|

市场调查报告书

商品编码

1521695

日本的危险物质物流-市场占有率分析、产业趋势/统计、成长预测(2024-2029)Japan Dangerous Goods Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

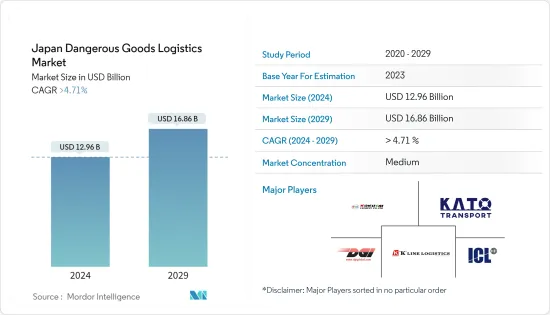

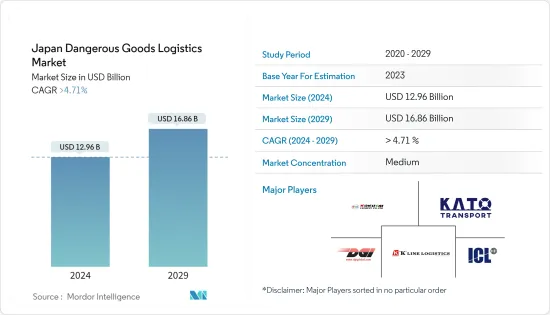

日本危险物质物流市场规模预计到 2024 年为 129.6 亿美元,预计到 2029 年将达到 168.6 亿美元,在预测期内(2024-2029 年)复合年增长率将超过 4.71%。

市场成长的推动因素包括各行业对危险材料的需求增加、运输和装卸法规收紧以及电子商务的兴起。在日本运送的危险物品主要类型包括化学品、爆炸物、易燃液体和放射性物质。

公司正在投资技术和合作伙伴关係,以应对监管和人才短缺等挑战。例如,三菱重工宣布推出智慧货柜解决方案,可即时监控敏感危险物质的温度和压力。

2024年1月,国土交通省宣布修订《爆炸物管理法》,以加强对建筑和拆除中使用的爆炸物的监管。这可能会对运输这些材料的物流公司产生影响。

2023 年 11 月,大型物流公司雅玛多运输与邮船物流合作推出专门针对锂离子电池的运输服务,锂离子电池是危险物质市场中不断成长的细分市场。此外,2023 年 10 月,另一家大公司日本通运宣布将在大阪开设一家新的物流设施,专门从事危险材料的处理,以引入该行业。

日本危险品物流市场趋势

电子商务的扩张促进了对危险材料的需求

- 电子商务平台提供的产品种类比传统实体店广泛许多。这包括各种被归类为危险材料的物品,例如电子产品、化妆品、清洁产品和医学实验室用品。消费者期望快速且方便的送货,迫使物流公司优化其运输危险物质的网路。这需要专用的卡车、包装解决方案和训练有素的人员。

- 日本的电子商务市场自 2013 年以来已经翻了一番,并且预计将继续成长。 2022年企业对消费者(B2C)电子商务市场规模将为22.7兆日圆,与前一年同期比较成长9.9%。日本的高互联网普及率和网路基础设施正在推动电子商务市场。行动应用程式 Mercari 以及乐天、雅虎购物和亚马逊等主要 B2C 公司的电子商务平台是日本电子商务市场的主要企业。根据2023年的一项调查,低价是影响近59%日本消费者购买行为的主要因素。

- 日本电子商务网站提供种类繁多的产品。需要明确的是,由于严格的法规和安全考虑,大多数危险材料无法轻鬆在线购买。然而,在某些类别中,电子商务在促进某些危险材料的销售方面发挥了作用。例如,某些染髮剂、指甲油,甚至某些护肤品可能含有因易燃性和潜在健康风险而被列为危险物质的成分。

- 根据Volza的日本出口资料,来自日本的清洁用品出货量为1,970万件,有1,706家日本出口商向1,995名买家出口。日本的清洁产品大多出口到越南、印度和土耳其。清洁产品出口前三名的国家是美国,有92,558件产品,其次是越南,有59,477件产品,中国则以42,909件产品位居第三。

对仓储基础设施的需求增加推动市场

- 某些危险材料,例如药品和化学品,需要特定的温度范围才能安全储存。因此,需要配备先进温度控制系统的专用设施。易燃易爆材料需要专门设计的仓库,具有防火结构、通风系统和先进的灭火技术。

