|

市场调查报告书

商品编码

1408851

永续发展咨询服务:市场占有率分析、产业趋势/统计、成长预测,2024-2029Sustainability Consulting Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

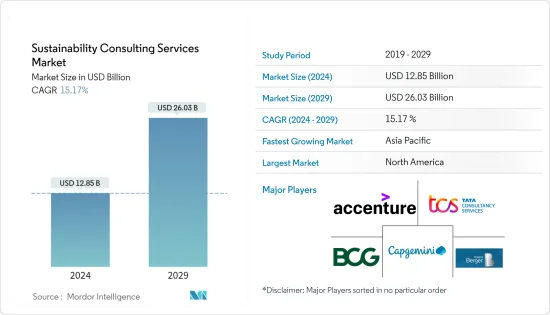

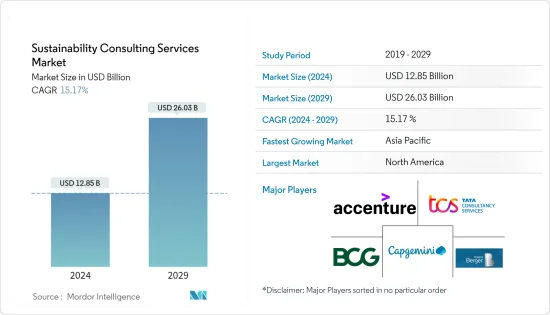

永续发展咨询服务市场规模预计到2024年为128.5亿美元,预计到2029年将达到260.3亿美元,在预测期内(2024-2029年)复合年增长率预计为15.17%。

新兴行业经济的强劲成长、电子废弃物的影响、政府监管的收紧以及页岩油气探勘的增加正在推动永续性咨询行业的发展。

主要亮点

- 随着企业努力适应不断变化的气候条件、减少温室气体排放并满足全球永续性标准,永续发展咨询服务市场预计将持续成长。因此,咨询公司在帮助政府、企业和非营利组织制定策略、实施永续实践以及应对复杂的气候变迁环境方面发挥着至关重要的作用。

- 随着永续金融政策和法规变得更加普及,公司被迫考虑环境和社会方面。这种日益增强的企业责任感增加了对永续性咨询服务的需求。企业正在寻求专家建议,以解决不断变化的合规框架、实施环保实践并遵守道德标准。随着永续金融复杂性的增加,对能够制定策略并确保遵守不断变化的标准的专家顾问的需求不断增加,从而推动了全球对永续发展咨询服务的需求。

- 全球污染水平不断上升,增加了对环境影响评估和污染预防技术等环境咨询服务的需求。例如,在中国,严格的政府环境法规正在增加对环境咨询服务的需求。

- 然而,各国缓慢采用永续实践为寻求促进永续性的环境顾问公司带来了问题。组织通常缺乏财务、技术和人力资源来为应对气候变迁调适等复杂且有争议的问题做好准备。还有许多相互衝突的问题很快就成为优先事项。因此,组织缺乏足够的资源来实施从设计到实施的全面适应计划。企业可能需要更多的资源和支持者来适应这个产业。

- 由于关门、旅行限制和远距工作,COVID-19 大流行对永续发展咨询服务业务产生了影响。服务需求下降,销售额也下降。当时,公司资金短缺,不得不采取裁员、减少活动费用、降低薪资等削减成本的措施。同时,后COVID-19情境表明,未来对永续发展咨询服务的需求将会增加,由于向低碳经济的转型,需求将会加速。

永续发展咨询服务的市场趋势

能源和电力成为最大的最终用户领域

- 能源和电力产业正在经历向更清洁、更永续的能源来源的重大转变。这种变化包括太阳能、风电、水力发电等可再生能源技术的利用,以及核能、能源储存等替代能源的探索。

- 可再生能源、脱碳、气候行动、工厂数位化、能源储存、工业物联网、智慧电网的不断变化以及对灵活能源资产的需求正在推动这一转变。这增加了能源和电力产业对气候变迁咨询服务的需求,以帮助最大限度地减少温室气体排放。

- 根据IEA最新的世界能源投资报告,2023年全球能源投资约2.8兆美元,其中超过1.7兆美元投资于干净科技(可再生能源、电力等)。用于汽车、核能、电网、储存、低排放燃料、效率提升、热泵等)。

