|

市场调查报告书

商品编码

1403843

管理资讯服务:市场占有率分析、产业趋势与统计、2024年至2029年的成长预测Managed Information Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

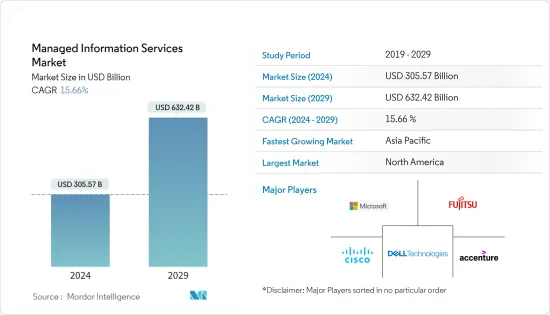

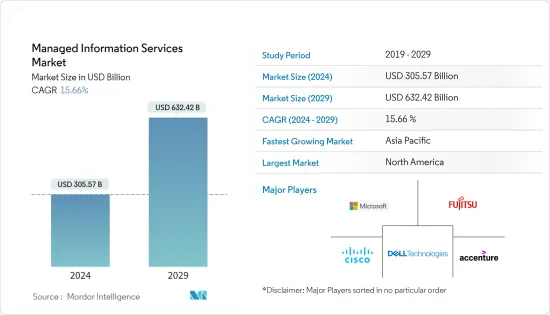

管理资讯服务市场规模预计到 2024 年为 3,055.7 亿美元,预计到 2029 年将达到 6,324.2 亿美元,在预测期内(2024-2029 年)复合年增长率为 15.66%。

满足企业需求的 MSP 正在降低成本并提高效率。随着越来越多的企业将更多业务转移到线上,他们需要更快、更安全、更互联、更可靠的网路。企业采用云端正在使市场受益。

主要亮点

- 世界各国政府正在推出有关人性化的人工智慧的各种法规。 2022 年 6 月,加拿大将提案《人工智慧和资料法案》(AIDA),该法案将要求对高影响力人工智慧系统进行风险管理和资讯。这些措施为託管服务提供者创造了新的机会,并促进业务的进一步发展。

- 日本政府将投资 63 万美元用于卫生和儿童保育部 (MoHCC) 与世界卫生组织 (WHO) 之间的联合计划。该计划将为马尼卡兰省和北马塔贝莱兰省提供安全、及时和负担得起的手术、产科和麻醉 (SOA) 护理服务。此外,它将加强该国的健康管理资讯系统(HMIS)并实现有效的决策。

- COVID-19疫情影响了各个行业,经济成长因各种生产途径的暂停而放缓。然而,相反,IT产业完全没有受到其他产业停工的影响。随着企业转向在家工作工作网路来维持业务,IT 解决方案变得越来越重要。这也增加了管理资讯服务市场的需求。

- 资讯管理对于任何组织的成功至关重要,并且需要对这些流程进行适当的投资。公司内部生产的系统具有内部成本估算,而市场上可用的系统具有不同的定价和功能。如果客户不愿意适当支出,那么为这些託管服务软体制定预算可能会很困难。

管理资讯服务市场的趋势

资料备份与復原占据市场主导地位

- 本地资料储存可能非常昂贵,并且需要新的硬件,例如伺服器和调製解调器。透过与 MSP 合作,公司可以将 IT业务委託给专业团队,使他们能够专注于核心业务。透过託管备份,您的 MSP 可以主动监控您的设施、资料中心和云端存储,以确保一切顺利运作。

- 根据埃森哲的研究,68% 的企业领导者认为网路安全风险正在增加。託管备份可保护资料免受常见网路威胁,因此,如果您的系统受到威胁,您无需在忙于恢復遗失或被盗的檔案时暂停业务。例如,如果您组织的文件因勒索软体攻击而被盗并被锁定,您可以使用 MSP 的备份资料快速恢復业务,而不是支付赎金或尝试在没有资料的情况下照常营业。您可以重新启动。

