|

市场调查报告书

商品编码

1433751

顾客分析:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Customer Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

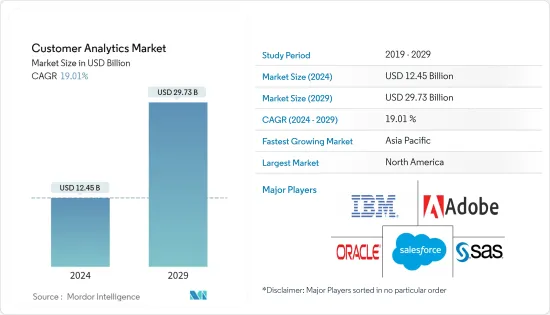

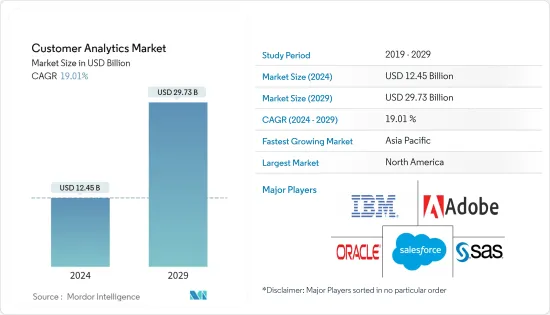

预计2024年全球客户分析市场规模将达124.5亿美元,2024年至2029年复合年增长率为19.01%,2029年将达297.3亿美元。

主要亮点

- 随着市场上已有各种云端基础的解决方案,我们预计会有更多的企业迁移到云端。企业还可以学习如何利用云端分析的潜力,其中託管了客户资料来源、资料模型、处理应用程式、运算能力、分析模型和资料储存等大多数元件。这有助于将情报纳入现有程序并改善营运决策。

- 推动客户分析市场成长的其他因素包括业务流程的技术进步,例如人工智慧(AI)、机器学习(ML)和自动化以简化行销流程,以及更个人化的客户体验,这包括需要了解客户的购买行为是为了提供

- 由于进一步提高客户满意度的需求不断增加,所考虑的行业正在迅速发展。零售企业使用客户分析来创建客製化的沟通和行销策略。他们知道哪些消费者购买什么,并且透过根据消费者资料为他们量身定制行销,他们也许能够改善客户体验和忠诚度。根据 ACSI 零售和消费者研究,由于重复购买、客户忠诚度、客户推荐、收益和参与带来的卓越购物体验,过去一年消费者满意度保持相对稳定,零售商们可以鬆一口气了。

- 推动该行业的另一个因素是社交媒体意识的不断增强。社群媒体分析透过将产品清单连结到电子商务网站,透过社群媒体平台提高品牌曝光度、品牌价值以及扩大消费者覆盖范围,从而增强社交网路的优势。这有助于人们监控和联繫。亚马逊和沃尔玛使用 Facebook、Instagram、YouTube 和 Twitter 等社群媒体网站来宣传其产品。社交平臺是现代商店,充当客户和企业之间的管道。

- 近年来,安全和隐私外洩事件增加。因此,客户变得更加关注隐私和安全。这是客户分析部门扩张的重大障碍。消费者分析中的关键资料架构对于防止资料遗失可能变得越来越重要,资料遗失会带来威胁。

- COVID-19的感染疾病阻碍了消费者分析产业的成长。由于大流行期间政府的严格封锁,市场关闭。因此,消费者分析产业在短时间内受到限制。网路零售这一成长最快的细分市场受到严重影响。然而,随着政府对关闭的网路购物网站的支持,一切正在慢慢恢復正常。

客户分析市场趋势

零售业的成长带动市场成长

- 在零售业,消费者重视并要求个人化的全通路体验。因此,许多零售商正在转向客户分析等技术,以便更好地了解消费者的需求。

- 随着零售额的成长,客户分析越来越多地被用来创造个人化的沟通和行销宣传活动。了解消费者购买模式和适应性行销策略可以提高客户体验和忠诚度。

- 随着网路使用的增加,网上购物也越来越发达。电子商务已成为零售和分销行业的重要平台。 2021年订单数量与前一年同期比较增加15%,推动跨国商务发展。来自不同国家的线上买家更有可能进行大量购买。光是亚马逊就占据了美国销售额的约 40% 和线上销售额成长的 80%。

