|

市场调查报告书

商品编码

1432663

玉米种子处理:市场占有率分析、产业趋势、成长预测(2024-2029)Maize Seed Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

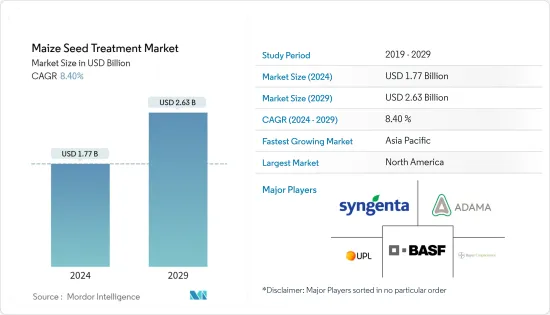

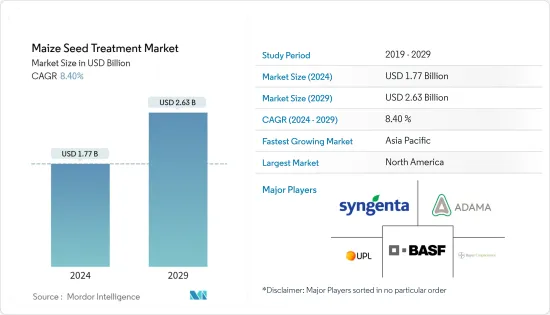

玉米种子处理市场规模预计到 2024 年为 17.7 亿美元,预计到 2029 年将达到 26.3 亿美元,在预测期内(2024-2029 年)复合年增长率为 8.40%。

主要亮点

- 玉米在全世界种植面积达 1.97 亿公顷,是继稻米和小麦之后的第三大重要谷物。这种作物普及采用市售混合种子,包括基改种子,已开发市场和新兴市场的农民都在采用先进的耕作方法来种植玉米。

- 近三年来,玉米种植害虫秋蚕大面积发生。适当的种子处理可以帮助保护幼苗免受这种致命害虫的侵害。本公司也致力于研发针对秋蚕的产品。

玉米种子处理市场趋势

种子汇率的提高导致商业领域的繁荣

商业玉米混合在世界各地越来越受欢迎。过去 20 年来,商业玉米混合一直在北美、欧洲和南美种植。然而,由于种子替代率的提高和混合动力采用率的提高,亚太和非洲等新兴市场正在经历显着成长。 2018年,亚太地区种子兑换率达近80%。由于混合品种的采用增加以及先进混合品种(包括基因改造品种)的普及,玉米种子处理产品的商业应用市场正在蓬勃发展。这些产品以 B2B 形式出售给种子公司。越来越多的销售玉米混合的种子公司也支持了玉米种子处理产品的商业应用市场。提高混合和种子汇率的下一个前沿是非洲,与这些相关的指标预计在预测期内将以强劲的速度成长。

北美引领全球市场

北美种植玉米的面积约 3500 万公顷。它是该地区最重要的作物,广泛用作粮食、牲畜饲料和饲料。该地区越来越多地采用基因改造和混合种子,使其成为世界上最大的地理区域。商业应用正在推动这个市场,公司推出了满足农民作物保护需求的产品,同时考虑土壤和环境的永续性。在预测期内,该地区预计仍将是玉米种子加工市场最大的区域部分。

玉米种子加工产业概况

玉米种子加工市场高度整合,主要企业占70%以上的市场占有率。这些参与者的高市场占有率归因于其高度多元化的产品系列以及大量的收购和协议。此外,这些参与者也专注于研发、扩大产品系列、广泛的地理分布和积极的收购策略。该市场的主要企业包括BASF股份公司、先正达股份公司、安道麦农业解决方案公司、UPL 有限公司和拜耳作物科学公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 市场限制因素

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 化学来源

- 合成

- 生物来源

- 产品类别

- 杀虫剂

- 杀菌剂

- 其他产品类型

- 目的

- 农场层面

- 商业的

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 其他北美地区

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 俄罗斯

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 非洲

- 南非

- 其他非洲

- 北美洲

第六章 竞争形势

- 最采用的策略

- 市场占有率分析

- 公司简介

- BASF SE

- Bayer Crop Science AG

- Syngenta AG

- Adama Agricultural Solutions

- UPL Limited

- Advanced Biological Marketing Inc.

