|

市场调查报告书

商品编码

1639547

语音分析-市场占有率分析、产业趋势/统计、成长预测(2025-2030)Speech Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

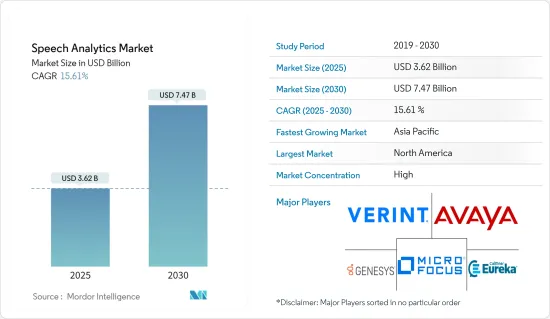

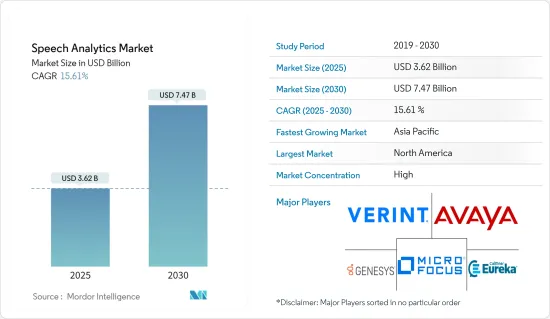

语音分析市场规模预计到 2025 年为 36.2 亿美元,预计到 2030 年将达到 74.7 亿美元,预测期内(2025-2030 年)复合年增长率为 15.61%。

语音分析解决方案可以将通话录音转化为可操作的资料,资料可以转化为整个企业有价值且有效的见解。这些解决方案主要用于处理广泛的客户互动。世界各地的公司正在整合语音分析,将内部记录的资料与外部联合资料相结合,以创建能够了解客户需求并全面减少客户流失的尖端解决方案。

主要亮点

- 语音分析透过提供可操作的见解、激励资料主导的决策以及改进单座席的培训方法来提高企业价值。衡量客服中心效率对于提高客户满意度非常重要。因此,语音分析可用于发现多个通话中的趋势问题,但当时并未被视为重大问题。透过使用语音分析工具,企业可以更了解无法解释的消费行为,并深入了解客户意图和满意度。

- 在 COVID-19 爆发期间,潜在的最终用户产业正在采用最尖端科技支援的语音分析解决方案,进一步推动了市场成长。客服中心长期以来一直是职场自动化的一大前沿领域,但新冠疫情加速了整个进程。人工智慧和机器学习也显着提高了公司将对话划分为相关类别并透过语音分析了解对话中发生的情况的速度。

- 语音分析解决方案的关键组成部分之一是将语音资料转换为文字。在证明监管合规性、审核以及在诉讼的发现过程中,文字比语音更容易共用和搜寻。任何需要数据的人都可以以在组织内易于找到的格式获取资料。 2022 年 1 月,Meta AI 发布了 data2vec。 data2vec 是一种高效能自监督演算法,适用于多种模式,包括音讯、文字和影像的单独应用。该演算法已被证明优于电脑视觉和语音的行业标准单目标演算法。

- 此外,市场上的供应商致力于产品创新和各种合作伙伴关係,为企业提供更好的解决方案。例如,Cogito 利用行为科学和深度学习开发了一种即时对话分析工具。该公司的人工智慧可以监听对话的内容和语气。 Cogito 可以侦测模仿、音量变化、音调等,让您即时了解客户的感受以及每家公司的通话进度。它还向客户服务负责人提供即时提案,以改善通话并评估绩效。

- Cogito 系统的首批大规模测试之一是在Humana 保险公司进行的,为期六个月,涵盖了总合200 个座席呼叫,净推荐值提高了28%,问题解决率提高了6%,呼叫次数也增加了6%。 Cogito 声称该系统已将回电次数减少了 10%,并将客户满意度提高了 28%。

- 语音分析软体和平台的需求迅速爆炸,带动了该领域多家新兴企业的发展,其中几家成长了近 10 倍。例如,品质监控和语音分析工具供应商 SuccessKPI 由于北美业务数位化程度的提高以及向拉丁美洲、欧洲和亚太地区的扩张,对其平台的需求增长了 200%。这一成长吸引了 Banneker Partners 于 2022 年 1 月投资 3,300 万美元,以实现客户成功、产品、合作伙伴、行销和销售团队在全球的快速扩张。

