEMICAL CONCENTRATION MONITOR MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 139 WATER & WASTEWATER TREATMENT: CHEMICAL CONCENTRATION MONITOR MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 140 WATER & WASTEWATER TREATMENT: CHEMICAL CONCENTRATION MONITOR MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 141 OTHER END-USE INDUSTRIES: CHEMICAL CONCENTRATION MONITOR MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 142 OTHER END-USE INDUSTRIES: CHEMICAL CONCENTRATION MONITOR MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 143 OTHER END-USE INDUSTRIES: CHEMICAL CONCENTRATION MONITOR MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 144 OTHER END-USE INDUSTRIES: CHEMICAL CONCENTRATION MONITOR MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 145 CHEMICAL CONCENTRATION MONITOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 146 CHEMICAL CONCENTRATION MONITOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 147 NORTH AMERICA: CHEMICAL CONCENTRATION MONITOR MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 148 NORTH AMERICA: CHEMICAL CONCENTRATION MONITOR MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 149 NORTH AMERICA: SOLAR CONTAINER MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 150 NORTH AMERICA: SOLAR CONTAINER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 151 NORTH AMERICA: SOLAR CONTAINER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 152 NORTH AMERICA: SOLAR CONTAINER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 153 EUROPE: CHEMICAL CONCENTRATION MONITOR MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 154 EUROPE: CHEMICAL CONCENTRATION MONITOR MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 155 EUROPE: CHEMICAL CONCENTRATION MONITOR MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 156 EUROPE: CHEMICAL CONCENTRATION MONITOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 157 EUROPE: CHEMICAL CONCENTRATION MONITOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 158 EUROPE: CHEMICAL CONCENTRATION MONITOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 159 ASIA PACIFIC: CHEMICAL CONCENTRATION MONITOR MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 160 ASIA PACIFIC: CHEMICAL CONCENTRATION MONITOR MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 161 ASIA PACIFIC: CHEMICAL CONCENTRATION MONITOR MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 162 ASIA PACIFIC: CHEMICAL CONCENTRATION MONITOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 163 ASIA PACIFIC: CHEMICAL CONCENTRATION MONITOR MARKET, COUNTRY, 2021-2024 (USD MILLION)

- TABLE 164 ASIA PACIFIC: CHEMICAL CONCENTRATION MONITOR MARKET, COUNTRY, 2025-2030 (USD MILLION)

- TABLE 165 ROW: CHEMICAL CONCENTRATION MONITOR MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 166 ROW: CHEMICAL CONCENTRATION MONITOR MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 167 ROW: CHEMICAL CONCENTRATION MONITOR MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 168 ROW: CHEMICAL CONCENTRATION MONITOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 169 ROW: CHEMICAL CONCENTRATION MONITOR, BY REGION, 2021-2024 (USD MILLION)

- TABLE 170 ROW: CHEMICAL CONCENTRATION MONITOR, BY REGION, 2025-2030 (USD MILLION)

- TABLE 171 MIDDLE EAST: CHEMICAL CONCENTRATION MONITOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 172 MIDDLE EAST: CHEMICAL CONCENTRATION MONITOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 173 AFRICA: CHEMICAL CONCENTRATION MONITOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 174 AFRICA: CHEMICAL CONCENTRATION MONITOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 175 SOUTH AMERICA: CHEMICAL CONCENTRATION MONITOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 176 SOUTH AMERICA: CHEMICAL CONCENTRATION MONITOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 177 CHEMICAL CONCENTRATION MONITOR MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2021-JULY 2025

- TABLE 178 CHEMICAL CONCENTRATION MONITOR MARKET: DEGREE OF COMPETITION, 2024

- TABLE 179 CHEMICAL CONCENTRATION MONITOR MARKET: REGION FOOTPRINT

- TABLE 180 CHEMICAL CONCENTRATION MONITOR MARKET: TYPE FOOTPRINT

- TABLE 181 CHEMICAL CONCENTRATION MONITOR MARKET: MEDIUM FOOTPRINT

- TABLE 182 CHEMICAL CONCENTRATION MONITOR MARKET: PRODUCT FOOTPRINT

- TABLE 183 CHEMICAL CONCENTRATION MONITOR MARKET: TECHNOLOGY FOOTPRINT

- TABLE 184 CHEMICAL CONCENTRATION MONITOR MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 185 CHEMICAL CONCENTRATION MONITOR MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 186 CHEMICAL CONCENTRATION MONITOR MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 187 CHEMICAL CONCENTRATION MONITOR MARKET: PRODUCT LAUNCHES, JANUARY 2021-JULY 2025

- TABLE 188 CHEMICAL CONCENTRATION MONITOR MARKET: DEALS, JANUARY 2021-JULY 2025

- TABLE 189 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 190 THERMO FISHER SCIENTIFIC INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- TABLE 192 EMERSON ELECTRIC CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 ABB: COMPANY OVERVIEW

