|

市场调查报告书

商品编码

1889165

全球宠物益生菌市场(至2030年):按类型(益生菌、益生元、后生元)、用途(干粮、湿粮、营养补充剂、零食)、宠物(犬、猫、其他)、剂型、功能、生产技术和地区划分Pet Biotics Market By Type (Probiotics, Prebiotics, and Postbiotics), Application (Dry, Wet, Supplements, and Snacks & Treats), Pet (Dogs, Cats, and Other Pets), Form, Function, Manufacturing Technology, and Region - Global Forecast to 2030 |

||||||

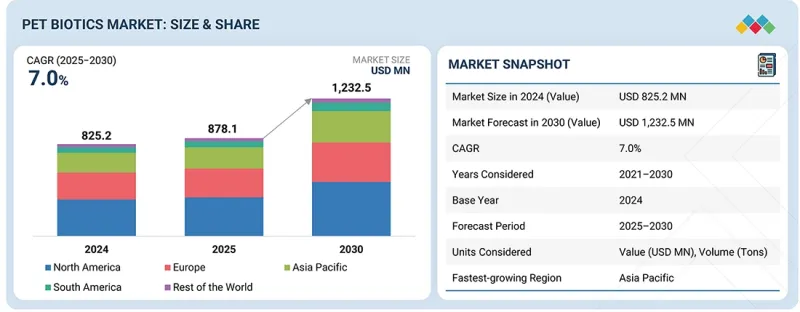

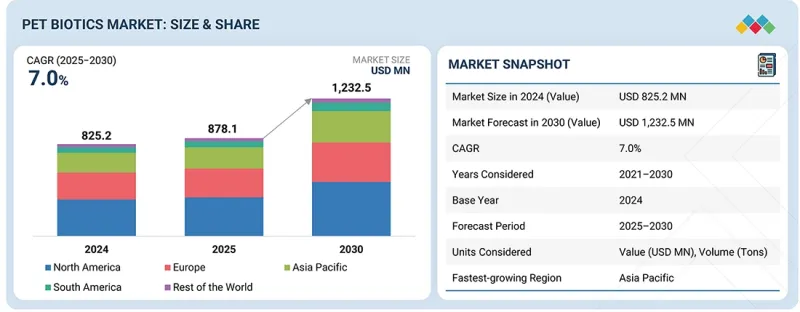

预计宠物生物製剂市场将从 2025 年的 8.781 亿美元成长到 2030 年的 12.325 亿美元,复合年增长率为 7.0%。

全球宠物益生菌市场正经历显着成长,这主要得益于宠物日益人性化的趋势。随着饲主寻求类似人类营养的肠道菌丛支持解决方案,对先进肠道健康成分的需求不断上升。此外,人们对预防性护理(包括增强免疫力、缓解压力、改善消化功能和提升整体健康水平)的日益关注,也加速了益生菌、益生元和后生元等功能性益生菌在宠物食品、补充剂和零食中的应用。同时,优质化趋势以及对天然、洁净标示和循证配方的追求,也为高品质、经临床检验的益生菌菌株创造了巨大的市场机会。此外,对个人化和病理特异性营养护理日益增长的需求,也为针对特定过敏、老龄化相关问题和品种需求的标靶益生菌提供了发展空间。

| 调查范围 | |

|---|---|

| 调查期 | 2021-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 单元 | 价值(美元)和数量(吨) |

| 部分 | 类型、用途、宠物、形态、功能、製造流程(定性)、地区 |

| 目标区域 | 北美洲、欧洲、亚太地区、南美洲、世界其他地区 |

然而,宠物益生菌市场预计将面临许多挑战,包括高品质菌株供应链的复杂性、各地监管法规的不一致,以及需要强有力的科学证据来建立消费者信任。此外,确保益生菌在各种宠物食品基质中的稳定性和活性仍然是一项技术难题。

总体而言,人们健康意识的提高和对以微生物组为中心的营养需求的增加,为宠物益生菌生产商创造了巨大的成长机会,使其能够占据相当大的市场份额。

“按类型划分,预计益生菌产品在预测期内将占据大部分市场份额。”

益生菌正占据市场主导地位,这主要得益于消费者对功能性营养的强劲需求,这类营养旨在支持宠物的消化健康、免疫力和整体健康。包括乳酸桿菌、双叉桿菌、芽孢桿菌和酿酒酵母在内的益生菌菌株已被科学证实能够显着改善肠道健康和免疫力,使宠物食品品牌能够做出令人信服的健康声明。微胶囊化和菌株特异性配方等技术进步,使得益生菌能够在加工和储存过程中保持活性。持续的专利活动和产品创新也展现了其巨大的商业性价值。儘管存在菌株敏感性、加工过程中活性降低以及缺乏长期研究等挑战,但益生菌已被证实的健康益处、消费者意识的提高以及行业的投入,使其成为干粮、湿粮、零食和营养补充剂中的首选成分。

“按宠物类型划分,预计狗类宠物将保持强劲的市场份额。”

这一趋势主要源自于宠物日益拟人化的趋势。饲主将狗狗视为家庭成员,并越来越重视狗狗的整体健康和福祉。狗狗经常会遇到一些常见的健康问题,例如关节疼痛、消化器官系统问题和皮肤过敏,这些问题都可以透过针对性的营养补充剂来缓解。因此,专为狗狗设计的益生菌和益生元产品需求显着增长,这些产品旨在维护狗狗的关节健康、毛髮光泽和免疫功能。

从地区来看,预计北美将在预测期内引领市场。

北美在宠物益生菌市场的领先地位得益于多方面因素的共同作用:高宠物拥有率、消费者在宠物健康方面的强劲支出以及先进的产业基础设施。该地区的宠物饲主高度重视功能性营养,从而推动了益生菌、益生元和后生元等促进肠道健康、增强免疫力系统和提升整体健康的产品的强劲需求。此外,北美拥有成熟的宠物食品产业,并利用先进的生产技术来确保敏感益生菌成分的功效。北美企业也具备开发各种宠物益生菌产品的优势,包括干粮、湿粮、点心和营养补充品。同时,完善的法规结构、强大的分销网络以及对研发和产品创新的大量投资,预计将进一步推动宠物益生菌产业的消费成长和市场领先地位。

本报告调查了全球宠物生物製剂市场,并提供了市场概况、影响市场成长的各种因素分析、技术和专利趋势、法律制度、案例研究、市场规模趋势和预测、按各个细分市场、地区/主要国家进行的详细分析、竞争格局以及主要企业的概况。

目录

第一章 引言

第二章执行摘要

第三章重要考察

第四章 市场概览

- 市场动态

- 司机

- 抑制因素

- 机会

- 任务

- 未满足的需求和閒置频段

- 与相关市场和不同产业相关的跨领域机会

- 一级/二级/三级公司的策略性倡议

第五章 产业趋势

- 波特五力分析

- 宏观经济展望

- 价值链分析

- 生态系分析

- 定价分析

- 贸易分析

- 2025-2026 年重要会议与活动

- 影响客户业务的趋势/颠覆性因素

- 投资和资金筹措方案

- 案例研究分析

- 2025年美国关税对宠物生物製品市场的影响

第六章:技术进步、人工智慧影响、专利、创新与未来应用

- 技术分析

- 专利分析

- 未来应用

- 生成式人工智慧将如何影响宠物食品产业

- 成功案例和实际应用

第七章 监理环境与永续性倡议

- 地方法规和合规性

- 对永续性的承诺

- 监理政策如何影响永续性倡议

- 认证、标籤和环境标准

第八章:顾客状况与购买行为

- 决策流程

- 采购过程中的关键相关利益者及其评估标准

- 采用障碍和内部挑战

- 各个终端用户产业尚未满足的需求

- 市场盈利

- 获利潜力

第九章 宠物生物製剂市场(按类型划分)

- 益生菌

- 细菌

- 酵母/真菌

- 益生元

- 寡糖

- 菊糖

- 聚葡萄糖

- 其他的

- 后生元

- 细菌

- 酵母/真菌

- 酿酒酵母

- 布拉氏酵母

第十章 宠物生物製品市场依应用领域划分

- 干粮

- 湿粮

- 补充

- 零食和点心

第十一章 宠物生物製剂市场类型

- 干燥

- 湿的

第十二章 宠物生物製品市场

- 狗

- 猫

- 其他的

第十三章 宠物生物製剂市场依功能划分

- 消化器官系统/肠道健康

- 免疫调节

- 代谢与体重管理

- 口腔和牙齿健康

- 其他功能

14. 依生产技术分類的宠物生物製品市场

- 发酵

- 离心和过滤

- 干燥/稳定化

- 封装和保护

- 惰性和细胞破坏

- 成分与混合

- 品管/存储

第十五章 宠物生物製品市场区域划分

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他的

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲和纽西兰

- 其他的

- 南美洲

- 巴西

- 阿根廷

- 其他的

- 世界其他地区

- 中东

- 非洲

第十六章 竞争格局

- 概述

- 主要参与企业的策略/优势

- 收入分析

- 市占率分析

- 估值和财务指标

- 品牌/产品对比

- 公司评估矩阵:主要企业

- 公司估值矩阵:Start-Ups/中小企业

- 竞争格局和趋势

第十七章:公司简介

- 主要企业

- ADM

- ALLTECH (US)

- KERRY GROUP PLC

- INTERNATIONAL FLAVORS & FRAGRANCES INC

- DSM-FIRMENICH

- CARGILL, INCORPORATED

- PROBI

- INGREDION (US)

- KEMIN INDUSTRIES, INC.

