|

市场调查报告书

商品编码

1430592

通讯管理系统:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Correspondence Management System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

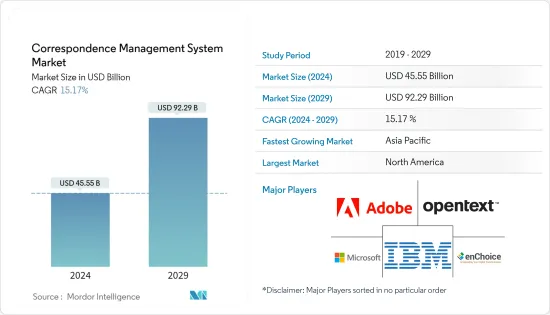

通讯管理系统市场规模预计到 2024 年将达到 455.5 亿美元,到 2029 年将达到 922.9 亿美元,在预测期内(2024-2029 年)复合年增长率为 15.17%。

CMS 中不断增长的技术采用趋势,例如 CMS 中对人工智慧的需求不断增长、基于语音的搜寻优化的使用增加以及内容管理中聊天机器人的使用增加,是预计在预测期内推动市场增长的一些因素。已成为一个因素。

主要亮点

- 自动化,特别是在遵循基于规则的流程的企业中,可以促进响应管理系统的选择,减少业务环境中的不一致,终止响应,从而实现高效的内部和外部通信系统。

- 由于世界各地的组织越来越多地采用数位工作文化以及行业内容的扩展,通讯管理系统市场正在全球迅速扩张。此外,巨量资料和分析解决方案的发展正在提高内部和外部通讯的自动化程度。此外,企业正在迅速利用即时通讯系统来有效管理所有通讯。

- 此外,随着云端基础的技术的出现和业务数位化的不断发展,公司经常转向邮件收发室自动化来自动化内部和外部业务通讯流程。这使得公司可以根据内容、外观和类别对收到的通讯进行分类,并将其发送给适当的部门或个人。

- 此外,通讯管理系统可自动化并提供速度和敏捷性,以产生卓越的客户和内部业务见解。组织正在利用数位转型来更快地满足客户需求。透过定期沟通让股东和消费者了解情况,公司可以增加收益并提高采用率。巨量资料和进阶分析等新IT应用程式和基础设施的引入也是推动通讯管理系统市场成长的因素之一。此外,公司可以利用巨量资料透过预测通讯管理系统解决方案来改善决策。

- 然而,限制和约束市场成长的挑战包括隔离资料、不同的资料整合平台以及缺乏技术能力。

- COVID-19 严重影响了依赖客户互动的企业。数位转换、互动性和收益成长现在比以往任何时候都更加重要。因此,许多公司认为内容管理系统和数位体验平台(管理线上体验的平台)是关键任务软体。投资、管理和营运这些平台的个人应该重新评估他们的平台需求,并确保他们的 CMS 能够适应延长的在家工作、增加的网路流量和不断变化的行销策略。此外,借助具有生产力、协作、效能和安全性功能的现代云端託管 CMS,将显着减轻因 COVID-19 导致的业务需求增加、截止日期紧迫和行销需求增加的负担。

通讯管理系统的市场趋势

方便、安全的内部和外部通讯推动市场成长

- 内容管理系统旨在供所有人使用。该程式一般具有用户友好的介面并且易于操作。不需要技术或程式设计知识,但根据 CMS 平台,可能需要一些帮助和专业知识。这些独特的优势促进了 CMS 采用的成长。

- 私人、个人化和互动式业务文件的开发、编辑和分发由通讯管理系统集中管理。该技术允许公司使用预先核准或自订编写的材料快速建立通信,并简化从创建到存檔的流程,从而为客户增加便利性。

- 因此,客户可以快速、准确、轻鬆、安全且适当地收到正确的讯息。这使得公司能够降低与复杂流程相关的成本和风险,同时最大限度地提高消费者互动的价值,从而推动市场成长。