- TABLE 194 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 ABB: PRODUCT LAUNCHES

- TABLE 196 ABB: DEALS

- TABLE 197 ENDRESS+HAUSER GROUP SERVICES AG: COMPANY OVERVIEW

- TABLE 198 ENDRESS+HAUSER GROUP SERVICES AG: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 199 ENDRESS+HAUSER GROUP SERVICES AG: PRODUCT LAUNCHES

- TABLE 200 ENDRESS+HAUSER GROUP SERVICES AG: DEALS

- TABLE 201 VERALTO: COMPANY OVERVIEW

- TABLE 202 VERALTO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 AMETEK.INC.: COMPANY OVERVIEW

- TABLE 204 AMETEK.INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 AMETEK.INC.: PRODUCT LAUNCHES

- TABLE 206 AMETEK.INC.: DEALS

- TABLE 207 METTLER TOLEDO: COMPANY OVERVIEW

- TABLE 208 METTLER TOLEDO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 YOKOGAWA ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 210 YOKOGAWA ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 211 YOKOGAWA ELECTRIC CORPORATION: PRODUCT LAUNCHES

- TABLE 212 XYLEM: COMPANY OVERVIEW

- TABLE 213 XYLEM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 XYLEM: PRODUCT LAUNCHES

- TABLE 215 XYLEM: DEALS

- TABLE 216 HORIBA GROUP: COMPANY OVERVIEW

- TABLE 217 HORIBA GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 HORIBA GROUP: PRODUCT LAUNCHES

- TABLE 219 HORIBA GROUP: DEALS

- TABLE 220 AGILENT TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 221 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY OVERVIEW

- TABLE 222 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 223 FUJI ELECTRIC CO., LTD.: COMPANY OVERVIEW

- TABLE 224 SIEMENS: COMPANY OVERVIEW

- TABLE 225 ENTEGRIS: COMPANY OVERVIEW

- TABLE 226 KURABO INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 227 ANTON PAAR GMBH: COMPANY OVERVIEW

- TABLE 228 CI SEMI: COMPANY OVERVIEW

- TABLE 229 VAISALA: COMPANY OVERVIEW

- TABLE 230 SHIMADZU CORPORATION: COMPANY OVERVIEW

- TABLE 231 SENSOTECH GMBH: COMPANY OVERVIEW

- TABLE 232 SERVOMEX: COMPANY OVERVIEW

- TABLE 233 PIMACS: COMPANY OVERVIEW

- TABLE 234 PERKINELMER: COMPANY OVERVIEW

List of Figures

- FIGURE 1 CHEMICAL CONCENTRATION MONITOR MARKET AND REGIONAL SCOPE

- FIGURE 2 CHEMICAL CONCENTRATION MONITOR MARKET: DURATION CONSIDERED

- FIGURE 3 CHEMICAL CONCENTRATION MONITOR MARKET: RESEARCH DESIGN

- FIGURE 4 DATA CAPTURED FROM SECONDARY SOURCES

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 CORE FINDINGS FROM INDUSTRY EXPERTS

- FIGURE 7 CHEMICAL CONCENTRATION MONITOR MARKET: RESEARCH APPROACH

- FIGURE 8 CHEMICAL CONCENTRATION MONITOR MARKET: BOTTOM-UP APPROACH

- FIGURE 9 CHEMICAL CONCENTRATION MONITOR MARKET: TOP-DOWN APPROACH

- FIGURE 10 CHEMICAL CONCENTRATION MONITOR MARKET SIZE ESTIMATION (DEMAND SIDE)

- FIGURE 11 CHEMICAL CONCENTRATION MONITOR MARKET SIZE ESTIMATION (SUPPLY SIDE)

- FIGURE 12 CHEMICAL CONCENTRATION MONITOR MARKET: DATA TRIANGULATION

- FIGURE 13 CHEMICAL CONCENTRATION MONITOR MARKET: RESEARCH ASSUMPTIONS

- FIGURE 14 CHEMICAL CONCENTRATION MONITOR MARKET SIZE, 2021-2030

- FIGURE 15 STATIONARY SEGMENT TO CAPTURE LARGER MARKET SHARE IN 2025

- FIGURE 16 LIQUID SEGMENT TO DOMINATE MARKET FROM 2025 TO 2030

- FIGURE 17 OPTICAL SEGMENT TO DOMINATE CHEMICAL CONCENTRATION MONITOR MARKET BETWEEN 2025 AND 2030

- FIGURE 18 WATER & WASTEWATER TREATMENT SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2025

- FIGURE 19 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN CHEMICAL CONCENTRATION MONITOR MARKET BETWEEN 2025 AND 2030