- BENEO GMBH

- PHILEO BY LESAFFRE

- LALLEMAND INC.

- SACCO SYSTEM

- SANZYME BIOLOGICS

- ORFFA

- Start-Ups/中小企业

- SYNBIO TECH INC.

- CANBIOCIN INC.

- BIO-CAT

- SPECIALTY ENZYMES & PROBIOTICS

- CREATIVE ENZYMES

- VERB BIOTICS

- BIOTENOVA SDN. BHD.

- BIOPROX HEALTHCARE

- PELLUCID LIFESCIENCES PVT. LTD

- HOLLISON, LLC. (US)

第十八章调查方法

第十九章:邻近及相关市场

第20章附录

The pet biotics market is estimated to be worth USD 878.1 million in 2025 and is projected to reach USD 1,232.5 million by 2030, at a CAGR of 7.0%. The global pet biotics market is experiencing significant growth, driven by the rising humanization of pets, which is increasing demand for advanced gut-health ingredients as owners seek microbiome-supporting solutions similar to those used in human nutrition. Additionally, there is a growing focus on preventive health, including immunity, stress reduction, digestion, and overall health performance, which is accelerating the use of functional biotics such as probiotics, prebiotics, and postbiotics, in pet food, supplements, treats & snacks. Furthermore, premiumization trends and the shift toward natural, clean-label, and scientifically backed formulations create strong opportunities for high-quality, clinically validated biotic strains. Additionally, the surge in individualized and condition-specific nutrition opens the door for targeted biotics addressing sensitivities, age-related issues, and breed-specific needs.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Tons) |

| Segments | By Type, application, pet, form, functions, manufacturing technology (qualitative), and region |

| Regions covered | North America, Europe, Asia Pacific, South America, and the Rest of the World (RoW) |

However, supply chain complexity for high-quality strains, regulatory inconsistencies across regions, and the need for strong scientific substantiation to build consumer trust are expected to pose challenges in the pet biotics market. Furthermore, ensuring the stability and survivability of biotics in various pet food matrices also remains a technical challenge.

Overall, increasing wellness awareness and demand for microbiome-focused nutrition present substantial growth opportunities for pet biotics manufacturers to gain a significant share in the market.

"Probiotic type is expected to hold a dominant market share during the forecast period"

The probiotic types in the pet biotic segments dominate the market due to strong consumer demand for functional nutrition that supports digestive health, immunity, and overall well-being in pets. Scientific evidence demonstrates that probiotic strains, such as Lactobacillus, Bifidobacterium, Bacillus, and Saccharomyces cerevisiae, provide measurable gut and immune benefits, which allows pet food brands to make compelling health claims. Technological advances, such as microencapsulation and strain-specific formulation, help maintain probiotic viability during processing and storage, while ongoing patent activity and product innovation indicate a high commercial value. Despite challenges like strain sensitivity, viability loss during processing, and limited long-term studies, the combination of proven health benefits, consumer awareness, and industry investment has made probiotics a preferred ingredient in dry food, wet food, treats, and supplements.

"Dog segment is expected to hold a strong market share among the pet types in the pet biotics market"

Dogs are expected to dominate the pet type segment in the pet biotics market. This trend is primarily driven by the increasing humanization of pets, where pet owners are more inclined to treat their dogs as family members and invest in their overall health and wellness. Dogs often suffer from common health issues such as joint pain, digestive problems, and skin allergies, which can be managed through targeted nutritional supplements. As a result, the demand for probiotics & prebiotics tailored specifically for dogs, such as those supporting joint health, coat shine, and immune function, is witnessing significant growth.

"North America is expected to dominate the global pet biotics market during the forecast period"

North America dominates the pet biotics market due to a combination of high pet ownership, strong consumer spending on pet health, and advanced industry infrastructure. With high awareness among pet owners in the region of functional nutrition, the demand for probiotics, prebiotics, and postbiotics is strong, as these products can promote gut health, immunity, and overall wellness. The region also has a well-established pet food industry that utilizes advanced manufacturing technologies to maintain the viability of sensitive biotic ingredients. Additionally, North American companies are well-positioned to develop a wide range of pet biotic products, including dry and wet foods, treats, and supplements. Furthermore, supportive regulatory frameworks, robust distribution networks, and considerable investment in R&D and product innovation are expected to drive consumption and market leadership in the pet biotic segment.

In-depth interviews have been conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the pet biotics market.

- By Company Type: Tier 1 - 30%, Tier 2 - 25%, and Tier 3 - 45%

- By Designation: Directors - 25%, Managers - 35%, Others - 40%

- By Region: North America - 20%, Europe - 30%, Asia Pacific - 35%, South America - 10%, and Rest of the World - 5%

Prominent companies in the market include ADM (US), Alltech (US), Kerry Group plc (Ireland), International Flavors & Fragrances Inc. (US), dsm-firmenich (Netherlands), Cargill, Incorporated (US), Probi (Sweden), Kemin Industries, Inc. (US), BENEO GmbH (Germany), Ingredion (US), Lallemand Inc. (Canada), Sacco System (Italy), Phileo by Lesaffre (France), Sanzyme Biologics (India), Orffa (Netherlands), BIO-CAT (US), and others.

Research Coverage

This research report categorizes the pet biotics market by type (probiotics, prebiotics, and postbiotics), application (dry food, wet food, supplements, and snacks & treats), pet (dogs, cats, and other pets), function (digestive/gut health, immune modulation, metabolic & weight management, oral & dental health, other functions), manufacturing technology (qualitative) (fermentation, centrifugation & filtration, drying & stabilization, encapsulation & protection, inactivation & cell disruption, formulation & blending, and quality control & storage), and region (North America, Europe, Asia Pacific, South America, and Rest of the World).

The report's scope encompasses detailed information on the major factors, including drivers, restraints, challenges, and opportunities, that influence the growth of the pet biotic industry. A thorough analysis of the key industry players has been done to provide insights into their business, services, key strategies, contracts, partnerships, agreements, product launches, mergers & acquisitions, and recent developments associated with the pet biotics market. This report provides a competitive analysis of emerging startups in the pet biotics market ecosystem. Furthermore, the study covers industry-specific trends, including technology analysis, ecosystem & market mapping, and patent & regulatory landscape, among others.

Reasons to Buy This Report

The report provides market leaders/new entrants with information on the closest approximations of revenue numbers for the overall pet biotics and its subsegments. It will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market, providing them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (rising pet humanization and preventive health focus), restraints (heat and moisture sensitivity of microbial strains), opportunities (rising demand for gut-health-focused and functional pet foods), and challenges (supply chain complexity for live microbes) influencing the growth of the pet biotics market

- Product Development/Innovation: Detailed insights into research & development activities and new product launches in the pet biotics market

- Market Development: Comprehensive information about lucrative markets-analysis of pet biotics across varied regions

- Market Diversification: Exhaustive information about new product sources, untapped geographies, recent developments, and investments in the pet biotics market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, brand/product comparison, and product footprints of leading players such as ADM (US), Alltech (US), Kerry Group plc (Ireland), International Flavors & Fragrances Inc. (US), dsm-firmenich (Netherlands), Cargill, Incorporated (US), Probi (Sweden), Kemin Industries, Inc. (US), BENEO GmbH (Germany), Ingredion (US), Lallemand Inc. (Canada), Sacco System (Italy), Phileo by Lesaffre (France), Sanzyme Biologics (India), Orffa (Netherlands), BIO-CAT (US), and other players in the pet biotics market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE AND SEGMENTATION

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

2 EXECUTIVE SUMMARY

- 2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN PET BIOTICS MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PET BIOTICS MARKET

- 3.2 PET BIOTICS MARKET, BY PET AND REGION

- 3.3 PET BIOTICS MARKET, BY TYPE

- 3.4 PET BIOTICS MARKET, BY PET

- 3.5 PET BIOTICS MARKET, BY APPLICATION

- 3.6 PET BIOTICS MARKET, BY FORM

- 3.7 PET BIOTICS MARKET, BY COUNTRY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Surge in pet adoption rates

