|

市场调查报告书

商品编码

1273514

统一通信即医疗保健服务市场——增长、趋势和预测 (2023-2028)Unified Communications as a Service in Healthcare Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,统一通信即服务市场预计将以 18.3% 的复合年增长率增长。

医疗保健行业需要专业人员快速响应以照顾患者。UcaaS 提供了这个机会来简化沟通过程并提高患者护理质量。

主要亮点

- 具有成本效益的基于云的解决方案的出现导致了据报导 IT 预算紧张的医疗保健提供商的采用增加。医疗机构联络中心通过引入统一通信服务,构建PBX系统,无缝响应来自多个地点的客户请求。

- 基于云的电话、消息传递和视频会议等 UCaaS 解决方案使护理人员能够实时访问关键数据。韩国等世界各地的政府也在测试远程医疗,以提供负担得起的远程患者护理,为 UCaaS 公司打开竞争环境。

- 结合组织移动性,UCaaS 提供了许多好处,包括实时通信以即时定位和连接护理人员、有效的呼叫路由以及无论位置如何的快速连接(可以通过功能丰富的智能手机实现)。医疗保健组织可以製定规则来限制从急诊室到手术的干扰和干扰。

- 由于其简单性,传统 UC 系统受到大多数公司的青睐。大型企业对采用 UCC 服务犹豫不决,因为很难区分标准託管和託管 UCC 平台。从传统的 PBX 通信迁移到 UCC 需要全体员工快速采用以充分利用其功能。因此,它会给企业 IT 部门带来压力并扰乱时间框架。

- UCaaS 平台使医疗保健公司即使在大流行期间也能保持内部和外部通信。建立一个基于云的平台,让员工通过电话保持联繫,通过视频会议和在线医生咨询建立虚拟团队会议,并使联络中心即使在医院工作完成后也能维持客户服务。大流行后,随着医疗保健行业的数字化转型,市场正在蓬勃发展。

统一通信即医疗保健服务的市场趋势

UCaaS 在医疗保健领域的出现推动市场增长

- 医疗保健行业的 UCaaS 是一种交付模型,其中各种通信和协作服务和应用程序外包给第三方提供商,并通过医疗保健行业范围的网络交付。UCaaS 技术包括在线状态技术、视频会议、企业消息传递和电话。

- 此外,具有成本效益的基于云的解决方案的出现导致 IT 预算有限的医疗保健提供商越来越多地采用该解决方案。使用 United Communications 的订阅服务,医疗保健联络中心构建了一个 PBX 系统来无缝地服务来自多个位置的客户请求。