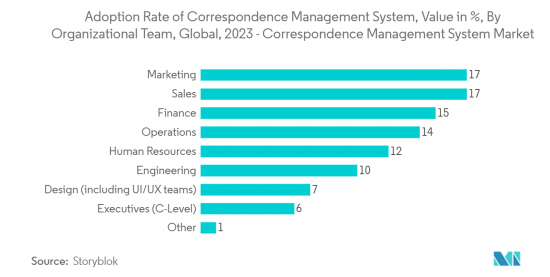

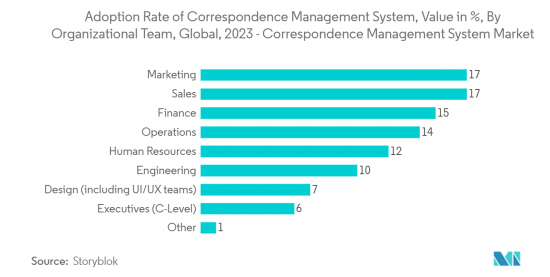

- 此外,Storyblok 进行的研究表明,到 2023 年,行销将成为最常用的 CMS 团队,占 17%,紧随其后的是销售(占 17%)和财务(占 15%)。设计团队是最不可能使用公司 CMS 的两个团队(7%)和管理人员(6%)。如此显着的采用率可能意味着 CMS 技术提供的便利性和安全性正在推动组织内部和外部通讯的有效性。

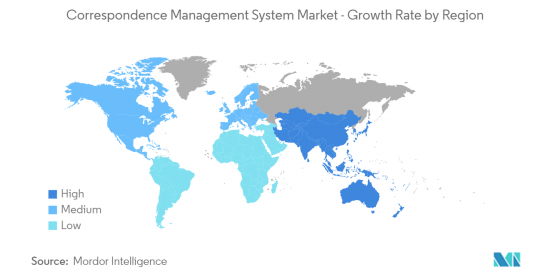

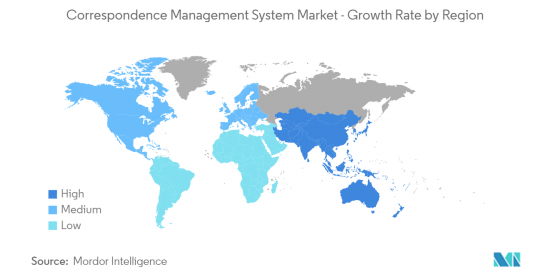

北美占据主要市场占有率

- 由于零售、电子商务、BFSI 和政府等各行业越来越多地使用自动化,以及对有效的内部和外部通讯以提高保留率的需求不断增长,北美预计将占据重要的市场占有率。北美最大的两个市场美国和加拿大越来越多地采用先进技术,包括通讯管理系统解决方案。

- 例如,根据微软公司的说法,透过自动化和简化的协作,该地区的时间和资源管理变得更加有效和有效率。例如,美国透过简化任务管理以及部门和团队之间的沟通,每年节省近 140 万美元。

- 企业预计将在 IT 和电讯等关键产业中更多地利用通讯管理系统,以避免对手动业务流程造成干扰。信件管理系统有效地管理、搜寻、追踪和报告信件和行动计划。各个新兴产业中通讯交流的增加预计将在全部区域产生 CMS 供应商。

- 该地区着名的通讯管理系统国际供应商包括 IBM、Microsoft、Adobe、Open Text、Pitney Bowes、Micropact、Xerox 和 Top Down Systems。这类大公司的存在是该全部区域产生大量收益的主要原因。

信函管理系统产业概况

通讯管理系统市场竞争适度,由几个主要参与者组成。全球主要供应商包括 IBM 公司、微软公司、OpenText 公司和 Adobe 公司。服务提供者正试图透过与软体公司合作的解决方案方法进入市场,将其作为端到端解决方案提供,并充当通讯管理解决方案的一站式商店。目前,在通讯管理系统市场上运营的公司正在以实惠的价格提供各种云端基础的解决方案,预计这将为提供这些系统的公司创造巨大的商机。

2023 年 2 月 - 数位文件和合约生命週期管理公司 SignDesk 宣布与 Microsoft 和 G7 CR Technologies 建立合作伙伴关係,以增强其云端部署能力。此次合作将使企业能够利用与 Sign Desk 产品整合的 Microsoft Azure 的强大功能。 SignDesk 的文件自动化套件也将出现在 Microsoft Marketplace 上。此产品组合中的解决方案可解决数位化入职、合约生命週期管理和数位化文件执行问题。

2022 年 11 月 - 领先的业务自动化解决方案供应商 enChoice 和 Rosslyn Data Technologies 签订了一项资产收购协议,根据该协议,enChoice 将收购 Rosslyn 的 Integrity 业务部门。此次收购将把 Integrity 的客户合约、专有软体资产和少量关键人员转移给 enChoice。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 对通讯系统自动化和个人化的需求不断增长

- 方便、安全的内部和外部沟通

- 市场限制因素

- 由于缺乏技术专业知识,卖家资料和不同的资料系统影响资料集成

- 初期投资高且缺乏意识

第六章市场区隔

- 按成分

- 软体

- 按服务

- 按配送通路

- 基于网路的

- 基于电子邮件

- 其他交付管道(例如基于简讯/彩信)

- 按部署模型

- 本地

- 云

- 按组织规模

- 中小企业

- 大公司

- 按行业分类

- BFSI

- 政府/公共机构

- 电信与资讯技术

- 卫生保健

- 零售/电子商务

- 其他行业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争形势

- 公司简介

- IBM Corporation

- Adobe Inc.