- 4.2.1.2 Rise in pet humanization and focus on preventive health

- 4.2.1.3 Growing veterinary recommendations and clinical backing

- 4.2.1.4 Premiumization and functional food trends

- 4.2.2 RESTRAINTS

- 4.2.2.1 Heat and moisture sensitivity of probiotic strains

- 4.2.2.2 Shelf-life viability concerns

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Innovation in ingredient formulation

- 4.2.3.2 Rising demand for gut-health-focused and functional pet foods

- 4.2.3.3 Increase in pet expenditure with substantial increase in pet food expenditure

- 4.2.3.4 Increase in urban pet lifestyle experiences: Pet cafes, rentals, and pet-friendly travel

- 4.2.4 CHALLENGES

- 4.2.4.1 Supply chain complexity for live microbes

- 4.2.4.2 Competition from alternative digestive health solutions

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS IN PET BIOTICS MARKET

- 4.3.2 WHITE SPACE OPPORTUNITIES - SYNBIOTIC (COMBINATION OF PROBIOTICS & PREBIOTICS)

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 4.5.1 KEY MOVES AND STRATEGIC FOCUS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 THREAT OF NEW ENTRANTS

- 5.1.2 THREAT OF SUBSTITUTES

- 5.1.3 BARGAINING POWER OF SUPPLIERS

- 5.1.4 BARGAINING POWER OF BUYERS

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMICS OUTLOOK

- 5.2.1 INTRODUCTION

- 5.2.2 SHIFT TOWARD PREVENTIVE PET HEALTH THROUGH SUPPLEMENT ADOPTION

- 5.2.3 EXPANSION OF PET INSURANCE COVERAGE GLOBALLY

- 5.2.4 ECO-CONSCIOUS PET OWNERSHIP DRIVING DEMAND FOR BIOTIC-BASED PET PRODUCTS

- 5.3 VALUE CHAIN ANALYSIS

- 5.3.1 RESEARCH & DEVELOPMENT

- 5.3.2 SOURCING

- 5.3.3 PRODUCTION & PROCESSING

- 5.3.4 DISTRIBUTION

- 5.3.5 MARKETING & SALES

- 5.3.6 END USERS

- 5.4 ECOSYSTEM ANALYSIS

- 5.4.1 DEMAND SIDE

- 5.4.2 SUPPLY SIDE

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY LIVESTOCK

- 5.5.2 AVERAGE SELLING PRICE TREND OF PET BIOTICS, BY REGION, 2021-2024

- 5.6 TRADE ANALYSIS

- 5.6.1 IMPORT SCENARIO OF HS CODE 3002

- 5.6.2 EXPORT SCENARIO OF HS CODE 3002

- 5.7 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 STABILIZED PLANT-BASED PROBIOTIC INTEGRATION BY A&B INGREDIENTS TO ENHANCE DIGESTIVE AND SKIN HEALTH IN DOGS

- 5.10.2 PROBIOWORLD'S DUAL-ACTION PET BIOTIC FORMULATION FOR DENTAL AND GUT HEALTH ENHANCEMENT

- 5.10.3 CHR. HANSEN (PART OF NOVONESIS GROUP) - PIONEERING SCIENCE-BASED PROBIOTICS PORTFOLIO FOR EVERY PET LIFE STAGE

- 5.11 IMPACT OF 2025 US TARIFF - PET BIOTICS MARKET

- 5.11.1 INTRODUCTION

- 5.11.2 KEY TARIFF RATES

- 5.11.3 PRICE IMPACT ANALYSIS

- 5.11.4 IMPACT ON COUNTRIES/REGIONS

- 5.11.4.1 US

- 5.11.4.2 Europe

- 5.11.4.3 Asia Pacific

- 5.11.5 IMPACT ON END-USE INDUSTRIES

6 TECHNOLOGY ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 TECHNOLOGY ANALYSIS

- 6.1.1 KEY TECHNOLOGIES

- 6.1.1.1 Fermentation

- 6.1.1.2 Filtration

- 6.1.1.3 Freeze-drying (Lyophilization)

- 6.1.1.4 Microencapsulation and nanoencapsulation

- 6.1.2 COMPLEMENTARY TECHNOLOGIES

- 6.1.2.1 IoT-based fermentation monitoring

- 6.1.2.2 Enzymatic hydrolysis

- 6.1.3 ADJACENT TECHNOLOGIES

- 6.1.3.1 Genome-scale metabolic modeling

- 6.1.3.2 Bioinformatics

- 6.1.3.3 Digital fermentation control

- 6.1.4 TECHNOLOGY/PRODUCT ROADMAP

- 6.1.4.1 Short-term | Foundation & Early Commercialization

- 6.1.4.2 Mid-term | Expansion & Standardization

- 6.1.4.3 Long-term | Mass Commercialization & Disruption

- 6.1.1 KEY TECHNOLOGIES

- 6.2 PATENT ANALYSIS

- 6.3 FUTURE APPLICATIONS

- 6.3.1 PSYCHOBIOTICS FOR BEHAVIORAL AND COGNITIVE HEALTH IN PETS

- 6.3.2 SYNBIOTICS AS NEXT-GENERATION GUT HEALTH SOLUTIONS IN PETS

- 6.3.3 ENGINEERED/BREED-PRECISION PROBIOTIC STRAINS FOR PET HEALTH

- 6.3.4 MICROBIOME-LINKED DIAGNOSTIC TOOLS FOR TARGETED PET BIOTIC THERAPIES

- 6.3.5 SPORE-BASED PROBIOTICS FOR SHELF-STABLE, HIGH-TEMPERATURE PET FOOD PROCESSING

- 6.4 IMPACT OF GEN AI ON PET FOOD INDUSTRY

- 6.4.1 TOP USE CASES AND MARKET POTENTIAL

- 6.4.2 BEST PRACTICE OF GEN AI IN PET FOOD INDUSTRY

- 6.4.3 CASE STUDIES OF AI IMPLEMENTATION IN PET INDUSTRY

- 6.4.3.1 CanBiocin's data-intelligent approach to enhancing fermentation efficiency and yield

- 6.4.3.2 Harmonizing formulation systems: PPF's pan-European implementation of BESTMIX Recipe Management

- 6.4.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.4.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN PET BIOTICS

- 6.4.6 IMPACT OF AI/GENERATIVE AI ON PET BIOTICS MARKET

- 6.5 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

7 REGULATORY LANDSCAPE AND SUSTAINABILITY INITIATIVES

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.1.3 LABELING REQUIREMENTS AND CLAIMS

- 7.1.4 ANTICIPATED REGULATORY CHANGES IN NEXT 5-10 YEARS

- 7.1.4.1 Mandatory validation of CFU viability & functional claims

- 7.1.4.2 Global harmonization of pet biotics ingredient approvals

- 7.1.4.3 Enhanced safety and antimicrobial-resistance (AMR) risk evaluation

- 7.1.4.4 Digital labeling, data transparency, and smart packaging requirements

- 7.2 SUSTAINABILITY INITIATIVES

- 7.2.1 SUSTAINABLE SOURCING

- 7.2.2 CARBON FOOTPRINT REDUCTION INITIATIVES

- 7.2.3 CIRCULAR ECONOMY APPROACHES

- 7.3 IMPACT OF REGULATORY POLICIES ON SUSTAINABILITY INITIATIVES

- 7.4 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 KEY STAKEHOLDERS INVOLVED IN BUYING PROCESS AND THEIR EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.4 UNMET NEEDS OF VARIOUS APPLICATION INDUSTRIES

- 8.5 MARKET PROFITABILITY

- 8.6 REVENUE POTENTIAL

- 8.6.1 COST DYNAMICS

- 8.6.2 MARGIN OPPORTUNITIES, BY INGREDIENT SOURCE

9 PET BIOTICS MARKET, BY TYPE

- 9.1 INTRODUCTION

- 9.2 PROBIOTICS

- 9.2.1 BACTERIA

- 9.2.1.1 Driving Digestive Strength and Immune Resilience in Companion Animals Through Science-backed Bacterial Probiotics

- 9.2.1.2 Lactobacillus

- 9.2.1.3 Bifidobacterium

- 9.2.1.4 Enterococcus

- 9.2.1.5 Bacillus

- 9.2.1.6 Streptococcus thermophilus

- 9.2.2 YEAST & FUNGI

- 9.2.2.1 Advanced yeast solutions transforming digestive wellness in companion animals

- 9.2.2.2 Saccharomyces cerevisiae

- 9.2.2.3 Saccharomyces Boulardii

- 9.2.1 BACTERIA

- 9.3 PREBIOTICS

- 9.3.1 STRENGTHENING GUT ECOLOGY FOR LONG-TERM VITALITY AND IMMUNE STRENGTH

- 9.3.2 OLIGOSACCHARIDES

- 9.3.2.1 Fructooligosaccharides (FOS)

- 9.3.2.2 Mannanoligosaccharides (MOS)

- 9.3.2.3 Galactooligosaccharides (GOS)