- FIGURE 20 INCREASING FOCUS ON PROCESS AUTOMATION AND QUALITY CONTROL TO DRIVE CHEMICAL CONCENTRATION MONITOR MARKET

- FIGURE 21 STATIONARY SEGMENT TO CAPTURE PROMINENT MARKET SHARE IN 2030

- FIGURE 22 LIQUID SEGMENT TO DOMINATE CHEMICAL CONCENTRATION MONITOR MARKET DURING FORECAST PERIOD

- FIGURE 23 OPTICAL SEGMENT TO DOMINATE CHEMICAL CONCENTRATION MONITOR MARKET FROM 2025 TO 2030

- FIGURE 24 WATER & WASTEWATER TREATMENT SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 25 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025 AND 2030

- FIGURE 26 INDIA TO REGISTER HIGHEST CAGR IN GLOBAL CHEMICAL CONCENTRATION MONITOR MARKET DURING FORECAST PERIOD

- FIGURE 27 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 28 IMPACT ANALYSIS: DRIVERS

- FIGURE 29 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 30 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 31 IMPACT ANALYSIS: CHALLENGES

- FIGURE 32 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 33 AVERAGE SELLING PRICE OF INLINE REFRACTOMETERS OFFERED BY KEY PLAYERS, 2024

- FIGURE 34 AVERAGE SELLING PRICE OF AMPEROMETRIC ION SENSORS OFFERED BY KEY PLAYERS, 2024

- FIGURE 35 AVERAGE SELLING PRICE TREND OF INLINE REFRACTOMETERS, BY REGION, 2021-2024

- FIGURE 36 AVERAGE SELLING PRICE TREND OF AMPEROMETRIC ION SENSORS, BY REGION, 2021-2024

- FIGURE 37 CHEMICAL CONCENTRATION MONITOR VALUE CHAIN

- FIGURE 38 ECOSYSTEM ANALYSIS

- FIGURE 39 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 40 IMPORT SCENARIO FOR HS CODE 9027-COMPLIANT PRODUCTS IN TOP FIVE COUNTRIES, 2020-2024

- FIGURE 41 EXPORT SCENARIO FOR HS CODE 9027-COMPLIANT PRODUCTS IN TOP FIVE COUNTRIES, 2020-2024

- FIGURE 42 INVESTMENT AND FUNDING SCENARIO, 2021-2024

- FIGURE 43 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 44 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 45 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- FIGURE 46 IMPACT OF AI/GEN AI ON CHEMICAL CONCENTRATION MONITOR MARKET

- FIGURE 47 STATIONARY SEGMENT TO HOLD LARGER MARKET SHARE IN 2025 AND 2030

- FIGURE 48 LIQUID SEGMENT TO CAPTURE LARGER SHARE OF CHEMICAL CONCENTRATION MONITOR MARKET IN 2030

- FIGURE 49 AMPEROMETRIC ION SENSORS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 50 OPTICAL SEGMENT TO EXHIBIT HIGHEST CAGR BETWEEN 2025 AND 2030

- FIGURE 51 HARDWARE SEGMENT TO DOMINATE CHEMICAL CONCENTRATION MONITOR MARKET DURING FORECAST PERIOD

- FIGURE 52 WATER & WASTEWATER TREATMENT SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 53 ASIA PACIFIC TO RECORD HIGHEST CAGR IN CHEMICAL CONCENTRATION MONITOR MARKET FROM 2025 TO 2030

- FIGURE 54 NORTH AMERICA: CHEMICAL CONCENTRATION MONITOR MARKET SNAPSHOT

- FIGURE 55 EUROPE: CHEMICAL CONCENTRATION MONITOR MARKET SNAPSHOT

- FIGURE 56 ASIA PACIFIC: CHEMICAL CONCENTRATION MONITOR MARKET SNAPSHOT

- FIGURE 57 MARKET SHARE ANALYSIS OF COMPANIES OFFERING CHEMICAL CONCENTRATION MONITORS, 2024

- FIGURE 58 CHEMICAL CONCENTRATION MONITOR MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2021-2024

- FIGURE 59 COMPANY VALUATION

- FIGURE 60 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 61 BRAND/PRODUCT COMPARISON

- FIGURE 62 CHEMICAL CONCENTRATION MONITOR MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 63 CHEMICAL CONCENTRATION MONITOR MARKET: COMPANY FOOTPRINT

- FIGURE 64 CHEMICAL CONCENTRATION MONITOR MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 65 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT

- FIGURE 66 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- FIGURE 67 ABB: COMPANY SNAPSHOT

- FIGURE 68 ENDRESS+HAUSER GROUP SERVICES AG: COMPANY SNAPSHOT

- FIGURE 69 VERALTO: COMPANY SNAPSHOT

- FIGURE 70 AMETEK.INC.: COMPANY SNAPSHOT

- FIGURE 71 METTLER TOLEDO: COMPANY SNAPSHOT

- FIGURE 72 YOKOGAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 73 XYLEM: COMPANY SNAPSHOT

- FIGURE 74 HORIBA GROUP: COMPANY SNAPSHOT

- FIGURE 75 CHEMICAL CONCENTRATION MONITOR MARKET: INSIGHTS FROM INDUSTRY EXPERTS