- Microsoft Corporation

- OpenText Corporation

- Rosslyn Data Technologies Inc.(enChoice, Inc.)

- Pitney Bowes Inc.

- Newgen Software Technologies Limited

- Fabasoft AG

- MicroPact Inc.

- Everteam SAS

- Ademero, Inc.

- Blue Project Software Inc.

- Xerox Holdings Corporation

- Palaxo International Ltd.

- Top Down Systems Corporation

- Harvest Technology Group

第八章投资分析

第九章 市场机会及未来趋势

The Correspondence Management System Market size is estimated at USD 45.55 billion in 2024, and is expected to reach USD 92.29 billion by 2029, growing at a CAGR of 15.17% during the forecast period (2024-2029).

The rising trends of technology adoption in CMS, such as rising demand for AI in CMS, increasing use of Voice-based search optimization, and rising chatbot usage for content management, are a few factors anticipated to drive the market growth during the forecast period.

Key Highlights

- Automation stimulates the selection of a correspondence management system, especially for businesses that follow rule-based processes, diminishing inconsistencies and terminating correspondences in the business environment, thereby allowing efficient internal and external communication systems.

- The correspondence management system market is expanding rapidly on a global scale due to the rise in the adoption of a digital working culture in organizations worldwide and the expansion of content in industries. In addition, developing big data and analytics solutions has increased internal and external communication automation. Additionally, businesses are fast using real-time communication systems to manage all correspondences effectively.

- Moreover, businesses frequently use mailroom automation to automate their internal and external business communication processes as a result of the emergence of cloud-based technologies and the growing digitalization of businesses. This helps businesses to classify their incoming correspondence according to its content, appearance, and category and send it to the appropriate department or individual.

- Further, a correspondence management system automates, providing speed and agility to generate superior customer and internal affairs insights. Organizations are using digital transformation to satisfy client demands more quickly. By keeping shareholders and consumers informed through regular contact, the solutions allow businesses to increase revenues, which raises the adoption rate. Introducing new IT applications and infrastructure, such as big data and sophisticated analytics, is another driver fueling the market's growth for correspondence management systems. Additionally, businesses may use big data to improve decision-making with solutions for a correspondence management system that has predictive capabilities.

- However, some challenges limiting and constraining the market's growth include segregated data, different platforms for data integration, and a lack of technical competence.

- COVID-19 has severely impacted businesses relying on customer interaction to generate income. Conversion, interactivity, and revenue growth through digital are being prioritized more than ever. As a result, many organizations view content management systems and digital experience platforms-platforms that govern online experiences-as mission-critical software. Individuals investing in, administering, and operating on these platforms need to reassess their platform needs and ensure their CMS can sustain them during prolonged WFH periods, more internet traffic, and changing marketing strategies. Moreover, the strain of increasing business requirements, tight deadlines, and increased marketing demands due to COVID-19 significantly lessened with the help of a contemporary cloud-hosted CMS with features surrounding productivity, collaboration, performance, and security.

Correspondence Management System Market Trends

Convenient and Secured Internal and External Communications to Drive the Market Growth

- Content management systems are intended to be used by everyone. The program typically has a user-friendly interface and is simple to navigate. While no technical or programming knowledge is necessary, some CMS platforms can require some assistance or expertise. Such characteristic benefits are factors responsible for the growth of CMS adoption.

- The development, compilation, and distribution of private, personalized, and interactive business correspondences are centralized and managed by correspondence management systems. The technology allows businesses to rapidly create communication using pre-approved and custom-written material in a simplified process from production to archive, thereby enhancing convenience to the clients.

- As a result, clients receive the appropriate message quickly, accurately, easily, securely, and relevantly. This enables companies to lower costs and risks related to a complicated process while maximizing the value of consumer interactions, thereby driving market growth.

- Moreover, according to a survey conducted by Storyblok, in 2023, the team that used the CMS most frequently was marketing, with 17%, closely followed by sales, 17%, and finance, 15%. Design teams and executives, with 7% and 6%, respectively, were the two teams that were least likely to use a company's CMS. Such significant adoption rates might signify the convenience and security offered by the CMS technology driving the effectiveness of internal and external communication across the organization.

