|

市场调查报告书

商品编码

1432970

深度学习:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Deep Learning - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

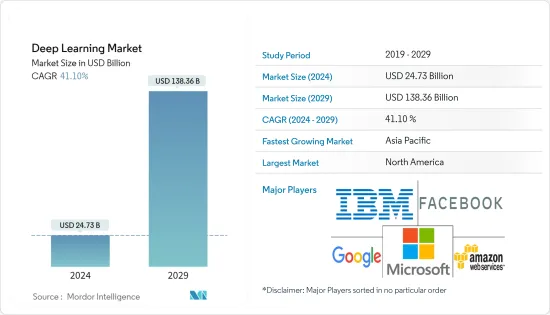

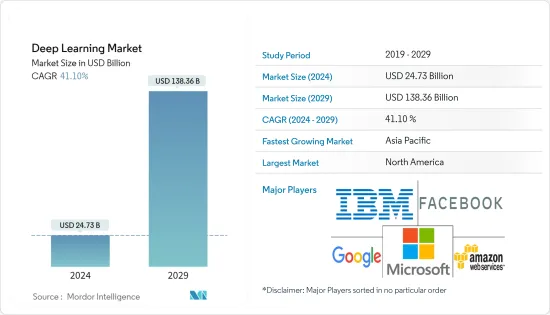

深度学习市场规模预计2024年为247.3亿美元,预计到2029年将达到1383.6亿美元,在预测期内(2024-2029年)复合年增长率为41.10%增长。

深度学习是机器学习 (ML) 的一个子领域,它在语音辨识和影像识别等多项人工智慧任务中取得了突破性进展。此外,自动化预测分析的能力也引发了机器学习的炒作。产品开发和改进支援的增加、流程优化和功能工作流程以及销售优化等因素正在推动各行业的公司投资深度学习应用程式。此外,现代机器学习方法显着提高了模型准确性,并为影像分类和文字翻译等应用开发了一类新型神经网路。

主要亮点

- 资料中心容量的增加、运算能力的提高以及无需人工输入即可执行任务的能力等技术进步正受到广泛关注。此外,云端运算技术在许多领域的快速采用也推动了深度学习产业的成长。

- 目前有多项进展正在推动深度学习的发展。据 SAS 称,演算法改进提高了深度学习技术的性能。越来越多的资料有助于建立具有多个深层的神经网络,例如来自物联网 (IoT) 的串流资料或来自社交媒体或医生笔记的文字资料。鑑于深度学习演算法的迭代性质(复杂性随着层数的增加而增加),大量的运算能力对于解决深度学习问题至关重要。运行深度学习演算法的硬体还必须支援训练网路所需的大量资料。

- 图形处理单元 (GPU) 和分散式云端运算的运算进步为使用者提供了巨大的运算能力。这项开发由 NVIDIA、Intel 和 AMD 等硬体供应商主导,旨在提高运算速度,并与 Tensorflow 和 Cognitive Toolkit 等最受欢迎的开放原始码平台整合等功能,实现相容性。微软、Chainer、Caffe、PyTorch 等因此,深度学习功能的开放原始码在公司中变得越来越普及。这些开放原始码框架允许使用者有效率、快速地建立机器学习模型。

- 深度学习在充分发挥其潜力之前需要克服严峻的挑战,包括黑盒子问题、人口过剩、缺乏上下文理解、资料要求以及可能影响市场的计算强度等,并存在许多限制。

- 因此,COVID-19 对科技业产生了重大影响。深度学习演算法被用来根据胸部 X 光和电脑断层扫描等临床影像来帮助诊断和检测 COVIDE-19 病例。由于医疗保健领域对 MRI 分析工具的需求不断增加,深度学习市场正在扩大。

