|

市场调查报告书

商品编码

1643224

电信託管服务:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Telecom Managed Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

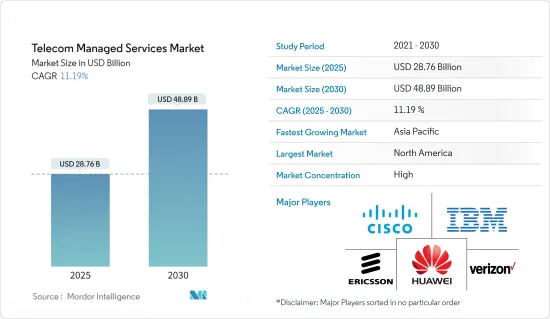

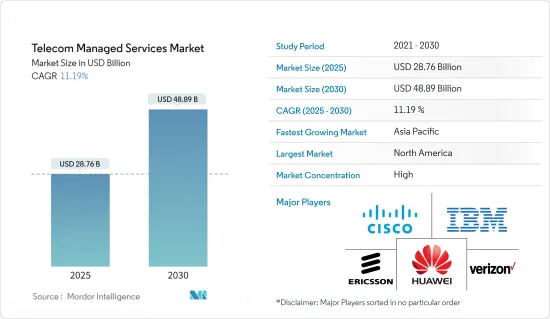

电信託管服务市场规模预计在 2025 年为 287.6 亿美元,预计到 2030 年将达到 488.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 11.19%。

由于各种技术的采用率很高、BYOD 政策审查频率增加(以使业务运营更加舒适和易于管理)以及由于组织中资料的快速增长而对高端安全性的需求不断增加,通讯领域已成为託管服务的重要市场。

关键亮点

- 过去几年,通讯产业经历了显着的成长。在竞争激烈的市场中,电信业者不断面临以低成本提供创新服务以留住客户的压力。网路优化需求的持续成长和网路效能的显着提升、SDN、5G 和 NFV 等技术的进步、智慧型手机的日益普及和 BYOD 趋势、以及网路攻击数量的增加等因素将在预测期内进一步推动通讯託管服务市场的成长。

- 随着电讯业务的蓬勃发展,各大公司纷纷转向 MSP(託管服务供应商)。 MSP 提供重要的服务水平,帮助公司实现更好的业务成果。企业通常面临收益、业务转型、成本采用以及通讯领域日益激烈的市场竞争等若干挑战,而这些挑战都依赖 MNO 和 CSP。此外,各种 SD-WAN 託管服务供应商透过广泛的安全产品来区分自己。例如,Cato Networks 提供一个云端原生平台,其中包括 NGFW、进阶威胁预防、CloudSecure Web 闸道、行动存取保护以及託管威胁侦测和回应服务。

- 电信公司也在收购託管服务供应商,以占领更大的市场占有率。例如,今年早些时候,网路系统、服务和软体供应商 Ciena Corporation 披露,它已签署具有约束力的协议,收购总部位于加州佩塔卢马的非上市Tibit Communications, Inc.,以及在马萨诸塞州伯灵顿设有办事处的非上市公司 Benu Networks, Inc.。 Tibit 和 Benu 主要致力于透过新一代 PON 技术增强用户管理和简化宽频存取网路。

- 预计在预测期内,公司对资料保密性、业务外包和确保客户最佳分工的安全疑虑等决定性因素将限制市场成长。

- 然而,COVID-19 疫情已影响到全球的营运服务,包括通讯管理服务和支援服务。此外,疫情已导致大量公司转向长期在家工作的文化。因此,大多数企业都转向能够为他们提供增值服务的服务供应商,以帮助最大限度地降低各种与安全相关的风险,从而成倍地扩大市场。

电信管理服务市场趋势

云端运算的使用增加预计将推动市场成长

- 通讯领域受到云端运算的严重影响。在过去五年中,云端运算的普及度大幅成长。它对商业、技术和资讯技术领域产生了重大影响。这导致全球在云端运算方面的支出增加。总体而言,它降低了电讯部门的营运和管理成本,同时在广泛的内容传输网路上保持了统一的通讯和团队合作。云端服务供应商使电讯业能够专注于其核心功能,而不必担心更新和维护 IT 和伺服器。

