|

市场调查报告书

商品编码

1432435

自助服务:市场占有率分析、产业趋势、成长预测(2024-2029)Self-Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

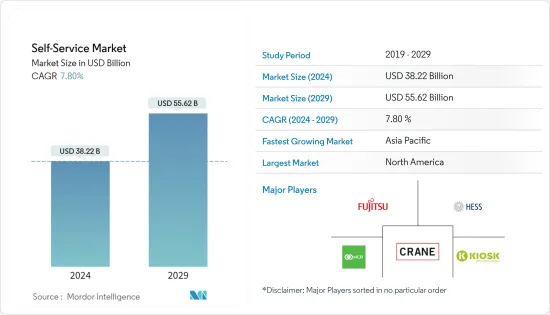

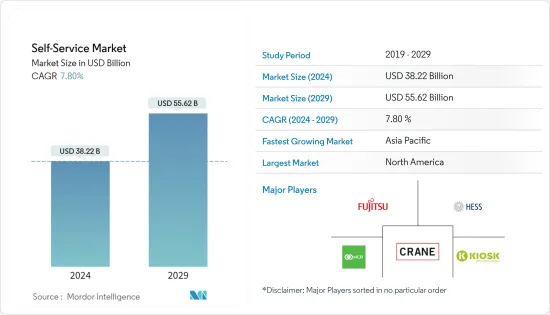

预计 2024 年自助服务市场规模将达到 382.2 亿美元,预计到 2029 年将达到 556.2 亿美元,在预测期内(2024-2029 年)复合年增长率为 7.80%。

自助服务技术长期以来一直在加油站的 ATM 机和加油站付费终端上使用。在当今世界,自助服务已融入消费者的生活,并正在成为许多行业数位转型之旅的重要组成部分。在日本,每 23 名走在街上的人就拥有一台自动贩卖机、售货亭或 ATM 等自助服务机,而且需求没有放缓的迹象。

主要亮点

- 与手动交易相比,消费者更喜欢自助服务技术,主要是出于卫生原因和送货速度。这场流行病无疑改变了製造业、医疗保健和其他非零售业自助服务的面貌,从根本上改变了消费者和企业行为。儘管受到短期社会封锁的影响,但消费者对杂货、家庭用品、医疗用品和家居装修产品的需求有所增加,促使企业采用自助服务技术,我们被迫采用基于接触的无现金技术。

- 自动化自助服务设备、无线连接、技术进步和远端系统管理的增加是影响自助服务技术需求的主要因素。此外,造成这种转变的原因之一是多个行业持续劳动力短缺,尤其是零售、餐饮和旅馆业。在劳动力如此紧张的行业中,许多企业无法获得足够的工人来满足需求。这意味着提高薪资来吸引员工,这对小型企业来说很难承受。因此,资讯亭的趋势呈上升趋势。

- 自动贩卖机系统是自助服务市场的另一个重要部分。它们广泛应用于零售商店和大型企业,系统用于分配食品、食品和饮料和其他适合该系统的产品。在新加坡、马来西亚等游客密集的国家,由于语言障碍,自动贩卖机预计会更全面地引入。

- 对系统安全性以及高昂的安装和维护成本的担忧阻碍了该市场的成长。全球网路攻击的增加和现有网路的脆弱性引起了用户的担忧。由于安全问题和资料外洩的风险,许多用户现在对使用这些系统持怀疑态度。

- 然而,随着 COVID-19 大流行的爆发,对自动贩卖机的需求可能会下降,因为一些零售连锁店暂时停止运营,大部分客户群转向线上通路。例如,拥有Topshop、Dorothy Perkins 和Miss Selfridge 等品牌的阿卡迪亚集团(Arcadia Group) 就警告称,冠状病毒大流行扰乱了高街零售业。我们正在扰乱商家的业务运营,可能不得不永久关闭一些商店。

自助服务市场趋势

自动提款机(ATM) 推动自助服务市场

- 银行业和其他行业越来越多地采用 ATM 机,是推动该市场成长的主要因素之一。随着人口的增加和银行服务普及,对 ATM 的需求正在迅速增加。该领域正在进行大量投资,以提供可靠的 ATM 和自助服务终端系统,从而推动该市场的成长。

