|

市场调查报告书

商品编码

1407952

线上模拟游戏:市场占有率分析、产业趋势/统计、2024年至2029年成长预测Online Simulation Games - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

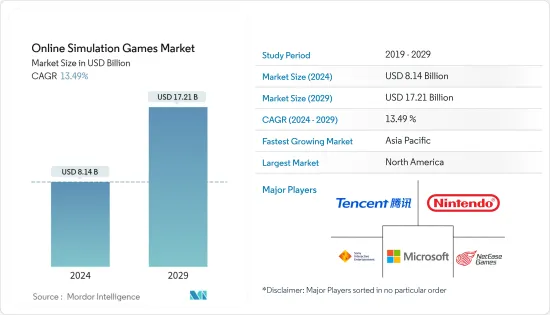

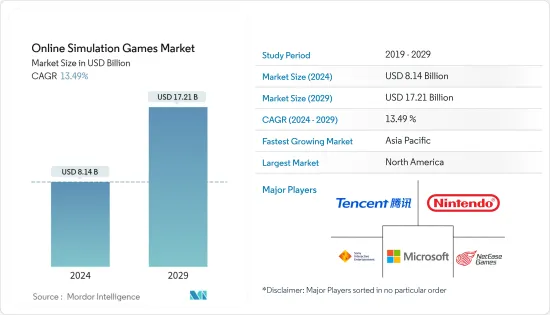

线上模拟游戏市场规模预计到 2024 年为 81.4 亿美元,预计到 2029 年将达到 172.1 亿美元,在预测期内(2024-2029 年)复合年增长率为 13.49%。

由于对现场游戏体验的需求不断增加以及对模拟游戏相对于传统游戏的偏好,线上模拟游戏市场预计将成长。由于越来越多的公司使用游戏模拟进行培训和分析,以及消费者对虚拟实境(VR)耳机的需求不断增加,全球游戏模拟市场正在不断扩大。

主要亮点

- 最常见和最常玩的游戏类型之一是模拟。点击和滑动机制适用于触控设备,使其成为智慧型手机上最受欢迎的游戏之一。模拟游戏易于使用且有趣,因此有些人会玩很多年。

- 模拟游戏的易懂性正在刺激模拟游戏市场的成长。在线上模拟游戏中,动作是自动的,选择引导游戏朝特定方向发展。目的是模拟特定活动。

- 此外,在 COVID-19 大流行期间,对数位游戏业务的影响是正面的。尤其是,人们对手机游戏的製作产生了浓厚的兴趣。在新冠肺炎 (COVID-19) 大流行期间,模拟赛车游戏在参与者和观众方面都有显着改善。这一增长很大程度上归功于几位职业赛车飞行员参加了在此期间举办的模拟赛车比赛。模拟游戏非常逼真,并提供网路游戏。

- 此外,使游戏开发更具成本效益的技术进步也将有助于市场开拓。此外,AR和VR头戴装置在线上模拟游戏中的使用预计将推动需求。改进和发展游戏体验和故事的需求将进一步推动线上模拟游戏市场,该市场已经在全球游戏产业中经历了显着成长。

- 市场扩张预计将受到对现场游戏体验不断增长的需求以及对模拟游戏相对于传统游戏日益增长的兴趣的推动。技术进步能够创造出具有成本效益的产品,预计也将对成长产生正面影响。

- 然而,模拟类型的发展也面临挑战。模拟市民有许多子类型,例如飞机模拟、生活模拟、城市建设模拟、生存模拟、农业模拟、体育模拟等。此外,游戏机的高成本可能会阻碍市场扩张。

线上模拟游戏市场趋势

智慧型手机的普及推动市场成长

- 行动游戏已超越主机和电脑游戏,成为最受欢迎的游戏形式。轻鬆存取手机游戏是其主要优势之一。大多数人拥有有游戏的智慧型手机。 AR、VR、云端游戏、5G等各种技术的发展和功能的增强,正在增加对行动游戏的需求。

- 智慧型手机和平板电脑的广泛普及以及流行手机游戏的免费提供在很大程度上影响了这一发展。

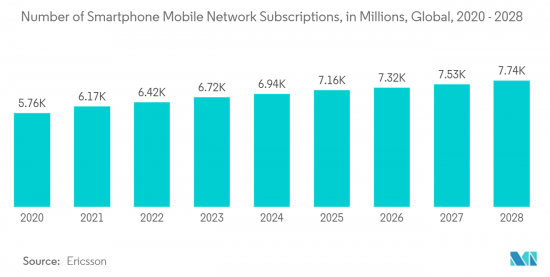

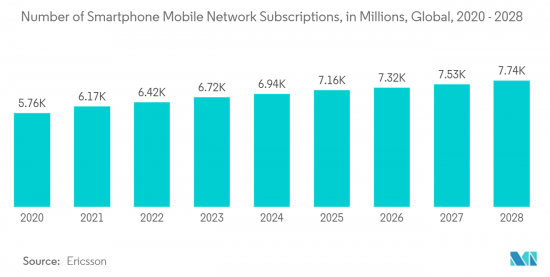

- 根据 GSMA 行动经济报告,全球行动网路用户达到 42 亿,成长 5%。预计到2025年用户将达50亿大关。行动互联网的普及将增加线上模拟游戏公司的收益成长。据爱立信称,全球约有 64 亿人使用智慧型手机连接网路。到 2028 年,这一数字预计将达到 77 亿以上。