North America to Hold Significant Market Share

- North America accounts for one of the significant market shares due to the growing use of automation and the increasing demand for effective internal and external communication for improved retention in several business verticals, such as retail and eCommerce, BFSI, and government. The adoption of advanced technology, such as solutions for correspondence management systems, has been increasing in the two strongest markets in North America: the United States and Canada.

- For instance, according to Microsoft Corporation, automation and simplified collaboration in the region make time and resource management more effective and productive. For example, the United States Air Force significantly saved nearly USD 1.4 million yearly by streamlining task management and communication among departments and teams.

- Businesses are expected to use the correspondence management system significantly to prevent manual business procedures from disrupting operations in crucial industry verticals like IT & telecom. The correspondence management system effectively maintains, searches, tracks, and reports correspondence and action plans. The rising communication exchange across various emerging industries are expected to create CMS vendors across the region.

- The region's prominent international providers of correspondence management systems include IBM, Microsoft, Adobe, OpenText, Pitney Bowes, MicroPact, Xerox, and Top Down Systems. The presence of such large enterprises are primarily responsible for the considerable revenue generation across the region.

Correspondence Management System Industry Overview

The Correspondence Management System Market is moderately competitive and consists of several major players. Some of the key providers across the globe include IBM Corporation, Microsoft Corporation, OpenText Corporation, and Adobe, Inc., among others. The Service Providers are trying to go to the market through a solution approach by tying up with software houses, providing it as an end-to-end solution, and behaving like a one-stop-shop for the correspondence management solution. The players operating in the correspondence management system market are now offering various cloud-based solutions at affordable prices, which are expected to provide considerable opportunities to the companies providing these systems.

February 2023 - SignDesk, a digital documents and contract lifecycle management player, announced a partnership with Microsoft and G7 CR Technologies to enhance the company's cloud deployment capabilities. Through this relationship, businesses will be able to use the Microsoft Azure features integrated with the SignDesk suite of products. The document automation suite from Sign Desk will also be featured in the Microsoft marketplace. The solutions in this portfolio address digital onboarding, contract lifecycle management, and digital document execution.

November 2022 - enChoice, a prominent provider of business automation solutions, and Rosslyn Data Technologies have entered into an asset acquisition agreement for enChoice to buy Rosslyn's Integritie business unit. Customer contracts, proprietary software assets, and a few key personnel of Integritie will transfer to enChoice as part of this acquisition.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Need for Automating and Personalizing Communication Systems

- 5.1.2 Convenient and Secured Internal and External Communications

- 5.2 Market Restraints

- 5.2.1 Cellar Data and Disparate Data Systems Impacting Data Integration augmented by Lack of Technical Expertise

- 5.2.2 Higher Initial Investments and Lack of Awareness

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Software

- 6.1.2 Services

- 6.2 By Delivery Channel

- 6.2.1 Web-based

- 6.2.2 Email-based

- 6.2.3 Other Delivery Channels (SMS/MMS-based, etc.)

- 6.3 By Deployment Model

- 6.3.1 On-Premises

- 6.3.2 Cloud

- 6.4 By Organization Size

- 6.4.1 Small & Medium Enterprises

- 6.4.2 Large Enterprises

- 6.5 By Industry Vertical

- 6.5.1 BFSI

- 6.5.2 Government & Public Sector

- 6.5.3 Telecom & IT

- 6.5.4 Healthcare

- 6.5.5 Retail & E-commerce

- 6.5.6 Other Industry Verticals

- 6.6 Geography

- 6.6.1 North America

- 6.6.2 Europe

- 6.6.3 Asia Pacific

- 6.6.4 Latin America

- 6.6.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Adobe Inc.

- 7.1.3 Microsoft Corporation

- 7.1.4 OpenText Corporation

- 7.1.5 Rosslyn Data Technologies Inc. (enChoice, Inc.)

- 7.1.6 Pitney Bowes Inc.

- 7.1.7 Newgen Software Technologies Limited

- 7.1.8 Fabasoft AG

- 7.1.9 MicroPact Inc.

- 7.1.10 Everteam SAS

- 7.1.11 Ademero, Inc.

- 7.1.12 Blue Project Software Inc.

- 7.1.13 Xerox Holdings Corporation

- 7.1.14 Palaxo International Ltd.

- 7.1.15 Top Down Systems Corporation

- 7.1.16 Harvest Technology Group