- 然而,这个市场在部署基于语音的通讯提出了挑战。从纯粹的技术层面来看,电脑系统容纳语音互动比聊天更难。背景噪音、不寻常的语音模式、不同的口音、糟糕的发音等使得人工智慧很难将语音翻译成文字。

语音分析市场趋势

通讯部门预计将占据主要市场占有率

- 由于互联世界的采用产生了大量资料,语音分析在通讯业务中变得越来越流行。最初,录製的通话是手动评估的,但随着通话数量的增加,对正确和准确评估的需求也随之增加,从而引入了音讯分析。

- 语音分析技术广泛应用于电信服务供应商的业务。随着商业市场的扩大,利润率提高、诈欺减少、风险降低、服务改善和客户满意度提高等许多好处都有助于吸引和留住更多客户。

- 企业主要使用云端基础的通讯和分析来识别高价值消费者并在整个客户生命週期中更好地管理他们来增加利润。该技术还有助于透过即时客户洞察来识别潜在危险。儘管颠覆性技术以及网路和行动工具不断涌现,但客户和企业之间的大多数顾客关怀互动仍然透过电话进行。

- 电信业者客服中心的目的是启用这些呼叫并从中收集有关消费者趋势和行为的资讯。随着资料处理在发现机会方面变得越来越重要,客服中心正在使用更多资料密集型技术。

- Telefonica Brasil 是南美洲最重要的通讯公司之一,完全依赖资料解决方案。该公司每天使用 IVR(互动式语音应答)管理平均 4000 万个呼叫,其中 900 万个呼叫由人工接听。这一数字预计在未来几年会增加,但人类操作员的就业预计在未来几年将减少。因此,面临的挑战是如何在降低成本的同时提高客户体验的品质。因此,实施语音分析解决方案成为至关重要的业务解决方案。

- 根据国际电信联盟预测,2019年行动用户总数将首次超过80亿,预计将达到83亿人。据报道,截至 2022 年,全球行动电话用户数将达到 86 亿,高于 2021 年的 84 亿。到 2027 年,全球 5G行动电话用户数量预计将超过 43 亿,其中仅东北亚地区的用户数量预计将超过 17 亿。全球行动电话订阅总数的成长预计将推动市场成长并在未来创造充足的机会。

北美预计将占据很大份额

- 美国语音分析市场受到多种因素的推动,包括数位行销支出的增加、政府机构技术支出的增加以及对该地区精神疾病患者治疗的日益关注。此外,中央情报局等机构正在积极资助可能有助于追踪恐怖分子和外国间谍活动的想法。这为硅谷新兴企业创造了许多机会,可以主动设计和创新现有的语音分析解决方案,以创建创新且引人注目的解决方案。

- 此外,美国国防部门在DARPA(国防高级研究计划局)等研发计划上投入了数十亿美元,在过去十年中为国家情报机构和国防部队提供了显着更先进的监控技术。这些投资是为了改善该领域的系统并启用语音分析系统。

- 该地区的用户也越来越多地在多个平台上使用语音控制,包括联网电视、个人电脑、平板电脑、汽车和穿戴式装置。此外,该地区的企业通常会采用这些解决方案来改善客户服务。美国最大的保险公司之一大都会人寿采用人工智慧系统主要是为了更好地回应客户的情感需求和要求。该系统是专门为让公司员工在对话过程中追踪和监控客户情绪而构建的,从而提高客户服务品质。

- 收购增加了市场上的业务整合。此外,2023 年 3 月,临床级语音分析领域的领导者 Speech Analytics 宣布,美国食品药物管理局(FDA) 已为其 Speech Vitals - ALS 技术授予突破性设备称号。 Speech Vitals-ALS 是一款收集和分析语音记录的软体应用程序,可帮助神经科在诊所和家中监测患有肌萎缩侧索硬化症 (ALS) 的成人。

- 此外,CallMiner 等提供人工智慧驱动的语音和客户互动分析的公司已在高盛的「后期成长股权」轮融资中筹集了约 7,500 万美元。 CallMiner 将客户互动(无论是透过语音、电子邮件、聊天或文字进行)转化为洞察和行动,从而在各种用例中改善和改变您的业务。