- 市场成长的关键驱动力是云端运算技术的采用日益广泛,尤其是在中小型企业中,以及行动性和巨量资料服务等技术的快速进步以提高业务效率。云端运算为电讯业提供了广泛的机会。它利用先进的技术显着扩大了全球通讯的覆盖范围,因为它可以帮助企业改善业务并更有效地利用技术。云端运算的好处包括云端传输模式、通讯服务、网路服务、可扩展且灵活的基础设施,以及高效且灵活的资源分配和管理。此外,云端运算还降低了硬体成本,因为服务供应商可以以低价提供软体,并藉助虚拟和配置软体分配高效的运算资源。

- 云端运算市场正在经历主要企业的多次收购、合併和投资。例如,今年最后一个季度,Colt Technology Services 与 IBM 的合作迈出了新的方向,两家公司在英国开设了一个新的工业 4.0 实验室。 IBM 提供其 Maximo 应用程式套件和 Cloud Satellite混合云端,而 Colt 提供其 Colt Edge 运算平台和 SD-WAN 技术。凭藉三个关键边缘使用案例——视觉检查推理、供应链远端检测、威胁监控和资料保护,两人最初专注于製造业。

- 此外,亚马逊网路服务宣布将于 2022 年第四季在瑞士推出一个新的云端运算区域。 2036年,AWS 欧洲地区每年将在工程、通讯、设施维护和建设等各领域新增 2,500 名全职员工。根据 AWS 介绍,三个可用区将组成新的苏黎世云区域。每个可用区资料中心都有独立的电源、实体安全、冷却系统和低延迟网路连线。这些可用区为高可用性应用程式提供了增强的容错能力,最大限度地减少了服务中断。

- 根据 Digital Ocean 的数据,2021 年,74% 的企业表示他们使用 AWS EC2 和 Azure VM 等云端託管/基础设施服务。企业也大量使用平台即服务 (PaaS) 解决方案,例如 Heroku 和 Azure App Service。值得注意的是,传统的中小企业通常使用较少的云端服务,因此其云端设定不太复杂。因此,随着企业采用云端託管/基础设施服务的整体增加,市场预计将呈指数级增长。

北美主导电信管理服务市场

- 北美贡献了最大的市场占有率,预计将在预测期内主导电信託管服务市场。预计该地区的市场将快速成长。推动北美市场成长的因素包括快速发展的技术进步、全球通讯公司寻求优化网路投资和提高客户满意度以及该地区网路攻击的增加。

- 此外,该地区伺服器配置错误问题的增加也是推动市场扩张的主要因素之一。许多公司都经历过伺服器配置错误,这是导致个人资讯外洩的主要原因。这导致人们更加关注具有透过附加价值服务全面降低安全相关风险能力的电讯託管服务供应商。 SOCRadar 已确认该伺服器的错误配置导致约 65,000 家企业的敏感资料外洩。 SOCRadar发现,错误配置的伺服器暴露了约65,000家公司的敏感资料。因此,该地区配置错误的伺服器的增加极大地促进了市场的成长。

- 此外,随着现代技术的快速发展和简化 IT 功能的需求,该地区越来越多的企业发现,借助电信 MSP 的帮助可以最好地跟上步伐。此外,市场还见证了主要企业推出的各种产品和创新,这是他们改善业务、接触客户和扩大影响力以满足多种应用需求的策略的一部分。

- 例如,今年早些时候,AT&T 推出了 AT&T 託管无线 WAN,这是一个由 AT&T 网路专家运行的即插即用系统,可为任何地方的任意数量的固定站点提供快速、灵活和安全的无线行动电话接入。此外,今年第二电讯,Emersion 宣布公共产业加速其北美企业发展。

- 此外,智慧型手机和平板电脑在美国越来越受欢迎,BYOD政策正在推行。预计全部区域不断上升的设备普及率和强大的网路连接将鼓励各组织采用 BYOD 计划。此外,该地区主要通讯业者的存在和资料中心的不断增加也有望推动市场的发展。此外,对提高业务流程业务效率和可靠性的需求日益增长,这也大大推动了该地区市场的发展。