- 此外,研发成本的增加以及对创建新手机游戏的投资预计将刺激产品需求。推动业务扩张的另一个因素是对便携式、轻型赛车模拟器的需求不断增长。市场整合和产品技术突破是模拟游戏产业的全球趋势。

- 例如,JetSynthesys 的电竞计划Nodwin Gaming 获得了 Krafton 2,250 万美元的投资。大逃杀游戏营运商 Battlegrounds Mobile India (BGMI) 宣布,将于 2022 年 6 月将首次股票公开发行所得收益中的 1 亿美元用于印度游戏和娱乐产业。

预计北美将占据较大市场占有率

- 北美在线上模拟游戏市场中占有很大份额。一些着名的市场参与者都位于北美,包括SONY互动娱乐、微软、动视暴雪、艺电和 Take-Two Interactive。

- 在北美,各个影院引入赛车平台来支援赛车运动和电子竞技,预计也将增加该地区对模拟游戏的需求。

- 例如,据报道,F1将于2022年2月为车迷开设模拟体验中心。这让您可以一睹坐在时速超过 300 公里的机器驾驶座上的感觉。中心将于年终在美国推出。

- 该地区各企业积极参与收购,加速企业发展。如前所述,Spin Games LLC 被 Bragg Gaming Group 以约 3,000 万美元的现金和股票收购。收购 Spin Games 扩大了 Bragg 的北美业务,并提供了独特且受欢迎的 iGaming 产品线。

线上模拟游戏产业概况

线上模拟游戏市场较为分散,主要参与者包括索尼互动娱乐公司、腾讯、任天堂、微软和网易公司。市场参与者正在采取联盟和收购等策略来加强其产品阵容并获得永续的竞争优势。

2023 年 1 月,菲律宾娱乐博彩公司 (PAGCOR) 计划在 2024 年推出线上博彩业务,理由是该国博彩业具有巨大的成长潜力。菲律宾赌场愿意在其线上模拟游戏中采用基于扩增实境和虚拟实境的技术。这使得游戏对于玩游戏的人来说更加刺激和真实。

2022 年 5 月,网易旗下线上游戏部门网易游戏宣布,总部位于德克萨斯州奥斯汀的 Jackalope Games 成为第一家美国工作室。作为网易游戏旗下的第一方工作室,Jackalope Games 开发 PC 和主机游戏。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 智慧型手机普及扩大

- 在各领域的训练和分析中增加游戏模拟的使用

- VR头戴装置的需求不断成长

- 市场抑制因素

- 需要昂贵的显示卡

第六章市场区隔

- 按类型

- 广告

- 应用程式内收费

- 付费应用程式

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 中东/非洲

- 世界其他地区

第七章竞争形势

- 公司简介

- Sony Interactive Entertainment Inc.

- Tencent

- Nintendo

- Microsoft

- NetEase, Inc.

- Activision Blizzard, Inc.

- Electronic Arts Inc.

- Take-Two Interactive Software, Inc.

- Bandai Namco Entertainment Inc.

- Square Enix Co., Ltd.

第八章投资分析

第9章市场的未来

The Online Simulation Games Market size is estimated at USD 8.14 billion in 2024, and is expected to reach USD 17.21 billion by 2029, growing at a CAGR of 13.49% during the forecast period (2024-2029).

The market for online simulation games is expected to grow due to increased demand for live gaming experiences and a preference for simulation games over traditional ones. The global gaming simulation market is expanding as a result of more firms using gaming simulation for training and analysis, as well as rising consumer demand for virtual reality (VR) headsets.

Key Highlights

- One of the most prevalent and well-played game genres is simulation. The tap-and-swipe mechanics adapt well to touch devices, making it one of the most popular games on smartphones. Simulation games are entertaining to interact with and simple to play, and some of them may be played for many years.

- The ease of understanding simulation games adds to the growth of the simulation games market. In online simulation games, actions occur automatically, and choices steer the game's progression in particular ways. Emulation of a certain activity is the goal.

- Also, the effect on the digital gaming business was favorable during the COVID-19 pandemic. Particularly, the creation of mobile games has drawn interest. During the COVID-19 pandemic period, Sim Racing games had a noticeable improvement in terms of participants and watchers. The major cause of this growth is attributed to the several professional race pilots who took part in the sim racing competitions that were organized during this time. Simulated racing games are quite realistic and provide internet play.

