|

市场调查报告书

商品编码

1433907

化学机械抛光 (CMP):市场占有率分析、行业趋势和统计、成长预测(2024-2029 年)Chemical Mechanical Polishing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

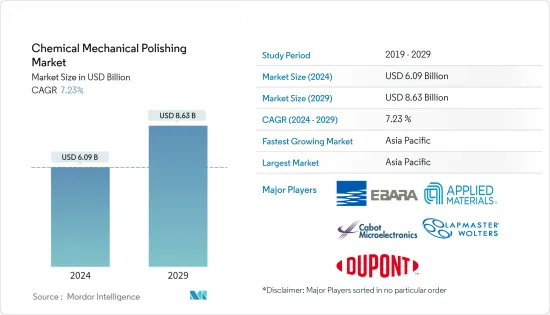

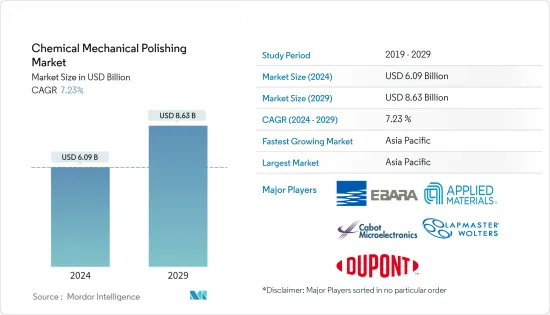

化学机械抛光(CMP)市场规模预计到2024年为60.9亿美元,预计到2029年将达到86.3亿美元,在预测期内(2024-2029年)持续增长,复合年增长率为7.23%。

化学机械抛光(CMP)是半导体晶圆製造过程中重要的製程技术步骤。该工艺利用化学浆料和机械运动来抛光或压平晶圆的顶面,以形成生产更耐用、更坚固的半导体材料所需的完美平坦表面。传统的抛光正在变得过时,供应商不再使用占用大量土地空间、安装成本很高且需要大量维护的不同机器,而是转向单独的组装。我们期待着一种-用于切片、探测和抛光的停止解决方案。儘管此类解决方案目前在市场上不太常见,但预计它们将在预测期内成为下一代抛光系统。

主要亮点

- 对电子设备性能要求的不断提高,催生了对更小、更坚固的半导体和电子设备的需求,从而导致对包括 CMP 在内的新製造材料和技术的需求增加。对电子产品不断增长的需求正在推动电子封装行业的成长,并提高客户对新电子设备功能的期望。

- 预测期内推动 CMP 市场成长的其他决定因素包括晶圆平坦化对 CMP 的需求不断增长、消费性电器产品的高需求以及电子机械系统 (MEMS) 的使用不断增加。除此之外,由于 IC 製造、电子机械系统 (MEMS)、光学、化合物半导体和电脑硬碟製造等最终用途应用数量的不断增加,预计对化学机械平坦化或抛光的需求也会增加。扩大。

化学机械抛光(CMP)市场趋势

CMP耗材支出预计在预测期内增加

- 随着半导体产业突破小型化的极限,重新开始进一步缩小规模将需要将新的独特材料整合到更复杂的结构中。随着需要整合到先进装置结构中的材料总数的增加,材料相互作用的复杂性迅速增加,并且 CMP 材料变得难以区分。卓越的均匀性和低缺陷率对于任何具有生产价值的 CMP 製程都很重要,这些参数从根本上由 CMP垫片的机械和结构特性控制。

- CMP 耗材在先进半导体元件的製造中发挥关键作用,帮助客户生产更小、更快、更复杂的装置。例如,卡博特微电子公司是工业木材防腐行业高性能材料的领先供应商,该行业在管道运营商和先进半导体设备的製造中发挥关键作用。磨料等关键 CMP 上游材料在控制缺陷的同时实现更好的抛光性能发挥更重要的作用。二氧化硅和二氧化铈领域正在取得新的进展,以转向高纯度胶体型磨料。

- 预计未来几年 CMP 耗材将在该产业强劲成长。对于22nm和14nm,业界必须非常严格地控制浆料和垫片品质以控制缺陷。在没有附聚物或有角颗粒的高级浆料中,浆料颗粒的型态变得非常重要。选择性要求对于浆料来说可能具有挑战性,因为垫片调节是提高选择性和整体製程控制的关键点。此外,记忆体和逻辑领域的新应用将继续为 CMP 耗材带来机会。