电信管理服务业概况

电信管理服务市场正在整合,大型企业占据市场主导地位。各行业的主要供应商都计划对该市场进行大量投资。因此,未来几年市场将经历巨大的成长。主要企业正在采用多种有机和无机成长策略,例如併购、联盟/伙伴关係关係和合资企业,以在市场上占据强势地位。市场的一些关键发展包括:

- 2022 年 11 月-通讯领域供应商 Agility Communications Group 被 BlackPoint IT Services 收购。主要原因是提供更全面的端到端 IT 服务和电讯能力,以支援美国以及亚洲和欧洲分公司的客户。

- 2022 年 8 月 - Verizon 和全球领先的消费信贷机构 Nova Credit 宣布扩大合作伙伴关係,作为其旗舰零售计划的一部分,透过电话或在选定的 Verizon 地点店内对新客户进行外国信用检查。该合作关係将允许 Verizon 提取潜在客户的国际信用檔案并将其转换为可用于获得贷款资格的信用评分。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 对电信管理服务市场的影响评估

第五章 市场动态

- 市场驱动因素

- 对电讯业务流程中提高业务效率、安全性和灵活性的需求

- 最大限度地降低企业基础设施管理成本

- 市场限制

- 确保为客户提供最佳部门

第六章 市场细分

- 按组织规模

- 大型企业

- 中小型企业

- 按服务类型

- 託管资料中心服务

- 资安管理服务

- 主机服务

- 管理资料和资讯服务

- 其他服务类型(託管通讯服务、行动化运营服务)

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Cisco Systems Inc.

- Huawei Technologies Co. Ltd

- International Business Machines Corporation

- Telefonaktiebolaget LM Ericsson

- Verizon Communications Inc.

- AT&T Inc.

- NTT Data Corporation

- Unisys Corporation

- Comarch SA

- GTT Communications Inc.

- Amdocs Inc.

- ZTE Corporation

- Nokia Corporation

- Tech Mahindra Limited

- Fujitsu Limited

第八章投资分析

第九章 市场机会与未来趋势

The Telecom Managed Services Market size is estimated at USD 28.76 billion in 2025, and is expected to reach USD 48.89 billion by 2030, at a CAGR of 11.19% during the forecast period (2025-2030).

The telecom sector is a significant market for managed services due to the high rate of various technological adoptions, increased frequency of confirmation of the BYOD policy (to make business operations much more comfortable and controllable), and the increased need for high-end security due to the rapidly increasing data among the organizations.

Key Highlights

- The telecom industry observed extensive growth during the past few years. Telecommunication companies are constantly pressured to deliver innovative services at lower costs to retain their customers in the competitive market. The factors, such as the constant requirement for network optimizations and the significant level of network performance, advancements in technologies, such as SDN, 5G, and NFV, growing smartphone usage and BYOD trends, and the growing number of cyber-attacks, will further encourage the growth of the telecom managed services market during the forecast period.

- Since telecom businesses are increasing rapidly, enterprises frequently rely on MSPs (Managed Service Providers). An MSP helps enterprises achieve excellent business outcomes by providing a significant level of service. The companies mostly face several challenges in terms of revenue, business transformation, cost implementation, and heightened competition in the marketplace in the telecom sector, due to which they depend on MNOs and CSPs. Moreover, various SD-WAN-managed service providers distinguish themselves with a broad range of security offerings. For instance, Cato Networks gives a cloud-native platform that includes NGFW, Advanced Threat Prevention, CloudSecure Web Gateway, Mobile Access Protection, and Managed Threat Detection and Response service.

- Telecom companies are also acquiring managed service providers to gain a more significant market share. For instance, recently this year, Networking systems, services, and software provider Ciena Corporation revealed that it had signed a binding agreement to buy privately held Tibit Communications, Inc. with headquarters in Petaluma, California, as well as privately held Benu Networks, Inc. with offices in Burlington, Massachusetts. Tibit and Benu mainly focus on simplifying broadband access networks with enhanced subscriber management and next-generation PON technologies.