- 对优质医疗服务的需求非常高,尤其是考虑到大流行。此外,儘管在这一领域取得了一些技术进步,特别是在预后服务方面,但仍有改进的空间。

- 人工智能的日益普及正在帮助组织实现数字化转型的目标。AI 驱动的工具使组织能够直观地记录通话、轻鬆转录和智能跟踪发言者,以瞭解用户需求并提供适当的服务。

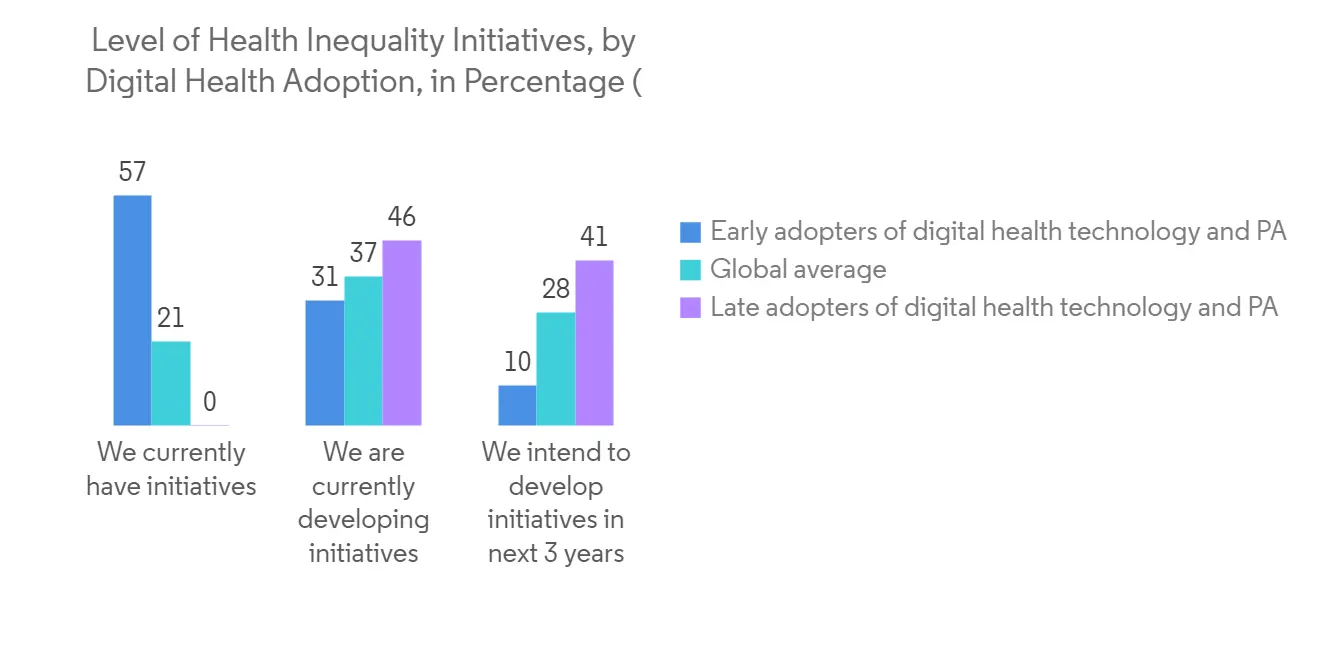

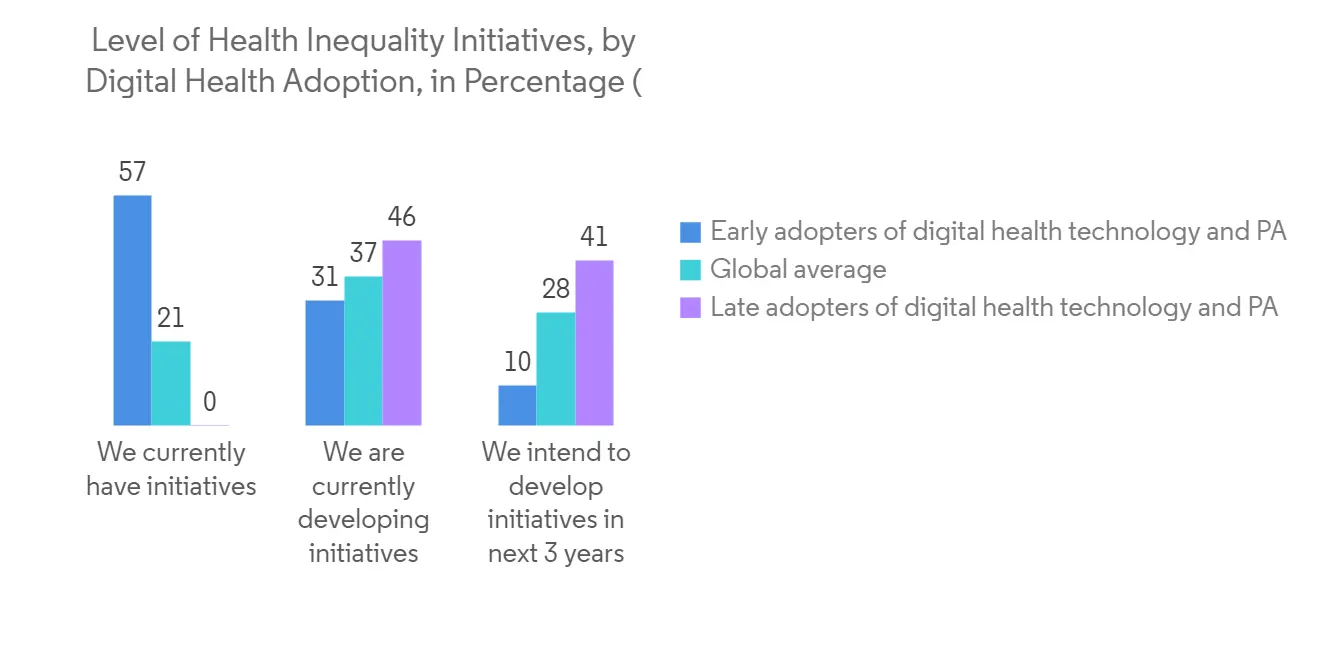

- 医疗保健组织对 BYOD 持乐观态度,因为它改进了工作流程、降低了成本,并促进了对医疗法律条款(如平价医疗法案)的遵守。医疗保健利益相关者对在整个医疗保健行业采用 BYOD 表现出信心。根据飞利浦 2022 年的一项民意调查,57% 被归类为数字健康技术和预测分析的早期采用者的医疗保健专业人员报告说,他们已采取措施解决健康不平等问题。这一比例高于全球平均水平 21%。