- 预测分析是商业智慧解决方案的流行趋势,它使组织能够准确预测未来客户的购买偏好。许多预测分析模型的发展主要是为了更好地服务现有客户、减少客户流失并建立更牢固的联繫。

- 如果商家能够分析消费者活动(例如流量、时间和暂停),就可以获得重要的洞见。 Motionlogic 是 T-Systems 的一款工具,可撷取并分析运动,以帮助实体零售商了解客户的行为和动机。这些流量模式可以连结到指示有吸引力的区域或目的地的特定触发器,并可以帮助零售商了解即时客户资料。

北美占主要份额

- 由于其强大的影响力,预计北美将拥有最大的市场占有率。为了改善该领域的客户体验,对巨量资料计划的需求不断增长,正在改变组织观点资料消费、收集和分析的方式。

- 美国公司更有可能维持或增加行销支出,导致该地区的成长率低于其他地区。

- 为了提供单一客户视图,美国银行建立了一个分析系统,该系统整合了来自美国线上和实体管道的资料。该银行将潜在客户转换率提高了 100% 以上,并透过向客服中心提供相关潜在客户和提案创造了更个人化的体验。

客户分析行业概览

消费者分析市场高度分散,老牌公司和新兴公司的竞争非常激烈。这些玩家希望透过在研发和玩家获取方面的支出来开发新产品,从而获得相对于竞争对手的优势。 Adobe Systems Inc.、IBM Corporation、Oracle Corporation 是该产业的重要参与者。

- 2022 年 3 月 - Adobe 向 Adobe Experience Cloud 引入了新的客户旅程分析。 Adobe 宣布推出新的体验分析实验工具。这使得组织能够测试真实场景并评估结果,以了解微小的变化如何影响其各种产品的整体客户体验。 Adobe 客户资料平台 (CDP) 和客户旅程分析也已集成,以提高 Adobe 发现客户群的能力。

- 2022 年 6 月 - Salesforce 推出新的 Customer 360 技术,将行销、商务和服务资料统一在一个平台上。这使企业能够连接、自动化和客製化每次接触并大规模建立信任。

- 2022 年 12 月 - 开放数位体验供应商 Acquia 宣布对其客户资料平台 (CDP) 进行变更,以扩大对业务行销团队的支援。这些附加功能扩展了行销人员和资料负责人使用 Acquia CDP 管理的资讯的方式,并加强了该产品在可组合客户资料倡议中的重要地位。 Acquia CDP 是 Acquia 数位体验平台 (DXP) 的组成部分,DXP 是业界第一个用于结合内容和资料以创建世界一流数位消费者体验的开放平台。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场促进与约束因素介绍

- 市场驱动因素

- 对提高客户满意度的需求不断增长

- 人们对社群媒体回应客户行为的兴趣日益浓厚

- 市场限制因素

- 资料安全和隐私问题

- 价值链分析

- 工业吸引力 - 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章技术蓝图

第六章市场区隔

- 依部署类型

- 本地

- 云端基础

- 按解决方案

- 社群媒体分析工具

- 网路分析工具

- 仪表板/报告工具

- 顾客之声 (VOC)

- ETL(提取、转换、载入)

- 分析模组/工具

- 按组织规模

- 中小企业

- 大公司

- 按服务

- 管理服务

- 专业服务

- 按最终用户产业

- 资讯科技/通讯

- 旅游/酒店业

- 零售

- BFSI

- 媒体娱乐

- 卫生保健

- 运输/物流

- 製造业

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争形势

- 公司简介

- Adobe

- Alteryx

- Angoss Software Corporation

- Axtria

- Bridgei2i Analytics Solution(Accenture)

- IBM

- Manthan Software Services Pvt. Ltd

- Microsoft

- NGDATA NV

- Oracle

- Pitney Bowes Inc.