亚太地区将经历最快的成长

- 亚太地区是化学机械平整最全面的市场,台湾、日本和中国大陆是亚太地区的一些主要市场。亚太地区的市场主导地位归因于该地区MEMS和NEMS等半导体IC製造外包的成长。

- 与世界其他地区相比,亚太地区提供了广泛的市场成长机会。由于晶圆厂市场整合的增加,该地区市场对委託半导体组装测试(OSAT)的需求庞大。

- 一些市场参与者正在加紧努力,抵御持续不断的垂直整合浪潮。在中国等国家,鼓励半导体产业的政府政策日益为半导体材料产业的发展创造机会,并支撑了市场的成长。

- 例如,中华人民共和国国务院发布的政策框架将先进半导体製造解决方案作为整个半导体产业的技术重点。

化学机械抛光 (CMP) 产业概览

化学机械抛光(CMP)市场竞争适中,由几个主要企业组成。在过去的20年里,市场已经获得了竞争力。从市场占有率来看,目前很少大公司占据市场主导地位。市场上的许多公司正在透过开拓新市场和赢得新契约来增加其在市场上的影响力。

- 2018 年 11 月 - 卡博特微电子公司宣布已完成先前宣布的 KMG Chemicals, Inc. 的收购。收购完成后,KMG 成为卡博特微电子公司的完全子公司。

- 2018 年 11 月 - Applied Materials, Inc. 的创业投资部门 Applied Ventures LLC 宣布与纽约州经济发展机构 Empire State Development (ESD) 建立新的合作伙伴关係,旨在加速纽约州北部的创新。宣布联合投资倡议。该倡议的目标是投资纽约州北部众多成熟和新兴行业的有前途的Start-Ups,包括半导体、人工智慧、先进光学、自动驾驶汽车、生命科学、清洁能源等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场促进与市场约束因素介绍

- 市场驱动因素

- 对半导体小型化的需求日益增长

- MEMS 和 NEMS 的使用不断增加推动 CMP 市场成长

- 对半导体小型化的需求日益增长

- 市场限制因素

- 製造复杂性

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 技术简介

第五章市场区隔

- 按类型

- 化学机械研磨设备

- 化学机械抛光耗材

- 泥

- PAD

- PAD调理剂

- 其他消耗品

- 按用途

- 化合物半导体

- 积体电路

- MEMS・NEMS

- 其他用途

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第六章 竞争形势

- 公司简介

- Applied Materials, Inc.

- Cabot Microelectronics Corporation

- Ebara Corporation

- Lapmaster Wolters GmbH

- DuPont de Nemours, Inc.

- Fujimi Incorporated

- Revasum Inc.

- LAM Research Corporation

- Okamoto Corporation

- Strasbaugh Inc.

- Tokyo Seimitsu Co. Ltd.(Accretech Create Corp.)

第七章 投资分析

第八章 市场机会及未来趋势

The Chemical Mechanical Polishing Market size is estimated at USD 6.09 billion in 2024, and is expected to reach USD 8.63 billion by 2029, growing at a CAGR of 7.23% during the forecast period (2024-2029).

Chemical Mechanical Polishing is an important process technology step in the semiconductor wafer fabrication process. In this process action, the top surface of the wafer is polished or planarized to produce a perfectly flat surface that is necessary to make more durable and more powerful semiconductor materials with the help of chemical slurry & mechanical movements. Traditional polishing is becoming old, and venders are anticipating one-stop solutions that could slice, probe, and polish in a separate assembly line, instead of using various machines that occupy a lot of land space and need high budget installation and heavy maintenance. Although such solutions are less common in the market currently, they are anticipated to be the next generation of polishing systems, over the forecast period.

Key Highlights

- Growing performance requirements of electronic devices are creating the need for smaller and more robust semiconductors and electronic devices which, in turn, is driving the demand for newer fabrication materials and techniques, including CMP. An increase in the demand for electronic products has pushed the electronic packaging industry and customer expectations have raised regarding the features of new electronic devices.

- The other determinants driving the growth of the CMP market during the forecast period are the growing need of CMP for wafer planarization, high demand for consumer electronic products, and increasing use of micro-electro-mechanical systems (MEMS). In addition to that, with an expanding number of end-use applications such as IC manufacturing, micro-electro-mechanical systems (MEMS), optics, compound semiconductors, and computer hard drive manufacturing, the demand for chemical mechanical planarization or polishing is expected to expand.