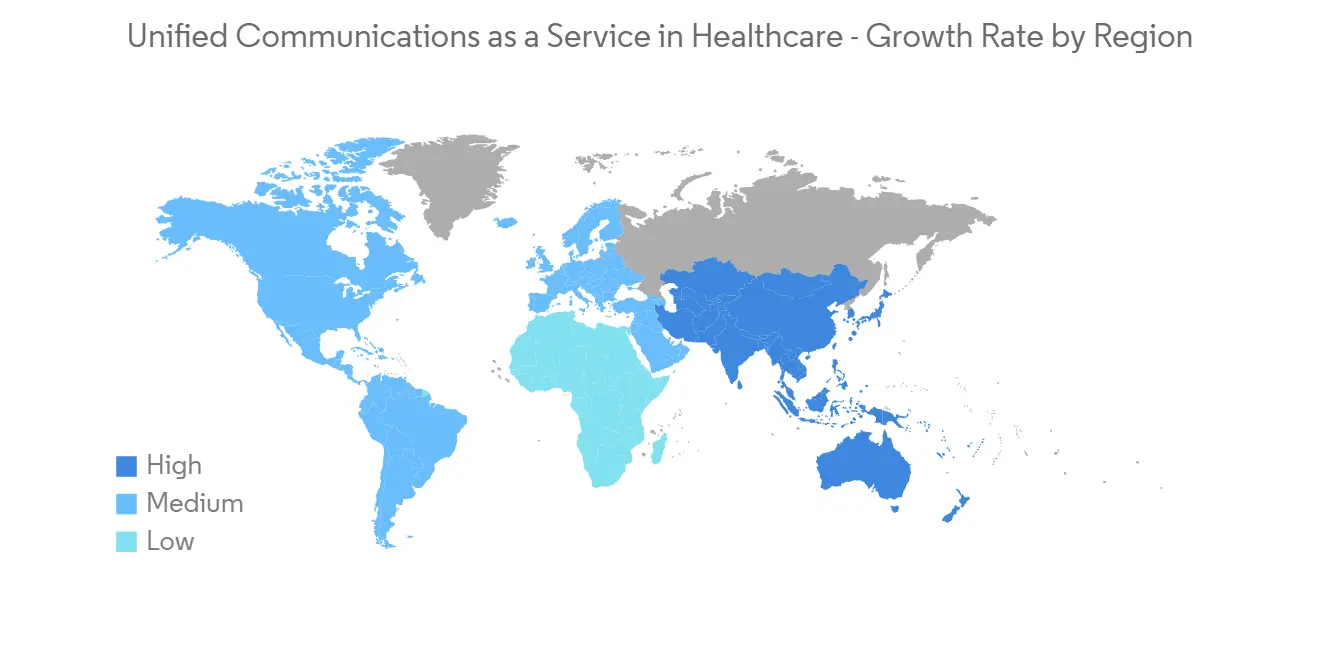

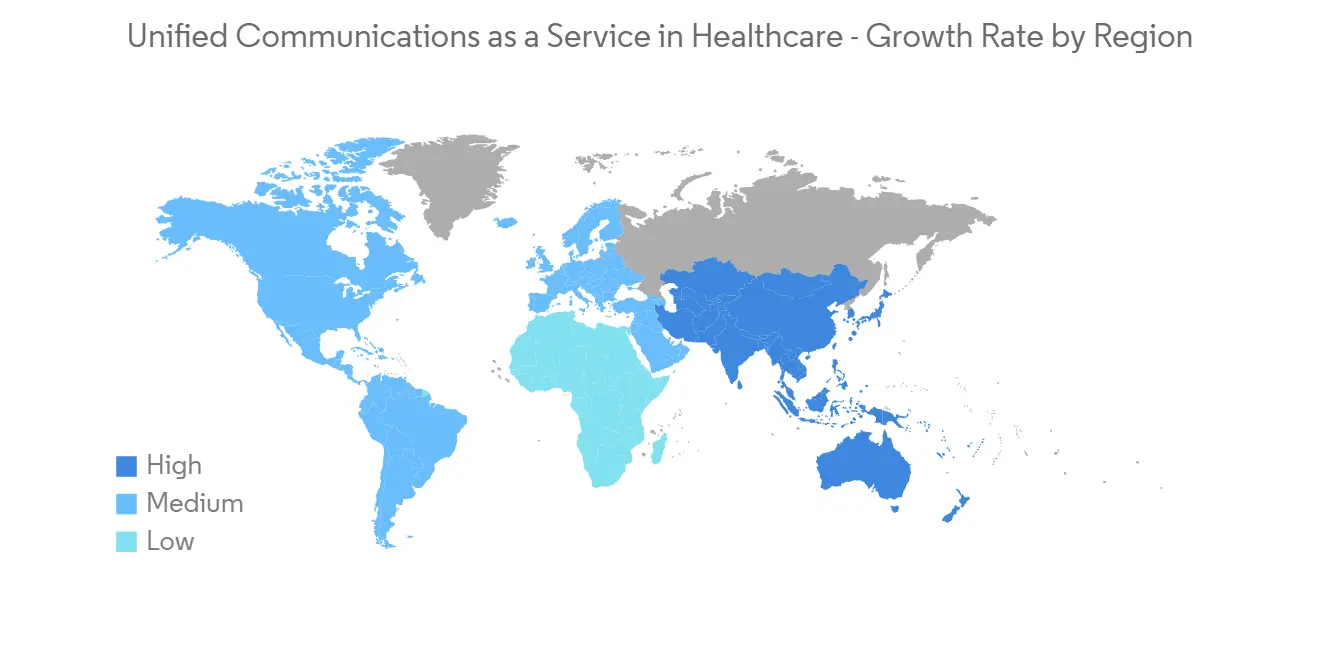

预计北美将占据最大的市场规模

- 云中的统一通信即服务 (UCaaS) 是一种支持商业任务的数字化转型。医疗保健中的 UCaaS 是一种将许多合作伙伴关係、通信应用程序和管理功能转移到外部供应商并通过医疗保健行业网络进行通信的方法。

- 这一领域的云采用,包括 EHR 系统和其他传统上在客户端-服务器架构上运行的企业应用程序的迁移,为 UC 运营商提供了在整个地区提供云服务的机会。

- 随着 5G 和边缘网络的兴起,供应商有望为北美的实时通信市场带来激动人心的变化。凭藉改进的安全性、简化的配置和一系列託管服务工具,UCaaS 提供了一个无限的创新服务竞争环境,可以帮助供应商在不久的将来最大限度地增加收入。

- 此外,UCaaS 与组织移动性相结合,提供了多种好处,例如实时通信以立即定位和连接护理人员、更快的连接、有效的呼叫路由(无论位置如何)以及医疗机构。建立规则以便从急诊室分心到手术可以缩小。

统一通信即医疗保健服务行业简介

统一通信即服务市场高度分散,主要参与者包括 Ring Central Inc.、8X8 Inc.、Verizon Communications Inc. 和 Comcast Corporation Vonage Holdings Inc. (Ericsson)。然而,随着 UCaaS 技术在医疗保健领域的进步,新进入者正在增加其在市场中的存在并扩大其在新兴国家的业务发展。市场参与者正在采用合作伙伴关係、合併、创新和收购等战略来加强他们的解决方案产品并获得持续的竞争优势。