- 9.3.3 INULIN

- 9.3.4 POLYDEXTROSE

- 9.3.5 OTHER PREBIOTIC TYPES

- 9.4 POSTBIOTICS

- 9.4.1 PREMIUM POSTBIOTIC SOLUTIONS DESIGNED FOR STABILITY, SAFETY, AND SUPERIOR PERFORMANCE

- 9.4.2 BACTERIA

- 9.4.2.1 Lactobacillus

- 9.4.2.2 Bifidobacterium

- 9.4.2.3 Other bacteria

- 9.5 YEAST & FUNGI

- 9.5.1 FUNCTIONAL YEAST INNOVATION SHAPING FUTURE OF PET WELLNESS

- 9.5.2 SACCHAROMYCES CEREVISIAE

- 9.5.3 SACCHAROMYCES BOULARDII

10 PET BIOTICS MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.1.1 DRY FOOD

- 10.1.1.1 Long-lasting gut health protection in every crunchy bite

- 10.1.2 WET FOOD

- 10.1.2.1 Smooth integration, stronger digestion-biotics that thrive in wet formats

- 10.1.3 SUPPLEMENTS

- 10.1.3.1 Premium supplement solutions for proactive pet well-being

- 10.1.4 SNACKS & TREATS

- 10.1.4.1 Reward with purpose-treats enriched with biotics for everyday vitality

- 10.1.1 DRY FOOD

11 PET BIOTICS MARKET, BY FORM

- 11.1 INTRODUCTION

- 11.2 DRY

- 11.2.1 STABLE, SCALABLE, AND SCIENCE-FORWARD-DRY BIOTICS POWERING NEXT-GENERATION PET WELLNESS

- 11.3 LIQUID

- 11.3.1 EASE OF INCORPORATION, PRECISION DOSING, AND SMOOTH DELIVERY FOR SENSITIVE AND RECOVERING PETS TO DRIVE DEMAND

12 PET BIOTICS MARKET, BY PET

- 12.1 INTRODUCTION

- 12.2 DOGS

- 12.2.1 DAILY GUT AND IMMUNE SUPPORT FOR HEALTHIER, HAPPIER CANINE COMPANIONS

- 12.3 CATS

- 12.3.1 GENTLE, TARGETED GUT SUPPORT CRAFTED FOR SENSITIVE FELINE DIGESTION

- 12.4 OTHER PETS

13 PET BIOTICS MARKET, BY FUNCTION

- 13.1 INTRODUCTION

- 13.2 DIGESTIVE/GUT HEALTH

- 13.3 IMMUNE MODULATION

- 13.4 METABOLIC & WEIGHT MANAGEMENT

- 13.5 ORAL & DENTAL HEALTH

- 13.6 OTHER FUNCTIONS

14 PET BIOTICS MARKET, BY MANUFACTURING TECHNOLOGY

- 14.1 INTRODUCTION

- 14.2 FERMENTATION

- 14.3 CENTRIFUGATION & FILTRATION

- 14.4 DRYING & STABILIZATION

- 14.5 ENCAPSULATION & PROTECTION

- 14.6 INACTIVATION & CELL DISRUPTION

- 14.7 FORMULATION & BLENDING

- 14.8 QUALITY CONTROL & STORAGE

15 PET BIOTICS MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 NORTH AMERICA

- 15.2.1 US

- 15.2.1.1 Global hub for pet biotics innovation, powered by presence of leading ingredient and technology companies

- 15.2.2 CANADA

- 15.2.2.1 Rising hub for functional pet nutrition and microbiome wellness

- 15.2.3 MEXICO

- 15.2.3.1 Rising market for digestive wellness and microbiome nutrition

- 15.2.1 US

- 15.3 EUROPE

- 15.3.1 GERMANY

- 15.3.1.1 Strong consumer demand for pet biotics to drive market

- 15.3.2 UK

- 15.3.2.1 Expanding companion-animal base to drive market

- 15.3.3 FRANCE

- 15.3.3.1 Rising health concerns to strengthen demand for pet biotics

- 15.3.4 ITALY

- 15.3.4.1 Growing pet humanization and premium nutrition trends to fuel market

- 15.3.5 SPAIN

- 15.3.5.1 Wellness-driven pet culture to accelerate pet biotics adoption

- 15.3.6 REST OF EUROPE

- 15.3.1 GERMANY

- 15.4 ASIA PACIFIC

- 15.4.1 CHINA

- 15.4.1.1 Rapid urban growth and wellness priorities to drive market

- 15.4.2 JAPAN

- 15.4.2.1 Health, premiumization, and sustainability to drive demand for pet biotics

- 15.4.3 INDIA

- 15.4.3.1 Consumer shift toward functional and preventive nutrition products to drive market

- 15.4.4 AUSTRALIA & NEW ZEALAND

- 15.4.4.1 Demand for premium and functional nutrition to support market growth

- 15.4.5 REST OF ASIA PACIFIC

- 15.4.1 CHINA

- 15.5 SOUTH AMERICA

- 15.5.1 BRAZIL

- 15.5.1.1 Expanding pet market to drive demand for pet biotics

- 15.5.2 ARGENTINA

- 15.5.2.1 Steady pet market growth to fuel pet biotics demand

- 15.5.3 REST OF SOUTH AMERICA

- 15.5.1 BRAZIL

- 15.6 REST OF THE WORLD

- 15.6.1 MIDDLE EAST

- 15.6.1.1 Rising pet humanization and urbanization to fuel demand for pet biotics

- 15.6.2 AFRICA

- 15.6.2.1 Growing focus on pet health to drive market

- 15.6.1 MIDDLE EAST

16 COMPETITIVE LANDSCAPE

- 16.1 OVERVIEW

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 16.3 REVENUE ANALYSIS

- 16.4 MARKET SHARE ANALYSIS

- 16.5 COMPANY VALUATION AND FINANCIAL METRICS

- 16.5.1 COMPANY VALUATION

- 16.5.2 FINANCIAL METRICS

- 16.6 BRAND/PRODUCT COMPARISON

- 16.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 16.7.1 STARS

- 16.7.2 EMERGING LEADERS

- 16.7.3 PERVASIVE PLAYERS

- 16.7.4 PARTICIPANTS

- 16.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 16.7.5.1 Company footprint

- 16.7.5.2 Regional footprint

- 16.7.5.3 Type footprint

- 16.7.5.4 Pet footprint

- 16.7.5.5 Application footprint

- 16.7.5.6 Form footprint

- 16.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 16.8.1 PROGRESSIVE COMPANIES

- 16.8.2 RESPONSIVE COMPANIES

- 16.8.3 DYNAMIC COMPANIES

- 16.8.4 STARTING BLOCKS

- 16.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 16.9 COMPETITIVE SCENARIO AND TRENDS

- 16.9.1 PRODUCT LAUNCHES

- 16.9.2 DEALS

- 16.9.3 EXPANSIONS

- 16.9.4 OTHER DEVELOPMENTS

17 COMPANY PROFILES

- 17.1 KEY PLAYERS

- 17.1.1 ADM

- 17.1.1.1 Business overview

- 17.1.1.2 Products/Services/Solutions offered

- 17.1.1.3 Recent developments

- 17.1.1.3.1 Expansions

- 17.1.1.4 MnM view

- 17.1.1.4.1 Key strengths

- 17.1.1.4.2 Strategic choices

- 17.1.1.4.3 Weaknesses & competitive threats

- 17.1.2 ALLTECH (US)

- 17.1.2.1 Business overview

- 17.1.2.2 Products/Services/Solutions offered

- 17.1.2.3 Recent developments

- 17.1.2.3.1 Product launches

- 17.1.2.4 MnM view

- 17.1.2.4.1 Key strengths

- 17.1.2.4.2 Strategic choices

- 17.1.2.4.3 Weaknesses & competitive threats

- 17.1.3 KERRY GROUP PLC

- 17.1.3.1 Business overview

- 17.1.3.2 Products/Services/Solutions offered

- 17.1.3.3 Recent developments

- 17.1.3.3.1 Deals

- 17.1.3.4 MnM view

- 17.1.3.4.1 Key strengths

- 17.1.3.4.2 Strategic choices

- 17.1.3.4.3 Weaknesses & competitive threats

- 17.1.4 INTERNATIONAL FLAVORS & FRAGRANCES INC

- 17.1.4.1 Business overview

- 17.1.4.2 Products/Services/Solutions offered

- 17.1.4.3 Recent developments

- 17.1.4.4 MnM view

- 17.1.4.4.1 Key strengths

- 17.1.4.4.2 Strategic choices

- 17.1.4.4.3 Weaknesses & competitive threats

- 17.1.5 DSM-FIRMENICH

- 17.1.5.1 Business overview

- 17.1.5.2 Products/Services/Solutions offered

- 17.1.5.3 Recent developments

- 17.1.5.3.1 Deals

- 17.1.5.4 MnM view

- 17.1.5.4.1 Key strengths

- 17.1.5.4.2 Strategic choices

- 17.1.5.4.3 Weaknesses & competitive threats

- 17.1.6 CARGILL, INCORPORATED

- 17.1.6.1 Business overview

- 17.1.6.2 Products/Services/Solutions offered

- 17.1.6.3 Recent developments

- 17.1.6.3.1 Deals

- 17.1.6.3.2 Expansions

- 17.1.6.3.3 Other developments

- 17.1.6.4 MnM view

- 17.1.6.4.1 Key strengths

- 17.1.6.4.2 Strategic choices

- 17.1.6.4.3 Weaknesses & competitive threats

- 17.1.7 PROBI

- 17.1.7.1 Business overview

- 17.1.7.2 Products/Services/Solutions offered

- 17.1.7.3 Recent developments

- 17.1.7.3.1 Deals

- 17.1.7.4 MnM view

- 17.1.8 INGREDION (US)

- 17.1.8.1 Business overview

- 17.1.8.2 Products/Services/Solutions offered

- 17.1.8.3 Recent developments

- 17.1.8.4 MnM view

- 17.1.9 KEMIN INDUSTRIES, INC.

