|

市场调查报告书

商品编码

1440176

海运:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Sea Freight Forwarding - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

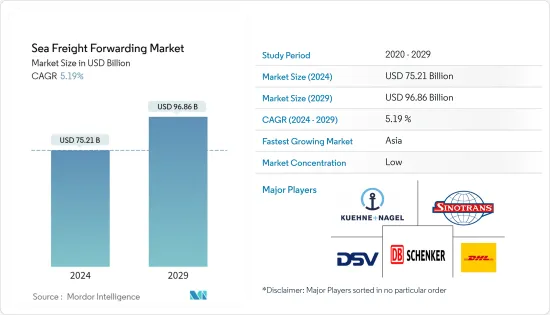

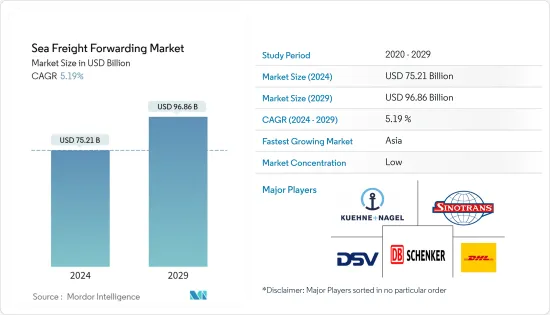

预计2024年海运市场规模为752.1亿美元,预计2029年将达到968.6亿美元,预测期内(2024-2029年)复合年增长率为5.19%。

主要亮点

- 由于网路普及不断提高、购买力平价不断上升以及专为电子商务行业设计的基础设施和服务的发展,全球海运市场正在蓬勃发展。冠状病毒的感染疾病对航运业产生了负面影响,为了安全和防止 COVID-19 的传播,航运业员工已关闭。

- 海运已成为多个最终用户产业的首选模式,多个策略合作伙伴关係也可能在预测期内推动海运的成长。不断成长的全球跨境电子商务市场正在推动拼箱货量的成长,对海运市场的成长产生正面影响。

- 数千年来,海上运输一直是运输货物、产品和人员的重要手段。如今,船舶运输煤炭、石油和天然气等重要商品,支撑全球经济。光是2021年,就出货了约150万吨煤炭和110万吨石油。

- 更重要的是,大约85%的货物透过海上运输,主要是透过货柜船。与其他运输工具相比,船舶具有巨大的运力,使其更加经济,适合运输大型、重型和体积大的物品,同时排放相对较低。

- 船东和分析师表示,预计今年剩余时间和 2023 年运费将进一步下降。随着未来两年大量新船投入使用,2023年至2024年船队规模净成长率预计将超过9%。相比之下,Bremer 表示,2024 年货柜吞吐量可能会略有负成长。

海运市场趋势

跨经纪商电子商务的兴起推动市场

2021年全球零售电子商务销售额达到约52,110亿美元,预计未来几年电子零售收益将进一步以更快的速度成长。此外,网路购物是全球最受欢迎的线上活动之一,推动了中国、印度和印尼等新兴市场的国内和跨境电子商务。这包括直接面向消费者的销售以及电子产品、药品和消费品的出货。

随着新兴经济体逐渐从製造业驱动的成长转向由不断扩大的中阶驱动的更高消费水平,电子商务的成长与该地区的消费成长密切相关。

跨境电商已占中国进出口贸易总额的25%。与中国相比,其他地区的电子商务相关业务规模要小得多,但也在快速成长。海运是电商货运最受欢迎的方式之一,受到许多企业青睐,预计2021年海运量将增加至200亿吨。

海上贸易运输量增加

海上贸易的成长透过降低运输成本使世界各地的客户受益。由于航运作为一种运输方式的效率不断提高以及经济进一步自由化,该行业持续增长的前景仍然乐观。

儘管目前情况严峻,但该行业的长期前景仍然非常乐观。世界人口持续成长,开发中国家将继续需要更多的货物和原料透过海上安全有效地运输。近期,透过海上进行的国际贸易量再次开始稳定成长。航运是最环保、最具成本效益的商业运输方式,这一事实最终将导致海上运输在世界贸易中所占的份额不断增加。

超过5万艘商船在海外运营,运输各类货物。全球船队由超过 100 万名几乎各国籍的海员组成,在 150 多个国家註册。

根据联合国贸易和发展会议 (UNCTAD) 的数据,商船运输为全球经济带来了价值约 3,800 亿美元的货运成本,约占贸易总额的 5%。

工业化程度的提高和国民经济自由化促进了自由贸易和消费品需求的成长。技术的进步也提高了运输作为运输手段的效率和速度。

1990年至2020年间,海运贸易量增加了一倍多,达到106.5亿吨。 2020年,货柜船承运国际海上贸易量18.5亿吨。截至 2021 年 1 月,巴拿马持有世界上最大的商船队,营运商席位达 3.436 亿载重吨。过去30年,海运贸易流量成长了近两倍,2021年达到1,500亿吨,导致海运业务量稳定成长。