- 2022 年 11 月:澳大利亚大型医疗公司 Healius Ltd(Healius)选择 RingCentral Inc. 为 UCaaS 和 CCaaS(联络中心即服务)提供集成解决方案。这项技术投资旨在通过首先增强语音基础领域的沟通,并从长远来看增加其他沟通渠道,来提升 Healius 在病理学和影像学方面的医患体验。RingCentral 平台提供的信息和见解也旨在提高员工队伍和运营效率。

- 2022 年 7 月:Ericsson完成对 Vonage Holdings Inc. (Vonage) 的收购,有助于Ericsson利用其技术领先地位为企业建立和扩展移动网络业务的目标。Ericsson现在可以使用强大的构建模块来提供全面的通信解决方案,包括通信平台即服务 (CPaaS)、UCaaS 和 CCaaS。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 本次调查范围

第二章研究方法论

第三章执行摘要

第四章市场洞察

- 市场概况

- 工业吸引力——波特五力分析

- 新进入者的威胁

- 买方/消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 对市场的影响

- 技术快照

第五章市场动态

- 市场驱动力

- UCaaS 在医疗保健领域的兴起

- 市场挑战

- 迁移到现代统一通信的准备缓慢

第六章市场细分

- 按地区

- 北美

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 韩国

- 亚太其他地区

- 世界其他地区

- 北美

第七章竞争格局

- 公司简介

- Ring Central Inc.

- 8X8 Inc.

- Verizon Communications Inc.

- Comcast Corporation

- Vonage Holdings Inc.(Ericsson)

- West Corporation

- Star2Star Communications LLC

- IBM Corporation

- ALE International ALE USA Inc.

第八章投资分析

第 9 章 市场机会和未来趋势

The unified communications-as-a-service market is expected to register a CAGR of 18.3% during the forecast period. The healthcare industry requires professionals to respond quickly to attend to the patient. UcaaS provides this opportunity to streamline communication processes and improve the quality of patient care.

Key Highlights

- The advent of cost-effective cloud-based solutions has seen increased adoption from healthcare providers, often categorized as having minimum IT budgets. With the subscription-based United Communication services in place, the healthcare contact centers are establishing their PBX systems and seamlessly addressing multiple customer requests from multiple sites.

- With UCaaS solutions, like cloud-based telephony, messaging, and video-conferencing, caregivers can access essential data in real time. Governments across regions, such as South Korea, are also testing telemedicine to provide affordable remote patient care, thus, giving scope for UCaaS companies.

- UCaaS, coupled with organizational mobility, provides numerous advantages, like real-time communications to locate and connect the caregivers instantly, effective call routing, and faster connections regardless of location (possible through feature-rich smartphones), and also enables the healthcare organization to establish rules and reduce interruptions and distractions from ER rooms to surgeries.

- Due to its simplicity, the old UC system is preferred by most enterprises. Large organizations are hesitant to employ UCC services since it is difficult for them to distinguish between standard hosted and managed UCC platforms. The move from traditional PBX communication to UCC will necessitate a faster adoption of the capabilities by the entire workforce to utilize the features thoroughly. As a result, pressure is placed on a company's IT department, which may disrupt the timeframe.

- UCaaS platforms enable healthcare businesses to keep internal and external communications running during the COVID-19 pandemic by keeping workers connected by phone, setting up virtual team meetings through video conferencing and online doctor consultancy, and setting up cloud-based platforms that enable contact centers to keep up with customer service even when in-hospital work is being completed. Post-pandemic, the market is growing rapidly with the digital transformation of the healthcare sector.

Unified Communications as a Service in Healthcare Market Trends

Emergence of UCaaS in Healthcare Sector Drives the Market Growth

- UCaaS in healthcare is a delivery model wherein various communication and collaboration services and applications are outsourced to a third-party provider and delivered over a network across the healthcare sector. UCaaS technologies include presence technology, video conferencing, enterprise messaging, and telephony.

- Furthermore, the advent of cost-effective cloud-based solutions has seen increased adoption from healthcare providers, often categorized as having minimum IT budgets. With the subscription-based United Communication services in place, healthcare contact centers are establishing their PBX systems and seamlessly addressing multiple customer requests from multiple sites.

- The need for high-quality healthcare services has become paramount, especially considering the pandemic. Moreover, there have been several technological advancements in this sector, especially in prognostic and diagnostic services; however, there is still room for improvement.

