|

市场调查报告书

商品编码

1433824

数位户外(户外)广告:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Digital Out of Home (OOH) Advertising - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

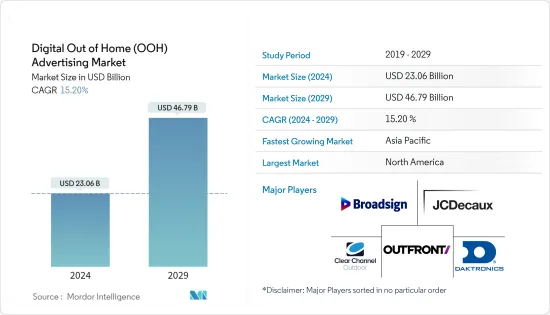

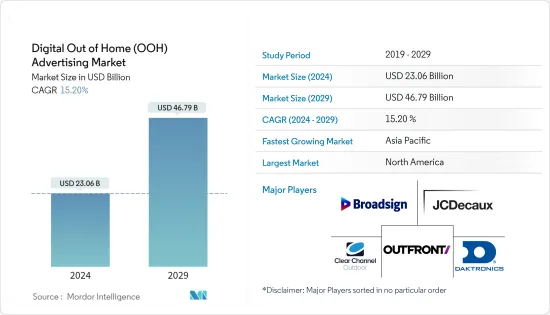

2024年,全球数位OOH(户外)广告市场规模将达230.6亿美元,2024-2029年预测期间复合年增长率为15.20%,2029年将达到467.9亿美元。

主要亮点

- 数位 OOH(户外)广告是商业广告接触广大受众的一种经济有效的方式,因此其使用量很大,并且正在推动预测期内的市场扩张。

- 此外,全球都市化和基础设施开拓的不断发展预计将在预测期内推动市场成长。此外,各行业户外广告支出的增加正在推动市场扩张,因为多个广告可以显示在一个萤幕上。

- 数位 OOH(户外)广告在广告界越来越受欢迎,因为它提高了消费者的品牌知名度,并补充了品牌在其他管道上的广告宣传,推动了市场成长。预计这种情况将会发生。此外,随着人们在办公室和家外花费更多时间,户外广告使企业能够定期、快速地接触大量人群,从而促进预测期内的市场成长。

- COVID-19 对数位 OOH(户外)广告市场的扩张产生了相当大的影响。疫情期间,主要产业对数位电子看板解决方案的需求减少,大大影响了数位 OOH(户外)广告解决方案的需求。此外,由于世界各国政府实施部分或全部封锁,导致缺乏合格的劳动力,这阻碍了大流行期间数位 OOH(户外)广告市场的扩张。

- 广告成本的波动可能会阻碍数位户外广告市场的成长。

数位 OOH(户外)广告市场的趋势

Transit 将在数位 OOH(户外)市场中占据很大份额

- 由于对与旅客相关的数位内容和资讯的需求,互动广告透过资讯亭、广告看板、广告看板等各种广告模式部署在平台上,占交通媒体收益成长的很大份额。

- 其结果是消费者行为在所有交通途径的客户参与方面发生转变,从而使企业能够在客户心目中策略性地发展其品牌。在接下来的三年里,这可能会让潜在客户远离传统媒体。

- 在欧洲和亚太地区,交通是最突出的部分,大众交通工具基础设施发达且密集,使得大众交通工具成为很大一部分人口的首选交通途径。

- 除其他交通途径外,机场对于头等舱和奢侈品的广告来说是特别有吸引力的场所。机场面临着寻找新方法来增加收益的压力。透过将海报等静态展示转变为数位简报,机场可以提供多个赞助商,而不仅仅是一个。这将极大地增加收益。此外,引进广告合作伙伴可以让机场分担更新新广告技术的成本负担。

- 继机场之后,数位 OOH(户外)广告的引入也在铁路领域取得进展。新兴国家对智慧火车站不断增长的需求正在推动户外数位媒体的需求。

亚太地区实现显着成长

- 亚太地区是所有地区中人口最多的地区。由于城市人口的增加和购买力的增强,亚太地区被认为是数位户外市场最大的成长市场之一。

- 亚太地区和其他新兴国家的消费者正在追随西方消费者的脚步,从传统媒体管道迅速过渡到互动式数位媒体。因此,数位 OOH(户外)广告市场在整个全部区域不断成长,西方国家,尤其是北美地区,在该市场占有重要地位。