- 世界上许多国家已经实施了许多倡议,鼓励在能源领域使用环境咨询服务。这些领域的公司努力提供适当的环境咨询服务。

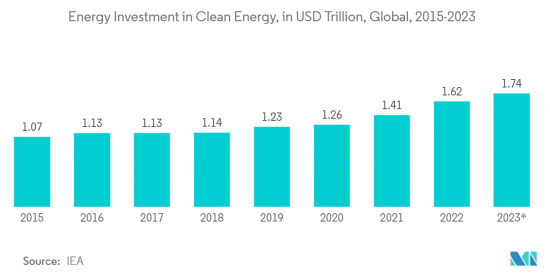

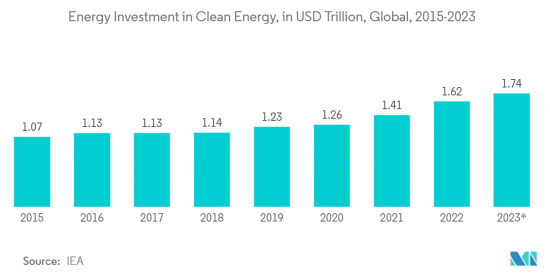

- 增加对清洁能源的能源投资预计将促进能源和电力领域的永续咨询服务。根据IEA预测,全球清洁能源投资预计将从2019年的1.22兆美元增至2022年的1.62兆美元,到2023年终将达到1.74兆美元。我是。

- 因此,气候变迁顾问提供了分析新技术对环境影响的专业知识,帮助公司驾驭法律规范,并设计实现永续性目标的计画。Masu。

预计北美将占据较大市场占有率

- 北美永续发展咨询服务市场的成长受到人们对环境问题意识的增强、关注永续性的公司以及不断发展的促进绿色实践的法规的影响。公司正在将永续实践纳入业务中,为市场扩张做出贡献。人们对永续性长期效益的认识不断增强,促使公司寻求咨询服务以实现有效的实施和报告。

- 在2022年联合国气候变迁纲要公约缔约方大会(COP27)上,美国宣布推出“净零政府倡议”,鼓励各国政府主动行动,到2050年实现政府运营净零排放。他呼吁他们实现这一目标。

- 交通、石油和天然气生产、发电和建筑等领域温室气体排放的增加是加拿大气候变迁的主要驱动因素之一,预计将进一步推动该国永续气候变迁咨询市场的发展。

- 该国的供应商正在迅速转向气候变迁顾问,以捕捉低碳经济中的新商机,并帮助他们制定和实施减少温室气体排放和适应气候影响的策略。我就是。例如,2023 年 5 月,美国领先的环境顾问公司 SWCA Environmental Consultants 收购了 ALO Advisors LLC,这是一家专注于为各行业客户提供永续性咨询服务的国际管理顾问公司。 ALO Advisors 协助您设计和部署永续发展策略、规划和投资,同时创造商业价值和正面的环境和社会影响。

永续发展咨询服务业概述

市场参与者正在采取联盟和收购等策略来增强其产品供应并获得永续的竞争优势。

- 2023年9月,Accenture将与东芝合作提供咨询服务,以支援两家公司客户的绿色转型(GX)工作。此次合作将针对温室气体排放高的产业和其他迫切需要提高能源效率的组织。东芝将为合作提供现有碳中和技术和服务的稳定基础,包括可再生能源系统、数位能源管理系统、可再生能源衍生的氢解决方案以及碳捕获和捕获设备。

- 2023年3月,波士顿顾问集团(BCG)宣布成立气候与永续发展政策与监管中心。该中心将为客户提供一站式服务,就不断变化的气候变迁的影响以及跨地区的永续性政策和法规提供综合建议。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 市场规模估计/预测

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

第五章市场动态

- 市场驱动因素

- 更重视减少碳足迹和实现净零目标

- 世界各国应对气候变迁的国家目标

- 市场挑战

- 普及率低,现实场景中差距较大

第六章市场区隔

- 按服务类型

- 气候变迁咨询服务

- 绿建筑咨询服务

- ESG咨询服务

- 其他的

- 按最终用户

- 建筑/房地产

- 按服务类型

- 区域分布

- 能源/电力

- 公共部门

- 其他的

- 建筑/房地产

- 按地区

- 北美洲

- 欧洲

- 英国

- 德国

- 比荷卢经济联盟

- 波兰

- 法国

- 北欧的

- 其他欧洲国家

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争形势

- 公司简介

- Accenture PLC

- Boston Consulting Group

- Tata Consultancy Services

- Capgemini SE

- Roland Berger

- Bain & Company

- KPMG

- Ernst & Young

- Deloitte Touche Tohmatsu Limited

- PricewaterhouseCoopers LLP

- McKinsey & Company Inc.

