|

市场调查报告书

商品编码

1436007

海运:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Maritime Freight Transport - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

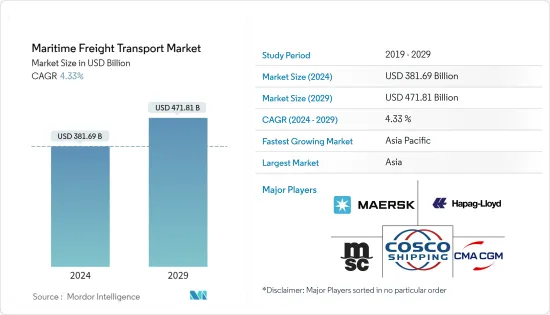

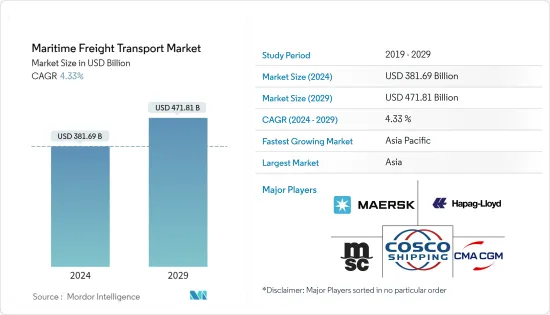

预计2024年海运市场规模为3,816.9亿美元,预计2029年将达4,718.1亿美元,预测期内(2024-2029年)复合年增长率为4.33%。

海运业运输了大约 90% 的世界贸易。海上贸易不断扩大,透过具有竞争力的货运成本使世界各地的消费者受益。由于航运作为一种运输方式的效率不断提高以及经济自由化程度不断提高,该行业进一步增长的前景仍然强劲。

所有贸易链,包括主要进出口贸易,都面临崩溃。由于当前的困难时期和情况的紧迫性,各国禁止从其他港口,特别是来自中国的货柜和船舶入境。

超过5万艘商船进行国际贸易,运送各类货物。全球船队在 150 多个国家註册,船员超过 100 万,几乎来自各国。

具体而言,2022 年初,粮食价格和司机 LK 货运的上涨预计导致消费性食品价格上涨 1.2%。 2021年,货柜船在港口停留时间比2020年增加了13.7%,加剧了延误和短缺。去年,全球船舶温室气体排放总量增加了4.7%。

贸发会议题为《海运回顾》的报告显示,多年来成长最快的部门是货柜贸易,预计 2023 年成长率将达到 1.9%。

海运市场趋势

容器化正在成为一种趋势

据联合国贸易和发展会议(UNCTAD)称,国际海运贸易尤其受到货柜货运、司机货运和天然气货运成长的推动。然而,地缘政治紧张局势和 COVID-19 等全球感染疾病等不确定性因素仍然是当前海运环境的首要主题,风险倾向于下行。我是。

长期来看,杂货容器化呈上升趋势。全球化货柜贸易的大部分继续穿越东西方货柜贸易的主要动脉:亚洲-欧洲、环太平洋地区和大西洋。预计在预测期内,货柜贸易和驱动要素贸易的复合年增长率分别为4.5%和3.9%。

目前全球有超过 1700 万个货柜在使用,且货柜不断发展。随着全球贸易迅速扩张,对高效货运的需求只会不断增加。

自从货柜首次标准化以来,供给和需求推动了成长和变化,但它们并不是影响货柜船上货柜数量的唯一因素。多年来货柜的大小也影响了这个数字。

亚太地区是成长最快的市场

亚太地区由一些世界上成长最快的经济体组成,包括中国和印度。贸易交流支持了这些国家航运业的成长,大部分的国际贸易都是透过海上进行。

全球货柜港口装卸活动的趋势也凸显了亚洲在全球贸易和航运中的核心角色。亚洲国家的区域内贸易显着增加,但这主要基于製造业贸易,这通常涉及碎片化的生产流程,其中零件在亚洲多个地点製造并在其他地方组装。预计将透过海上运输扩大贸易。需求成长主要发生在亚洲,受到持续的能源政策转变以及澳洲和美国出口能力增加的支持。

亚太地区的特征是主要国家的存在为海运市场提供了巨大的航运价值。中国、日本、新加坡、韩国则名列全球前10大船舶拥有国。

例如,截至2021年1月,中国机队总资产达到1,960亿美元,而日本机队总资产为1,880亿美元,新加坡机队总资产为790亿美元,韩国机队总资产为5,960亿美元。1十亿。

