|

市场调查报告书

商品编码

1406889

联网电视:市场占有率分析、行业趋势和统计数据、2024 年至 2029 年的成长预测Connected TV - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

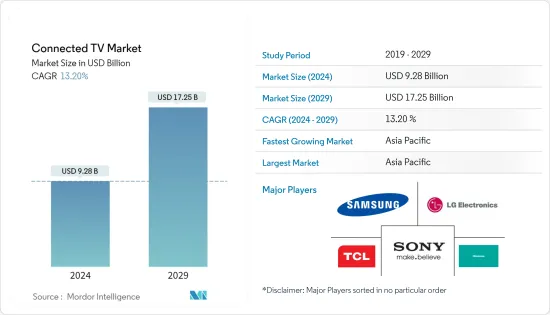

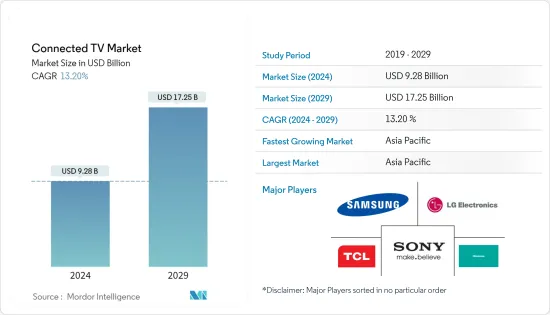

预计2024年联网电视市场规模为92.8亿美元,预计2029年将达到172.5亿美元,在市场估计和预测期间(2024-2029年)复合年增长率为13.20%。

连网智慧电视将负责改变电视产业,因为它们透过网路服务提供标准CRT电视所不具备的广泛创新。该电视配备 Wi-Fi 和乙太网路端口,允许用户连接到互联网。

主要亮点

- Apple TV、Amazon Fire TV 和 Google Chromecast 等串流媒体正在改变消费者的观看习惯。一些製造商正在与Over-The-Top内容和设备供应商合作,提供无需机上盒的内建功能。例如,TCL公司与Roku公司合作推出4K HDR电视。

- 此外,电视製造商还在用户介面、内容集中和应用开发方面的最新进展上竞争。例如,智慧型电视配备的作业系统可以运行用于串流视讯和音乐的应用程式和Widgets。智慧型电视提供各种先进的运算功能以及与常见网路功能的连接。这使得消费者能够在智慧型电视上搜寻、交谈、探索、共用、更新和下载多媒体内容,从而推动了对联网电视的需求。

- 此外,世界媒体的快速数位化正在以数位化和智慧替代品取代传统电视萤幕,进一步刺激市场开拓。此外,在美国,随着消费者人均收入的增加和产品变得更加容易取得,对智慧联网电视的需求也在增加。

- 此外,由于环境智慧、自动用户援助和消费者可支配收入增加等功能,智慧型电视在物联网生态系统中的重要性日益增加,也推动了市场的成长。

- 因为它类似于电脑或智慧型手机,所以连接的电视可能会崩溃或死机。客户对资料外洩以及透过网路连线未授权存取摄影机和麦克风的担忧日益增加,这可能会限制评估期间联网电视市场的成长。

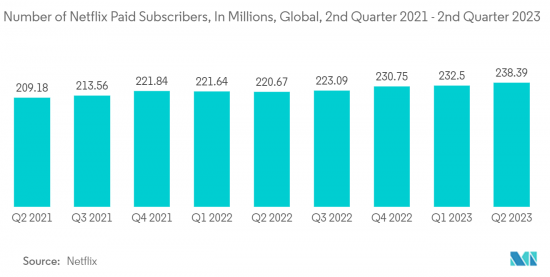

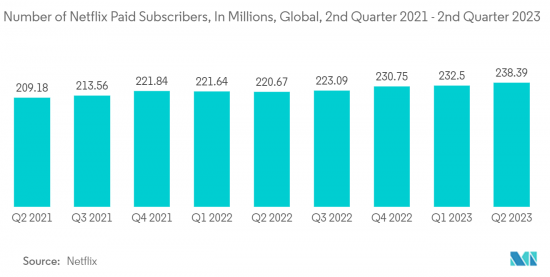

- COVID-19 的爆发对所有消费者的生活方式和生活方式产生了巨大影响。由于就地避难令和在家工作的规定,在家中的视讯消费达到了历史最高水准。开发中国家行动用户的成长已成为智慧型电视的主要动力,因为越来越多的消费者希望继续在家中的大萤幕上消费串流内容。