- Determinants, such as security concerns related to the confidentiality of data of businesses that are outsourcing the business and assuring the optimum business functionality of the clients, are expected to restrict the market growth during the forecast period.

- However, due to the COVID-19 outbreak, operational services, like telecom managed services and support services, were affected globally. Moreover, due to this pandemic, a broad range of firms has significantly undergone a long-term work-from-home culture. Hence, most organizations are turning to service providers for their ability to minimize various security-related risks with the value-added service they offer, which drives the market exponentially.

Telecom Managed Services Market Trends

Rise in the Usage of Cloud Computing is Expected to Drive the Market Growth Significantly

- The telecom sectors have been significantly impacted by cloud computing. For the past five years, cloud computing has experienced tremendous growth in popularity. It greatly affects the business, technology, and information technology sectors. This has caused a rise in global spending on cloud computing. Overall, it decreased operational and administrative costs in the telecom sector while preserving unified communication and teamwork with an extensive Content Delivery Network. Cloud service providers let the telecom industry concentrate on core business functions rather than IT, server updates, or upkeep concerns.

- The primary drivers of the market's growth are the increasing adoption of cloud computing technologies, especially by small and medium-sized businesses, and the rapid advancement of technology, including mobility and big data services, to improve operational efficiency. Cloud Computing offers a broad range of opportunities in the telecom industry. It could help companies improve their business and use technology more efficiently, so it has significantly increased the reach of telecommunications worldwide using advanced technologies. Some of its benefits include Cloud Delivery Model, Communication Services, Network Services, Highly scalable and flexible infrastructure, Efficient and flexible resource allocation and management, etc. Moreover, using cloud computing, service providers can provide software at lower rates with the help of virtualization and provisioning software, allocating efficient computing resources and thus reducing hardware costs as well.

- The market is witnessing several acquisitions, mergers, and investments by key players as part of its strategy to improvise business and its presence to reach customers and meet their requirements for various applications. For instance, recently, in the last quarter of this year, Colt Technology Services and IBM's cooperative relationship took a new direction when the two joined up to open a new Industry 4.0 lab in the United Kingdom where businesses can try edge cloud services. While IBM will give its Maximo Application Suite and Cloud Satellite hybrid cloud, Colt will contribute its Colt Edge computing platform and SD-WAN technology. With three critical edge use cases-visual inspection-based inferencing, supply chain telemetry, threat monitoring, and data protection-the duo initially focuses on the manufacturing industry.

- Moreover, in the Q4 of the year 2022, Amazon Web Services declared the introduction of a new cloud computing region in Switzerland. Through 2036, the corporation would add 2,500 full-time employees yearly in various sectors, including engineering, telecommunications, facility maintenance, and construction, due to the Europe AWS area. According to AWS, three availability zones make up the new cloud region in Zurich. Each availability zone's data centers have access to separate power, physical security, a cooling system, and a low-latency network connection. These availability zones should offer improved fault tolerance for high-availability applications to ensure minimal service interruption.

- As per Digital Ocean, In 2021, 74 % of enterprises indicated using cloud hosting/infrastructure services such as AWS EC2 or Azure VMs. Enterprises are also using the platform as a service (PaaS) solution, including Heroku or Azure App Service, to a great extent. Notably, traditional small and midsize businesses generally use fewer cloud services and therefore have less complex cloud setups. Hence the overall rise in the usage of cloud hosting/infrastructure services by enterprises will drive the market exponentially.

North America to Dominate the Telecom Managed Services Market

- North America held the most significant market share and is anticipated to dominate the telecom-managed services market during the forecast period. The market will experience an abrupt rise in this region. The factors encouraging the growth of the market in North America include quickly evolving technological developments, the presence of the world's largest telecom firms looking to optimize their network investments & intensify customer satisfaction, and rising network cyber-attacks in this region.