深度学习市场趋势

零售领域越来越多地使用深度学习来推动市场发展

- 零售业最近的营运基础发生了巨大变化,许多知名品牌选择减少现场产品供应的数量,转而采用线上服务。为了保持活力,零售商必须满足客户的期望并采取相应行动,否则就有失去忠诚度的风险。对于零售商来说,实施快速发展的技术来实现这一目标也很重要。深度学习使零售商能够以前所未有的方式实现客户体验自动化并简化流程。例如,线上场景中的货架分析可以帮助提供有用的推荐和产品的快速分类,让客户在更多支援下更快地做出正确的选择。

- 沃尔玛等线上零售商已开始使用人工智慧从客户那里获取产品推荐,但才刚开始充分利用该技术所能提供的潜力。透过使用深度学习,零售商可以真正利用人工智慧的力量来优化用户体验并自动执行耗时的任务。例如,线上零售商可以使用深度学习自动标记视觉资料,以改善用户体验的各个方面。您可以使用人工智慧来优化搜寻并为您的搜寻查询返回更好的结果,并使用色彩校正来提高产品图像的质量,尤其是低品质的产品照片。未来,零售商将能够利用深度学习技术快速收集资料并自动分析资讯。

- 雪花计算哈佛商业评论的一项研究指出,选择根据资料做出决策的零售商生存时间更长。毫无疑问,零售业正迅速变得极为资料化。根据同一项研究,89% 的零售商认为提高对顾客期望的洞察力是一个重要目标。深度学习在零售业中使用的模型非常复杂且先进,足以应对机器学习模型失败的挑战。例如,零售应用程式模型中的深度学习足够智能,可以理解大萤幕智慧型手机的发布可能会侵蚀平板电脑的销售。当资料遗失时,零售业的深度学习可以从模式中了解商品是否没有销售或缺货。

- 如今,需求预测和客户智慧只是零售和消费品公司利用智慧自动化执行的不同内部活动的两个例子。但在未来三年内,经营团队计划将智慧自动化和深度学习整合到更复杂的业务中。这些步骤需要更大的资料集、外部协作和额外的系统连接。预计在此期间,跨价值链的组织领域的普及将增加至 70% 以上。

- 例如,运动鞋、服装和设备製造商耐吉公司利用尖端自动化技术创建了一个系统,让消费者设计自己的鞋子并在离开商店后穿上它们。参与 Nike Maker Experience 的客户穿着普通的 Nike Presto X 运动鞋,并使用语音指令进行客製化。该技术使用扩增实境、物件追踪和投影系统向买家展示製作的鞋子。

预计北美将占据主要份额

- 由于资料量预计将持续成长,以及企业以消费者为中心的解决方案中对 DL 整合的需求不断增加,预计北美将在全球深度学习市场中占据主要份额。预测与客户行为和业务相关的关键趋势和洞察变得越来越重要,这正在推动领先公司使用人工智慧和巨量资料来驱动价值并提供个人化体验,这是改变方向的重要驱动力。例如,Netflix基于Scala等JVM语言建构了机器学习平台。该平台帮助观众突破先入为主的观念,发现他们最初可能没有选择的节目。

- 为了提高任务效率、扩大劳动力能力、防止浪费、诈骗和滥用以及提高业务效率,美国政府机构现在严重依赖人工智慧和机器学习技术。人工智慧技术的进步、人工智慧用例和应用的激增以及商业解决方案的扩展都有助于将人工智慧的使用扩展到美国太空总署和能源部等专门机构的研发工作之外。

- 美国运输部颁布了新的安全法规,以消除车辆后方的盲点并提高车辆后方人员的能见度。根据美国公路交通安全管理局的统计,在涉及所有车辆的倒车事故中,约有 292 人死亡、18,000 人受伤。此类法规预计将推动 ADAS 的采用,从而为该地区的深度学习市场提供机会。此外,该地区汽车製造商也不断增加投资来开发先进的解决方案,从而推动市场成长。

- 此外,美国公司也正在不断扩大研发力度,开发新产品。例如,2022 年 12 月,Google LLC 宣布发布一款新工具,让用户在 Google Sheets 中开发人工智慧模型。该工具名为 Simple ML,现已推出测试版。它作为 Google Sheets附加元件提供,可供用户免费下载。