除了这些市场之外,还有几个新兴市场也准备采用海洋分析,包括印度、印尼、越南、马来西亚、菲律宾和泰国。根据国内货币基金组织(IMF)的数据,截至2022年12月,前10名的海上贸易国家包括中国、韩国、马来西亚和台湾。

海运业概况

航运市场高度集中,少数参与者占据相当大的市场份额。市场上的知名公司包括 MSC、COSCO 和 AP Moller。

由于航运固有的国际性和多相关人员方面,海上运输是一个复杂的活动领域。该行业的公司目前正在执行国际海事组织从 2020 年 1 月起针对船用燃料的全球硫法规,该行业正在实施减少碳排放和环境污染影响的计划。我们的重点是遵守分钟限制的减少。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

- 分析调查方法

- 调查阶段

第三章执行摘要

第四章市场动态与洞察

- 目前的市场状况

- 市场动态

- 促进因素

- 世界贸易的成长

- 对具有成本效益的运输的需求

- 抑制因素

- 日益严格的法规影响市场成长

- 燃料成本上涨影响市场

- 机会

- 利用新技术提振市场

- 全球海上贸易需求不断成长

- 促进因素

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间的敌意强度

- 价值链/供应链分析

- 技术进步

- 政府法规和重大倡议

- 转运贸易洞察

- 深入了解容器化和非容器化货物

- 运费和海运费用

- 深入了解多式联运/货柜使用情况

- 供需分析

- COVID-19 对市场的影响

第五章市场区隔

- 按类型

- 容器化

- 一般的

- 冷冻车

- 非容器化

- 容器化

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 俄罗斯

- 法国

- 英国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 澳洲

- 印度

- 其他亚太地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 南美洲

- 巴西

- 哥伦比亚

- 阿根廷

- 南美洲其他地区

- 北美洲

第六章 竞争形势

- 市场集中度概况

- 公司简介

- AP Moller(Maersk)

- Mediterranean Shipping Company SA(MSC)

- CMA-CGM

- China Ocean Shipping(Group)Company(COSCO)

- Hapag-Lloyd

- ONE-Ocean Network Express

- Evergreen Line

- HMM Co. Ltd

- Yang Ming Marine Transport

- Zim

- Wan Hai Lines

- PIL Pacific International Line*

第七章 市场的未来

第8章附录

The Maritime Freight Transport Market size is estimated at USD 381.69 billion in 2024, and is expected to reach USD 471.81 billion by 2029, growing at a CAGR of 4.33% during the forecast period (2024-2029).

The maritime freight transport industry is responsible for the carriage of around 90% of world trade. Seaborne trade continues to expand, bringing benefits for consumers across the world through competitive freight costs. Thanks to the growing efficiency of shipping as a mode of transport and increased economic liberalization, the prospects for the industry's further growth continue to be strong.

All the trade chains, including the major import and export trade, face a downfall. During this adverse time and the urgency of the situation, a ban had been imposed by various countries on the entry of containers and vessels that are being operated from other ports, especially those that are transported from China.

Over 50,000 merchant ships are trading internationally, transporting every kind of cargo. The world fleet is registered in over 150 nations and manned by over a million seafarers of virtually every nationality.

Concretely, it was estimated that higher grain prices and dry bulk freight rates in early 2022 contributed to a 1.2% increase in consumer food prices. Container ships spent 13.7% longer in port in 2021 compared to 2020, exacerbating delays and shortages. During the last year, total greenhouse gas emissions from the world fleet increased by 4.7%.

For many years, the fastest-growing segment was containerized trade, for which growth in 2023 is expected to reach 1.9%, according to a report titled Review of Maritime Transport by UNCTAD.

Maritime Freight Transport Market Trends

Containerization is Evolving as a Trend

According to UNCTAD (United Nations Conference on Trade and Development), international maritime trade is driven in particular by growth in containerized, dry bulk, and gas cargo. However, uncertainties like geopolitical tensions and global pandemics like COVID-19 remain an overriding theme in the current maritime transport environment, with risks tilted to the downside.

The long-term trend toward the containerization of general cargo is upward rising. A large share of globalized containerized trade continued to be carried across the major East-West containerized trade arteries, namely Asia-Europe, the Trans-Pacific, and the Transatlantic. Containerized and dry bulk trades are expected to register a compound annual growth rate of 4.5% and 3.9%, respectively, over the forecast period.