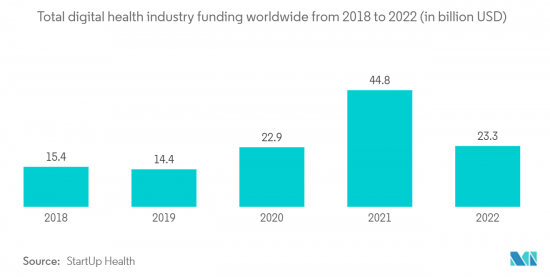

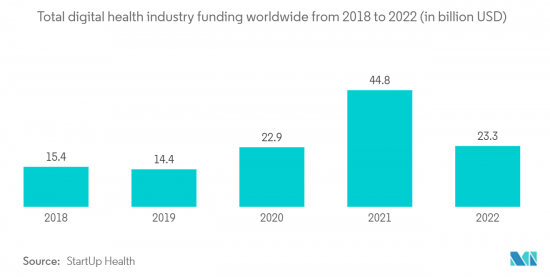

- 医疗保健和金融业是骇客的主要目标。 84% 的医院和医疗中心使用云端服务来实现备份、分析和灾害復原功能,76% 的医疗服务供应商已将其现有IT基础设施迁移到云端。

- 2023 年 3 月 - 医疗解决方案公司 Advantus 与 GE Health Care (GEHC) 合作,为卫生系统和供应商提供福利。 GEHC 管理医疗机构内的全套医疗设备,包括持续维护、召回监控和回应、消毒和分配。这降低了成本并提高了生产力。该计划还提供 GE Medical 的即时定位系统技术,帮助医疗保健提供者定位设备,这样他们就可以花更少的时间寻找医疗设备,而将更多的时间花在患者身上。追踪并精确定位您的位置。

亚太地区将经历最高的成长

- 中国企业正用数位平台取代官僚作风,让前端员工可以直接存取所需的工具和资源。该平台集中了标准服务、资讯和功能,以支援分散的决策。例如,在韩都集团,数位平台使用云端基础的供应链管理软体将自主团队与内部和外部工厂连接起来。该平台将使外部合作伙伴能够按需为 HStyle 生产商品,并使 HStyle 能够为其他客户提供服务。

- 2023 年 3 月 - Menzies Aviation 利用 Wipro 开发的新产品转变其航空货运管理服务。该产品透过增强的自动化有助于提高业务效率、员工体验和客户服务。该产品将在包括澳门在内的中国五个地区推出。

- 2023 年 3 月 - 印度的 Lal PathLabs 博士委託Kyndryl 管理IT基础设施堆迭,包括其本地 IT 环境和跨越多个超大规模云端服务供应商的云端基础设施。采用这项服务后,Lal PathLabs 博士专注于提高客户满意度,同时将客服中心的工作负载高峰减少两位数百分比。

- 2022 年 3 月 - 瑞穗金融集团与 Google 合作,加速零售银行服务的数位化。由此,瑞穗金融集团分析资料并提供有关银行应用程式和分店中客户交易的见解。

管理资讯服务产业概述

管理资讯服务市场高度整合,并由着名的管理资讯服务提供者主导。这些 MSP 与多家公司签订合同,提供资讯技术软体和服务。随着企业向数位技术转型,MSP 变得更加普遍。在此领域提供服务的重要 MSP 包括 Accenture、DELL Technologies、Fujitsu、Cisco Systems Inc 和 Microsoft。

2023年3月,总部位于印尼的Indosat Ooredoo Hutchison与Tech Mahindra签署了IT服务合约。 Indosat 目前的功能将转变为新时代的数位优先平台,从单一观点提供整个 IT 堆迭的无缝可见性和託管服务。 Indosat 目前为 1.022 亿行动电话用户提供服务。这项合作关係使 Indosat 有机会透过 IT 託管服务发展其企业业务。

2023 年 3 月,管理平台 Vanta 宣布了託管服务提供者计划,该计划为託管服务提供者提供安全监控和自动合规性。该计划具有多租户管理主机、世界一流的合作伙伴支援和灵活的收费整合。我们拥有一支敬业的专家团队,并提供精心挑选的资源、培训计划等,以确保我们的合作伙伴取得成功。