- Salesforce Inc.

- SAS Institute Inc.

- Teoco Corporation

- Aruba Networks Inc.(Hewlett Packard Enterprise Development LP)

第八章投资分析

第九章 市场机会及未来趋势

The Customer Analytics Market size is estimated at USD 12.45 billion in 2024, and is expected to reach USD 29.73 billion by 2029, growing at a CAGR of 19.01% during the forecast period (2024-2029).

Key Highlights

- Due to the variety of cloud-based solutions already on the market, more businesses are expected to migrate to the cloud. Companies might also learn how to exploit the potential of cloud analytics, where the bulk of the components, such as customer data sources, data models, processing apps, computing capacity, analytic models, and data storage, are hosted. This might assist in incorporating intelligence into existing procedures and improve operational decision-making.

- Other factors driving the growth of the customer analytics market include the need to understand customer purchasing behavior to provide a more personalized customer experience, in addition to the advancement of technology such as artificial intelligence (AI), machine learning (ML), and business process automation to streamline marketing processes.

- The industry under consideration is rapidly developing due to the rising need for greater customer pleasure. Customer analytics are used in retail to produce tailored communications and marketing strategies. They know which consumers buy what, and tailoring marketing to them based on shopper data may increase customer experience and loyalty. According to the ACSI Retail and Consumer Study, retailers may sigh relief as consumer satisfaction remains relatively stable in the previous year due to a great shopping experience via repeat purchases, customer loyalty, customer referrals, revenues, and participation.

- Another element propelling the industry is the rise in social media awareness. Social media analytics enhances the benefits of social networking by increasing brand exposure, increasing brand value, and expanding consumer reach through social media platforms by linking their product list with e-commerce sites, which assists in monitoring people and connection development. Amazon and Walmart have utilized social media sites such as Facebook, Instagram, YouTube, and Twitter to promote their items. Social platforms are modern-day shops that act as a conduit between customers and entities.

- In recent years, there has been a rise in security and privacy breaches. As a result, customers began to worry more about their privacy and security. This has been a critical impediment to the expansion of the customer analytics sector. Significant data architecture in consumer analytics may become increasingly crucial to safeguard, threatening data loss.

- The COVID-19 epidemic hampered the growth of the consumer analytics sector. Markets were shuttered because of the government's rigorous lockdown during the pandemic. Thus, the consumer analytics industry was restricted for a short time. Internet retail, the fastest-growing market segment, was seriously impacted. However, it has progressively returned to normalcy due to government support for online shopping sites during the closure.

Customer Analytics Market Trends

Growing Retail Sector to Drive Market Growth

- In the retail sector, consumers value and demand a personalized omnichannel experience. As a result, many retailers are turning to technology like customer analytics to understand better what their consumers want and need.

- As retail sales grow, customer analytics is increasingly used to create personalized communications and marketing campaigns. Knowing consumers' purchase patterns and adaptable marketing strategies improve customer experience and loyalty.

- Online purchasing has increasingly developed as Internet usage has increased. E-commerce has emerged as a critical platform in the retail and distribution industries. The number of orders climbed by 15% in 2021 compared to the previous year, fueling development in cross-border commerce. Online buyers from different nations are more likely to make significant purchases. Amazon alone accounts for around 40% of US sales and 80% of the increase in online sales.

- Predictive analytics is a popular trend in business intelligence solutions, allowing organizations to accurately forecast future customer purchasing preferences. Many predictive analytic models are developed primarily to give better service to existing customers, reduce churn, and build stronger connections.

- When merchants can analyze consumer activity, including flows, timing, and stops, they may draw significant insights. Motionlogic, a T-Systems tool, captures and analyzes motions to help brick-and-mortar retailers understand customers' journeys and motives. These traffic patterns may be linked to specific triggers to indicate attractive areas and destinations, which may aid retailers in comprehending real-time customer data.