- AT Kearney Inc.

- Godrej & Boyce Mfg. Co. Ltd(Godrej Industries Limited)

- RPS Group(Tetra Tech Inc.)

- SEA Energy

第八章投资分析

第九章 市场未来展望

The Sustainability Consulting Services Market size is estimated at USD 12.85 billion in 2024, and is expected to reach USD 26.03 billion by 2029, growing at a CAGR of 15.17% during the forecast period (2024-2029).

Strong economic growth in emerging sectors, the impact of electronic waste, tightening government regulations, and the increasing exploration for shale oil and gas are driving the sustainability consulting industry.

Key Highlights

- The sustainability consulting services market is expected to continue to grow as companies strive to adapt to changing climate conditions, decrease greenhouse gas emissions, and meet global sustainability standards. Consulting firms, therefore, play an essential role in helping governments, businesses, and non-profit organizations develop strategies, implement sustainable practices, and deal with a complex climate-changing environment.

- The growing prevalence of sustainable financial policies and regulations forces companies to consider environmental and social aspects. This increased corporate responsibility has increased the demand for sustainability consulting services. Businesses seek expert advice to deal with evolving compliance frameworks, implement environmentally friendly practices, and adhere to ethical standards. As the complexity of sustainable finance increases, the need for expert advisors who can develop strategies and ensure compliance with evolving standards increases, driving the demand for sustainability consulting services worldwide.

- The rising pollution levels worldwide have increased the demand for environmental consulting services, such as environmental impact assessment and pollution prevention technology. For example, in China, the government's strict environmental regulations have increased the demand for environmental consulting services.

- However, the slow adoption of sustainability methods in various nations poses a problem for environmental consulting firms looking to promote sustainability. Organizations often lack the financial, technical, and human resources to prepare for complex and divisive issues like climate change adaptation. There are also many conflicting challenges that quickly become priorities. Therefore, organizations do not have sufficient resources to carry out comprehensive adaptation programs from design to implementation. Companies may need more resources and supporters for industry adaptation.

- Due to lockdowns, travel restrictions, and remote work, the COVID-19 pandemic impacted the sustainability consulting services business. Demand for services decreased, and sales also decreased. At the time, due to a lack of funds, cost-cutting measures were needed, such as reducing staff, reducing event participation fees, and reducing salaries. Meanwhile, in the post-COVID-19 scenario, the demand for the service accelerated due to the transition to a low-carbon economy, suggesting an increased need for sustainability consulting services in the future.

Sustainability Consulting Services Market Trends

Energy and Power to be the Largest End User Segment

- The energy and power industries are experiencing a substantial change toward cleaner and more sustainable energy sources. This shift comprises using renewable energy technologies such as solar, wind, and hydropower and exploring alternatives such as nuclear energy and energy storage.

- The changing renewable energy landscape, decarbonization, climate change measures, plant digitalization, energy storage, IIoT, smart grids, and the need for flexible energy assets are driving this transformation. This raises the demand for climate change consulting services in the energy and power sectors, which will help to minimize greenhouse gas emissions.

- About USD 2.8 trillion is set to be invested globally in energy in 2023, of which more than USD 1.7 trillion is expected to go to clean technologies - including renewables, electric vehicles, nuclear power, grids, storage, low-emissions fuels, efficiency improvements, and heat pumps - according to the IEA's latest World Energy Investment report.

- Many countries worldwide are implementing many initiatives to encourage the use of environmental consulting services in the energy sector. Companies in these sectors work diligently to offer appropriate environmental consulting services.

- The growing energy investment in clean energy is expected to drive sustainable consulting services in the energy and power segment. According to IEA, the global energy investment in clean energy grew from USD 1.22 trillion in 2019 to USD 1.62 trillion in 2022 and is expected to reach USD 1.74 trillion by the end of 2023.

- As a result, climate change consultants provide expertise in analyzing the environmental impact of new technologies, assisting businesses in navigating regulatory frameworks and designing plans to meet sustainability goals.