- 印度央行资料显示,印度各地安装的小型自动提款机(ATM)数量大幅增加。例如,截至 2022 年 12 月,有 141,900 台微型 ATM 机在使用。此外,由于可以轻鬆执行所有银行业务,例如存入支票、查看余额、转帐和提款,人们现在依赖于全年 365 天、每天 24 小时开放的 ATM,而不是去银行在特定的时间里,我开始依赖他。此外,银行能够减轻与大量人员业务的负担,银行方面的流程也变得更加顺畅。

快速成长的亚太地区

- 预计亚太地区在预测期内将以显着的速度发展。这是因为大型企业和小型企业越来越多地采用自助服务技术来扩大业务范围并增加服务贡献。此外,印度、中国和日本等国家消费者消费能力的增强和意识的提高也推动了市场的成长。

- 根据 IATA 的数据,2023 年 4 月的总运输量(RPK)较 2022 年 4 月增长了 45.8%,其中亚太地区所占份额最高,为 170.8% RPK。随着国内航班旅客数量的增加,Vistara、Indigo、印度航空等航空公司都推出了自助报到机。用户数量逐年增加,对Kiosk终端的需求预计也会增加。

- 此外,印度零售业蓬勃发展,近期销售数据乐观。据 Reliance Retails 称,印度零售市场是全球成长最快的市场之一,预计到 2032 年将达到 2 兆美元。此外,经济扩张、人口变化、可支配收入增加、都市化和不断变化的消费者偏好正在对所研究的市场产生积极影响。

- 此外,COVID-19 大流行的爆发预计将增加食品链中对售货亭的需求。例如,在印度西部和南部拥有并经营麦当劳餐厅的 Westlife Development 已为顾客安装了自助点餐机,并因疫情而提高了餐厅的安全标准。

自助服务业概况

由于自助服务终端、自动贩卖机和 ATM 机的自助服务需求不断增加,自助服务市场高度分散。消费者需求的不断增长使其成为对企业有吸引力的市场。试图以最低成本满足人们需求的公司之间的激烈竞争正在扩大市场。该市场的主要企业包括 KIOSK Information Systems Inc.、NCR Corporation、HESS Cash Systems GmbH &Co.、Crane Co. 和 Fujitsu Limited。

2023 年 6 月,零售技术供应商 365 Retail Markets 宣布推出 MM6 for Markets,这是一款先进的自助服务终端,旨在增强消费者自助服务体验。这款檯面自助服务终端配备 22 吋触控萤幕和多种付款选项,非常适合高人流、高接触性微型市场的客户。

2023 年 6 月,Gem OpenCube Technologies Pvt Ltd 设计了世界上第一台水、茶和咖啡 (WTC) 自动贩卖机。就像街角的自动茶店一样,这台机器是全自动水、茶、咖啡和饼干自动贩卖机,24/7运作,无需人工干预。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究前提和结果

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

第五章市场动态

- 市场驱动因素

- 日益关注客户满意度推动零售和食品产业的需求

- 基础设施开发(新建/维修)和智慧城市倡议的高投资

- 技术投资以改善对残疾人和新用户的支持

- 市场限制因素

- 成本和维护仍然是重要的考虑因素

第六章 主要技术进展

- 自助服务机的演变

- 无障碍终端关键技术和设计发展(欧美主要工作小组和标准化机构支援)| 主要自助终端製造商提供的主要功能

- 与自助服务终端相关的关键案例研究和使用案例(麦当劳、供应商等)| 主要供应商引用的主要最终用户研究

第七章市场区隔

- 类型

- 自助服务终端

- ATM

- 自动贩卖机

- 最终用户

- 金融机构

- 零售/速食连锁店

- 款待

- 卫生保健

- 旅游/交通

- 其他最终用户

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 南美洲

- 中东/非洲

第八章 竞争形势

- 公司简介

- NCR Corporation

- Zebra Technologies

- Advanced Kiosks

- ProtouchUK

- SEDCO

- Embross

- Frank Mayer & Associates, Inc.