Chemical Mechanical Polishing Market Trends

CMP Consumable Spending is Expected to Increase over the Forecast Period

- As the semiconductor industry has driven the limits of miniaturization such that new and distinct materials will require to be integrated into more complex structures to resume further scaling. With an increment in the total number of materials that must be integrated into advanced device structures, the complexity of materials interactions grows rapidly and CMP materials are no distinct. Extraordinary uniformity and low defectivity are critical to any production-worthy CMP process, and those critical parameters are fundamentally controlled by the mechanical and structural properties of the CMP pad.

- CMP consumable plays a critical role in the production of advanced semiconductor devices, helping to enable the manufacture of smaller, faster and more complex devices for its customers. For example, Cabot Microelectronics Corporation is a leading provider of performance materials for pipeline operators and the industrial wood preservation industry playing a critical role in the production of advanced semiconductor devices. Key CMP upstream material like abrasive plays a more critical role to achieve better polishing performance while controlling defects. New development to move to high purity colloidal type abrasives are taking place in both silica and ceria segments.

- CMP consumables are expected to have a strong industry growth outlook over the next several years. For 22nm and 14nm, the industry needs to have extremely tight control over the slurries and pad quality to control defects. With no agglomerations and angular particles, in advanced slurries, the morphology of the slurry particles will be critical. Selectivity requirements will prove challenging to slurries as selectivity is increased and pads are tuned as a key point of the overall process control. In addition, new applications in both memory and logic will continue to drive the opportunities for CMP consumables going forward.

Asia-Pacific to Witness Fastest Growth

- Asia-Pacific is the most comprehensive market of chemical mechanical planarization with Taiwan, Japan, and China are some of the principal markets in Asia-Pacific. The market dominance of Asia-Pacific is owing to the growing outsourcing of semiconductor IC fabrication, such as MEMS and NEMS in the region.

- Asia-Pacific contributes a wide range of opportunities to the market's growth, compared to the rest parts of the world. The market in the region witnessed huge demand from the Outsourced Semiconductor Assembly and Test (OSAT), owing to progressing consolidation in the fab market.

- Several market players are strengthening to withstand the ongoing wave of vertical integration. In countries like China, the government policies that encourage the semiconductor industry are increasingly generating opportunities for the development of the semiconductor materials industry, which is, in turn, supporting the growth of the market.

- For example, the policy framework issued by the State Council of the People's Republic of China pointed to make advanced semiconductor manufacturing solutions, a technology-priority across the semiconductor industry.

Chemical Mechanical Polishing Industry Overview

The chemical mechanical polishing market is moderately competitive and consists of several major players. The market has gained a competitive edge over the past two decades. In terms of market share, few of the major players currently dominate the market. Many of the companies in the market are increasing their market presence by securing new contracts by tapping new markets.

- November 2018 - Cabot Microelectronics Corporation announced that it has completed its previously announced acquisition ofKMG Chemicals, Inc. As a result of the acquisition, KMG has become a wholly-owned subsidiary of Cabot Microelectronics.

- November 2018 -Applied Ventures, LLC, the venture capital arm ofApplied Materials, Inc., announced a new co-investment initiative withEmpire State Development(ESD), New York State's economic development organization, aimed at accelerating innovation in Upstate New York. The goal of the initiative is to invest in promising Upstate New York startups across a broad range of established and emerging industries including semiconductors, artificial intelligence, advanced optics, autonomous vehicles, life sciences, clean energy and more..

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increasing Need for Miniaturization of Semiconductors

- 4.3.2 Increasing Use of MEMS & NEMS is Fueling the Growth of the CMP Market

- 4.3.3 Increasing Need for Miniaturization of Semiconductors

- 4.4 Market Restraints

- 4.4.1 Complexity Regarding Manufacturing

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technology Snapshot

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 CMP Equipment

- 5.1.2 CMP Consumable

- 5.1.2.1 Slurry

- 5.1.2.2 PAD

- 5.1.2.3 PAD Conditioner

- 5.1.2.4 Other Consumable Types

- 5.2 By Application

- 5.2.1 Compound Semiconductors

- 5.2.2 Integrated Circuits

- 5.2.3 MEMS & NEMS

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Rest of World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Applied Materials, Inc.

- 6.1.2 Cabot Microelectronics Corporation

- 6.1.3 Ebara Corporation

- 6.1.4 Lapmaster Wolters GmbH

- 6.1.5 DuPont de Nemours, Inc.

- 6.1.6 Fujimi Incorporated

- 6.1.7 Revasum Inc.

- 6.1.8 LAM Research Corporation

- 6.1.9 Okamoto Corporation

- 6.1.10 Strasbaugh Inc.

- 6.1.11 Tokyo Seimitsu Co. Ltd. (Accretech Create Corp.)