- 一些危险材料,例如贵重金属和危险材料,需要加强安全措施,并需要具有存取限制、监控系统和强大安全通讯协定的仓库。

- 2023年7月,亚马逊日本宣布将在日本建立两个新的物流基地。一个是千叶市,另一个是埼玉县狭山市,都位于东京都会区。亚马逊位于千叶的新千叶履约中心将成为该公司在日本最大的机器人基地,配备机器人拾取和移动货架。自动化系统可以帮助工人减少库存和从货架上取出产品所需的时间。此外,还有更多的可用空间,据说可以比传统仓库多储存多达 40% 的库存。

- NEC 公司的目标是透过一款新型机器人,使部署在日本各地仓库中的自主移动机器人(AMR) 的效率提高一倍,该机器人可以在设施内移动时自动调整速度。随机控制技术」。我们计划在 2024 年 3 月之前将这项技术商业化,并将其引入全国范围内的 NEC 下属 AMR。近年来,由于人手不足,日本的大型仓库一直在使用机器人在其设施内运输物料。这些AMR配置了较低的运行速度以确保安全,但运输效率是一个问题。

日本危险品物流业概况

日本危险物质物流市场本质上是细分的,有全球和参与企业。由于电子商务、技术整合和经济成长等多种因素,预计该市场将在预测期内成长。日本领先公司正在整合各种尖端技术,包括仓库管理系统、无人机送货和自动化。我们还采用了运输管理系统来更好地规划和追踪设施,从而提高生产力和价值提案。该市场的主要企业包括国际通运、佐川环球物流、日本通运、K Line 物流、邮船物流等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行概述

第四章市场洞察

- 目前的市场状况

- 产业价值链分析

- 政府法规和倡议

- 危险品类别概述

- 技术简介

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 对危险物质的需求不断增长

- 扩大电子商务成长

- 市场限制因素

- 缺乏合格的人才

- 基础设施限制

- 市场机会

- 技术进步

- 产业伙伴关係和协作

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第六章 市场细分

- 按服务

- 运输

- 仓储/配送

- 附加价值服务

- 目的地

- 国内的

- 国际的

第七章 竞争格局

- 市场集中度概览

- 公司简介

- Kokusai Express

- "K" Ling Logistics Limited

- KATO Transport

- DGI(Dangerous Goods International)Global

- ICL Logistics Japan Co Limited

- Nippon Express

- Yamato Transport

- Chikko Corporation

- LOGISTEED Japan Ltd

- Yusen Logistics

- Mitsui Chemicals

- SAGAWA Global Logistics

- Uyeno Logichem Ltd*

- 其他公司

第八章 市场未来展望

第九章 附录

The Japan Dangerous Goods Logistics Market size is estimated at USD 12.96 billion in 2024, and is expected to reach USD 16.86 billion by 2029, growing at a CAGR of greater than 4.71% during the forecast period (2024-2029).

The market growth is driven by factors such as increasing demand for dangerous goods in various industries, stricter regulations for transportation and handling, and the rise of e-commerce. The major types of dangerous goods transported in Japan include chemicals, explosives, flammable liquids, and radioactive materials.

Companies are investing in technology and partnerships to address challenges like regulations and talent shortages. For instance, Mitsubishi Heavy Industries launched a smart container solution that allows the real-time monitoring of temperature and pressure for sensitive, dangerous goods.

In January 2024, the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) announced revisions to the "Law on the Control of Explosives" to strengthen regulations for explosives used in construction and demolition. This could impact logistics companies transporting these materials.

In November 2023, Yamato Transport, a major logistics company, partnered with Yusen Logistics to offer specialized transportation services for lithium-ion batteries, a growing segment in the dangerous goods market. Also, in October 2023, Nippon Express, another major player, announced opening a new logistics facility in Osaka dedicated to handling dangerous goods and showcasing the industry.

Japan Dangerous Goods Logistics Market Trends

Increasing E-commerce Growth is Contributing to the Demand for Dangerous Goods

- E-commerce platforms offer a much wider variety of products compared to traditional brick-and-mortar stores. This includes a range of items classified as dangerous goods, such as electronics, cosmetics, cleaning products, and medical and laboratory supplies. Consumers expect fast and convenient delivery, which puts pressure on logistics companies to optimize their networks for the transportation of dangerous goods. This can involve dedicated trucks, packaging solutions, and trained personnel.

- Japan's e-commerce market has doubled since 2013 and is expected to continue growing. In 2022, the business-to-consumer (B2C) e-commerce market was valued at JPY 22.7 trillion, which is a 9.9% increase from the previous year. The e-commerce market is driven by Japan's high internet penetration and network infrastructure. The mobile-based app Mercari and re-commerce platforms from major B2C companies like Rakuten, Yahoo Shopping, and Amazon Marketplaces are key players in Japan's e-commerce market. A 2023 survey found that low price is the leading factor influencing the purchase behavior of almost 59% of Japanese consumers.