- Advantech Co. Limited

- Diebold Nixdorf

- IER Group

- HESS Cash systems GmbH & Co.

- Crane Co.(USA)

- Azkoyen Group

- Fujitsu Ltd.

- MaasInternationalEuropeB.V

第九章投资分析

第十章投资分析市场的未来

The Self-Service Market size is estimated at USD 38.22 billion in 2024, and is expected to reach USD 55.62 billion by 2029, growing at a CAGR of 7.80% during the forecast period (2024-2029).

Self-service technology has been around for ages with ATMs and pay-at-the-pump gas station terminals. In the present world, self-service is woven into the fabric of consumerism and is becoming an essential part of many verticals' paths to digital transformation. To put this into context, in Japan, for every 23rd person walking the streets, there is self-service assistance in the form of a vending machine, kiosk, and ATM, and the demand doesn't appear to decline.

Key Highlights

- Consumers prefer self-service technology over manual dealings, mainly due to hygiene reasons and speed of delivery. The pandemic has certainly changed the face of self-service in manufacturing, healthcare, and other non-retail sectors, radically shifting consumer and business behavior. Despite the short-term social lockdown impact, the increase in demand for groceries, general merchandise, medical supplies, and home improvement among shoppers forced businesses to adopt self-assisted technologies for promoting social distancing and contact-free and cashless technologies.

- The increase in automated and self-service devices, wireless connectivity, technological advancements, and remote administration are the key factors impacting the need for self-service technology. Furthermore, one reason for this shift is an ongoing labor shortage that spans several industries, particularly retail, restaurants, and hospitality. In such a tight labor industry, many operators simply can't find enough workers to meet demand. This meant wage hikes to attract employees, which are difficult for small and mid-sized companies to bear. As a result, kiosk trends are on the rise.

- The automatic vending machine system is another significant segment of the self-service market. These are widely used in retail stores or big-scale enterprises wherein the system is used for dispensing food, beverages, or any other product suitable to the system. Vending machines are expected to witness a more comprehensive implementation, owing to language barriers in countries such as Singapore and Malaysia, with a high tourism rates.

- Concerns relating to the security of the systems and high costs associated with the installation and maintenance of the designs are challenging the growth of this market. The increasing cyber-attacks worldwide and vulnerabilities in the existing network result in user concerns. Many users are now skeptical about utilizing these systems due to security concerns and the risk of data compromise.

- However, with the onset of the COVID-19 pandemic, the demand for vending machines was likely to decline as several retail chains halted their business temporarily, and a larger demographic of the customer base shifted to online channels. For instance, as per company reports, Arcadia Group - which owns brands including Topshop, Dorothy Perkins, and Miss Selfridge, could permanently close some of its shops as the coronavirus pandemic hinders the business operations of high street retailers.

Self-Service Market Trends

Automated Teller Machine (ATM) to Drive the Self-Service Market

- The growing inclination toward adopting ATMs in the banking sectors and other industries is one of the primary factors driving the growth of this market. With the increasing population and growing adoption of banking services among the public, the demand for ATMs is increasing rapidly. Considerable investments in this sector to provide reliable ATMs and kiosk systems are helping the growth of this market.

- According to data from the RBI, there was a significant rise in the number of micro Automated Teller Machines (ATMs) installed throughout India. For instance, 14.19 lakh micro ATMs were in use as of December 2022. Moreover, the ease of doing all sorts of banking activities like cheque deposits, balance inquiries, money transfers, money withdrawals, and much more helps people to rely on ATMs with 24*7 service rather than going to banks in specified hours. It also allowed the bank to ease out their workload of catering to so many people and made the process smooth at their end too.

Asia-Pacific to be the Fastest Growing Region

- The Asia-Pacific region is anticipated to develop at a substantial pace through the forecast period, owing to the growing adoption of self-service technologies by large organizations and SMEs to spread their presence and increase their service contributions. Moreover, the growing consumer spending power and increasing awareness in countries such as India, China, and Japan are also boosting the market's growth.