- 亚太地区大众交通工具基础设施发达,人口密度高,大众交通工具成为许多人的首选。

- 此外,虽然该地区主要由时代互联网和上海文广新闻传媒集团等本土企业主导,但德高集团等大型企业也在该地区占有重要的市场占有率。

数位 OOH(户外)广告业概述

数位 OOH(户外)广告市场高度分散。该行业由在多个市场运营的几家大型户外广告媒体公司和在一个或几个当地市场运营数量有限的小型本地公司组成。

- 2022 年 1 月 - Hivestack 在马来西亚推出程式化数户外(DOOH) 市场。 Hivestack 宣布与全球 14 个国家的 GroupM 以及 Dentsu 子公司 Posterscope 达成协议,并已于 2021 年 12 月开始现场宣传活动。这些机构的客户可以针对马来西亚境内和 Hivestack 的优质全球网络,针对资料驱动的受众发起宣传活动。透过Hivestack供应端平台(SSP),Hivestack也拥有马来西亚最大、最强大的投资组合,包括BIG Tree、Seni Jaya、Spectrum、Laguna、Lantern Media、Sky Blue、Power Screen、WOW Media、Era Jaya、AOS Media等等。我们已锁定OOH/DOOH 媒体所有者。这些媒体所有者可以透过与世界各地的广告商即时连接来将其优质 DOOH 库存收益。

- 2021 年 8 月 - Airsqreen 推出 DOOH 广告平台。这种简单的技术将广告商和萤幕经营者联繫起来,使该行业的信任度和收益潜力达到了新的水平。 Airsqreen 创建了一个简单、经济高效的解决方案,透过即时检验为 DOOH 广告带来完全的透明度,并创造新的营运效率。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 价值链分析

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场动态

- 促进因素

- 增加大众交通工具基础设施

- 数位萤幕的采用增加

- 连网型萤幕带来更大的广告弹性

- 抑制因素

- 安装和维护成本高

第六章市场区隔

- 目的

- 广告看板

- 过境

- 街道家具

- 其他用途

- 最终用户

- 零售

- 医疗保健/製药

- 金融服务

- 车

- 电讯/公共事业

- 政府机关

- 其他最终用户

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 西班牙

- 法国

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 新加坡

- 韩国

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 智利

- 其他拉丁美洲

- 中东/非洲

- GCC

- 南非

- 其他中东/非洲

- 北美洲

第七章 竞争形势

- 公司简介

- JCDecaux Group

- Clear Channel Outdoor Holdings Inc.

- BroadSign International LLC

- OUTFRONT Media

- Daktronics Inc.

- Talon Outdoor Ltd

- oOh!media Limited

- QMS Media Limited

- SevenOne Media GmbH

- Stroer SE & Co. KGaA

- Exterion Media Group

- The Times Group

- EyeMedia LLC

第八章投资分析

第9章市场的未来

简介目录

Product Code: 66350

The Digital Out of Home Advertising Market size is estimated at USD 23.06 billion in 2024, and is expected to reach USD 46.79 billion by 2029, growing at a CAGR of 15.20% during the forecast period (2024-2029).

Key Highlights

- As digital out-of-home advertisements are a cost-effective way for commercials to reach a wide range of audiences, their utilization is significant and growing, driving market expansion during the forecast period.

- Furthermore, increased urbanization and infrastructure development worldwide are expected to drive market growth during the forecast period. Again, growing expenditure on outdoor advertising by various industries is propelling market expansion because of its ability to show several advertisements on a single screen.

- Digital outdoor advertising is getting popular in the advertising world since it raises brand awareness among consumers and complements the brand's advertising campaigns on other channels, which are expected to drive market growth. Furthermore, as people spend more time outside their offices and homes, out-of-home advertising allows companies to reach a large number of people regularly and quickly, boosting the market growth during the projection period.

- COVID-19 has considerably impacted the expansion of the digital-out-of-home advertising market. During the pandemic, the decline in demand for digital signage solutions across key industries substantially influenced the need for digital out-of-home advertising solutions. Furthermore, the lack of a competent workforce owing to partial and total lockdown enacted by governments worldwide hampered the expansion of the digital out-of-house advertising market during a pandemic.

- The volatility of the cost of advertising may hinder the growth of the digital out-of-home (OOH) advertising market.

Digital Out of Home (OOH) Advertising Market Trends

Transit Accounts for a Significant Share of Digital OOH Market

- The demand for digital content and information relevant to travelers has resulted in interactive commercials via various modes of advertisement, such as Kiosks, billboards, and Signboards, on the platform, which contributes to a large share of the increase in transportation media revenues.

- As a result, there has been a change in the behavior of consumers in terms of customer engagement across all means of transportation, allowing companies to grow their brands in the minds of their customers strategically. Over the next three years, this will drive potential customers away from traditional media.