2022 年 11 月,Entech MSP 从 Prospect Partners 筹集私募股权资金,以支持其服务的进一步扩展。透过这笔资金筹措,Entech 将收购多个位于佛罗里达州的 MSP,并建立全州范围的託管服务。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 中小企业IT预算有限导致IT基础设施外包

- 市场抑制因素

- 缺乏熟练的专业人员

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按功能分类

- 资料备份与復原

- 网路监控与安全

- 人力资源

- 系统管理

- 依实施型态

- 本地

- 云

- 按行业分类

- 通讯/IT

- BFSI

- 零售

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 澳洲

- 其他亚太地区

- 拉丁美洲

- 墨西哥

- 巴西

- 其他拉丁美洲

- 中东/非洲

- 阿拉伯聯合大公国

- 南非

- 中东和非洲其他地区

- 北美洲

第六章竞争形势

- 公司简介

- Fujitsu Ltd

- Cisco Systems Inc.

- IBM Corporation

- Hewlett-Packard Enterprise

- Microsoft Corporation

- Dell Technologies Inc.

- Nokia Solutions and Networks

- Accenture PLC

- Rackspace Inc.

- Tata Consultancy Services Limited

- Wipro Ltd

- Deutsche Telekom AG

第七章 投资分析

第八章 市场机会及未来趋势

The Managed Information Services Market size is estimated at USD 305.57 billion in 2024, and is expected to reach USD 632.42 billion by 2029, growing at a CAGR of 15.66% during the forecast period (2024-2029).

Servicing the needs of companies, MSPs are cutting costs and increasing efficiency. As more and more companies move the bulk of their operations online, businesses are looking for their networks to be fast, secure, connected, and reliable. The adoption of cloud by businesses has been a boon to the market.

Key Highlights

- Governments around the world are introducing various regulations for human-centric AI. In June 2022, Canada proposed the Artificial Intelligence and Data Act (AIDA), in which risk management and information disclosure regarding high-impact AI systems will be mandatory. These initiatives will generate new opportunities for managed service providers and help them further flourish their businesses.

- The Government of Japan plans to invest 0.63 million USD towards a joint project between the Ministry of Health and Child Care (MoHCC) and WHO (World Health Organisation). This project will provide safe, timely, affordable Surgical, Obstetric, and Anaesthesia (SOA) care services in Manicaland and Matabeleland North Provinces. Further, it will strengthen the national Health Management Information Systems (HMIS) to allow effective decision-making.

- The COVID-19 outbreak impacted various industries, and the economy's growth slowed down due to the shutdown of different production channels. But on the contrary, the IT sector was not completely affected negatively by the lockdowns that hampered other industries. The importance of IT solutions increased as firms turned to work-from-home networks to maintain their operations. This also increased the demand for Managed Information Services Market.

- Information management is critical to every organization's success and requires proper investment in these processes. Systems produced internally by the company will have their internal cost estimation, and systems available on the market will have different pricing and capabilities. Budgeting decisions for these managed services software can be challenging if clients are unwilling to spend appropriately.

Managed Information Services Market Trends

Data Backup and Recovery to Dominate the Market

- On-premises data storage can become expensive, requiring new hardware like servers, modems, etc. By partnering with an MSP, the companies can focus on core business needs as they outsource their IT tasks to this dedicated team. With managed backup, an MSP proactively monitors facilities, data centers, and cloud storage to ensure everything runs smoothly.

- According to a study by Accenture, 68% of business leaders feel their cybersecurity risks are increasing. Managed backup protects data from common cyber threats so that companies don't have to pause operations while scrambling to recover lost or stolen files if systems are infiltrated. For instance, if an organization's files are stolen and locked in a ransomware attack, they can quickly resume business operations using MSP's backup data instead of paying the ransom or trying to continue business as usual without data.

- The healthcare and finance industries are the primary targets of hackers. 84% of hospitals and healthcare centers use cloud service for backup, analytics, and disaster recovery functions, and 76% of healthcare service providers are moving their existing IT infrastructure to the cloud.