- According to IATA, total traffic in April 2023 in RPKs rose 45.8% compared to April 2022, with Asia-Pacific registering the highest share of 170.8% RPK. The increasing number of domestic passengers has led to the introduction of self-check-in kiosks by airlines such as Vistara, Indigo, and Air India. As the number of passengers grows every year, the demand for these kiosks is also expected to increase.

- Moreover, the retail industry in India is prospering, with optimistic sales in the recent past. According to Reliance Retails, the Indian retail market is one of the fastest growing in the world and is expected to reach USD 2 trillion by 2032. Also, economic expansion, shifting demography, increasing disposable income, urbanization, and evolving consumer tastes and preferences thus are positively impacting the studied market.

- Further, the onset of the COVID-19 pandemic was anticipated to increase the demand for kiosks in food chains. For instance, Westlife Development, which owns and operates McDonald's restaurants in West and South India, is opening its restaurants with enhanced safety norms because of the pandemic by installing self-ordering Kiosk machines for the customers.

Self-Service Industry Overview

The self-service market is highly fragmented due to increased demand for self-service in kiosks, vending machines, and ATMs. The rising demand from the consumer is making the market attractive for companies. Stiff competition among the players to cater to the people's needs with minimal cost magnifies the market. Some key players in the market are KIOSK Information Systems Inc., NCR Corporation, HESS Cash Systems GmbH & Co., Crane Co., and Fujitsu Ltd, among others.

In June 2023, retail technology provider 365 Retail Markets announced the launch of MM6 for Markets, its latest kiosk designed to enhance the self-service consumer experience. The countertop kiosk features a 22-inch touchscreen and diverse payment options, making it the right fit for customers in high-touch, high-traffic micro-market locations.

In June 2023 - Gem OpenCube technologies pvt ltd designed the World's 1st Water, Tea, and Coffee (WTC) Automatic vending machine. As an automatic Tea shop at the street corner, these machines are fully automated Water, Tea, Coffee, and biscuit dispensing machines working 24/7 without human intervention.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Deliverables

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Growing emphasis on ensuring customer satisfaction to drive demand in the Retail & Food sector

- 5.1.2 High investments in the infrastructure developments (new & refurbishments) and smart city initiatives

- 5.1.3 Technological investments to enable greater support for the differently abled populace & new users

- 5.2 Market Restraints

- 5.2.1 Cost and maintenance remains a key consideration

6 MAJOR TECHNOLOGICAL DEVELOPMENTS

- 6.1 Evolution of Self-Service Kiosks

- 6.2 Key technological & design developments Barrier-Free Kiosks(Major working groups & standard agencies lending support in Europe & the US) | major features provided by the key self-service kiosk manufacturers

- 6.3 Major case studies & use-cases related to Self-Service Kiosks(McDonalds, Wendys, etc.) | Key end-user surveys cited by major vendors

7 MARKET SEGMENTATION

- 7.1 Type

- 7.1.1 Kiosk

- 7.1.2 ATM

- 7.1.3 Vending Machine

- 7.2 End-user

- 7.2.1 BFSI

- 7.2.2 Retail & Fast Food Chain

- 7.2.3 Hospitality

- 7.2.4 Healthcare

- 7.2.5 Travel & Transportation

- 7.2.6 Other End-users

- 7.3 Geography

- 7.3.1 North America

- 7.3.2 Europe

- 7.3.3 Asia-Pacific

- 7.3.4 South America

- 7.3.5 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 NCR Corporation

- 8.1.2 Zebra Technologies

- 8.1.3 Advanced Kiosks

- 8.1.4 ProtouchUK

- 8.1.5 SEDCO

- 8.1.6 Embross

- 8.1.7 Frank Mayer & Associates, Inc.

- 8.1.8 Advantech Co. Limited

- 8.1.9 Diebold Nixdorf

- 8.1.10 IER Group

- 8.1.11 HESS Cash systems GmbH & Co.

- 8.1.12 Crane Co. (USA)

- 8.1.13 Azkoyen Group

- 8.1.14 Fujitsu Ltd.

- 8.1.15 MaasInternationalEuropeB.V