深度学习行业概况

深度学习市场由IBM、Google和微软等几家大公司组成,这些公司拥有丰富的产业经验,尤其是在巨量资料/分析平台方面,因此市场较为分散。其他新参与企业也进入了市场,并成功增加了整个行业的深度学习用例数量。对市场产生重大影响的着名新参与企业包括 H2O.ai、KNIME 和 Dataiku。

2023 年 11 月 - 为了推进电讯业机器学习 (ML) 技术和人工智慧 (AI) 领域的发展,Telenor 和爱立信签署了一份为期三年的合作谅解备忘录(Memorandum of Understanding),以探索和开发)签署。 ,测试先进的人工智慧/机器学习解决方案,以在不影响行动网路连接品质的情况下提高能源效率。

2022 年 10 月,Zendesk Inc. 宣布发布智慧分类和智慧辅助,这是新的人工智慧解决方案,使企业能够自动分类客户支援请求并大规模存取有价值的资料。

2022 年 9 月,计算科学和人工智慧公司 Altair 宣布收购高级资料分析和机器学习 (ML) 软体领域的领导者 Rapid Miner。透过此次收购,Altair 期待加强其端到端资料分析 (DA) 产品组合。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争公司之间的敌意强度

- 产业相关人员分析

- 评估 COVID-19感染疾病对深度学习市场的影响

第五章市场动态

- 市场驱动因素

- 计算能力的提高与大规模非结构化资料的存在相结合

- 持续努力将深度学习整合到消费群的解决方案中

- 零售领域越来越多地使用深度学习来推动市场发展

- 市场挑战

- 营运和基础设施问题,例如硬体复杂性和对熟练劳动力的需求

- 市场机会

- 深度学习技术演进

- 主要机器学习库分析

第六章市场区隔

- 提供

- 硬体

- 软体和服务

- 最终用户产业

- BFSI

- 零售

- 製造业

- 卫生保健

- 车

- 通讯和媒体

- 其他最终用户产业

- 目的

- 影像识别

- 讯号识别

- 资讯处理

- 其他用途

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第七章 竞争形势

- 公司简介

- Facebook Inc.

- Amazon Web Services Inc

- SAS Institute Inc

- Microsoft Corporation

- IBM Corp

- Advanced Micro Devices Inc

- Intel Corp

- NVIDIA Corp

- Rapidminer Inc

第八章投资分析

第9章市场的未来

The Deep Learning Market size is estimated at USD 24.73 billion in 2024, and is expected to reach USD 138.36 billion by 2029, growing at a CAGR of 41.10% during the forecast period (2024-2029).

Deep learning, a subfield of machine learning (ML), led to breakthroughs in several artificial intelligence tasks, including speech recognition and image recognition. Furthermore, the ability to automate predictive analytics is leading to the hype for ML. Factors such as enhanced support in product development and improvement, process optimization and functional workflows, and sales optimization, among others, have been driving enterprises across industries to invest in deep learning applications. Furthermore, the latest machine-learning approaches have significantly improved the accuracy of models, and new classes of neural networks have been developed for applications like image classification and text translation.

Key Highlights

- Technological advances, such as increasing data center capacity, high computing power and the ability to carry out tasks without human input, have attracted significant attention. In addition, the growth of the deep learning industry is fueled by rapidly adopting cloud computing technology across a number of sectors.

- Several developments are now advancing deep learning. According to SAS, improvements in algorithms have boosted the performance of deep learning methods. The increasing amount of data volumes has been supportive of the building of neural networks with several deep layers, including streaming data from the Internet of Things (IoT) and textual data from social media and physicians' notes. A significant amount of computational power is essential to solve deep learning problems, considering the iterative nature of deep learning algorithms-their complexity increases as the number of layers increases. The hardware running deep learning algorithms also needs to support the large volumes of data required to train the networks.