- Corteva Agriscience

- Incotec Group BV

- Valent USA Corporation

第七章 市场机会及未来趋势

The Maize Seed Treatment Market size is estimated at USD 1.77 billion in 2024, and is expected to reach USD 2.63 billion by 2029, growing at a CAGR of 8.40% during the forecast period (2024-2029).

Key Highlights

- Maize is grown over 197 million hectares worldwide and is the third important cereal crop, after rice and wheat. The crop has high degree of penetration in commercial hybrid seeds, including genetically modified seed, and farmers adopt advanced farming practices for maize cultivation in both developed and developing markets.

- In last three years, there was a widespread incidence of the pest fall amyworm in maize cultivation. Proper seed treatment can go a long way in protecting young plants against this deadly pest. Companies have also been engaging in R&D to develop products that target fall amyworm.

Maize Seed Treatment Market Trends

Increasing Seed Replacement Rate Leading to Boom in the Commercial Segment

Commercial maize hybrids are increasingly becoming popular across the world. Traditionally, North America, Europe, and South America have been cultivating commercial maize hybrids, since last two decades. However, increasing seed replacement rates and rising adoption of hybrids led to a remarkable growth of developing markets, such as Asia-Pacific and Africa. In 2018, seed replacement rates in Asia-Pacific stood at close to 80%. Increased adoption of hybrid varieties and penetration of advanced hybrids, including genetically modified varieties, have resulted in a booming market for commercial applications of maize seed treatment products. These products are being sold at a B2B level to seed companies. An increase in the number of seed companies selling maize hybrids has also supported the market for commercial applications of maize seed treatment products. The next frontier of hybridization and increased seed replacement rates is Africa, where the metrics related to these are expected to increase at a robust pace over the forecast period.

North America Leads the Global Market

Maize is grown over approximately 35 million hectares in North America. It is the most important grain crop in the region, with extensive application as grain, animal feed, and forage. Increased adoption of genetically modified and hybrid seeds in the region makes the geographical segment the largest among all the regions across the world. The market is driven by commercial applications, where companies are launching products that satisfy the crop protection needs of the farmer, while keeping sustainability of the soil and environment in mind. The region is expected to remain the largest geographical segment in the maize seed treatment market over the forecast period.

Maize Seed Treatment Industry Overview

The maize seed treatment market is highly consolidated, with the top global players occupying more than 70% of the market share. The greater market shares of these players can be attributed to highly diversified product portfolio and numerous acquisitions and agreements. Moreover, these players are focusing on R&D, expansion of product portfolio, wide geographical presence, and aggressive acquisition strategies. Some of the key players in the market include BASF SE, Syngenta AG, Adama Agricultural Solutions, UPL Limited, and Bayer Crop Science, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Chemical Origin

- 5.1.1 Synthetic

- 5.1.2 Biological

- 5.2 Product Type

- 5.2.1 Insecticides

- 5.2.2 Fungicides

- 5.2.3 Other Product Types

- 5.3 Application

- 5.3.1 Farm-level

- 5.3.2 Commercial

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Spain

- 5.4.2.5 Russia

- 5.4.2.6 Italy

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 BASF SE

- 6.3.2 Bayer Crop Science AG

- 6.3.3 Syngenta AG

- 6.3.4 Adama Agricultural Solutions

- 6.3.5 UPL Limited

- 6.3.6 Advanced Biological Marketing Inc.

- 6.3.7 Corteva Agriscience

- 6.3.8 Incotec Group BV

- 6.3.9 Valent USA Corporation