- The e-commerce sites in Japan offer a vast array of products. It is important to clarify that most dangerous goods are not readily available for purchase online due to strict regulations and safety concerns. However, there are some specific categories where e-commerce does play a role in facilitating the sale of certain dangerous goods. For instance, certain hair dyes, nail polishes, and even some skincare products might contain ingredients regulated as dangerous goods due to flammability or potential health risks.

- As per Volza's Japan Export data, cleaning product shipments from Japan stood at 19.7K, exported by 1,706 Japanese exporters to 1,995 buyers. Japan exports most of its cleaning products to Vietnam, India, and Turkey. The top three exporters of cleaning products are the United States with 92,558 shipments, followed by Vietnam with 59,477, and China at the third spot with 42,909 shipments.

Increasing Demand for Warehouse Storage Infrastructures is Driving the Market

- Certain dangerous goods, like pharmaceuticals or chemicals, require specific temperature ranges for safe storage. This necessitates dedicated facilities with advanced temperature control systems. Flammable or explosive materials require specially designed warehouses with fire-resistant construction, ventilation systems, and advanced fire suppression technologies.

- Some dangerous goods, like valuable metals or hazardous materials, require enhanced security measures, necessitating warehouses with restricted access, surveillance systems, and robust security protocols.

- In July 2023, Amazon Japan announced that it would establish two new distribution hubs in Japan, one in the city of Chiba and the other in the Saitama Prefecture City of Sayama, both in the greater Tokyo area. Amazon Chiba Minato Fulfillment Center, to be created in the city of Chiba, will be the company's largest robotized hub in Japan, where robots pick up racks and move around. The automated system will help workers and reduce the time spent stocking the shelves and taking items off the racks. It also allows for more space, and the building can apparently stock up to 40% more inventory than conventional warehouses.

- NEC Corporation aims to double the efficiency of autonomous mobile robots (AMRs) deployed in warehouses across Japan by developing a new "risk-sensitive stochastic control technology" that enables them to automatically adjust their speed as they navigate the facility. The company planned to put this technology into practice by March 2024 and have it installed in NEC's cooperative AMRs in the nation. In recent years, the labor shortage has pushed large warehouses in Japan to use robots to transport materials within their facilities. These AMRs are configured to travel with reduced speed to ensure safety, making transport efficiency a challenge.

Japan Dangerous Goods Logistics Industry Overview

The Japanese dangerous goods logistics market is fragmented in nature, with a mix of global and regional players. The market is expected to grow during the forecast period due to several factors, such as e-commerce, technology integration, and growing economies. The major companies in Japan have embraced various modern technologies, such as warehousing management systems, drone delivery, and automation. They have also adopted the transportation management system, which enabled better planning and tracking facilities, resulting in increased productivity and value proposition. The major players in this market are Kokusai Express, SAGAWA Global Logistics, Nippon Express, K Line Logistics, and Yusen Logistics.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Industry Value Chain Analysis

- 4.3 Government Regulations and Initiatives

- 4.4 Brief on Dangerous Goods Classes

- 4.5 Technology Snapshot

- 4.6 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Dangerous Goods

- 5.1.2 Increasing E-commerce Growth

- 5.2 Market Restraints

- 5.2.1 Lack of Qualified Personnel

- 5.2.2 Infrastructure Limitations

- 5.3 Market Opportunities

- 5.3.1 Technological Advancements

- 5.3.2 Partnerships and Collaborations in the Industry

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitutes

- 5.4.5 intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Service

- 6.1.1 Transportation

- 6.1.2 Warehousing and Distribution

- 6.1.3 Value-added Services

- 6.2 By Destination

- 6.2.1 Domestic

- 6.2.2 International

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 Kokusai Express

- 7.2.2 "K" Ling Logistics Limited

- 7.2.3 KATO Transport

- 7.2.4 DGI (Dangerous Goods International) Global

- 7.2.5 ICL Logistics Japan Co Limited

- 7.2.6 Nippon Express

- 7.2.7 Yamato Transport

- 7.2.8 Chikko Corporation

- 7.2.9 LOGISTEED Japan Ltd

- 7.2.10 Yusen Logistics

- 7.2.11 Mitsui Chemicals

- 7.2.12 SAGAWA Global Logistics

- 7.2.13 Uyeno Logichem Ltd*

- 7.3 Other Companies