- Transit is the most prominent segment, as public transportation is the preferred mode of transportation for a large portion of the population in Europe and Asia-Pacific, owing to advanced and dense public transportation infrastructure.

- Airports are an attractive setting for advertising, particularly for top-tier and luxury products, among numerous modes of transportation. Airports are under increasing pressure to find new techniques to generate revenue. By converting static displays like posters to digital presentations, airports may offer several sponsors instead of just one. This dramatically increases revenue. Additionally, by bringing in advertising partners, airports can share the cost burden of updating to new advertising technologies.

- Following airports, railways have seen significant adoption of digital out-of-home advertising. The rising demand for smart railway stations in emerging economies is driving up demand for DOOH.

Asia Pacific to Register Significant Growth

- The Asia Pacific has the largest population of all the regions. With an increase in the urban population and increased purchasing power, Asia-Pacific is considered to be one of the largest growing markets for the Digital and OOH market.

- Consumers in Asia-Pacific and other emerging nations are following the footsteps of their western counterparts and are quickly migrating from traditional media channels to attractive digital mediums. This, in turn, is resulting in the growth of the digital out-of-home (OOH) advertising market across the region as the western counterparts, particularly the North American region, hold a significant presence in the market.

- Transportation is the most dominant segment, as public transport has been the preferred option by a significant population in Asia-Pacific due to its advanced and high-density public transport infrastructure.

- Moreover, the region is dominated by local players, like Times Internet and Shanghai Media Group, while major players, like JCDecaux also have considerable market share in this region.

Digital Out of Home (OOH) Advertising Industry Overview

The Digital Out of Home (OOH) Advertising Market is highly fragmented. The industry is comprised of several large outdoor advertising and media companies with operations in multiple markets, as well as the smaller, local companies operating a limited number of structures in one or a few of the local markets.

- January 2022 - Hivestack has launched a programmatic digital out-of-home (DOOH) marketplace in Malaysia. Hivestack has announced agreements with GroupM in 14 countries worldwide and Dentsu-owned Posterscope, which has already activated a live campaign in December 2021. These agency customers may now utilize data-driven audience targeting to start campaigns both within Malaysia and throughout Hivestack's premium global network. Hivestack has also secured some of the largest and most powerful OOH/DOOH media owners in Malaysia through the Hivestack Supply Side Platform (SSP), including BIG Tree, Seni Jaya, Spectrum, Laguna, Lantern Media, Sky Blue, Power Screen, WOW Media, Era Jaya, and AOS Media. These media owners can monetize their premium DOOH inventory by connecting to a worldwide pool of advertisers in real time.

- August 2021 - Airsqreen introduced an Advertising Platform for Digital Out-of-Home (DOOH) Advertising. This simple technology connects advertisers to screen operators, giving the industry a new level of confidence and revenue possibilities. Airsqreen created a simple, cost-effective solution that brings full transparency to DOOH advertising through real-time verification and creates new operational efficiencies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Value Chain Analysis

- 4.2 Market Overview

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.1.1 Increase in Public Transit Infrastructure

- 5.1.2 Increasing Adoption of Digital Screens

- 5.1.3 High Advertising Flexibility with Connected Screens

- 5.2 Restraints

- 5.2.1 High Installation and Maintenance Costs

6 MARKET SEGMENTATION

- 6.1 Application

- 6.1.1 Billboard

- 6.1.2 Transit

- 6.1.3 Street Furniture

- 6.1.4 Other Applications

- 6.2 End-User

- 6.2.1 Retail

- 6.2.2 Healthcare/Pharmaceuticals

- 6.2.3 Financial Services

- 6.2.4 Automotive

- 6.2.5 Telecom/Utilities

- 6.2.6 Government Agencies

- 6.2.7 Other End-Users

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 Spain

- 6.3.2.4 France

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Singapore

- 6.3.3.5 South Korea

- 6.3.3.6 Rest of Asia Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Chile

- 6.3.4.4 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 GCC

- 6.3.5.2 South Africa

- 6.3.5.3 Rest of Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 JCDecaux Group

- 7.1.2 Clear Channel Outdoor Holdings Inc.

- 7.1.3 BroadSign International LLC

- 7.1.4 OUTFRONT Media

- 7.1.5 Daktronics Inc.

- 7.1.6 Talon Outdoor Ltd

- 7.1.7 oOh!media Limited

- 7.1.8 QMS Media Limited

- 7.1.9 SevenOne Media GmbH

- 7.1.10 Stroer SE & Co. KGaA

- 7.1.11 Exterion Media Group

- 7.1.12 The Times Group

- 7.1.13 EyeMedia LLC

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219