- March 2023 - Healthcare solutions company Advantus partnered with GE Health Care (GEHC) to deliver benefits to health systems and suppliers. GEHC will manage complete medical equipment in a healthcare facility - including ongoing maintenance, monitoring for and addressing recalls, disinfection, and distribution. This will help reduce costs and improve productivity. The program will also offer GE HealthCare's real-time location system technology that tracks and locates a provider's equipment so caregivers can spend less time searching for equipment and more time with patients.

Asia-Pacific to Witness the Highest Growth

- Chinese businesses are adopting digital platforms to replace bureaucracy and give front-end staff direct access to the required tools and resources. That platform centralizes standard services, information, and capabilities to support decentralized decision-making. For instance, at Handu Group, a digital platform connects autonomous teams to internal and external factories using cloud-based supply-chain-management software. The platform allows external partners to produce goods on a requirement basis for HStyle but frees them up to serve other customers.

- March 2023 - Menzies Aviation will use a new product developed by Wipro to transform its air cargo management services. This will help the aviation leader to improve business efficiencies, employee experience, and customer service through increased automation. The product will be rolled out in 5 locations, including Macau in China.

- March 2023 - In India, Dr. Lal PathLabs appointed Kyndryl to manage its IT infrastructure stack, including the on-premises IT environment and cloud infrastructure across multiple hyper-scale cloud service providers. After adopting this service, Dr. Lal PathLabs concentrated on raising customer satisfaction while lowering call center workload spikes by a double-digit percentage.

- March 2022 - Mizuho Financial Group, a Japanese firm, partnered up with Google to expedite the digitization of its retail banking services, thereby leaving behind the computer system difficulties that plagued it for months. This will provide insights to the finance company to analyze data about customer transactions conducted on its banking apps and at retail branches.

Managed Information Services Industry Overview

The managed information services market is highly consolidated and dominated by prominent managed information service providers. These MSPs sign contracts with various companies to help them with information technology software and services. As businesses shift to digital technologies, these MSPs have a wider scope of expansion. Some significant MSPs offering their services in this sector include Accenture, DELL Technologies Fujitsu, Cisco Systems Inc, Microsoft, and so on.

In March 2023, Indonesia-based Indosat Ooredoo Hutchison signed a contract with Tech Mahindra for IT services. Indosat current functionalities will be transformed into a new-age digital-first platform that enables seamless visibility and managed services across its entire IT stack from a single viewpoint. Indosat presently serves 102.2 million mobile subscribers. Through this partnership, Indosat will get the chance to grow its enterprise business along with IT-managed services.

In March 2023, Vanta, the management platform, introduced the Managed Service Provider Program, which offers security monitoring and automated compliance for managed service providers. The program features a multi-tenant management console, world-class partner support, and flexible billing integration. A dedicated team of experts has been formed to ensure partner success, including curated resources and training programs.

In November 2022, to help expand its services further, Entech MSP took private equity funding from Prospect Partners. The funding will allow Entech to acquire several Florida-based MSPs to build a state-wide managed services practice.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Limited IT Budget of SMEs Leads to Outsourcing of IT Infrastructure

- 4.3 Market Restraints

- 4.3.1 Lack of Skilled Professionals

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Function

- 5.1.1 Data Backup and Recovery

- 5.1.2 Network Monitoring and Security

- 5.1.3 Human Resource

- 5.1.4 System Management

- 5.2 By Deployment Mode

- 5.2.1 On-premise

- 5.2.2 Cloud

- 5.3 By End-user Vertical

- 5.3.1 Telecommunication and IT

- 5.3.2 BFSI

- 5.3.3 Retail

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 Australia

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Mexico

- 5.4.4.2 Brazil

- 5.4.4.3 Rest of Latin America

- 5.4.5 Middle-East & Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East & Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Fujitsu Ltd

- 6.1.2 Cisco Systems Inc.

- 6.1.3 IBM Corporation

- 6.1.4 Hewlett-Packard Enterprise

- 6.1.5 Microsoft Corporation

- 6.1.6 Dell Technologies Inc.

- 6.1.7 Nokia Solutions and Networks

- 6.1.8 Accenture PLC

- 6.1.9 Rackspace Inc.

- 6.1.10 Tata Consultancy Services Limited

- 6.1.11 Wipro Ltd

- 6.1.12 Deutsche Telekom AG