North America Accounts for Major Share

- North America is expected to have the largest market share due to its robust presence. As the demand for big data projects to improve customer experience grows in this area, organizations' perspectives on data consumption, collecting, and analysis are changing.

- Corporations in the United States are likely to maintain or increase their marketing expenditures, resulting in a low growth rate for the region compared to other locations.

- To provide a single customer view, United States Bank established an analytics system incorporating data from online and physical channels in the United States. The bank raised its lead conversion rate by more than 100% and created more personalized experiences by providing relevant leads and suggestions to the contact center.

Customer Analytics Industry Overview

The market for consumer analytics is highly fragmented, with fierce competition from established and developing businesses. By spending on R&D and player acquisitions, these players hope to acquire an advantage over their competitors through new product development. Adobe Systems Inc., IBM Corporation, and Oracle Corporation are critical participants in the industry under consideration.

- March 2022 - Adobe introduced a new Customer Journey Analytics for Adobe's Experience Cloud. Adobe launched a new experimentation tool in experience analytics that allows organizations to test real-world scenarios and evaluate the results to understand how little changes can affect the overall customer experience across their various products. Adobe Customer Data Platform (CDP) and Customer Journey Analytics have also been combined to improve Adobe's capacity to uncover customer segments.

- June 2022 - Salesforce introduced new Customer 360 technologies that combine marketing, commerce, and service data on a single platform, allowing businesses to connect, automate, and customize every encounter and develop trusted relationships at scale.

- December 2022 - Acquia, the open digital experience provider, announced changes to its customer data platform (CDP) that expand support for business marketing teams. The additional features broaden how marketers and data scientists can engage with information managed by Acquia CDP and reinforce the product's important position in composable customer data initiatives. Acquia CDP is a component of Acquia Digital Experience Platform (DXP), the industry's first open platform for combining content and data to create world-class digital consumer experiences.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Rising Demand for Improved Customer Satisfaction

- 4.3.2 Increase in Social Media Concern to Address Customer Behavior

- 4.4 Market Restraints

- 4.4.1 Data Security and Privacy Concerns

- 4.5 Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 TECHNOLOGY ROADMAP

6 MARKET SEGMENTATION

- 6.1 By Deployment Type

- 6.1.1 On-premise

- 6.1.2 Cloud-based

- 6.2 By Solution

- 6.2.1 Social Media Analytical Tools

- 6.2.2 Web Analytical Tools

- 6.2.3 Dashboard and Reporting Tools

- 6.2.4 Voice of Customer (VOC)

- 6.2.5 ETL (Extract, Transform, and Load)

- 6.2.6 Analytical Modules/Tools

- 6.3 By Organization Size

- 6.3.1 Small and Medium Enterprises

- 6.3.2 Large Enterprises

- 6.4 By Service

- 6.4.1 Managed Service

- 6.4.2 Professional Service

- 6.5 By End-user Industry

- 6.5.1 Telecommunications and IT

- 6.5.2 Travel and Hospitality

- 6.5.3 Retail

- 6.5.4 BFSI

- 6.5.5 Media and Entertainment

- 6.5.6 Healthcare

- 6.5.7 Transportation and Logistics

- 6.5.8 Manufacturing

- 6.5.9 Other End-user Industries

- 6.6 By Geography

- 6.6.1 North America

- 6.6.2 Europe

- 6.6.3 Asia-Pacific

- 6.6.4 Latin America

- 6.6.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Adobe

- 7.1.2 Alteryx

- 7.1.3 Angoss Software Corporation

- 7.1.4 Axtria

- 7.1.5 Bridgei2i Analytics Solution (Accenture)

- 7.1.6 IBM

- 7.1.7 Manthan Software Services Pvt. Ltd

- 7.1.8 Microsoft

- 7.1.9 NGDATA NV

- 7.1.10 Oracle

- 7.1.11 Pitney Bowes Inc.

- 7.1.12 Salesforce Inc.

- 7.1.13 SAS Institute Inc.

- 7.1.14 Teoco Corporation

- 7.1.15 Aruba Networks Inc. (Hewlett Packard Enterprise Development LP)