- Furthermore, technological advancements that make game development more cost-effective will also contribute to market growth. Additionally, the use of AR and VR headsets in online simulation games is expected to drive demand. The need to improve and advance gaming experiences and stories will further fuel the online simulation game market, which has already seen significant growth in the global gaming industry.

- The market expansion is anticipated to be aided by rising demand for live gaming experiences and rising interest in simulation games over conventional games. The creation of cost-effective items made possible by technological advancements is also anticipated to positively affect growth.

- However, the development of the simulation genre is a challenge. There are plenty of sim subgenres, including aircraft sims, life sims, city-builder sims, survival simulations, agricultural sims, sports sims, and a tonne of other sims because one can model almost anything. Also, the expensive cost of gaming consoles might hinder the market from expanding.

Online Simulation Games Market Trends

Increased Adoption of Smartphones is Expected to Drive the Market Growth

- Mobile gaming has surpassed console and PC gaming as the most popular gaming format. The accessibility of mobile gaming is one of its primary advantages. The majority of people own smartphones with games. Various technology developments and enhancements, including AR, VR, cloud gaming, and 5G, have increased the demand for mobile games.

- The broad availability of smartphones and tablets and the availability of popular mobile games for no cost have significantly impacted this development.

- As per the GSMA Mobile Economy Report, global mobile internet subscribers were reported to be 4.2 billion, a 5 percent increase. The subscribers are estimated to reach the 5 billion mark by 2025. This growth in the adoption of mobile internet increases the revenue growth of online simulation game firms. Also, As per Ericsson, there are almost 6.4 billion people around the world who use smartphones to connect to the internet. This number is expected to reach more than 7.7 billion by 2028.

- Additionally, growing R&D expenditures and investments to create new mobile games will spur product demand. A further element promoting business expansion is the rising need for portable and lightweight racing simulators. Market consolidation and product technology breakthroughs are two worldwide simulation game industry trends.

- For instance, Nodwin Gaming, an esports project of JetSynthesys, received a USD 22.5 million investment from Krafton. Battlegrounds Mobile India (BGMI), the company behind the battle royale game, has announced that it will spend USD 100 million of the proceeds from its initial public offering in the Indian gaming and entertainment industry in June 2022.

North America is Expected to Hold Significant Market Share

- North America dominated the online simulation games market with a significant share. Some of the prominent market players are based in North America, including Sony Interactive Entertainment, Microsoft, Activision Blizzard, Electronic Arts, and Take-Two Interactive.

- The implementation of racing platforms at various theatres in North America to support motorsports and e-sports is also projected to increase demand for simulation games in the region.

- For instance, according to reports, F1 will open fan-focused simulation experience centers in February 2022. This will give viewers a glimpse of what it would be like to be in the driver's seat of a car capable of exceeding 300 kmph. At the end of 2022, the center will be developed in the United States.

- Various firms in the region actively participated in acquisitions to accelerate corporate development. Spin Games LLC was acquired by Bragg Gaming Group in a cash and stock deal valued at about USD 30 million, as previously stated. The purchase of Spin Games expands Bragg's North American business and gives it access to a unique and popular iGaming product line.

Online Simulation Games Industry Overview

The online simulation games market is moderately fragmented with the presence of major players like Sony Interactive, Entertainment Inc., Tencent, Nintendo, Microsoft, and NetEase, Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In January 2023, the Philippine Amusement and Gaming Corporation (PAGCOR) has a plan to launch its online gaming operations in 2024, as there is a huge growth potential in the country's gaming industry. Casino Filipino is ready to employ augmented and virtual reality-based technology in its online simulation games; this can simulate the sights and sounds of a physical casino. This will make the games more exciting and realistic for people who play them.

In May 2022, Jackalope Games, a company situated in Austin, Texas, was announced as the first American studio by NetEase Games, the online games branch of NetEase, Inc. As a first-party studio of NetEase Games, Jackalope Games will develop PC and console games.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Defnition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Adoption of Smartphones

- 5.1.2 Increased Utilization of Gaming Simulation for Training and Analysis Across a Variety of Fields

- 5.1.3 Growing Demand for VR Headsets

- 5.2 Market Restraints

- 5.2.1 Need for Expensive Graphic Cards

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Advertising

- 6.1.2 In-App Purchase

- 6.1.3 Paid App

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Middle East and Africa

- 6.2.5 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Sony Interactive Entertainment Inc.

- 7.1.2 Tencent

- 7.1.3 Nintendo

- 7.1.4 Microsoft

- 7.1.5 NetEase, Inc.

- 7.1.6 Activision Blizzard, Inc.

- 7.1.7 Electronic Arts Inc.

- 7.1.8 Take-Two Interactive Software, Inc.

- 7.1.9 Bandai Namco Entertainment Inc.

- 7.1.10 Square Enix Co., Ltd.