- Moreover, the rise in misconfigured servers within the region is also one of the significant reasons behind the market expansion. Various firms are experiencing misconfigured servers which lead to the prime cause of personal data being compromised. Hence, they are significantly turning to telecom-managed service providers for their overall ability to reduce security-related risks with their value-added services. Recently this year, Microsoft, a US-based company, confirmed that a misconfiguration of a Microsoft server endpoint exposed specific customer data, including emails and personal information.SOCRadar has identified that sensitive data of around 65,000 entities became public due to this misconfigured server. Hence, the rise in misconfigured servers in the region significantly drives the market's growth.

- Moreover, with the speedy acceleration of modern technology and the need for streamlined IT functions, an increasing number of businesses in the region are finding it best to keep pace with the help of Telecom MSP. Additionally, the market is witnessing various product launches and innovations by key players as part of its strategy to improve business and their presence to reach customers and meet their requirements for multiple applications.

- For instance, earlier this year, to provide fast, flexible, and secure wireless cellular access to any number of fixed sites, anywhere, AT&T offered AT&T Managed Wireless WAN, a plug-and-play system run by AT&T network professionals. Moreover, in the 2nd quarter of this year, Emersion, whose powerful business automation platform supercharges billing, provisioning, and order flow for telecom, MSP, and utility businesses, announced the acceleration of its presence in North America.

- Further, the penetration of smartphones and tablets is increasing in the United States, which in turn is driving the BYOD policy. The increasing penetration of devices and robust network connectivity across the region are expected to encourage organizations to adopt BYOD policies. Additionally, the presence of key telecom players in the region and the increasing deployment of data centers is expected to drive the market. Also, the rise in the need for improved operational efficiency and reliability in business processes is exponentially driving the market in the region.

Telecom Managed Services Industry Overview

The telecom-managed services market is consolidated, and significant players dominate it. Primary vendors across various verticals are planning for considerable investments in this market. As a result, the market is poised to grow at an extraordinary rate in the upcoming years. The principal players are embracing several organic and inorganic growth strategies, like mergers and acquisitions, collaboration and partnerships, and joint ventures, to gain a strong position in the market. Some of the critical development in the market are:

- November 2022 - Agility Communications Group, a provider in the telecommunications sector, has been acquired by BlackPoint IT Services. The key reason behind this is to provide end-to-end IT services and telecoms with even more comprehensive capabilities to assist their clientele across the United States and their branch offices in Asia and Europe.

- August 2022 - As part of its flagship retail program, Verizon and Nova Credit, the top consumer-permission credit agency in the world, have announced that they have expanded their partnership to conduct foreign credit checks for clients new to the country over the phone and in some Verizon stores. With the help of this cooperation, Verizon will be able to pull prospective customers' international credit files and convert them into credit scores that could make them eligible for financing.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Telecom Managed Services Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Demand for Enhanced Operational Efficiency, Security, and Agility in Telecom Business Process

- 5.1.2 Cost Minimization in Managing Enterprise Infrastructure

- 5.2 Market Restraints

- 5.2.1 Assuring the Optimum Business Functionality of the Customers

6 MARKET SEGMENTATION

- 6.1 By Organization Size

- 6.1.1 Large Enterprises

- 6.1.2 Small and Medium Enterprises

- 6.2 By Service Type

- 6.2.1 Managed Data Center Services

- 6.2.2 Managed Security Services

- 6.2.3 Managed Network Services

- 6.2.4 Managed Data and Information Services

- 6.2.5 Other Service Types (Managed Communication Services and Managed Mobility Services)

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 Huawei Technologies Co. Ltd

- 7.1.3 International Business Machines Corporation

- 7.1.4 Telefonaktiebolaget LM Ericsson

- 7.1.5 Verizon Communications Inc.

- 7.1.6 AT&T Inc.

- 7.1.7 NTT Data Corporation

- 7.1.8 Unisys Corporation

- 7.1.9 Comarch SA

- 7.1.10 GTT Communications Inc.

- 7.1.11 Amdocs Inc.

- 7.1.12 ZTE Corporation

- 7.1.13 Nokia Corporation

- 7.1.14 Tech Mahindra Limited

- 7.1.15 Fujitsu Limited