- 此外,CallCabine 等公司正在优先发布 atmos 语音分析平台中的两个有针对性的语音应用程序,以提供有关 COVID-19 爆发及其对客户互动影响的关键业务情报。此类创新和交易预计将透过各种附加价值和优势创造增强的客户体验,吸引更多消费者,并有望对该国的市场成长产生积极影响。

语音分析产业概况

语音分析市场得到整合,只有少数主要市场参与企业占据了大部分市场占有率。我们可以看到,老字型大小企业正试图在语音分析市场上占上风。这些公司利用各种策略合作措施来增加市场占有率和盈利。

- 2023 年 2 月 - Nvidia 和 Airtel 宣布推出用于客服中心业务的语音分析解决方案。 Bharti Airtel 宣布推出一款由人工智慧驱动的解决方案,以改善客服中心所有入境呼叫的客户体验。这个语音分析系统是与 Nvidia 合作建构的,旨在更好地帮助客服中心员工和客户,同时降低运算成本。 Airtel 使用 Nvidia 的对话式 AI套件包 NvidiaNeMo 和多框架推理服务软体 Triton Inference Server 创建了这个专门的语音应用程式。

- 2022 年 6 月 - 临床级语音分析领域的领导者 Speech Analytics 宣布与 Koneksa 合作开发数位生物标记,利用 Masu 的 Speech Vitals 技术进一步增强其平台和研究能力。语音分析和 Koneksa 的研究级同类最佳技术经过优化,可透过开发和商业性製药管道进行大规模临床测试。这种整合旨在轻鬆地将音讯指标纳入 Koneksa 的研究和数位生物标记开发倡议中。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- 技术简介

第五章市场动态

- 市场驱动因素

- 利用分析来提高客户维繫和客户满意度

- 电商平台增加

- 市场限制因素

- 实施成本高

第六章 市场细分

- 部署

- 本地

- 一经请求

- 组织规模

- 小型企业

- 大公司

- 最终用户

- BFSI

- 通讯

- 医疗保健

- 零售

- 政府机构

- 旅游/酒店业

- 其他的

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Verint System Inc.

- Nice Ltd.

- Avaya Inc.

- Micro Focus International PLC

- Genesys Telecommunications Laboratories Inc.

- Callminer Inc.

- Raytheon BBN Technologies

- Calabrio Inc.

- VoiceBase Inc.(Liveperson Inc.)

- OpenText Corp

第八章投资分析

第9章市场的未来

The Speech Analytics Market size is estimated at USD 3.62 billion in 2025, and is expected to reach USD 7.47 billion by 2030, at a CAGR of 15.61% during the forecast period (2025-2030).

Speech analytics solutions can convert call recordings to actionable data and then translate the data into valuable, effective insights across the enterprise. These solutions are primarily utilized to handle a broad range of customer interactions. Enterprises globally have incorporated speech analytics through a combination of internally recorded data and externally syndicated data to generate a cutting-edge solution to understand customer requirements and comprehensively reduce churn.

Key Highlights

- Speech analytics provides actionable insights that boost corporate value and motivate data-driven decision-making to improve individual agent training methodologies. To improve customer satisfaction, it is critical to measure contact center efficiency. As a result, using speech analytics, users can uncover issues that may be trending across several calls but were not identified as a major concern at the time. Companies can use speech analytics tools to comprehend unexplained consumer behavior better and gain customer insights into intent and satisfaction level.

- During the COVID-19 outbreak, the potential end-user industries were adopting cutting-edge technology-enabled speech analytics solutions, further boosting market growth. While call centers have long been a great frontier of workplace automation, the pandemic accelerated the overall process. Also, AI and machine learning have massively upscaled the speed at which companies may segment conversations into relevant categories through speech analytics to understand what's happening in a conversation.

- One of the critical components of speech analytics solutions is transforming audio data into text. Text is much easier to share and search than audio to prove regulatory compliance, conduct an audit, or enable the discovery process in the event of litigation. The data is available for anyone who needs it in an easily found format within the organization. In January 2022, Meta AI released data2vec, a high-performance self-supervised algorithm that applies to multiple modalities, including separate applications onto speech, text, and images. It was identified to have outperformed industry-standard single-purpose algorithms for computer vision and speech.