联网电视市场趋势

智慧型电视占最大市场占有率

- 与传统电视相比,智慧电视具有前沿的功能和应用升级。此外,Apple 和 Roku 正在开发专用智慧型电视的作业系统。例如,LG 电子的 WebOS 和三星电子的 Tizen 使客户能够从商店下载程式并存取线上串流应用程式。

- 近年来,由于高速宽频存取的增加,线上材料的观看量急剧增加。此外,不断扩大的电子产业开始与各种技术进步融合,包括语音命令和运算智能,推动了对智慧型设备(包括智慧联网电视)的需求。

- 此外,随着各种智慧型电视品牌采用Android作为作业系统,观众现在可以轻鬆存取Netflix、Amazon Prime和Hotstar等流行的OTT服务。可以从 Android 作业系统存取 Facebook、Twitter、YouTube 等 Android 应用程式。

- 此外,蓝牙遥控器允许观众在这些电视上存取语音命令。例如,SONY的 One-Flick 遥控器具有内建麦克风,可让您透过语音搜寻任何内容。 Android 内建游戏、音乐、电影和应用程式商店。

- 此外,多种串流媒体服务(包括 Amazon Fire TV、Apple TV、媒体装置和 Google Chromecast)的轻鬆可用性预计将改变人们的体验和观看模式。因此,我们将看到製造商迅速转向与内容提供商和 OTT 设备製造商合作开发电视内建功能。

亚太地区占最大市场占有率份额

- 在亚太地区,消费者可支配净收入的成长正在推动智慧电视的需求。此外,Amazon Prime Video、HOOQ 和 Netflix 等Over-The-Top平台在该地区的日益普及也推动了市场成长。例如,2023年5月,三星推出了最新的Neo QLED智慧型电视系列,具有4K和8K解析度。最新的Neo QLED智慧型电视系列有50吋、55吋、65吋、75吋、85吋和98吋尺寸可供选择。

- 此外,网路的普及也促进了智慧型电视销售的增加,推动了市场的成长。 IBEF预测,到2023年,印度OTT视讯串流市场规模将达50亿美元。预计年终,印度市场规模将达到8.23亿美元,可望成为全球第十大OTT市场。

- 由于偏好从传统电视转向智慧电视,印度家庭正处于一个转折点。中等收入群体生活方式的改变是由于收入增加、意识增强、新技术的采用以及互联网普及的提高。此外,预计在预测期内加速印度智慧型电视市场成长的关键因素是政府倡议,特别是针对二线和三线城市的倡议。

- 此外,印度宽频网路普及的不断提高以及客户对线上内容偏好的变化也有望刺激市场成长。 Netflix、Amazon Prime 和 Hotstar 等影片串流公司的大量投资增加了付费电视用户。此外,Daiwa 最近推出了一款采用 webOS TV 的独特 4K 超高清智慧型电视。这款 50 吋智慧型电视由 webOS TV 提供支持,并具有 ThinQAI 语音援助和 Magic Remote。

联网电视产业概述

联网电视市场有多个参与者。这些拥有大量市场占有率的大公司致力于扩大其国际消费群。由于最近消费者兴趣的增加,该行业被视为一个有前途的投资目的地。营运商正在投资新兴技术来开发大量专业知识,以提供长期竞争优势。

2023年4月,小米在印度推出了三款新款4K智慧电视。新系列有 43 吋、50 吋和 55 吋三个版本。与现有 X 系列相比,X Pro 型号在宽色域内提供了改进的色彩、对比度、饱和度和亮度。

2023 年 1 月,Roku 发布了 Roku Select 系列和 Roku Plus 系列电视。 Roku将生产从24吋到75吋的11款机型,并将搭载Roku的作业系统。它将于 2023 年春季在美国上市。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业相关人员分析(智慧型电视製造商、中介软体供应商、串流媒体播放器供应商、供应商/经销商、最终用户)

- 联网电视- 技术形势(智慧型电视、串流媒体播放器、游戏机(用于串流媒体)) - 包括游戏机市场估计和区域形势

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 网路普及的预期成长与传统电视的转变

- 产业协同且良好的市场环境(从网路电视到智慧型电视的转变)

- 市场挑战

- 成本问题以及与替代媒体的竞争

第六章市场区隔

- 按设备

- 智慧型电视

- 智慧电视市场概况及预测(单位:百万台,2020-2027)

- 按主要作业系统(Android、Tizen、WebOS、Roku、Firefox 等)分類的智慧电视市场细分

- 智慧型电视解析度的关键转变和趋势 - 4K、Ultra、8K 等

- 串流媒体播放器市场概况及预测(单位:百万台,2020-2027)

- 智慧型电视

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 亚太地区其他地区

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章 竞争形势

- 公司简介

- Samsung Corporation

- LG Electronics

- Hisense

- TCL

- Sony Corporation

- Skyworth

- Vizio Inc.