- 17.1.9.1 Business overview

- 17.1.9.2 Products/Services/Solutions offered

- 17.1.9.3 MnM view

- 17.1.10 BENEO GMBH

- 17.1.10.1 Business overview

- 17.1.10.2 Products/Services/Solutions offered

- 17.1.10.3 Recent developments

- 17.1.10.3.1 Other Developments

- 17.1.10.4 MnM view

- 17.1.11 PHILEO BY LESAFFRE

- 17.1.11.1 Business overview

- 17.1.11.2 Products/Services/Solutions offered

- 17.1.11.3 Recent developments

- 17.1.11.3.1 Deals

- 17.1.11.4 MnM view

- 17.1.12 LALLEMAND INC.

- 17.1.12.1 Business overview

- 17.1.12.2 Products/Services/Solutions offered

- 17.1.12.3 Recent developments

- 17.1.12.4 MnM view

- 17.1.13 SACCO SYSTEM

- 17.1.13.1 Business overview

- 17.1.13.2 Products/Services/Solutions offered

- 17.1.13.3 Recent developments

- 17.1.13.4 MnM view

- 17.1.14 SANZYME BIOLOGICS

- 17.1.14.1 Business overview

- 17.1.14.2 Products/Services/Solutions offered

- 17.1.14.3 Recent developments

- 17.1.14.4 MnM view

- 17.1.15 ORFFA

- 17.1.15.1 Business overview

- 17.1.15.2 Products/Services/Solutions offered

- 17.1.15.3 Recent developments

- 17.1.15.4 MnM view

- 17.1.1 ADM

- 17.2 STARTUPS/SMES

- 17.2.1 SYNBIO TECH INC.

- 17.2.1.1 Business overview

- 17.2.1.2 Products/Services/Solutions offered

- 17.2.1.3 Recent developments

- 17.2.1.4 MnM view

- 17.2.2 CANBIOCIN INC.

- 17.2.2.1 Business overview

- 17.2.2.2 Products/Services/Solutions offered

- 17.2.2.3 Recent developments

- 17.2.2.3.1 Deals

- 17.2.2.4 MnM view

- 17.2.3 BIO-CAT

- 17.2.3.1 Business overview

- 17.2.3.2 Products/Services/Solutions offered

- 17.2.3.3 Recent developments

- 17.2.3.3.1 Deals

- 17.2.3.4 MnM view

- 17.2.4 SPECIALTY ENZYMES & PROBIOTICS

- 17.2.4.1 Business overview

- 17.2.4.2 Products/Services/Solutions offered

- 17.2.4.3 Recent developments

- 17.2.4.3.1 Product launches

- 17.2.4.4 MnM view

- 17.2.5 CREATIVE ENZYMES

- 17.2.5.1 Business overview

- 17.2.5.2 Products/Services/Solutions offered

- 17.2.5.3 Recent developments

- 17.2.5.4 MnM view

- 17.2.6 VERB BIOTICS

- 17.2.7 BIOTENOVA SDN. BHD.

- 17.2.8 BIOPROX HEALTHCARE

- 17.2.9 PELLUCID LIFESCIENCES PVT. LTD

- 17.2.10 HOLLISON, LLC. (US)

- 17.2.1 SYNBIO TECH INC.

18 RESEARCH METHODOLOGY

- 18.1 RESEARCH DATA

- 18.1.1 SECONDARY DATA

- 18.1.1.1 Key data from secondary sources

- 18.1.2 PRIMARY DATA

- 18.1.2.1 Key data from primary sources

- 18.1.2.2 Breakdown of primary profiles

- 18.1.2.3 Key insights from industry experts

- 18.1.1 SECONDARY DATA

- 18.2 MARKET SIZE ESTIMATION

- 18.2.1 TOP-DOWN APPROACH

- 18.2.2 SUPPLY-SIDE ANALYSIS

- 18.2.3 BOTTOM-UP APPROACH (DEMAND SIDE)

- 18.3 DATA TRIANGULATION AND MARKET BREAKUP

- 18.4 RESEARCH ASSUMPTIONS

- 18.5 RESEARCH LIMITATIONS AND RISK ASSESSMENT

19 ADJACENT & RELATED MARKETS

- 19.1 INTRODUCTION

- 19.2 STUDY LIMITATIONS

- 19.3 PET SUPPLEMENTS MARKET

- 19.3.1 MARKET DEFINITION

- 19.3.2 MARKET OVERVIEW

- 19.4 PET FOOD INGREDIENTS MARKET

- 19.4.1 MARKET DEFINITION

- 19.4.2 MARKET OVERVIEW

20 APPENDIX

- 20.1 DISCUSSION GUIDE

- 20.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 20.3 CUSTOMIZATION OPTIONS

- 20.4 RELATED REPORTS

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 KEY MOVES AND STRATEGIC FOCUS

- TABLE 3 IMPACT OF PORTER'S FIVE FORCES ON PET BIOTICS MARKET

- TABLE 4 ROLES OF COMPANIES IN PET BIOTICS MARKET ECOSYSTEM

- TABLE 5 IMPORT SCENARIO FOR HS CODE: 3002, BY COUNTRY, 2020-2024 (TONS)

- TABLE 6 EXPORT SCENARIO FOR HS CODE: 3002, BY COUNTRY, 2020-2024 (TONS)

- TABLE 7 PET BIOTICS MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 8 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 9 LIST OF MAJOR PATENTS PERTAINING TO PET BIOTICS MARKET, 2020-2025

- TABLE 10 TOP USE CASES AND MARKET POTENTIAL

- TABLE 11 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- TABLE 12 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 GLOBAL: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 GLOBAL INDUSTRY STANDARDS IN PET BIOTICS MARKET

- TABLE 19 LABELING REQUIREMENTS AND CLAIMS IN PET BIOTICS MARKET

- TABLE 20 CERTIFICATIONS, LABELING, AND ECO-STANDARDS IN PET BIOTICS MARKET

- TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 22 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 23 UNMET NEEDS IN PET BIOTICS MARKET, BY APPLICATION INDUSTRY (SUPPLY CHAIN)

- TABLE 24 COST DYNAMICS IN PET BIOTICS MARKET

- TABLE 25 MARGIN OPPORTUNITIES IN PET BIOTICS MARKET, BY INGREDIENT SOURCE

- TABLE 26 PET BIOTICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 27 PET BIOTICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 28 PET BIOTICS MARKET, BY TYPE, 2021-2024 (TONS)

- TABLE 29 PET BIOTICS MARKET, BY TYPE, 2025-2030 (TONS)

- TABLE 30 PROBIOTICS: PET BIOTICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 31 PROBIOTICS: PET BIOTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 PROBIOTICS: PET BIOTICS MARKET, BY REGION, 2021-2024 (TONS)

- TABLE 33 PROBIOTICS: PET BIOTICS MARKET, BY REGION, 2025-2030 (TONS)

- TABLE 34 PROBIOTICS: PET BIOTICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 35 PROBIOTICS: PET BIOTICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 36 BACTERIA: PET BIOTICS MARKET FOR PROBIOTICS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 37 BACTERIA: PET BIOTICS MARKET FOR PROBIOTICS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 BACTERIA: PET BIOTICS MARKET FOR PROBIOTICS, BY SUBTYPE, 2021-2024 (USD MILLION)