- Moreover, the market is witnessing efforts from vendors toward product innovation and various partnerships to provide businesses with better solutions. For example, Cogito has developed a real-time conversation-analysis tool based on behavioral science and deep learning. The company's AI listens to conversations for both content and tone. Cogito claims that it may detect mimicking, change in volume, pitch, etc., to gain real-time insight into how customers are exactly feeling and how all company calls are going. It also provides real-time suggestions to customer service representatives to improve the call and evaluate performance.

- One of the first extensive tests of Cogito's system was done at the insurance company Humana during a six-month trial which involved a total of 200 agents' calls, thereby making use of the system resulted in a 28% improvement in net promoter scores, a 6% improvement in resolution of the issues, and fewer callers asking to speak to a manager. Cogito claims that its system reduces callbacks by 10% and increases customer satisfaction by 28%.

- The rapid explosion of demand for speech-to-analysis software and platforms has heralded the growth of several startups in the field, including a few companies that recorded nearly 10x growth. For instance, SuccessKPI, a quality monitoring and speech analytics tools provider, recorded a 200% increase in demand for their platform due to the growing digitization of operations in North America and their expansion into Latin America, Europe, and Asia-Pacific. The growth invited a USD 33.0 million investment from Banneker Partners in January 2022 to enable the rapid expansion of customer success, product, partner, marketing, and sales teams globally.

- However, the market studied is witnessing challenges in deploying voice-based communications. It is more challenging for a computer system to deal with voice interactions than chat on a purely technical level. Background noise, unusual speech patterns, different accents, and poor pronunciation make it hard for an AI to translate voices into text.

Speech Analytics Market Trends

Telecommunications Sector is Expected to Occupy Significant Market Share

- Due to the huge volume of data generated by the introduction of the connected world idea, speech analytics has become increasingly popular in the telecom business. Initially, the recorded calls were assessed manually; however, as the number of calls has increased, so has the necessity for adequate and accurate assessment, resulting in speech analytics implementation.

- Telecom service provider businesses widely use speech analytics technologies. As the business market expands, many advantages, including higher margins, decreased fraud, reduced risk, improved service, and enhanced customer happiness, are helping attract and keep more clients.

- Organizations primarily use cloud-based communication analytics, which may identify high-value consumers and manage them appropriately throughout the customer life cycle to increase profits. This technology also assists in identifying potential dangers with real-time insights into customers. Most customer care interactions between customers and businesses are conducted over the phone, despite disruptive technology and the widespread usage of web and mobile tools.

- The goal of telecommunication firms' call centers is to enable these calls and gather information about consumer trends and behavior that can be gleaned from them. As data processing has become increasingly crucial for spotting opportunities, contact centers use technology based on more significant amounts of data.

- Various telecommunication companies are already using Speech Analytics solutions like Telefonica Brazil, the most vital telecommunication player in South America, which is taking complete advantage of Comdata's solution. The corporation uses IVR (interactive voice response) to manage an average of 40 million calls daily, with 9 million calls handled by humans. While those numbers are predicted to increase in the future, fewer human operators are anticipated to be employed in the following few years. Consequently, the problem is how to lower expenses while improving the quality of the client experience. Implementing a Speech Analytics solution is thus a crucial business solution.

- As per ITU, the total number of mobile subscriptions is estimated to have exceeded eight billion for the first time in 2019, reaching 8.3 billion subscriptions. As of 2022, there were a reported 8.6 billion mobile phone subscriptions worldwide, up from 8.4 billion in 2021. The number of 5G mobile subscriptions worldwide is expected to exceed 4.3 billion by 2027, with over 1.7 billion subscriptions expected in North East Asia alone. This rise in the total number of mobile (cellular) subscriptions worldwide will boost market growth and create ample opportunities in the future.

North America is Expected to Hold Major Share

- The United States' speech analytics market is driven by various factors, such as increased digital marketing spending, increased technological spending by government agencies, and an increasing focus on treating people with mental illness in the region. Moreover, agencies like the CIA actively fund ideas that might help track terrorists and foreign spy activity. This also opens many opportunities for Silicon Valley startups, actively designing and innovating existing speech analytics solutions to build innovative and attractive solutions.