- The increasing deployment of artificial intelligence has greatly aided organizations in catering to the digital transformation goal. AI-powered tools have allowed organizations to intuitively record calls, facilitate effortless transcriptions, and intelligently track speakers to understand users' needs and offer relevant services.

- Healthcare organizations are optimistic about BYOD since it facilitates improved workflow, cost savings, and compliance with healthcare legislation provisions, such as the US Affordable Care Act. Healthcare players are showing confidence in adopting BYOD across the healthcare sector. According to Philips 2022 poll, 57% of healthcare professionals classified as early adopters of digital health technologies and predictive analytics reported having measures to address health disparities, compared to 21% of the global average.

North America is Expected to Register the Largest Market

- Unified Communication as a Service (UCaaS) in the cloud is a digital transformation for reinforcing commercial tasks. UCaaS in healthcare is a conveyance methodology in which many partnerships, communication applications, and administrations are moved to an outsider supplier and conveyed across a network in the healthcare industry.

- The cloud adoption in the sector, which includes moving EHR systems and other enterprise applications, which traditionally ran on client-server architectures, also provides scope for UC companies offering their services over the cloud on a subscription basis across the region.

- As a result of the rise of 5G and edge networking, vendors could expect exciting changes in the real-time communication market in the North American region. UCaaS provides a place for endless creative services and a collection of managed services tools that may help suppliers maximize revenue generation in the near years due to improved security, simpler provisioning, and a set of managed services tools.

- In addition, UCaaS, coupled with organizational mobility, provides several advantages, like real-time communications to instantly locate and connect caregivers, faster connections, and effective call routing, regardless of location, enabling healthcare organizations to establish rules and reduce distractions from ER rooms to surgeries.

Unified Communications as a Service in Healthcare Industry Overview

The unified communications-as-a-service market is highly fragmented, with significant players like Ring Central Inc., 8X8 Inc., Verizon Communications Inc., and Comcast Corporation Vonage Holdings Inc.(Ericsson). However, with the advancement in UCaaS technologies across the healthcare sector, new players are increasing their market presence and expanding their business footprint across emerging economies. Players in the market are adopting strategies such as partnerships, mergers, innovations, and acquisitions to enhance their solutions offerings and gain sustainable competitive advantage.

- November 2022: Healius Ltd (Healius), one of Australia's leading healthcare corporations, selected RingCentral Inc. to deliver an integrated UCaaS and contact center as a service (CCaaS) solution. This technological investment is intended to improve the doctor and patient experience in Healius' pathology and diagnostic imaging practices by enhancing communications, first in the fundamental domain of speech and then adding other communication channels in the long run. The information and insights given by the RingCentral platform are also intended to increase workforce and operational efficiency.

- July 2022: Ericsson completed its acquisition of Vonage Holdings Inc. (Vonage), contributing to Ericsson's goal of using technological leadership to build its mobile network business and expand into the enterprise. Ericsson now has access to strong building blocks allowing it to offer a comprehensive range of communications solutions, including Communications Platform as a Service (CPaaS), UCaaS, and CCaaS.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

- 4.4 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Emergence of UCaaS in the Healthcare Sector

- 5.2 Market Challenges

- 5.2.1 Low Readiness to Move to Modern Unified Communications

6 MARKET SEGMENTATION

- 6.1 By Geography

- 6.1.1 North America

- 6.1.1.1 United States

- 6.1.1.2 Canada

- 6.1.2 Europe

- 6.1.2.1 Germany

- 6.1.2.2 United Kingdom

- 6.1.2.3 France

- 6.1.2.4 Rest of Europe

- 6.1.3 Asia-Pacific

- 6.1.3.1 China

- 6.1.3.2 Japan

- 6.1.3.3 South Korea

- 6.1.3.4 Rest of Asia-Pacific

- 6.1.4 Rest of the World

- 6.1.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Ring Central Inc.

- 7.1.2 8X8 Inc.

- 7.1.3 Verizon Communications Inc.

- 7.1.4 Comcast Corporation

- 7.1.5 Vonage Holdings Inc. (Ericsson)

- 7.1.6 West Corporation

- 7.1.7 Star2Star Communications LLC

- 7.1.8 IBM Corporation

- 7.1.9 ALE International ALE USA Inc.