- TABLE 39 BACTERIA: PET BIOTICS MARKET FOR PROBIOTICS, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 40 LACTOBACILLUS: PET BIOTICS MARKET FOR PROBIOTICS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 41 LACTOBACILLUS: PET BIOTICS MARKET FOR PROBIOTICS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 BIFIDOBACTERIUM: PET BIOTICS MARKET FOR PROBIOTICS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 43 BIFIDOBACTERIUM: PET BIOTICS MARKET FOR PROBIOTICS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 ENTEROCOCCUS: PET BIOTICS MARKET FOR PROBIOTICS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 45 ENTEROCOCCUS: PET BIOTICS MARKET FOR PROBIOTICS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 BACILLUS: PET BIOTICS MARKET FOR PROBIOTICS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 47 BACILLUS: PET BIOTICS MARKET FOR PROBIOTICS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 STREPTOCOCCUS THERMOPHILUS: PET BIOTICS MARKET FOR PROBIOTICS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 49 STREPTOCOCCUS THERMOPHILUS: PET BIOTICS MARKET FOR PROBIOTICS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 YEAST & FUNGI: PET BIOTICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 51 YEAST & FUNGI: PET BIOTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 YEAST & FUNGI: PET BIOTICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 53 YEAST & FUNGI: PET BIOTICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 54 SACCHAROMYCES CEREVISIAE: PET BIOTICS MARKET FOR YEAST & FUNGI, BY REGION, 2021-2024 (USD MILLION)

- TABLE 55 SACCHAROMYCES CEREVISIAE: PET BIOTICS MARKET FOR YEAST & FUNGI, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 SACCHAROMYCES BOULARDII: PET BIOTICS MARKET FOR YEAST & FUNGI, BY REGION, 2021-2024 (USD MILLION)

- TABLE 57 SACCHAROMYCES BOULARDII: PET BIOTICS MARKET FOR YEAST & FUNGI, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 PREBIOTICS: PET BIOTICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 59 PREBIOTICS: PET BIOTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 PREBIOTICS: PET BIOTICS MARKET, BY REGION, 2021-2024 (TONS)

- TABLE 61 PREBIOTICS: PET BIOTICS MARKET, BY REGION, 2025-2030 (TONS)

- TABLE 62 PREBIOTICS: PET BIOTICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 63 PREBIOTICS: PET BIOTICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 64 OLIGOSACCHARIDES: PET BIOTICS MARKET FOR PREBIOTICS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 65 OLIGOSACCHARIDES: PET BIOTICS MARKET FOR PREBIOTICS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 OLIGOSACCHARIDES: PET BIOTICS MARKET FOR PREBIOTICS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 67 OLIGOSACCHARIDES: PET BIOTICS MARKET FOR PREBIOTICS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 68 FOS: PET BIOTICS MARKET FOR PREBIOTICS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 69 FOS: PET BIOTICS MARKET FOR PREBIOTICS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 MOS: PET BIOTICS MARKET FOR PREBIOTICS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 71 MOS: PET BIOTICS MARKET FOR PREBIOTICS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 GOS: PET BIOTICS MARKET FOR PREBIOTICS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 73 GOS: PET BIOTICS MARKET FOR PREBIOTICS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 INULIN: PET BIOTICS MARKET FOR PREBIOTICS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 75 INULIN: PET BIOTICS MARKET FOR PREBIOTICS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 76 POLYDEXTROSE: PET BIOTICS MARKET FOR PREBIOTICS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 77 POLYDEXTROSE: PET BIOTICS MARKET FOR PREBIOTICS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 OTHER PREBIOTICS: PET BIOTICS MARKET FOR PREBIOTICS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 79 OTHER PREBIOTICS: PET BIOTICS MARKET FOR PREBIOTICS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 80 POSTBIOTICS: PET BIOTICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 81 POSTBIOTICS: PET BIOTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 82 POSTBIOTICS: PET BIOTICS MARKET, BY REGION, 2021-2024 (TONS)

- TABLE 83 POSTBIOTICS: PET BIOTICS MARKET, BY REGION, 2025-2030 (TONS)

- TABLE 84 POSTBIOTICS: PET BIOTICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 85 POSTBIOTICS: PET BIOTICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 86 BACTERIA: PET BIOTICS MARKET FOR POSTBIOTICS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 87 BACTERIA: PET BIOTICS MARKET FOR POSTBIOTICS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 88 BACTERIA: PET BIOTICS MARKET FOR POSTBIOTICS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 89 BACTERIA: PET BIOTICS MARKET FOR POSTBIOTICS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 90 YEAST & FUNGI: PET BIOTICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 91 YEAST & FUNGI: PET BIOTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 92 YEAST & FUNGI: PET BIOTICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 93 YEAST & FUNGI: PET BIOTICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 94 PET BIOTICS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 95 PET BIOTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 96 DRY FOOD: PET BIOTICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 97 DRY FOOD: PET BIOTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 98 WET FOOD: PET BIOTICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 99 WET FOOD: PET BIOTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 100 SUPPLEMENTS: PET BIOTICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 101 SUPPLEMENTS: PET BIOTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 102 SNACKS & TREATS: PET BIOTICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 103 SNACKS & TREATS: PET BIOTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 104 PET BIOTICS MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 105 PET BIOTICS MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 106 DRY: PET BIOTICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 107 DRY: PET BIOTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 108 LIQUID: PET BIOTICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 109 LIQUID: PET BIOTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 110 PET BIOTICS MARKET, BY PET, 2021-2024 (USD MILLION)

- TABLE 111 PET BIOTICS MARKET, BY PET, 2025-2030 (USD MILLION)

- TABLE 112 DOGS: PET BIOTICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 113 DOGS: PET BIOTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 114 CATS: PET BIOTICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 115 CATS: PET BIOTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 116 OTHER PETS: PET BIOTICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 117 OTHER PETS: PET BIOTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 118 PET BIOTICS MARKET, BY FUNCTION, 2021-2024 (USD MILLION)

- TABLE 119 PET BIOTICS MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 120 PET BIOTICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 121 PET BIOTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 122 PET BIOTICS MARKET, BY REGION, 2021-2024 (TONS)

- TABLE 123 PET BIOTICS MARKET, BY REGION, 2025-2030 (TONS)

- TABLE 124 NORTH AMERICA: PET BIOTICS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 125 NORTH AMERICA: PET BIOTICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 126 NORTH AMERICA: PET BIOTICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 127 NORTH AMERICA: PET BIOTICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 128 NORTH AMERICA: PET BIOTICS MARKET, BY TYPE, 2021-2024 (TONS)

- TABLE 129 NORTH AMERICA: PET BIOTICS MARKET, BY TYPE, 2025-2030 (TONS)

- TABLE 130 NORTH AMERICA: PET BIOTICS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 131 NORTH AMERICA: PET BIOTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 132 NORTH AMERICA: PET BIOTICS MARKET, BY PET, 2021-2024 (USD MILLION)

- TABLE 133 NORTH AMERICA: PET BIOTICS MARKET, BY PET, 2025-2030 (USD MILLION)

- TABLE 134 NORTH AMERICA: PET BIOTICS MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 135 NORTH AMERICA: PET BIOTICS MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 136 US: PET BIOTICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 137 US: PET BIOTICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 138 US: PET BIOTICS MARKET, BY PET, 2021-2024 (USD MILLION)

- TABLE 139 US: PET BIOTICS MARKET, BY PET, 2025-2030 (USD MILLION)

- TABLE 140 CANADA: PET BIOTICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 141 CANADA: PET BIOTICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 142 CANADA: PET BIOTICS MARKET, BY PET, 2021-2024 (USD MILLION)

- TABLE 143 CANADA: PET BIOTICS MARKET, BY PET, 2025-2030 (USD MILLION)

- TABLE 144 MEXICO: PET BIOTICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 145 MEXICO: PET BIOTICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 146 MEXICO: PET BIOTICS MARKET, BY PET, 2021-2024 (USD MILLION)

- TABLE 147 MEXICO: PET BIOTICS MARKET, BY PET, 2025-2030 (USD MILLION)

- TABLE 148 EUROPE: PET BIOTICS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 149 EUROPE: PET BIOTICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 150 EUROPE: PET BIOTICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 151 EUROPE: PET BIOTICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 152 EUROPE: PET BIOTICS MARKET, BY TYPE, 2021-2024 (TONS)

- TABLE 153 EUROPE: PET BIOTICS MARKET, BY TYPE, 2025-2030 (TONS)

- TABLE 154 EUROPE: PET BIOTICS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 155 EUROPE: PET BIOTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 156 EUROPE: PET BIOTICS MARKET, BY PET, 2021-2024 (USD MILLION)

- TABLE 157 EUROPE: PET BIOTICS MARKET, BY PET, 2025-2030 (USD MILLION)

- TABLE 158 EUROPE: PET BIOTICS MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 159 EUROPE: PET BIOTICS MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 160 GERMANY: PET BIOTICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 161 GERMANY: PET BIOTICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 162 GERMANY: PET BIOTICS MARKET, BY PET, 2021-2024 (USD MILLION)

- TABLE 163 GERMANY: PET BIOTICS MARKET, BY PET, 2025-2030 (USD MILLION)