North America Expected to Hold Significant Market Share

- The growth of the sustainability consulting services market in North America is influenced by increasing awareness of environmental issues, corporate emphasis on sustainability, and regulatory developments promoting green practices. Companies are seeking to integrate sustainable practices into their operations to contribute to the market's expansion. The growing recognition of the long-term benefits of sustainability is driving organizations to seek consulting services for effective implementation and reporting.

- The United States announced the launch of the Net-Zero Government Initiative during the 2022 United Nations Climate Change Conference of the Parties (COP27), inviting governments to lead and achieve net-zero emissions from national government operations by 2050.

- The rising amount of greenhouse gas emissions due to transportation, gas and oil production, electricity generation, and buildings is one of the significant factors driving climate change in Canada, which is expected to drive the country's sustainable climate change consulting market further.

- Vendors in the country are rapidly turning to climate change consultants to help develop and implement strategies to reduce their greenhouse emissions and adapt to the impacts of climate, seizing new business opportunities in the low-carbon economy. For instance, in May 2023, SWCA Environmental Consultants, a leading environmental consulting firm in the United States, acquired ALO Advisors LLC, an international management consulting firm focused on sustainability advisory services for clients throughout a wide range of industries. ALO Advisors helps clients design and deploy sustainability strategies, initiatives, and investments that simultaneously create business value and positive environmental and social impacts.

- Global professional services firm Accenture announced the acquisition of decarbonization strategy-focused consultancy Green Domus, the latest in a string of sustainability-related transactions by the company. The acquisition will bring solutions for clients to help embed carbon data and insights into decision-making.

Sustainability Consulting Services Industry Overview

The sustainability consulting services market is fragmented with the presence of major players like Accenture PLC, Boston Consulting Group, Tata Consultancy Services, Capgemini SE, and Roland Berger. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- In September 2023, Accenture collaborated with Toshiba to provide consulting services to support the green transformation (GX) efforts of the companies' clients. The collaboration will target industries with high greenhouse gas emissions and other organizations urgently needing to improve energy efficiency. Toshiba brings a robust stable of existing carbon-neutrality technologies and services to the collaboration, including renewable energy systems, digital energy management systems, renewable energy-derived hydrogen solutions, and carbon dioxide capture and recovery facilities.

- In March 2023, Boston Consulting Group (BCG) announced the formation of its global Center for Climate & Sustainability Policy & Regulation to support clients as they navigate and shape the global transition to a net-zero, nature-positive world. The Center will serve as a one-stop shop for clients, providing them with integrated advice on the implications of evolving climate and sustainability policy and regulation across geographies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Size Estimates and Forecasts

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Focus on the Reduction of Carbon Footprint and Fulfilment of Net Zero Targets

- 5.1.2 National Goals Across the Globe to Combat Climate Change

- 5.2 Market Challenges

- 5.2.1 Lower Levels of Adoption with Large Gaps in the Realistic Scenario

6 MARKET SEGMENTATION

- 6.1 By Service Type

- 6.1.1 Climate Change Consultancy Services

- 6.1.2 Green Building Consultancy Services

- 6.1.3 ESG Consultancy Services

- 6.1.4 Other Sustainability Consultancy Services

- 6.2 By End User

- 6.2.1 Construction and Real Estate

- 6.2.1.1 Breakdown By Service Type

- 6.2.1.2 Breakdown By Geography

- 6.2.2 Energy and Power

- 6.2.3 Public Sector

- 6.2.4 Other End Users

- 6.2.1 Construction and Real Estate

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 Benelux

- 6.3.2.4 Poland

- 6.3.2.5 France

- 6.3.2.6 Nordics

- 6.3.2.7 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Accenture PLC

- 7.1.2 Boston Consulting Group

- 7.1.3 Tata Consultancy Services

- 7.1.4 Capgemini SE

- 7.1.5 Roland Berger

- 7.1.6 Bain & Company

- 7.1.7 KPMG

- 7.1.8 Ernst & Young

- 7.1.9 Deloitte Touche Tohmatsu Limited

- 7.1.10 PricewaterhouseCoopers LLP

- 7.1.11 McKinsey & Company Inc.

- 7.1.12 A. T. Kearney Inc.

- 7.1.13 Godrej & Boyce Mfg. Co. Ltd (Godrej Industries Limited)

- 7.1.14 RPS Group (Tetra Tech Inc.)

- 7.1.15 SEA Energy