- Haier Group

- Sharp Electronics

- Panasonic

- Xiaomi Corporation

- Amazon(streaming media player-Fire TV)

- Apple(streaming media player-Apple TV)

- Roku(streaming media player-Roku)

- Google(Chromecast)

第八章智慧电视厂商市场占有率分析

第9章 串流媒体播放器:厂商市场占有率分析

第十章投资分析及市场展望

The Connected TV Market size is estimated at USD 9.28 billion in 2024, and is expected to reach USD 17.25 billion by 2029, growing at a CAGR of 13.20% during the forecast period (2024-2029).

As they offer a wide range of innovations that are unavailable with standard CRT TVs via internet services, networked smart televisions will be accountable for transforming the television industry. The TVs are equipped with Wi-Fi or Ethernet ports to allow users to remain connected to the Internet.

Key Highlights

- Streaming media such as Apple TV, Amazon Fire TV, and Google Chromecast is changing consumers' viewing habits. Several manufacturers collaborate with OTT (over-the-top) content and device suppliers to deliver built-in functionality without needing a set-top box. TCL Corporation, for instance, worked with Roku Inc. on the launch of a 4K HDR TV.

- Moreover, TV manufacturers are competing with each other for the latest advances in user interfaces, content aggregation, and application development. For example, smart TVs come equipped with an operating system that's capable of running applications or widgets for streaming videos and music. A range of advanced computing capabilities and connections with common internet capability is provided by intelligent TVs. It enables consumers to find, talk, explore, share, make updates, and download multimedia content on Smart TVs, driving demand for connected televisions.

- In addition, the rapid global digitization of media has replaced traditional TV screens with digitized and smarter alternatives that have further stimulated market development. Moreover, demand for smart connected TVs has been increasing in countries such as the United States due to rising consumer per capita incomes and easy availability of products.

- Furthermore, market growth increases are being fueled by an increase in the importance of Smart TVs to the Internet of Things ecosystem due to features like ambient intelligence, automated user assistance, and increasing consumer disposable income.

- Due to their resemblance to a computer or a smartphone, linked TVs might crash and freeze. Customers' growing worries about data breaches and unauthorized access to the camera or microphone by internet connectivity may restrain the market expansion for connected TVs during the assessment period.

- The COVID-19 pandemic drastically affected the lifestyles of all consumers and the way they lived; as a result of sheltered orders and work-at-home mandates, video consumption in households reached an all-time high. As more and more consumers looked to keep consuming streaming content on larger screens in their homes, the increasing number of mobile users in developing countries was a major driver for smart TV.

Connected TV Market Trends

Smart TV Accounts for the Largest Market Share

- Smart TVs are upgraded with cutting-edge capabilities and applications compared to traditional televisions. Furthermore, Apple and Roku are creating operating systems specifically for smart TVs. For instance, WebOS by LG Electronics and Tizen, developed by Samsung Electronics Co. Ltd., allows customers to download programs from their stores and access online streaming applications.

- Viewership of online material has grown dramatically in recent years due to high-speed broadband access has increased. Furthermore, the expanding electronics sector has started merging different technical advancements, including voice command and computational intelligence, with a growing demand for intelligent gadgets, including smart connected TVs.

- Furthermore, viewers can now easily access popular OTT services like Netflix, Amazon Prime, and Hotstar, thanks to various smart TV brands employing Android as their operating system. Android applications like Facebook, Twitter, and YouTube are accessible through the Android OS.

- Additionally, with Bluetooth remotes, viewers may access voice commands on these TVs. For instance, the One-Flick remote from Sony has an integrated microphone that enables voice searches for anything. Android includes built-in games, music, and movies and its application store.

- Besides, the easy availability of multiple streaming, such as Amazon Fire TV, Apple TV, media devices, and Google Chrome cast, is estimated to change people's experiences and view patterns. It is set to further result in the rapid shift of manufacturers towards partnerships and collaborations with content providers and OTT device producers for developing inbuilt features in their TV sets.

Asia-Pacific Accounts For the Largest Market Share

- In Asia-Pacific, the demand for smart TVs was primarily driven by an increase in consumers' net disposable income. Further, the market growth is stimulated by the rising popularity of over-the-top platforms in the region, such as Amazon Prime Video, HOOQ, Netflix, and others. For instance, in May 2023, Samsung launched its latest Neo QLED smart TVs range with 4K and 8K resolutions. The latest Neo QLED series of smart TVs come in 50-inch, 55-inch, 65-inch, 75-inch, 85-inch, and 98-inch sizes.