Today, over 17 million shipping containers are used worldwide, which is evolving constantly. With global trade expanding rapidly, the demand for efficient cargo transport will only grow as well.

Supply and demand have facilitated growth and change since the first standardized containers, but they're not the only factors that have impacted how many containers are on a container ship. The size of containers over the years has affected the number as well.

Asia-Pacific is the Fastest Growing Market

The Asian-Pacific region consists of some of the fastest-growing economies in the world, like China and India. The trade exchanges support this growth in the maritime transportation sector by these countries, of which the majority of international trade takes place via sea routes.

Trends in global container port-handling activities also highlight the central role of Asia in global trade and shipping. Asian countries are experiencing a large increase in intra-regional trade, mostly based on manufacturing trades and reflecting fragmented production processes, where parts are generally manufactured in multiple locations across Asia and assembled in another location. This is also expected to increase trade, supported by marine transportation. Demand growth originated mostly in Asia, bolstered by ongoing energy policy shifts and rising export capacity in Australia and the United States.

The Asia Pacific region is characterized by the presence of some major countries that contribute substantial fleet value to the maritime freight transport market. China, Japan, Singapore, and South Korea are among the top ten ship-owning countries worldwide.

For instance, as of January 2021, China's total fleet asset value reached USD 196 billion, whereas Japan's total fleet asset value reached USD 188 billion, Singapore's total fleet asset value was USD 79 billion, and South Korea's total fleet asset value reached USD 59.6 billion.

In addition to these markets, there are several other potential developing markets for the adoption of maritime analytics, such as India, Indonesia, Vietnam, Malaysia, the Philippines, and Thailand. As per the Internal Monetary Fund (IMF), in December 2022, the top 10 sea trading countries included China, South Korea, Malaysia, and Taiwan.

Maritime Freight Transport Industry Overview

The maritime transport market is fairly concentrated, with a few players accounting for significant amounts of shares in the market. Some of the prominent companies in the market are MSC, COSCO, and AP Moller.

Maritime transport is a complex activity area, owing to the inherently international nature of shipping and its multi-stakeholder dimension. The companies in the sector currently are focusing on complying with the International Maritime Organization's lower global sulfur cap on marine fuels from January 2020 as the segment moves towards implementing the plans to reduce its carbon footprint and contribution to pollution.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Increasing global trade

- 4.2.1.2 Demand for cost-effective transportation

- 4.2.2 Restraints

- 4.2.2.1 Increasing regulations affecting the growth of the market

- 4.2.2.2 Surge in fuel costs affecting the market

- 4.2.3 Opportunities

- 4.2.3.1 Usage of new technologies boosting the market

- 4.2.3.2 Increasing demand for maritime trade across the globe

- 4.2.1 Drivers

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Value Chain/Supply Chain Analysis

- 4.5 Technological Advancements

- 4.6 Government Regulations and Key Initiatives

- 4.7 Insights into Transshipment Trade

- 4.8 Insights into Containerized and Non-containerized Shipments

- 4.9 Freight Rates and Maritime Transport Costs

- 4.10 Insights into Intermodal/Container Utilization

- 4.11 Demand-Supply Analysis

- 4.12 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Containerized

- 5.1.1.1 General

- 5.1.1.2 Reefer

- 5.1.2 Non-containerized

- 5.1.1 Containerized

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 Russia

- 5.2.2.3 France

- 5.2.2.4 United Kingdom

- 5.2.2.5 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 Australia

- 5.2.3.4 India

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 Middle East and Africa

- 5.2.4.1 Saudi Arabia

- 5.2.4.2 South Africa

- 5.2.4.3 Rest of Middle East and Africa

- 5.2.5 South America

- 5.2.5.1 Brazil

- 5.2.5.2 Colombia

- 5.2.5.3 Argentina

- 5.2.5.4 Rest of South America

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 AP Moller (Maersk)

- 6.2.2 Mediterranean Shipping Company SA (MSC)

- 6.2.3 CMA-CGM

- 6.2.4 China Ocean Shipping (Group) Company (COSCO)

- 6.2.5 Hapag-Lloyd

- 6.2.6 ONE - Ocean Network Express

- 6.2.7 Evergreen Line

- 6.2.8 HMM Co. Ltd

- 6.2.9 Yang Ming Marine Transport

- 6.2.10 Zim

- 6.2.11 Wan Hai Lines

- 6.2.12 PIL Pacific International Line*