海运行业概况

海运市场竞争激烈且高度分散,参与者众多。海运是充当中间人的个人或公司,透过普通海洋运输运输货物并代表客户安排所有运输事宜。

海运处理所有必要的物流并执行与出货相关的活动。从 2012 年到 2022 年,海运量增加了两倍,近年来市场上出现了许多新进业者。

市场上现有的主要企业包括Kuehne+Nagel、DHL Supply Chain & Global Forwarding、DB Schenker、DSV Panalpina、中国外运送、Expeditors、日本通运、CEVA Logistics、CH Robinson、嘉里物流等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究成果

- 调查先决条件

- 调查范围

第二章调查方法

- 分析调查方法

- 调查阶段

第三章执行摘要

第四章市场洞察

- 目前的市场状况

- 价值链/供应链分析

- 科技趋势

- 投资场景

- 政府法规和倡议

- 焦点 - 海运成本/运费

- 电商产业洞察

- COVID-19疾病对海运市场的影响

第五章市场动态

- 市场驱动因素

- 市场限制因素

- 市场机会

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对的强度

第六章市场区隔

- 按类型

- FCL

- LCL

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 荷兰

- 英国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 澳洲

- 印度

- 新加坡

- 马来西亚

- 印尼

- 韩国

- 其他亚太地区

- 中东和非洲

- 南非

- 埃及

- 海湾合作委员会国家

- 其他中东和非洲

- 南美洲

- 巴西

- 智利

- 南美洲其他地区

- 北美洲

第七章 竞争形势

- 市场集中度概况

- 公司简介

- Kuehne+Nagel

- Sinotrans

- DHL

- DB Schenker

- DSV Panalpina

- Expeditors

- CH Robinson

- Ceva Logistics

- Kerry Logistics

- Nippon Express

- Hellmann Worldwide Logistics

- Geodis

- Fr. Meyer's Sohn

- Yusen Logistics

- Bollore Logistics

第八章市场的未来

第九章 免责声明

The Sea Freight Forwarding Market size is estimated at USD 75.21 billion in 2024, and is expected to reach USD 96.86 billion by 2029, growing at a CAGR of 5.19% during the forecast period (2024-2029).

Key Highlights

- The global sea freight forwarding market is booming, owing to the growing internet penetration, increasing Purchasing Power Parity, and developments in infrastructure and services designed particularly for the e-commerce industry. The epidemic negatively impacted the shipping industry as workforces in these sectors were shut down for safety and to prevent the spread of COVID-19.

- Sea freight forwarding has emerged as a preferred mode among several end-user industries and several strategic partnerships are also likely to promote the growth of sea freight forwarding during the forecast period. The growing global cross-border e-commerce market is driving the LCL volume and is positively impacting the sea freight forwarding market growth.

- Sea freight has been an important means of transporting goods, products, and people for thousands of years. Today, ships transport vital commodities such as coal, oil and gas, supporting the global economy. In 2021 alone, about 1.5 million tonnes of coal and about 1.10 million tonnes of oil were shipped.

- More importantly, about 85% of all goods are transported by sea, mainly by container ships. Compared to other means of transport, vessels have vast capacities suitable for transporting large, heavy, and bulky items that are more economical while producing relatively small amounts of emissions.

- Shipping rates are expected to drop further for the rest of the year and into 2023, according to shipowners and analysts. With a number of new vessels entering service over the next two years, net growth in the fleet size is expected to be over 9% through 2023 to 2024. By contrast, container volume growth in 2024 could be slightly negative according to Braemer.

Sea Freight Forwarding Market Trends

Rising Cross Broder E-Commerce is driving the Market

In 2021, retail e-commerce sales worldwide amounted to around USD 5,211 Billion and e-retail revenues are projected to grow even further at a quicker pace in the coming few years. Further, as online shopping is one of the most popular online activities worldwide is driving both the domestic and cross-border e-commerce in developing markets such as China, India, and Indonesia. This encompasses not just direct-to-consumer retail, but also shipments of electronics, pharmaceuticals, and consumer packaged goods.

Growth in e-commerce is tied very closely to the consumption growth in the region as developing economies make the gradual shift from growth by manufacturing for export to higher levels of consumption by expanding middle classes.