- TABLE 164 UK: PET BIOTICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 165 UK: PET BIOTICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 166 UK: PET BIOTICS MARKET, BY PET, 2021-2024 (USD MILLION)

- TABLE 167 UK: PET BIOTICS MARKET, BY PET, 2025-2030 (USD MILLION)

- TABLE 168 FRANCE: PET BIOTICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 169 FRANCE: PET BIOTICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 170 FRANCE: PET BIOTICS MARKET, BY PET, 2021-2024 (USD MILLION)

- TABLE 171 FRANCE: PET BIOTICS MARKET, BY PET, 2025-2030 (USD MILLION)

- TABLE 172 ITALY: PET BIOTICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 173 ITALY: PET BIOTICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 174 ITALY: PET BIOTICS MARKET, BY PET, 2021-2024 (USD MILLION)

- TABLE 175 ITALY: PET BIOTICS MARKET, BY PET, 2025-2030 (USD MILLION)

- TABLE 176 SPAIN: PET BIOTICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 177 SPAIN: PET BIOTICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 178 SPAIN: PET BIOTICS MARKET, BY PET, 2021-2024 (USD MILLION)

- TABLE 179 SPAIN: PET BIOTICS MARKET, BY PET, 2025-2030 (USD MILLION)

- TABLE 180 REST OF EUROPE: PET BIOTICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 181 REST OF EUROPE: PET BIOTICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 182 REST OF EUROPE: PET BIOTICS MARKET, BY PET, 2021-2024 (USD MILLION)

- TABLE 183 REST OF EUROPE: PET BIOTICS MARKET, BY PET, 2025-2030 (USD MILLION)

- TABLE 184 ASIA PACIFIC: PET BIOTICS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 185 ASIA PACIFIC: PET BIOTICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 186 ASIA PACIFIC: PET BIOTICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 187 ASIA PACIFIC: PET BIOTICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 188 ASIA PACIFIC: PET BIOTICS MARKET, BY TYPE, 2021-2024 (TONS)

- TABLE 189 ASIA PACIFIC: PET BIOTICS MARKET, BY TYPE, 2025-2030 (TONS)

- TABLE 190 ASIA PACIFIC: PET BIOTICS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 191 ASIA PACIFIC: PET BIOTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 192 ASIA PACIFIC: PET BIOTICS MARKET, BY PET, 2021-2024 (USD MILLION)

- TABLE 193 ASIA PACIFIC: PET BIOTICS MARKET, BY PET, 2025-2030 (USD MILLION)

- TABLE 194 ASIA PACIFIC: PET BIOTICS MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 195 ASIA PACIFIC: PET BIOTICS MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 196 CHINA: PET BIOTICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 197 CHINA: PET BIOTICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 198 CHINA: PET BIOTICS MARKET, BY PET, 2021-2024 (USD MILLION)

- TABLE 199 CHINA: PET BIOTICS MARKET, BY PET, 2025-2030 (USD MILLION)

- TABLE 200 JAPAN: PET BIOTICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 201 JAPAN: PET BIOTICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 202 JAPAN: PET BIOTICS MARKET, BY PET, 2021-2024 (USD MILLION)

- TABLE 203 JAPAN: PET BIOTICS MARKET, BY PET, 2025-2030 (USD MILLION)

- TABLE 204 INDIA: PET BIOTICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 205 INDIA: PET BIOTICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 206 INDIA: PET BIOTICS MARKET, BY PET, 2021-2024 (USD MILLION)

- TABLE 207 INDIA: PET BIOTICS MARKET, BY PET, 2025-2030 (USD MILLION)

- TABLE 208 AUSTRALIA & NEW ZEALAND: PET BIOTICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 209 AUSTRALIA & NEW ZEALAND: PET BIOTICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 210 AUSTRALIA & NEW ZEALAND: PET BIOTICS MARKET, BY PET, 2021-2024 (USD MILLION)

- TABLE 211 AUSTRALIA & NEW ZEALAND: PET BIOTICS MARKET, BY PET, 2025-2030 (USD MILLION)

- TABLE 212 REST OF ASIA PACIFIC: PET BIOTICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 213 REST OF ASIA PACIFIC: PET BIOTICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 214 REST OF ASIA PACIFIC: PET BIOTICS MARKET, BY PET, 2021-2024 (USD MILLION)

- TABLE 215 REST OF ASIA PACIFIC: PET BIOTICS MARKET, BY PET, 2025-2030 (USD MILLION)

- TABLE 216 SOUTH AMERICA: PET BIOTICS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 217 SOUTH AMERICA: PET BIOTICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 218 SOUTH AMERICA: PET BIOTICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 219 SOUTH AMERICA: PET BIOTICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 220 SOUTH AMERICA: PET BIOTICS MARKET, BY TYPE, 2021-2024 (TONS)

- TABLE 221 SOUTH AMERICA: PET BIOTICS MARKET, BY TYPE, 2025-2030 (TONS)

- TABLE 222 SOUTH AMERICA: PET BIOTICS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 223 SOUTH AMERICA: PET BIOTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 224 SOUTH AMERICA: PET BIOTICS MARKET, BY PET, 2021-2024 (USD MILLION)

- TABLE 225 SOUTH AMERICA: PET BIOTICS MARKET, BY PET, 2025-2030 (USD MILLION)

- TABLE 226 SOUTH AMERICA: PET BIOTICS MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 227 SOUTH AMERICA: PET BIOTICS MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 228 BRAZIL: PET BIOTICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 229 BRAZIL: PET BIOTICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 230 BRAZIL: PET BIOTICS MARKET, BY PET, 2021-2024 (USD MILLION)

- TABLE 231 BRAZIL: PET BIOTICS MARKET, BY PET, 2025-2030 (USD MILLION)

- TABLE 232 ARGENTINA: PET BIOTICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 233 ARGENTINA: PET BIOTICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 234 ARGENTINA: PET BIOTICS MARKET, BY PET, 2021-2024 (USD MILLION)

- TABLE 235 ARGENTINA: PET BIOTICS MARKET, BY PET, 2025-2030 (USD MILLION)

- TABLE 236 REST OF SOUTH AMERICA: PET BIOTICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 237 REST OF SOUTH AMERICA: PET BIOTICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 238 REST OF SOUTH AMERICA: PET BIOTICS MARKET, BY PET, 2021-2024 (USD MILLION)

- TABLE 239 REST OF SOUTH AMERICA: PET BIOTICS MARKET, BY PET, 2025-2030 (USD MILLION)

- TABLE 240 REST OF THE WORLD: PET BIOTICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 241 REST OF THE WORLD: PET BIOTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 242 REST OF THE WORLD: PET BIOTICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 243 REST OF THE WORLD: PET BIOTICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 244 REST OF THE WORLD: PET BIOTICS MARKET, BY TYPE, 2021-2024 (TONS)

- TABLE 245 REST OF THE WORLD: PET BIOTICS MARKET, BY TYPE, 2025-2030 (TONS)

- TABLE 246 REST OF THE WORLD: PET BIOTICS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 247 REST OF THE WORLD: PET BIOTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 248 REST OF THE WORLD: PET BIOTICS MARKET, BY PET, 2021-2024 (USD MILLION)

- TABLE 249 REST OF THE WORLD: PET BIOTICS MARKET, BY PET, 2025-2030 (USD MILLION)

- TABLE 250 REST OF THE WORLD: PET BIOTICS MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 251 REST OF THE WORLD: PET BIOTICS MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 252 MIDDLE EAST: PET BIOTICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 253 MIDDLE EAST: PET BIOTICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 254 MIDDLE EAST: PET BIOTICS MARKET, BY PET, 2021-2024 (USD MILLION)

- TABLE 255 MIDDLE EAST: PET BIOTICS MARKET, BY PET, 2025-2030 (USD MILLION)

- TABLE 256 AFRICA: PET BIOTICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 257 AFRICA: PET BIOTICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 258 AFRICA: PET BIOTICS MARKET, BY PET, 2021-2024 (USD MILLION)

- TABLE 259 AFRICA: PET BIOTICS MARKET, BY PET, 2025-2030 (USD MILLION)

- TABLE 260 OVERVIEW OF STRATEGIES ADOPTED BY KEY PET BIOTICS MARKET PLAYERS

- TABLE 261 PET BIOTICS MARKET: MARKET SHARE ANALYSIS, 2024

- TABLE 262 PET BIOTICS MARKET: REGIONAL FOOTPRINT, 2024

- TABLE 263 PET BIOTICS MARKET: TYPE FOOTPRINT, 2024

- TABLE 264 PET BIOTICS MARKET: PET FOOTPRINT, 2024

- TABLE 265 PET BIOTICS MARKET: APPLICATION FOOTPRINT, 2024

- TABLE 266 PET BIOTICS MARKET: FORM FOOTPRINT, 2024

- TABLE 267 PET BIOTICS MARKET: DETAILED LIST OF KEY STARTUPS/SMES, 2024

- TABLE 268 PET BIOTICS MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 269 PET BIOTICS MARKET: PRODUCT LAUNCHES, APRIL 2022-SEPTEMBER 2023