- Computational advances in graphic processing units (GPUs) and distributed cloud computing have put incredible computing power at the users' disposal. This development is led by hardware providers, such as NVIDIA, Intel, and AMD, among others, which have been improving the computational speeds among other features and making them compatible with most-used open-source platforms, such as Tensorflow, Cognitive Toolkit (Microsoft), Chainer, Caffe, and PyTorch, among others. Therefore, 'open-sourcing deep learning capabilities' have become increasingly popular across enterprises. These open-source frameworks enable users to build machine-learning models efficiently and quickly.

- Deep learning has a number of serious limitations that need to be overcome before it can achieve its full potential, such as the black box problem, overpopulation, lack of contextual understanding, data requirements and computational intensity, which might effect market

- As a result, COVID-19 has had an excellent impact for the technology sector. Deep learning algorithms have been employed for assisting diagnosis and detection of COVIDE-19 cases based on clinical images, e.g. chest Xray or CT scans. The growing demand for MRI analysis tools within the healthcare sector which has led to a rise in the depth learning market.

Deep Learning Market Trends

Growing Use of Deep Learning in Retail Sector is Driving the Market

- The retail industry has seen a drastic shift in its base of operations in recent times, with many notable brands choosing to reduce the number of onsite offerings in favor of online service. For retailers to remain viable, they need to meet customer expectations, act accordingly, or risk losing loyalty. It is also becoming vital for retailers to adopt burgeoning technologies to make this a reality. Deep learning allows retailers to automate customer experience and streamline processes in a way hitherto unknown. For example, shelf analytics in online scenarios can help with useful recommendations of merchandise and quick classification, which allows customers to make correct choices with more support more quickly.

- Online retailers such as Walmart are starting to use AI to get product recommendations from customers but are just barely utilizing the full potential the technology can offer. By using deep learning, retailers can truly harness the power of AI to optimize user experiences and automate time-consuming tasks. For instance, online retailers can use Deep Learning to automatically tag visual data to improve many facets of the user experience. They can use AI to refine the search and return better results to search queries or enhance product images' quality, especially low-quality product photos using color enhancement. Moving forward, retailers can quickly gather data and analyze information automatically using Deep Learning technology.

- A study by Snowflake Computing Harvard Business Review points out that retailers who choose to make data-driven decisions have survived longer. Undoubtedly, retail is rapidly becoming extremely data-oriented. As per the same study, 89% of retailers consider gaining improved insights into customer expectations a significant goal. The models that Deep learning in retail utilizes are sophisticated and advanced enough to handle the challenges that machine learning models fail at. For example, deep learning in retail application models is intelligent enough to understand that the release of smartphones with larger screens can eat up tablets' sales. In the case of missing data, deep learning in retail could learn from patterns whether an item isn't selling or is out of stock.

- These days, demand forecasting and customer intelligence are only two examples of distinct internal activities that retail and consumer products companies utilize intelligent automation to carry out. Executives, however, intend to integrate intelligent automation and deep learning into more intricate operations over the course of the following three years. These procedures call for larger data sets, external cooperation, and extra system connections. The estimated penetration is anticipated to increase to above 70% across organizational domains that span the value chain over that period.

- For instance, sports footwear, apparel, and equipment manufacturer Nike Inc. has created a system that allows consumers to design their own shoes and wear them after they leave the store-utilizing the fresh automated system. Customers who participate in The Nike Maker Experience put on a pair of unadorned Nike Presto X sneakers and customize them via voice commands. The technology shows the buyer the created shoes using augmented reality, object tracking, and projection systems.

North America is Expected to Hold Major Share

- North America is expected to have a significant share in the global deep learning market, owing to the sustained rise in considerable data volume, coupled with the anticipated increase in the demand for the integration of DL in consumer-centric solutions of enterprises. The growing emphasis on predicting the key trends and insights related to customer behavior and operations has been a critical driver for significant enterprises to veer toward the use of AI and big data for driving value and offering a personalized experience. For instance, Netflix built a machine learning platform based on JVM languages, like Scala. The platform helps break viewers' preconceived notions and find shows that they might not have initially chosen.