In China, cross-border e-commerce transactions already accounted for up to 25 percent of total import and export trading volumes. Compared to China, in other regions, the size of e-commerce related businessess is much smaller, but the growth is also rapid. One of the most preferred modese for e-commerce freight forwarding is through sea and many business are favoring that as evidenced by the growing of ocean freight volumes to 20 billion tons in 2021.

Rise In Seaborne Trade Transport Volume

The growth of seaborne trade benefits customers all around the world by lowering the cost of shipping. The prospects for the industry's continued growth remain favorable due to the increasing efficiency of shipping as a mode of transportation and further economic liberalization.

Despite the current circumstances, the industry's long-term prospects are still highly favorable. The world's population is still growing, and developing nations will keep needing more of the goods and raw materials that shipping transfers so securely and effectively. The volume of international trade conducted by sea has recently started to rise steadily once more. The fact that shipping is the most environmentally benign and cost-effective method of commercial transportation should eventually lead to an increase in the percentage of world trade that is transported by sea.

Over 50,000 merchant ships operate abroad and carry all different kinds of goods. More than a million seafarers of essentially every nationality make up the world fleet, which is registered in more than 150 countries.

According to the United Nations Conference on Trade and Development (UNCTAD), the operation of commercial ships generates freight rates worth roughly USD 380 billion for the global economy or about 5% of all trade.

The expansion of free trade and the demand for consumer goods has been fueled by rising industrialization and the liberalization of national economies. Technology advancements have also increased the effectiveness and speed of the shipping as a mode of transportation.

Between 1990 and 2020, seaborne trade volumes more than doubled to reach 10.65 billion tons. In 2020, 1.85 billion tons of international seaborne trade was carried by container ships. As of January 2021, Panama had the world's largest merchant fleet with 343.6 million DWT operator seats. The business volume of ocean freight forwarders has been steadily increasing because in the last three decades, the seaborne trade transport volume roughly tripled, reaching 150 billion metric tons in 2021.

Sea Freight Forwarding Industry Overview

The Sea Freight Forwarding Market is highly competitive and is highly fragmented with the presence of many players. A Sea Freight forwarder is an individual or company that acts as an intermediary and dispatches the shipments via common sea carriers and makes all arrangements for those shipments on behalf of its clients.

Sea Freight forwarders handle all the logistics needed and perform activities pertaining to shipments. With the Ocean freight volumes tripling from 2012 to 2022, the market has seen many new players entering in the last few years.

Some of the existing major players in the market include Kuehne + Nagel, DHL Supply Chain & Global Forwarding, DB Schenker, DSV Panalpina, Sinotrans, Expeditors, Nippon Express, CEVA Logistics, C.H. Robinson, and Kerry Logistics.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Technological Trends

- 4.4 Investment Scenarios

- 4.5 Government Regulations and Initiatives

- 4.6 Spotlight - Sea Freight Transportation Costs/Freight Rates

- 4.7 Insights on the E-commerce Industry

- 4.8 Impact of COVID-19 on the Sea Freight Forwarding Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.2 Market Restraints

- 5.3 Market Opportunities

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitutes

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Full Container Load (FCL)

- 6.1.2 Less-than Container Load (LCL)

- 6.1.3 Others

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.1.3 Mexico

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 France

- 6.2.2.3 Netherlands

- 6.2.2.4 United Kingdom

- 6.2.2.5 Italy

- 6.2.2.6 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 Australia

- 6.2.3.4 India

- 6.2.3.5 Singapore

- 6.2.3.6 Malaysia

- 6.2.3.7 Indonesia

- 6.2.3.8 South Korea

- 6.2.3.9 Rest of Asia-Pacific

- 6.2.4 Middle East & Africa

- 6.2.4.1 South Africa

- 6.2.4.2 Egypt

- 6.2.4.3 GCC Countries

- 6.2.4.4 Rest of Middle East & Africa

- 6.2.5 South America

- 6.2.5.1 Brazil

- 6.2.5.2 Chile

- 6.2.5.3 Rest of South America

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 Kuehne + Nagel

- 7.2.2 Sinotrans

- 7.2.3 DHL

- 7.2.4 DB Schenker

- 7.2.5 DSV Panalpina

- 7.2.6 Expeditors

- 7.2.7 C.H Robinson

- 7.2.8 Ceva Logistics

- 7.2.9 Kerry Logistics

- 7.2.10 Nippon Express

- 7.2.11 Hellmann Worldwide Logistics

- 7.2.12 Geodis

- 7.2.13 Fr. Meyer's Sohn

- 7.2.14 Yusen Logistics

- 7.2.15 Bollore Logistics