- Furthermore, growing internet penetration contributes to increased smart TV sales, fueling market growth. The IBEF projects that by 2023, the market size of OTT video streaming in India is expected to reach USD 5 billion. With an estimated USD 823 million at the end of this year, India is expected to become the 10th largest OTT market in the world.

- With a shift in preference from traditional TV sets to smart televisions, India's households are on the verge of transition. Changing the lifestyle of middle-income populations is due to a rise in incomes, better awareness, adoption of new technology, and an increase in internet penetration. In addition, critical factors expected to accelerate the growth of the smart TV market in India during the forecast period are government initiatives that have been particularly targeted at tier II and III cities.

- In addition, market growth will be stimulated by a shift in the customer's preference towards online content as more and more areas of India are experiencing an increased proliferation of broadband internet. Significant investment flows by video streaming media companies, like Netflix, Amazon Prime, and Hotstar, increased Pay-TV subscribers. Further, Daiwa recently launched a unique 4K UHD smart TV powered by webOS TV. The 50-inch smart TVs are powered by webOS TV, with ThinQAI voice assistance and Magic Remote.

Connected TV Industry Overview

The connected TV market includes several players. These large firms, holding a significant market share, concentrate on growing their international consumer base. Due to the recent surge in consumer interest, this industry is seen as a viable investment prospect. The businesses invest in emerging technology to develop substantial expertise to provide them with a long-term competitive advantage.

In April 2023, Xiaomi India launched three new 4K smart TVs. The new series includes three variants - 43-inch, 50-inch, and 55-inch. The X Pro models offer improved colors, contrast, saturation, and brightness across a wide color gamut compared to the existing X series.

In January 2023, Roku unveiled its Roku Select and Roku Plus Series TVs, the first to be designed and made by the company. Roku will make 11 models, ranging from 24 to 75 inches, which will feature Roku's operating system. The sets will be available in the United States starting in spring 2023.

In July 2022, Honor launched the Honor Smart Screen X3 and Smart Screen X3i series of smart TVs in the Chinese market. These Smart TVs are a successor to last year's Honor Smart Screen X2. The newly announced Honor Smart Screen X3 comes in two different screen sizes, 55-inch and 65-inch. Furthermore, in May 2022, LG launched a new line of OLED-based smart TVs and ultra-premium R Signature TVs with rollable display panels in New Delhi. The company introduced premium variants of smart OLED TVs - G2, C2, Z2, A2, and Signature R OLED series with screen sizes ranging between 42-inch- and 97-inch and slim bezel design language.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis (Smart TV Manufacturers, Middleware providers, Streaming Media player vendors, Suppliers/Distributors, End-users)

- 4.3 Connected TV - Technology Landscape (Smart TVs, Streaming Players, Gaming Consoles (for streaming)) - includes a market estimates and geographical view of the gaming consoles

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing internet penetration and anticipated shift from conventional TVs

- 5.1.2 Industry collaborations and favorable market conditions (shift from internet TV to smart TV)

- 5.2 Market Challenges

- 5.2.1 Cost issues and competition from alternative mediums

6 MARKET SEGMENTATION

- 6.1 By Device

- 6.1.1 Smart TV

- 6.1.1.1 Smart TV Market Overview and Estimates (in million units, 2020-2027)

- 6.1.1.2 Smart TV Market breakdown by key OS (Android, Tizen, WebOS, Roku, Firefox, etc.)

- 6.1.1.3 Key shifts and trends in Smart TV Resolution - 4K, Ultra, 8K, etc.

- 6.1.2 Streaming Media Player - Market Overview and Estimates (in million units, 2020-2027)

- 6.1.1 Smart TV

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.2.4 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 India

- 6.2.3.3 Japan

- 6.2.3.4 Rest of Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Samsung Corporation

- 7.1.2 LG Electronics

- 7.1.3 Hisense

- 7.1.4 TCL

- 7.1.5 Sony Corporation

- 7.1.6 Skyworth

- 7.1.7 Vizio Inc.

- 7.1.8 Haier Group

- 7.1.9 Sharp Electronics

- 7.1.10 Panasonic

- 7.1.11 Xiaomi Corporation

- 7.1.12 Amazon (streaming media player - Fire TV)

- 7.1.13 Apple (streaming media player - Apple TV)

- 7.1.14 Roku (streaming media player - Roku)

- 7.1.15 Google (Chromecast)