- In order to increase mission effectiveness, stretch workforce capacity, prevent waste, fraud, and abuse, and increase operational efficiency, agencies in the US now rely heavily on artificial intelligence and machine learning technology. The advancement of AI technology, a rising number of AI use cases and applications, and the expansion of commercial solutions have all helped to expand the usage of AI outside the R&D activities at specialized organizations like NASA and the Department of Energy.

- The United States Department of Transportation formed a new safety regulation to help eliminate blind zones behind vehicles and view people present behind vehicles. According to National Highway Traffic Safety Administration stats, around 292 fatalities and 18,000 injuries occur due to back-over crashes involving all vehicles. Such regulations are anticipated to encourage the adoption of ADAS, thereby offering opportunities for the region's deep learning market. Furthermore, the region is also seeing an increase in investments from automakers to develop advanced solutions, driving the growth of the market.

- Moreover, companies in the US are continuously expanding on their R&D to develop new products. For instance, in December 2022, Google LLC announced the launch of a new tool in order to enable users to develop artificial intelligence models in Google Sheets. The tool, dubbed Simple ML, is available in beta. It's provided as an add-on to Google Sheets that users can download at no charge.

Deep Learning Industry Overview

The deep learning market is fragmented as it consists of several large players, such as IBM, Google, and Microsoft, among others, with substantial industrial experience in big data/analytical platforms. Other new entrants also have been making their way into the market and have been successfully increasing the number of use cases of deep learning across industries. Prominent new entrants that have made a significant impact on the market include H2O.ai, KNIME, and Dataiku.

In November 2023 - In a step towards advancing the realm of machine learning (ML) technologies and artificial intelligence (AI) within the telecommunications industry, Telenor and Ericsson have signed an (MoU) for a three-year collaboration that aims to explore, develop, and test advanced AI/ML solutions towards enhancing energy efficiency without compromising on the quality of connectivity in mobile networks.

In October 2022, Zendesk Inc. announced the launch of a new AI solution, Intelligent Triage and Smart Assist, empowering businesses to triage customer support requests automatically and access valuable data at scale.

In September 2022, Altair, a company providing computational science and artificial intelligence, announced the acquisition of rapid miner, a leader in advanced data analytics and machine learning (ML) software. With this acquisition, Altair's looking forward to strengthening its end-to-end data analytics (DA) portfolio.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Stakeholder Analysis

- 4.4 Assessment of Impact of COVID-19 on Deep Learning Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Computing Power, coupled with the Presence of Large Unstructured Data

- 5.1.2 Ongoing Efforts toward the Integration of DL in Consumer-based Solutions

- 5.1.3 Growing Use of Deep Learning in Retail Sector is Driving the Market

- 5.2 Market Challenges

- 5.2.1 Operational and Infrastructural Concerns, such as Hardware Complexity and Need for Skilled Workforce

- 5.3 Market Opportunities

- 5.4 Technology Evolution of Deep Learning

- 5.5 Analysis of Key Machine Learning Libraries

6 MARKET SEGMENTATION

- 6.1 Offering

- 6.1.1 Hardware

- 6.1.2 Software and Services

- 6.2 End-User Industry

- 6.2.1 BFSI

- 6.2.2 Retail

- 6.2.3 Manufacturing

- 6.2.4 Healthcare

- 6.2.5 Automotive

- 6.2.6 Telecom and Media

- 6.2.7 Other End-user Industries

- 6.3 Application

- 6.3.1 Image Recognition

- 6.3.2 Signal Recognition

- 6.3.3 Data Processing

- 6.3.4 Other Applications

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Facebook Inc.

- 7.1.2 Google

- 7.1.3 Amazon Web Services Inc

- 7.1.4 SAS Institute Inc

- 7.1.5 Microsoft Corporation

- 7.1.6 IBM Corp

- 7.1.7 Advanced Micro Devices Inc

- 7.1.8 Intel Corp

- 7.1.9 NVIDIA Corp

- 7.1.10 Rapidminer Inc