- Furthermore, the United States (US) defense sector invested billions of dollars in research and development projects like the DARPA (Defense Advanced Research Projects Agency) to provide the nation's intelligence agencies and defense forces with significantly advanced surveillance technologies over the last decade. Such investments are being done to improvise the system and enable the speech analytics system in the sector.

- The region is also seeing increased usage of voice controls by users across multiple platforms like connected TVs, PCs, tablets, automobiles, and wearables. Moreover, enterprises in the region adopt these solutions usually to increase their customer service. One of the largest insurance organizations in the United States, MetLife, adopted an AI system primarily to improvise responses to its customers' emotional needs and requirements. The system was specifically built to help the company's staff members track and monitor customers' emotions during conversations, thereby fostering the quality of customer service interactions.

- Acquisitions have allowed for the consolidation of operations in the marketplace. Moreover, in March 2023, Aural Analytics, Inc., a leader in clinical-grade speech analytics, announced that the US Food and Drug Administration (FDA) has designated its Speech Vitals - ALS technology as a Breakthrough Device. Speech Vitals - ALS is a software application that collects and analyzes speech recordings to help neurologists monitor adults with amyotrophic lateral sclerosis (ALS) in both clinic and home settings.

- Furthermore, players such as CallMiner, a provider of artificial intelligence-enabled speech and customer interaction analytics, have raised a sum of around USD 75 million in a "late-stage, growth equity" round from Goldman Sachs CallMiner aims to translate the interactions that its customers have with their customers, whether they occur over voice, email, chat, or text into "insights" and "actions so they may improvise and change their business across many different use cases.

- Furthermore, companies such as CallCabine prioritized the release of two targeted speech applications within their atmos voice analytics platform to deliver business-critical intelligence surrounding the COVID-19 pandemic and its impact on customer interactions. These innovations and deals are expected to create an enhanced customer experience with various added benefits and advantages, attracting more consumers, which is anticipated to impact the country's market growth positively.

Speech Analytics Industry Overview

The Speech Analytics Market is consolidated, as only a few significant market players occupy most of the market share. It is seen that well-established players are trying to obtain dominance in the speech analytics market. These companies leverage various strategic collaborative initiatives to increase their market share and profitability.

- February 2023 - Nvidia and Airtel have announced the launch of a speech analytics solution for call center operations. Bharti Airtel has announced a solution based on artificial intelligence to improve the customer experience for all inbound calls to its contact center. The voice analytics system, which is built in conjunction with Nvidia, is designed to assist call center workers and customers better while lowering computer costs. Airtel used Nvidia's conversational AI toolkit NvidiaNeMo and a multi-framework inference serving software Triton Inference Server to create this specialized voice application.

- June 2022 - Aural Analytics, Inc., a leader in clinical-grade speech analytics, announced a partnership with Koneksa in digital biomarker development to further strengthen its platform and research capabilities using Aural Analytics' technology, Speech Vitals. The premier research-grade technologies from Aural Analytics and Koneksa are optimized to enable clinical trials at scale throughout development and commercial pharma pipelines. This integration aims to make it simple to incorporate speech metrics into Koneksa research and digital biomarker development initiatives.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Leveraging Analytics For Customer Retention And Offering Greater Customer Satisfaction

- 5.1.2 Rising Number of E-commerce Platforms

- 5.2 Market Restraints

- 5.2.1 High Implementation Costs

6 MARKET SEGMENTATION

- 6.1 Deployment

- 6.1.1 On-Premise

- 6.1.2 On-Demand

- 6.2 Size of Organization

- 6.2.1 Small and Medium Enterprises

- 6.2.2 Large Enterprises

- 6.3 End User

- 6.3.1 BFSI

- 6.3.2 Telecommunications

- 6.3.3 Healthcare

- 6.3.4 Retail

- 6.3.5 Government

- 6.3.6 Travel and Hospitality

- 6.3.7 Other End Users

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East & Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Verint System Inc.

- 7.1.2 Nice Ltd.

- 7.1.3 Avaya Inc.

- 7.1.4 Micro Focus International PLC

- 7.1.5 Genesys Telecommunications Laboratories Inc.

- 7.1.6 Callminer Inc.

- 7.1.7 Raytheon BBN Technologies

- 7.1.8 Calabrio Inc.

- 7.1.9 VoiceBase Inc. (Liveperson Inc.)

- 7.1.10 OpenText Corp