- TABLE 270 PET BIOTICS MARKET: DEALS, JULY 2023 - OCTOBER 2025

- TABLE 271 PET BIOTICS MARKET: EXPANSIONS, FEBRUARY 2020-NOVEMBER 2025

- TABLE 272 PET BIOTICS MARKET: OTHER DEVELOPMENTS, NOVEMBER 2024

- TABLE 273 ADM: BUSINESS OVERVIEW

- TABLE 274 ADM: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 275 ADM: EXPANSIONS

- TABLE 276 ALLTECH: COMPANY OVERVIEW

- TABLE 277 ALLTECH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 278 ALLTECH: PRODUCT LAUNCHES

- TABLE 279 KERRY GROUP PLC: COMPANY OVERVIEW

- TABLE 280 KERRY GROUP PLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 281 KERRY GROUP PLC: DEALS

- TABLE 282 INTERNATIONAL FLAVORS & FRAGRANCES INC: COMPANY OVERVIEW

- TABLE 283 INTERNATIONAL FLAVORS & FRAGRANCES INC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 284 DSM-FIRMENICH: COMPANY OVERVIEW

- TABLE 285 DSM-FIRMENICH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 286 DSM-FIRMENICH: DEALS

- TABLE 287 CARGILL, INCORPORATED: COMPANY OVERVIEW

- TABLE 288 CARGILL, INCORPORATED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 289 CARGILL, INCORPORATED: DEALS

- TABLE 290 CARGILL, INCORPORATED: EXPANSIONS

- TABLE 291 CARGILL, INCORPORATED: OTHER DEVELOPMENTS

- TABLE 292 PROBI: COMPANY OVERVIEW

- TABLE 293 PROBI: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 294 PROBI: DEALS

- TABLE 295 INGREDION: COMPANY OVERVIEW

- TABLE 296 INGREDION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 297 KEMIN INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 298 KEMIN INDUSTRIES, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 299 BENEO GMBH: COMPANY OVERVIEW

- TABLE 300 BENEO GMBH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 301 BENEO GMBH: OTHER DEVELOPMENTS

- TABLE 302 PHILEO BY LESAFFRE: COMPANY OVERVIEW

- TABLE 303 PHILEO BY LESAFFRE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 304 PHILEO BY LESAFFRE (FRANCE): DEALS

- TABLE 305 LALLEMAND INC.: COMPANY OVERVIEW

- TABLE 306 LALLEMAND INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 307 LALLEMAND INC.: DEALS

- TABLE 308 SACCO SYSTEM: COMPANY OVERVIEW

- TABLE 309 SACCO SYSTEM (ITALY): PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 310 SANZYME BIOLOGICS: COMPANY OVERVIEW

- TABLE 311 SANZYME BIOLOGICS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 312 ORFFA: COMPANY OVERVIEW

- TABLE 313 ORFFA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 314 SYNBIO TECH INC.: COMPANY OVERVIEW

- TABLE 315 SYNBIO TECH INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 316 SYNBIO TECH INC.: EXPANSION

- TABLE 317 CANBIOCIN INC.: COMPANY OVERVIEW

- TABLE 318 CANBIOCIN INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 319 CANBIOCIN INC.: DEALS

- TABLE 320 BIO-CAT (US): COMPANY OVERVIEW

- TABLE 321 BIO-CAT: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 322 BIO-CAT: DEALS

- TABLE 323 SPECIALTY ENZYMES & PROBIOTICS: COMPANY OVERVIEW

- TABLE 324 SPECIALTY ENZYMES & PROBIOTICS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 325 SPECIALTY ENZYMES & PROBIOTICS: PRODUCT LAUNCHES

- TABLE 326 CREATIVE ENZYMES: COMPANY OVERVIEW

- TABLE 327 CREATIVE ENZYMES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 328 MARKETS ADJACENT TO PET BIOTICS MARKET

- TABLE 329 PET SUPPLEMENTS MARKET, BY PET TYPE, 2021-2024 (USD MILLION)

- TABLE 330 PET SUPPLEMENTS MARKET, BY PET TYPE, 2025-2030 (USD MILLION)

- TABLE 331 PET FOOD INGREDIENTS MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 332 PET FOOD INGREDIENTS MARKET, BY FORM, 2023-2028 (USD MILLION)

List of Figures

- FIGURE 1 MARKET SCENARIO

- FIGURE 2 GLOBAL PET BIOTICS MARKET, 2021-2030

- FIGURE 3 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN PET BIOTICS MARKET (2020-2025)

- FIGURE 4 DISRUPTIONS INFLUENCING GROWTH OF PET BIOTICS MARKET

- FIGURE 5 HIGH-GROWTH SEGMENTS IN PET BIOTICS MARKET, 2025-2030

- FIGURE 6 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN PET BIOTICS MARKET, IN TERMS OF VALUE, DURING FORECAST PERIOD

- FIGURE 7 RISING PET HUMANIZATION AND PREVENTIVE HEALTH FOCUS CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 8 DOGS SEGMENT AND NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARES IN 2025

- FIGURE 9 PROBIOTICS SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 10 DOGS SEGMENT TO LEAD MARKET IN 2025

- FIGURE 11 DRY FOOD SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 12 DRY FORM TO DOMINATE MARKET IN 2025

- FIGURE 13 US TO DOMINATE MARKET

- FIGURE 14 PET BIOTICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 15 US: EXPENDITURE IN PET INDUSTRY, 2020-2024 (USD BILLION)

- FIGURE 16 PET BIOTICS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 17 INGREDIENTS MOST FREQUENTLY PERCEIVED TO HAVE HEALTH BENEFITS

- FIGURE 18 PERCENTAGE INCREASE YEAR OVER YEAR AND COMBINED NUMBER OF PETS IN US

- FIGURE 20 PET BIOTICS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 21 AVERAGE SELLING PRICE OF KEY PLAYERS, BY APPLICATION, 2025 (USD)

- FIGURE 22 AVERAGE SELLING PRICE TREND OF PET BIOTICS, BY REGION, 2021-2024 (USD/TON)

- FIGURE 23 IMPORT OF HS CODE 3002, BY KEY COUNTRY, 2020-2024 (TONS)

- FIGURE 24 EXPORT OF HS CODE 3002, BY KEY COUNTRY, 2020-2024 (TONS)

- FIGURE 25 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 26 INVESTMENT AND FUNDING SCENARIO

- FIGURE 29 FUTURE APPLICATIONS

- FIGURE 31 PET BIOTICS MARKET DECISION-MAKING FACTORS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR THREE APPLICATIONS

- FIGURE 33 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 34 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- FIGURE 36 PET BIOTICS MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 37 PET BIOTICS MARKET, BY FORM, 2025 VS. 2030 (USD MILLION)

- FIGURE 38 PET BIOTICS MARKET, BY PET, 2025 VS. 2030 (USD MILLION)

- FIGURE 40 CHINA TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 41 NORTH AMERICA: PET BIOTICS MARKET SNAPSHOT

- FIGURE 42 ASIA PACIFIC: PET BIOTICS MARKET SNAPSHOT

- FIGURE 43 REVENUE ANALYSIS OF KEY PLAYERS, 2022-2024 (USD BILLION)

- FIGURE 44 MARKET SHARE ANALYSIS, 2024

- FIGURE 45 COMPANY VALUATION FOR MAJOR PLAYERS IN PET BIOTICS MARKET, 2025

- FIGURE 46 EV/EBITDA OF MAJOR PLAYERS, 2025

- FIGURE 47 PET BIOTICS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 48 PET BIOTICS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 49 PET BIOTICS MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 50 PET BIOTICS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 51 ADM: COMPANY SNAPSHOT

- FIGURE 52 KERRY GROUP PLC: COMPANY SNAPSHOT

- FIGURE 53 INTERNATIONAL FLAVORS & FRAGRANCES INC: COMPANY SNAPSHOT

- FIGURE 54 DSM-FIRMENICH: COMPANY SNAPSHOT

- FIGURE 55 CARGILL, INCORPORATED: COMPANY SNAPSHOT

- FIGURE 56 PROBI: COMPANY SNAPSHOT

- FIGURE 57 INGREDION: COMPANY SNAPSHOT

- FIGURE 58 PET BIOTICS MARKET: RESEARCH DESIGN

- FIGURE 59 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 60 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 61 SUPPLY-SIDE ANALYSIS: SOURCES OF INFORMATION AT EVERY STEP

- FIGURE 62 PET BIOTICS MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 63 DATA TRIANGULATION